Abstract

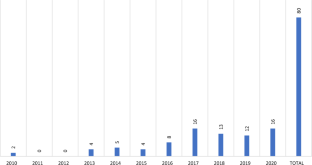

This study employs a systematic review approach to examine the existing body of literature on risk management in Islamic banking. The focus of this work is to analyze published manuscripts to provide a comprehensive overview of the current state of research in this field. After conducting an extensive examination of eighty articles classified as Q1 and Q2, we have identified six prominent risk themes. These themes include stability and resilience, risk-taking behavior, credit risk, Shariah non-compliance risk, liquidity risk, and other pertinent concerns that span various disciplines. The assessment yielded four key themes pertaining to the risk management of the Islamic banking system, namely prudential regulation, environment and sustainability, cybersecurity, and risk-taking behavior. Two risk frameworks were provided based on the identified themes. The microframework encompasses internal and external risk elements that influence the bank's basic activities and risk feedback system. The macro-framework encompasses several elements that influence the risk management environment for Islamic banks (IB), including exogenous institutional factors, domestic endogenous factors, and global endogenous factors. Thematic discoveries are incorporated to identify potential avenues for future research and policy consequences.

Based on Brocke et al. (2009)

Modified from Al Rahahleh et al. (2019)

Similar content being viewed by others

Data availability

The data that support the findings of this study are available from the corresponding author upon reasonable request.

Notes

Riba has been at the center of mainstream debate categorizing Islamic finance from its counterpart. While many scholars identify Riba is the excessive amount of additional payment charged or given on the principal amount, for others it is the fixed or predetermined amount of payment on the top of the principal amount. However, the consensus among Islamic scholars forwards the notion that Riba in any form is prohibited in Islam.

Mudarabah is a partnership-based Islamic finance contract between two parties, one party supplying the finance (rabbulmal), while the other party gets involved with their physical labor and skills (mudarib), granting each party a share of the income at predetermined ratio.

Musharakah is another classical partnership contract in Islamic banking where more than one party contributes in financing a shared company. The contract involves both parties agreeing on sharing profit on an agreed-upon ratio and sharing losses on ratio of equity capital financed.

Operational risk is the potential loss due to inefficient internal processing, system and people, and external factors such as the limited legal support and uncontrollable compliance issues (Čihák & Hesse 2010).

References

AAOIFI. (2010). Governance standards for Islamic financial institutions. In. Bahrain: Accounting and auditing organization for Islamic Financial Institutions

Abdul-Rahman, A., A.A. Sulaiman, and N.L.H.M. Said. 2018. Does financing structure affects bank liquidity risk? Pacific-Basin Finance Journal 52: 26–39. https://doi.org/10.1016/j.pacfin.2017.04.004.

Abedifar, P., P. Giudici, and S.Q. Hashem. 2017. Heterogeneous market structure and systemic risk: Evidence from dual banking systems. Journal of Financial Stability 33: 96–119. https://doi.org/10.1016/j.jfs.2017.11.002.

Abedifar, P., P. Molyneux, and A. Tarazi. 2013. Risk in Islamic Banking. Review of Finance 17 (6): 2035–2096. https://doi.org/10.1093/rof/rfs041.

Aggarwal, R.K., and T. Yousef. 2000. Islamic banks and investment financing. Journal of Money, Credit and Banking 32 (1): 93–120.

Ahmad, A.U.F., M. Rashid, and A. Shahed. 2014. Perception of bankers and customers towards deposit and investment mechanisms of islāmic and conventional Banking: Empirical evidence from Bangladesh. Journal of Islamic Business and Management 219 (2622): 1–24.

Akin, T., Z. Iqbal, and A. Mirakhor. 2016. The composite risk-sharing finance index: Implications for Islamic finance. Review of Financial Economics 31: 18–25. https://doi.org/10.1016/j.rfe.2016.06.001.

