Avoid common mistakes on your manuscript.

1 Introduction

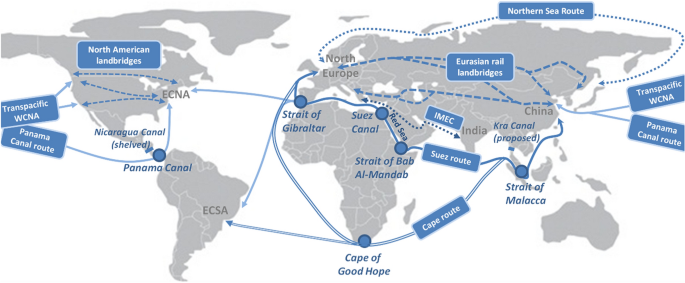

The attack of Hamas on Israel of October 7, 2023, and the military response of the latter in Gaza have made news headlines for much of the last quarter of 2023 and early 2024. The international community has attempted to prevent escalation and the spreading of the conflict to other parts of the Middle East and the wider world. Despite those efforts, a major security situation emerged in mid-November in the Red Sea and the Strait of Bab al-Mandab more specifically (map in Fig. 1), when Houthi Rebels based in Yemen started to target international shipping transiting through the region. In a matter of weeks, the situation escalated, adversely affecting both shipping and trade.

The Red Sea crisis is yet another major disruption affecting the dynamics in shipping and logistics. In the past few years, interoceanic passages and routes have been significantly affected by a series of weather anomalies (e.g., the drought which has reduced the capacity of the Panama Canal by 36% (Associated Press 2024), military conflicts (e.g., the Russia–Ukraine war; the Gaza-Israel crisis), and nautical accidents and vessel groundings (e.g., the ‘Ever Given’ incident, when the Suez Canal was blocked for six days in March 2021, at a cost to trade of USD10 billion a day).

This editorial provides not only insights into the course of events which have occurred during the Red Sea crisis, but it also analyzes the short-term—and probably longer-term—impacts of the Red Sea crisis on vessel operations and shipping networks; freight rates and pricing practices; and on global supply chains. The Editorial was finalized on February 13, 2024. As the Red Sea crisis is still unfolding at the time of writing, the Editorial focuses primarily on the early impacts of the crisis on the shipping industry and global supply chains. The full impacts can only be known with some degree of accuracy once the crisis has come to an end or has been contained in such a way that the levels of uncertainty and insecurity faced by shipping and trade have been reduced to acceptable levels. However, it remains unclear under what conditions shipping lines will consider the Red Sea as a safe passage. Will they resume vessel transits when the Red Sea is without incidents for X number of days, or alternatively, will the Red Sea passage be considered safe only when Houthi rebels formally agree to stop all actions after negotiation talks or military intervention?

2 Prelude and course of events

The current crisis in the Red Sea has been brewing for some time, with its origins in the ongoing civil war in Yemen between the internationally recognized government, operating out of Saudi Arabia, and the Houthi militia. While the former is primarily backed by Saudi Arabia and an international coalition, the latter has the support of both Iran and troops allegiant to the former President Ali Abdullah Saleh (Guzansky and Eran 2018).

The roots of the civil war in Yemen are far too complex to analyze in this editorial; this would be beyond our scope anyway. However, one might not be totally wrong in seeing this conflict which, in ten years, has claimed the lives of more than a quarter of a million people due to the hostilities and their consequences, as the terrain of Saudi-Iranian rivalries. With the acceptance of the two countries into the BRICSFootnote 1 in August 2023 (effective January 1, 2024), the world had hoped that a kind of rapprochement among the two arch-rivals was on the horizon, engineered by China: Saudi Arabia’s biggest oil buyer. Unfortunately, at the January 2024 Davos meeting in Switzerland, Saudi Arabia announced that “Saudi Arabia has not yet joined BRICS” (Reuters 2024c). Apparently, the country’s indecisiveness is not totally independent of either the evolution of the Gaza/Red Sea situation or of the, again, heightened frictions between China and the US, in spite of the warm encounter of the two leaders at the San Francisco APEC meeting of November 2023.

In 2014, the Houthi militia succeeded in capturing the main ports and cities along Yemen’s Red Sea coast. What started as a civil war, confined solely to Yemen, soon escalated into a regional conflict, with a Saudi-led military intervention in support of the government in March 2015 (Hokayem and Roberts 2016). This intervention was primarily aimed at ensuring the security of the Bab al-Mandab strait: a chokepoint at the southern entrance to the Red Sea (see Fig. 1). Shared by Yemen, Eritrea and Djibouti, the Bab al-Mandab chokepoint is the Cerberus that ‘guards’ the entrance to the Red Sea. The Strait has a width of something less than 30 km and it is divided into two channels by Perim Island (Al-Yadomi 1991). The Strait makes the strategic importance of the Gulf of Aden even more pronounced, with most major powers, starting with China (in Djibouti) and the US, maintaining a military presence in the Gulf which has traditionally been plagued by high levels of piracy activity and illegal arms trafficking over the dark web and in other ways. International cooperation initiatives and regional laws (e.g., Djibouti’s) have been rather unsuccessful in improving the security situation in the Gulf.

The relative success of the Saudi military intervention in 2015 has not, however, prevented the Houthi militia from engaging in maritime reprisals since that time. Using drone boats, cruise missiles, speedboats, and mines (Knights and Mello 2015; Abdullah and Singh 2018), the narrowness of the Bab al-Mandab strait has been utilized by the Houthi militia to instigate sporadic attacks mainly, but not exclusively,Footnote 2 against Saudi military vessels and oil cargoes, ultimately driving Saudi Arabia to suspend its oil exports through the Bab al-Mandab strait (Orkaby 2021).

When Israel started its military action against Hamas in Gaza in mid-October 2023, Muslim countries and groups such as Hezbollah did not declare war on Israel. The notable exception was the Ansar Allah (Partisans of God) group: Houthi rebels who control the west of Yemen including most of its Red Sea coast near the Strait of Bab Al-Mandab. In early November 2023, the Houthi launched long-range ballistic missiles at Israel, but all were intercepted by the US and the Saudi military. From mid-November 2023, the Houthi militia started to focus more on attacking merchant vessels. Initially, hijacking actions were conducted such as on the roro vessel Galaxy Leader. This was soon followed by attacks on merchant vessels traveling through the lower Red Sea and the Strait of Bab Al-Mandab, using drones, missiles, and gunmen on speedboats. While the Houthi initially claimed they were only targeting merchant vessels traveling to or from Israel or of Israeli ownership, it soon became evident that also ships of countries supportive of Israeli actions in Gaza were being attacked.

