Abstract

While many issue areas of global governance have witnessed the proliferation of evermore overlapping institutions, the topologies underlying regime complexes differ from strongly centralised, to rather decentralised institutional structures. This paper contributes to a better understanding of this phenomenon in two ways. First, it proposes a conceptualisation of institutional topologies that takes a social network perspective. Second, building on economic good theories, the paper complements the existing arguments about policy area competition claiming that they overlooked the important role of the (non-)excludability of institutional benefits. This policy specific variable shapes an institutional complex’s propensity for competition which, in turn, spurs the (de)centralisation of institutional complexes. Two structured comparisons provide empirical support for this argument: comparing the propensities for competition and network structures underlying the institutional complexes of TA and intellectual property protection, I show that despite their many similarities, fundamental differences regarding the excludability of institutional benefits co-vary with fundamentally different institutional configurations. I complement these findings with qualitative case studies of institutionalisation processes in both policy fields rendering further empirical support for the theory’s underlying causal claim.

Similar content being viewed by others

Notes

Crossing both dimensions, the economic literature differentiates between purely private goods, club goods, common pool resources and public goods. For more nuanced and detailed differentiations of different types of good see e.g. Kaul et al. (2003); Barrett (2007); Sandler (2004: 82); Cornes and Sandler (1996).

In particular powerful states have profound interests in institutions that provide public goods. Such institutions can stabilise the institutional order thereby fortifying their central position and reassuring themselves against potential revisionist behaviour by emerging powers (Gowa 1989; Nye 2002; Gilpin 2016: 364 f.).

I gathered state membership status from each organisation’s official institutional website and available up-to-date documents containing membership status information.

For the policy field of TA, I consulted the OCED dataset on Statutory Corporate Income Tax Rates to identify 17 states with the relatively lowest CIT rates and 19 states with the highest CIT rates for the year 2018 (OECD 2019a). For the policy field of IPRs, I consulted the WIPO dataset on total patent applications (direct and PCT national phase entries) identifying 33 states with the highest total number of patent applications as reported for the year 2017 (WIPO 2019).

For the issue area of TA, I consulted Rixen (2008, 2011), Brauner (2002) and Christians (2010) to identify the most important multilateral tax institutions. For the issue area of IPRs, I consulted Helfer (2004), (2009), Raustiala and Victor (2004) and Sell (2017) to identify the most relevant multilateral IPR institutions.

To ensure comparability of frequencies across institutions and policy fields, I performed weighting procedures. For each 5 years, the number of references within a specific set of institutional documents was weighted by the total number of documents.

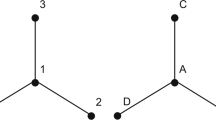

Dark shades indicate high betweenness centralities, light shades indicate low betweenness centralities. The measure of betweenness centrality captures the number of shortest paths passing through a respective node indicating how all other network institutions connect via this institution (Freeman 1977: 35).

Tables including all centralisation scores for both reference networks are available in this paper’s Appendix.

References

Abbott, K. W. and D. Snidal (2000) ‘Hard and soft law in international governance’, International Organization 54(3): 421–56.

Abbott, K. W. and D. Snidal (1998) ‘Why states act through formal international organizations’, Journal of Conflict Resolution 42(1): 3–32.

Adede, O. (2003) ‘Origins and History of the TRIPS Negotiations’, in Christophe Bellmann, Ricardo Melendez-Ortiz, eds, Trading in Knowledge: Development Perspectives on TRIPS, Trade and Sustainability, 23–35, London: Routledge.

Alter, K. J. and S. Meunier (2009) ‘The politics of international regime complexity’, Perspectives on Politics 7(1): 13–24.

Baistrocchi, E. A. (2013) ‘The International Tax Regime and the BRIC World: Elements for a Theory’, Oxford Journal of Legal Studies 33(4): 733–66.

Bernauer, T. (1995) ‘Theorie der Klub-Güter und Osterweiterung der NATO’ [‘Theory of club goods and eastward expansion of NATO’, translated by the author], Zeitschrift für Internationale Beziehungen 79–105.

Biermann, F., P. Pattberg, H. Van Asselt and F. Zelli (2009) ‘The fragmentation of global governance architectures: A framework for analysis’, Global Environmental Politics 9(4): 14–40.

Brauner, Y. (2002) ‘An international tax regime in crystallisation’, Tax L Rev 56: 259.

Buchanan, J. M. (1965) ‘An economic theory of clubs’, Economica 32(125): 1–14.

Busch, M. L. (2007) ‘Overlapping institutions, forum shopping, and dispute settlement in international trade’, International Organization 61(04): 735–61.

Carraro, C. and D. Siniscalco (1998) ‘International Institutions and Environmental Policy: International environmental agreements: Incentives and political economy’, European Economic Review 42(3–5): 561–72.

Christians, A. (2010) ‘Taxation in a Time of Crisis: Policy Leadership from the OECD to the G20’, Nw. JL and Soc. Poly 5: 19.

Copelovitch, M. S. and Putnam T. L. (2014) ‘Design in context: Existing international agreements and new cooperation’, International Organization 68(2): 471–93.

Cornes, R. and Sandler T. (1996) The theory of externalities, public goods, and club goods, Cambridge: Cambridge University Press.

Correa, C. M. (2000) Intellectual property rights, the WTO and developing countries: the TRIPS agreement and policy options, London: Zed Books.

Daßler, B., T. Heinkelmann-Wild and A. Kruck (2022) ‘Wann eskalieren westliche Mächte institutionelle Kontestation? Interne Kontrolle, externe Effekte und Modi der Kontestation internationaler Institutionen’ [‘When do Western powers escalate institutional contestation? Internal Control, External Effects and Modes of Contestation of International Institutions’, translated by the author], Zeitschrift für Internationale Beziehungen, forthcoming.