Al-Shboul, M., A. Maghyereh, A. Hassan, and P. Molyneux. 2020. Political risk and bank stability in the Middle East and North Africa region. Pacific-Basin Finance Journal 60: 101291. https://doi.org/10.1016/j.pacfin.2020.101291.

Al Rahahleh, N., M.I. Bhatti, and F.N. Misman. 2019. Developments in risk management in Islamic finance: A review. Journal of Risk and Financial Management 12 (1): 37–58. https://doi.org/10.3390/jrfm12010037.

Alaabed, A., M. Masih, and A. Mirakhor. 2016. Investigating risk shifting in Islamic banks in the dual banking systems of OIC member countries: An application of two-step dynamic GMM. Risk Management 18 (4): 236–263. https://doi.org/10.1057/s41283-016-0007-3.

Alam, N., B.A. Hamid, and D.T. Tan. 2019. Does competition make banks riskier in dual banking system? Borsa Istanbul Review 19: S34–S43. https://doi.org/10.1016/j.bir.2018.09.002.

Alandejani, M., and M. Asutay. 2017. Nonperforming loans in the GCC banking sectors: Does the Islamic finance matter? Research in International Business and Finance 42: 832–854. https://doi.org/10.1016/j.ribaf.2017.07.020.

Alhammadi, S., S. Archer, and M. Asutay. 2020. Risk management and corporate governance failures in Islamic banks: A case study. Journal of Islamic Accounting and Business Research 11 (9): 1921–1939.

Ali, M., and C.H. Puah. 2018. Does bank size and funding risk effect banks’ stability? A lesson from Pakistan. Global Business Review 19 (5): 1166–1186. https://doi.org/10.1177/0972150918788745.

Ali, S.S., N.S. Shirazi, and M.S. Nabi. 2013. The role of Islamic finance in the development of the IDB member countries: A case study of the Kyrgyz Republic and Tajikistan. Islamic Economic Studies 130 (905): 1–10.

Anwer, Z. 2020. Salam for import operations: Mitigating commodity macro risk. Journal of Islamic Accounting and Business Research 11 (8): 1497–1514. https://doi.org/10.1108/JIABR-09-2018-0142.

Ariffin, N.M., S. Archer, and R.A.A. Karim. 2009. Risks in Islamic banks: Evidence from empirical research. Journal of Banking Regulation 10: 153–163.

Archer, S., and R.A.A. Karim. 2009. Profit-sharing investment accounts in Islamic banks: Regulatory problems and possible solutions. Journal of Banking Regulation 10 (4): 300–306.

Archer, S., R.A.A. Karim, and V. Sundararajan. 2010. Supervisory, regulatory, and capital adequacy implications of profit-sharing investment accounts in Islamic finance. Journal of Islamic Accounting and Business Research 1 (1): 10–31. https://doi.org/10.1108/17590811011033389.

Asutay, M. 2007. Conceptualisation of the second best solution in overcoming the social failure of Islamic finance: Examining the overpowering of homoislamicus by homoeconomicus. IIUM Journal in Economics and Management 15 (2): 167–195.

Asutay, M. 2012. Conceptualising and locating the social failure of Islamic finance: Aspirations of Islamic moral economy vs the realities of Islamic finance. Asian and African Area Studies 11 (2): 93–113.

Aysan, A.F., and M. Disli. 2019. Small business lending and credit risk: Granger causality evidence. Economic Modelling 83: 245–255. https://doi.org/10.1016/j.econmod.2019.02.014.

Baele, L., M. Farooq, and S. Ongena. 2014. Of religion and redemption: Evidence from default on Islamic loans. Journal of Banking & Finance 44: 141–159. https://doi.org/10.1016/j.jbankfin.2014.03.005.

Baker, M.J. 2000. Writing a literature review. The Marketing Review 1 (2): 219–247.

Basher, S.A., L.M. Kessler, and M.K. Munkin. 2017. Bank capital and portfolio risk among Islamic banks. Review of Financial Economics 34: 1–9. https://doi.org/10.1016/j.rfe.2017.03.004.

