Abstract

Uncertain future and fears about the stock-outs will compel the customers to stock goods at home, resulting in panic buying. Even though it is a frequently observed consumer behaviour, there is scant literature in dual-channel supply chain (DCSC) which address this demand disruption. This study analytically models and analyses the impact of panic buying in a DCSC. For that we consider a two-echelon dual-channel supply chain comprising of a manufacturer, brick and mortar store (r-store), and online store (e-store). The interaction between the upstream and downstream channel members is modelled using a Stackelberg game. Further, we examined two models based on the channel power difference between the r-store and e-store, i.e., (i) r-store leader model and (ii) the e-store leader model. We also used Monte-Carlo simulation to deduce corollaries and managerial insights. We found that the Law of demand doesn’t hold during panic buying disruption, and even essential goods act like Veblen goods during the period. Contrary to the expectation, panic buying was also found to be beneficial for the e-store. Counter-intuitive results with respect to the channel power were also obtained in the sense that it is beneficial for the r-store to operate under the leadership of the e-store and vice versa. The study shows that the manufacturer is better off with panic buying.

Similar content being viewed by others

Introduction

Background of the study

COVID-19 has disturbed our lives unprecedentedly, and countries around the globe struggle to cope with the havoc created by the pandemic (Chesbrough 2020; Dolgui and Ivanov 2021). The governments immediately closed their international borders and instigated strong lock-down measures, and people were told to endure inside their houses. The declaration of lock-down created havoc among the people, especially a drastic shift was observed in the consumption and consumer behaviour (Elnahla and Neilson 2021; Hall et al. 2020; Zulauf et al. 2021). The first response from the consumers’ side was panic buying (Hao et al. 2020; Mahajan et al. 2021; Yuen et al. 2020). Panic buying can be defined as the unusual and extensive buying of substantial volume of goods, especially essentials, in anticipation of a shortage or stock out. It generally lasts for short time and will disrupt the supply chain (Zheng et al. 2021). Using the market insights from COVID-19 pandemic, this study analytically models the panic buying disruption to make the supply chain more robust during future panic buying disruptions.

For the study, we consider the period between the announcement of lock-down by the government and the commencement of lock-down, and for most countries, this period spans a maximum of 24 h (Gettleman and Schultz 2020). The period was repeating as many countries imposed frequent lock downs after unlocking for a certain period. During this period, the brick and mortar store (r-store) faced a sudden surge in demand (Levinson and Melissa 2020; O’connell et al. 2020), and with the rapid spread of the news of the lock-down, supermarkets were emptied. Reports of these vacant supermarkets accelerated the pace of panic buying. Rice and noodles disappeared from the shelves of Asia, flour became impossible to find in Europe, and toilet paper shortage was severe in Australia and the USA (Mao 2020). Irrespective of the cultural and geographical boundaries, antipyretics, sanitisers, masks, and gloves were emptied from the traditional brick and mortar retail stores (r-stores). Repeated assurances from the government about refilling the stock-outs were in vain, and to an extent, it only accelerated the panic buying.

Nevertheless, the e-commerce industry was less affected by panic buying syndrome (Meshram 2020) owing to the lead time between ordering and delivery of the product and people’s behaviour to have immediate gratification during emergencies (Kulkarni 2020; Nakayama and Wan 2021). Many researchers have empirically cited this behaviour (Hao et al. 2020; Mahajan et al. 2021; Yuen et al. 2020). For instance, during the initial stages of the pandemic disruption, the sales of ‘Target.com’ and ‘Amazon.com’ were constant (Levinson and Melissa 2020). Thus, in tune with these business situations, we assume that panic buying has resulted in an asymmetric demand disruption in the sense that mostly brick and mortar channels were facing the disruption.

A similar pattern of consumer behaviour was observed during the Ukraine War crisis (of 2022). After the declaration of war, Europeans started stocking up survival gears like sleeping bags, camping cookers and canned food which led to severe panic buying. For instance, Ica Gruppen, a Swedish grocery retailer, reported that sales of milk powder, pasta, grains, and canned foods rose by 20% (Thomasson and Soderpalm 2022) after the declaration of war on Ukraine by Russia. Thus, it became imperative to model the panic buying period, to ensure a seamless supply of goods during the period and to make the supply chain robust during such disruption situations.

Based on the insights obtained from the above-discussed market situations, we model these disruptions in a Dual Channel supply chain (DCSC) (Rahmani and Yavari 2019; Rofin and Mahanty 2018; Zhang et al. 2021) consisting of manufacturer, r-store and online store (e-store). The channel power difference has been incorporated into the models reflecting the realistic market conditions and examined r-store leader (RL) model and e-store leader (EL) model. Specifically, the central objectives that are addressed in this study are as follows.

-

1.

To model the impact of panic buying disruption on the optimal decisions of DCSC channel members when r-store is holding a superior channel power than the e-store.

-

2.

To model the impact of panic buying disruption on the optimal decisions of DCSC channel members when e-store is holding a superior channel power than the r-store.

-

3.

To compare the influence of panic buying disruption between the two channel power structures.

We employ game theory (Reisman et al. 2001; Watada et al. 2014; Zhang and Sun 2020; Zhi et al. 2019) to address the objectives mentioned above due to its suitability to model the interactive analytics among the supply chain members with rational decision-making capability (Vasnani et al. 2019; Zhang and Hezarkhani 2020). The study’s contributions are two-fold: (i) Modelling of interactive decision making in a symmetric DCSC considering asymmetric panic buying disruption (ii) Assessment of the impact of panic buying on the optimal decisions and optimal profit of the channel members belonging to a DCSC.