By mid-December 2023, security threats escalated to the point where Maersk, MSC, BP, and other shipping groups suspended canal passages or started to reroute traffic via the Cape of Good Hope. At the same time, a maritime coalition to defend shipping against attacks was initiated. Table 1 provides an overview of the main incidents and events during the Red Sea crisis, listing the many (mostly failed) attacks on cargo ships. When the lack of security in the region started to hurt international shipping and trade, a growing international reaction emerged, led by the US. A key statement was made on December 18, 2023, by US Secretary of Defense Lloyd Austin, explicitly referring to the freedom of navigation and resulting in the establishment of Operation Prosperity Guardian:Footnote 3

The recent escalation in reckless Houthi attacks originating from Yemen threatens the free flow of commerce, endangers innocent mariners, and violates international law. The Red Sea is a critical waterway that has been essential to freedom of navigation and a major commercial corridor that facilitates international trade. Countries that seek to uphold the foundational principle of freedom of navigation must come together to tackle the challenge posed by this non-state actor launching ballistic missiles and unmanned aerial vehicles (UAVs) at merchant vessels from many nations lawfully transiting international waters. (U.S. Department of Defence, 2023).

The situation escalated further in early January 2024, with a massive Houthi attack on January 10, followed on January 12 by the first counterstrike by air on Yemen territory by US and UK military forces. Between mid-November and mid-February, some 40 Houthi attacks have been carried out on vessels transiting the southern Red Sea and the Gulf of Aden. Damage on ships has been minimal in most cases, mainly thanks to the interception and neutralization of a large number of Houthi missiles, drones, and speedboats by warships in the region. By the third week of January, the attacks were spreading in terms of both geography (i.e., no longer only in the southern part of the Red Sea but also in the Gulf of Aden) and the scope of the targets (i.e., also targeting naval vessels). The expanding geographical scope of the risk zone makes it increasingly difficult for the navies, who are having to spread their already limited assets over a wider area.

The threat of retaliations from both sides has brought security concerns into a new phase. The Houthi militia—as certain analysts foresee—might even aim for a direct confrontation with the US. Such an escalation in the Red Sea crisis could undermine the ongoing peace talks between the Houthi and Saudi Arabia who, as mentioned earlier, have been involved in a bloody war since 2015. Concerns also persist that the situation could escalate still further if a successful Houthi attack were to result in fatalities on board vessels and/or the sinking of cargo ships transiting the Red Sea. However, the security situation could improve significantly overnight, in case an agreement is reached, between all parties concerned, on a longer-term ceasefire in Gaza.

3 Supply chain impacts

The Red Sea is one of the world’s major interoceanic trade passages with two entries: the Suez Canal in the North and the Bab al-Mandab Strait in the south. According to the US Energy Information Administration (2023), an annual average of 8.8 million barrels of oil shipments pass through the Bab al-Mandab strait each day, representing 8.7% of the global demand of 101.7 million barrels per day in December 2023 (International Energy Agency 2023). The Suez Canal route is normally used by nearly one-third of global container traffic and around 12–15% of global goods trade (UNCTAD 2024). Data from Lloyd’s Intelligence show that about 1500 merchant vessels per month would normally transit the Suez Canal before the start of the Red Sea crisis in mid-November. Changes in the composition of the vessels transiting the Suez Canal over time can be inferred from Fig. 2. While the full impact of the Red Sea crisis on shipping and global supply chains is yet to be seen, businesses and shipping lines are trying, as far as possible, to mitigate the potential logistics ramifications of the crisis. This section explores the major current and potential future impacts of the Red Sea crisis by examining (a) the impacts on vessel operations and shipping network configurations, (b) changes in freight rates and surcharge practices, and (c) broader ramifications for global supply chains.

Source Own elaboration based on data from UNCTAD (2024).

Index of Daily Transits of the Suez Canal by Vessel Type 2016–2024 (Average value = 100).

3.1 Vessel rerouting

The attacks carried out by the Houthi militia have clearly and dramatically reduced trade through the Suez Canal, as shipping lines have opted to reroute their vessels on the significantly longer voyage around the Cape of Good Hope. In the absence of any ports of call at all, Seadistance.net (2024) suggests that circumnavigating Africa as an alternative route to the Suez Canal adds 4575 nautical miles in sailing distance between Shanghai and Rotterdam and 12 days in additional sailing time, assuming an average speed of 16 knots. Table 2 presents our estimates based on the characteristics of a typical weekly liner service on the Asia–North Europe trade route, and assuming an average speed increase of only one knot in the case of Cape rerouting. The diversion around the Cape causes total sailing distance to increase by 29%, while total round voyage time goes up by 17%.

Irrespective of the additional costs and time involved, however, the vast majority of large container carriers have suspended Red Sea operations, while the fleets of a number of smaller niche and regional operators continue to use the Red Sea. CMA CGM was the only large container carrier still transiting the Red Sea with the help of escorts by the French navy. Eventually, the French carrier also switched to the Cape route in early February 2024.

Linerlytica data show that between December 15, 2024, and January 7, 2024, a total of 354 container ships have been diverted to the Cape route, representing a capacity of 4.65 million TEU or 16.4% of the global container fleet (Container News 2024). Clarksons Research came up with similar figures for January 9, 2024: 364 containerships with a capacity of 4.2 million TEU (Wright 2024). These figures suggest that about 80% of all containerships that would normally pass via the Suez Canal were rerouted via the Cape. In late December 2023, Goldman Sachs already reported that the Red Sea crisis affects approximately 30% of global container trade with 70 to 80% of vessels having been rerouted, while UNCTAD (2024) estimates that the trade volume going through the Suez Canal decreased by 42% over the last two months. When examining the liner service announcements of carriers and alliances, it becomes apparent that rerouting via the Cape will continue into February 2024 (Xeneta 2024a). Obviously, carriers can shift back to the Suez route earlier should the security situation in the Red Sea, Bab al-Mandab, and the Gulf of Aden suddenly improves. The wide adoption of rerouting vessels via the Cape of Good Hope has several impacts:

-

1.

