Abstract

The telecommunications sector faces a major challenge of high customer churn. Despite this, there is still a lack of research that explores the switching intention for telecommunication services, particularly with bundle services that currently dominate the market. This study aims to provide insight into consumer behaviour regarding bundle telecommunication services by examining the factors that impact satisfaction and switching intention, both directly and indirectly. Eighteen hypotheses were defined based on the literature, and were tested through a quantitative study with 910 bundle service customers using structural equation modelling with Smart-PLS. The results show that internet and television services have the strongest indirect impact on switching intention, mediated by overall satisfaction and loyalty. Additionally, the results indicate that switching costs and barriers do not significantly affect switching intention, and surprisingly, perceived contractual lock-in positively influences switching intention. This study provides a comprehensive understanding of the customer experience with bundled telecommunications services and offers relevant insights for telecommunication managers to prevent customer loss to competitors.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The telecommunications sector is marked by intense competition, with companies fighting for customers, market share, and long-term survival (Kyei and Bayoh 2017), in parallel with the high churn of customers, who repeatedly change operators (Kumar et al. 2018). Given that acquiring new customers is becoming increasingly difficult and expensive, several authors suggest that priority should be given to retaining the most valuable existing customers rather than trying to acquire new ones (Ahn et al. 2006; Hadden et al. 2007), i.e., reduce churn.

Despite the growing number of studies on switching intention in the telecommunications market, most of them use predictive models with algorithms to identify customers who are more likely to switch operators, based on data from the operators themselves, comprising customer profile variables (e.g. Amin et al. 2019; Ullah et al. 2019). These studies do not aim or help to identify the causes that lead to abandoning the operator but rather to identify who is more likely to switch operator. In fact, studies on the determinants of churn are still insufficient to provide a holistic view of the phenomenon and complement the perspectives provided by predictive algorithm-based studies. In addition, and while bundled services have become the dominant mode of consumption of telecommunications services (de Matos et al. 2018), most studies focus on mobile telecommunications, with some exceptions (e.g. Carrizo-Moreira et al. 2017; Prince and Greenstein 2014). Bundled services refer to selling two or more distinct services in a bundle for a single price (Prince and Greenstein 2014), often marketed at a discounted price (Lee 2017). Bundling services together can allow service providers to gain a competitive advantage by avoiding high churn rates (Uner et al. 2015). Hence, study of the determinants of switching intention, particularly of bundled services, is essential for companies to identify which factors have the greatest impact, and use that information to prevent losing customers (Oechsle 2022), in order to decrease the churn rate and increase customers' loyalty. This study aims to provide insight into consumer behaviour regarding bundle telecommunication services by examining the factors that impact satisfaction and switching intention, both directly and indirectly.

This article makes several contributions. Firstly, the present study fills a significant gap in the literature by investigating customer satisfaction and switching intentions in the context of bundle telecommunication services, which currently dominate the market but have received limited attention in prior research. The article presents a comprehensive tool that integrates multiple variables representing customer experience, providing a valuable resource for future research on customer behavior. The proposed model enables managers to identify which services have the greatest impact on customer satisfaction and prioritize indicators for resource management and customer retention efforts. The empirical findings of the study offer valuable insights into the Portuguese market and the services that significantly influence customer satisfaction, based on a robust sample size.

Next section synthetises the main contributions in the literature regarding switching intention determinants that supported hypotheses development.

Switching intention determinants

Satisfaction

Customer satisfaction is understood as the result of a complex psychological comparison between expected and received performance levels of the product/service (e.g. Johnson et al. 1995; Oliver and Swan 1989). The earliest theoretical models in satisfaction studies were based on the confirmation/disconfirmation paradigm (Oliver and Swan 1989; Olshavsk and Miller 1972). According to this paradigm, customers assess their satisfaction levels by comparing their current experiences with previous ones and expectations and perceptions of product performance. Thus, satisfaction refers to customers' overall evaluation of their buying and consumption experiences (Johnson and Fornell 1991), which may evolve based on total purchases and consumption experiences of a good or service (Fornell 1992; Johnson and Fornell 1991). Customer satisfaction is considered one of companies’ primary objectives (Becker et al. 2015) and is associated with a higher propensity for the customer to remain loyal (Caruana 2002).

Several studies point to satisfaction as the main predictor of the propensity to switch telecom operators (e.g. Calvo-Porral et al. 2017; Dey et al. 2020; Eshghi et al. 2007; Garcia-Marinoso and Suarez 2019; Izogo 2015; Quoquab et al. 2018) and the main determinant of bundled services customer loyalty (Carrizo-Moreira et al. 2017). High levels of customer satisfaction significantly reduce the likelihood that customers will switch operators (e.g. Becker et al. 2015; Mannan et al. 2017; Martins et al. 2013; Mbarek and Baeshen 2019; Sweeney and Swait 2008). To provide a broad perspective of the phenomenon, this paper considers the different components of the bundled telecommunications service (television service, internet service, fixed telephone service, and mobile service). Thus, the following hypotheses were defined:

H1:

Customer satisfaction with the mobile service is positively related to overall satisfaction with the telecommunications operator.

H2:

Customer satisfaction with the television service is positively related to overall satisfaction with the telecommunications operator.

H3:

Customer satisfaction with the Internet service is positively related to overall satisfaction with the telecommunications operator.

H4:

Customer satisfaction with the landline telephone service is positively related to overall satisfaction with the telecommunications operator.

However, in addition to the core services included in the bundle, other factors, such billing, stand out as especially associated with telecommunications customer satisfaction (Ahn et al. 2006; Lunn and Lyons 2018). Billing is a traditional performance dimension upon which telecommunication operators are monitored for the satisfaction of their customers (Athanassopoulos and Iliakopoulos 2003). For many telecom customers, the monthly bill is the main point of contact with the service providers. Also, according to the telecommunications regulator in Portugal (ANACOM 2021a), billing and the invoice itself is one of the main reasons for consumer complaints, so we postulate:

H5:

Customer satisfaction with the invoice is positively related to overall satisfaction with the Telecommunications operator.

Additionally, interactions with different touchpoints are considered important in explaining satisfaction. According to Lemon and Verhoef (2016), the customer journey involves other points of contact with the company over time, which affect the entire customer experience, and are therefore associated with satisfaction. Previous studies show that transaction-specific satisfaction can be empirically distinguished from overall satisfaction (e.g. Jones and Jaebeom Suh 2000a, b; Keiningham et al. 2014), namely store interactions, which integrate activities (based on empirical evidence) such as payment of invoices, provision of services, acquisition of new products and handling of complaints. Also, overall satisfaction can be thought of as a function of prior transaction-specific satisfaction encounters (Jones and Jaebeom Suh 2000a, b; Keiningham et al. 2014). Overall satisfaction refers to “the consumer’s overall dis/satisfaction with the organization based on all encounters and experiences with that particular organization” (Bitner and Hubbert 1994, pp. 76–77). It can be viewed as a function of all previous transaction-specific satisfactions (Parasuraman et al. 1994; Teas 1993). As such, the following hypothesis is postulated:

H6:

Customer satisfaction with in-store interactions is positively related to overall satisfaction with the telecom operator.