Related literature

The literature related to this study is primarily comprised of demand disruptions under the dual-channel supply chain framework. Based on our research problem, we have adopted a systematic approach for screening the most relevant articles from the Scopus database. From Fig. 1, it can be observed that there were 1126 articles under the keyword ‘Dual-channel supply chain’. We narrowed this list by using the keyword ‘Disruption’ and ‘Demand disruption’, resulting in 50 and 36 articles, respectively. Further, we screened the 36 articles using the analysis methodology, i.e., ‘game-theory’ leading to 15 articles. We have only reported those articles that are closest and most relevant to our research problem.

With the development of the internet, many customers got habituated to electronic shopping, which prompted many manufacturers to open a direct sales channel along with the traditional r-store (Chiang et al. 2003). After Chiang et al., (2003) there were many studies conducted to study the pricing (Hua et al. 2011; Kurata et al. 2007), inventory policies (Takahashi et al. 2011; Yao et al. 2009), channel coordination (Chen et al. 2012; Saha 2016) in DCSC. Rofin and Mahanty, (2018) made a shift in the traditional DCSC studies by introducing an indirect online channel along with the traditional channel. They studied different combinations of dual-channel configurations viz. r-store–e-store; company store–e-store; and r-store–e-marketplace. In our study we are using the r-store–e-store configuration.

With the advent of globalisation, due to the dynamic nature of the market environment, disruptions (Dolgui and Ivanov 2021; Dubey et al. 2018; Govindan et al. 2020; Ivanov and Dolgui 2021; Lohmer et al. 2020; Queiroz et al. 2020; Xu et al. 2021) were extensively prevalent in the supply chain. Most prominent were demand and production disruptions. Since panic buying triggers disruptions in the demand of a product, we are reporting the studies in the field of demand disruptions. Demand disruptions can occur due to many reasons and in numerous forms (Gupta et al. 2021; Hosseini-Motlagh et al. 2020; Huang et al. 2013; Ma et al. 2021). For instance, when a channel faces a reputation crisis (Pi et al. 2019), the customers move to another channel. This occurs when there are multiple channels for customers to buy the product from. This causes asymmetric demand disruptions where one channel will face positive demand disruption and the other will face negative demand disruption. Similarly, during disasters like floods, earthquakes there can be symmetric disruption (Cao 2014; Huang et al. 2012; Rahmani and Yavari 2019; Tang et al. 2018; Pan Zhang et al. 2015) were, irrespective of channel all the partners face demand disruption. The historical progress and comparison of disruption studies are reported in Table 1.

Based on the analysis of existing studies, we found the following research gaps. (i) Even though many researchers have considered the disruption while studying DCSC, there is scant literature on asymmetric demand disruption, i.e., all the studies deemed a simultaneous disruption for the downstream channel partners. But during panic buying, this is not true, and the disruptions are uneven and asymmetric. Such panic buying disruptions are not addressed and analysed in DCSC studies.(ii) The studies in the domain of DCSC model, a brick and mortar store and manufacturer owned online channel. But, nowadays, the manufacturer is also relying on online retailers (e-stores) to sell their products. The literature in this field is scant. (iii) In real market situations, there are channel power structures, i.e., there are downstream channel partners, who rise to the role of channel leader by brand image, sales volume, early entry etc. These channel power structures are not given weightage in DCSC studies with disruption. In our study, we try to address these research gaps.

The ensuing content of the paper is organised as follows. In segment 2, we propose the model assumptions and research method. Segment 3 deals with the equilibrium analysis, and segment 4 reports the comparative study of normal buying scenario and panic buying scenario. Furthermore, numerical analysis and simulation are presented in segment 5, and segment 6 reports the discussions and managerial insights. The last chapter deals with conclusions.

Model assumptions and research method

Basic framework

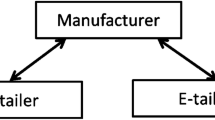

The study is entirely analytical. We took the insights from empirical research and actual business environment to analytically model the panic buying scenario. For the study, we consider a DCSC (Rofin and Mahanty 2018; Wang and Li 2021; Zhang et al. 2021) where the manufacturer offers his product to the customer via r-store and the e-store (Rofin and Mahanty 2018, 2020), as shown in Fig. 2. We assume that the manufacturer is a monopolist and the channel leader (He et al. 2021; Wang et al. 2021). Hence, we used Stackelberg game to model the interaction between upstream manufacturer and downstream r-store and e-store.

Channel power

There are numerous studies that assumed equal channel power for the downstream channel members. However, it is highly unlikely that the channel members hold equal channel power (Huang et al. 2018, 2015; Rofin and Mahanty 2021). In most markets, there are market leaders who can dictate the product’s price, making the followers set their respective prices after observing the price set by the channel leader. Channel leadership can be attributed to features such as sales volume, brand image and early entry (Rofin and Mahanty 2021). R-stores like Walmart, 7-Eleven, Aldi and e-stores like Amazon, Alibaba, e-bay are examples of firms enjoying channel leadership. Considering the channel power difference in the actual market conditions, we propose the following two models, (i) R-store leader (RL) model with r-store holding higher channel power and E-store leader (EL) model with e-store holding higher channel power. Therefore, the interaction among the downstream channel members is modelled using a Stackelberg game. Consequently, there are two Stackelberg games. The main game is between the manufacturer and the downstream r-store and e-store, and the sub game is between the r-store and the e-store.

Decision making process

The general structure is as follows. First, the manufacturer announces the wholesale price, w to the r-store and e-store. After observing the wholesale price, the leader of the sub game will fix the price, followed by the follower. After that sales and profit realisation. This decision flow is shown in Fig. 3.

Therefore, the decision variable of the manufacturer is w and the decision variable of the r-store and e-store is their prices ( \({p}_{\rm r}\) and \({p}_{\rm e}\) respectively).

