Abstract

News of extensions can cause stock price movements in the parent brand. Marketers extend brands into areas that vary in how typical they are of the parent brand. The degree of extension typicality can be an important cue for investors in their performance expectations of the brand. Integrating insights from Categorization Theory, Behavioral Finance, and Berlyne’s Two-Factor Theory, the authors argue that the impact of typicality on investor reactions depends upon the level of market exposure to a particular brand extension. Our study emphasizes that firms should take critical marketing actions to influence the buzz around the launch, depending on the extension’s typicality level. The results support our hypotheses. Particularly interesting is the finding that more atypical extensions become acceptable the greater market exposure to them (through marketing efforts as advertising and public relations).

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Sony launched a Virtual Reality device in 2017 (Time 2017). This new product category could be considered typical of the brand considering its consumer electronics-related associations developed over many years. Recently, Sony also announced the launch of its new car brand in collaboration with Honda—Afeela—expected to be available in the market in 2016 (The Verge 2022a, b). Sony’s decision to introduce a new brand name for the new category could be interpreted as perceiving risk of brand dilution had they proceeded with a brand extension rather than a new brand name.

Sony’s branding choice is relevant to all stakeholders, including financial ones. As Sony seemingly assumes, will having a more typical brand extension produce greater financial returns (as in the case of the Virtual Reality device) than an atypical extension (as in the electric car category)? Does that assumption hold in all contexts, especially regarding marketing support provided to the extension? More specifically, would the increased risk that an atypical brand extension brings be compensated by greater financial returns? Finally, can this impact be influenced by marketing actions?

Compared to the extensive work on consumer and market-level consequences of brand extensions (for recent examples, see Eggers and Eggers 2022; Mathur et al. 2022), the financial consequences of brand extensions remain less explored (see Kovalenko et al. 2022 for an exceptionFootnote 1; Swaminathan et al. 2022 for a recent review on brand actions and their financial consequences). The difficulty in linking marketing actions like brand extensions to firm value makes the contribution of branding activities to the bottom line ambiguous. Hence, proving marketing’s worth at the C-Suite is problematic (e.g., Hanssens and Pauwels 2016). This uncertainty follows naturally from firm value being calculated at the corporate level with no easy way to measure the contribution to firm value of different products and brands. We seek to contribute to this critical gap by capitalizing on the advantage of corporate brands having the same brand name between the brand at higher (corporate) levels and lower (product/service) levels. We examine three such corporate brands in different sectors, Sony, Ralph Lauren, and Virgin, their extensions into new product/service categories, and the impact on investors of the typicality of these extensions.

Our emphasis on typicality is motivated by the brand extension literature. This literature has evolved from its earlier emphasis on “fit” toward understanding under what conditions (Chun et al. 2015) and when (Parker et al. 2018) distant (“low fit”) brand extensions should be introduced. The existence of successfully diversified brands such as Virgin, Samsung, General Electric, and 3M has provided momentum to the decreasing preoccupation with levels of fit.

Our central construct—typicality—is related to the concept of fit. Hence, the brand extension literature findings have great implications for our research. We define typicality as the degree to which an extension category is considered representative of the brand associations rather than the level of “fit” only between the parent and extension categories.Footnote 2 Our definition is similar to the consideration of the role of brand-specific associations in Broniarczyk and Alba (1994). However, our definition differs from the brand-specific associations in Broniarczyk and Alba (1994) in that we consider the totality of all category-specific and brand-specific associations in judging whether a new extension is typical of the brand. Hence, all potential marketing activities (e.g., public relations activities of outspoken CEOs such as Richard Branson for Virgin) that add to the brand associations are implicitly incorporated into the measurement of typicality, not only category-related ones. In addition, we consider the build-up of these brand associations over time rather than comparing between (only) the parent brand and one extension.

This paper proceeds as follows. “Conceptual development” section explains our conceptual framework. “Sample and methodology” section describes the data and methodology. “Results” section presents our results, and “Conclusion” section concludes this study.