Basiruddin, R., and H. Ahmed. 2019. Corporate governance and Shariah non-compliant risk in Islamic banks: Evidence from Southeast Asia. Corporate Governance: The International Journal of Business in Society 20 (2): 240–262. https://doi.org/10.1108/CG-05-2019-0138.

BCBS. (2001). Customer Due Diligence for Banks. Switzerland: Basel Committee on Banking Supervision.

Belkhir, M., J. Grira, M.K. Hassan, and I. Soumaré. 2019. Islamic banks and political risk: International evidence. The Quarterly Review of Economics and Finance 74: 39–55. https://doi.org/10.1016/j.qref.2018.04.006.

Bitar, M., M.K. Hassan, and T. Walker. 2017. Political systems and the financial soundness of Islamic banks. Journal of Financial Stability 31: 18–44. https://doi.org/10.1016/j.jfs.2017.06.002.

Berger, A.N., N. Boubakri, O. Guedhami, and X. Li. 2019. Liquidity creation performance and financial stability consequences of Islamic banking: Evidence from a multinational study. Journal of Financial Stability 44: 100692.

Boukhatem, J., and M. Djelassi. 2020. Liquidity risk in the Saudi banking system: Is there any Islamic banking specificity? The Quarterly Review of Economics and Finance 77: 206–219.

Bouslama, G., and Y. Lahrichi. 2017. Uncertainty and risk management from Islamic perspective. Research in International Business and Finance 39: 718–726. https://doi.org/10.1016/j.ribaf.2015.11.018.

Brocke, J. V., Simons, A., Niehaves, B., Niehaves, B., Reimer, K., Plattfaut, R., & Cleven, A. (2009). Reconstructing the giant: On the importance of rigour in documenting the literature search process. Paper presented at the European Conference on Information Systems (ECIS).

Butt, M., and M. Aftab. 2013. Incorporating attitude towards Halal banking in an integrated service quality, satisfaction, trust and loyalty model in online Islamic banking context. International Journal of Bank Marketing 31 (1): 6–23. https://doi.org/10.1108/02652321311292029.

Chamberlain, T., S. Hidayat, and A.R. Khokhar. 2020. Credit risk in Islamic banking: Evidence from the GCC. Journal of Islamic Accounting and Business Research 11 (5): 1055–1081. https://doi.org/10.1108/jiabr-09-2017-0133.

Chattha, J.A., M.S. Alhabshi, and A.K.M. Meera. 2020. Risk management with a duration gap approach: Empirical evidence from a cross-country study of dual banking systems. Journal of Islamic Accounting and Business Research 11 (6): 1257–1300. https://doi.org/10.1108/jiabr-10-2017-0152.

Chattha, J.A., and S.M. Alhabshi. 2018. Benchmark rate risk, duration gap and stress testing in dual banking systems, 62, 101063. Pacific-Basin Finance Journal. https://doi.org/10.1016/j.pacfin.2018.08.017.

Chong, B.S., and M.-H. Liu. 2009. Islamic banking: Interest-free or interest-based? Pacific-Basin Finance Journal 17 (1): 125–144. https://doi.org/10.1016/j.pacfin.2007.12.003.

Choudhury, T.T., S.K. Paul, H.F. Rahman, Z. Jia, and N. Shukla. 2020. A systematic literature review on the service supply chain: Research agenda and future research directions. Production Planning & Control 31 (16): 1–22.

Čihák, M., and H. Hesse. 2010. Islamic Banks and Financial Stability: An Empirical Analysis. Journal of Financial Services Research 38 (2): 95–113. https://doi.org/10.1007/s10693-010-0089-0.

Cooper, H.M. 1988. Organizing knowledge syntheses: A taxonomy of literature reviews. Knowledge in Society 1 (1): 104.

Cox, S. 2005. Developing the Islamic capital market and creating liquidity. Review of Islamic Economics 9 (1): 75.