Impact on fleet capacity The mass rerouting of vessels via the Cape requires significantly more fleet capacity to transport the same quantity of goods, in the same time interval and port call frequency. A typical North Europe–Asia liner service requires 11 to 12 vessels to guarantee a weekly frequency. Assuming commercial vessel speeds remain unchanged (i.e., 15 to 17 knots for a typical container vessel), the additional sailing time associated with the Cape route diversion implies that at least two vessels will have to be added to such a loop in order to maintain a weekly departure schedule. On the positive side, the rerouting allows carriers to absorb some of the fleet overcapacity that has entered the market since the second half of 2022. On the negative side, though, the sudden changes in fleet deployment will inevitably result in short-term capacity constraints, with a shortage of slot space for shippers likely to occur in the period immediately before the Chinese New Year (CNY). MDS Transmodal estimates that 2.6 m TEU of slot space is required to address the shortfall in capacity caused by the diversions (Nightingale 2024). This represents some 200 extra vessels, taking into account the ship sizes deployed and the region served. Moreover, carriers are reinstating services, suspended earlier due to COVID-19 (blank sailings). At the same time, as a direct result of the vessel ordering spree of 2021 and early 2022, a lot of new capacity is scheduled to enter the market in 2024: 478 vessels totalling approximately 3.1 million TEU, beating the previous record of 2023 by 41%. Although the recycling of ships is also expected to increase, this will not offset the scale at which capacity is being added to the market: with an anticipated net growth of approximately 10%, total capacity in the market is foreseen to exceed 30 million slots (Rasmussen 2024).

-

2.

Initial shock effect in the global shipping network The Red Sea disruptions have resulted in a short-term shock effect in the container business. For example, the Asia–Europe route was heavily impacted in late December 2023 and early January 2024 given the uncertainty and volatility surrounding the decisions of carriers to halt Red Sea transits or to start rerouting via the Cape. Some vessel departures were held back in Asia, while others changed course during their voyage (even multiple times) or faced ad hoc changes in port call sequences. Ultimately, the vast majority of large container carriers decided to suspend Red Sea operations, which eventually rendered greater clarity on key logistics variables, such as expected transit times and available vessel capacity. For example, in late January 2024, 2M partners Maersk and MSC announced that they have reset their schedules for container services between Asia and the USEC through the end of March with diversion via the Cape route. This is part of broader changes to the Asia–Europe and trans-Pacific network with new rotations around the Cape, thus implying a more permanent round-Africa solution.

-

3.

The Mediterranean Sea as a temporary cul-de-sac The rerouting of vessels via the Cape implies that the role of the Mediterranean Basin, Romans’ ‘Mare Nostrum’ and, to some (Haralambides 2023), the ‘hub-of-hubs’ that connects four continents, may be seriously affected. The Mediterranean Sea has become a de facto maritime cul-de-sac, with vessels entering and exiting via the Straits of Gibraltar. In the container market, this unique situation might incentivize carriers to split services on core Asia–Europe routes by making more intensive use of transshipment hubs near the Straits of Gibraltar; i.e., not only Tanger Med and Algeciras, but also Sines and Valencia—possibly continuing on their way to the US East Coast-, and the large north European hubs (Rotterdam, Antwerp-Bruges, Hamburg to name but a few). Similar alternatives (i.e., of splitting services to US East Coast, southern and northern Europe) could potentially be offered by the West African ports of Abidjan, Cotonou, Lagos and Lomé (Chen et al. 2020). Such operational contingency measures would alleviate the pressure on the utilization of the larger deep-sea vessels and make it somewhat easier to address any capacity shortfalls caused by rerouting via the Cape.

-

4.

Higher ship emissions The rerouting around the Cape and the longer sailing distances, increase total bunker consumption and ship emissions. Furthermore, the longer roundtrip times imply that at least two ships should be added to an Asia–Europe service to sustain weekly departures. The additional ships also add to total fleet emissions for a given cargo demand. For a typical Asia–North Europe weekly liner service, the increase in emissions at sea associated with Cape rerouting can be estimated at 42% for an individual vessel and 67% for the fleet needed to operate a weekly service on this trade route (see Table 2 for further details). These additional emissions are bad news for an industry that has to consider IMO’s indicative checkpoints (IMO 2023) of reducing emissions by at least 20%, and striving for 30%, by 2030 compared to 2008 levels, and at least 70%, striving for 80%, by 2040, reaching net-zero “by or around (i.e., close to) 2050.”

-

5.

Lower toll revenues for Suez Canal Authority (SCA) Fewer Suez Canal transits have resulted in significantly lower toll revenues for Egypt. In the fiscal year 2022-2023, tolls had reached a record USD 9.4 billion (Reuters 2023), representing 2% of the country’s GDP. Understandably, Egypt is eager to protect this major source of revenue. However, SCA reported about 40% less toll revenues in the first two weeks of 2024, compared to the same period in 2023 (Reuters 2024a). Using the above data on rerouted container vessels, it can be estimated that the SCA suffered a loss of USD 175 to 350 million of canal transit fees, only from container vessels, between December 15, 2023 and January 9, 2024.

The Red Sea crisis adds to the call for more routing flexibility in the global transport network. Bottlenecks (or, better, chokepoints) in the global shipping network such as Bab al-Mandab, or the Red Sea by and large, are manyFootnote 4 and so have been the various plans to bypass them, motivated by concerns about the security of navigation and of naval deployments (Haralambides and Merk 2020). China, for instance, is not particularly happy with the Straits of Malacca and she has often been found willing to look into, even finance, the Kra Canal, which would cut Thailand in half, bypassing the Straits of Malacca, much to the disgruntlement of Singapore (Peng Er 2018; Tseng and Pilcher 2022). Among other benefits, this would save more than three days in navigational time.Footnote 5 The Panama Canal chokepoint has given rise to the now defunct idea of building the Nicaragua canal (Yip and Wong 2015; Chen et al. 2019). Presently, a Maglev technology tunnel in northern Colombia, connecting the Atlantic and the Pacific oceans in 30 min over a distance of 130 km, is in search of private investors. Similar ideas, to bypass the Red Sea, are not missing either: The latest is the India–Middle East–Europe Corridor (IMEC), while the Arctic North Sea Route (NSR) is a niche alternative to Suez examined and tested over many years (see Fig. 1 for an overview of routing alternatives on the main east–west trade routes).

