Abstract

Economic knowledge plays a central role in many theories of political behavior. But empirical studies have found many citizens to be poorly informed about the official state of the economy. Analyzing two waves of the Eurobarometer database, we re-examine the distribution of public knowledge of three macroeconomic indicators in two dozen European countries. Respondents with high income and education give more accurate estimates than others, in line with previous studies. As we show, however, such differences in knowledge do not only reflect varying levels of information. People’s estimates are also shaped by affective dynamics, in particular a more pessimistic outlook that leads to overestimation of official unemployment and inflation (but not growth) figures. We find that emotive factors can bias inflation and unemployment estimates of respondents who find themselves in a privileged economic situation in a direction that incidentally also makes them more accurate, even though respondents are not necessarily being better informed. In real-world politics, official economic statistics thus do not function as a shared information backdrop that could buttress the quality of public deliberation. Instead, knowledge of them is itself driven by personal socio-economic circumstances.

Similar content being viewed by others

Introduction

Citizens’ knowledge about national economic performance plays an important role in many models of political behaviour. The economic voting literature has found incumbents’ re-election chances to increase when the economy does well, and to shrink when it does not (Kramer 1971; Lewis-Beck and Stegmaier 2000; Healy et al. 2017). Scholarship suggests that, for that reason, democratic leaders actively use monetary and fiscal stimuli just before elections (Nordhaus 1975; Alesina and Roubini 1992; Brender and Drazen 2008). Public debates and media narratives, too, frequently take a strong connection between economic fortunes and the fate of incumbent politicians as given.

At least implicitly, many of the underlying theories and cognitive models presume voters to be relatively well-informed about the state of the national economy. Studies of public economic knowledge have come to quite different conclusions, however: it is generally poor and unequally distributed, with economic knowledge strongest among the affluent and highly-educated.

We re-visit and advance this literature through a systematic evaluation of the two Eurobarometer waves that probed European citizens’ knowledge of official national unemployment, inflation, and growth statistics in two dozen countries in 2007 and 2015.Footnote 1 Confirming earlier studies, many respondents’ estimates diverge substantially from official figures, and they vary systematically with respondents’ socio-economic status. The less educated and affluent respondents are, the further off estimates lie. Respondents with high education and well-paying jobs—social groups to which we refer as socio-economic “insiders”—tend to offer estimates closer to official headline indicators.

Previous studies have interpreted such patterns as evidence that insiders are better informed about current affairs than outsiders. But that is not a foregone conclusion. Economic views of those in society who find themselves in a privileged position can be more in line with the official state of the economy not because they are more knowledgeable or possess higher “cognitive ability” (Stimson 1975), but because mainstream narratives about the economy track their life-experiences more closely than those of more marginalized groups. A recent study has shown the reporting of economic news to be ‘class-biased’ in the sense of being more sensitive to the changing economic fortunes of the rich than those of the poor (Jacobs et al. 2021, p. 1017): “the ‘economy’ [as represented in the news media] on which most voters have been voting has, in an important sense, not been theirs.” Similar dynamics may also shape public knowledge about official macroeconomic statistics.

As we show, most people overestimate inflation and unemployment figures, such that those who offer atypically optimistic (i.e. low) estimates may be simply extrapolating from their own more comfortable situation. Low estimates may be less a sign of knowledge than of an optimistic guess. The economic knowledge of socio-economic insiders may be colored by their societal position and experience–their affect, in other words–as much as that of outsiders.

Our key contribution thus lies in further unravelling the patterns in people’s biased economic knowledge. Theoretically, we distinguish informational drivers (some people know better) from affective ones (answers are driven by optimism or pessimism). Empirically, a specific feature of our data helps us tease the two apart: for inflation and unemployment indicators, poor information and pessimism both push estimates upwards, making the two hard to distinguish. But for growth figures, low estimates point to pessimism. This allows us to discern different sources of misestimation. For instance, someone who overestimates unemployment, inflation and growth is likely to be poorly informed. In contrast, exaggerated estimates of unemployment and inflation but not of growth suggest pessimism.

Leveraging these differences, we find that what people (think they) know about the economy is not only driven by “better information” but also positive or negative predispositions. Higher education levels and active engagement with current political affairs are associated with better estimates. Financial security and a general trust in statistics, however—characteristic of socio-economic insiders—correlate with more optimistic estimates, not necessarily more accurate ones. The people whom we find to be genuinely less informed are those who self-identify as politically far-left or far-right, and those who do not frequently discuss politics. People on the political fringes tend to make poor, but more or less random, guesses (a pattern that appears to have strengthened over time). Those who rarely discuss politics give excessively high numbers for everything: unemployment, inflation and growth.

These findings matter for how we understand the role of economic information in politics: one could hope that statistics serve as intersubjectively shared yardsticks against which different judgments of economic conditions can be evaluated. Statistical information could function as a corrective to affective judgments of the economy.

But this is not what we observe in practice. People’s knowledge does not only fuel socio-economic dynamics (and for example voting behavior) but is also driven by them. Hence, economic knowledge is not objective information that people either do or do not possess. Instead, what people think they know about the economy depends on their personal economic circumstances and expectations for the future.

In what follows, we first lay out how economic knowledge matters to politics, and what we know about it already. We then outline what we argue to be the two main alternative approaches to economic knowledge, the informational and the affective approaches. The subsequent sections detail our hypotheses, data, model, and results.

The relevance of economic knowledge for democratic politics

Scientific literature has elucidated the importance of citizens’ economic perceptions and views for democratic politics. Economic voting models connect economic performance and election outcomes—even if scholars of economic voting disagree whether voters assign more weight to past (retrospective) or expected future (prospective) developments in their economic evaluation (Mackuen et al. 1992), and whether they care more about their own personal well-being (egocentric) or that of their in-groups (sociotropic) (Kinder and Kiewiet 1981; Healy et al. 2017).

In economics, literature on political business cycles focusing on the “supply side” of economic policy has drawn similar conclusions. Given their ability to influence monetary and fiscal policy, politicians can be expected to stimulate the economy before elections, hoping that short-term economic improvements will be mistaken for incumbents’ policy competence. Even though the empirical evidence is somewhat mixed (Drazen 2000), the theoretical argument is broadly accepted. Pundits have for example blamed Donald Trump’s failed re-election bid on the Covid-19 related economic slump (e.g. Lowrey 2020) and insufficient economic stimulus before election day (e.g. Greenblatt 2020). Beyond election time, citizen assessments of economic performance can shape public opinion on policy issues, including trade (Rho and Tomz 2017), offshoring (Mansfield and Mutz 2013), migration (Mayda 2006), tax policy (Pampel et al. 2019) or climate change (Huber et al. 2020).

Although it is rarely made explicit, citizens’ economic knowledge is a key link in the causal chain that connects macroeconomic conditions (beyond personal ones) to political outcomes. Much of the literature mentioned above presumes that economic conditions matter because voters can discern and act on them.