Daher, H., M. Masih, and M. Ibrahim. 2015. The unique risk exposures of Islamic banks’ capital buffers: A dynamic panel data analysis. Journal of International Financial Markets, Institutions and Money 36: 36–52. https://doi.org/10.1016/j.intfin.2015.02.012.

Dar, H.A., and J.R. Presley. 2000. Lack of profit loss sharing in Islamic banking: Management and control imbalances. International Journal of Islamic Financial Services 2 (2): 3–18.

David, R.J., and S.K. Han. 2004. A systematic assessment of the empirical support for transaction cost economics. Strategic Management Journal 25 (1): 39–58.

Effendi, K.A., and D. Disman. 2017. Liquidity risk: Comparison between Islamic and conventional banking. European Research Studies Journal. 20 (2A): 308–318. https://doi.org/10.35808/ersj/643.

Elamer, A.A., C.G. Ntim, H.A. Abdou, and C. Pyke. 2019. Sharia supervisory boards, governance structures and operational risk disclosures: Evidence from Islamic banks in MENA countries. Global Finance Journal 46: 100488. https://doi.org/10.1016/j.gfj.2019.100488.

Elgharbawy, A. 2020. Risk and risk management practices: A comparative study between Islamic and conventional banks in Qatar. Journal of Islamic Accounting and Business Research 11 (8): 1155–1581. https://doi.org/10.1108/JIABR-06-2018-0080.

Ergeç, E.H., and B.G. Arslan. 2013. Impact of interest rates on Islamic and conventional banks: The case of Turkey. Applied Economics 45 (17): 2381–2388. https://doi.org/10.1080/00036846.2012.665598.

Fakhfekh, M., N. Hachicha, F. Jawadi, N. Selmi, and A.I. Cheffou. 2016. Measuring volatility persistence for conventional and Islamic banks: An FI-EGARCH approach. Emerging Markets Review 27: 84–99. https://doi.org/10.1016/j.ememar.2016.03.004.

Fischl, M., M. Scherrer-Rathje, and T. Friedli. 2014. Digging deeper into supply risk: A systematic literature review on price risks. Supply Chain Management: An International Journal 19 (5): 480–503. https://doi.org/10.1108/SCM-12-2013-0474.

Gait, A. H., & Worthington, A. C. (2007). A primer on Islamic finance: Definitions, sources, principles and methods, University of Wollongong Research Online, Australia. Retrieved from https://ro.uow.edu.au/commpapers/341

Gheeraert, L. 2014. Does Islamic finance spur banking sector development? Journal of Economic Behavior & Organization 103: S4–S20. https://doi.org/10.1016/j.jebo.2014.02.013.

Gheeraert, L., and L. Weill. 2015. Does Islamic banking development favor macroeconomic efficiency? Evidence on the Islamic finance-growth nexus. Economic Modelling 47: 32–39. https://doi.org/10.1016/j.econmod.2015.02.012.

Ginena, K. 2014. Sharī‘ah risk and corporate governance of Islamic banks. Corporate Governance (bingley) 14: 86–103. https://doi.org/10.1108/CG-03-2013-0038.

Grassa, R. 2016. Ownership structure, deposits structure, income structure and insolvency risk in GCC Islamic banks. Journal of Islamic Accounting and Business Research 7 (2): 93–111. https://doi.org/10.1108/JIABR-11-2013-0041.

Hamid, B.A., W. Azmi, and M. Ali. 2020. Bank risk and financial development: Evidence from dual banking countries. Emerging Markets Finance and Trade 56 (2): 286–304. https://doi.org/10.1080/1540496X.2019.1669445.

Hamza, H., and Z. Saadaoui. 2013. Investment deposits, risk-taking and capital decisions in Islamic banks. Studies in Economics and Finance 30 (3): 244–265. https://doi.org/10.1108/SEF-Feb-2012-0016.

