Abstract

This study investigates the relationship between financial performance and technical innovation of 21 listed shipping firms employing a panel data methodology. Using vessel-level and firm-level data over the period 2013 to 2019, we show that vessels’ technical innovation exhibits a positive relationship with firms’ financial performance. We identify three types of technical innovation for listed shipping firms, namely ice-class, eco, and propulsion types, and show that shipping firms operating eco-type ships exhibit higher financial performance on average during the sample period examined. This result has important implications not least on the decision-making of shipping firms to invest in technically innovative ships.

Similar content being viewed by others

Notes

According to Clarksons (2021), the average 1, 3, and 5-year time charter hires for double hull Suezmax tankers in 2020 were $27,899, $26,106, and $24,500, whereas the average 1, 3, and 5-year time charter hires for double hull Eco Suezmax tanker for year 2020 were $31,053, $29,197, and $27,788.

Dwt is the deadweight tonnage of a ship.

All U.S. firms have a standard industrial code (SIC) of 4400 (Water Transportation) or the sub-code 4410/4412 (Deep Sea Foreign Transportation of Freight). The SIC 4400 is a parent directory and is described as (URL accessed on 24th October 2020, https://siccode.com/sic-code/44/water-transportation): “This major group includes establishments engaged in freight and passenger transportation on the open seas or inland waters, and establishments furnishing such incidental services as lighterage, towing, and canal operation. This major group also includes excursion boats, sight-seeing boats, and water taxis.” while the SIC 4412 is a sub-directory and is described as (URL accessed on 24th October 2020, https://siccode.com/sic-code/4412/deep-sea-foreign-transportation-freight): “Establishments primarily engaged in operating vessels for the transportation of freight on the deep seas between the United States and foreign ports. Establishments operating vessels for the transportation of freight which travel to foreign ports and to non-contiguous territories are classified in this industry.”

Central index key is the identifier of each U.S. listed shipping firm and is formed by ten-digit numbers provided for each shipping firm by SEC. A ticker is an alphanumeric identifier for a shipping company listed in Oslo stock exchange. We use the ticker to match the vessel level data of the listed Oslo shipping firm with the firm level data for each company in the Thomson Reuters database.

Bearish market is defined as the market which is observed by price declines of at least 20% of share prices. Also, BDI fall from 10,245 in June to 743 in December 2008. BDI is a macro-variable used to assess the condition of the shipping freight markets. From that time, BDI keeps remaining at low level and the shipping freight markets remain in trough conditions (Tae-Hwee Lee and Leung Yip 2018; Yin et al. 2018) indicating the low liquidity and economic stagnation of the shipping freight markets.

No vessel was identified with two or three types of technical innovation simultaneously.

Fleet is the ships owned by a shipping firm measured in number or deadweight tonnage for each year.

\({\text{NO}}_{x}\) means nitrogen oxide and is a chemical compound of oxygen and nitrogen. \({\text{SO}}_{x}\) means sulfur oxide.

Scrubbers are used by ships for limiting air pollution by removing sulfur oxides from the ship’s engine and boiler exhaust gases. This regulation came into force on 1st January 2020 by IMO. The limit of sulfur is 0.50% globally.

For each year from 2013 to 2019, we identify each ship for each shipping firm owns that is ‘eco’ type. For example, in the SEC Form 20F of Tsakos energy navigation with CIK 0001166663 we see that the ship with the name ULYSSES is referred as ECO VLCC design.

The establishment date of each firm is collected through each firm’s webpage and double-checked through its financial statements.

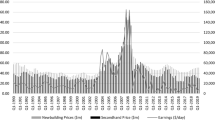

ClarkSea freight rate earnings are computed by Clarksons Shipping Intelligence Network (SIN) by collecting the daily freight rate earnings from each shipping route less: 1. port fees, adjusted for different currency exchange quotations and total commissions, 2. cost of bunkers. Then, the result is divided by the voyage days to calculate earnings per day for each ship type. More information can be found in Annexes 1–4 of the Clarksons (2020) “Sources & Methods for the Shipping Intelligence Weekly”.

Panel data regressions have been widely followed in the shipping finance literature, see for instance Kavussanos and Tsouknidis (2014, 2016).