Basic equations

We assume the following linear demand functions (Li et al. 2019; Pi et al. 2019; Yang et al. 2020) for modelling.

where suffix r and e denote r-store and e-store, respectively, and a indicates the base market potential. The magnitude of \({a}_{\rm r}\; \text{and}\; {a}_{\rm e}\) is large compared with other parameters (Li et al. 2016; Pi et al. 2019). \(\lambda\) and \(\gamma\) denotes the own price elasticity and cross price sensitivity, respectively, and \(\lambda >\gamma\) (Ding et al. 2016; Huang et al. 2016).

The profit of the r-store and e-store can be derived using the following equation

Since the manufacturer is deriving his profit from the order quantities of the r-store and e-store, the profit of the manufacturer can be expressed as follows.

where s denotes the unit production cost and \({Q}_{\rm r},{Q}_{\rm e}\) are, respectively, the order quantities of r-stores and e-store.

Equilibrium analysis

In this section, the equilibrium analysis of both the ‘RL game’ and ‘EL game’ is presented based on two scenarios: the normal buying scenario (subscript 1) and the panic buying scenario (subscript 2).

Equilibrium analysis of normal buying scenario

We used the backward induction principle to solve the game and obtain the equilibrium conditions. The pseudocode of the entire Stackelberg game is shown below.

The optimal decisions obtained from the equilibrium analysis of RL game and EL game are presented in Table 2.

The expressions are simplified using the symbol \(\theta\). Kindly refer to the Appendix for expansion.

Equilibrium analysis of panic buying disruption scenario

Even though there is no obvious indication of an imminent shortage in the near future, people tend to engage in panic buying during pandemics, wars and catastrophes (Barnes et al. 2021). This usually happens for a narrow time gap (mostly 24 h) (Austin 2020). Many studies empirically prove that the consumers prefer to have immediate gratification during panic buying (Hao et al. 2020; Mahajan et al. 2021; Yuen et al. 2020). Consequently, customers choose r-stores for panic buying for the immediate possession of goods (Kulkarni 2020; Nakayama and Wan 2021). Due to the bottlenecks in the supply chain (Leung et al. 2018; Ramaekers et al. 2018), e-stores take time in most places to deliver the goods to the doorstep. Thus, the uncertainty of future events makes the e-store an unviable option for panic buying. Consistent with this actual market environment, we assume that the panic buying disruption applies only to the r-store and not the e-store (Levinson and Melissa 2020; Meshram 2020).

The panic buying disruption is modelled as an increase in base market potential (Cao 2014; Kavian Rahmani and Yavari 2019; Soleimani et al. 2016), i.e., the base market potential of the disrupted r-store will be \({(a}_{\rm r}+{{\Delta a}}_{\rm r}),\), where \({{\Delta a}}_{\rm r}\) is the change in demand due to panic buying disruption. The optimal decisions derived from equilibrium analysis of RL game and EL game are shown in Table 3.

The expressions are simplified using the symbols \(\theta .\) Kindly refer to the Appendix for expansion.

Comparative study of normal buying scenario and panic buying disruption

In the prior section, we derived the optimal decisions for both RL and EL models under normal buying scenario and panic buying disruption. In this section, we compare the optimal decisions to derive the propositions. Here \(\Delta\) represent change.

Proposition 1

The optimal decision of the manufacturer changed during panic buying disruption, and accordingly, the increase in wholesale price is quantified as

Proposition 1 suggests that during panic buying disruption, the manufacturer offers a higher wholesale price for both the r-store and e-store. Panic buying disruption created a positive demand disruption, which the manufacturer used to increase the wholesale price to maximise his profit. By comparing the pre disruption and panic buying period, we found that the change in wholesale price was directly proportional to the degree of disruption, \({\Delta a}_{\rm r}\). Most countries have rules against wholesale price discrimination (Rofin and Mahanty 2020, 2021). Consequently, the manufacturer will be forced to charge the same high wholesale price for both the downstream partners, which is evident from Proposition 1.

Proposition 2

The optimal decision of the downstream channel partners changed during panic buying disruption, and accordingly, we have the increase in optimal price as

Proposition 2 shows that the optimal price of both r-store and e-store increased during panic buying disruption irrespective of the leadership models. This period witnessed an increase in demand for the r-store, and the r-store responded to this sudden surge in demand by increasing its optimal price. As shown in Proposition 1, this period also witnessed an increase in the optimal wholesale price of the manufacturer. This also forced the r-store to increase the price. But to our surprise, the e-store also witnessed an increase in its price. This is mainly attributed to two reasons. The optimal wholesale price of the manufacturer increased during this period, which forced the e-store to raise its price. Adding to this, the increase in the price of the product in r-store created a cross price sensitivity effect in the e-store. This is evident in the mathematical model with the presence of \(\gamma.\)

Proposition 3

The optimal order quantity of the downstream channel partners changed as follows

Proposition 3 quantifies the increase or decrease in the optimal order quantity of the r-store and e-store during panic buying disruption. It shows that the optimal order quantity of the r-store increased during both RL and EL models, whereas the optimal order quantity of the e-store increased only during RL model. This period witnessed an increase in demand for the r-store, and as a result, the optimal order quantity of the r-store increased irrespective of the channel leadership. The rise in price of the product (see Proposition 2) also couldn’t control this increase in optimal order quantity. Consequently, we observe that the essential goods act like Veblen goods during panic buying disruption. By analysing the optimal order quantity of the e-store, we found that channel leadership plays a crucial role in order quantity. The second-mover advantage helped the e-store, and as a result, the optimal order quantity of the e-store increased during panic buying disruption in the RL model.

Proposition 4

The optimal profit of the downstream partners changed during panic buying disruption, and accordingly, we have

Proposition 4 implies that the optimal profit increased for the r-store irrespective of the channel power structure, increased for the e-store during the RL model, and decreased during the EL model. The panic buying disruption induced a positive demand disruption which increased the optimal wholesale price (see Proposition 1) and optimal price of the downstream channel partners (see Proposition 2). Along with this, the period witnessed an increase in the optimal order quantity of the r-store (irrespective of channel power) and e-store during RL model. This helped the r-store to enjoy a higher profit. Though the price of the product increased for the e-store under EL model, the optimal order quantity decreased. Consequently, the profit of the e-store decreased during EL model. Hence the panic buying period is beneficial for the r-store irrespective of the channel power and the e-store under RL model.