In addition to stores, it should be noted that the vast majority of customer interactions with telecom operators occur through a contact centre, and these experiences are determinants of opinions about every company (van der Aa et al. 2015). There are several studies providing ample evidence of high customer dissatisfaction with contact centre services (Bennington et al. 2000; Jaiswal 2008), which culminate in disappointment and defection (Meyer and Schwager 2007). Therefore, the biggest challenge for contact centres is to fulfill their role of value creation and make a positive impact on long-term customer relationships through customer satisfaction (van der Aa et al. 2015). Hence, we postulate:

H7:

Customer satisfaction with customer service interactions is positively related to overall satisfaction with the Telecom operator.

Reputation

Brand reputation refers to customers' perception of service quality associated with the brand name (Hess 2008). It is the aggregate perception of the salient features of companies or brands (Veloutsou and Moutinho 2009). It is formed as an aggregation of images, accumulating in customers' minds over time into an overall evaluation of a company. (Foroudi 2019). Brand reputation results from the brand's identity, its promises, and the extent to which consumers experience what the brand promises (Veloutsou and Moutinho 2009). Evidence has revealed that reputation is a result of high levels of customer satisfaction (Saeidi et al. 2015; Walsh et al. 2006). From this, it is possible to postulate:

H8:

Overall satisfaction with the telecommunications operator is positively related to brand reputation.

Previous studies indicate that a favourable reputation protects companies by creating a shield during a crisis. Customers tend to attribute less responsibility for the crisis and give the organisation the benefit of the doubt. They tend to devalue negative information and focus on the positive aspects associated with the brand (Sengupta et al. 2015).

According to Davies et al. (2010), brand reputation shapes the customer's future behaviour with the company and can increase customer retention. Han and Hyun (2013) highlighted that reputation directly affected the future decision to repurchase from the service provider. Indeed, brand reputation has been seen as an antecedent of loyalty in different fields (Groth 2005; Loureiro and Kastenholz 2011; Walsh and Beatty 2007). Therefore, we expect telecom brand reputation to enhance telecom brand loyalty:

H9:

Telecom operator brand reputation is positively related to customer loyalty.

Switching costs & barriers

Switching costs are important constraints that prevent customers from freely switching to other service operators (Ahn et al. 2006; Su et al. 2012), playing an important role in switching behaviour and customer retention (Keaveney 1995; Kim and Yoon 2004). Switching costs include transaction costs, learning costs and artificial or contractual switching costs (Klemperer 1987, 1995). Transaction costs are the financial costs directly inherent to switching, such as installing/activating the services from the new operator. Learning to use one brand may not be transferable to other brands of the same product/service, even if all brands are functionally identical. Learning costs refer to customers' efforts to reach the same level of comfort and ease with the new product or service (Seo et al. 2008). Hellier et al. (2003) explain that the higher the levels of satisfaction with the service, the greater the perception of lost satisfaction the customer can expect when switching service providers, and consequently the higher the predicted switching costs. Several authors validated this positive effect of satisfaction on switching costs (e.g. Edward and Sahadev 2011; Matzler et al. 2015). This positive effect of satisfaction on switching costs has been validated by several authors, who have also demonstrated that switching costs are one of the antecedents of switching intentions (e.g. Burnham et al. 2003; Dey et al. 2020; Edward and Sahadev 2011; Kumar et al. 2017; Mannan et al. 2017; Quoquab et al. 2018). Hence, we postulate:

H10:

Overall satisfaction with the telecom operator is positively related to switching costs and barriers.

H11:

Switching costs and barriers are negatively related to switching intention.

Finally, artificial, or contractual costs are deliberately created by a service provider. For example, the costs inherent to loyalty contracts penalize customers if they intend to break the contract before a predefined time (Caruana 2003; Gao et al. 2022; Joachim 2004; Klemperer 1987; Weiss and Anderson 1992). Thus, a customer who is administratively "tied" to a telecom operator is less likely to look at competing alternatives because they cannot change the operator without paying the associated penalty (Becker et al. 2015; Calvo-Porral et al. 2017; Garcia-Marinoso and Suarez 2019), increasing in this way switching costs and barriers. Therefore, we postulate:

H12:

The perception of "administrative prison" is positively related to switching costs and barriers.

Also, minimum contract durations, also know as binding contracts or “administrative prison”, had a inverse influence on switching intention (Becker et al. 2015; Gao et al. 2022; Kumar et al. 2017; Mannan et al. 2017; Quoquab et al. 2018; Seo et al. 2008; Shin and Kim 2008; Svendsen and Prebensen 2013), and as such, we postulate that:

H13:

The perception of "administrative prison" is negatively related to switching intention.

Perceived value

Customer perceived value is often described as a trade-off between what customers receive and pay for, when purchasing a service (Thaichon et al. 2014). The notion of value is generally viewed as the perceived benefits the customer receives from the offer provided by the company concerning the cost or sacrifice made to obtain those benefits (Zeithaml 1988). Based on a review of previous definitions, Chen and Dubinsky (2003, p. 326) define customer perceived value "as the consumer's perception of the net benefits obtained in exchange for the costs incurred in obtaining the desired benefits", so higher levels of satisfaction with the service received can lead to higher levels of perceived value (Loureiro et al. 2012). If a customer is satisfied with a product or service, they are more likely to perceive it as having high value, whereas if they are dissatisfied, they are more likely to perceive it as having low value. As some studies show these two variables are strongly related (Reichheld 1996; Woodruff 1997), and some postulate that perceived value is a consequence of consumer satisfaction (Loureiro et al. 2012), we postulate the following:

H14:

Overall satisfaction with the telecom operator is positively related to customer perceived value.

In addition, in the case of higher perceived value, consumers will perceive the costs associated with changing that supplier as higher (Liu 2006; Thuy et al. 2016; Yang and Peterson 2004a). Customer-perceived value can increase switching costs and barriers, making it more difficult for customers to switch to a competitor. When customers perceive that a product or service has high value, they are more likely to invest time, money, and resources in learning how to use it effectively, integrating it into their lives, and building a relationship with the company. Hence, we postulate the following:

H15:

Customer perceived value is positively related to switching costs and barriers.

Several studies (e.g. Cronin et al. 2000; Jiang et al. 2016; Kuo et al. 2009; Kusumawati and Rahayu 2020; Wang et al. 2004; Woodruff 1997; Yang and Peterson 2004a) identify perceived value as an important precursor to customer loyalty, so we postulate:

H16:

Customer perceived value is positively related to customer loyalty.

Loyalty

Loyalty is defined as a customer's intention or predisposition to repurchase from the same firm (Edvardsson et al. 2000). Customer loyalty has shifted from the traditional view of commercial transactions to a sophisticated view of interactions between customers and suppliers (Ozuem et al. 2016). The antecedents of customer loyalty have been extensively studied, with satisfaction emerging as one of the most significant predictors, including in the telecommunications literature (e.g. Calvo-Porral et al. 2017; Dey et al. 2020; Eshghi et al. 2007; Garcia-Marinoso and Suarez 2019; Martins et al. 2013; Quoquab et al. 2018). Hence, we postulate:

H17:

Overall satisfaction with the telecom operator is positively related to customer loyalty.