Coefficients of VIF for each independent variable are computed using the following formula \(VIF = \frac{1}{{1 - R_{i}^{2} }}\). \((R_{i}^{2}\) is the coefficient of determination). VIF result of more than 10 indicate high collinearity namely, there is a linear combination among regressors.

To preserve space, we do not report these results. They are available from the authors upon request.

References

Adland, Roar, Harrison Alger, Justina Banyte, and Haiying Jia. 2017. Does Fuel Efficiency Pay? Empirical Evidence from the Drybulk Timecharter Market Revisited. Transportation Research Part a: Policy and Practice 95 (January): 1–12. https://doi.org/10.1016/j.tra.2016.11.007.

Agnolucci, Paolo, Tristan Smith, and Nishat Rehmatulla. 2014. Energy Efficiency and Time Charter Rates: Energy Efficiency Savings Recovered by Ship Owners in the Panamax Market. Transportation Research Part a: Policy and Practice 66 (1): 173–184. https://doi.org/10.1016/j.tra.2014.05.004.

Ahvenjärvi, Sauli. 2017. The Human Element and Autonomous Ships. TransNav, the International Journal on Marine Navigation and Safety of Sea Transportation 10 (3): 517–521. https://doi.org/10.12716/1001.10.03.18.

Amit, Raphael, and Christoph Zott. 2001. Value Creation in E-Business. Strategic Management Journal 22 (6–7): 493–520. https://doi.org/10.1002/SMJ.187.

Andreou, Panayiotis C., Christodoulos Louca, and Photis M. Panayides. 2014. Corporate Governance, Financial Management Decisions and Firm Performance: Evidence from the Maritime Industry. Transportation Research Part E: Logistics and Transportation Review 63 (March): 59–78. https://doi.org/10.1016/j.tre.2014.01.005.

Baker, William, and James Sinkula. 2002. Market Orientation, Learning Orientation and Product Innovation: Delving into the Organization’s Black Box. Journal of Market-Focused Management 5 (1): 5–23. https://doi.org/10.1023/A:1012543911149.

Bayus, Barry L., Gary Erickson, and Robert Jacobson. 2003. The Financial Rewards of New Product Introductions in the Personal Computer Industry. Management Science 49 (2): 197–210. https://doi.org/10.1287/mnsc.49.2.197.12741.

Belloc, Filippo. 2012. CORPORATE GOVERNANCE AND INNOVATION: A SURVEY. Journal of Economic Surveys 26 (5): 835–864. https://doi.org/10.1111/j.1467-6419.2011.00681.x.

Bierly, Paul, and Alok Chakrabarti. 2009. Generic Knowledge Strategies in the US. Pharmaceutical Industry. In Knowledge and Strategy 17: 231–250. https://doi.org/10.1002/smj.4250171111.

Bigliardi, Barbara. 2013. The Effect of Innovation on Financial Performance: A Research Study Involving SMEs. Innovation: Management, Policy and Practice 15 (2): 245–255. https://doi.org/10.5172/impp.2013.15.2.245.

Bourbonnais, Pascale, and Frederic Lasserre. 2015. Winter Shipping in the Canadian Arctic: Toward Year-Round Traffic? Polar Geography 38 (1): 70–88. https://doi.org/10.1080/1088937X.2015.1006298.

Bouslah, Kais, Lawrence Kryzanowski, and Bouchra M’Zali. 2013. The Impact of the Dimensions of Social Performance on Firm Risk | Elsevier Enhanced Reader. Journal of Banking & Finance 37: 1258–1273.

Brammer, S., and A. Millington. 2008. Does It Pay to Be Different? an Analysis of the Relationship between Corporate Social and Financial Performance. Strategic Management Journal 29 (12): 1325–1343.

Breusch, T.S., and A.R. Pagan. 1980. The Lagrange Multiplier Test and Its Applications to Model Specification in Econometrics. The Review of Economic Studies 47 (1): 239. https://doi.org/10.2307/2297111.

Bromiley, Philip. 1991. Testing a Causal Model of Corporate Risk Taking and Performance. Academy of Management Journal 34 (1): 37–59. https://doi.org/10.5465/256301.

Bromiley, Philip. 2017. Testing a Causal Model of Corporate Risk Taking and Performance. The Academy of Management Journal 34 (1): 37–59. https://doi.org/10.5465/256301.