Proposition 5

During panic buying, manufacturer’s optimal profit increased under both the channel power models, and we found that

Prposition 5 quantifies the increase in profit of the manufacturer during panic buying disruption. Manufacturer was the channel partner who could leverage maximum benefit from the panic buying disruption. Though the demand disruption was only for the r-store, there was no wholesale price discrimination. As a result, the wholesale price increased for both the downstream channel partners. In addition to this, increase in optimal order quantity for the r-store (irrespective of channel power structure), and e-store (during RL model) helped the manufacturer to increase his profit.

Numerical analysis and simulation

Analysis of the optimal price and optimal order quantity

This section analyses the impact of panic buying on the DCSC under different channel power structures numerically. Following the basic premise, \(\lambda >\gamma ; \lambda\) and \(\gamma\) are assumed to be 1.5 and 1.2, respectively. Further, \(s\) is assumed to be 5. We are considering a demand disruption (Δar) of 40% due to panic buying. The values for numerical analysis were selected based on the logical relationship among parameters, the assumptions underlying the linear demand function, and previous research (Rahmani and Yavari 2019; Rofin and Mahanty 2018). We experimented with multiple sets of numerical values and observed a consistent behaviour; hence, only a representative instance is reported. Owing to the significance of base demand, we have considered three cases as follows (i) \({a}_{\rm r}= {a}_{\rm e}({a}_{\rm r}={a}_{\rm e}=125)\), (ii) \({a}_{\rm r}< {a}_{\rm e}({a}_{\rm r}=100; {a}_{\rm e}=150)\), (iii) \({a}_{\rm r}> {a}_{\rm e} ({a}_{\rm r}=150; {a}_{\rm e}=100).\) Following corollaries are derived based on the results obtained from the numerical example.

Corollary 1

Irrespective of base demand disparity of the r-store and e-store ( \({a}_{\rm r}= {a}_{\rm e}\) or \({a}_{\rm r}< {a}_{\rm e}\) or \({a}_{\rm r}> {a}_{\rm e}\)) the relationship among the optimal price of the r-store, the optimal price of the e-store, the optimal order quantity of the r-store and the optimal order quantity of the e-store is as follows

From Corollary 1, it can be observed that both the r-store and e-store charge highest price under panic buying and their respective channel leadership roles. However, the r-store places highest order quantity when the e-store is the leader under panic buying. Similarly, the e-store places highest order quantity when the r-store is the leader under panic buying. It can be inferred that the Law of demand does not hold during panic buying since both the r-store and e-store place the highest order quantity during panic buying period when their respective prices are higher compared to their prices during normal buying scenario. In other words, the r-store and e-store can enjoy a higher margin during panic buying. Thus, even the essential goods act as Veblen goods during panic buying. Here, it is interesting to note that, though the r-store is facing panic buying the e-store also charges higher prices during the period. This can be explained by the same wholesale price charged by the manufacturer to both the r-store and e-store. When the r-store is facing panic buying disruption, it is optimal for the manufacturer to charge higher wholesale price for the r-store. But in order to avoid wholesale price discrimination the same wholesale price is charged for the e-store also. Subsequently, the increase in wholesale price forces the e-store to increase her price.

It is interesting to observe the counter-intuitive result of r-store placing higher order quantity under EL model and the e-store placing higher order quantity under RL model. This result indicates that, even during abnormal conditions like panic buying, the consumer price sensitivity is the determining factor of the channel member performance than the channel power. A conclusive statement regarding the performance of the channel members can only be made after ascertaining the profit of the channel members, which is reported in subsequent sections.

Analysis of the optimal profit of the channel partners

To obtain deeper insights and decisive evidence on the performance of channel partners, we have done Monte-Carlo Simulation (Caiado et al. 2021; Liao et al. 2020; Silva et al. 2021) to model the probability of variation of profit due to the intervention of panic buying. Following the basic modelling premises, we assume that the disruption factor for the r-store, \({{\Delta a}}_{\rm r}\sim N(\text{40,100})\) during panic buying. Based on that we have derived the following corollaries on the profit function.

Corollary 2

The optimal profit of the r-store increased significantly during panic buying disruption and accordingly we have \({\pi }_{\text{r}2}^{\text{EL}*}> {\pi }_{\text{r}2}^{\text{RL}*}>{\pi }_{\text{r}1}^{\text{EL}*}{>\pi }_{\text{r}1}^{\text{RL}*}\)

It is evident from Fig. 4 that the profit of the r-store increases during panic buying period irrespective of the channel leadership model under consideration. As expected, r-store obtains higher profit during panic buying. But contrary to the expectation, the profit of the r-store is higher under EL model. This can be attributed to the lower price charged by the r-store under EL model leading to higher sales volume.

Corollary 3

The optimal profit of the e-store varied significantly during different scenarios and accordingly, we have \({\pi }_{\text{e}2}^{\text{RL}*}>{\pi }_{\text{e}1}^{\text{RL}*}> {\pi }_{\text{e}2}^{\text{EL}*}{>\pi }_{\text{e}1}^{\text{EL}*}\)

The profit of the e-store considerably increased during panic buying period as shown in Fig. 5. Contrary to the r-store, where panic buying played the crucial role; for e-store channel leadership played the significant role. Thus, from Fig. 5 it can be deduced that the RL model dominates EL model with respect to the performance of e-store irrespective of the market condition (disruption or no disruption). This is corroborated by the higher optimal order quantity placed by the e-store under the RL model as seen in Corollary 1.