Eshghi et al. (2007) explained that loyalty encompasses an affective and behavioural dimension. As an affective state, loyalty represents a psychological reaction and conviction towards a product or service. The behavioural dimension manifests that affective state, which is sometimes equated with customer retention. Customer loyalty plays a key role in businesses, as loyal customers buy more, pay premium prices and promote the company through positive word-of-mouth (e.g. Calvo-Porral and Levy-Mangin 2015; Carrizo-Moreira et al. 2017; Hanifati and Salehudin 2021; Mosavi et al. 2018) and are less likely to switch suppliers. Hence, we postulate:

H18:

Customer loyalty to the telecom operator has a negative impact on switching intention.

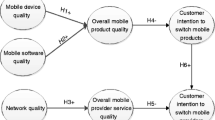

Based on the hypotheses, Fig. 1 shows the conceptual model defined for this study.

Method

Materials

An online self-administered questionnaire was used to test the hypotheses defined for this study. The questionnaire consisted of several sections. The first section gathered respondents' socio-demographic and service characterization data. In the second section, all service attributes, including television service, internet service, landline telephone service, and mobile service, were evaluated, along with the bill itself and the most recent interactions with the brand's different points of contact, such as the customer service (contact centre) or a visit to one of the respective operator's shops. The third section evaluated brand reputation and perceived value, followed by overall satisfaction with the operator and loyalty. The questionnaire also measured the constructs of switching intention, switching costs and barriers, and "contractual lock-in," or the perception of "administrative lock-in."

The items included in the American Customer Satisfaction Index (ACSI) Telecommunications Report were adapted to measure service attributes. The perceived value scale was constructed with three items adapted from Thaichon et al. (2014). To assess brand reputation, four items were used. Three items were adapted from those used by Veloutsou and Moutinho (2009) and an item for the perception of innovation was inserted: (1) loyalty reward, (2) honesty and fairness, (3) innovation and (4) brand trust. All of them were measured on the same scale mentioned above for perceived value.

Satisfaction was assessed with the ACSI multi-item scale (Fornell et al. 1996): (1) Customers' overall satisfaction with service delivery; (2) The extent to which the service met expectations; (3) and the extent to which the service provided compares to ideal service. This multi-item scale has been used in several studies (e.g. Angelova and Zekiri 2011; Dani 2014; Shi and Zhao 2007). ECSI multi-item scale (Committee 1998) (European Customer Satisfaction Index) was used to measure loyalty: (1) Intention to remain a customer in the future; (2) Intention to recommend the company to colleagues and friends; and (3) Competitor price sensitivity. This scale has also been used in several studies (e.g. Bayol et al. 2000; Eurico et al. 2018; Revilla-Camacho et al. 2017).

Finally, switching intention scale was derived from Kim and Yoon (2004). The constructs switching costs and barriers were adapted from Chen and Hitt (2002) and "contractual lock-in" was based on the scale used by Jones et al. (2000). To standardise the scales, all the variables described above were measured using a 10-point Likert-type scale, i.e., there is no mid-point on the scale, so respondents have to choose (Sarantidou 2017). Some literature supports using 10-point Likert-type scales, as no differences were observed for scales with other intervals (Coelho and Esteves 2007; Kalburan et al. 2019). In addition, respondents always had the option to select a category of "Not applicable/Do not know" in case of lack of knowledge or applicability.

Before distributing the questionnaire, a pre-test was conducted with 50 respondents to check whether the questionnaire was easy to understand and whether there was any difficulty in interpreting the items of the model. As a result of the pre-test, minor changes were made to some words for better understanding.

Participants

The population under study comprised all individuals aged ≥ 18 years, decision-makers and/or influencers in the decision-making process concerning packaged telecommunications services, residing in mainland Portugal. The study adopted proportional stratified sampling as recommended by Kothari (2004), as this is more efficient when the cost of selecting an item is the same for each of the strata and when the purpose is to estimate the value of the population or some characteristic. In this research, the strata identified and used were: customer seniority, time to end loyalty, internet speed, and geographical location. The data were collected through a market research agency in July 2021. Nine hundred and ten responses were collected from customers of 4P packages (television, Internet, fixed telephone and mobile service) from the main telecommunications operators in Portugal (Vodafone, NOS and MEO), which represent 96% of the market. The characteristics of the sample can be seen in Table 1. The data that support the findings of this study are available from the corresponding author upon request.

Procedures

This study used partial least squares structural equation modelling (PLS-SEM). PLS-SEM allows researchers to analyse the associations between theoretical constructs and assess the model’s reliability and validity (Hair et al. 1998). This analysis has proven to be an excellent way to assess relationships between constructs in the social and behavioural sciences (de Souza Bido and da Silva 2019). The complexity of the model tested (many constructs and many observed variables), the use of constructs with formative variables, and the little-explored theoretical support for the model justify the use of PLS-SEM. In these situations, covariance-based structural equation modelling (CB-SEM) or maximum likelihood estimation (MLE) models are not recommended, and variance-based structural equation modelling (VB-SEM) or partial least square (PLS) models are recommended (Hair et al. 2012).

As such, we used Smart-PLS3 (Ringle et al. 2015) software to assess the relationships of the structural model. Initial descriptive statistics were obtained using IBM SPSS 28.

Results

Measurement model

The measurement model analysis reveals that all indicators have factor loadings greater than 0.7, the minimum recommended value (Hair et al. 2005), except for one item of the loyalty construct and one item of the switching intention construct, which was removed. In Table 2, we can observe that all variables have CR and Cronbach alpha values greater than 0.7 and AVE values greater than 0.5, meeting the minimum acceptable values, according to Hair et al. (2005). Thus, the results present acceptable convergent validity.

Discriminant validity was assessed by observing that the AVE of each factor is greater than the square of the correlations between factors in all situations, complying with Fornell and Larcker (1981) and indicating acceptable discriminant validity (Table 3). A second criterion was also used, where the items were analysed in terms of factor loadings and cross-loadings. The factorial loadings are found to be higher than the cross-loadings (horizontally and vertically) in all the indicators, thus indicating acceptable discriminant validity. The analysis results show that the model has acceptable construct validity, convergent validity and discriminant validity, according to Tables 2 and 3.

Testing of hypotheses

Having validated the measurement model, we will now analyse the relationships between the variables and analyse the hypotheses based on the conceptual model mentioned above in Fig. 1. Figure 2 presents the conceptual model with the results of the relationships. All relationships were tested based on the examination of standardised paths. Significance levels were estimated using a bootstrap resampling method (Henseler et al. 2009) with 5000 interactions. The results illustrated in Fig. 2 demonstrate that the model explains 81.4% of the variance of overall satisfaction, 76.1% of the variance of reputation, 78.6% of the variance of perceived value, 83.2% of the variance of loyalty, 27.5% of the variance of switching costs and barriers and 37.7% of the variance of switching intention.

Table 4 presents all the hypothesis tests performed. Internet service (β = 0.377, p < 0.001), television service (β = 0.230, p < 0.001), billing (β = 0.187, p < 0.001), contact centre interactions (β = 0.141, p < 0.001), mobile service (β = 0.082, p < 0.01), and in-store interactions (β = 0.052, p < 0.05) are positively related to overall satisfaction with the telecom operator, thus supporting H1, H2, H3, H5, H6, and H7. Contrarily, the results indicate that landline phone service has an insignificant effect on overall satisfaction, so H4 is not supported.