Conceptual development

Financial consequences of brand extensions

Determination of brand equity is a complex endeavor. Non-financial market measures of a brand have shortcomings, such as inherent subjectivity and lack of theoretical underpinnings. Aaker and Jacobson (2001) proposed that current-term accounting measures such as ROI and earnings cannot appropriately reflect firm value because they do not reflect the benefits of investing in intangible assets such as brands. A defining characteristic of brand assets (e.g., brand equity) is inherently slow-moving and not immediately visible (Srinivasan and Hanssens 2009). A well-managed brand’s equity changes are usually too slow to manifest on a firm’s bottom line. For these reasons, stock returns have been a gold standard metric for assessing branding’s impact on the firm (Srinivasan and Hanssens 2009).

Determining how brand extensions add to or subtract from the parent brand is an equally challenging endeavor because it is unclear how to separate the values of different brands and brand extensions from the total firm value. Due to this difficulty, there is a paucity of research on brand extensions at the financial level.

This study follows the spirit of Srinivasan and Hanssens (2009), who highlight the importance of investors’ reactions to changes in essential marketing assets and actions that have the potential to change the outlook on the firm’s cash flows. For this purpose, we focus on integrating relevant behavioral decision theories (applied to behavioral finance) and information processing-based theories.

Representativeness bias

People often take mental shortcuts in complex decision-making rather than lengthy analytical processing (Yates 1990). One of these shortcuts is the representativeness bias, the tendency to attribute one characteristic to imply another under bounded rationality (Tversky and Kahneman 1974). Representativeness bias makes people form quick opinions, a kind of “stereotypical” thinking (Shefrin 2008). Representativeness bias holds that “people expect samples to be highly representative of their parent populations” (Tversky and Kahneman 1981, p. 2). Shafir et al. (1990), building on the work of Tversky and Kahneman (1981) on representativeness bias, show that “the judged probability that an instance belongs to a category is an increasing function of the typicality of the instance in the category” (p. 229).

Typicality effects

Research conducted in cognitive psychology has shown that categories have graded structures (Lingle et al. 1984). People perceive members or natural object categories (such as birds, vehicles, and trees) and goal-derived categories (such as belongings to save from one’s house in case of a fire) to demonstrate variance in their representativeness or typicality of the category. Research by Mervis and Rosch (1981) has shown that, as category members become more typical, they are “(1) named first in free recall or category instances, (2) classified faster than less typical instances, (3) classified with fewer errors, (4) learned more rapidly as a category member, (5) used as cognitive reference points in comparisons….” (Loken and Ward 1987, p. 3). Thus, it is unsurprising that typicality should also impact the relationship between extensions and dilution effects on the parent brand.

Fluency: mechanism behind typicality effects

Research has shown that people prefer typical stimuli over less typical ones in various research domains. The concept of fluency explains the mechanism behind typicality’s positive effects (e.g., Reber et al. 2004). Fluency can be defined as the cognitive ease experienced by people as they process a stimulus (Schwarz 2004). Fluency has been shown to elicit positive affect for diverse stimuli. Following fluency theory, the argument could be made that typical extensions would bring about greater fluency in their processing and, consequently, more trust and positive affective attitudes toward the parent brand. Ultimately, we expect investors to exhibit higher confidence in the parent brand and drive up the stock price, thereby creating abnormal returns.

The moderating effect of increasing exposure levels

Klink and Smith (2001) showed that increased exposure to brand extension information generated more positive ratings of low-fit brand extensions than one-time-only exposure settings in the prior brand extension research. Similarly, we expect that exposure will moderate the effect of typicality on abnormal returns. We use Berlyne’s two-factor theory (1970)—frequently used by marketing scholars, e.g., Anand and Sternthal (1990)—to explain exposure effects.

In particular, initial exposure leads to increased positive reactions toward the stimulus based on greater habituation, whereas further exposure increases the tedium process with its negative consequences. Therefore, we expect that typical brand extensions would generate more positive abnormal returns at lower public exposure levels. Greater atypicality would result in more positive abnormal returns at higher exposure levels. We expect these results due to the positive effect of increased habituation (for atypical extensions) and the negative effect of tedium (for typical extensions) for higher exposure levels. Thus, formally stated:

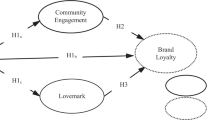

Hypothesis 1

Exposure moderates the impact of extension typicality on abnormal returns.

