Abstract

This study aims to analyze the impact of consumption values on the adoption of NBG’s mobile banking services and the role of customers’ motivation and app adoption in this process. The study reveals users’ attitudes and behavior towards mobile banking by establishing significant connections between selected UTAUT constructs. Based on a critical case of the m-banking services of a leading Greek financial institution, we gathered 418 full-answered questionnaires from a convenience sample of 654 customers to test 18 research hypotheses. The research results confirm that the three selected UTAUT constructs, are antecedents of behavioral intention, supporting the initial assumption. This study analyzes the factors that drive the adoption and usage of mobile banking apps, providing valuable insights for marketing academia and managers.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

In today’s world, banking services have expanded to various marketing channels. Conventional retail banking is losing appeal, whereas modern services like mobile banking are gaining traction. With the swift development of mobile technology in recent years, mobile banking has become the preferred choice for most customers. This service enables users to effortlessly access financial information and fulfill their financial obligations promptly and effectively.

Financial institutions have several advantages regarding mobile banking apps, such as expanding revenue sources, maintaining a customer base, and entering new markets (Karjaluoto et al. 2021). Bank marketers aim to improve mobile banking apps to enhance customers’ experiences and motivation (Bitrián et al. 2021). However, there is a lack of research on customers’ experiences and expectations of mobile banking services, and more research is needed to account for differences between generations of mobile banking customers (e.g., Shams et al. 2020).

Our study delves into the expectations of mobile banking users from generations X and Z, exploring their unique characteristics regarding mobile banking services (Shams et al. 2020).

X generation represents the parents’ generation and Z their children generation. We aim to determine whether users’ trust and willingness to use NBG’s m-banking services are impacted by the values associated with them (Karjaluoto et al. 2021). To achieve this, we employ the Unified Theory of Acceptance and Use of Technology (UTAUT) (Venkatesh et al. 2003), to test the selected three UTAUT constructs, as antecedents of behavioral intention. Our study seeks to better understand banking customers by analyzing their motivation and willingness to use mobile banking services based on gender and the distinctive traits of two generations. Furthermore, we will scrutinize their usage behavior to facilitate the adoption of mobile apps for banking services (Bitrián et al. 2021).

In 2021, Karjaluoto et al. delved into the correlation between trust, intention, and consumption values for mobile banking app users. Simultaneously, Shams et al. (2020) studied the differences in expectations and experiences of mobile banking services among generations X, Y, and Z. Similarly, Souiden et al. (2020) identified the key factors impacting customers’ adoption of mobile banking services and the obstacles they encounter. This article presents a critical case study of NBG to accomplish two research objectives. Firstly, we will examine how consumption values impact the adoption of m-banking services. Secondly, we will explore how customers’ usage behavior and intentions can facilitate the use of mobile apps in banking.

Background information about National Bank of Greece S.A.

The National Bank of Greece was the country’s first bank and a prestigious financial organization since its founding in 1841. The bank, which operates in North Macedonia and Cyprus, is dedicated to maintaining its status as the nation’s top financial institution and assisting the Greek economy. With a strong focus on transparency and consistency for all stakeholders, its variety of financial solutions is accessible to various clientele, including retail, commercial, corporate, premium, and private customers. With web and mobile banking already in place, the bank is undergoing a digital transformation under its current CEO, Pavlos Mylonas. Additionally, the bank is leveraging social media to appeal to younger customers, although the outcomes have yet to be as expected.

Importance of the topic and justification for the focus of the study

Nowadays, mobile devices are an essential part of our daily routine. People of all ages use them to communicate and access various features. According to Karjaluoto et al. (2021), the mobile communication industry contributes 4.5% to the global GDP, and mobile internet users are expected to reach 5 billion by 2025. Therefore, banking marketers need to offer mobile banking apps to meet their customers’ increasing demands, as Shams et al. (2020) pointed out. However, for these apps to thrive, they must provide a pleasant user experience that encourages and captivates users, as highlighted by Garzaro et al. (2021).

Quantitative models often prioritize age as the primary consideration when comparing different generations without delving into other generational variances. Nonetheless, prior research has emphasized that various generations possess distinct perspectives toward embracing mobile banking services. Moreover, crucial factors that impact the inclination to adopt mobile banking have been analyzed, such as security, convenience, accessibility, and hedonic motivation (Shams et al. 2020).

Most studies on consumers’ intentions to use mobile banking are grounded on various theoretical frameworks (Farzin et al. 2021; Shaikh and Karjaluoto 2015). A considerable information gap exists since the use and effects of mobile banking apps among generations X and Z have yet to be sufficiently investigated (e.g., Fadhilah and Aruan 2023; Lin et al. 2023). Tam and Oliveira (2017) and Farzin et al. (2021) have noted that the technology acceptance model (TAM) has been employed in the vast majority of studies on mobile banking adoption intention; this indicates the significance of incorporating alternative theories to address any potential gaps in the literature. This study tackles this problem and offers theoretical and practical ramifications. It provides insightful information to customers of various generations and adds to the body of research already available on the influence of behavioral intention in banking. Moreover, marketing managers aiming to increase the usage of mobile banking apps could benefit from the research results.

Theoretical background, theoretical model and conceptual model

Around thirty years ago, there was a growing interest in the research community to adopt technology in both organizational and private settings (Compeau and Higgins 1995a; Goodhue 1995; Leonard-Barton and Deschamps 1988; Davis 1989). By 2000, the technology adoption research had produced much data regarding user behavior about technology adoption (Hu et al. 1999). Various models and theories were developed to describe technology adoption, providing insight into the variation in technology usage intention (Venkatesh and Davis 2000; Taylor and Todd 1995a, b; Davis 1989; Davis et al. 1989). However, the disciplinary origins of these models limited their application to specific situations.

The Theories of Planned Behavior and Reasoned Action offer a psychological perspective on human behavior by looking at factors such as attitude, perceived behavioral control, and subjective norms (Ajzen 2011). They can be applied in various study contexts beyond information system management as they provide general insights into people’s underlying attitudes.

On the other hand, the Diffusion of Innovation Theory focuses on innovation-specific elements that impact consumers’ actions towards adopting new technologies (Moore and Benbasat 1991). The different viewpoints of the models reflect the variables they include, such as social elements, experience, facilitating conditions, motivational factors, attitudinal aspects related to technological performance, and subjective norms.

Venkatesh et al. (2003) introduced the UTAUT, a comprehensive model integrating eight theories to identify the important elements affecting the adoption of technology in organizations. Notably, the UTAUT model explains a much more significant variance in information technology adoption, a marked improvement over previous theories. Understanding technology usage in business is crucial, and the UTAUT model highlights two key determinants (the intention to use technology and various factors that can support or hinder this intention). Three direct determinants and four contingencies influence the intention to use technology. The model is essential in comprehending technology acceptance in the business world, influenced by behavioral intention and facilitating conditions. Facilitating conditions refer to the technical and organizational support necessary for successful technology adoption. Additionally, UTAUT recognizes that age, gender, voluntariness of use, and experience can all impact the importance of these determinants. For example, gender affects the three factors contributing to behavioral intention, while age impacts all determinants. Experience affects three of four fundamental constructs except performance expectancy, while voluntariness of use only affects social influence (Fig. 1).

Theoretical model: Venkatesh et al. (2003)

Fundamental constructs of UTAUT and theoretical assumptions

Performance expectancy

The notion of performance expectancy held significant weight in previous iterations of UTAUT, as it intersected with various factors, including C-TAM-TPB’s perceived usefulness, MM’s extrinsic motivation, MPCU’s job suitability, IDT’s relative advantage, and SCT’s outcome expectations (Venkatesh et al. 2003). Research has shown that this construct remains consistently a key driver, with its effect impacted by two primary variables: gender and age. Generally speaking, men tend to prioritize task orientation, thus elevating the importance of performance expectancy. Moreover, younger individuals value extrinsic rewards more than older individuals, which can affect their performance expectancy. It is essential to examine these factors in conjunction, as there may be notable variations in their impact as individuals age. To summarize, according to UTAUT, younger males, in particular, are more likely to have their behavioral intentions influenced by performance expectancy.