Hassan, M.K., M. Rashid, A.S. Wei, B.O. Adedokun, and J. Ramachandran. 2019a. Islamic business scorecard and the screening of Islamic businesses in a cross-country setting. Thunderbird International Business Review 61 (5): 807–819.

Hassan, M.K., S. Aliyu, M. Huda, and M. Rashid. 2019b. A survey on Islamic Finance and accounting standards. Borsa Istanbul Review 19: S1–S13.

Hassan, M.K., A. Khan, and A. Paltrinieri. 2019c. Liquidity risk, credit risk and stability in Islamic and conventional banks. Research in International Business and Finance 48: 17–31. https://doi.org/10.1016/j.ribaf.2018.10.006.

Hassan, M.K., O. Unsal, and H.E. Tamer. 2016. Risk management and capital adequacy in Turkish participation and conventional banks: A comparative stress testing analysis. Borsa Istanbul Review 16 (2): 72–81. https://doi.org/10.1016/j.bir.2016.04.001.

Hernandez, J.A., K.H. Al-Yahyaee, S. Hammoudeh, and W. Mensi. 2019. Tail dependence risk exposure and diversification potential of Islamic and conventional banks. Applied Economics 51 (44): 4856–4869. https://doi.org/10.1080/00036846.2019.1602716.

How, J.C., M.A. Karim, and P. Verhoeven. 2005. Islamic financing and bank risks: The case of Malaysia. Thunderbird International Business Review 47 (1): 75–94.

Ibrahim, M.H., and S.A.R. Rizvi. 2018. Bank lending, deposits and risk-taking in times of crisis: A panel analysis of Islamic and conventional banks. Emerging Markets Review 35: 31–47. https://doi.org/10.1016/j.ememar.2017.12.003.

Ibrahim, M.H., and F. Sufian. 2014. A structural VAR analysis of Islamic financing in Malaysia. Studies in Economics and Finance 31: 371–386. https://doi.org/10.1108/SEF-05-2012-0060.

IFSB. (2020). Islamic Financial Services Industry Stability Report. Kuala Lumpur: IFSB.

Imam, P., and K. Kpodar. 2016. Islamic banking: Good for growth? Economic Modelling 59: 387–401. https://doi.org/10.1016/j.econmod.2016.08.004.

Kabir, M.N., A. Worthington, and R. Gupta. 2015. Comparative credit risk in Islamic and conventional bank. Pacific-Basin Finance Journal 34: 327–353. https://doi.org/10.1016/j.pacfin.2015.06.001.

Khan, F. 2010. How ‘Islamic’is Islamic banking? Journal of Economic Behavior & Organization 76 (3): 805–820.

Khediri, K.B., L. Charfeddine, and S.B. Youssef. 2015. Islamic versus conventional banks in the GCC countries: A comparative study using classification techniques. Research in International Business and Finance 33: 75–98. https://doi.org/10.1016/j.ribaf.2014.07.002.

Kisman, Z. 2020. Risk management: Comparative study between Islamic banks and conventional banks. Journal of Economics and Business 3 (1): 232–237. https://doi.org/10.31014/aior.1992.03.01.192.

Kweh, Q.L., W.-M. Lu, M. Nourani, and M.H. Ghazali. 2018. Risk management and dynamic network performance: An illustration using a dual banking system. Applied Economics 50 (30): 3285–3299. https://doi.org/10.1080/00036846.2017.1420889.

Lassoued, M. 2018. Comparative study on credit risk in Islamic banking institutions: The case of Malaysia. The Quarterly Review of Economics and Finance 70: 267–278. https://doi.org/10.1016/j.qref.2018.05.009.

Lee, S.P., M. Isa, and N.A. Auzairy. 2020. The relationships between time deposit rates, real rates, inflation and risk premium: The case of a dual banking system in Malaysia. Journal of Islamic Accounting and Business Research 11 (5): 1033–1053. https://doi.org/10.1108/JIABR-01-2018-0010.