Brown, S.L., and K.M. Eisenhardt. 1995. Product development: Past research, present findings, and future directions. Academy of Management Review 20 (2): 343–378. https://doi.org/10.5465/amr.1995.9507312922.

Buzzell, R.D., B.T. Gale, and R.G. Sultan. 1975. Market share—a key to profitability. Harvard Business Review 53: 1–9.

Caves, Richard E., and Pankaj Ghemawat. 1992. Identifying Mobility Barriers. Strategic Management Journal 13 (1): 1–12. https://doi.org/10.1002/smj.4250130102.

Clarksons. 2021. Shipping Intelligence Network.

Cohen, Wesley M., and Daniel A. Levinthal. 1989. Innovation and Learning: The Two Faces of R & D. The Economic Journal 99 (397): 569. https://doi.org/10.2307/2233763.

Coles, Jeffrey L., Michael L. Lemmon, and J. Felix Meschke. 2012. Structural Models and Endogeneity in Corporate Finance: The Link between Managerial Ownership and Corporate Performance. Journal of Financial Economics 103 (1): 149–168. https://doi.org/10.1016/j.jfineco.2011.04.002.

Daft, Richard L. 1978. A Dual-Core Model of Organizational Innovation. Academy of Management Journal 21 (2): 193–210. https://doi.org/10.5465/255754.

Damanpour, Fariborz. 1991. Organizational Innovation: A Meta-analysis of Effects of Determinants and Moderators. Academy of Management Journal 34 (3): 555–590. https://doi.org/10.5465/256406.

Damanpour, Fariborz, and William M. Evan. 1984. Organizational Innovation and Performance: The Problem of ‘Organizational Lag.’ Administrative Science Quarterly 29 (3): 392. https://doi.org/10.2307/2393031.

Damanpour, Fariborz, Kathryn A. Szabat, and William M. Evan. 1989. The relationship between types of innovation and organizational performance. Journal of Management Studies 26 (6): 587–602. https://doi.org/10.1111/j.1467-6486.1989.tb00746.x.

Darroch, Jenny, and Rod Mcnaughton. 2002. Examining the Link between Knowledge Management Practices and Types of Innovation. Journal of Intellectual Capital 3 (3): 210–222. https://doi.org/10.1108/14691930210435570.

Deshpandé, Rohit, John U. Farley, and Frederick E. Webster. 1993. Corporate Culture, Customer Orientation, and Innovativeness in Japanese Firms: A Quadrad Analysis. Journal of Marketing 57 (1): 23–37. https://doi.org/10.1177/002224299305700102.

DNV-GL. 2011. Ships SPECIAL SERVICE AND TYPE – ADDITIONAL CLASS Passenger and Dry Cargo Ships. DNV Det Norske Veritas, no. July.

Drobetz, Wolfgang, Dimitrios Gounopoulos, Andreas Merikas, and Henning Schröder. 2013a. Capital Structure Decisions of Globally-Listed Shipping Companies. Transportation Research Part E: Logistics and Transportation Review 52 (June): 49–76. https://doi.org/10.1016/j.tre.2012.11.008.

Drobetz, Wolfgang, Andreas G. Merikas, Anna Merika, and Efthymios G. Tsionas. 2013b. Corporate Social Responsibility (CSR) Revisited: The Case of International Shipping. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.2351542.

Drobetz, Wolfgang, Malte Janzen, and Ignacio Requejo. 2019. Capital Allocation and Ownership Concentration in the Shipping Industry. Transportation Research Part E: Logistics and Transportation Review 122 (February): 78–99. https://doi.org/10.1016/j.tre.2018.09.010.

Dwyer, Rocky, and David Lamond. 2008. Treading the Lines between Self-interest, Cultural Relativism and Universal Principles: Ethics in the Global Marketplace. Management Decision 46 (8): 1122–1131. https://doi.org/10.1108/00251740810901336/FULL/PDF.

Dwyer, Rocky, David Lamond, Stephanie S. Pane Haden, Jennifer D. Oyler, and John H. Humphreys. 2009. Historical, Practical, and Theoretical Perspectives on Green Management: An Exploratory Analysis. Management Decision 47 (7): 1041–1055. https://doi.org/10.1108/00251740910978287/FULL/PDF.