Effort expectancy

Three contingencies influence effort expectancy: gender, age, and experience. Similarly, to performance expectancy, effort expectancy is rooted in previous models’ core constructs. In particular, perceived ease of use of TAM, complexity of MPCU, and ease of use of IDT are strongly associated with effort expectancy (Rouidi et al., 2022). The exciting part of effort expectancy is that it loses its importance over time; it is significant during post-training periods and before the actual utilization of technology. However, it tends to become insignificant during extended and sustained system usage. Increased age is connected with increased difficulty processing new technology systems, especially when working. According to Venkatesh et al. (2003), women with minimal experience tend to value effort expectancy more. In conclusion, effort expectancy affects older females more deeply, particularly those with less experience with such systems.

Social influence

When embracing new technology, social influence plays a crucial role. It is a critical concept in UTAUT, encompassing a range of notions, including social factors (e.g., MPCU and image in IDT), TRA, TPB, and DTPB. These ideas relate to the image individuals expect to project to their friends, family, colleagues, and peers after using a new technology system (Williams et al. 2015). Social influence is a complex construct that depends on various factors. According to Venkatesh et al. (2003), three different mechanisms can influence the social impact on a person’s behavior (compliance, internalization, and identification). Subjective norms, social factors, and image also play a significant role in shaping social influence. Compliance can occur when people feel pressured to conform to social expectations from those who reward or punish certain behaviors. Age, experience, and gender can all impact social influence, especially for older women unfamiliar with specific tasks.

Facilitating conditions

Venkatesh et al. (2003) suggest that these core construct does not directly determine behavioral intention but rather actual system usage, as it pertains to the existence of barriers that may hinder or facilitate system utilization. According to Martinez and McAndrews (2023), facilitating conditions did not impact use behavior. Accordingly, Tandon (2021) shows that there is no significant impact on customer satisfaction. Facilitating conditions, which stem from perceived behavioral control in TPB, DTPB, and C-TAM-TPB, are external factors that can impact system use. These conditions encompass facilitating MPCU conditions and IDT compatibility, as noted by Jadil et al. (2021). However, the impact of these conditions on system use can differ based on age and experience. Individuals with more experience may be adept at finding alternative ways to use the system. Thus, the impact of facilitating conditions may be less critical. Older individuals are more likely to seek and receive help when using a technology system than younger individuals. Overall, facilitating conditions are expected to be crucial in older individuals with increasing experience.

The UTAUT is a comprehensive framework that sheds light on the factors influencing technology usage. According to UTAUT, several crucial assumptions affect user behavior:

-

1.

Performance expectancy is the belief that users will adopt and use technology more if they expect it to enhance their productivity and performance.

-

2.

Effort expectancy is the users’ perception of technology being easy to use and comprehend, which makes them more likely to adopt and use it.

-

3.

Social influence plays a critical role, where users’ behavior can be influenced by their social networks’ opinions, recommendations, and norms.

-

4.

Facilitating conditions such as access to resources and support are vital for successful technology adoption and usage.

The UTAUT model explains how users’ intention to use technology is related to their actual usage behavior. It considers factors such as their expectations of performance, how much effort they expect to put in, and the influence of others around them. In addition, it recognizes that certain conditions may facilitate or hinder usage and that individual differences such as gender and age may affect these factors. Using UTAUT, this study aims to understand better what drives users to adopt mobile banking applications and how they behave in this context. The model’s comprehensive nature and attention to essential details make it a solid foundation for this research.

Conceptual model, research model, research hypotheses and literature support

The UTAUT model has been criticized for its limited ability to describe behavioral intention in various contexts. In order to address this, many researchers have expanded the model by including other behavioral factors and adding new moderating effects. However, some researchers have expressed concern about the widespread use of UTAUT, noting that many studies in the IS context mention the original work without utilizing the model. Recent research on the effect of facilitating conditions on user behavior in mobile banking customers did not find conclusive evidence. Our conceptual model (Fig. 2) represents a subset of UTAUT constructs and moderating variables based on the research aim of the study, including the effect of consumption values on users’ behavior and the intermediate effect of behavioral intentions of Gen Z and Gen X for mobile banking app adoption. We understand the bias-variance trade-off and the risk of overfitting, so we have carefully selected the variables that we believe will lead to accurate predictions on new data.

Our research model is built upon the original UTAUT proposed by Venkatesh et al. (2003). We have refined our approach and eliminated the non-significant determinants. As such, we focus solely on the “three fundamental UTAUT constructs” (social influence, performance expectancy, and effort expectancy), and exclude all other constructs and moderators in our testing. In addition, one of the four contingencies of the original UTAUT (gender) is included in the research model.

In the generation process, the age variable will also be considered. It is worth noting that the research model has undergone significant modifications from its original version, and as a result, the significance of each moderating relationship is thoroughly tested. Prior studies that utilized the UTAUT research model have either employed a modified version with a select few original moderators or completely neglected them (Dwivedi et al. 2019). Ultimately, the research model aims to explore the impact of consumption values on the behavior of banking customers concerning mobile banking applications.

Our research aims to assess the validity of a modified version of the UTAUT model concerning the adoption of mobile banking services while also considering consumption values as additional determinants of mobile banking customers’ behavior. The accompanying Fig. 2 outlines our research model.

The research model includes the following eighteen (18) research hypotheses.

-

H1: Performance expectancy positively influences behavioral intention.

-

H2: Effort expectancy positively influences behavioral intention.

-

H3: Social influence positively influences behavioral intention.

-

H4: Behavioral intention positively influences user’s behavior.

-

H5: Performance expectancy positively influences user’s behavior through the intermediate effect of behavioral intention.

-

H6: Effort expectancy positively influences user’s behavior through the intermediate effect of behavioral intention.

-

H7: Social influence positively influences user’s behavior through the intermediate effect of behavioral intention.

-

H8a: While social influence influences behavioral intention, this relationship is stronger for women than men.

-

H8b: While effort expectancy influences behavioral intention, this relationship is stronger for women than men.

-

H8c: While performance expectancy influences behavioral intention, this relationship is stronger for men than women.

-

H9a: While social influence influences behavioral intention, this relationship is stronger for Generation X than Generation Z.

-

H9b: While effort expectancy influences behavioral intention, this relationship is stronger for Generation X than Generation Z.

-

H9c: While performance expectancy influences behavioral intention, this relationship is stronger for Generation X than Generation Z.

-

H10: Functional value positively influences user’s behavior.

-

H11: Social value positively influences user’s behavior.

-

H12: Emotional value positively influences user’s behavior.

-

H13: Epistemic value positively influences user’s behavior.

-

H14: Conditional value positively influences user’s behavior.

Table 1 includes the operational definitions of the key constructs and the measurement items of variables.

Venkatesh et al. (2003) formulated their model by drawing on established research identifying influential factors in predicting technology adoption and usage integrated into the UTAUT model or customized to align with the research framework.

Behavioral intention and user’s behavior

Theory of Reasoned Action/TRA (1975) and Theory of Planned Behavior/TPB (Ajzen 1991) have extensively explored the correlation between intended behavior and actual behavior. Additionally, Davis’ TAM (1989) incorporates aspects of intended behavior to forecast user behavior.