Louhichi, A., and Y. Boujelbene. 2016. Credit risk, managerial behaviour and macroeconomic equilibrium within dual banking systems: Interest-free vs. interest-based banking industries. Research in International Business and Finance 38: 104–121. https://doi.org/10.1016/j.ribaf.2016.03.014.

Louhichi, A., S. Louati, and Y. Boujelbene. 2020. The regulations–risk taking nexus under competitive pressure: What about the Islamic banking system? Research in International Business and Finance. https://doi.org/10.1016/j.ribaf.2019.101074.

Mahdi, I.B.S., and M.B. Abbes. 2018. Behavioral explanation for risk taking in Islamic and conventional banks. Research in International Business and Finance 45: 577–587. https://doi.org/10.1016/j.ribaf.2017.07.111.

Masood, O., J. Younas, and M. Bellalah. 2017. Liquidity risk management implementation for selected Islamic banks in Pakistan. Journal of Risk 19 (S1): S57–S69. https://doi.org/10.21314/JOR.2017.375.

Megeid, N.S.A. 2017. Liquidity risk management: Conventional versus Islamic banking system in Egypt. Journal of Islamic Accounting and Business Research 8 (1): 100–128. https://doi.org/10.1108/JIABR-05-2014-0018.

Mirza, N., B. Rahat, and K. Reddy. 2015. Business dynamics, efficiency, asset quality and stability: The case of financial intermediaries in Pakistan. Economic Modelling 46: 358–363. https://doi.org/10.1016/j.econmod.2015.02.006.

Mohamad, S., J. Othman, R. Roslin, and O.M. Lehner. 2014. The use of Islamic hedging instruments as non-speculative risk management tools. Venture Capital 16 (3): 207–226. https://doi.org/10.1080/13691066.2014.922824.

Mohammad, S., M. Asutay, R. Dixon, and E. Platonova. 2020. Liquidity risk exposure and its determinants in the banking sector: A comparative analysis between Islamic, conventional and hybrid banks. Journal of International Financial Markets, Institutions and Money 66: 101196. https://doi.org/10.1016/j.intfin.2020.101196.

Mokni, R.B.S., A. Echchabi, D. Azouzi, and H. Rachdi. 2014. Risk management tools practiced in Islamic banks: Evidence in MENA region. Journal of Islamic Accounting and Business Research 5: 77–97. https://doi.org/10.1108/JIABR-10-2012-0070.

Mollah, S., M.K. Hassan, O. Al Farooque, and A. Mobarek. 2017. The governance, risk-taking, and performance of Islamic banks. Journal of Financial Services Research 51 (2): 195–219. https://doi.org/10.1007/s10693-016-0245-2.

Neifar, S., and A. Jarboui. 2018. Corporate governance and operational risk voluntary disclosure: Evidence from Islamic banks. Research in International Business and Finance 46: 43–54. https://doi.org/10.1016/j.ribaf.2017.09.006.

Newbert, S.L. 2007. Empirical research on the resource-based view of the firm: An assessment and suggestions for future research. Strategic Management Journal 28 (2): 121–146.

Noor, N.S.M., M.H.M. Shafiai, and A.G. Ismail. 2019. The derivation of Shariah risk in Islamic finance: A theoretical approach. Journal of Islamic Accounting and Business Research 10 (5): 663–678. https://doi.org/10.1108/JIABR-08-2017-0112.

Oz, E., Ali, M. M., Khokher, Z. U. R., & Rosman, R. (2016). Sharī’ah Non-Compliance Risk in the Banking Sector: Impact on Capital Adequacy Framework of Islamic Banks. Working Paper Series: WP-05/03/2016, Kuala Lumpur: IFSB.

Paltrinieri, A., Dreassi, A., Rossi, S., & Khan, A. (2020). Risk-adjusted profitability and stability of Islamic and conventional banks: Does revenue diversification matter?. Global Finance Journal, In press, 100517. https://doi.org/10.1016/j.gfj.2020.100517

Pappas, V., S. Ongena, M. Izzeldin, and A.-M. Fuertes. 2017. A survival analysis of Islamic and conventional banks. Journal of Financial Services Research 51 (2): 221–256. https://doi.org/10.1007/s10693-016-0239-0.