Erikstad, Stein Ove, and Sören. Ehlers. 2012. Decision Support Framework for Exploiting Northern Sea Route Transport Opportunities. Ship Technology Research 59 (2): 34–42. https://doi.org/10.1179/str.2012.59.2.003.

GD, WIN. 2018. X-DF Engines Excellence Built In. 2018. https://www.wingd.com/en/documents/general/brochures/x-df-faq-brochure.pdf/.

Geroski, Paul, and Steve Machin. 1992. Do Innovating Firms Outperform Non-Innovators? Business Strategy Review 3 (2): 79–90. https://doi.org/10.1111/j.1467-8616.1992.tb00030.x.

Greve, Henrich R. 2003. A Behavioral Theory of R&D Expenditures and Innovations: Evidence from Shipbuilding. Academy of Management Journal 46 (6): 685–702. https://doi.org/10.5465/30040661.

Haider, Jane, Georgios Katsogiannis, Stephen Pettit, and Kyriaki Mitroussi. 2013. The Emergence of Eco-Ships: Inevitable Market Segmentation?

Haraldson Viktoria Swedish ICT, Sandra, and Sweden SandraHaraldson. 2015. Digitalization of Sea Transports Digitalization of Sea Transports-Enabling Sustainable Multi-Modal Transports Full Paper Introduction-Digitalization for Sustainable Sea Transports. In Americas Conference on Information Systems. www.monalisaproject.eu.

Hausman, Jerry A. 1978. Specification Tests in Econometrics. Econometrica: Journal of the Econometric Society 46: 1251–1271.

Hound, N. 2020. HMM Algeciras: Largest Engine Powers World’s Largest Containership. International Institute of Marine Surveying. 2020. https://www.iims.org.uk/hmm-algeciras-largest-engine-powers-worlds-largest-containership/.

Humpert, Malte. 2014. Arctic Shipping: An Analysis of the 2013 Northern Sea Route Season.

IMO. 2020. Shipping in Polar Waters.

Ishizaka, Motokazu, Koichiro Tezuka, and Masahiro Ishii. 2018. Evaluation of Risk Attitude in the Shipping Freight Market under Uncertainty. Maritime Policy & Management 45 (8): 1042–1056. https://doi.org/10.1080/03088839.2018.1463107.

Jenssen, Jan Inge. 2003. Innovation, Capabilities and Competitive Advantage in Norwegian Shipping. Maritime Policy and Management 30 (2): 93–106. https://doi.org/10.1080/0308883032000084841.

Jenssen, Jan Inge, and Trond Randøy. 2002. Factors That Promote Innovation in Shipping Companies. Maritime Policy and Management 29 (2): 119–133. https://doi.org/10.1080/03088830110078346.

Jenssen, Jan Inge, and Trond Randøy. 2006. The Performance Effect of Innovation in Shipping Companies. Maritime Policy and Management 33 (4): 327–343. https://doi.org/10.1080/03088830600895485.

Kahneman, D. 1979. Prospect Theory: An Analysis of Decision under Risk. Econometrica 47: 278.

Kavussanos, Manolis G., and Dimitris A. Tsouknidis. 2014. The Determinants of Credit Spreads Changes in Global Shipping Bonds. Transportation Research Part E: Logistics and Transportation Review 70 (1): 55–75. https://doi.org/10.1016/j.tre.2014.06.001.

Kollamthodi. 2008. Kollamthodi: Greenhouse Gas Emissions from Shipping: Trends, Projections and Abatement Potential. 2008. https://scholar.google.com/scholar_lookup?title=GreenhouseGas Emissions from Shipping%3ATrends Projections and Abatement Potential&author=S.Kollamthodi&publication_year=2008.

Kostopoulos, Konstantinos, Alexandros Papalexandris, Margarita Papachroni, and George Ioannou. 2011. Absorptive Capacity, Innovation, and Financial Performance. Journal of Business Research 64 (12): 1335–1343. https://doi.org/10.1016/j.jbusres.2010.12.005.

Lamond, David. 2007. Corporate Social Responsibility: Making Trade Work for the Poor. Management Decision. https://doi.org/10.1108/MD.2007.00145HAA.003/FULL/XML.

Laursen, Keld, and Ammon Salter. 2006. Open for Innovation: The Role of Openness in Explaining Innovation Performance among U.K. Manufacturing Firms. Strategic Management Journal 27 (2): 131–150. https://doi.org/10.1002/smj.507.