Theory of Reasoned Action highlights the distinction between behavioral intention and actual behavior. It acknowledges that individuals may intend to act but not follow through or opt for a different action. The TPB builds on this framework, recognizing the critical role that behavioral intention plays in shaping actual behavior. Similarly, Fred Davis’ TAM underscores the significance of behavioral intention as a precursor to behavior. Both models yield more accurate predictions of behavior usage when behavioral intention is taken into account, as compared to the Theory of Reasoned Action. Rashmini et al. (2020) analyzed mobile online banking adoption behavior in developing countries using the UTAUT model. Hence, a comprehensive understanding of behavioral intention is crucial in accurately predicting behavior:

-

H4: The behavioral intention positively influences user’s behavior.

Performance expectancy

Perceived usefulness, introduced by Davis (1989) in the TAM, is particularly relevant to performance expectancy. It refers to an individual’s belief that adopting a system will improve their performance or create a positive correlation between usage and performance in their work environment. Extrinsic motivation is the foundation of performance expectancy. In a study by Davis et al. (1992), extrinsic and intrinsic motivation were differentiated, with extrinsic motivation being linked to perceived usefulness (performance expectancy) due to the rewards and benefits associated with job performance. Thompson et al. (1991) proposed three dimensions for personal computing system adoption, with job fit being one of them. It aligns with Davis’ perceived usefulness, highlighting the system’s ability to assist in task completion. Moore and Benbasat (1991) identified relative advantage as a critical factor influencing the rate of innovation adoption. It links to perceived usefulness, focusing on individuals’ perceptions of the value of innovation characteristics rather than the characteristics themselves. Compeau and Higgins (1995b) explored computer self-efficacy and outcome expectations, finding that expected outcomes of system adoption are associated with individuals’ liking of the behavior. They also distinguished between performance-related and personal outcome expectations, which are intertwined with performance expectancy. Venkatesh et al. (2003) examined the relationship between performance expectancy and behavioral intention in the original UTAUT.

According to Martinez and McAndrews (2023), performance expectancy and habit are strong predictors of intention and use behavior, in accordance with previous research has shown that performance expectancy is a crucial aspect of UTAUT. An example of research on users’ intentions to use FinTech services can be found in the findings of Yan et al. (2021). Additionally, a recent study by Chan et al. (2022) revealed a significant correlation between performance expectancy and users’ intentions to use FinTech and online banking services.

-

H1: Performance expectancy positively influences behavioral intention.

Other studies document that gender and age moderate this relationship, with men, especially younger ones, placing more value on performance expectancy than women (e.g., Al-Saedi et al. 2020; Williams et al. 2015). The literature recognizes the connection between expected technology outcomes, behavioral intention, and actual behavior, providing a theoretical basis for the following hypotheses:

-

H8c: While performance expectancy influences behavioral intention, this relationship is stronger for men than women.

-

H10d: While performance expectancy influences behavioral intention, this relationship is stronger for Generation Z than Generation X.

Effort expectancy

Effort expectancy is crucial for gauging a user’s experience with a new system. It considers accessibility, complexity, and perceived ease of use. First introduced by Davis (1989) as part of the TAM, perceived ease of use refers to the effort required to adopt an information service system. When faced with similar performance expectations, users tend to choose the system that is easier to use. Perceived ease of use is influenced by self-efficacy and can impact the user’s attitude toward system usage. Furthermore, external factors such as additional features can enhance the system’s usability and improve perceived ease of use. According to Davis’s perceived ease of use, user-friendliness is positively linked to behavioral intention. It involves the system’s ability to cater to the user’s preferences, values, and needs. Venkatesh et al. (2003) emphasize the importance of effort expectancy during the initial stages of use, which gradually diminishes as the user becomes more familiar with the system.

-

H2: Effort expectancy positively influences behavioral intention.

Research indicates that men are more inclined to embrace technology than women, and younger individuals are more prompt to adopt new technological advancements than their older counterparts (e.g., Kim and Chiu 2019; Li and Kirkup 2007). However, whether these trends are consistent across different age groups and genders regarding mobile technology remains to be determined. Women may prioritize their concerns about the perceived effort required to use new technology. At the same time, older generations may hesitate to adopt mobile apps if they perceive them as complicated (e.g., Chua et al. 2023). Consequently, the level of effort expectancy substantially impacts both the intention to use and the actual utilization of new technology. The following hypotheses will delve into this relationship:

-

H8b: While effort expectancy influences behavioral intention, this relationship is stronger for women than men.

-

H9c: While effort expectancy influences behavioral intention, this relationship is stronger for Generation X than Generation Z.

Social influence

Social factors heavily influence how an individual is perceived by their peers or colleagues when adopting an innovation system, including subjective norms and image. According to Ajzen (1991), subjective norms play a significant role in determining an individual’s intention regarding a particular action. These norms refer to the perceived social pressure to act or refrain from acting. When subjective norms increase, it has a positive impact on behavioral intention. Mathieson (1991) further emphasized the importance of subjective norms in behavioral intention and suggested that the focus should be on the information systems used rather than the systems themselves. Essentially, subjective norms represent the perceived opinions of essential individuals whose beliefs are considered significant to the individual. Compliance with these norms is linked to behavioral intention.

The impact of subjective norms on behavioral intention cannot be overstated, as perceived behavioral control affects both intention and behavior. Within organizational settings, subjective norms are incredibly influential in shaping behavioral intention, leading to tangible outcomes. Nonetheless, when external pressure to perform is lacking, subjective norms may not hold as much weight in determining behavioral intention. Thompson et al. (1991) found that social factors, previously referred to as “social norms”, impact an individual’s behavior intention. These factors consist of messages from others that provide direction on what the individual should do. Social factors include subjective culture, which comprises norms, roles, and values that strongly influence behavior intention. Multiple studies confirm the noteworthy correlation between social norms and behavior. According to Moore and Benbasat (1991), the image construct is linked to social influence. This construct reflects individuals’ openness to new ideas to enhance their social standing. Previous studies indicate that the desire for social status motivates the adoption of innovations.

Recently, research has demonstrated that social influence plays a positive role in the intention to use mobile banking services (e.g., Chen et al. 2023) and the actual usage of such services (e.g., Chetioui et al. 2023). Additionally, empirical evidence indicates that this relationship is moderated in online banking services (e.g., Kaur and Arora 2023). In order to test these hypotheses, we test the following:

-

H3: Social influence positively influences behavioral intention.

It has been found that men are more susceptible to social influence than previously thought, despite some authors (such as Acheampong et al. 2018; Lee et al. 2019; Liébana-Cabanillas et al. 2014) claiming otherwise. Furthermore, according to the UTAUT framework, the positive impact of social influence (as demonstrated by studies such as Wiese and Kruger 2016 and Guo 2015) significantly affects the intention of younger generations to use mobile payment services. Therefore, we will be examining the following:

-

H8a: While social influence influences behavioral intention, this relationship is stronger for women than men.

-

H9a: While social influence influences behavioral intention, this relationship is stronger for Generation X than Generation Z.

Consumption values

The success of modern technologies, particularly mobile banking, greatly depends on how consumers perceive their value. Trust and user adoption are closely linked to the perceived value of mobile banking services. Various research works documented the impact of consumption values on online platforms usage (e.g., Talwar et al. 2023), A recent study documents consumers’ changing financial behavior during the COVID-19 lockdown concerning online and mobile banking use in Greece (Bechlioulis and Karamanis 2023).

Despite this, examining consumption values in this area has yet to be exhaustive. For example, the Theory of Consumption Values, first introduced by Sheth et al. (1991), provides insight into how the decision to use a product or service is influenced by various consumption values that vary depending on the circumstances. Furthermore, conditional value can impact consumer behavior in specific situations, such as seasonal products, one-time events, or emergencies.

Concerning the impact of functional value on technology usage is documented in several studies (Chakraborty and Paul 2023; Karjaluoto et al. 2021; McCabe et al. 2012). Therefore, we examine the following research hypothesis:

-

H10: Functional value positively influences user’s behavior.