Similarly, overall satisfaction (β = 0.872, p < 0.001) with the operator has a positive effect on brand reputation, supporting H8. Satisfaction (β = 0.886, p < 0.001) also positively affects perceived value, supporting H14. Likewise, satisfaction (β = 0.596, p < 0.001), brand reputation (β = 0.251, p < 0.001), and perceived value (β = 0.097, p < 0.05) have a positive impact on customer loyalty, thus supporting H17, H9 and H16.

The results also indicate that the perception of “contractual lock-in” to the operator (β = 0.459, p < 0.001), perceived value (β = 0.230, p < 0.001), and overall satisfaction (β = 0.141, p < 0.05) have a positive impact on switching costs and barriers, thus supporting H12, H15 and H10. Regarding H13, although the effect of “administrative prison” (β = 0.310, p < 0.001) is significant on switching intention, its sign is positive, and not negative, as postulated, not confirming the proposed hypothesis. Regarding loyalty (β = − 0.462, p < 0.001), this has a significant negative impact on switching intention, thus finding support for H18. Contrarily, the results show that switching costs and barriers do not significantly affect switching intention, thus not finding support for H11.

As seen above, loyalty emerges as the best predictor of switching intentions. However, when we analyse the indirect effects, overall satisfaction with the operator (β = − 0.396, p < 0.001) and fixed internet service (β = − 0.149, p < 0.001) stand out with the highest indirect effects on switching intention, as shown in Table 5.

To understand these indirect effects better, the specific indirect effects of these variables on switching intention were calculated, and the results can be seen in Tables 6 and 7.

Findings reveal that satisfaction influences switching intention through brand reputation, perceived value, and loyalty. It is through loyalty that it has a greater influence (β = − 0.276, p < 0.001). Concerning fixed Internet service, the greatest impact on switching intention occurs through satisfaction and loyalty (β = − 0.104, p < 0.001), as shown in Table 7.

Specific indirect effects are highlighted in Table 8. The internet service, the television service, the bill itself, and interactions with the contact centre have indirect effects on perceived value, brand reputation and loyalty through overall satisfaction with the operator.

Discussion and conclusions

This study shows that the components of bundled telecommunication services that most impact on switching intentions (mediated by overall satisfaction) are internet, television, billing issues, interactions with the contact centre, mobile service, and lastly, in-store interactions. The importance of the internet service has been increasing in recent years, especially during the COVID-19 pandemic. In Portugal, the global effect of COVID-19 on average traffic per access during the six quarters in which the pandemic occurred was, on average, + 36.1% per quarter (ANACOM 2021b). Although the current strategies of telecommunication companies tend to place the maximum number of services within the bundled service, including the fixed telephone, we would say that in the short term, this service could be removed from these commercial offers, thus challenging operators to develop other types of services that consumers perceive as added value. Instead, bundled services should focus on exceptional customer experience of internet and television services. The billing issues should also be looked at very closely by operators. It is not only the antecedent with the third-highest impact on overall satisfaction with the operator but is also one of the main reasons for complaints in the telecommunications sector (ANACOM 2021a).

The results also showed that the perception of contractual lock-in to an operator is the determinant with the greatest impact on the switching costs and barriers, which is expected in Portugal, as the telecommunications sector is characterised by the predominance of services that include minimum contractual terms and charges for consumers arising from early termination of the contract on their initiative. These conditions discourage consumers from changing operators, weakening the dynamics of competition in the sector and make consumers more vulnerable to the exercise of market power. Looking at the results obtained in the study, and considering that in the future, there will be legislative restrictions on the practice of loyalty-contracts, it is recommended that operators focus on customer satisfaction and the perceived value of their services instead of "administratively imprisoning" their customers. If customers are extremely satisfied and perceive a high service value, their costs and barriers to switching will naturally be higher.

In the same line of thought, the results show that the perception of contractual lock-in is positively related to the switching intention. The same is not true if this was expected to be the case with costs and barriers to change. When consumers feel that they are somehow tied to the operator, they have a greater intention to switch. In reality, consumers who have a loyalty contract cannot do so without paying the penalties arising from early termination of the contract. However, these results indicate that this construct raises the switching intention, which, after the end of the loyalty contract, may materialize in a real change. Hypothesis 16 was not validated since there was the same assumption that the greater the perception of "administrative prison", the lower the switching intention. It is also interesting to note that switching costs and barriers do not significantly affect switching intention. The same result was obtained by Martins et al. (2013) and Garcia-Marinoso and Suarez (2019). Finally, the results confirm that loyalty significantly affects switching intention. The higher the consumer's loyalty, the lower their switching intention, and a similar result was obtained by Mahajan et al. (2017).

Telecommunication operators offer a similar service, so the differentiating factor must be high quality of service and customer satisfaction. As identified in the study, the quality of service for Internet and television, but especially for the Internet, due to the exponential growth of its use, should be a target for continuous improvement by the operators. As the data also indicate, the fixed telephone service does not have any significant impact on general satisfaction with the operator, and it will tend to be used less and less. As such, we recommend that operators introduce other services in their packages, to increase the switching costs, essentially the learning costs. For example, if 5G technology penetration is expected to grow, IoT services will be an opportunity.

Theoretical implications

The study offers a holistic view of the customer experience with bundled telecommunications services, providing a comprehensive framework for understanding the determinants of customer satisfaction and switching intention. This article makes several theoretical contributions. Firstly, the study fills a gap in the literature by providing a specific focus on telecommunications bundle services. By examining the interactions between customer experience, overall satisfaction, perceived value, brand reputation, loyalty, switching costs and barriers, “administrative lock-in”, and switching intention, the study offers a comprehensive framework for explaining customer satisfaction and switching intention. The study highlights not only the direct effects of customer experience as antecedents of satisfaction, but also the direct and indirect effects on switching intention. Hence, this study extends the extant literature to examine multiple mediators that affect switching intention in the telecommunications industry among consumers in Portugal.

The results also contribute to the theoretical discussion on the relationships between the variables in the proposed model. The antecedents of satisfaction, constructed from various indicators, account for 81.4% of the variation in customer satisfaction, which is the variable with the greatest impact on customer loyalty in bundled telecommunication services. This finding is consistent with earlier studies (Carrizo-Moreira et al. 2017) and reinforces the results of several researchers who have identified customer satisfaction as a significant factor in reducing the intention to switch providers (Calvo-Porral et al. 2017; Dey et al. 2020; Eshghi et al. 2007; Garcia-Marinoso and Suarez 2019; Izogo 2015; Quoquab et al. 2018). Furthermore, satisfaction is found to significantly impact brand reputation (Saeidi et al. 2015; Walsh et al. 2006) and perceived value (Loureiro et al. 2012), contributing to the ongoing discussion on these variables.

Regarding customer loyalty, the proposed model accounts for 83.2% of its variance, with satisfaction being the antecedent that has the greatest impact, in line with earlier studies in the telecommunications field (Calvo-Porral et al. 2017; Dey et al. 2020; Eshghi et al. 2007; Garcia-Marinoso and Suarez 2019; Martins et al. 2013; Quoquab et al. 2018). Additionally, the model identifies brand reputation as a significant predictor of customer loyalty, which corroborates previous research (Groth 2005; Loureiro and Kastenholz 2011; Walsh and Beatty 2007).