Hypothesis 1A

At lower exposure levels, extension typicality leads to higher abnormal returns.

Hypothesis 1B

At higher exposure levels, extension atypicality leads to higher abnormal returns.

This study conceptualizes exposure as the level of investor exposure to the news of a brand extension before making an investment decision. Exposure could be operationalized as public interest and buzz around a brand extension launch within our applied context. This level of excitement around the launch of the brand extension can be measured through a proxy variable of online search activity.

Sample and methodology

Sample

We focused on three companies that introduced their new products/services as corporate brand extensions, i.e., using the same brand name for all offerings. These three companies had varying levels of brand breadth (ranging from Sony, which is highly focused on consumer electronics, to Virgin, which is present in a wide range of unrelated activities). Ralph Lauren is situated in the middle of the “brand breadth spectrum” between Sony and Virgin, a luxury-oriented lifestyle brand in areas such as haute-couture fashion, watches, jewelry, and chocolate, among others. All three operated in a mixture of both product and service markets. Included in our sample were all events (i.e., corporate brand extensions) in the time frame when the parent companies were publicly traded.

Methodology

“Event study” methodology assesses investors’ expectations regarding the financial consequences of brand extensions. Fama et al. (1969) pioneered event studies that measure the change in stock price (i.e., the change in market expectations of firm value) related to the release of new information. The method has been used widely to gauge the effects of various events, such as announcements of earnings, dividends, stock splits, and changes in regulatory and accounting practices.

The impact of marketing events has also been the subject of event study analysis (Chaney et al. 1991; Horsky and Swyngedouw 1987; Jarrell and Peltzman 1985; Simon and Sullivan 1993). Due to its widespread use, the methodology of event studies has become relatively standardized. Our study will closely follow the established conventions of event studies (Brown and Warner 1980, 1985; Schwert 1981).

In the instance of an event, the market rapidly achieves a consensus about the security price. Under the market efficiency hypothesis, the estimated abnormal or excess stock return is an unbiased estimate of the event’s future earnings (change in market value) (Malkiel and Fama 1970; Fama 1991). The excess or abnormal stock return calculates the difference between the actual (realized) return and the return that would have occurred had the event not occurred. Empirical research supports this assumption of financial theory that investors will (1) quickly integrate the implications of the brand extension announcement into their estimations, (2) predict long-term cash flows from the revenue and cost sides, (3) buy or sell depending on their expectation of the future value of the stock and whether the price is currently too low or too high. In this way, the change in stock price following the brand extension announcement provides an unbiased estimate of what investors expect the firm to generate in future long-term earnings.

Excess stock market return

Market expectations of the discounted value of the firm’s future cash flows are reflected in the price of a security, that is,

where \(P_{t}\) is the stock price at the time, \(X_{\pi }\) is the net cash flow at period \(\tau\) , and r is the appropriate discount rate for the market expectation of the firm’s future cash flows. When an event occurs, the market rapidly assimilates its financial implications into the security’s price. After controlling for the expected movement in the stock price and given marketwide fluctuations, the percentage change in the price of the stock surrounding an event or an announcement, that is, \(R_{it}\) = \((P_{it} - P_{it - 1} )/P_{it - 1}\), reflects market expectations of the long-term financial impact of the event.

Due to market efficiency, the abnormal or excess stock return is an unbiased estimate of the future earnings (change in market value) generated by the event (Malkiel and Fama 1970; Fama 1991). Abnormal or excess stock return measures the difference between the actual and expected returns had the event not occurred.

We use the market-adjusted return method to derive abnormal returns within this study. The Market-adjusted return (MAR) for each firm i and day t measure the degree of deviations of stock returns from the market index as the abnormal return.

We use 21 days for the event window (10 days before and after the determined event date), informed by the following considerations:

Although shorter event windows, such as the 11-day event window, are more common in the event study literature (Holler 2014), we believe the 21-day event window to be more appropriate for our research context. First, one reason for the prevalent use of shorter event windows is the emphasis on when the market reaches efficiency, defined as the point after which past information no longer predicts future price movements. While this focus helps to determine a minimum event window, Krivin et al. (2003) argue that it does not necessarily define the appropriate end of the window. For example, while Busse and Green (2002) show settlement effects within 15 min, their results also point to significant price reactions 10 days later.