Social values were found to have a minor impact on the link between these values and m-banking services. The results emphasize the significance of the core purpose of mobile banking services and the practical benefits they provide in promoting consumer adoption. Trust was also a critical factor in adopting these services, as consumers expect banks to provide reliable, professional, and secure services that align with their expectations and safeguard their interests. Research has shown that emotional factors, such as trustworthiness, professionalism, and security, are critical drivers for the widespread adoption of mobile banking (e.g., Pang and Ruan 2023). Further studies have revealed that social value is also critical in the relationship between functional, epistemic, and emotional values despite intangible mobile banking. The authors have created a perceived value scale to understand better and predict the various dimensions of consumption values and their impact on behavior. Other researchers looked at the effect of several consumption values on the intention to utilize mobile banking services (Sheth et al. 2021), focusing on trust. The study identified social, functional, epistemic, and emotional consumption values as four separate types. However, functional, epistemic, and emotional values strongly influenced the adoption of these services (e.g., Karjaluoto et al. 2021). Considering Goh et al. (2014) study based on the Theory of Consumption Values to create a consumption value model for adopting mobile banking. They discovered a link between behavioral purpose and social, practical, epistemological, and emotional values. Customers of mobile banking value social status, convenience, time savings, productivity, security, and dependability. Therefore, we examine the following research hypotheses:

-

Social value positively influences user’s behavior.

-

Emotional value positively influences user’s behavior.

-

Epistemic value positively influences user’s behavior.

A condition can encourage or inhibit a choice (Hung and Hsieh 2010). The circumstances around the use of mobile apps drive conditional value. Omigie et al. (2017) state that these conditions include time, places, devices, and technical settings. Therefore, we examine the following research hypothesis:

H14: Conditional value positively influences user’s behavior.

Intermediate relationships

The significant mediating influence of behavioral intention on the relationship between each UTAUT constructs and users’ behavior is examined in many studies (e.g., Shahzad et al. 2022; Ashfaq et al. 2021; Ifedayo et al. 2021). For example, the mediating role of behavioral intention on the relationship between effort and actual usage examined in several studies (e.g., Moya et al. 2018; Jabeen et al. 2018). Other studies indicate that behavioral intention positively mediates between social influence on actual adoption (e.g., Nassar et al. 2019). Therefore, we examine the following research hypotheses:

-

H5: Performance expectancy positively influences user’s behavior through the intermediate effect of behavioral intention.

-

H6: Effort expectancy positively influences user’s behavior through the intermediate effect of behavioral intention.

-

H7: Social influence positively influences user’s behavior through the intermediate effect of behavioral intention.

Methodology

Research method

Our research aims to explore the behavior of NBG’s m-banking users, focusing on the distinct characteristics and intentions of two different generations to utilize m-banking services. Channaveer and Baikady (2022) discuss the multiple definitions of a "case study." While some emphasize using unstructured and qualitative data analysis, others highlight a comprehensive investigation of a specific case. Nonetheless, all definitions share the objective of conducting research and analysis to thoroughly understand a particular subject, event, group, or situation.

Recently, scholars have initiated research into the correlation between the consumption values of Generations X and Z and customers’ use of NBG mobile banking services. Being one of the four systemic banks in Greece serving a diverse customer base, NBG presents a compelling case to examine. Furthermore, NBG has invested noteworthy in its web and mobile banking applications. According to Channaveer and Baikady’s (2022) research, case studies usually employ qualitative research methods, but there are situations where qualitative and quantitative approaches are utilized. This fusion of methods yields a more profound comprehension of a particular phenomenon. Typically, the quantitative aspect acknowledges a singular reality, while the qualitative part permits multiple interpretations.

When selecting a research method, it’s essential to consider the questions the study aims to answer rather than personal preference. Quantitative methods most effectively explore the relationship between two variables and typically begin with "What." On the other hand, qualitative methods are better suited for complex research questions that start with "Why" or "How." A quantitative approach is often favored if a study aims to generalize its findings to a larger population (Sarker and Al-Muaalemi 2022). Our study utilizes a quantitative approach using case study methodology. We collect primary data through a questionnaire and analyze it statistically to test the research hypotheses.

Data Collection Process

A survey was carried out through the Survey Monkey platform, where the questionnaires were distributed online and via email to a random selection of NBG customers during March and April 2023. Our focus group for this study comprised customers of NBG who are frequent users of the mobile banking app available on the Android Play Store or Apple App Store and belong to either Generation X or Z. For comprehensive research, precise data collection is crucial (Berenson et al. 2015). The author can gather primary data by studying the entire population or a sample, while secondary data is derived from previous research. Although analyzing the whole population may yield more dependable outcomes, analyzing a sample is a more practical approach (Berenson et al. 2015). When examining a population, scientists frequently utilize sampling methods to investigate a smaller subset of it (Sarker and Al-Muaalemi 2022). A non-probability sample is used when there is no knowledge about selection probability (e.g., Sarker and Al-Muaalemi 2022). This study will employ a non-probability sampling method to select a representative sample of NBG m-banking customers.

We employed convenience sampling at NBG branches to recruit participants for our mobile banking study. Our sample exclusively comprised customers who use mobile banking and identify as members of Generations X and Z, and we secured their consent to receive the questionnaire via email. These criteria were the defining factors in shaping our study’s sample.

-

Element: Bank customers born from 1964 to 1983 and 1993 to 2005.

-

Sampling unit: M-banking customers of Generations X and Z.

-

Sampling area: Athens, Greece.

-

Period of data collection: March and April 2023.

Research instrument and measurement of variables

Customers using NBG m-banking received a questionnaire through email. The survey aims to gather feedback on their experiences with the underlined app. A questionnaire is a set of written or printed questions with answer options, typically used in surveys or statistical studies. While closed-ended questions are common in questionnaires, some may include open-ended questions to provide a more comprehensive analysis. The inclusion of open-ended questions can reveal unexpected insights and enhance the study. According to Chowdhury et al. (2022), a questionnaire is a valuable research instrument.

According to a recent study by Chowdhury et al. (2022), questionnaires have pros and cons. On the positive side, they are a convenient and cost-effective way to gather a substantial amount of data quickly. Moreover, they allow respondents to answer anonymously. However, low response rates may occur if people ignore the survey request or technical issues delay the process. Furthermore, researchers may only sometimes have the means to monitor responses, which could impact the validity of the results. Lastly, some respondents may hesitate to share their honest thoughts in written form due to various reasons, such as anxiety or insecurity. The questionnaire used in the study only contained closed-ended questions categorized into two types: multiple-choice and scale. Multiple choice questions give the respondent a list of pre-defined options based on their understanding of the question. On the other hand, scale questions require the respondent to indicate their level of agreement with the statement presented in the question. One of the most commonly used scale questions is the Likert scale, where respondents express their opinions on the subject by selecting a number from 1 (“strongly disagree”) to 5 (“strongly agree”).

Berenson et al. (2015) identified category and numerical variables as the main variables; while numerical variables can be measured or tallied, categorical variables can be categorized into separate groups. Numerical variables can be characterized as continuous or discrete, while categorical variables can be further divided into nominal and ordinal categories. These properties, such as gender, music genre, color, letter grades, or service ratings, are categorical variables. Contrary to ordinal variables like letter grades and service ratings, which can be organized from lowest to highest or worst to best, nominal variables like gender, music genre, and color cannot be ranked in any particular order. Numerical variables are measured by numeric values. Continuous variables, such as age, can have any value.

The same variable can take different forms depending on the study’s definition. For instance, age is a numerical variable since it can be measured and counted. However, it is regarded as a categorical (ordinal) variable if categorized into generations. The questionnaire contains categorical primary variables, both nominal and ordinal. Within this study, categorical and numerical variables fall under the classifications of nominal, ordinal, interval, or ratio measurements. There are different ways to measure variables. Nominal variables are the most basic form but cannot be ranked. Ordinal variables, on the other hand, can be ranked in a specific order. Numerical variables are measured using either interval or ratio scales. The difference between interval and ratio scales is that ratio scales have an actual zero point, whereas interval scales do not. Measurements can be accurately quantified on interval and ratio scales.