Empirical research has raised doubts about such knowledge—both regarding economics as commonly taught in schools and universities (Blendon et al. 1997; Shiller 1997; Blinder and Krueger 2004; Medrano and Braun 2012; Rho and Tomz 2017) and macroeconomic statistics (Del Giovane et al. 2009; Fullone et al. 2008; Papacostas 2008; Ansolabehere et al. 2013, 2014; Mohr et al. 2014; Vicente and López 2017; Runge and Hudson 2020). One Spanish survey found more than 80 percent of respondents claiming “little or no knowledge” about the effects of raising or lifting trade barriers (Medrano and Braun 2012). A British study found respondents to have some understanding of economic concepts related to personal finances—such as inflation or interest rates—but little grasp of abstract ones such as GDP (Runge and Hudson 2020). While economists and policymakers commonly attach great weight to a single percentage point of inflation or growth more or less, citizen estimates are often five percentage points or more off the official numbers (see our detailed descriptive statistics below.)

Given such findings, much economic voting scholarship has sidestepped public knowledge of official macroeconomic statistics as explanatory variables because—with such large errors—it is hard to link them to political behavior directly. Some have suggested that voters can gauge economic trends even without cognizance of official figures (Popkin 1991; Sniderman et al. 1991; Kayser and Peress 2012). Others have turned attention to media narratives (Soroka et al. 2015; Kayser and Peress 2020; Jacobs et al. 2021) or partisan cues (De Vries et al. 2017; Bisgaard and Slothuus 2018) instead of the numbers feeding those narratives.

We take one step back. What people (think they) know about national economic performance indeed differs from official estimates. But that does not make such knowledge unimportant. Instead, we argue, it challenges us to understand better what shapes the citizen perceptions that subsequently inform political dynamics. Rather than bypassing this link in the causal chain, we want to tease it apart empirically. But before turning to the empirical investigation, the following sections review previous findings about public statistical knowledge and develop our theoretical conjectures about informational versus affective drivers of it.

What drives differences in people’s economic knowledge?

A few studies have analyzed the drivers of public knowledge of macroeconomic statistics. Ansolabehere et al. (2014) found that Americans with less education and those with ethnic and racial minority backgrounds on average report higher national unemployment figures. Suggesting that people take cues from their immediate environments, citizens of states with relatively high unemployment also report higher national figures. A recent report by the UK’s Office for National Statistics concludes that “survey respondents were more knowledgeable, confident, and interested in economic statistics when they were male and older, from higher socioeconomic groups and had higher education levels” (Runge and Hudson 2020). Earlier studies from Germany (Mohr et al. 2014) and Italy (Fullone et al. 2008) had come to similar conclusions. Pan-European studies also show significant cross-country differences (Papacostas 2008; Vicente and López 2017), some of which may be attributed to socio-economic differences between countries (e.g. different average levels of education) or national economic conditions.Footnote 2 Others have shown how news coverage (Soroka et al. 2015; Kayser and Peress 2020; Jacobs et al. 2021) and partisan cues (De Vries et al. 2017; Bisgaard and Slothuus 2018) shape citizen knowledge.Footnote 3 Studies that have examined economic knowledge and attitudes beyond macroeconomic statistics have identified similar patterns (Walstad 1997; Burgoon and Hiscox 2004; Guisinger 2016).

The informational versus affective approaches to economic knowledge

These findings suggest that economic insiders, or those with relative economic privilege, have superior economic knowledge. This “informational approach” holds that some people know better, and that better knowledge is a function of personal traits such as education, income, gender, occupational status, and so on. In this view, economic assessments and hence political behavior are partly a function of how well-informed people are (Hainmueller and Hiscox 2006), or the information sources citizens consult strongly influencing their political behavior (Soroka et al. 2015). This informational view also chimes with debates in the economic voting literature about levels of voter “sophistication” and how (inferred) cognitive abilities can influence their disposition to behave like egocentric or sociotropic voters (Carpini and Keeter 1996; Gomez and Wilson 2007),Footnote 4 or whether they are forward-looking (“bankers”) or backward-looking (“peasants”) in their economic assessments (Mackuen et al. 1992).

The alternative view—what we call the affective approach—sees differences in economic knowledge rooted in non-informational factors such as ideological predisposition, observation bias and personal circumstances, rather than in cognitive abilities. Such factors matter for economic judgments more generally. Ideological orientation, for example, informs immigration attitudes more than presumed self-interest (Hainmueller and Hiscox 2007). Wolfe and Mendelsohn (2005) come to similar conclusions about Canadian trade attitudes, while Mansfield and Mutz (2013) and Mutz and Lee (2020) find ideological orientation to dominate US citizen views of trade policy and offshoring by American companies. Legge and Rainey (2003) see German attitudes towards privatization shaped by basic ideological orientation rather than by self-interested calculation.

The informational perspective differentiates people who have knowledge from those who do not; the affective view draws the line along differing beliefs or assessments. We bring these two perspectives to macroeconomic statistics: when we find that economic insiders provide estimates relatively close to the official figures, does that mean they know better, or that they guess as much as everyone else, but have biases pointing in the right direction?

Hypotheses and observable implications

For our purposes, economic knowledge is whatever people (think they) know about the state of the economy, expressed through macroeconomic indicators. We thus do not assume that official figures about unemployment or inflation are objectively correct. Indicators’ underlying definitions are ambiguous enough to justify doubts about their concept validity (Aragão and Linsi 2022; Linsi and Mügge 2019; Mügge and Linsi 2021; Mügge 2022). At the same time, the survey questions explicitly ask for people’s familiarity with official numbers as reported in the media, such that they become our yardstick for accuracy.

We take differences in people’s responses as indications of their familiarity with economic information (if the distance between personal estimates and official figures is large but not clearly biased in one direction) or of biased perceptions (if the difference shows clear directional biases to systematically over- or underestimate official figures).

Our data contains estimates for economic growth, inflation, and unemployment. The former differs from the latter in two important ways: first, inflation and unemployment are intuitively more concrete than growth (Runge and Hudson 2020). They are about life getting more expensive and people losing their jobs and hence easy to relate to. People who observe large price changes, for example for fuel or groceries, are likely to make quick inferences about overall inflation levels (Del Giovane et al. 2009; Moati 2011; Ansolabehere et al. 2013). Mutatis mutandis, the same applies to unemployment figures. Economic growth, in contrast, is a much more abstract concept. In an era of “great income stagnation”, when the gains of economic growth have been highly concentrated (Tyson and Madgavkar 2016; Jacobs et al. 2021), the link between growth and incomes has been weak at best.

Findings from focus group interviews in the United Kingdom support these intuitions:

[P]articipants reported they paid particular attention to the economy and certain economic indicators when it had big personal financial implications, such as getting a mortgage, or when downturns in the economy affected their job prospects and finances. However, at the same time, participants admitted and regretted that they lacked a detailed understanding of the economy. […] GDP was seen as economic jargon, contributing to the feeling that economics was largely inaccessible to them. (Runge and Hudson 2020)

Extrapolations from personal circumstances may thus bias unemployment and inflation estimates more than growth estimates.