The model accounts for 37.7% of the variation in switching intention for bundle services in the telco industry, which is consistent with prior research in telecommunications (e.g. Dey et al. 2020; Mannan et al. 2017; Quoquab et al. 2018; Sweeney and Swait 2008).The findings also indicate that customer loyalty negatively affects the intention to switch operators, supporting earlier studies (e.g. Calvo-Porral and Levy-Mangin 2015; Carrizo-Moreira et al. 2017; Hanifati and Salehudin 2021; Mosavi et al. 2018).

The study provides novel insights into the impact of binding contracts on switching behavior, revealing a positive effect on switching intention despite the perception of being trapped in an 'administrative prison.' This finding contradicts previous research on the telecommunications industry, which demonstrated negative effects of binding contracts (Garcia-Marinoso and Suarez 2019; Martins et al. 2013) and opens up avenues for future studies to explore this relationship further. One potential explanation is that customers, feeling obligated to stay with their current operator due to contractual obligations, are more inclined to seek out experiences with other providers.

The findings of the study also contribute to corroborating the results of studies and theoretical propositions by authors such as Gianfranco Walsh et al. (2006), Keramati and Ardabili (2011), Loureiro and Kastenholz (2011), Quoquab et al. (2018), Garcia-Marinoso and Suarez (2019) and Dey et al. (2020).

Managerial implications

The present research offers significant contributions to practitioners in the highly competitive telecommunications industry by providing insights on the customer experience. The proposed model serves as a useful guide for management to gain a deep understanding of the services that have the most significant impact on customer satisfaction, and the indicators that should be prioritized for resource management. By analysing the entire customer experience, marketing managers can develop effective strategies to improve customer experience, loyalty, profitability, and market share.

The results indicate that internet and television have the strongest indirect impact on switching intention, mediated by overall satisfaction and loyalty. Surprisingly, perceived contractual lock-in positively influences switching intention, while switching costs and barriers do not significantly affect it. The findings suggest that management must consider the entire customer experience when analysing switching behaviour. Furthermore, satisfaction influences switching intention through brand reputation and perceived value, highlighting the importance of these constructs in customer retention.

The study also reveals that problems with billing, interactions with contact centers and brand stores, and mobile services have a positive impact on overall satisfaction, while the fixed telephone service does not. These results provide guidance on developing effective strategies to improve customer experience and retention. Rather than relying on contractual obligations, management must focus on delivering customer experiences that exceed expectations to retain customers.

To make informed decisions on resource allocation and service improvement, it is recommended that the evaluation of the customer experience be conducted over time to monitor the effectiveness of the strategies implemented and identify emerging trends and issues that need to be addressed. Overall, the insights gained from this study can be used to develop effective strategies to improve customer experience and loyalty, ultimately leading to increased profitability and market share.

Limitations and suggestions for future research

While this study offers valuable insights into switching intention in bundled telecommunication services, there are several limitations and opportunities for future research worth noting. Future research could involve adapting the holistic model proposed in this article to different contexts, including cross-cultural comparisons between countries. While the present study included specific service components, such as internet and television, future research could consider using an index to synthesize customer service, thus creating a more parsimonious model. This would be particularly useful when investigating the indirect impacts of services, which may not be the primary focus of the study. Given the importance of understanding change decisions over time, longitudinal studies could be undertaken to examine how switching intention develops over extended periods. Another interesting avenue for future research would be to investigate the relationship between switching intention and actual behavior, verifying to what extent intention translates into action. In addition, future research could explore other variables that may affect switching behavior, such as demographics and personality traits, to enhance the current model.

Data availability

The data that support the findings of this study are available from the corresponding author upon request.

References

Ahn, J.H., S.P. Han, and Y.S. Lee. 2006. Customer churn analysis: Churn determinants and mediation effects of partial defection in the Korean mobile telecommunications service industry. Telecommunications Policy 30 (10–11): 552–568. https://doi.org/10.1016/j.telpol.2006.09.006.

Amin, A., F. Al-Obeidat, B. Shah, A. Adnan, J. Loo, and S. Anwar. 2019. Customer churn prediction in telecommunication industry using data certainty. Journal of Business Research 94: 290–301. https://doi.org/10.1016/j.jbusres.2018.03.003.

ANACOM. 2021a. Reclamações sobre serviços de comunicações—Relatório do 3.º semestre de 2021a. In Autoridade Nacional de Comunicações.

ANACOM. 2021b. Serviços de acesso à Internet em local fixo—3.º trimestre de 2021b. In Autoridade Nacional de Comunicações.

Angelova, B., and J. Zekiri. 2011. Measuring customer satisfaction with service quality using American Customer Satisfaction Model (ACSI Model). International Journal of Academic Research in Business and Social Sciences 1 (3): 232.

Athanassopoulos, A.D., and A. Iliakopoulos. 2003. Modeling customer satisfaction in telecommunications: Assessing the effects of multiple transaction points on the perceived overall performance of the provider. Production and Operations Management 12 (2): 224–245.

Bayol, M.-P., A. de la Foye, C. Tellier, and M. Tenenhaus. 2000. Use of PLS path modelling to estimate the European Consumer Satisfaction Index (ECSI) model. Statistica Applicata 12 (3): 361–375.

Becker, J.U., M. Spann, and T. Schulze. 2015. Implications of minimum contract durations on customer retention. Marketing Letters 26 (4): 579–592. https://doi.org/10.1007/s11002-014-9293-2.

Bennington, L., J. Cummane, and P. Conn. 2000. Customer satisfaction and call centers: An Australian study. International Journal of Service Industry Management 11 (2): 162–173. https://doi.org/10.1108/09564230010323723.

Bitner, M.J., and A.R. Hubbert. 1994. Encounter satisfaction versus overall satisfaction versus quality. Service Quality: New Directions in Theory and Practice 34 (2): 72–94.

Burnham, T.A., J.K. Frels, and V. Mahajan. 2003. Consumer switching costs: A typology, antecedents, and consequences. Journal of the Academy of Marketing Science 31 (2): 109–126. https://doi.org/10.1177/0092070302250897.

Calvo-Porral, C., and J.P. Levy-Mangin. 2015. Switching behavior and customer satisfaction in mobile services: Analyzing virtual and traditional operators. Computers in Human Behavior 49: 532–540. https://doi.org/10.1016/j.chb.2015.03.057.

Calvo-Porral, C., A. Faíña-Medín, and M. Nieto-Mengotti. 2017. Satisfaction and switching intention in mobile services: Comparing lock-in and free contracts in the Spanish market. Telematics and Informatics 34 (5): 717–729. https://doi.org/10.1016/j.tele.2016.08.022.

Carrizo-Moreira, A., P.M. Freitas-da Silva, and V.M. Ferreira-Moutinho. 2017. The effects of brand experiences on quality, satisfaction and loyalty: An empirical study in the telecommunications multiple-play service market. Innovar 27: 23–36. https://doi.org/10.15446/innovar.v27n64.62366

Caruana, A. 2002. Service loyalty—The effects of service quality and the mediating role of customer satisfaction. European Journal of Marketing 36 (7/8): 811–828.

Caruana, A. 2003. The impact of switching costs on customer loyalty: A study among corporate customers of mobile telephony. Journal of Targeting, Measurement and Analysis for Marketing 12 (3): 256–268.