Research results

Sample characteristics, descriptive statistics and reliability analysis

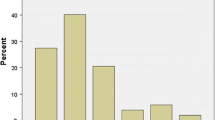

We sent out questionnaires by email to 654 customers, and 445 of them responded. However, only 418 of those responses were completed. Out of those, 76 responses were from Generation Y and had to be excluded from our sample. We ended up with 342 individuals who belong to either Generation X or Generation Z and use mobile banking services. Of these, 207 respondents (60.53%) were female and 135 (39.47%) were male. The distribution of respondents shows that 49.71% belong to Generation Z. In comparison, 50.29% belong to Generation X. Most respondents were single (51.17%), while a significant portion were married with or without children (10.23% and 28.07%, respectively). The majority of respondents were employees (64.62%), but there were also students (16.37%), self-employed individuals (13.45%), and unemployed individuals (4.68%). Most of the respondents had achieved higher education as their highest level (44.15%), followed by postgraduate education (29.53%) and secondary education (23.39%). Regarding annual income, the highest proportion of respondents earned €0–20,000 per year (64.62%), while a significant percentage (26.61%) earned €20,001–35,000 annually.

The study participants were individuals who used mobile banking, with a significant number having prior experience with the service. More than half of the respondents, 52.05%, had 4–10 years of experience, while 37.72% had 1–3 years of experience. A smaller percentage of 8.19% had been using mobile banking for over ten years, and only 2.05% had limited experience. When asked about their experience with electronic banking services, 72.22% reported familiarity with conventional web banking, while 27.78% stated that mobile banking was their first experience.

A Likert scale was used to score 39 questions that assessed various aspects of the study. Every question had a variable associated with the chosen basic UTAUT constructions. The responses’ reliability was assessed via Cronbach’s alpha tests. All constructs demonstrated high internal consistency. Descriptive statistics were used to compare the constructs with the newly grouped variables based on the median responses provided by the participants. The Likert scale mean responses ranged from 2.4181 to 4.3216. The structures with the greatest mean values were referred to as the "fundamental UTAUT constructs," whereas the constructs with the lowest mean values were Social Value, Conditional Value, and Social Influence. Performance Expectancy, Effort Expectancy, Behavioral Intention, Functional Value, and Emotional Value were the constructs with the highest median values. Concurrently, the median values of Conditional Value, Social Influence, and Social Value were the lowest. Each concept was rated by the participants on a five-point rating system, with five representing the highest rating. According to the results, 75% of participants agreed with the constructs of effort expectation, performance expectation, behavioral intention, and functional value, which had the highest interquartile range. However, 75% of participants disagreed with social influence and social value, and at least 50% disagreed with conditional value.

Participants’ responses to the questions about epistemic value, conditional value, emotional value, and social value varied, with standard deviations of 0.97396, 0.94264, 0.91020, and 0.90811, respectively. However, when it came to Functional Value, Behavioral Intention, Performance Expectancy, and Effort Expectancy, they all responded with the same standard deviations—0.58319, 0.58980, 0.63058, and 0.64096, respectively. The values of 0.3755, 0.3535, 0.3448, and 0.3018, respectively, indicated the most significant coefficients of variation for Social Value, Conditional Value, Epistemic Value, and Social Influence. Conversely, the coefficient of variation values for behavioral intention, performance expectation, effort expectation, emotional value, and functional value were the lowest, at 0.1358, 0.1407, 0.1544, 0.1628, and 0.2533, respectively.

Six of the ten groups of items show a negative skewness, meaning their values typically fall above the distribution’s mean. These items, which all have a noticeably negative skewness, include Performance Expectancy, Behavioral Intention, Effort Expectancy, and Functional Value items. Furthermore, they have high kurtosis values, which point to a leptokurtic distribution. On the other hand, items measuring Social Value, Social Influence, and Conditional Value show positive skewness and are below the normal distribution’s mean. The kurtosis values for these items vary, with Conditional Value exhibiting negative kurtosis, while Social Value and Social Influence show mildly negative and positive kurtosis values, respectively. Based on this, we can infer that responses to Conditional Value items are more closely centered around the mean and that a significant proportion of responses may disagree with these items.

The data analysis reveals that responses to Emotional Value questions are heavily skewed towards negativity (− 0.843), with a positive kurtosis (0.779) indicating a concentration of values around the mean. Conversely, the distribution of responses to Epistemic Value questions is nearly normal (0.090 skewness) but with negative kurtosis (− 0.699), implying ambiguity in the answers.

Frequencies, multiple response analysis and cross-tabulation analysis

During the survey, respondents were presented with the option to furnish multiple responses to a series of five inquiries. These questions were centered on the mobile banking applications they employ, the operating systems they utilize for mobile banking, the nature of transactions they tend to carry out via mobile banking, any other financial technology mobile applications they may use, and any social media applications they may also use.

-

1.

Which m-banking apps do you use? According to a survey of 342 individuals, the majority (75.10%) use NBG’s mobile banking app, which is expected since the participants were NBG’s clientele. Alpha Bank’s mobile banking app was acknowledged by 40.10% of the sample, while Piraeus Bank’s and Eurobank’s were used by 39.50% and 35.10% of respondents, respectively. Many participants utilize various banks’ mobile banking apps in addition to NBG’s. There were 668 responses, with the highest percentage (38.50%) referring to NBG’s app. Alpha Bank, Piraeus Bank, and Eurobank’s mobile banking apps each received almost equal percentages of responses: 20.50%, 20.20%, and 18%, respectively.

-

2.

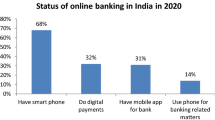

What smart devices do you use for m-banking? Out of the 360 participants surveyed, 342 provided answers to this question. The results revealed that 68.40% of the respondents use Android smart devices, while 36.30% use iOS smart devices. It was surprising to note that only a small percentage of the participants use Android and iOS devices. Regarding the overall response rate, 64.80% indicated the use of Android devices, 34.30% indicated the use of iOS devices, and a mere 0.80% referred to other operating systems.

-

3.

What transactions do you usually make via m-banking? In our survey, participants had the freedom to choose from a wide range of options, and this question was crucial for completing the survey. All 342 respondents answered this question, and the majority stated that they frequently conduct money transfers, payments, balance inquiries, transaction statements, and transaction notifications. Fewer respondents chose investment services, business online services, and insurance services. Lastly, consumer online services (such as online statements), credit card and loan payments, and digital wallet payments were in the middle of respondents’ preferences.

-

4.

Do you use other fintech mobile applications? Out of all respondents, 188 individuals provided an answer to this question, while 154 did not respond, representing 55% and 45%, respectively. Based on our survey, popular fintech apps for mobile among our sample include Revolut, PayPal, Google Pay, and Apple Pay. Interestingly, these apps have nearly identical proportions of users, with 43.10%, 43.10%, 42.60%, and 35.10%, respectively. The 188 respondents’ answers accounted for 313 responses, with an intriguing similarity between the percentages: 25.90% for Revolut, 25.90% for PayPal, 25.60% for Google Pay, and 21.10% for Apple Pay.

-

5.

Do you use social networking apps? Out of 342 participants, a vast majority of 339 provided at least one response to the question, resulting in 1,850 responses. Our findings reveal that over 75% of the respondents utilize the most popular social media apps, namely Viber, Facebook, YouTube, Instagram, and Messenger. The usage percentages for these apps range from 76.70% to 89.70%. In contrast, Snapchat, Twitch, and Twitter were the most minor preferred apps among our sample group, with percentages ranging from 6.20% to 17.70%. Roughly a third of the respondents used LinkedIn, WhatsApp, and TikTok, with percentages ranging from 35.10% to 38.30%. The percentages of responses across all apps varied significantly, with the first five apps ranging from 14.10% to 16.40%, the last three apps ranging from 1.10% to 3.20%, and the rest falling between 6.40% and 7%.