3.2 Freight rates and surcharges

As might be expected, the Red Sea crisis has had a noticeable impact on spot freight rates. The Shanghai Containerized Freight Index (SCFI) for North Europe increased from 707 USD/TEU in mid-November to 3103 USD/TEU in the third week (W3) of January 2024 (+ 339%), followed by a small decrease to reach 2723 USD/TEU in W6 2024. The massive freight rate increases remained much lower, however, than the record freight rates encountered during the COVID-19 years (2021–early 2022), close to 8000 USD/TEU. The SCFI for the Med recorded a 252% increase in the same period, to reach 4037 USD/TEU in W3 2024 (Fig. 3), followed by a modest drop to 3753 USD/TEU in week 6. It should be noted that sailings to Mediterranean ports are significantly longer due to the situation in the Red Sea. Other indices report similar increases. The Drewry World Container Index for transporting an FEU from China to North Europe surged to USD 4,406 in mid-January 2024 (+ 282% compared to mid-November 2023). Data from Xeneta (2024b) show ocean freight rates from the Far East to North Europe to have increased by 124% since the crisis escalated in mid-December 2023. Freight rate increases are also in part a result of growing fears of insufficient shipping capacity and containers, to transport products before the Chinese New Year Spring Festival.

Rate impacts can also be found in other trade routes, mainly in the Trans-Pacific (SCFI of 3974 USD/TEU in mid-January 2024) and the China–East Coast North America (ECNA) routes (5813 USD/TEU). The latter route has been strongly impacted by the combined effect of the Red Sea crisis and the Panama Canal’s low water levels which have severely restricted the daily vessel transits since early 2023.Footnote 6 The low water situation in the Panama Canal had already caused notable changes to vessel routings, with diversions of quite a few Asia–ECNA services from the Panama Canal route to Suez. However, with the emergence of the Suez crisis, there has been significant motivation for Asian-sourced cargoes, bound for ECNA destinations, to utilize transpacific routings to access land-bridge rail services from US West Coast ports. A lateral impact of this trend would be the revival of WCNA port throughputs, which have been losing out constantly to ECNA ports (Kent and Haralambides 2022; Cariou and Notteboom 2023).

Long-term contract rates in container shipping might also be impacted by the Red Sea crisis. If the current situation persists for long, new contracts will be negotiated at much higher rates than before the outbreak of the crisis. Also, container carriers might no longer honor long-term contracts, pushing shippers onto the spot market. In particular, carriers might opt for contracts of the lowest agreed rates, considering them of lower value, vis à vis spot rates. This can have operational implications for shippers, such as an increased risk of container rollings.Footnote 7

The higher freight rates are a combined result of capacity being absorbed by the longer Cape route, which reduces available slots per unit of time, by the additional fuel costs involved in this route due to the longer distance, and by the negative shipper expectations about the (un)availability of capacity going forward. Ancillary costs such as insurance have also increased. Insurance risk premiums for sailing through the high-risk area increased from 0.07% of the value of a ship in early December 2023 to about 0.5% to 0.7% in mid-January 2024 (Economist Intelligence Unit 2024). According to Bloomberg (2024), vessel insurance for passing the Bab Al-Mandab Strait has increased to 0.75–1% of the vessel value by the third week of January 2024. This implies USD 1.1 to 1.5 million in insurance costs for a 20,000 + TEU container vessel of a value of USD 150 million. In spite of the elevated insurance and fuel costs, the savings from not having to pay canal feesFootnote 8 reduce significantly the cost differential between the two routes. This gives carriers even less incentive to return to the Suez routing if risk levels (and associated insurance costs) remain high. In the bulk charter market, ship owners and charterers are attempting to balance the risks associated with a Red Sea transit. From a legal point of view, it is difficult to refuse a voyage when insurers are still prepared to insure it. However, the surge in insurance costs has made it much easier for the parties involved to agree on a rerouting via the Cape.

The additional net costs of rerouting have prompted carriers to announce special surcharges. Since late November 2023, most container carriers have introduced ‘war risk surcharges’ for shipments to and from Israel. On December 20, 2023, CMA CGM introduced a ‘Red Sea Charge’ of USD 2700 per FEU for all cargo shipped to or from Red Sea ports. The carrier also implemented a ‘contingency charge’ of USD 1000 per FEU on the westbound Asia–Med route and USD 525 per FEU for eastbound Europe–Asia shipments. In early January 2024, MSC introduced a ‘contingency adjustment charge’ of USD 500 per TEU and USD 1000 per FEU on the Europe–Asia and Europe–Middle East routes. Hapag-Lloyd uses a similar ‘operational recovery surcharge.’ Maersk applies a ‘Transit Disruption Surcharge’ for cargo on vessels affected by the disruptions. The surcharge amounts to USD 400 per FEU and applies to bookings between December 21, 2023, and January 28, 2024. As the service disruptions impact the flow of empty equipment, a number of carriers have also implemented empty equipment imbalance surcharges. The above surcharges come on top of other widely used surcharges such as the bunker adjustment factor (BAF; a fuel surcharge) or peak season surcharges.

Despite the higher freight rates, the Red Sea crisis and diversions around the Cape are not expected to structurally improve the demand/supply imbalance in the container market. As mentioned earlier, a lot of new vessel capacity will become operational in 2024 and 2025, exceeding demand expectations, even considering the need for additional vessels to compensate for the longer sailing distances around the Cape. It is highly likely that the Red Sea crisis will prove to be merely a delaying factor in the growing overcapacity situation in liner shipping. In other words, the global container market is getting so heavily oversupplied with new vessels that there is ample room to cover the current scale of the Red Sea disruptions. Carriers started to reschedule their services in late January 2024, and the peak effect before the Chinese New Year has already been discounted. Overcapacity adds further downward pressure on freight rates in the medium term. In early February 2024, major carriers such as Maersk suggested that they do not expect the crisis to significantly improve the operating margins in the industry for the year 2024. A lot will depend on how long the Red Sea crisis will last.

3.3 Broader supply chain impacts

The Red Sea crisis affects trade conditions and shippers are challenged to build resilience and work on contingency plans until confidence in the security of the Red Sea route has been restored. Shippers try to adapt to a new Cape route reality by diversifying their supply chains and looking at alternative routes and transport modes.