Second, higher numbers generally indicate a worse economic situation in the case of inflation and unemployment, but a better situation in the case of economic growth. Whereas high growth rates are a reason for optimism, high levels of unemployment indicate a bigger risk to lose one’s job, and high inflation implies that goods will become more expensive.Footnote 5

If the general public typically considers higher values as positive for growth, but negative for unemployment and inflation, we can leverage these differences to study to which extent personal experiences color subjective economic knowledge. They allow us to test whether certain personal attributes are associated with more accurate estimates because respondents are indeed better informed, or whether their estimates are merely more optimistic, even if they guess as much as everybody else.

Our empirical analysis uses two Eurobarometer (EB) waves, with respondent-level information that we use to proxy key explanatory variables. Vicente and López (2017) have analyzed differences in economic knowledge using one of the EB waves (2015) that we analyze as well. Although many of our variables coincide with theirs, their analysis is less theory-driven and more focused on cross-country differences, uses a different specification, and does not include the earlier EB wave (which we leverage to compare pre-Eurozone crisis to post-crisis levels of public economic knowledge, cf. hypothesis 5 below). For us, their results are inspiration for hypotheses about our own data rather than established facts about patterns within it.

Learning and socialization

Scholarship indicates a strong positive connection between education levels and the accuracy of economic and political knowledge (Blendon et al. 1997; Walstad 1997; Caplan 2002b, 2002a, 2011; Walstad and Rebeck 2002; Mohr et al. 2014). Most of it takes the informational perspective: the quality of subjective economic knowledge is seen as a function of people’s information levels, building on the level of obtained formal education. Long education trajectories may influence new consumption patterns; exposure to economics training may promote accurate recollection of quantitative economic information. To the extent that this intuition is correct, we might expect highly educated people to answer questions about all three indicators more accurately than those with less education.

But there is also an affective dynamic through which education levels may influence the accuracy of respondents’ estimates: more educated people may offer more sanguine estimates than less educated ones because of their typically more favorable socio-economic positions and prospects (Jacobs et al. 2021). If so, we would expect the accuracy of personal estimates to correlate with education levels, but in a slightly different pattern: higher education should correlate with lower, less pessimistic (and hence more accurate) estimates for unemployment and inflation, but higher estimates for economic growth.

H1a (informational):

the higher people’s education levels, the more accurate their estimates for all three indicators because they are better informed about current affairs.

H1b (affective):

Higher education levels correlate with less pessimistic, lower (more accurate) estimates for unemployment and inflation, but higher estimates for growth because they extrapolate from their own, more comfortable, position.

In addition, and potentially covarying with education, individuals may have developed an interest in political and economic topics, supporting economic news consumption (Sniderman et al. 1991; Carpini and Keeter 1996) and hence more accurate estimates.

This mechanism is not obvious. A strong investment in politics could also augment affective predispositions, such that the pessimism/optimism dynamics would be amplified through ‘echo chamber’ effects (Matteo et al. 2021). Strong political interests might thus also let people’s economic knowledge diverge. But the resulting patterns would differ:

H2a (informational):

people who actively participate in political discussions and indicate interest in economic issues offer more accurate estimates of all three indicators because they are better informed about current affairs.

H2b (affective):

people who actively participate in political discussions and indicate interest in economic issues are more exposed to narratives that tend to exaggerate economic trends and may therefore offer less accurate estimates.

Finally, the relationship between learning and socialization and the accuracy of economic knowledge may also be mediated by political ideology and individuals’ trust in government institutions. Traditionally, ideological biases have mainly been conceptualized in terms of partisanship (Ansolabehere et al. 2013; De Vries et al. 2017): supporters of political incumbents would put a gloss on present economic conditions and outlook for the future; opponents would do the opposite. More recently, we see an emergent division between relatively centrist citizens on the one hand, and politically more extreme ones (both left and right) on the other. The latter can be seen as part of an anti-establishment group in the population, marked by higher disregard for and lack of trust in democratic institutions and the kinds of policies implemented through them (Hopkin 2020).

In addition to their support of incumbent governments, people’s experiences of economic conditions may thus be systematically colored by the degree to which they find themselves in the political mainstream versus the fringes. But it is conceivable that the causal arrow runs in the other direction: those who perceive economic conditions to be dismal might find themselves driven towards anti-establishment opinions. For our purposes, the direction of the causal arrow is less important than the fact that anti-establishment positions and particularly negative economic assessments may be two sides of the same coin, with economic perceptions simultaneously fueling and reflecting the ideologically colored predisposition of citizens.

At the same time, people outside the political mainstream may not believe that economic figures have much purchase and therefore ignore them more readily, so that when queried about them, volunteer estimates that are further from official figures (Runge and Hudson 2020; Jacobs et al. 2021). To investigate this establishment/anti-establishment dimension, we consider individuals’ political ideological self-placement, its distance to the incumbent government’s ideological positioning, and the relative trust citizens have in national economic statistics.

The key difference between informational and affective conceptions lies in how these biases play out as citizens on the political extremes may be exposed to discourses which paint a particularly dismal picture of economic conditions.

H3a (informational):

people closer to centrist political positions as well as those having greater trust in government statistics will offer more accurate estimates for all three indicators because they are better informed about current affairs, and/or are less exposed to more extreme claims about the economy made by politicians and commentators on the political fringes.

H3b (affective):

people closer to centrist political positions as well as those having greater trust in government statistics will offer less pessimistic, lower (and more accurate) estimates for unemployment and inflation, but higher ones for growth because they extrapolate from their own, more comfortable position.

Salience and exposure

The second cluster of explanatory variables relate to the salience of economic statistics in public debate and the direct exposure of individuals to the economic developments these indicators seek to capture.

A rational choice view of information acquisition emphasizes that gathering information is costly, and people will expend effort to acquire information when it has a direct bearing on their personal situation (Sniderman et al. 1991; Feddersen and Sandroni 2006). By this logic, people in precarious positions would pay closer attention to reporting about specific economic developments and would be more up to date than those who can afford to pay less attention. In other words, financial and economic distress might improve estimates. We would expect such an effect in particular for unemployment figures, which relate most immediately to people’s personal situations.

At the same time, the affective perspective suggests that economic hardship may increase anxieties and encourage people to extrapolate from their own situation to society as a whole. Scholars have shown that blanket economic judgments about whether things are going well or not are often influenced by people’s personal experiences and expectations. Judgments of one’s personal situation and of the general situation bleed into each other, either because people make inferences about national economic conditions from the case they know best (their own) or because their emotions (pessimism, frustration, anxiety) color their general perceptions.