Rashid, M., J. Ramachandran, and T.S.B.T.M. Fawzy. 2017. Cross-country panel data evidence of the determinants of liquidity risk in Islamic banks: A contingency theory approach. International Journal of Business and Society 18 (S1): 3–22.

Rizwan, M.S., M. Moinuddin, B. L’Huillier, and D. Ashraf. 2018. Does a one-size-fits-all approach to financial regulations alleviate default risk? The case of dual banking systems. Journal of Regulatory Economics 53: 37–74. https://doi.org/10.1007/s11149-017-9340-z.

Rosly, S.A., M.A. Naim, and A. Lahsasna. 2017. Measuring Shariah non-compliance risk (SNCR): Claw-out effect of al-bai-bithaman ajil in default. Journal of Islamic Accounting and Business Research 8 (3): 272–283. https://doi.org/10.1108/JIABR-02-2016-0018.

Rosman, R., and A.R.A. Rahman. 2015. The practice of IFSB guiding principles of risk management by Islamic banks: International evidence. Journal of Islamic Accounting and Business Research 6 (2): 150–172. https://doi.org/10.1108/JIABR-09-2012-0058.

Rowley, J., and F. Slack. 2004. Conducting a literature review. Management Research News 27 (6): 31–39.

Saeed, M., and M. Izzeldin. 2016. Examining the relationship between default risk and efficiency in Islamic and conventional banks. Journal of Economic Behavior & Organization 132: 127–154. https://doi.org/10.1016/j.jebo.2014.02.014.

Safiullah, M., and A. Shamsuddin. 2018. Risk in Islamic banking and corporate governance. Pacific-Basin Finance Journal 47: 129–149. https://doi.org/10.1016/j.pacfin.2017.12.008.

Shah, S.A.A., R. Sukmana, and B.A. Fianto. 2020. Duration model for maturity gap risk management in Islamic banks. Journal of Modelling in Management 15 (3): 1167–1186. https://doi.org/10.1108/JM2-08-2019-0184.

Smaoui, H., K. Mimouni, and A. Temimi. 2020. The impact of Sukuk on the insolvency risk of conventional and Islamic banks. Applied Economics 52 (8): 806–824. https://doi.org/10.1080/00036846.2019.1646406.

Sobarsyah, M., W. Soedarmono, W.S.A. Yudhi, I. Trinugroho, A. Warokka, and S.E. Pramono. 2020. Loan growth, capitalization, and credit risk in Islamic banking. International Economics 163: 155–162. https://doi.org/10.1016/j.inteco.2020.02.001.

Sorwar, G., V. Pappas, J. Pereira, and M. Nurullah. 2016. To debt or not to debt: Are Islamic banks less risky than conventional banks? Journal of Economic Behavior & Organization 132: 113–126.

Srairi, S. 2019. Transparency and bank risk-taking in GCC Islamic banking. Borsa Istanbul Review 19 (Supplement 1): 64–74. https://doi.org/10.1016/j.bir.2019.02.001.

Srairi, S. 2013. Ownership structure and risk-taking behaviour in conventional and Islamic banks: Evidence for MENA countries. Borsa Istanbul Review 13 (4): 115–127. https://doi.org/10.1016/j.bir.2013.10.010.

Toumi, K., J.-L. Viviani, and Z. Chayeh. 2019. Measurement of the displaced commercial risk in Islamic Banks. The Quarterly Review of Economics and Finance 74: 18–31. https://doi.org/10.1016/j.qref.2018.03.001.

Touri, O., R. Ahroum, and B. Achchab. 2020. Management and monitoring of the displaced commercial risk: A prescriptive approach. International Journal of Emerging Markets. https://doi.org/10.1108/IJOEM-07-2018-0407.