Corollary 4

Manufacturer obtained maximum profit during panic buying disruption, and accordingly, we find that, \({\pi }_{\text{m}2}^{\text{EL}*}> {\pi }_{\text{m}2}^{\text{RL}*}>{\pi }_{\text{m}1}^{\text{EL}*}{=\pi }_{\text{m}1}^{\text{RL}*}\)

Figure 6 shows that the profit of the manufacturer increases during panic buying disruption irrespective of channel power. But on close observation, we found that the optimal profit was slightly higher for EL model than RL model. This is mainly attributed to the fact that the channel partner, which was under panic buying disruption (retailer), experienced higher order quantity during EL model (see Corollary 1).

Discussions and managerial insights

This study provides important insights for managers in the domain of manufacturing and retailing. Specifically, the study proposes the optimal pricing strategies and optimal strategies for order quantity when the demand faced by the r-store and e-store is normal as well as when there is a panic buying disruption. Further, the study has also considered the impact of channel power in the pricing strategies and strategies related to optimal order quantity. Thus, this study is unique in capturing the interaction of channel power and degree of panic buying disruption in devising optimal strategies for manufacturers, brick and mortar stores (r-stores) and e-stores (e-stores).

From this study, the following observations are made. It is optimal for the r-store and e-store to charge a higher price when they enjoy channel leadership irrespective of whether they face a normal demand or panic buying demand. Regarding order quantity, it is optimal for the r-store to place higher order quantity when the e-store is the channel leader irrespective of whether they face a normal demand or panic buying demand, and it is optimal for the e-store to place higher order quantity when the r-store faces panic buying irrespective of the channel leadership. The pattern observed in the case of order quantity of the e-store is different from that of the r-store. Specifically, the e-store places higher order quantity when he faces normal demand when r-store is the channel leader than under panic buying scenario when e-store is the channel leader.

The above-mentioned observations do not convey whether the optimal pricing strategies and strategies related to optimal order quantities are beneficial or disadvantageous for the channel members. To understand the implications of pricing and order quantity strategies, we examined the profit of the channel members and found that the r-store obtains the highest profit when the e-store is the channel leader under panic buying, and e-store derives maximum profit when the r-store is the channel leader under panic buying. In other words, both r-store and e-store enjoy second-mover advantage. The manufacturer obtains the highest profit when the e-store is the channel leader under panic buying. Thus, panic buying is a desirable phenomenon for all the channel members including the e-store. These findings can act as the guidelines for managers in the retailing business on effective pricing strategies and strategies related to order quantity during the normal business environment and during rare occasions such as pandemics, war or natural disasters causing panic buying disruption.

It is interesting to notice the counter-intuitive results regarding the preference of overall supply chain configuration. For instance, it is beneficial for the r-store to operate under a channel structure in which the e-store is the leader and vice versa. Nevertheless, since the overall channel leadership is assigned to the manufacturer in this study, it is the discretion of the manufacturer to choose the channel structure. Since e-store channel leadership is what is advantageous for the manufacturer, and it can be predicted that the manufacturer will prefer to constitute the channel structure in which the e-store holds higher channel power than the r-store. This deduction has managerial implications for the design of the supply chain configuration and shows the influence of channel power differences within a supply chain network on the performance of channel members. The findings of the study can consider while developing decision support systems so that the DCSC can be robust during panic buying disruptions.

Conclusion

This study aimed to model and examine the impact of panic buying on the profit of r-store, e-store and manufacturer belonging to a dual-channel supply chain when the r-store and e-store are engaged in competition. Game-theoretic models were developed for two settings (i) r-store holds higher channel power (ii) e-store holds higher channel power. Equilibrium analysis was carried out on the game-theoretic models assuming that the r-store faces normal demand pattern, and it faces panic buying disruption. Optimal pricing strategies and optimal strategies related to order quantities of the channel members were derived, and optimal profit of the channel members was obtained as the outcome of the equilibrium analysis of the game-theoretic models. Then we compared the decisions during normal demand and panic buying disruption to model and quantify the change. Further, a numerical example was employed to quantify the result and to obtain managerial insights. The study is unique in capturing the interacting effects of channel power, panic buying and dual-channel supply chain competition.

This study can be extended in several ways. The dynamics of the game-theoretic model under this study and the profit outcomes of the channel members are subjected to the major assumption that the positive demand disruption caused due to panic buying occurs to the r-store. It is worthwhile to investigate the impact of positive or negative demand disruption for the e-store. In this study, we have assumed that the supply is not constrained. The demand disruption models presented in the study is a good starting point to develop models that consider the supply constraints. Further, it was assumed that the manufacturer supplies the product to both the r-store and e-store at the same wholesale price. As a result of this, the e-store increases her price when there is a positive demand disruption for the r-store. Relaxing the assumption of equal wholesale price and investigating the effect of wholesale price discrimination may tell us a different story.

References

Austin, K. 2020. Coronavirus: Supermarkets ask shoppers to be “considerate” and stop stockpiling. BBC. https://www.bbc.com/news/business-51883440. Accessed 20 June 2022.

Barnes, S.J., M. Diaz, and M. Arnaboldi. 2021. Understanding panic buying during COVID-19: A text analytics approach. Expert Systems with Applications 169: 114360. https://doi.org/10.1016/j.eswa.2020.114360.

Caiado, R.G.G., L.F. Scavarda, L.O. Gavião, P. Ivson, D.L.D.M. Nascimento, and J.A. Garza-Reyes. 2021. A fuzzy rule-based industry 4.0 maturity model for operations and supply chain management. International Journal of Production Economics. https://doi.org/10.1016/j.ijpe.2020.107883.

Cao, E. 2014. Coordination of dual-channel supply chains under demand disruptions management decisions. International Journal of Production Research 52 (23): 7114–7131. https://doi.org/10.1080/00207543.2014.938835.