It is not self-evident that we would find a similar link between personal circumstances and actual economic knowledge, as opposed to economic judgments. Consonant with a more rationalist view of information acquisition and cognition, people may be able to separate their personal situation from knowledge about general conditions, knowing that things in general are going well even if they aren’t for themselves personally. Two alternative hypotheses follow:

H4a (informational):

individuals with greater exposure to the risk of unemployment or inflation offer more accurate estimates of the respective figures because they are better informed about economic trends that directly affect them.

H4b (affective):

individuals with greater exposure to the risk of unemployment or inflation offer more pessimistic, less accurate estimates of the respective figures because the estimates they give are colored by their anxieties.

Finally, salience may also matter in a different way. The cost of acquiring knowledge about economic statistics is partly a function of their prominence in public debate (Popkin 1991; Sniderman et al. 1991; Feddersen and Sandroni 2006). If they make newspaper headlines, they are relatively “cheap” to pick up. If one needs to dig in specialist sources to find them, they are more expensive. Does easy-to-acquire information, as the informational perspective expects, improve the accuracy of people’s estimates?

To test the effect of this form of salience, we compare the pre- and post-crisis EB waves. Europeans’ concerns about the state of their economies skyrocketed in the aftermath of the 2008 financial crash. For six consecutive years (2007–2013), Europeans perceived unemployment, the national economy and rising prices as the three most relevant issues in their countries (Eurobarometer 67 and 80). News coverage clearly increased as well; with a 16 percent increase in unemployment from 2006 to 2014 in some EU countries (Eurostat 2018), it is not surprising that Europeans centered their attention on these macroeconomic indicators.

From an informational perspective, we would expect that, averaged across Europe, the growing importance of economic issues would increase citizens’ attention to economic information and hence improve their subjective economic knowledge. From an affective perspective, we would expect that the greater salience of these indicators in public debate would reinforce negative perceptions. Our final pair of hypotheses follows:

H5a (informational):

ceteris paribus, people’s knowledge of all three indicators is more accurate in the aftermath of the economic crisis than before it due to their greater salience in the media and public debates.

H5b (affective):

people’s knowledge of all three indicators is more pessimistic and less accurate in the aftermath of the economic crisis than before it because estimates are primarily colored by gloom.

Data

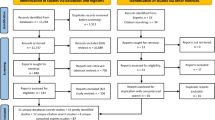

To test these hypotheses, we analyze data from the (only) two waves of the Eurobarometer survey that included questions about citizens’ knowledge of economic indicators: EB67.2 conducted in 2007 and EB83.3 conducted in 2015. In both waves, randomly selected samples of roughly 1,000 respondents each from two dozen European countries were probed about their knowledge of three macroeconomic statistics: the national unemployment, inflation and growth rates. Details about sample sizes and the countries surveyed can be found in Appendix Table A2.

Questions were phrased in the following way:

“What was the official unemployment rate, the percentage of active people who do not have a job, in (OUR COUNTRY) in 2014? I can tell you that the exact figure is between 0% and 30%” (Question QF4 in EB83.3 questionnaire), etc.

In total, the two surveys yielded more than 56,000 possible personal estimates of national unemployment and inflation rates across two dozen countries at two points in time, and slightly more than 43,000 estimates of the growth rate (omitted from some country samples in the EB survey).

We analyze this information in two ways: to investigate the drivers of the (in-)accuracy of respondents’ estimates, i.e. how close they are to the official figures (independently of whether they are over- or under-estimates), we calculate the absolute value of the distance between personal estimates and the official figures.Footnote 6 A value of 0 represents a perfectly accurate estimate; the higher the value, the further removed respondents’ estimates are from the actual figures. To gauge the direction in which covariates tend to bias knowledge of economic statistics, we rely on the net difference between personal estimates and official rates. In this case, positive values indicate over-estimates, and negative values under-estimates.Footnote 7

The state of economic perceptions: descriptive analysis

Vicente and López (2017) have analyzed the second wave of the Eurobarometer (EB 83.3) in a study for the Journal of Official Statistics. They place heavy emphasis on describing the data and on differences in estimate accuracy across countries. Although these differences are interesting in their own right, they are less relevant to our endeavor, which emphasizes the theoretical relationships discussed above.

Table 1 provides an overview of the broad distribution of responses (the size of country-samples is summarized in Appendix Table A2). It shows, for each indicator and wave, the total number of responses and non-responses (‘don’t knows’) as well as the proportion of the former that are roughly correct (less than 2 [1] percentage point off the actual figure).Footnote 8

First off, we see that knowledge about official economic statistics among citizens is remarkably low: about half of the respondents in the 2007 survey did not provide any estimate when probed, indicating that they ‘don’t know’ the unemployment, inflation or growth rate. Those who did respond often provided estimates far removed from the official figures: only 1 in 5 respondents in 2007 offered numbers less than two percentage points removed from the actual figure, while only 1 in 10 were correct within one percentage point.

Respondents’ willingness to provide an estimate was much higher in the post-crisis survey of 2015, in which the proportion of ‘don’t knows’ fell to between 20 and 30 percent. At the same time, the share of roughly correct answers did not clearly improve from 2007 to 2015. (Note that the phrasing of questions about knowledge of indicators was the same in the two waves, so that this notable difference in non-responses must be driven primarily by the increase in salience of economic news, not the design of the survey. A point we discuss further below.)

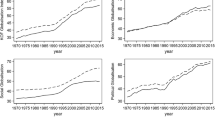

To illustrate the deviance of personal estimates from the official figures, Fig. 1 plots the distribution of the variable capturing the net difference between the estimates given by respondents and the official rates. The histograms show that the estimates of many respondents lie rather far from the official figures.

The plots also suggest that citizens see their economies more pessimistically than official figures indicate: 75 to 85 percent of respondents think that the rate of unemployment and inflation are higher than indicated in official statistics, while the ratio is lower for economic growth, where about half of respondents underestimate official growth rates.

Because absolute values of official statistics are relatively small, respondents are likely to over- rather than underestimate inflation, growth (and to a lesser extent) unemployment, inviting overly optimistic estimates for growth and overly pessimistic ones for inflation and unemployment. A priori, these dynamics affect all respondents, however, and our central aim is to understand better why they affect some more than others.

Methods

To assess our hypotheses, we next run a series of hierarchical multi-level regression models in which we test, for each of the three indicators (unemployment, inflation and growth), the strength and robustness of the correlation of individual respondent characteristics with the absolute and net distance between personal estimates and official figures. In our main specifications, we employ random intercepts at the country and NUTS2-region level.Footnote 9

Our central question is to what degree subjective economic knowledge is driven by informational versus affective dynamics. In line with the hypotheses presented above, we consider a range of variables to capture possible alternative dimensions of this distinction. Before we present the results, we briefly summarize these measures.Footnote 10

The education variable is categorical and indicates at what age respondents completed their full-time education (less than 15 years old; 16–17 years old; 18–20 years old; 21–24 years old; older than 25 years).