Lee, Cheng Yu, Wu. Hsueh Liang, and Huei Wen Pao. 2014. How Does R&D Intensity Influence Firm Explorativeness? Evidence of R&D Active Firms in Four Advanced Countries. Technovation 34 (10): 582–593. https://doi.org/10.1016/j.technovation.2014.05.003.

Lee, Ki Hoon, and Byung Min. 2015. Green R&D for Eco-Innovation and Its Impact on Carbon Emissions and Firm Performance. Journal of Cleaner Production 108 (December): 534–542. https://doi.org/10.1016/J.JCLEPRO.2015.05.114.

Lim, Kian-Guan., and Michelle Lim. 2020. Financial Performance of Shipping Firms That Increase LNG Carriers and the Support of Eco-Innovation. Journal of Shipping and Trade 5 (1): 1–25. https://doi.org/10.1186/s41072-020-00080-0.

Lim, Kian Guan, Nikos K. Nomikos, and Nelson Yap. 2019. Understanding the Fundamentals of Freight Markets Volatility. Transportation Research Part E: Logistics and Transportation Review 130 (October): 1–15. https://doi.org/10.1016/J.TRE.2019.08.003.

Liu, Miaojia, and Jacob Kronbak. 2010. The Potential Economic Viability of Using the Northern Sea Route (NSR) as an Alternative Route between Asia and Europe. Journal of Transport Geography 18 (3): 434–444. https://doi.org/10.1016/j.jtrangeo.2009.08.004.

Margolis, Joshua, Joshua D. Margolis, Hillary Anger Elfenbein, and James P. Walsh. 2007. Does it pay to be good? A Meta-Analysis and Redirection of Research on the Relationship Between Corporate Social and Financial Performance. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.1866371.

Merika, Anna, Sotiria Theodoropoulou, Anna Triantafyllou, and Alexandros Laios. 2015. The Relationship between Business Cycles and Capital Structure Choice: The Case of the International Shipping Industry. Journal of Economic Asymmetries 12 (2): 92–99. https://doi.org/10.1016/j.jeca.2015.04.001.

Michael, Jensen C. 1986. Agency Costs of Free Cash Flow, Corporate Finance, and Takeovers Agency Costs of Free Cash Flow, Corporate Finance, and Takeovers. American Economic Review 76 (2): 323–329. https://doi.org/10.2307/1818789.

Naceur, Samy Ben, and Mohamed Goaied. 2002. The Relationship between Dividend Policy, Financial Structure, Profitability and Firm Value. Applied Financial Economics 12 (12): 843–849. https://doi.org/10.1080/09603100110049457.

Nelson, Richard R., and Sidney G. Winter. 1982. The Schumpeterian Tradeoff Revisited. The American Economic Review 72: 114.

Notteboom, Theo, and Jasmine Siu Lee. Lam. 2014. Dealing with Uncertainty and Volatility in Shipping and Ports. Maritime Policy & Management 41 (7): 611–614. https://doi.org/10.1080/03088839.2014.965297.

Panayides, Photis. 2006. Enhancing Innovation Capability through Relationship Management and Implications for Performance. European Journal of Innovation Management 9 (4): 466–483. https://doi.org/10.1108/14601060610707876.

Panayides, Photis M., Neophytos Lambertides, and Christos S. Savva. 2011. The Relative Efficiency of Shipping Companies. Transportation Research Part E: Logistics and Transportation Review 47 (5): 681–694. https://doi.org/10.1016/j.tre.2011.01.001.

Partners, Capital Product. 2020. SEC Form 20-F. 2020. https://www.sec.gov/Archives/edgar/data/1392326/000119312520056321/d891393d20f.htm.

Pava, Moses L., and Joshua Krausz. 1996. The Association between Corporate Social-Responsibility and Financial Performance: The Paradox of Social Cost. Journal of Business Ethics 15 (3): 321–357. https://doi.org/10.1007/BF00382958.

Petersen, Mitchell A. 2009. Estimating Standard Errors in Finance Panel Data Sets: Comparing Approaches. The Review of Financial Studies 22 (1): 435–480.

Preston, Lee E., and Douglas P. O’Bannon. 2016. The Corporate Social-Financial Performance Relationship: A Typology and Analysis. Business and Society 36 (4): 419–429. https://doi.org/10.1177/000765039703600406.