Chen, P.Y., and L.M. Hitt. 2002. Measuring switching costs and the determinants of customer retention in Internet-enabled businesses: A study of the Online brokerage industry. Information Systems Research 13 (3): 255–274. https://doi.org/10.1287/isre.13.3.255.78.

Chen, Z., and A.J. Dubinsky. 2003. A conceptual model of perceived customer value in e-commerce: A preliminary investigation. Psychology & Marketing 20 (4): 323–347. https://doi.org/10.1002/mar.10076.

Coelho, P.S., and S.P. Esteves. 2007. The choice between a five-point and a ten-point scale in the framework of customer satisfaction measurement. International Journal of Market Research 49 (3): 313–339.

Committee, E. T. 1998. European customer satisfaction index: foundation and structure for harmonized national pilot projects. Report prepared for the ECSI Steering Committee.

Cronin, J.J., M.K. Brady, and G.T.M. Hult. 2000. Assessing the effects of quality, value, and customer satisfaction on consumer behavioral intentions in service environments. Journal of Retailing 76 (2): 193–218.

Dani, V. 2014. Measuring customer satisfaction for F&B chains in Pune using ACSI Model. Procedia-Social and Behavioral Sciences 133: 465–472.

Davies, G., R. Chun, and M.A. Kamins. 2010. Reputation gaps and the performance of service organizations. Strategic Management Journal 31 (5): 530–546. https://doi.org/10.1002/smj.825.

de Matos, M.G., P. Ferreira, and R. Belo. 2018. Target the ego or target the group: Evidence from a randomized experiment in proactive churn management. Marketing Science 37 (5): 793–811. https://doi.org/10.1287/mksc.2018.1099.

de Souza Bido, D., and D. da Silva. 2019. SmartPLS 3: especificação, estimação, avaliação e relato. Administração: Ensino e Pesquisa 20 (2): 488–536.

Dey, B.L., W. Al-Karaghouli, S. Minov, M.M. Babu, A. Ayios, S.S. Mahammad, and B. Binsardi. 2020. The Role of Speed on Customer Satisfaction and Switching Intention: A Study of the UK Mobile Telecom Market. Information Systems Management 37 (1): 2–15. https://doi.org/10.1080/10580530.2020.1696526.

Edvardsson, B., M.D. Johnson, A. Gustafsson, and T. Strandvik. 2000. The effects of satisfaction and loyalty on profits and growth: Products versus services. Total Quality Management 11 (7): S917–S927.

Edward, M., and S. Sahadev. 2011. Role of switching costs in the service quality, perceived value, customer satisfaction and customer retention linkage. Asia Pacific Journal of Marketing and Logistics 23: 327.

Eshghi, A., D. Haughton, and H. Topi. 2007. Determinants of customer loyalty in the wireless telecommunications industry. Telecommunications Policy 31 (2): 93–106. https://doi.org/10.1016/j.telpol.2006.12.005.

Eurico, S., P. Pinto, J.A. Silva, and C. Marques. 2018. The ECSI model in higher education in tourism: A segmentation analysis in the Portuguese case. Tourism 66 (2): 208–226.

Fornell, C. 1992. A national customer satisfaction barometer—The Swedish experience. Journal of Marketing 56 (1): 6–21.

Fornell, C., and D.F. Larcker. 1981. Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research 18 (1): 39–50.

Fornell, C., M.D. Johnson, E.W. Anderson, J.S. Cha, and B.E. Bryant. 1996. The American customer satisfaction index: Nature, purpose, and findings. Journal of Marketing 60 (4): 7–18.

Foroudi, P. 2019. Influence of brand signature, brand awareness, brand attitude, brand reputation on hotel industry’s brand performance. International Journal of Hospitality Management 76: 271–285. https://doi.org/10.1016/j.ijhm.2018.05.016.

Gao, L., E. de Haan, I. Melero-Polo, and F.J. Sese. 2022. Winning your customers’ minds and hearts: Disentangling the effects of lock-in and affective customer experience on retention. Journal of the Academy of Marketing Science. https://doi.org/10.1007/s11747-022-00898-z.

Garcia-Marinoso, B., and D. Suarez. 2019. Switching mobile operators: Evidence about consumers’ behavior from a longitudinal survey. Telecommunications Policy 43 (5): 426–433. https://doi.org/10.1016/j.telpol.2018.12.001.

Groth, M. 2005. Customers as good soldiers: Examining citizenship behaviors in Internet service deliveries. Journal of Management 31 (1): 7–27. https://doi.org/10.1177/0149206304271375.

Hadden, J., A. Tiwari, R. Roy, and D. Ruta. 2007. Computer assisted customer churn management: State-of-the-art and future trends. Computers & Operations Research 34 (10): 2902–2917. https://doi.org/10.1016/j.cor.2005.11.007.

Hair, J.F., R.E. Anderson, R.L. Tatham, and W.C. Black. 1998. Multivariate data analysis. Upper Saddle River, NJ: Prentice Hall.

Hair, J.F., R.E. Anderson, R.L. Thatam, and W.C. Black. 2005. Análise multivariada de dados. Porto Alegre: Prentice Hall.

Hair, J.F., M. Sarstedt, C.M. Ringle, and J.A. Mena. 2012. An assessment of the use of partial least squares structural equation modeling in marketing research. Journal of the Academy of Marketing Science 40 (3): 414–433. https://doi.org/10.1007/s11747-011-0261-6.

Han, H., and S.S. Hyun. 2013. Image congruence and relationship quality in predicting switching intention: Conspicuousness of product use as a moderator variable. Journal of Hospitality & Tourism Research 37 (3): 303–329. https://doi.org/10.1177/1096348012436381.

Hanifati, L.N., and I. Salehudin. 2021. The effect of perceived product quality, brand personality, and loyalty on brand switching intention of technological products. South East Asian Journal of Management 15 (2): 169–187. https://doi.org/10.21002/seam.v15i2.13336.

Hellier, P.K., G.M. Geursen, R.A. Carr, and J.A. Rickard. 2003. Customer repurchase intention: A general structural equation model. European Journal of Marketing 37: 1762.

Henseler, J., C.M. Ringle, and R.R. Sinkovics. 2009. The use of partial least squares path modeling in international marketing. InNew challenges to international marketing. Emerald Group Publishing Limited

Hess, R.L. 2008. The impact of firm reputation and failure severity on customers’ responses to service failures. Journal of Services Marketing 22: 385.

Izogo, E.E. 2015. Determinants of attitudinal loyalty in Nigerian telecom service sector: Does commitment play a mediating role? Journal of Retailing and Consumer Services 23: 107–117. https://doi.org/10.1016/j.jretconser.2014.12.010.

Jaiswal, A.K. 2008. Customer satisfaction and service quality measurement in Indian call centres. Managing Service Quality: an International Journal 18: 405.

Jiang, L., M. Jun, and Z.L. Yang. 2016. Customer-perceived value and loyalty: How do key service quality dimensions matter in the context of B2C e-commerce? Service Business 10 (2): 301–317. https://doi.org/10.1007/s11628-015-0269-y.

Joachim, B. 2004. Higher profits through customer lock-in. Mason: South Western Educational Publishing.