Second, the main concern with longer event windows is that confounds are more likely to bias the results. In our study, because the extensions are unique and numerous, it is unlikely that there exist confounds that bias our results systematically. Further, when the market fully incorporates that news into the stock price remains unknown due to potential leakage of the news. In these situations, a longer event window is considered more appropriate.

Finally, atypical extensions may need more time to show abnormal effects as larger surprises take longer for the market to process (Krivin et al. 2003). In unreported regressions, we observe that event effects get stronger for atypical extensions as the event window progresses, which is very common in studies using longer event windows (e.g., Lehman and Schwerdtfeger 2016).

Model

To test our hypotheses, we regress the dependent variable of abnormal returns against the typicality of the extensions (in terms of the parent brand) and the online search figures (of the parent brand):

Dependent variable

Abnormal returns

We used the Wharton Research Data Services (WRDS) to access historical stock prices and the “Event Study by WRDS” module to estimate the event studies, using the “Market-Adjusted Return model” within the New York Stock Exchange (NYSE) and the Tokyo Stock Exchange (Tosho).Footnote 3

Independent variables

Typicality

To judge the typicality of each brand extension, we surveyed U.S. participants (50 responses for each set of brand extensions of the three firms) on the academic research platform PROLIFIC to get representative average typicality scores for each brand extension. The survey instrument was adapted from Loken and John’s (1993) study. It included questions on how representative the participants felt each product/service extension category was of the three brands examined (Sony, Ralph Lauren, Virgin). The extensions’ degree of typicality was judged on a scale of 1 to 7 (see Fig. 1). The survey was run with the following pre-screening criteria to restrict the sample to (1) U.S. Nationals who reside in the U.S., (2) 20–70 years of age, (3) above 85% acceptance rate by other researchers for previous studies in which the respondent participated, (4) has previously undertaken investment activities.Footnote 4

Level of exposure

This construct was operationalized through the proxy of online (Google) search corresponding to the time relative to the event (the extension launch news.). We used the online search proxy based on the assumption that online search represents the public interest and higher levels of public interest capture higher exposure to an idea (e.g., a brand extension).

Event time counter

This variable runs from − 10 to 10, with 0 equal to the event date.

Empirical analysis

Determinants of abnormal returns

Using regression analysis, we studied the determinants of abnormal returns. Because we expected that news of the corporate brand extension would reach investors on different dates within the event period of 21 days, we used panel regression (a combination of the different extension news event cross-sections and the time series of the calendar date relative to the event day).

In order to account for possible problems with heteroskedasticity and collinearity, we used a split-sample weighted least squares approach.Footnote 5 The split-sample approach is a prevalent method used to detect interaction effects by examining the coefficient of the variable of interest (typicality) at low versus high levels of the moderator (level of exposure). In addition, weighted least squares resolves potential heteroskedasticity by weighing each observation according to its variance level. Specifically, we used the Stata command “vwls.” This function differs from ordinary least squares (OLS) regression in not assuming homoskedasticity and requiring the conditional variance of the dependent variable to be estimated prior to the regression. Once these conditional variances are estimated, variance-weighted least squares regression uses this estimated variance as the true variance when computing coefficient standard errors. (StataCorp 2005).

Results

Consistent with H1A and H1B, all three companies investigated show a sign switch from higher typicality (for lower exposure levels) to atypicality (for higher exposure levels), leading to greater positive abnormal returns. As predicted by H1A, for lower exposure levels, the coefficients for typicality for the respective companies are (β = 0.0014**, p < 0.05) for Sony, (β = 0.0004, p > 0.1) for Ralph Lauren, and (β = 0.0266***, p < 0.001) for Virgin. Supporting H1B, for higher exposure levels, the coefficients for typicality for the examined firms are (β = 0.0021***, p < 0.001) for Sony, (β = − 0.0046, p < 0.001) for Ralph Lauren, and (β = − 0.0057, p > 0.1) for Virgin (Tables 1, 2).