Przychodzen, Justyna, and Wojciech Przychodzen. 2015. Relationships Between Eco-Innovation and Financial Performance - Evidence from Publicly Traded Companies in Poland and Hungary. Journal of Cleaner Production 90 (March): 253–263. https://doi.org/10.1016/j.jclepro.2014.11.034.

Riska, K. 2010. Design of ice breaking ships.

Roberts, Michael R., and Toni M. Whited. 2013. Endogeneity in Empirical Corporate Finance. In Handbook of the Economics of Finance, vol. 2, 493–572. https://doi.org/10.1016/B978-0-44-453594-8.00007-0.

Schilling, Melissa A., and Charles W.L.. Hill. 1998. Managing the New Product Development Process: Strategic Imperatives. Academy of Management Executive 12 (3): 67–81. https://doi.org/10.5465/ame.1998.1109051.

Schneckenberg, Dirk, Vivek K. Velamuri, Christian Comberg, and Patrick Spieth. 2017. Business Model Innovation and Decision Making: Uncovering Mechanisms for Coping with Uncertainty. R&D Management 47 (3): 404–419. https://doi.org/10.1111/RADM.12205.

Schulz, Martin, and Lloyd A. Jobe. 2001. Codification and Tacitness as Knowledge Management Strategies: An Empirical Exploration. Journal of High Technology Management Research 12 (1): 139–165. https://doi.org/10.1016/S1047-8310(00)00043-2.

Schumpeterian, The, Tradeoff Revisited, Richard R Nelson, and Sidney G Winter. 1982. American Economic Association. Source: The American Economic Review 72, 243

Shane, Scott, and S. Venkataraman. 2000. The Promise of Entrepreneurship as a Field of Research. The Academy of Management Review 25 (1): 217–226. https://doi.org/10.5465/AMR.2000.2791611.

Shapiro, S.S., and M.B. Wilk. 1965. An Analysis of Variance Test for Normality (Complete Samples). Biometrika 52 (3/4): 591. https://doi.org/10.2307/2333709.

Shipping, Ardmore. 2019. SEC FORM 20-F. 2019. https://www.sec.gov/Archives/edgar/data/1577437/000110465920043130/tm206807-1_20f.htm.

Simpson, Penny M., Judy A. Siguaw, and Cathy A. Enz. 2006. Innovation Orientation Outcomes: The Good and the Bad. Journal of Business Research 59 (10–11): 1133–1141. https://doi.org/10.1016/j.jbusres.2006.08.001.

Sok, Phyra, and Aron O’Cass. 2015. Examining the New Product Innovation - Performance Relationship: Optimizing the Role of Individual-Level Creativity and Attention-to-Detail. Industrial Marketing Management 47 (May): 156–165. https://doi.org/10.1016/j.indmarman.2015.02.040.

Solakivi, Tomi, Tuomas Kiiski, and Lauri Ojala. 2018. The Impact of Ice Class on the Economics of Wet and Dry Bulk Shipping in the Arctic Waters. Maritime Policy & Management 45 (4): 530–542. https://doi.org/10.1080/03088839.2018.1443226.

Solesvik, Marina, and Odd Jarl Borch. 2015. Innovation on the Open Sea: Examining Competence Transfer and Open Innovation in the Design of Offshore Vessels. In Technology Innovation Management Review, vol 5. Talent First Network. www.timreview.ca.

Solutions, MAN Energy. 2021. ME-GI. 2021. https://www.man-es.com/marine/products/megi-mega/me-gi.

Stopford, Martin. 2009. Maritime Economics. Routledge.

Syriopoulos, Theodore, and Michael Tsatsaronis. 2011. The Corporate Governance Model of the Shipping Firms: Financial Performance Implications. Maritime Policy and Management 38 (6): 585–604. https://doi.org/10.1080/03088839.2011.615867.

Syriopoulos, Theodore, and Michael Tsatsaronis. 2012. Corporate Governance Mechanisms and Financial Performance: CEO Duality in Shipping Firms. Eurasian Business Review 2 (1): 1–30. https://doi.org/10.14208/BF03353805.