Johnson, M.D., E.W. Anderson, and C. Fornell. 1995. Rational and adaptive performance expectations in a customer. Journal of Consumer Research 21 (4): 695–707.

Johnson, M.D., and C. Fornell. 1991. A framework for comparing customer satisfaction across individuals and product categories. Journal of Economic Psychology 12 (2): 267–286.

Jones, M.A., D.L. Mothersbaugh, and S.E. Beatty. 2000. Switching barriers and repurchase intentions in services. Journal of Retailing 76 (2): 259–274. https://doi.org/10.1016/s0022-4359(00)00024-5.

Jones, M.A., and J. Suh. 2000a. Transaction-specific satisfaction and overall satisfaction: An empirical analysis. Journal of Services Marketing 14 (2): 147–159. https://doi.org/10.1108/08876040010371555.

Jones, M.A., and J. Suh. 2000b. Transaction-specific satisfaction and overall satisfaction: An empirical analysis. Journal of Services Marketing 14: 147.

Kalburan, C., S.B. Hasiloglu, and A. Bardakci. 2019. Does a difference in the number of response categories change the results for ACSI in the mobile phone sector? International Journal of Mobile Communications 17 (6): 746–759. https://doi.org/10.1504/ijmc.2019.102725.

Keaveney, S.M. 1995. Customer switching behavior in-service industries—An exploratory-study. Journal of Marketing 59 (2): 71–82. https://doi.org/10.2307/1252074.

Keiningham, T.L., L. Aksoy, E.C. Malthouse, B. Lariviere, and A. Buoye. 2014. The cumulative effect of satisfaction with discrete transactions on share of wallet. Journal of Service Management 25 (3): 310–333. https://doi.org/10.1108/josm-08-2012-0163.

Keramati, A., and S.M.S. Ardabili. 2011. Churn analysis for an Iranian mobile operator. Telecommunications Policy 35 (4): 344–356. https://doi.org/10.1016/j.telpol.2011.02.009.

Kim, H.S., and C.H. Yoon. 2004. Determinants of subscriber churn and customer loyalty in the Korean mobile telephony market. Telecommunications Policy 28 (9–10): 751–765. https://doi.org/10.1016/j.telpol.2004.05.013.

Klemperer, P. 1987. Markets with consumer switching costs. Quarterly Journal of Economics 102 (2): 375–394. https://doi.org/10.2307/1885068.

Klemperer, P. 1995. Competition when consumers have switching costs—An overview with applications to industrial-organization, macroeconomics and International-Trade. Review of Economic Studies 62 (4): 515–539. https://doi.org/10.2307/2298075.

Kothari, C.R. 2004. Research methodology: Methods and techniques. New Delhi: New Age International.

Kumar, D.P., K. Rajyalakshmi, and S.S. Asadi. 2017. Analysis of mobile technology switching behavior of consumer using chi-square technique: A model study from Hyderabad. International Journal of Civil Engineering and Technology 8 (9): 99–109.

Kumar, V., A. Leszkiewicz, and A. Herbst. 2018. Are you back for good or still shopping around? Investigating customers’ repeat churn behavior. Journal of Marketing Research 55 (2): 208–225. https://doi.org/10.1509/jmr.16.0623.

Kuo, Y.F., C.M. Wu, and W.J. Deng. 2009. The relationships among service quality, perceived value, customer satisfaction, and post-purchase intention in mobile value-added services. Computers in Human Behavior 25 (4): 887–896. https://doi.org/10.1016/j.chb.2009.03.003.

Kusumawati, A., and K.S. Rahayu. 2020. The effect of experience quality on customer perceived value and customer satisfaction and its impact on customer loyalty. Human Systems Management 39 (2): 219–232. https://doi.org/10.3233/hsm-190564.

Kyei, D.A., and A.T.M. Bayoh. 2017. Innovation and customer retention in the Ghanaian telecommunication industry. International Journal of Innovation 5 (2): 171–183. https://doi.org/10.5585/iji.v5i2.154.

Lee, S. 2017. Does bundling decrease the probability of switching telecommunications service providers? Review of Industrial Organization 50 (3): 303–322. https://doi.org/10.1007/s11151-016-9532-1.

Lemon, K.N., and P.C. Verhoef. 2016. Understanding customer experience throughout the customer journey. Journal of Marketing 80 (6): 69–96. https://doi.org/10.1509/jm.15.0420.

Liu, A.H. 2006. Customer value and switching costs in business services: Developing exit barriers through strategic value management. Journal of Business & Industrial Marketing 21: 30.

Loureiro, S.M.C., and E. Kastenholz. 2011. Corporate reputation, satisfaction, delight, and loyalty towards rural lodging units in Portugal. International Journal of Hospitality Management 30 (3): 575–583. https://doi.org/10.1016/j.ijhm.2010.10.007.

Loureiro, S.M.C., I.M.D. Sardinha, and L. Reijnders. 2012. The effect of corporate social responsibility on consumer satisfaction and perceived value: The case of the automobile industry sector in Portugal. Journal of Cleaner Production 37: 172–178. https://doi.org/10.1016/j.jclepro.2012.07.003.

Lunn, P.D., and S. Lyons. 2018. Consumer switching intentions for telecoms services: Evidence from Ireland. Heliyon. https://doi.org/10.1016/j.heliyon.2018.e00618.

Mahajan, V., R. Misra, and R. Mahajan. 2017. Review on factors affecting customer churn in telecom sector. International Journal of Data Analysis Techniques and Strategies 9 (2): 122–144. https://doi.org/10.1504/IJDATS.2017.085898.

Mannan, M., M.F. Mohiuddin, N. Chowdhury, and P. Sarker. 2017. Customer satisfaction, switching intentions, perceived switching costs, and perceived alternative attractiveness in Bangladesh mobile telecommunications market. South Asian Journal of Business Studies 6 (2): 142–160. https://doi.org/10.1108/sajbs-06-2016-0049.

Martins, R.C., L.F. Hor-Meyll, and J.B. Ferreira. 2013. Factors affecting mobile users’ switching intentions: A comparative study between the Brazilian and German markets. BAR—Brazilian Administration Review 10 (3): 239–262. https://doi.org/10.1590/S1807-76922013000300002.

Matzler, K., A. Strobl, N. Thurner, and J. Füller. 2015. Switching experience, customer satisfaction, and switching costs in the ICT industry. Journal of Service Management 26: 117.

Mbarek, R., and Y. Baeshen. 2019. Telecommunications customer churn and loyalty intention. Marketing and Management of Innovations. https://doi.org/10.21272/mmi.2019.4-09.

Meyer, C., and A. Schwager. 2007. Understanding customer experience. Harvard Business Review 85 (2): 116.

Mosavi, S.M., M.S. Sangari, and A. Keramati. 2018. An integrative framework for customer switching behavior. Service Industries Journal 38 (15–16): 1067–1094. https://doi.org/10.1080/02642069.2018.1428955.

Oechsle, F. 2022. Increasing the robustness of uplift modeling using additional splits and diversified leaf select. Journal of Marketing Analytics. https://doi.org/10.1057/s41270-022-00186-3.

Oliver, R.L., and J.E. Swan. 1989. Equity and disconfirmation perceptions as influences on merchant and product satisfaction. Journal of Consumer Research 16 (3): 372–383.