Conclusion

There is little research on the impact of brand extensions on financial returns within the brand extension literature. In addition, the consumer behavior theory used in brand extension research logically applies to investor behavior, yet these theories have not been applied in a financial context. The contribution of our study is to provide a theoretical explanation and empirical validation of the impact of brand extension typicality on investor behavior. We find that this impact depends on the level of brand extension exposure to investors, as evidenced by online search figures. Specifically, the typicality of corporate brand extensions matters, but its effect on abnormal returns can be positive or negative, depending on the extent of exposure to investors.

Our work builds on that of Lane and Jacobson (1995), which focuses on brand attitude and brand name familiarity as moderators of the financial impact of brand extensions. Other related work includes Rao et al. (2004) and Hsu et al. (2016), which focus on the financial implications of brand architecture strategies. In particular, Hsu et al. (2016) address the brand dilution risk of having a family or master branding strategy, stretching a brand over diverse product categories. The present study expands on the direction proposed by these papers, significantly contributing to the literature stream of the financial consequences of brand leveraging.

Our findings support the findings of Kovalenko et al. (2022), who find that brand extensions produce sub-optimal financial results when firms launch an innovative or low-fit new product. Our study also concludes that higher typicality (for low exposure settings) produces superior results. However, we add to the findings of Kovalenko et al. (2022) by showing that the level of exposure moderates the financial effect of extension typicality.

A direct managerial implication of this study is that there should be a greater focus on marketing communications for atypical extensions than for typical ones. Indeed, the extension no longer benefits from positive consumer and investor associations from the parent. Thus, the brand needs to make additional marketing communications efforts to turn a negative typicality effect into a positive one.

Our study’s findings suggest several potential directions for future research. While we have examined three different sectors to test our hypotheses, additional empirical work is needed to explore conditions under which the typicality effect is stronger vs. weaker. Notably, we have examined three firms with offerings in both product and service categories. Future research may examine the situation for firms that exclusively offer service products. Indeed, recent research has uncovered that, for service brand extensions, the findings of the necessity of “fit” do not apply (Dimitriu and Warlop 2021).

Understanding other brand characteristics that affect the negative impact of atypical extensions on abnormal returns is also essential. It is plausible that broader brands active in more diverse businesses, e.g., Virgin, perform better in the marketplace when they launch atypical brand extensions under low exposure than more narrow brands, such as Sony. Hence, narrower brands might perform worse because their product categories are less accessible from the largely diluted brand name. This expectation is in line with the research of Dawar (1996), who contended that brand breadth should be defined not only by product category variability but also by the strength of association between the brand and the categories. The strength of the association, in turn, is determined by the retrievability from memory of product associations. Because the strength of product category–brand association is a determinant of typicality, accessibility, and typicality are most likely correlated. Hence, we would also expect the moderating effect of exposure to be higher for a broad brand like Virgin, where the level of exposure can reverse the reactions to atypicality more easily. Our findings also support this idea as Virgin as a representative of broader brands, has more positive coefficients for typicality in lower exposure levels than under higher exposure levels. More research is necessary to describe the moderating role of brand breadth on the relationship between typicality and abnormal returns demonstrated in this research. We hope our paper sparks future research within this promising and relevant area of the financial consequences of brand actions, including integrating (consumer) psychology and behavioral finance theories.

Notes

Kovalenko et al. (2022) look at the antecedents and consequences of branding decisions by developing a comprehensive conceptual framework based on the marketing strategy literature and testing it empirically. Our paper is differentiated from theirs in that we integrate consumer behavior and behavioral finance theories and focus exclusively on feedback effects to the parent brand arising from extension typicality. Further, our research postulates the mechanisms underlying potential marketing actions which may influence their effectiveness for different levels of extension typicality.

Previous research has found typicality to be related to the construct of familiarity (e.g., Nedungadi and Hutchinson 1985). The more familiar is an object, the more it will be judged as being typical. We recognize that within our framework, the more typical the consideration of an extension will be related to how familiar the consumers are to that particular business line of the brand. However, given the innate relatedness of both constructs, we judge this relation to be natural.

Sony is publicly traded on the Tokyo Stock Exchange (Tosho).

Prolific allows us to set the pre-screening criteria of “investment experience” but not the quantity of the investment. It is expected that these are generally investors of small magnitude due to their participation in the PROLIFIC platform. We chose to use this pre-screening criteria because even small investors are likely to develop analytical abilities regarding events such as brand extensions.