We use two variables to capture personal economic situation: respondents’ answers to the question “How would you judge the current financial situation of your household?” (very good; rather good; rather bad; very bad) and their occupation (the survey slots these into eight categories: self-employed, manager, other white-collar worker, manual worker, house person, unemployed, retired, student). We further include five variables that proxy for respondents’ political ideology and interest in political and economic issues. To gauge whether people find themselves more or less in the political (centrist) mainstream or self-identify with more radical, anti-establishment political ideas, we use a categorical variable derived from respondents’ self-placement on a scale ranging from 1 (very left) to 10 (very right), which we compress into five categories (far left [1,2]; center-left [3,4]; center [5, 6]; center-right [7,8]; far right [9, 10]). To separately evaluate the role of incumbent government support, we further create a variable measuring the distance of respondents’ self-placement from ParlGov’s (Döring and Manow 2021) classification of the relevant incumbent government’s ideological position on the same ten-point scale.

We measure relative trust in political institutions, and statistics in particular, with the following question: “Personally, how much trust do you have in the official statistics in [OUR COUNTRY], for example the statistics on unemployment, inflation or economic growth? Would you say that you tend to trust these official statistics or tend not to trust them?” (answers coded as a dummy: tend to trust; tend not to trust). We derive people’s engagement with political discussion from their answer to the question: “When you get together with friends and relatives, would you say you discuss frequently, occasionally or never about national political matters?” Respondents were offered three possible answers (never; occasionally; frequently). Finally, we proxy the importance respondents attach to economic issues with a variable that counts the number of economic issues respondents mention among “the two most important issues facing [OUR COUNTRY] at the moment” (the values thus range between 0 and 2).Footnote 11

To tease apart subjective economic knowledge from general economic assessments, we include the responses to a question about relative economic optimism: “What are your expectations for the next twelve months: will the next twelve months be better, worse, or the same when it comes to the economic situation in [OUR COUNTRY]?” (better; same; worse).

To capture the effects of salience, we use a dummy for the EB wave to see whether the financial and economic crisis, which heightened the salience of economic issues across Europe, indeed had the effect of improving subjective economic knowledge.

In all models, we also control for respondents’ age (the linear function as well as the square term) and gender. At the country-level, we control for official rates of inflation, growth or unemployment (from Eurostat) as well as GDP per capita (logged). Descriptive statistics and a correlation matrix are provided in Appendix Tables 4, 5, 6.

Results and interpretation

Our main results are presented in Table 2. For each indicator, it shows the strength of the various variables as predictors of the (in)accuracy of subjective economic knowledge (Models 1, 3 and 5) as well as the direction in which they bias personal estimates (Models 2, 4 and 6). In the ‘inaccuracy’ models, the dependent variable captures the absolute distance between personal estimates and the official figures; in the ‘direction’ models, the net difference. Positive coefficients in the ‘inaccuracy’ models thus indicate that the respective covariates are associated with personal estimates that are further removed from the official figures; negative coefficients indicate ‘better’ estimates. In the ‘direction’ models, positive signs indicate higher, and negative signs lower, estimates, independent of their (in)accuracy.

To facilitate the interpretation of these multidimensional results, we also run the model with binary transformations of the categorical variables and plot the coefficients of some key variables graphically in Fig. 2.

Plot of coefficients (binarized variables). To facilitate visualization, coefficients are based on re-estimations of the main models with key variables binarized in the following manner: highly educated equal to one for respondents who pursued education beyond the age of 20; discuss politics for those indicating to discuss politics ‘occasionally’ or ‘frequently’; comfortable financial situation for those judging it to be ‘rather good’ or ‘very good’; trust in statistics for those who indicate that they ‘tend to trust statistics’; and political support of extreme parties for individuals who self-classify in the two outermost categories on either end of the 1–10 scale.

In addition, Appendix Table 7 shows the importance of the same explanatory variables as predictors of ‘don’t know’ responses.

Overall, the results show how both informational and affective dynamics color what people (think they) know about national economic performance. Table 3 offers a systematic overview of the findings in light of the hypotheses developed in the previous paragraphs.

In line with our informational hypotheses, more educated respondents (who are also notably more likely to reply, cf. Appendix Table 7) offer more accurate, lower estimates of unemployment, inflation and growth. Based on the binarized estimates plotted in Fig. 2, estimates of highly educated individuals are about 0.5 percentage points closer (lower) to official rates for all three indicators. Similarly, respondents who discuss political matters frequently are significantly more likely to reply (cf. appendix Table 7) and offer more accurate, lower estimates across all three indicators. The same is true for respondents who self-identify with more centrist political-ideological positions who also tend to give more accurate, lower estimates of unemployment, inflation and growth than respondents on the political fringes. In particular, respondents who place themselves on the far right offer significantly less accurate numbers for all three indicators (including growth). The same applies for respondents further removed from the incumbent government in ideological terms, who tend to offer less accurate estimates that overestimate unemployment while the directional bias is less systematic for inflation and growth rates. This provides at least some evidence that people closer to the political mainstream and those who are socialized into ‘finding politics interesting’ are somewhat more informed about official macroeconomic statistics’ representation of the state of the economy.

Other variables indicate the importance of affective dynamics. Respondents who indicate being in a better financial situation and those who express trust in statistics also offer lower, more accurate estimates of inflation and unemployment. But the picture is different for growth where the same groups of people tend to indicate higher, but not clearly more accurate, estimates. This implies that relatively richer respondents and those who are more at ease with the political establishment are more optimistic about the state of the economy and, all else equal, offer more sanguine estimates of economic growth than materially more deprived respondents–a pattern that conforms with the intuition that emotive factors can bias inflation and unemployment estimates in a direction that incidentally also makes them more accurate, even though respondents are not necessarily being better informed.

The other two measures of respondents’ general assessments of the economy in the survey–the importance they attach to economic issues and their expectation about its future course–also tap into this. While correlations are smaller in substantive terms, we find that respondents who attach greater importance to economic issues offer less rather than more accurate estimates, which are consistently more pessimistic (higher for unemployment and inflation; lower for growth). The general pattern is that “caring” about the economy translates into exaggerated (pessimistic) estimates, not more accurate knowledge. Respondents who give more somber predictions about the expected future offer higher, less accurate estimates of present levels of unemployment and inflation–but not growth. Of course these relationships can go in two directions: people may offer overly gloomy estimates because of their general economic pessimism or they may be pessimistic because they have bleak (but inaccurate) economic statistics in their minds. The direction of the causal arrow is less important to us, however, than the observation that the two go hand in hand.