The crisis is generating a heightened interest in Eurasian overland rail services, which are faster but more expensive than seaborne transport. Transit times on the most northern rail corridor connecting China via Kazakhstan and Russia to Poland and Western Europe typically range between 15 and 25 days, with freight rates ranging from 7000 to 15,000 euro per container. The Eurasian rail services primarily constitute a niche option for high-value cargo in limited quantities, so their overall share in Asia–Europe trade is expected to remain rather modest.

Next to a growing interest in Eurasian rail services, there is also a visible interest in combined air and sea transport. There has also been an upward surge in demand (and freight rates therefore) for air cargo transport of high-value shipments from Asia to Europe, particularly from the Middle East to both Europe and the US. For example, Freightos reported that the average air freight cost on the Middle East to Europe route increased 35% to USD 2.03 per kg in the period between mid-December 2023 and mid-January 2024. By including air transport in the supply chain, a part of the delays and uncertainties can be avoided. The additional cost of expensive air freight solutions can be accepted, particularly when there exists a severe risk of production stoppages or empty shelves.

The massive vessel rerouting via the Cape can result in congestion in alternative routes which in its turn will also impact the supply chain. The longer transit times associated with the Cape route have generated some short-term impacts for shippers. The latter are confronted with much higher floating inventories and delayed deliveries, i.e., with higher unreliability that strikes at the heart of efficient global logistics. These effects affect particularly industries that rely on just-in-time (JIT) and make-to-order (MTO) delivery and production systems. For example, in the automotive industry, Tesla suspended production at its Gigafactory Berlin–Brandenburg between January 29 and February 11 due to a discontinuation in the constant flow of components from Asian suppliers to the German plant caused by vessel reroutings (Reuters 2024b). Volvo Cars in Ghent (Belgium) ceased production for three days in mid-January, also due to a shortfall of components (Reuters 2024b). Suzuki Motor suspended production at its plant in Hungary between 14 and 21 January 2024 (NHK 2024). The fruit and vegetable business is another sector impacted by the longer transit times. These examples show that MTO/JIT based production facilities and supply chains feel immediately the effects of any major disruption to the clockwork operations of the global production/distribution systems. Such short-term shortages of components and products increase the risk of a bullwhip effect (Lee et al. 1997), whereby small fluctuations can be amplified and cause bigger repercussions along the chain, such as in seaports. The sudden switch to the Cape route in the early weeks of the Red Sea crisis was most impactful. However, by late January, some shipping lines started to adjust their schedules to fit the new Africa routing reality. This significantly reduced uncertainty about maritime transit times, allowing supply chain planners to implement more robust solutions for streamlining the goods flow.

Another direct effect of the Red Sea crisis is box availability concerns. Longer roundtrip times and adjusted sailing routes mean that quite a number of empty containers end up in the wrong place at the wrong time. The Baltic Exchange (2024) estimated a shortfall of about 780,000 TEUs in Asia just prior to the Chinese New Year. To relieve some of the pressure, the production of new boxes (mainly in China) has grown since late December 2023.

A number of commentators have been seeing the timing of the Red Sea crisis as the preamble of a ‘perfect storm’ in global supply chains: Fast rising freight rates and surcharges; longer transit times for ships urgently required in Asia to load before the Chinese New Year; and box availability issues, all compounded by the enduring capacity restrictions experienced at the Panama Canal, they indicate a metaphorical ‘perfect storm.’ In such a situation, shippers are anxious to secure vessel and box capacity from freight forwarders and carriers, and this comes at a price. Still, there is the general feeling that the current crisis is far more manageable compared to what supply chains had to endure during the COVID-19 disruptions. In a way, this is partly explained by the fleet capacity situation, in terms of (un)availability, which was far worse then (see Notteboom et al. 2021; Cullinane and Haralambides 2021; Cullinane et al. 2023 for a more detailed analysis).

4 Quo vadis: temporary adaptation or structural adjustment?

Shipping, global logistics, and ports are operating in a volatile environment characterized by uncertainty and risks imposed on their stakeholders not only by the external environment, but also by their own actions and business decisions.

It is not unimaginable that, during 2024, the Red Sea crisis will be combined with other disruptions such as extreme weather events or geopolitical tensions. These could extend the period of supply chain unreliability, witnessed by both shipping and ports since the outbreak of the COVID-19 crisis in 2020 (Notteboom et al. 2021; Cullinane and Haralambides 2021; Cullinane et al. 2023). In a ‘VUCA’ world (Volatile, Uncertain, Complex, and Ambiguous; Bennet and Lemoine 2014), turbulence in shipping markets is likely to persist, requiring resilience and proactive planning to withstand additional shocks.

If the security situation in the Red Sea does not improve significantly in Q2 2024, this might lead to an increased risk of inflationary pressures, depending on how long the disruption persists and whether other disruptions emerge. In the meantime, decision-makers in supply chains will seek to implement short-term solutions to the difficulties faced. This has already resulted in:

-

(a)

Rerouting of vessels A fairly speedy rerouting of maritime flows which may well persist into the medium-term, depending on how the Red Sea crisis evolves;

-

(b)

Using modal alternatives greater use of modal alternatives, primarily of rail (particularly Eurasian and US land-bridges); and

-

(c)

Supply chain redesign a revamping of sourcing, supply chain configurations, and production schedules.

Depending on how events evolve, some interesting questions arise as to whether some of the above short-term, adaptive, steps (fire-fighting) will be accepted and adopted as longer-term logistics solutions—i.e., as structural adjustments:

4.1 Rerouting of vessels

The Cape route is not discovered today. As a matter of fact, circumnavigating Africa has been the sole alternative in the Asia–Europe trades during the Arab–Israeli wars (the Suez Crisis of 1956; the Six-Day war of 1967 and the Yom Kippur war of 1973), and whenever there was intensification of piracy activities in the Red Sea, high bunker prices and need for slow steaming, exorbitant hikes in Suez Canal tolls, etc. (Notteboom and Rodrigue 2011a, b; Notteboom 2012). Incidentally, the Cape Route does not serve only Europe, but ships, on their way there, or to the Americas, can tranship at South African ports, thus also serving both East and West Africa (see Fig. 1). Two other, perhaps more ‘radical,’ alternatives to Suez are the Arctic Northern Sea Route (NSR) and the recently announced India–Middle East–Europe Corridor (IMEC).