There is a possible endogeneity problem in that typicality and/or exposure levels could be dependent on abnormal returns. We tested that within our model using the Hausman–Wu Test for endogeneity. This test did not detect improved efficiency for an instrumental-variable model versus our model, and hence we were able to rule out any endogeneity concerns.

References

Aaker, D.A., and R. Jacobson. 2001. The value relevance of brand attitude in high-technology markets. Journal of Marketing Research 38 (4): 485–493.

Anand, P., and B. Sternthal. 1990. Ease of message processing as a moderator of repetition effects in advertising. Journal of Marketing Research 27 (3): 345–353.

Badicicco, Lisa. 2017. Sony is Launching a New PlayStation VR Headset. Time. https://time.com/4965037/new-sony-playstation-vr-headset-2017/

Broniarczyk, S.M., and J.W. Alba. 1994. The importance of the brand in brand extension. Journal of Marketing Research 31 (2): 214–228.

Brown, S.J., and J.B. Warner. 1980. Measuring security price performance. Journal of Financial Economics 8 (3): 205–258.

Brown, S.J., and J.B. Warner. 1985. Using daily stock returns: The case of event studies. Journal of Financial Economics 14 (1): 3–31.

Busse, J.A., and T.C. Green. 2002. Market efficiency in real time. Journal of Financial Economics 65 (3): 415–437.

Chaney, P.K., T.M. Devinney, and R.S. Winer. 1991. The impact of new product introductions on the market value of firms. Journal of Business 64 (4): 573–610.

Chun, H.H., W.C. Park, A.B. Eisingerich, and D.J. MacInnis. 2015. Strategic benefits of low fit brand extensions: When and why? Journal of Consumer Psychology 25 (4): 577–595.

Dawar, N. 1996. Extensions of broad brands: The role of retrieval in evaluations of fit. Journal of Consumer Psychology 5 (2): 189–207.

Dimitriu, R., & Warlop, L. (2021). Is similarity a constraint for service-to-service brand extensions?. International Journal of Research in Marketing.

Eggers, F., and F. Eggers. 2022. Drivers of autonomous vehicles—analyzing consumer preferences for self-driving car brand extensions. Marketing Letters 33 (1): 89–112.

Fama, E.F. 1991. Efficient capital markets: II. The Journal of Finance 46 (5): 1575–1617.

Fama, E.F., L. Fisher, M.C. Jensen, and R. Roll. 1969. The adjustment of stock prices to new information. International Economic Review 10 (1): 1–21.

Hanssens, D.M., and K.H. Pauwels. 2016. Demonstrating the value of marketing. Journal of Marketing 80 (6): 173–190.

Holler, J. 2014. Event-study methodology and statistical significance. Event-Study Methodology and Statistical Significance 1: 5–10.

Horsky, D., and P. Swyngedouw. 1987. Does it pay to change your company’s name? A stock market perspective. Marketing Science 6 (4): 320–335.

Hsu, L., S. Fournier, and S. Srinivasan. 2016. Brand architecture strategy and firm value: How leveraging, separating, and distancing the corporate brand affects risk and returns. Journal of the Academy of Marketing Science 44: 261–280.

Jarrell, G., and S. Peltzman. 1985. The impact of product recalls on the wealth of sellers. Journal of Political Economy 93 (3): 512–536.

Klink, R.R., and D.C. Smith. 2001. Threats to the external validity of brand extension research. Journal of Marketing Research 38 (3): 326–335.

Kovalenko, L., A. Sorescu, and M.B. Houston. 2022. What brand do I use for my new product? The impact of new product branding decisions on firm value. Journal of the Academy of Marketing Science 50 (2): 338–365.

Krivin, D., R. Patton, E. Rose, and D. Tabak. 2003. Determination of the appropriate event window length in individual stock event studies. Available at SSRN 466161.

Lane, V., and R. Jacobson. 1995. Stock market reactions to brand extension announcements: The effects of brand attitude and familiarity. Journal of Marketing 59 (1): 63–77.