Trad, N., M.A. Trabelsi, and J.F. Goux. 2017. Risk and profitability of Islamic banks: A religious deception or an alternative solution? European Research on Management and Business Economics 23: 40–45. https://doi.org/10.1016/j.iedeen.2016.09.001.

Tranfield, D., D. Denyer, and P. Smart. 2003. Towards a methodology for developing evidence-informed management knowledge by means of systematic review. British Journal of Management 14 (3): 207–222.

Wahab, H.A., B. Saiti, S.A. Rosly, and A.M.M. Masih. 2017. Risk-Taking Behavior and Capital Adequacy in a Mixed Banking System: New Evidence from Malaysia Using Dynamic OLS and Two-Step Dynamic System GMM Estimators. Emerging Markets Finance and Trade 53 (1): 180–198.

Warninda, T.D., I.A. Ekaputra, and R. Rokhim. 2019. Do Mudarabah and Musharakah financing impact Islamic Bank credit risk differently? Research in International Business and Finance 49: 166–175.

Wiryono, S.K., and K.A. Effendi. 2018. Islamic Bank Credit Risk: Macroeconomic and Bank Specific Factors. European Research Studies Journal 21 (3): 53–62.

Yahya, M.H., J. Muhammad, and A.R.A. Hadi. 2012. A comparative study on the level of efficiency between Islamic and conventional banking systems in Malaysia. International Journal of Islamic and Middle Eastern Finance and Management 5 (1): 48–62.

Zaher, T.S., and M. Hassan. 2001. A comparative literature survey of Islamic finance and banking. Financial Markets, Institutions & Instruments 10 (4): 155–199.

Zainol, Z., and S.H. Kassim. 2012. A critical review of the literature on the rate of return risk in Islamic banks. Journal of Islamic Accounting and Business Research 3: 121–137.

Zheng, C., S. Moudud-Ul-Huq, M.M. Rahman, and B.N. Ashraf. 2017. Does the ownership structure matter for banks’ capital regulation and risk-taking behavior? Empirical evidence from a developing country. Research in International Business and Finance 42: 404–421.

Zhou, G., and G. Ye. 1988. Forward-backward search method. Journal of Computer Science and Technology 3 (4): 289–305.

Zins, A., and L. Weill. 2017. Islamic banking and risk: The impact of Basel II. Economic Modelling 64: 626–637.

Zorn, T., and N. Campbell. 2006. Improving the writing of literature reviews through a literature integration exercise. Business Communication Quarterly 69 (2): 172–183.

Funding

We did not receive any funding to complete this study.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix A1: List of journals reviewed

Appendix A1: List of journals reviewed

No | Name of the journal |

|---|---|

1 | Applied economics |

2 | Borsa Istanbul review |

3 | Business & society |

4 | Corporate Governance (Bingley) |

5 | Corporate Governance: The International Journal of Business in Society |

6 | Economic modelling |

7 | Emerging markets finance and trade |

8 | Emerging markets review |

9 | European research studies journal |

10 | Global business review |

11 | Global finance journal |

12 | Journal of banking & finance |

13 | Journal of economics and business |

14 | Journal of financial services research |

15 | Journal of financial stability |

16 | Journal of International financial markets, institutions, and money |

17 | Journal of Islamic accounting and business research |

18 | Journal of risk |

19 | Pacific-basin finance journal |

20 | Research in International business and finance |

21 | Review of finance |

22 | Review of financial economics |

23 | Risk management |

24 | SAGE open |

25 | Studies in economics and finance |

26 | The quarterly review of economics and finance |

27 | Venture capital |

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Hassan, M.K., Sohel, M.N.I., Choudhury, T. et al. A systematic literature review of risks in Islamic banking system: research agenda and future research directions. Risk Manag 26, 3 (2024). https://doi.org/10.1057/s41283-023-00135-z

Accepted:

Published:

DOI: https://doi.org/10.1057/s41283-023-00135-z