Chen, J., H. Zhang, and Y. Sun. 2012. Implementing coordination contracts in a manufacturer Stackelberg dual-channel supply chain. Omega 40 (5): 571–583. https://doi.org/10.1016/j.omega.2011.11.005.

Chesbrough, H. 2020. To recover faster from Covid-19, open up: Managerial implications from an open innovation perspective. Industrial Marketing Management 88: 410–413. https://doi.org/10.1016/j.indmarman.2020.04.010.

Chiang, W.Y.K., D. Chhajed, and J.D. Hess. 2003. Direct marketing, indirect profits: A strategic analysis of dual-channel supply-chain design. Management Science 49 (4): 5–8. https://doi.org/10.1287/mnsc.49.1.1.12749.

Ding, Q., C. Dong, and Z. Pan. 2016. A hierarchical pricing decision process on a dual-channel problem with one manufacturer and one r-store. International Journal of Production Economics. 175 (5): 197–212. https://doi.org/10.1016/j.ijpe.2016.02.014.

Dolgui, A., and D. Ivanov. 2021. Ripple effect and supply chain disruption management: New trends and research directions. International Journal of Production Research 59 (1): 102–109. https://doi.org/10.1080/00207543.2021.1840148.

Dubey, R., A. Gunasekaran, S.J. Childe, S. Fosso Wamba, D. Roubaud, and C. Foropon. 2018. Empirical investigation of data analytics capability and organisational flexibility as complements to supply chain resilience. International Journal of Production Research 59 (1): 110–128. https://doi.org/10.1080/00207543.2019.1582820.

Govindan, K., H. Mina, and B. Alavi. 2020. A decision support system for demand management in healthcare supply chains considering the epidemic outbreaks: A case study of coronavirus disease 2019 (COVID-19). Transportation Research Part E: Logistics and Transportation Review 138: Article 101967. https://doi.org/10.1016/j.tre.2020.101967.

Gupta, V., D. Ivanov, and T.M. Choi. 2021. Competitive pricing of substitute products under supply disruption. Omega 101: Article 102279. https://doi.org/10.1016/j.omega.2020.102279.

Elnahla, N., and L.C. Neilson. 2021. Retaillance: A conceptual framework and review of surveillance in retail. The International Review of Retail, Distribution and Consumer Research 31 (3): 330–357. https://doi.org/10.1080/09593969.2021.1873817.

Gettleman, J., and K. Schultz. 2020. Coronavirus in India: Modi orders total lockdown of 21 days. The New York Times. https://www.nytimes.com/2020/03/24/world/asia/india-coronavirus-lockdown.html. Accessed 20 June 2022.

Hall, M.C., G. Prayag, P. Fieger, and D. Dyason. 2020. Beyond panic buying: Consumption displacement and COVID-19. Journal of Service Management 32 (1): 113–128. https://doi.org/10.1108/JOSM-05-2020-0151.

Hao, N., H.H. Wang, and Q. Zhou. 2020. The impact of online grocery shopping on stockpile behavior in Covid-19. China Agricultural Economic Review 12 (3): 459–470. https://doi.org/10.1108/CAER-04-2020-0064.

He, P., Z. Wang, V. Shi, and Y. Liao. 2021. The direct and cross effects in a supply chain with consumers sensitive to both carbon emissions and delivery time. European Journal of Operational Research 292 (1): 172–183. https://doi.org/10.1016/j.ejor.2020.10.031.

Hosseini-Motlagh, S.M., N. Nami, and Z. Farshadfar. 2020. Collection disruption management and channel coordination in a socially concerned closed-loop supply chain: A game theory approach. Journal of Cleaner Production 276, Article 124173. https://doi.org/10.1016/j.jclepro.2020.124173.

Hua, G., T.C.E. Cheng, and S. Wang. 2011. Electronic books: To “e” or not to “e”? A strategic analysis of distribution channel choices of publishers. International Journal of Production Economics 129 (2): 338–346. https://doi.org/10.1016/j.ijpe.2010.11.011.

Huang, H., H. Ke, and L. Wang. 2016. Equilibrium analysis of pricing competition and cooperation in supply chain with one common manufacturer and duopoly r-stores. International Journal of Production Economics 178: 12–21. https://doi.org/10.1016/j.ijpe.2016.04.022.

Huang, S., S. Chen, and H. Li. 2018. Optimal decisions of a r-store-owned dual-channel supply chain with demand disruptions under different power structures. International Journal of Wireless and Mobile Computing 14 (3): 277–287. https://doi.org/10.1504/IJWMC.2018.092370.

Huang, S., G. Chen, and Y. Ma. 2015. Online channel operation mode: Game theoretical analysis from the supply chain power structures. Journal of Industrial Engineering and Management 8 (5): 1602–1622. https://doi.org/10.3926/jiem.1616.

Huang, S., C. Yang, and H. Liu. 2013. Pricing and production decisions in a dual-channel supply chain when production costs are disrupted. Economic Modelling 30 (1): 521–538. https://doi.org/10.1016/j.econmod.2012.10.009.

Huang, S., C. Yang, and X. Zhang. 2012. Pricing and production decisions in dual-channel supply chains with demand disruptions. Computers and Industrial Engineering 62 (1): 70–83. https://doi.org/10.1016/j.cie.2011.08.017.

Ivanov, D., and A. Dolgui. 2021. OR-methods for coping with the ripple effect in supply chains during COVID-19 pandemic: Managerial insights and research implications. International Journal of Production Economics 232: Article 107921. https://doi.org/10.1016/j.ijpe.2020.107921.

Kulkarni, S.R. 2020. Effect of Covid-19 on the shift in consumer preferences with respect to shopping modes (offline/online) for groceries: An exploratory study. International Journal of Management. http://www.iaeme.com/IJM/index.asp581, http://www.iaeme.com/IJM/issues.asp?JType=IJM&VType=11&IType=10.