The results regarding our hypotheses about salience and exposure also indicate the importance of affective dynamics. Overall, we find that individuals more exposed to the risks of unemployment and inflation are not better informed about the respective statistics. The unemployed and people in presumably less secure professions (e.g. manual workers and the self-employed) give higher, less (not more) accurate estimates of unemployment and inflation levels (as well as growth rates). People particularly exposed to inflation, for example pensioners and respondents taking care of the household and groceries, also give much higher, less accurate estimates of its level. This clearly goes against the informational hypotheses. People at greater risk of unemployment or inflation do not pay closer attention to relevant statistics. Instead, their estimates reflect greater levels of anxiety and the cues they take from their immediate environment. In other words, personal distress colors subjective economic knowledge negatively.

Last but not least, the growing salience of economic news in public debates in the aftermath of the financial crisis has led to a notable increase in the proportion of people who do offer an estimate when probed (cf. Appendix Table 7; also Table 1). It has not, however, led to better knowledge. On the contrary, the accuracy of people’s estimates decreased in the post-crisis Eurobarometer wave, and quite significantly so in substantive terms. The accuracy of post-crisis estimates is clearly lower. Controlling for the level of actual rates, respondents tend to still overestimate unemployment and inflation substantially more in the 2015 survey than in the previous wave. In the case of growth respondents give lower estimates, which also tend to be less accurate, but only marginally so. In either case, these results quite clearly reject the informational hypothesis that greater salience leads to more accuracy.

Robustness checks

To probe the robustness of these results, Appendix Table 8 re-estimates the results from Table 2 in a model with country fixed-effects instead of random intercepts. The results are nearly identical. Taking into account the sharp decrease in ‘don’t know’ responses from the first to the second wave (shown in Table 1), we also compare the results of the 2007 survey and the 2015 survey separately in Appendix Tables 9 and 10. Encouragingly, the results are very similar in substantive terms, indicating that the increase in responses after the crisis does not drive our findings about the general dynamics at play. One interesting difference concerns the result about ideological distance from the incumbent government whose estimates appear to be clearly less accurate and more systematically biased in the more recent 2015 wave than in the pre-crisis survey, in line with observations about political polarization and growing misinformation on the political fringes (‘echo chamber’ effects) in recent years (Matteo et al. 2021). Otherwise the patterns in either of the waves alone are largely identical to the pooled results.

Conclusion

What shapes what people know about the economy? How do they relate to official economic statistics? To what degree can such data count as a shared informational background to public deliberations and the formation of individual economic assessments and preferences?

On the whole, our findings are not encouraging. In the samples of the two large-scale Eurobarometer waves we have examined, less than a third of respondents across Europe offer an estimate of the unemployment, inflation or growth rate that lies within two percentage points of the actual official figure. In that sense, public quantitative economic knowledge is wanting. Furthermore, we have found that (the lack of) such knowledge is not randomly distributed. All else equal, socio-economic insiders—such as highly educated, financially comfortable and politically centrist males—are most likely to be aware of official macroeconomic statistics. The further we move away from this privileged subgroup, the worse estimates become.

Why is that so? Our analysis suggests that it is due to a confluence of informational and affective dynamics. On the one hand, higher levels of education and an active interest in political affairs are associated with better (generally lower) estimates across the three indicators. But such informational dynamics face limitations in explaining the distribution of the (lack of) public economic knowledge on their own. For instance, we find little evidence for the idea that the accuracy of people’s information is a function of how relevant particular knowledge might be to them. There is relatively little evidence, for example, that people in socio-economic positions or employment categories for whom particular information might be especially useful also report it more accurately. Personal economic and political gloom strongly affects what people think they know about the economy—not just general assessments, but actual numbers they are willing to attach to economic conditions. For labor markets, general pessimism about the future translates into higher unemployment estimates here and now. Personal economic distress equally lets people report much higher unemployment and inflation rates than is true for people with fewer economic worries. At least in part, the higher accuracy of economic insiders’ estimates is rooted in their positive economic outlook—their optimism—rather than better knowledge per se. Across the board, we find a clear tendency, in other words, to extrapolate from one’s personal situation.

Political gloom, too, colors subjective economic knowledge. People placing themselves at the political extremes, and hence dissatisfied with the status quo, offer much less accurate estimates across the board than others, suggesting that they tune out of official information channels about economic conditions. The evidence suggests, even if less strongly so, that this results in a pessimistic bias: people at the political extremes think they know economic conditions to be worse. The same holds for citizens who distrust statistics more generally. Here too we find a strong correlation with more pessimistic economic estimates.

These findings upend models of economic opinion formation that theorize economic information as an exogenous input. At first sight, this does not augur well for deliberative democracy, which thrives on the availability of intersubjectively shared common ground–the facts everyone can agree on. (During the past years, American politics has offered a worrying illustration of what happens when that common ground crumbles.) At the same time, our analysis does not assume that official figures offer accurate or even universally useful assessments of economic conditions. They differ enough across socio-economic classes, regions and individuals to justify doubts about just how meaningful “national economic conditions” are for citizens (cf. Jacobs et al. 2021). In that view, it may be understandable after all that people are less invested in such information than common imageries would expect. Either way, our findings underline that statistics are far from the objective economic yardsticks that their champions all too often still hold them to be.

Notes

To our knowledge, these two waves are the only ones in which respondents were asked to estimate official macroeconomic statistics, constraining our ability to extend our analyses beyond those two waves.

We consciously do not investigate cross-country differences, but we do control for them in our analyses.

Our datasets omit information on media consumption or partisan attachments necessary to evaluate such dynamics. But we include proxies on respondents’ interest in politics, their ideological self-placement, as well as the latter’s distance from the incumbent government position.

Although the nature of these supposed implications remain debated. Whereas Gomez and Wilson (2001) claim that “low sophisticates” are more likely to be influenced by (less difficult to evaluate) sociotropic economic concerns, Carpini and Keeter (1996) suggest that pocketbook voting should be more common among less knowledgeable individuals.

Whereas very low, negative rates of inflation (deflation) can equally be a concern for economists, such considerations seem less prominent among the general public. The same focus group interviews from the UK referred to above, for instance, found that people in general have a clear preference for low inflation: “The general theme was that people thought it was best for businesses and for the economy as a whole when prices stay the same or rise slightly, while they said it was best for individuals and their families when prices fall or stay the same. […] When asked about the impact of falling prices (the term ‘deflation’ was rarely used by participants), the main response was that this never happened” (Runge and Hudson, 2020). These findings confirm the results of Shiller’s (1997) study, in which respondents saw no upside whatsoever to inflation, a view in contrast to that of expert economists, who appreciate for example moderate inflation’s positive effects on household debt.

We treat the statistics published by Eurostat for 2006 and 2014 as the ‘official’ figures. For countries in the sample for which Eurostat does not publish figures (Turkey, Macedonia, Montenegro, Serbia, Albania, Croatia and Turkish Cyprus), we use statistics published in the World Banks’ World Development Indicators database.

Given the large number of ‘don’t know’ responses, we additionally generate a dummy variable which indicates whether a respondent offered any estimate at all. These results are included in Appendix Table 7.

That is: if the actual official unemployment rate was 5.0 percent, any estimate lying within 3.0 [4.0] and 7.0 [6.0] percent is classified as ‘correct’.