The feedback from the Likert-type questions offers valuable insights into the participants’ perceptions of each factor. Most respondents acknowledge the practicality and efficiency of m-banking in accomplishing tasks, saving time on mundane activities, and its ease of use, ultimately leading to favorable results. Nonetheless, a few individuals might have started using it due to external factors or proficiency.

Cross-tabulation analysis uncovered that many participants either agreed or strongly agreed with the statements in the Performance Expectancy construct (57.30% and 37.70%, respectively). The cross-tabulation analysis only revealed a few instances where differences were noted. Similarly, respondents either agreed or strongly agreed with the items in the Effort Expectancy construct (67.30% and 24%, respectively). Most respondents (regardless of their categorization, such as m-banking app users or social networking app users) answered with a 4 (agree).

The majority of respondents opted for neutrality (answering with a 3), disagreement (answering with a 2), or were unsure (with a median of 2.5) when it came to Social Influence. Categorically, there were significant variances. However, for Behavioral Intention, most respondents agreed or strongly agreed with the construct’s statements (59.90% and 28.10%, respectively), with a minor exception. The responses for Functional Value were also apparent, with the majority (62.90%) selecting answer 4. Yet, a few respondents (23.40%) were hesitant and neither agreed nor disagreed, while 12.90% strongly agreed with the construct’s items. There were only minor differences among groups. Regarding Social Value, half of the participants (50%) disagreed or strongly disagreed with the statements, while 26.90% were undecided. There were a few instances where this trend diverged.

Upon analyzing the feedback for Emotional Value items, it is clear that the majority (51.80%) of respondents support the construct statements. However, 26% of participants neither agree nor disagree, while 11.10% strongly agree. This trend remains consistent across all categories. Regarding Epistemic Value items, most participants (33.60%) do not agree with the concept, with 32.20% remaining neutral. Only 24.30% of respondents agree with the statements. This trend also remains consistent across all categories. Likewise, responses to Conditional Value items reveal that 73.10% of participants do not agree or stay neutral towards the statements, while approximately 42.10% disagree or strongly disagree. It is worth noting that regardless of categorization based on questions with multiple responses, the proportions of feedback consistently follow the same trend.

Results of Mann–Whitney U and Kruskal–Wallis H tests

We utilized Mann–Whitney U tests to assess gender, prior use of traditional banking services, and other fintech mobile application usage. Participants were presented with two options for each question, making the Mann–Whitney U test fitting for our study. Our findings revealed no noteworthy distinctions among the groups based on the four fundamental UTAUT constructs (PE, EE, SI, and BI). In nearly all instances, the p value exceeded the significance level (0.05), resulting in the inability to reject the null hypothesis.

The Kruskal–Wallis H test is a valuable statistical technique for assessing whether there are notable distinctions between independent groups based on factors such as age, family status, employment, education, and income. The Kruskal–Wallis H test indicated insufficient evidence to dismiss the null hypothesis in this investigation. It implies that the p values for each test exceeded the significance level of 0.05, signifying no substantial differences among the groups under scrutiny.

Research hypotheses testing

A variety of non-parametric tests were utilized to assess the relationship between variables. These included Spearman’s rank correlation, Goodman and Kruskal’s gamma, Kendall rank correlation (tau-b), and Somers’ D coefficients. Our decision to use these tests instead of Pearson’s correlation coefficient was based on the fact that it did not align with our research assumptions. Each test offered unique advantages. For example, Spearman’s rank correlation was most suitable for ordinal and continuous data, while Goodman and Kruskal’s gamma was effective for non-linear Likert-scale relationships and ordinal data. Similarly, Kendall rank correlation (tau-b) provided an association measurement without linearity assumptions, and Somers’ D emphasized correlation accuracy and symmetric interpretation between variables.

Research hypothesis H1

We conducted a series of tests to explore the connection between Performance Expectancy and Behavioral Intention. Performance Expectancy was the independent variable, while Behavioral Intention was the dependent variable. Here are the results:

Pearson’s correlation

Although the test didn’t meet all the requirements, it provided valuable insights. It revealed a positive correlation (r = 0.592) between Performance Expectancy and Behavioral Intention, with a significance level below 0.001 (p < 0.001). It implies that Performance Expectancy positively impacts 59.2% of the variance of Behavioral Intention.

Spearman’s Correlation

This test also indicated a positive monotonic relationship between the two variables. It demonstrated that Performance Expectancy influences 57.2% (ρ = 0.572) of the variance of Behavioral Intention, with a significance level below 0.001 (p < 0.001).

Goodman and Kruskal’s gamma Correlation

The results were similar to the prior tests, showing a complete certainty (p = 0) that Performance Expectancy positively affects 83.4% (γ = 0.834) of the variance of Behavioral Intention.

kendall’s rank correlation (tau-b)

This test also demonstrated a positive monotonic relationship between the variables. Performance Expectancy positively influences 54.9% of the variance of Behavioral Intention with a significance level below 0.001 (p < 0.001) (τ = 0.549).

Somers’ D correlation

The test findings were comparable to the earlier ones, indicating that Performance Expectancy has a positive influence on 54.9% (D = 0.549) of the variance of Behavioral Intention with a significance level below 0.001 (p < 0.001).

Based on these tests, we can reject the null hypothesis and accept Research Hypothesis H1, which postulates a positive connection between Performance Expectancy and Behavioral Intention.

Research hypothesis H2

To confirm the theory that Effort Expectancy and Behavioral Intention have a positive correlation, we conducted identical tests to our previous ones. This time, Effort Expectancy was the independent variable, and Behavioral Intention was the dependent variable. Our focus was on determining the relationship between the two.

Through various tests conducted, it was discovered that Effort Expectancy has a positive correlation with Behavioral Intention. Although not all Pearson’s correlation coefficient assumptions were met, the test provided valuable insight. Pearson’s Correlation test revealed a coefficient of 0.53, indicating that Effort Expectancy positively affects 53% of the variation in Behavioral Intention, with a significance level below 0.001 (p < 0.001)

Other tests, such as Spearman’s Correlation, Goodman and Kruskal’s gamma Correlation, and Kendall’s Rank Correlation Coefficient, also produced comparable results, showcasing a positive monotonic relationship between the two variables. In particular, Goodman and Kruskal’s gamma Correlation test demonstrated that Effort Expectancy positively influences 76% of the variance of Behavioral Intention with a correlation coefficient of 0.76 and a significance level of p = 0. Overall, the tests indicate a positive influence of Effort Expectancy on Behavioral Intention, with various correlation coefficients ranging from 0.495 to 0.76.

In summary, in light of the tests conducted to calculate the correlation between Effort Expectancy and Behavioral Intention, we can safely reject the null hypothesis and accept Research Hypothesis H2.

Research hypothesis H3

We employed a comparable approach to examine the existence of a positive correlation between Social Influence and Behavioral Intention. Throughout our various tests, we consistently utilized Social Influence as the independent variable and Behavioral Intention as the dependent variable. Our analysis specifically focused on:

According to the test results, Social Influence and Behavioral Intention are positively correlated. Pearson’s Correlation coefficient is 0.233 with a significance level below 0.001, indicating that Social Influence positively influences 23.3% of the variance of Behavioral Intention. The Spearman’s Correlation test also shows a positive monotonic relationship between the two variables with a coefficient of 0.227 and a significance level of p < 0.001. The Goodman and Kruskal’s gamma Correlation test provides similar results, indicating that Social Influence positively influences 29.2% of the variance of Behavioral Intention with a significance level of p < 0.001. Kendall’s Rank Correlation Coefficient is positive (τ = 0.196) at an almost absolute significance level (p < 0.001), thus indicating a positive monotonic relationship between the variables, and Social Influence positively influences 19.6% of the variance of Behavioral Intention. Lastly, Somers’ D correlation test also suggests a positive influence of Social Influence on Behavioral Intention with a significance level of p < 0.001 and a coefficient of 0.193. We can safely reject the null hypothesis and accept Research Hypothesis H3 based on these tests.