Kurata, H., D.Q. Yao, and J.J. Liu. 2007. Pricing policies under direct vs. indirect channel competition and national vs. store brand competition. European Journal of Operational Research 180 (1): 262–281. https://doi.org/10.1016/j.ejor.2006.04.002.

Leung, K.H., K.L. Choy, P.K.Y. Siu, G.T.S. Ho, H.Y. Lam, and C.K.M. Lee. 2018. A B2C e-commerce intelligent system for re-engineering the e-order fulfilment process. Expert Systems with Applications 91: 386–401. https://doi.org/10.1016/j.eswa.2017.09.026.

Levinson, R., and F. Melissa. 2020. Walmart trailed supermarkets amid peak panic-buying—data. Reuters. https://www.reuters.com/article/us-health-coronavirus-walmart-analysis-idUSKBN22U2CU. Accessed 20 June 2022.

Li, B., M. Zhu, Y. Jiang, and Z. Li. 2016. Pricing policies of a competitive dual-channel green supply chain. Journal of Cleaner Production 112 (3): 2029–2042. https://doi.org/10.1016/j.jclepro.2015.05.017.

Li, G., L. Li, and J. Sun. 2019. Pricing and service effort strategy in a dual-channel supply chain with showrooming effect. Transportation Research Part e: Logistics and Transportation Review 126 (3): 32–48. https://doi.org/10.1016/j.tre.2019.03.019.

Liao, H., N. Shen, and Y. Wang. 2020. Design and realisation of an efficient environmental assessment method for 3R systems: A case study on engine remanufacturing. International Journal of Production Research 58 (19): 5980–6003. https://doi.org/10.1080/00207543.2019.1662132.

Mahajan, V., G. Cantelmo, and C. Antoniou. 2021. Explaining demand patterns during COVID-19 using opportunistic data: A case study of the city of Munich. European Transport Research Review. https://doi.org/10.1186/s12544-021-00485-3.

Mao, F. 2020. Coronavirus panic: Why are people stockpiling toilet paper? BBC News. https://www.bbc.com/news/world-australia-51731422 . Accessed 20 June 2022.

Lohmer, J., N. Bugert, and R. Lasch. 2020. Analysis of resilience strategies and ripple effect in blockchain-coordinated supply chains: An agent-based simulation study. International Journal of Production Economics 228: Article 107882. https://doi.org/10.1016/j.ijpe.2020.107882.

Ma, S., Y. He, and R. Gu. 2021. Dynamic generic and brand advertising decisions under supply disruption. International Journal of Production Research 59: 188–212. https://doi.org/10.1080/00207543.2020.1812751.

Meshram, J. 2020. How COVID-19 affected the online grocery buying experiences—A study of select cities of Mumbai and Pune. International Journal of Latest Technology in Engineering, Management & Applied Science. https://www.ijltemas.in/DigitalLibrary/Vol.9Issue11/01-05.pdf.

Nakayama, M., & Wan, Y., 2021. A quick bite and instant gratification: A simulated Yelp experiment on consumer review information foraging behaviour. Information Processing and Management, 58 (1), Article 102391. https://doi.org/10.1016/j.ipm.2020.102391

O’Connell, M., Á. De Paula, and K. Smith. 2020. Preparing for a pandemic: Spending dynamics and panic buying during the covid-19 first wave. Fiscal Studies 42: 249–264. https://doi.org/10.1111/1475-5890.12271.

Pi, Z., Fang, W., & Zhang, B., 2019. Service and pricing strategies with competition and cooperation in a dual-channel supply chain with demand disruption. Computers and Industrial Engineering, 138 (2), Article 106130. https://doi.org/10.1016/j.cie.2019.106130

Queiroz, M.M., D. Ivanov, A. Dolgui, and S. Fosso Wamba. 2020. Impacts of epidemic outbreaks on supply chains: Mapping a research agenda amid the COVID-19 pandemic through a structured literature review. Annals of Operations Research. https://doi.org/10.1007/s10479-020-03685-7.

Rahmani, K., and M. Yavari. 2019. Pricing policies for a dual-channel green supply chain under demand disruptions. Computers and Industrial Engineering 127 (2): 493–510. https://doi.org/10.1016/j.cie.2018.10.039.

Ramaekers, K., A. Caris, S. Moons, and T. van Gils. 2018. Using an integrated order picking-vehicle routing problem to study the impact of delivery time windows in e-commerce. European Transport Research Review 10 (2): 1–11. https://doi.org/10.1186/s12544-018-0333-5.

Reisman, A., A. Kumar, and J.G. Motwani. 2001. A meta review of game theory publications in the flagship US-based OR/MS journals. Management Decision. 39: 147–155. https://doi.org/10.1108/EUM0000000005420.

Rofin, T.M., and B. Mahanty. 2018. Optimal dual-channel supply chain configuration for product categories with different customer preference of online channel. Electronic Commerce Research 18 (3): 507–536. https://doi.org/10.1007/s10660-017-9269-4.

Rofin, T.M., and B. Mahanty. 2020. Impact of wholesale price discrimination by the manufacturer on the profit of supply chain members. Management Decision 60 (2): 449–470. https://doi.org/10.1108/MD-11-2019-1644.

Rofin, T.M., and B. Mahanty. 2021. Impact of wholesale price discrimination on the profit of chain members under different channel power structures. Journal of Revenue and Pricing Management 20 (2): 91–107. https://doi.org/10.1057/s41272-021-00293-3.

Saha, S. 2016. Channel characteristics and coordination in three-echelon dual-channel supply chain. International Journal of Systems Science 47 (3): 740–754. https://doi.org/10.1080/00207721.2014.904453.