Irrespective of the current crisis, the NSR has been studied for years and major companies such as Cosco and Maersk have experimented with its use. The route is 40% shorter compared to Suez and, as a result of the accelerating melting of Arctic ice, NSR could claim an increasing share of the Suez traffic, in the bilateral trade between China and the European Union which approaches rapidly 1 trillion USD (Lee and Kim 2015; Solvang et al. 2018; Tseng and Cullinane 2018; Theocharis et al. 2019; Xu et al. 2011). In theory, the NSR can serve as an all-water alternative to the Suez route, particularly to connect East Asia to Northern Europe. However, extant studies on NSR show that the economic feasibility of developing container shipping along this route is very low and a number of major container carriers have even pledged not to develop the NSR option for environmental reasons (Verny and Grigentin 2009; Zhu et al. 2018). In the Summer of 2023, NSR shipping activity included the first and very modest regular container service between Asia and Europe operated by the Chinese NewNew shipping line using four small container vessels with capacities ranging from 1200 to 2800 TEUs (Humpert 2024). For now, the NSR remains a niche route for some energy- and mining-related maritime trade such as the transit of Norwegian LNG to Japan, or the shipment of hydrocarbons out of the Arctic (Schøyen and Bråthen 2011; Gunnarsson and Moe 2021).

The USD20 billion IMEC project, which also shortens distances by 40%, was introduced by the leaders of the G20 summit in India (September 2023), as a concept circumventing the Red Sea and as a counterbalance to China’s Belt and Road Initiative (BRI). The concept involves sea-leg, connecting West India to the UAE: a railway line traversing Saudi Arabia, ending through Jordan to the Israeli ports, to be concluded by a final second maritime link to the southern European ports of Piraeus, Genova, and Marseilles.Footnote 9

As said above, a much less radical alternative and longer-term routing solution may be offered by cargoes that have up to now been moving from Asia to the US East Coast via Suez and now, during this crisis period, could switch via the Transpacific to the US West Coast ports in order to access US land–bridge rail services. A lateral impact of this trend would be the revival of WCNA port throughputs, which have been losing out consistently to ECNA ports in recent years (Kent and Haralambides, 2022; US Department of Transportation 2023).

4.2 Using modal alternatives (rail, air)

If the appropriate level of service quality is successfully delivered by the alternative modal options that are being experimented with during this crisis, could this mean that a share of the market (however, small and, however, inexorably associated with high value and/or time-sensitive cargoes) is forever lost to container shipping?

4.3 Supply chain redesign

Will the short-term fixes that are currently implemented provide impetus to more radical and permanent longer-term solutions? At the extreme, does a ‘VUCA world’ undermine the concept of globalization to such an extent that ‘reshoring,’ ‘nearshoring,’ and ‘friendshoring’ begin to emerge as trending supply chain strategies (Hartman et al. 2017; Piatanesi and Arauzo-Carod 2019; Maihold 2022; Van Hassel et al. 2022; Javorcik et al. 2023)

Whatever short-term or longer-term solutions are implemented for counteracting the difficulties caused by the current Red Sea crisis, it is to be hoped that this experience will again reinforce the need for greater supply chain resilience (Tukamuhabwa et al. 2015) in the face of major disruptions to normal shipping operations. It remains to be seen, however, if the most important lessons learned during the COVID-19 pandemic can be put to good use in assuaging the worst potential effects of the current crisis.

Notes

Brazil, Russia, India, China, South Africa.

Most notably, the Houthis launched a cruise missile attack against a US destroyer in 2016, but the missile was intercepted before reaching its target (RANE Worldview 2016).

Presently, 20 countries are partaking, some anonymously. With the exception of Greece, the European South (Spain, Italy, France) declined the US invitation to join; the ‘north’ is represented by Denmark and The Netherlands only.

The strategic significance of chokepoints could not be better exemplified than by the Pass of Thermopylae where, in the Second Persian War of 480 BC, the Spartan King Leonidas, with 300 of his men, managed to fend off the vast armies of Xerxes I.

Interestingly, the current Thai government is reviving the 2015 plan of its predecessor, inviting instead private investor interest for a 90 km landbridge, at a predicted cost of USD28 billion, including the construction of two mega-seaports (Ranong and Chumphon) at the two ends of the Isthmus.

When the Canal operates at full capacity, it can handle 40 transits a day. With all the measures the Panama Canal Authority (PCA) has taken because of the drought, that number had decreased to only 22 in late 2023. In mid-January 2024, the canal’s capacity increased marginally to 24 daily transits (PCA data). The problem, obviously, is that the water situation results in draft restrictions, so the quantity of cargo that ships can carry is limited, compared to earlier times. Some shipping lines and shippers have opted for alternative routes (such as the Suez route or the US land-bridge) to deal with the lower overall capacity of the Canal, the lower payload of vessels caused by draft restrictions, and the strong increase in Panama Canal transit fees resulting from PCA’s auction-based pricing system.

When a container is ‘rolled,’ it has not been loaded onto the vessel it was meant to sail on. Container rollings can have various reasons such as vessel overbooking, port call cancelation, vessel weight issues, documentation issues, and so on.

Suez Canal transit fees range between USD 750,000 and 1 million in the case of a one-way transit of a large containership.

Notwithstanding India’s obvious interest in the project, the country has never relinquished her interest in Russia’s International North South Transport Corridor (INSTC) which, starting probably from the Iranian Gulf port of Chabahar, continues north, over 7000 km, eventually reaching Moscow, calling on its way at Tehran and Baku (Azerbaijan) and, from Moscow, branching out westwards to Turkey.

References

Abdulla, K.A., and J.S.H. Singh. 2018. The Influence of Geography in Asymmetric Conflicts in Narrow Seas and the Houthi Insurgency in Yemen. Malaysian Journal of International Relations 6 (1): 84–90.

Al-Yadomi, H. 1991. The Strategic Importance of Bab Al-Mandab Strait. US Army War College, Pennsylvania, April 9th. https://apps.dtic.mil/sti/pdfs/ADA236804.pdf

Associated Press. 2024. Panama Canal Traffic Cut by More Than a Third Because of Drought. January 19th. https://apnews.com/article/panama-canal-global-trade-routes-drought-climate-change-bd76a77825a2e8e751a24346f8fd54a9

Baltic Exchange. 2024. FBX Index January 2024: Expect Disruptions to Continue. January 11th. https://www.balticexchange.com/en/news-and-events/news/guest-column/2024/expect-disruptions-to-continue.html

Bennett, N., and J. Lemoine. 2014. What VUCA Really Means for You. Harvard Business Review 92 (1/2): 1–7.