Research hypothesis H4

A method similar to the previous tests was used to test the correlation between Behavioral Intention and User Behavior. The independent variable was the construct of Behavioral Intention, while the dependent variable was the User’s Behavior. In analytical terms:

After conducting several tests to determine the correlation between Behavioral Intention and User Behavior, we can confidently reject the null hypothesis and accept the Research Hypothesis H4. Pearson’s correlation provided valuable insight, indicating a positive correlation (r = 0.212) between the two variables at a significance level below 0.001 (p < 0.001). Behavioral Intention will likely influence 21.2% of the variance of User’s Behavior. Spearman’s correlation produced similar results, demonstrating a positive monotonic association between the variables with almost absolute certainty (p < 0.001) and 23.7% (ρ = 0.237) of the variance of User’s Behavior positively influenced by Behavioral Intention. Similarly, Goodman and Kruskal’s gamma Correlation showed almost absolute certainty (p < 0.001) that Behavioral Intention positively influences 43.5% (γ = 0.435) of the variance of User Behavior. Kendall’s Rank Correlation (tau-b) also demonstrated a positive monotonic relationship (τ = 0.228) with an almost absolute significance level (p < 0.001). We can conclude that Behavioral Intention positively influences 22.8% of the variance of User Behavior. Lastly, Somer’s D correlation test yielded comparable results, with almost absolute certainty (p < 0.001) that Behavioral Intention positively influences 22.7% (D = 0.227) of the variance of User’s Behavior. In conclusion, these tests suggest that Behavioral Intention positively impacts User Behavior.

Research hypothesis H10

To test the positive correlation between the constructs of Functional Value and User Behavior, we conducted all the tests mentioned above using the construct of Functional Value as the independent variable and the construct of User Behavior as the dependent variable. Analytically:

Despite not meeting all its assumptions, the Pearson’s Correlation test provided valuable insights. The results indicated a positive correlation (r = 0.198) between Functional Value and User Behavior, with a significance level below 0.001 (p < 0.001). In simpler terms, the test suggested that Functional Value positively influences 19.8% of User’s Behavior. Similar results were produced by Spearman’s and Goodman and Kruskal’s gamma Correlation tests, with almost absolute certainty (p < 0.001) that Functional Value positively influenced User Behavior. The Kendall’s Rank Correlation test also showed a positive monotonic relationship between the variables, with 20.4% of User Behavior positively influenced by Functional Value. Lastly, Somers’ D correlation test yielded similar results, indicating a positive influence (D = 0.203) on User’s Behavior by Functional Value. These test results allowed us to safely reject the null hypothesis and accept the Research Hypothesis H10.

Research hypothesis H11

The same method was utilized to examine the relationship between Social Value and User Behavior. Social Value was considered the independent variable, while User Behavior was the dependent variable in all tests conducted. Analytically speaking:

After thoroughly analyzing the relationship between Social Value and User Behavior, we utilized Pearson’s, Spearman’s, Goodman and Kruskal’s gamma, Kendall’s Rank, and Somers’ D correlations. These tests’ results indicated a positive correlation between the two variables. However, none of them met the significance level of α = 0.05. As such, we cannot reject the null hypothesis or confirm Research Hypothesis H11. While it remains uncertain whether a monotonic relationship exists between Social Value and User Behavior, we can deduce that Social Value may have a small but positive influence on User Behavior, ranging from 3.50% to 6.10% of the variance.

Research hypothesis H12

To investigate the positive relationship between Emotional Value and User Behavior, we tested Emotional Value as the independent variable and User Behavior as the dependent variable. Specifically:

Various methods were employed to test the correlation between Emotional Value and User Behavior, including Pearson’s Correlation, Spearman’s Correlation, Goodman and Kruskal’s gamma Correlation, Kendall’s Rank Correlation (tau-b), and Somer’s D Correlation. Despite not all assumptions being satisfied, the tests yielded valuable insights. Pearson’s correlation indicated a significant positive correlation between Emotional Value and User Behavior (r = 0.169) at a significance level of less than 0.001 (p < 0.001), implying that Emotional Value favorably influences 16.9% of the variation in User Behavior. Spearman’s correlation also demonstrated a positive monotonic association between the two variables, with 17.7% (ρ = 0.177) of the variation in User’s Behavior being positively influenced by Emotional Value. Goodman and Kruskal’s gamma Correlation produced comparable results, with an almost certain probability (p < 0.001) that Emotional Value positively influences 29.2% (γ = 0.292) of the variation in User Behavior. Kendall’s Rank Correlation (tau-b) demonstrated a positive correlation (τ = 0.165) at a nearly absolute significance level (p < 0.001), indicating that Emotional Value positively influences 16.5% of the variation in User Behavior. Lastly, Somer’s D Correlation test produced comparable results, with an almost inevitable (p < 0.001) 16.3% (D = 0.163) of the variation in User’s Behavior being positively influenced by Emotional Value. These tests allow us to reject the null hypothesis and accept Research Hypothesis H12 confidently.

Research hypothesis H13

We performed various tests to examine the relationship between Epistemic Value and User Behavior. We used Epistemic Value as the independent variable and User’s Behavior as the dependent variable in our analysis. Specifically, we conducted the tests mentioned previously. After performing multiple correlation tests between Epistemic Value and User Behavior, we have enough evidence to reject the null hypothesis and accept Research Hypothesis H13. Although Pearson’s coefficient of correlation did not meet all assumptions, it provided valuable insights into the positive correlation between Epistemic Value and User Behavior (r = 0.136). This result indicates that Epistemic Value positively influences 13.6% of the variance of User’s Behavior at a significance level of 0.006 (p = 0.006).

Similarly, Spearman’s Correlation test showed a positive monotonic relationship between the variables, with 14.1% (ρ = 0.141) of the variance of User’s Behavior positively influenced by Epistemic Value at a significance level of 0.005 (p = 0.005). The results of Goodman and Kruskal’s gamma Correlation were almost absolute (p = 0.008), indicating that Epistemic Value positively influences 22% (γ = 0.220) of the variance of User’s Behavior. Kendall’s Rank Correlation Coefficient also revealed a positive monotonic relationship between the variables (τ = 0.130), with 13% of the variance of User’s Behavior positively influenced by Epistemic Value at an almost absolute significance level (p = 0.005). Finally, Somer’s D Correlation test produced similar results, suggesting that Epistemic Value positively influences 12.7% (D = 0.127) of the variance of User’s Behavior with a significance level of 0.008 (p = 0.008). The correlation tests between Epistemic Value and User Behavior strongly support Research Hypothesis H13.

Research hypothesis H14

We adopted a comparable methodology to investigate the correlation between Conditional Value and User Behavior. We executed tests with Conditional Value as the independent variable and User Behavior as the dependent variable. We adhered to the same procedure as previously utilized in terms of analysis.

After conducting tests on Pearson’s Correlation, Spearman’s Correlation, Goodman and Kruskal’s gamma Correlation, Kendall’s Rank Correlation (tau-b), and Somer’s D Correlation, it was determined that they all produced similar results. Despite not all assumptions of Pearson’s coefficient of correlation being met, the test still provided valuable information confirmed by non-parametric tests. Based on the tests, Conditional Value and User Behavior might have a negative correlation. The tests indicated that 1.2–1.9% of the variance of User’s Behavior may be negatively influenced by Conditional Value. However, the certainty of these conclusions ranged from 20.5 to 60.1% and were considered ambiguous. Overall, the findings could be more explicit regarding the existence of a dependable association between the variables. After analyzing the assessments, it was concluded that there was no significant correlation between Conditional Value and User Behavior, as the significance level of α = 0.05 was not reached. As a result, the null hypothesis cannot be dismissed, and Research Hypothesis H14 cannot be validated.