Silva, L.M.F., A.C.R. de Oliveira, M.S.A. Leite, and F.A.S. Marins. 2021. Risk assessment model using conditional probability and simulation: Case study in a piped gas supply chain in Brazil. International Journal of Production Research 59 (10): 2960–2976. https://doi.org/10.1080/00207543.2020.1744764.

Soleimani, F., A. Arshadi Khamseh, and B. Naderi. 2016. Optimal decisions in a dual-channel supply chain under simultaneous demand and production cost disruptions. Annals of Operations Research 243 (1–2): 301–321. https://doi.org/10.1007/s10479-014-1675-6.

Takahashi, K., T. Aoi, D. Hirotani, and K. Morikawa. 2011. Inventory control in a two-echelon dual-channel supply chain with setup of production and delivery. International Journal of Production Economics 133: 403–415. https://doi.org/10.1016/j.ijpe.2010.04.019.

Tang, C., H. Yang, E. Cao, and K.K. Lai. 2018. Channel competition and coordination of a dual-channel supply chain with demand and cost disruptions. Applied Economics 50: 4999–5016. https://doi.org/10.1080/00036846.2018.1466989.

Thomasson, E., and H. Soderpalm. 2022. Ukraine war sparks Europe rush to buy survival gear and food. Reuters. https://www.reuters.com/world/europe/ukraine-war-sparks-europe-rush-buy-survival-gear-food-2022-03-16. Accessed 20 June 2022.

Vasnani, N.N., F.L.S. Chua, L.A. Ocampo, and L.B.M. Pacio. 2019. Game theory in supply chain management: Current trends and applications. International Journal of Applied Decision Sciences 12 (1): 56–97. https://doi.org/10.1504/IJADS.2019.096552.

Wang, D., and W. Li. 2021. Optimisation algorithm and simulation of supply chain coordination based on cross-border E-commerce network platform. Eurasip Journal on Wireless Communications and Networking. https://doi.org/10.1186/s13638-021-01908-4.

Wang, T.Y., Z.Q. Wang, and P. He. 2021. Impact of information sharing modes on the dual-channel closed loop supply chains under different power structures. Asia-Pacific Journal of Operational Research. https://doi.org/10.1142/S0217595920500517.

Watada, J., T. Waripan, and B. Wu. 2014. Optimal decision methods in two-echelon logistic models. Management Decision. 52: 1273–1287. https://doi.org/10.1108/MD-03-2013-0139.

Xu, J., X. Zhou, J. Zhang, and D.Z. Long. 2021. The optimal channel structure with retail costs in a dual-channel supply chain. International Journal of Production Research 59 (1): 47–75. https://doi.org/10.1080/00207543.2019.1694185.

Yan, B., Z. Jin, Y. Liu, and J. Yang. 2018. Decision on risk-averse dual-channel supply chain under demand disruption. Communications in Nonlinear Science and Numerical Simulation 55: 206–224. https://doi.org/10.1016/j.cnsns.2017.07.003.

Yang, W., J. Zhang, and H. Yan. 2020. Impacts of online consumer reviews on a dual-channel supply chain. Omega. https://doi.org/10.1016/j.omega.2020.102266.

Yao, D.Q., X. Yue, S.K. Mukhopadhyay, and Z. Wang. 2009. Strategic inventory deployment for retail and e-tail stores. Omega 37 (3): 646–658. https://doi.org/10.1016/j.omega.2008.04.001.

Yuen, K.F., X. Wang, F. Ma, and K.X. Li. 2020. The psychological causes of panic buying following a health crisis. International Journal of Environmental Research and Public Health 17 (10): Article 3513. https://doi.org/10.3390/ijerph17103513.

Zhang, C., Y. Wang, Y. Liu, and H. Wang. 2021. coordination contracts for a dual-channel supply chain under capital constraints. Journal of Industrial and Management Optimization 17 (3): 1485–1504. https://doi.org/10.3934/jimo.2020031.

Zhang, P., Y. Xiong, and Z. Xiong. 2015. Coordination of a dual-channel supply chain after demand or production cost disruptions. International Journal of Production Research 53: 3141–3160. https://doi.org/10.1080/00207543.2014.975853.

Zhang, R., and B. Sun. 2020. A competitive dynamics perspective on evolutionary game theory, agent-based modeling, and innovation in high-tech firms. Management Decision 58: 948–966. https://doi.org/10.1108/MD-06-2018-0666.

Zhang, Y., and B. Hezarkhani. 2020. Competition in dual-channel supply chains: The manufacturers’ channel selection. European Journal of Operational Research 291 (1): 244–262. https://doi.org/10.1016/j.ejor.2020.09.031.

Zheng, R., B. Shou, and J. Yang. 2021. Supply disruption management under consumer panic buying and social learning effects. Omega 101: Article 102238. https://doi.org/10.1016/j.omega.2020.102238.

Zhi, B., X. Liu, J. Chen, and F. Jia. 2019. Collaborative carbon emission reduction in supply chains: An evolutionary game-theoretic study. Management Decision 57 (4): 1087–1107. https://doi.org/10.1108/MD-09-2018-1061.

Zulauf, K., F.S. Cechella, and R. Wagner. 2021. The bidirectionality of buying behavior and risk perception: An exploratory study. International Review of Retail, Distribution and Consumer Research. https://doi.org/10.1080/09593969.2021.1936596.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

For reducing the complexity of reporting, we used the following symbols to represent some equations.

Proof of Proposition 1

Proof of Proposition 2

Proof of Proposition 3

Proof of Proposition 4

Proof of Proposition 5

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Raju, S., Rofin, T.M. & Kumar, S.P. Pricing decisions during panic buying and its effect on a dual-channel supply chain under different channel power structures. J Revenue Pricing Manag 23, 83–95 (2024). https://doi.org/10.1057/s41272-023-00425-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41272-023-00425-x