In robustness checks, we evaluate the consistency of our main results in country fixed-effect models (cf. Appendix Table 8).

The degree of correlation among independent variables is generally low, the highest being 0.23 (between occupational status and education). See correlation matrix in Appendix Table 6.

The issues we counted as ‘economic’ are: economic situation; rising prices; taxation; unemployment; government debt; pensions. The remaining ones, which we did not count as economic, are: terrorism, housing, immigration, health and social security, the education system, the environment, other, none.

References

Alesina, A., and N. Roubini. 1992. Political Cycles in OECD Economies. The Review of Economic Studies 59 (4): 663–688. https://doi.org/10.2307/2297992.

Ansolabehere, S., M. Meredith, and E. Snowberg. 2014. Mecro-economic voting: Local information and micro-perceptions of the macro-economy. Economics & Politics 26 (3): 380–410.

Ansolabehere, S., M. Meredith, and E.E. Snowberg. 2013. Asking about Numbers: Why and How. Political Analysis 21 (1): 48–69. https://doi.org/10.1093/pan/mps031.

Aragão, R., and L. Linsi. 2022. Many shades of wrong: what governments do when they manipulate statistics. Review of International Political Economy 29 (1): 88–113. https://doi.org/10.1080/09692290.2020.1769704

Bisgaard, M., and R. Slothuus. 2018. Partisan Elites as Culprits? How Party Cues Shape Partisan Perceptual Gaps. American Journal of Political Science 62 (2): 456–469. https://doi.org/10.1111/ajps.12349.

Blendon, R.J., J.M. Benson, M. Brodie, R. Morin, D.E. Altman, D. Gitterman, M. Brossard, and M. James. 1997. Bridging the Gap Between the Public’s and Economists’ Views of the Economy. Journal of Economic Perspectives 11 (3): 105–118.

Blinder, A.S., and A.B. Krueger. 2004. What Does the Public Know About Economic Policy, and How Does It Know It? NBER Working Paper Series, No. 10787. https://doi.org/10.3386/w10787

Brender, A., and A. Drazen. 2008. How Do Budget Deficits and Economic Growth Affect Reelection Prospects? Evidence from a Large Panel of Countries. American Economic Review 98 (5): 2203–2220. https://doi.org/10.1257/aer.98.5.2203.

Burgoon, B.A., and M.J. Hiscox. 2004. The Mysterious Case of Female Protectionism: Gender Bias in Attitudes Toward International Trade. UCSD Political Economy Working Paper series. https://hdl.handle.net/11245/1.223205

Caplan, B. 2002a. Systematically Biased Beliefs about Economics: Robust Evidence of Judgemental Anomalies. The Economic Journal 112 (479): 433–458.

Caplan, B. 2002b. What Makes People Think Like Economists? Evidence on Economic Cognition from the “Survey of Americans and Economists on the Economy.” The Journal of Law and Economics. https://doi.org/10.1086/322812.

Caplan, B. 2011. The Myth of the Rational Voter: Why Democracies Choose Bad Policies. Princeton, NJ: Princeton University Press.

Carpini, M.X.D., and S. Keeter. 1996. What Americans Know About Politics and Why It Matters. Yale University Press.

Del Giovane, P., S. Fabiani, and R. Sabbatini. 2009. What’s Behind ‘Inflation Perceptions’? A Survey-Based Analysis of Italian Consumers. Giornale Degli Economisti e Annali Di Economia 68: 25–52.

Döring, H., and P. Manow. 2021. Parliaments and Governments Database (ParlGov): Information on Parties, Elections and Cabinets in Modern Democracies. Development Version. https://www.parlgov.org/.

Drazen, A. 2000. The Political Business Cycle after 25 Years. NBER Macroeconomics Annual 15: 75–117. https://doi.org/10.2307/3585387.

Feddersen, T., and A. Sandroni. 2006. Ethical Voters and Costly Information Acquisition. Quarterly Journal of Political Science 1: 287–311.

Fullone, F., et al. 2008. What Do Citizens Know About Statistics? The Results of an OECD/ISAE Survey on Italian Consumers. In Statistics, Knowledge and Policy 2007: Measuring and Fostering the Progress of Societies, ed. OECD, 197–211. Paris: OECD Publishing.

Gomez, B.T., and J.M. Wilson. 2007. Economic Voting and Political Sophistication: Defending Heterogeneous Attribution. Political Research Quarterly 60 (3): 555–558. https://doi.org/10.1177/1065912907304642.

Greenblatt, A. 2020. Five Reasons Donald Trump Lost Presidency. Governing. https://www.governing.com/now/Five-Reasons-Donald-Trump-Lost-the-Presidency.html.

Guisinger, A. 2016. Information, Gender, and Differences in Individual Preferences for Trade. Journal of Women, Politics and Policy. https://doi.org/10.1080/1554477X.2016.1192428.

Hainmueller, J., and M.J. Hiscox. 2006. Learning to Love Globalization: Education and Individual Attitudes Toward International Trade. International Organization 60 (2): 469–498.

Hainmueller, J., and M.J. Hiscox. 2007. Educated Preferences: Explaining Attitudes toward Immigration in Europe. International Organization 61 (2): 399–442.

Healy, A.J., M. Persson, and E. Snowberg. 2017. Digging into the Pocketbook: Evidence on Economic Voting from Income Registry Data Matched to a Voter Survey. American Political Science Review 111 (04): 771–785. https://doi.org/10.1017/s0003055417000314.

Hopkin, J. 2020. Anti-System Politics: The Crisis of Market Liberalism in Rich Democracies. Oxford, UK: Oxford University Press.

Huber, R.A., M.L. Wicki, and T. Bernauer. 2020. Public Support for Environmental Policy Depends on Beliefs Concerning Effectiveness, Intrusiveness, and Fairness. Environmental Politics 29 (4): 649–673. https://doi.org/10.1080/09644016.2019.1629171.

Jacobs, A.M., et al. 2021. Whose News? Class-Biased Economic Reporting in the United States. American Political Science Review 115 (3): 1016–1033. https://doi.org/10.1017/S0003055421000137.

Kayser, M.A., and M. Peress. 2012. Benchmarking across Borders: Electoral Accountability and the Necessity of Comparison. The American Political Science Review 106 (3): 661–684.

Kayser, M.A., and M. Peress. 2020. Do Voters Respond to the Economy or to News Reporting on the Economy? In GRIPE: Global Research in International Political Economy. https://s18798.pcdn.co/gripe/wp-content/uploads/sites/18249/2020/08/KayserPeress_EconNews_Mediation_GRIPE_2020.pdf.

Kinder, D.R., and D.R. Kiewiet. 1981. Sociotropic Politics: The American Case. British Journal of Political Science 11 (2): 129–161.

Kramer, G.H. 1971. Short-Term Fluctuations in U.S. Voting Behavior, 1896–1964. The American Political Science Review. 65 (1): 131–143. https://doi.org/10.2307/1955049.