Bloomberg. 2024. Add Soaring Insurance Bills to Mounting Red Sea Trade Chaos. January 15th. https://www.bloomberg.com/news/articles/2024-01-15/add-soaring-insurance-bills-to-mounting-red-sea-trade-chaos

Cariou, P., and T. Notteboom. 2023. Implications of COVID-19 on the US Container Port Distribution System: Import cargo Routing by Walmart and Nike. International Journal of Logistics Research and Applications 26 (11): 1536–1555.

Chen, J., T. Notteboom, X. Liu, H. Yu, N. Nikitakos, and C. Yang. 2019. The Nicaragua Canal: Potential Impact on International Shipping and Its Attendant Challenges. Maritime Economics & Logistics 21: 79–98.

Chen, K., S. Xu, and H. Haralambides. 2020. Determining Hub Port Locations and Feeder Network Designs: The Case of China-West Africa Trade. Transport Policy 86: 9–22.

Container News. 2024. 80% of All Container Ships on Suez Route Divert to Cape of Good Hope. January 9th. https://container-news.com/80-of-all-container-ships-on-suez-route-divert-to-cape-of-good-hope/

Cullinane, K.P.B., and H. Haralambides. 2021. Global Trends in Maritime and Port Economics: The COVID-19 Pandemic and Beyond. Maritime Economics & Logistics 23: 369–380.

Cullinane, K.P.B., H. Haralambides, and T. Notteboom. 2023. Short-Term Effects and Longer-Term Impacts of the Covid-19 Pandemic on the International Shipping and Port Industries. International Journal of Transport Economics L (1/2): 45–88.

Economist Intelligence Unit. 2024. War Risks Raise Marine Insurance Premiums. January 12th. https://www.eiu.com/n/war-risks-raise-marine-insurance-premiums/

Gunnarsson, B., and A. Moe. 2021. Ten Years of International Shipping on the Northern Sea Route. Arctic Review on Law and Politics 12: 4–30.

Guzansky, Y. and O. Eran. 2018. The Red Sea: An Old-New Arena of Interest. INSS Insight. No. 1068, June 24th. https://www.inss.org.il/publication/red-sea-old-new-arena-interest/

Haralambides, H.E. 2023. The State-of-Play in Maritime Economics and Logistics Research (2017–2023). Maritime Economics & Logistics. https://doi.org/10.1057/s41278-023-00265-x.

Haralambides, Η.Ε. and O. Merk. 2020. The Belt and Road Initiative: Impacts on Global Maritime Trade Flows. International Transport Forum Discussion Papers, No. 2020/02, OECD Publishing, Paris.

Hartman, P.L., J.A. Ogden, J.R. Wirthlin, and B.T. Hazen. 2017. Nearshoring, Reshoring, and Insourcing: Moving Beyond the Total Cost of Ownership Conversation. Business Horizons 60 (3): 363–373.

Hokayem, E., and D.B. Roberts. 2016. The War in Yemen. Survival 58 (6): 157–186. https://doi.org/10.1080/00396338.2016.1257202.

Humpert, M. 2024. Northern Sea Route Saw Seven Containership Voyages in 2023, including Controversial Chinese Container Ship, High North News.

IMO. 2023. 2023 IMO Strategy on Reduction of GHG Emissions From Ships, Annex 1—Resolution MEPC.377(80), Marine Environment Protection Committee (MEPC), Adopted on 7 July 2023, London: International Maritime Organization.

International Energy Agency. 2023. Oil Market Report. https://www.iea.org/reports/oil-market-report-december-2023

Javorcik, B., L. Kitzmueller, H. Schweiger, and M.A. Yildirim. 2023. Economic costs of friend-shoring. Centre for Economic Studies IFO Institute Working Paper No. 10869. Munich.

Kent, Paul, and Hercules Haralambides. 2022. A Perfect Storm or an Imperfect Supply Chain? The US Supply Chain Crisis. Maritime Economics & Logistics. https://doi.org/10.1057/s41278-022-00221-1.

Lee, T., and H.J. Kim. 2015. Barriers of Voyaging on the Northern Sea Route: A Perspective from SHIPPING COMPAnies. Marine Policy 62: 264–270.

Lee, H.L., V. Padmanabhan, and S. Whang. 1997. The Bullwhip Effect in Supply Chains. IEEE Engineering Management Review 43 (2): 108–117.

Maihold, G. 2022. A New Geopolitics of Supply Chains: The Rise of Friend-Shoring. Social Science Open Access Repository. https://nbn-resolving.org/urn:nbn:de:0168-ssoar-81700-2

NHK. 2024. Suzuki Suspends Plant in Hungary Over Houthi Attacks in the Red Sea. January 16th. https://www3.nhk.or.jp/nhkworld/en/news/20240116_26/#:~:text=Suzuki%20Motor%20says%20it%20has,from%20January%2015%20to%2021

Nightingale, L. 2024. Red Sea Attacks Prompt 2m TEU Drop in Suez Boxship Traffic. Lloyds List. January 10th. https://www.lloydslist.com/LL1147891/Red-Sea-attacks-prompt-2m-teu-drop-in-Suez-boxship-traffic

Notteboom, T.E. 2012. Towards a New Intermediate Hub Region in Container Shipping? Relay and Interlining Via the Cape Route vs. the Suez Route. Journal of Transport Geography 22: 164–178.

Notteboom, T.E., T. Pallis, and J.P. Rodrigue. 2021. Disruptions and Resilience in Global Container Shipping and Ports: The COVID-19 Pandemic Versus the 2008–2009 Financial Crisis. Maritime Economics & Logistics 23: 179–210.

Notteboom, T.E., and J.P. Rodrigue. 2011. Challenges to and Challengers of the Suez Canal. Port Technology International: The Review of Advanced Technologies for Ports and Terminals World-Wide 51: 14–17.

Orkaby, A. 2021. The Red Sea and the Gulf of Aden. In Air Power in the Indian Ocean and the Western Pacific: Understanding Regional Security Dynamics, 1st ed., ed. H.M. Hensel. Abingdon: Routledge.

Peng Er, L. 2018. Thailand’s Kra Canal Proposal and China’s Maritime Silk Road: Between Fantasy and Reality? Asian Affairs: An American Review 45 (1): 1–17.