Lawler, Richard. 2022a. Sony pivots into cars with Sony Mobility and a Vision-S SUV prototype at CES 2022. The Verge. https://www.theverge.com/2022/1/4/22867818/sony-mobility-cars-vision-prototype-ces-2022/

Lawler, Richard. 2022b. Sony and Honda just announced their new electrical car brand, Afeela. The Verge. https://www.theverge.com/2023/1/4/23539863/sony-honda-electric-vehicle-afeela-ces-reveal-photos/

Lehmann, E.E., and M.T. Schwerdtfeger. 2016. Evaluation of IPO-firm takeovers: An event study. Small Business Economics 47: 921–938.

Lingle, J.H., M.W. Altom, and D.L. Medin. 1984. Of cabbages and kings: Assessing the extendibility of natural object concept models to social things. Mahwah: Lawrence Erlbaum Associates Publishers.

Loken, B., and D.R. John. 1993. Diluting brand beliefs: When do brand extensions have a negative impact? Journal of Marketing 57 (3): 71–84.

Loken, B., and J. Ward. 1987. Measures of the attribute structure underlying product typicality. ACR North American Advances.

Malkiel, B.G., and E. Fama. 1970. Efficient capital markets: A review of theory and empirical work. The Journal of Finance 25 (2): 383–417.

Mathur, P., M. Malika, N. Agrawal, and D. Maheswaran. 2022. EXPRESS: The context (In) dependence of low fit brand extensions. Journal of Marketing, 00222429221076840.

Mervis, C.B., and E. Rosch. 1981. Categorization of natural objects. Annual Review of Psychology 32 (1): 89–115.

Nedungadi, P., and J. Hutchinson. 1985. The prototypicality of brands: Relationships with brand awareness, preference and usage. ACR North American Advances.

Parker, J.R., D.R. Lehmann, K.L. Keller, and M.G. Schleicher. 2018. Building a multi- category brand: When should distant brand extensions be introduced? Journal of the Academy of Marketing Science 46 (2): 300–316.

Rao, V.R., M.K. Agarwal, and D. Dahlhoff. 2004. How is manifest branding strategy related to the intangible value of a corporation? Journal of Marketing 68 (4): 126–141.

Reber, R., N. Schwarz, and P. Winkielman. 2004. Processing fluency and aesthetic pleasure: Is beauty in the perceiver’s processing experience? Personality and Social Psychology Review 8 (4): 364–382.

Schwarz, N. 2004. Metacognitive experiences in consumer judgment and decision making. Journal of Consumer Psychology 14 (4): 332–348.

Schwert, G.W. 1981. The adjustment of stock prices to information about inflation. The Journal of Finance 36 (1): 15–29.

Shafir, E.B., E.E. Smith, and D.N. Osherson. 1990. Typicality and reasoning fallacies. Memory and Cognition 18 (3): 229–239.

Shefrin, H. 2008. A behavioral approach to asset pricing. Amsterdam: Elsevier.

Simon, C.J., and M.W. Sullivan. 1993. The measurement and determinants of brand equity: A financial approach. Marketing Science 12 (1): 28–52.

Srinivasan, S., and D.M. Hanssens. 2009. Marketing and firm value: Metrics, methods, findings, and future directions. Journal of Marketing Research 46 (3): 293–312.

StataCorp, L P. 2005. Stata base reference manual. College Station: StataCorp LLC.

Swaminathan, V., S. Gupta, K.L. Keller, and D. Lehmann. 2022. Brand actions and financial consequences: a review of key findings and directions for future research. Journal of the Academy of Marketing Science, 1–26.

Tversky, A., and D. Kahneman. 1974. Judgment under uncertainty: Heuristics and biases. Science 185 (4157): 1124–1131.

Tversky, A., and D. Kahneman. 1981. The framing of decisions and the psychology of choice. Science 211 (4481): 453–458.

Yates, J.F. 1990. Judgment and decision making. Hoboken: Prentice-Hall Inc.

Funding

Open Access funding provided by Colombia Consortium.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Sezen, B., Hanssens, D. Financial returns to corporate brand extensions: does typicality matter?. J Market Anal 11, 287–296 (2023). https://doi.org/10.1057/s41270-023-00220-y

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41270-023-00220-y