Legge, J.S., and H.G. Rainey. 2003. Privatization and Public Opinion in Germany. Public Organization Review 3 (1): 127–149.

Lewis-Beck, M.S., and M. Stegmaier. 2000. Economic Determinants of Electoral Outcomes. Annual Review of Political Science 3: 183–219.

Linsi, L. and D. Mügge. 2019. Globalization and the growing defects of international economic statistics. Review of International Political Economy 26 (3): 361–383. https://doi.org/10.1080/09692290.2018.1560353

Lowrey, A. 2020. The Economy is Collapsing. So Are Trump’s Reelection Chances: this year’s projected headline numbers look dire for the president. The Atlantic. https://www.theatlantic.com/ideas/archive/2020/04/most-important-number-trumps-re-election-chances/609376/.

Mackuen, M.B., et al. 1992. Peasants or Bankers? The American Electorate and the U.S. Economy. The American Political Science Review 86 (3): 597–611.

Mansfield, E.D., and D.C. Mutz. 2013. US Versus Them: Mass Attitudes Toward Offshore Outsourcing. World Politics. https://doi.org/10.1017/s0043887113000191.

Matteo, C., et al. 2021. The Echo Chamber Effect on Social Media. Proceedings of the National Academy of Sciences. https://doi.org/10.1073/pnas.2023301118.

Mayda, A.M. 2006. Who is Against Immigration? A Cross-Country Investigation of Individual Attitudes Toward Immigrants. The Review of Economics and Statistics 88 (3): 510–530. https://doi.org/10.1162/rest.88.3.510.

Medrano, J.D., and M. Braun. 2012. Uninformed Citizens and Support for Free Trade. Review of International Political Economy. https://doi.org/10.1080/09692290.2011.561127.

Moati, P. 2011. Les statistiques victimes de la défiance : le cas du pouvoir d’achat. http://www.philippe-moati.com/article-les-statistiques-victimes-de-la-defiance-le-cas-du-pouvoir-d-achat-70623316.html

Mohr, I., et al. 2014. What do consumers know about the economy? Journal Für Verbraucherschutz Und Lebensmittelsicherheit 9: 231–242. https://doi.org/10.1007/s00003-014-0869-9.

Mügge, D. 2022. Economic statistics as political artefacts. Review of International Political Economy 29 (1): 1–22. https://doi.org/10.1080/09692290.2020.1828141

Mügge, D. and L. Linsi. 2021. The national accounting paradox: how statistical norms corrode international economic data. European Journal of International Relations 27(2): 403–427. https://doi.org/10.1177/1354066120936339

Mutz, D.C., and A.H.-Y. Lee. 2020. How Much is One American Worth? How Competition Affects Trade Preferences. American Political Science Review. https://doi.org/10.1017/S0003055420000623.

Nordhaus, W.D. 1975. The Political Business Cycle. The Review of Economic Studies. 42 (2): 169–190. https://doi.org/10.2307/2296528.

Pampel, F., G. Andrighetto, and S. Steinmo. 2019. How Institutions and Attitudes Shape Tax Compliance: A Cross-National Experiment and Survey. Social Forces 97 (3): 1337–1364. https://doi.org/10.1093/sf/soy083.

Papacostas, A. 2008. Europeans' Knowledge on Economical Indicators. In Statistics, Knowledge and Policy Measuring and Fostering the Progress of Societies, ed. OECD, 177–198. Paris: OECD Publishing.

Popkin, S.L. 1991. The Reasoning Voter: Communication and Persuasion in Presidential Campaigns. Chicago: Chicago University Press.

Rho, S., and M. Tomz. 2017. Why Don’t Trade Preferences Reflect Economic Self-Interest? International Organization 71(S1): S85-S108. https://doi.org/10.1017/s0020818316000394.

Runge, J., and N. Hudson. 2020. Public understanding of economics and economic statistics. ESCoE Occasional Paper 03. London. https://www.escoe.ac.uk/publications/public-understanding-of-economics-and-economic-statistics/.

Shiller, R. 1997. Why Do People Dislike Inflation? In Reducing Inflation: Motivation and Strategy, ed. C. Romer and D. Romer. Chicago: University of Chicago Press.

Sniderman, P.M., R.A. Brody, and P.E. Tetlock. 1991. Reasoning and Choice: Explorations in Political Psychology. Cambridge, U.K.: Cambridge University Press.

Soroka, S.N., D.A. Stecula, and C. Wlezien. 2015. It’s (Change in) the (Future) economy, stupid: Economic indicators, the media, and public opinion. American Journal of Political Science 59 (2): 457–474. https://doi.org/10.1111/ajps.

Stimson, J.A. 1975. Belief Systems: Constraint, Complexity, and the 1972 Election. American Journal of Political Science 19 (3): 393–417. https://doi.org/10.2307/2110536.

Tyson, L., and A. Madgavkar. 2016. The Great Income Stagnation, Project Syndicate. https://www.mckinsey.com/mgi/overview/in-the-news/the-great-income-stagnation.

Vicente, M., and A. López. 2017. Figuring Figures: Exploring Europeans Knowledge of Official Economic Statistics. Journal of Official Statistics 33 (4): 1051–1085.

De Vries, C.E., S.B. Hobolt, and J. Tilley. 2017. Facing Up to the Facts: What Causes Economic Perceptions? Electoral Studies 51: 115–122. https://doi.org/10.1016/j.electstud.2017.09.006.

Walstad, W.B. 1997. The Effect of Economic Knowledge on Public Opinion of Economic Issues. The Journal of Economic Education 28 (3): 195–205.

Walstad, W.B., and K. Rebeck. 2002. Assessing the Economic Knowledge and Economic Opinions of Adults. Quarterly Review of Economics and Finance 42 (5): 921–935. https://doi.org/10.1016/S1062-9769(01)00120-X.

Wolfe, R., and M. Mendelsohn. 2005. Values and Interests in Attitudes Toward Trade and Globalization: The Continuing Compromise of Embedded Liberalism. Canadian Journal of Political Science. https://doi.org/10.1017/S0008423905050055.

Acknowledgements

The research was made possible by funding received through the ERC Starting Grant FICKLEFORMS (Grant #637883), the NWO Vidi project 016.145.395 and support from the Swiss National Science Foundation (Grant P2SKP1_168289). We also gratefully acknowledge helpful comments from the anonymous reviewers and our colleagues in the PETGOV research group at the University of Amsterdam, the able research assistance of Sacha Palies, and the thorough textual edit by Takeo David Hymans.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

See Tables 4, 5, 6, 7, 8, 9, and 10.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Linsi, L., Mügge, D. & Carillo-López, A. The delusive economy: how information and affect colour perceptions of national economic performance. Acta Polit 58, 651–694 (2023). https://doi.org/10.1057/s41269-022-00258-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41269-022-00258-3