Piatanesi, B., and J.M. Arauzo-Carod. 2019. Backshoring and Nearshoring: An Overview. Growth and Change 50 (3): 806–823.

RANE Worldview. 2016. A New Threat to Red Sea Shipping. October 5th. https://worldview.stratfor.com/article/new-threat-red-sea-shipping

Rasmussen, N. 2024. Record Deliveries Could Push Container Fleet Above 30 Million Teu in 2024. BIMCO Market Report. January 10th. https://www.bimco.org/news-and-trends/market-reports/shipping-number-of-the-week/20240110-snow

Reuters. 2023. Suez Canal Annual Revenue Hits Record USD9.4 Billion, Chairman Says. June 21st. https://www.reuters.com/world/africa/suez-canal-annual-revenue-hits-record-94-bln-chairman-2023-06-21/

Reuters. 2024a. Egypt's Suez Canal Revenues Down 40% Due to Houthi Attacks. January 12th. https://www.reuters.com/markets/commodities/egypts-suez-canal-revenues-down-40-due-houthi-attacks-2024-01-11/

Reuters. 2024b. Tesla, Volvo Car Pause Output as Red Sea Shipping Crisis Deepens. January 13th. https://www.reuters.com/business/autos-transportation/tesla-berlin-suspend-most-production-two-weeks-over-red-sea-supply-gap-2024-01-11/

Reuters. 2024c. Saudi Arabia Has Not Yet Joined BRICs—Minister. January 16th. https://www.reuters.com/world/saudi-arabia-has-not-yet-joined-brics-minister-2024-01-16/

Seadistance.net. 2024. Sea distance calculator. http://www.shiptraffic.net/2001/05/sea-distances-calculator.html

Schøyen, H., and S. Bråthen. 2011. The Northern Sea Route Versus the Suez Canal: Cases from Bulk Shipping. Journal of Transport Geography 19 (4): 977–983.

Solvang, H.B., S. Karamperidis, N. Valantasis-Kanellos, and D.W. Song. 2018. An Exploratory Study on the Northern Sea Route as an Alternative Shipping Passage. Maritime Policy & Management 45 (4): 495–513.

Theocharis, D., V.S. Rodrigues, S. Pettit, and J. Haider. 2019. Feasibility of the Northern Sea Route: The Role of Distance, Fuel Prices, Ice Breaking Fees and Ship Size for the Product Tanker Market. Transportation Research Part E: Logistics and Transportation Review 129: 111–135.

Tseng, P.H., and K. Cullinane. 2018. Key Criteria Influencing the Choice of Arctic Shipping: A Fuzzy Analytic Hierarchy Process Model. Maritime Policy & Management 45 (4): 422–438.

Tseng, P.H., and N. Pilcher. 2022. Examining the Opportunities and Challenges of the Kra Canal: A PESTELE/SWOT Analysis. Maritime Business Review 7 (2): 161–174.

Tukamuhabwa, B.R., M. Stevenson, J. Busby, and M. Zorzini. 2015. Supply Chain Resilience: Definition, Review and Theoretical Foundations for Further Study. International Journal of Production Research 53 (18): 5592–5623.

UNCTAD. 2024. Red Sea, Black Sea and Panama Canal: UNCTAD Raises Alarm on Global Trade Disruptions. January 26th. https://unctad.org/news/red-sea-black-sea-and-panama-canal-unctad-raises-alarm-global-trade-disruptions

US Department of Defense. 2023. Statement from Secretary of Defense Lloyd J. Austin III on Ensuring Freedom of Navigation in the Red Sea, 18 December 2023.

US Department of Transportation. 2023. Transportation Statistics Annual Report 2023, Bureau of Transportation Statistics, Washington, DC. https://doi.org/10.21949/1529944

US Energy Information Administration. 2023. Red Sea Chokepoints are Critical for International Oil and Natural Gas Flows. December 4th. https://www.eia.gov/todayinenergy/detail.php?id=61025

Van Hassel, E., T. Vanelslander, K. Neyens, H. Vandeborre, D. Kindt, and S. Kellens. 2022. Reconsidering Nearshoring to Avoid Global Crisis Impacts: Application and Calculation of the Total Cost of Ownership for Specific Scenarios. Research in Transportation Economics 93: 101089.

Wright, R. 2024. Red Sea Security Fears Cut Container Shipments Through Suez Canal. Financial Times. January 10th. https://www.ft.com/content/007e8ec6-7124-4e11-b40f-9863bf64df0c

Verny, J., and C. Grigentin. 2009. Container Shipping on the Northern Sea Route. International Journal of Production Economics 122 (1): 107–117.

Xeneta. 2024a. Red Sea Crisis: Latest data from Xeneta Forecasts Ocean Freight Shipping Rates are Set to Rise Further in February. January 23rd. https://www.xeneta.com/news/red-sea-crisis-latest-data-from-xeneta-forecasts-ocean-freight-shipping-rates-are-set-to-rise-further-in-february

Xeneta. 2024b. Shippers must act quickly to protect supply chains amid surging ocean freight rates and market confusion. January 11th. https://www.xeneta.com/blog/red-sea-crisis-shippers-must-act-quickly-to-protect-supply-chains-amid-surging-ocean-freight-rates-and-market-confusion#:~:text=The%20latest%20data%20from%20Xeneta,Mediterranean%20have%20increased%20by%20118%25

Xu, H., Z. Yin, D. Jia, F. Jin, and H. Ouyang. 2011. The Potential Seasonal Alternative of Asia-Europe Container Service Via Northern Sea Route Under the Arctic Sea Ice Retreat. Maritime Policy & Management 38 (5): 541–560.

Yip, T.L., and M.C. Wong. 2015. The Nicaragua Canal: Scenarios of Its Future Roles. Journal of Transport Geography 43: 1–13.

Zhu, S., X. Fu, A.K. Ng, M. Luo, and Y.E. Ge. 2018. The Environmental Costs and Economic Implications of Container Shipping on the Northern Sea Route. Maritime Policy & Management 45 (4): 456–477.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Notteboom, T., Haralambides, H. & Cullinane, K. The Red Sea Crisis: ramifications for vessel operations, shipping networks, and maritime supply chains. Marit Econ Logist 26, 1–20 (2024). https://doi.org/10.1057/s41278-024-00287-z

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41278-024-00287-z