Tae-Hwee Lee, Taylor, and Tsz Leung Yip. 2018. A Cause of Oversupply and Failure in the Shipping Market: Measuring Herding Behavior Effects A Cause of Oversupply and Failure in the Shipping Market: Measuring Herding Behavior Effects. Maritime Policy & Management the Flagship Journal of International Shipping and Port Research. https://doi.org/10.1080/03088839.2018.1454990.

Tankers, Pyxis. 2020. SEC FORM 20-F.

Theocharis, Dimitrios, Stephen Pettit, Vasco Sanchez Rodrigues, and Jane Haider. 2018. Arctic Shipping: A Systematic Literature Review of Comparative Studies. Journal of Transport Geography 69 (May): 112–128. https://doi.org/10.1016/j.jtrangeo.2018.04.010.

Thornhill, Stewart. 2006. Knowledge, Innovation and Firm Performance in High- and Low-Technology Regimes. Journal of Business Venturing 21 (5): 687–703. https://doi.org/10.1016/j.jbusvent.2005.06.001.

Totterdell, Peter, Desmond Leach, Kamal Birdi, Chris Clegg, and Toby Wall. 2002. An Investigation of the Contents and Consequences of Major Organizational Innovations. International Journal of Innovation Management 06 (04): 343–368. https://doi.org/10.1142/s1363919602000641.

Tsouknidis, Dimitris A. 2016. Dynamic Volatility Spillovers across Shipping Freight Markets. Transportation Research Part E: Logistics and Transportation Review 91 (July): 90–111. https://doi.org/10.1016/j.tre.2016.04.001.

Tsouknidis, Dimitris A. 2019. The Effect of Institutional Ownership on Firm Performance: The Case of U.S.-Listed Shipping Companies. Maritime Policy and Management 46 (5): 509–528. https://doi.org/10.1080/03088839.2019.1584408.

UNCTAD. 2020. Review of Maritime Transport. UNCTAD. Geneva. https://doi.org/10.18356/af26da33-en.

Utterback, James. 1994. Mastering the Dynamics of Innovation: How Companies Can Seize Opportunities in the Face of Technological Change. https://papers.ssrn.com/abstract=1496719.

Weerawardena, Jay, Aron O’Cass, and Craig Julian. 2006. Does Industry Matter? Examining the Role of Industry Structure and Organizational Learning in Innovation and Brand Performance. Journal of Business Research 59 (1): 37–45. https://doi.org/10.1016/j.jbusres.2005.02.004.

Wintoki, M.B., J.S. Linck, and J.M. Netter. 2012. Endogeneity and the Dynamics of Internal Corporate Governance. Journal of Financial Economics 105 (3): 581–606.

Yin, Jingbo, Wu. Yijie, and Lu. Linjun. 2018. Assessment of Investment Decision in the Dry Bulk Shipping Market Based on Real Options Thinking and the Shipping Cycle Perspective Assessment of Investment Decision in the Dry Bulk Shipping Market Based on Real Options Thinking and the Shipping Cycle Per. Maritime Policy & Management the Flagship Journal of International Shipping and Port Research. https://doi.org/10.1080/03088839.2018.1520400.

Yunus, Muhammad, Bertrand Moingeon, and Laurence Lehmann-Ortega. 2010. Building Social Business Models: Lessons from the Grameen Experience. Long Range Planning 43 (2–3): 308–325. https://doi.org/10.1016/J.LRP.2009.12.005.

Zhu, Qinghua, Junjun Liu, and Kee Hung Lai. 2016. Corporate Social Responsibility Practices and Performance Improvement among Chinese National State-Owned Enterprises. International Journal of Production Economics 171 (January): 417–426. https://doi.org/10.1016/j.ijpe.2015.08.005.

Acknowledgements

We would like to thank the Editor-in-Chief and two anonymous referees for their insightful comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

See Table

5 and Fig.

An excerpt from the fleet of Ardmore shipping Inc. for 31st of December 2018. Note This figure shows an excerpt from the fleet of U.S. listed shipping firm Ardmore shipping Inc. for the year ended 31 December 2018. It includes ships that exhibit technical innovation, for example the Ardmore Seavaliant is an eco-design vessel

5.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Kouspos, A.A., Panayides, P.M. & Tsouknidis, D.A. The relationship between technical innovation and financial performance in shipping firms. Marit Econ Logist 25, 698–727 (2023). https://doi.org/10.1057/s41278-022-00251-9

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41278-022-00251-9