Olshavsk, R.W., and J.A. Miller. 1972. Consumer expectations, product performance, and perceived product quality. Journal of Marketing Research 9 (1): 19–21.

Ozuem, W., T. Thomas, and G. Lancaster. 2016. The influence of customer loyalty on small island economies: An empirical and exploratory study. Journal of Strategic Marketing 24 (6): 447–469. https://doi.org/10.1080/0965254x.2015.1011205.

Parasuraman, A., V.A. Zeithaml, and L.L. Berry. 1994. Reassessment of expectations as a comparison standard in measuring service quality—Implications for further research. Journal of Marketing 58 (1): 111–124.

Prince, J., and S. Greenstein. 2014. Does service bundling reduce churn? Journal of Economics & Management Strategy 23 (4): 839–875. https://doi.org/10.1111/jems.12073.

Quoquab, F., J. Mohammad, N.M. Yasin, and N.L. Abdullah. 2018. Antecedents of switching intention in the mobile telecommunications industry: A partial least square approach. Asia Pacific Journal of Marketing and Logistics 30 (4): 1087–1111. https://doi.org/10.1108/apjml-06-2017-0121.

Reichheld, F.F. 1996. Learning from customer defections. Harvard Business Review 74 (2): 56–67.

Revilla-Camacho, M.A., F.J. Cossio-Silva, and B. Palacios-Florencio. 2017. Corporate responsibility under the ECSI model: An application in the hotel sector. European Research on Management and Business Economics 23 (1): 23–32. https://doi.org/10.1016/j.iedeen.2016.07.003.

Ringle, C. M., S. Wende, and J.-M. Becker. 2015. SmartPLS 3. Boenningstedt: SmartPLS GmbH, 584.

Saeidi, S.P., S. Sofian, P. Saeidi, and S.A. Saaeidi. 2015. How does corporate social responsibility contribute to firm financial performance? The mediating role of competitive advantage, reputation, and customer satisfaction. Journal of Business Research 68 (2): 341–350. https://doi.org/10.1016/j.jbusres.2014.06.024.

Sarantidou, P. 2017. Enriching the ECSI model using brand strength in the retail setting. European Journal of Management and Business Economics 26 (3): 294–312. https://doi.org/10.1108/ejmbe-10-2017-017.

Sengupta, A.S., M.S. Balaji, and B.C. Krishnan. 2015. How customers cope with service failure? A study of brand reputation and customer satisfaction. Journal of Business Research 68 (3): 665–674. https://doi.org/10.1016/j.jbusres.2014.08.005.

Seo, D., C. Ranganathan, and Y. Babad. 2008. Two-level model of customer retention in the US mobile telecommunications service market. Telecommunications Policy 32 (3–4): 182–196. https://doi.org/10.1016/j.telpol.2007.09.004.

Shi, B.J., and G.J. Zhao. 2007. Introducing ACSI model to measure customer's satisfaction for banking, service. In Proceedings of the 2007 International Conference on Management Science and Engineering, Finance Analysis Section, 171–175.

Shin, D.H., and W.Y. Kim. 2008. Forecasting customer switching intention in mobile service: An exploratory study of predictive factors in mobile number portability. Technological Forecasting and Social Change 75 (6): 854–874. https://doi.org/10.1016/j.techfore.2007.05.001.

Su, Q., P. Shao, and Q. Ye. 2012. The analysis on the determinants of mobile VIP customer churn: A logistic regression approach. International Journal of Services, Technology and Management 18 (1–2): 61–74. https://doi.org/10.1504/IJSTM.2012.049016.

Svendsen, G.B., and N.K. Prebensen. 2013. The effect of brand on churn in the telecommunications sector. European Journal of Marketing 47 (8): 1177–1189. https://doi.org/10.1108/03090561311324273.

Sweeney, J., and J. Swait. 2008. The effects of brand credibility on customer loyalty. Journal of Retailing and Consumer Services 15 (3): 179–193. https://doi.org/10.1016/j.jretconser.2007.04.001.

Teas, R.K. 1993. Expectations, performance evaluation, and consumers perceptions of quality. Journal of Marketing 57 (4): 18–34.

Thaichon, P., A. Lobo, C. Prentice, and T.N. Quach. 2014. The development of service quality dimensions for internet service providers: Retaining customers of different usage patterns. Journal of Retailing and Consumer Services 21 (6): 1047–1058.

Thuy, P.N., L.N. Hau, and F. Evangelista. 2016. Service value and switching barriers: A personal values perspective. Service Industries Journal 36 (3–4): 142–162. https://doi.org/10.1080/02642069.2016.1158252.

Ullah, I., B. Raza, A.K. Malik, M. Imran, S. Ul Islam, and S.W. Kim. 2019. A churn prediction model using random forest: Analysis of machine learning techniques for churn prediction and factor identification in telecom sector. IEEE Access 7: 60134–60149. https://doi.org/10.1109/access.2019.2914999.

Uner, M.M., F. Guven, and S.T. Cavusgil. 2015. Bundling of telecom offerings: An Empirical Investigation in the Turkish market. Telecommunications Policy 39 (1): 53–64. https://doi.org/10.1016/j.telpol.2014.12.004.

van der Aa, Z., J. Bloemer, and J. Henseler. 2015. Using customer contact centres as relationship marketing instruments. Service Business 9 (2): 185–208. https://doi.org/10.1007/s11628-013-0223-9.

Veloutsou, C., and L. Moutinho. 2009. Brand relationships through brand reputation and brand tribalism. Journal of Business Research 62 (3): 314–322. https://doi.org/10.1016/j.jbusres.2008.05.010.

Walsh, G., and S.E. Beatty. 2007. Customer-based corporate reputation of a service firm: Scale development and validation. Journal of the Academy of Marketing Science 35 (1): 127–143. https://doi.org/10.1007/s11747-007-0015-7.

Walsh, G., K. Dinnie, and K.P. Wiedmann. 2006. How do corporate reputation and customer satisfaction impact customer defection? A study of private energy customers in Germany. Journal of Services Marketing 20: 412.

Wang, Y.G., H.P. Lo, and Y.H. Yang. 2004. An integrated framework for service quality, customer value, satisfaction: Evidence from China’s telecommunication industry. Information Systems Frontiers 6 (4): 325–340. https://doi.org/10.1023/b:isfi.0000046375.72726.67.

Weiss, A.M., and E. Anderson. 1992. Converting from independent to employee salesforces—the role of perceived switching costs. Journal of Marketing Research 29 (1): 101–115. https://doi.org/10.2307/3172496.

Woodruff, R.B. 1997. Customer value: The next source for competitive advantage. Journal of the Academy of Marketing Science 25 (2): 139–153.

Yang, Z., and R.T. Peterson. 2004a. Customer perceived value, satisfaction, and loyalty: The role of switching costs. Psychology & Marketing 21 (10): 799–822.

Zeithaml, V.A. 1988. Consumer perceptions of price, quality, and value: A means-end model and synthesis of evidence. Journal of Marketing 52 (3): 2–22.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ribeiro, H., Barbosa, B., Moreira, A.C. et al. A closer look at customer experience with bundle telecommunication services and its impacts on satisfaction and switching intention. J Market Anal (2023). https://doi.org/10.1057/s41270-023-00222-w

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41270-023-00222-w