Mediation and moderation analysis

We conducted a mediation analysis to test hypotheses H5, H6, and H7, which involved intermediate relationships. Additionally, to confirm hypotheses H8a, H8b, H8c, H9a, H9b, and H9c, we performed a moderation analysis. For these analyses, we used the reliable and non-parametric bootstrapping method. This method examines the connection between an independent, mediator, and dependent variable. It assesses the relationship between the independent and dependent variables with and without the mediator’s effect, using 5000 bootstrap samples to create 95% confidence intervals (Preacher and Hayes 2008).

Research hypothesis H5

We conducted a thorough analysis to test our hypothesis, utilizing multiple regression through bootstrapping. Our findings indicate a significant positive correlation between Performance Expectancy and Behavioral Intention (path a, b = 0.6430, p = 0). Additionally, we observed a significant positive correlation between Behavioral Intention and User Behavior (path b, b = 0.4878, p = 0.028 < 0.05), (see Fig. 3).

However, we did not keep a meaningful direct relationship between Performance Expectancy and User Behavior (path c, b = 0.4319, p = 0.731 > 0.05). Interestingly, when accounting for Behavioral Intention in the model, the relationship between Performance Expectancy and User Behavior became significant (path c′, b = 0.3137, p = 0.05), indicating a full mediation effect.

Moreover, we calculated the 95% confidence interval of the mediated relationship between Performance Expectancy and User Behavior to be (0.0371, 0.6301) (excluding zero value). We have a 95% confidence that 3% to 63% of the variance of User’s Behavior can be explained by the influence of Performance Expectancy on User’s Behavior through Behavioral Intention. As a result, we can confidently accept Research Hypothesis H5 and reject the null hypothesis.

Research hypothesis H6

We utilized multiple regression analysis with bootstrapping to verify our hypothesis. Our findings indicate a strong positive correlation between the independent variable (Effort Expectancy) and the mediator (Behavioral Intention) (path a, b = 0.5824, p = 0), (see Fig. 4).

Additionally, the mediator (Behavioral Intention) has a significant positive correlation with the dependent variable (User’s Behavior) (path b, b = 0.5236, p = 0.0133 < 0.05). However, we did not uncover a significant direct relationship between the independent and dependent variables (path c, b = 0.4193, p = 0.748 > 0.05). Nevertheless, when we included the mediator in the model, the relationship between the independent and dependent variables became significant (path c′, b = 0.3050, p = 0.05). It suggests that a full mediation effect is in play.

Additionally, we established a 95% confidence interval for the mediated relationship between the independent and dependent variables, which is (0.0663, 0.5705) (excluding zero). It means that we are 95% certain that 6% to 57% of the variance in User’s Behavior can be explained by the influence of Effort Expectancy on User’s Behavior through the intermediate effect of Behavioral Intention. Based on these findings, we can confidently reject the null hypothesis and accept Research Hypothesis H6.

Research hypothesis H7

To test our hypothesis, we utilized a multiple regression analysis with bootstrapping. Our study revealed a positive correlation between the independent variable (Social Influence) and the mediator (Behavioral Intention) (path a, b = 0.1905, p = 0). The mediator (Behavioral Intention) also displayed a significant positive correlation with the dependent variable (User’s Behavior) (path b, b = 0.7268, p = 0.0001 < 0.05), (see Fig. 5).

However, the independent variable did not display a direct significant relationship with the dependent variable (path c, b = − 0.0733, p = 0.6248 > 0.05). When we incorporated the mediator into the model, the relationship between the independent and dependent variables became significant (path c′, b = 0.1384, p = 0.05), indicating a complete mediation effect.

Furthermore, the mediated relationship between the independent and dependent variables has a 95% confidence interval (0.0532, 0.2627). We can be 95% certain that the influence of Social Influence on User Behavior through the intermediate effect of Behavioral Intention accounts for 5% to 26% of the variance in User Behavior. Consequently, we can reject the null hypothesis and accept Research Hypothesis H7.

To evaluate moderation, we employed a similar analysis approach. We once again utilized the bootstrapping method, but this time, we concentrated on the moderating impact of a third variable. Essentially, we constructed a linear regression model featuring four variables:

-

The independent variable(s).

-

The dependent variable.

-

The moderating variable(s).

-

The product(s) of the equation (i.e., the independent variable multiplied by the moderating variable).

To obtain insightful statistical findings, we transformed the conceptual model into a statistical model, which entails a linear regression analysis. Our tests involved generating 95% confidence intervals through 5000 bootstrap samples.

Research hypothesis H8a

After analyzing the correlation between Social Influence and Behavioral Intention using a linear regression model with bootstrapping, it was discovered that introducing Gender as a moderator resulted in the correlation between the two variables losing significance (R2 = 0.2016, p = 0.1653 > 0.05), (see Fig. 6).

Furthermore, there was no significant relationship discovered between Gender and Behavioral Intention (R2 = 0.0359, p = 0.88 > 0.05), and the interaction between Social Influence and Gender also showed an insignificant relationship with Behavioral Intention (R2 = − 0.0071, p =0.9354 > 0.05). Consequently, despite the model being significant (p = 0.0003), the null hypothesis cannot be rejected.

Research hypothesis H8b

Based on the analysis using bootstrapping, we developed a linear regression model with Effort Expectancy as the independent variable, Behavioral Intention as the dependent variable, and Gender as the moderating variable. The model showed a good fit with an R2 value of 0.2856 and a p value of 0. Moreover, we found that Effort Expectancy has a positive linear relationship with Behavioral Intention with an R2 value of 0.4135 and a p value of 0.0207 (see Fig. 7).

However, we observed that Gender and its interaction with Effort Expectancy have non-significant linear relationships with the dependent variable. The R2 value for Gender was − 0.3753 with a p value of 0.3945 (> 0.05), while the R2 value for the interaction between Gender and Effort Expectancy was 0.1061 with a p value of 0.3118 (> 0.05). Thus, we cannot reject the null hypothesis.

Research hypothesis H8c

The bootstrapping linear regression model results reveal a firm fit, as evidenced by an R2 value of 0.3605 and a p value of 0. All three independent variables, Performance Expectancy, Behavioral Intention, and Gender, have a significant relationship with the dependent variable. Specifically, Performance Expectancy stands out with an impressive R2 value of 0.9995 and a p value of 0, while Gender has a significant R2 value of − 0.9848 with a p value of 0.0228 (see Fig. 8)

Additionally, the interaction between Gender and Behavioral Intention is noteworthy, with an R2 value of − 0.2165 and a p value of 0.0287. Further analysis indicates that the connection between Performance Expectancy and Behavioral Intention for m-banking is more vital for males (Gender value 1) than females (Gender value 2). The R2 value for males is 0.7830 with a p value of 0, while the R2 value for females is 0.5665 with a p value of 0. It implies that we can be sure with 100% confidence that the performance expectancy of the service influences 78% of the variation in the behavioral intention of males regarding m-banking. On the other hand, only 56% of the variance in the behavioral intention of females regarding m-banking is affected by their performance expectancy for the service. Therefore, we reject the null hypothesis and favor the alternate one.

Research hypothesis H9a

The correlation between Social Influence and Behavioral Intention is no longer significant after bootstrapping and introducing Generation as a moderator in a linear regression model. The R2 value is 0.0986, and the p value is 0.1157, indicating no critical relationship between the two variables since the p value is more significant than 0.05. Additionally, Generation does not have a substantial relationship with Behavioral Intention. The R2 value is − 0.0545, and the p value is 0.096, more significant than 0.05 (see Fig. 9).