Daßler, B., Kruck A. and Zangl B. (2019) ‘Interactions between hard and soft power: The institutional adaptation of international intellectual property protection to global power shifts’, European Journal of International Relations 25(2): 588–612.

Dehejia, V. H. and Genschel P. (1999) ‘Tax competition in the European Union’, Politics and Society 27(3): 403–30.

Dosi, G. and Stiglitz J. E. (2014) ‘The role of intellectual property rights in the development process, with some lessons from developed countries: an introduction’ in Mario Cimoli, Giovanni Dosi, Keith E. Maskus, Ruth L. Okediji, Jerome H. Reichman, eds., Intellectual property rights: Legal and economic challenges for development, 1: 1–55, Oxford: Oxford Scholarship Online.

Drahos, P. (2002) ‘Developing Countries and International Intellectual Property Standard Setting’, The Journal of World Intellectual Property 5(5): 765–89.

Eden, L. and Kudrle R. T. (2005) ‘Tax havens: Renegade states in the international tax regime?’, Law and Policy 27(1): 100–27.

Finger, J. M., & Nogues, J. J. (2002) ‘The Unbalanced Uruguay Round Outcome: The New Areas in Future WTO Negotiations’, The World Economy 25(3), 321–40.

Fischbacher, U. and Gachter S. (2010) ‘Social preferences, beliefs, and the dynamics of free riding in public goods experiments’, American Economic Review 100(1): 541–56.

Freeman, L. C. (1977) ‘A set of measures of centrality based on betweenness’, Sociometry 40 (1): 35–41.

Gehring, T. and B. Faude (2014) ‘A theory of emerging order within institutional complexes: How competition among regulatory international institutions leads to institutional adaptation and division of labor’, The Review of International Organizations 9(4): 471-98.

Genschel, P. and T. Plumper (1997) ‘Regulatory competition and international cooperation’, Journal of European Public Policy 4(4): 626–42.

Gholiagha, S., Holzscheiter, A. and Liese, A. (2020) ‘Activating norm collisions: Interface conflicts in international drug control’, Global Constitutionalism 9(2): 290-317.

Gould, D. M. and W. C. Gruben (1996) ‘The role of intellectual property rights in economic growth’, Journal of Development Economics 48(2): 323–50.

Gowa, J. (1989) ‘Rational hegemons, excludable goods, and small groups: An epitaph for hegemonic stability theory?’, World Politics 41(3): 307–24.

Green, J. F. (2021) ‘Hierarchy in Regime Complexes: Understanding Authority in Antarctic Governance’, International Studies Quarterly, forthcoming.

Grinberg, I. (2016) ‘Does FATCA teach broader lessons about international tax multilateralism?’, Global Tax Governance: 157–75.

Gruber, L. (2001) ‘Power politics and the free trade bandwagon’, Comparative Political Studies 34(7): 703–41.

Hafner-Burton, E. M., M. Kahler and A. H. Montgomery (2009) ‘Network analysis for international relations’, International Organization: 559–592.

Haftel, Y., Z., and Lenz, T. (2021) ‘Measuring institutional overlap in global governance’, The Review of International Organizations:1-25.

Hakelberg, L. (2015) ‘The power politics of international tax cooperation: Luxembourg, Austria and the automatic exchange of information’, Journal of European Public Policy 22(3): 409–28.

Heinkelmann-Wild, T., A. Kruck and B. Daßler (2021) ‘A Crisis from Within: The Trump Administration and the Contestation of the Liberal International Order’ in Böller, F. and Werner, W., eds., Hegemonic Transition, 69-86, Cham: Palgrave Macmillan.

Helfer, L. R. (2004) ‘Regime shifting: the TRIPs agreement and new dynamics of international intellectual property lawmaking’, Yale Journal of International Law 29: 1–83.

Helfer, L. R. (2009) ‘Regime shifting in the international intellectual property system’, Perspectives on Politics 7(1): 39–44.

Henning, C. R. (2019) ‘Regime complexity and the institutions of crisis and development finance’, Development and Change 50(1): 24–45.

Hofmann, S. C. (2011) ‘Why institutional overlap matters: CSDP in the European security architecture’, Journal of Common Market Studies 49(1): 101-20.

Hofmann, S. C. (2019) ‘The politics of overlapping organizations: Hostage-taking, forum-shopping and brokering’, Journal of European Public Policy 26(6): 883-905.

Hooghe, L. and G. Marks (2015) ‘Delegation and pooling in international organizations’, The Review of International Organizations 10(3): 305–28.

Humphrey, C. (2014) ‘The politics of loan pricing in multilateral development banks’, Review of International Political Economy 21(3): 611–39.

Johnson, T. & Urpelainen, J. (2012) ‘A Strategic Theory of Regime Integration and Separation’, International Organization 66(4): 645-77.

Jupille, J. H., W. Mattli and D. Snidal (2013) Institutional Choice and Global Commerce, Cambridge: Cambridge University Press.

Keohane, R. O. and D. G. Victor (2011) ‘The regime complex for climate change’, Perspectives on Politics 9(1): 7–23.

Kölliker, A. (2001) ‘Bringing together or driving apart the union? Towards a theory of differentiated integration’, West European Politics 24(4): 125–51.

Koremenos, B., C. Lipson C and D. Snidal (2001) ‘The rational design of international institutions’, International Organization 55(4): 761–99.

Kreuder-Sonnen, C., & Zürn, M. (2020) ‘After fragmentation: Norm collisions, interface conflicts, and conflict management’, Global Constitutionalism 9(2): 241-67.

Kruck, A., T. Heinkelmann-Wild, B. Daßler, and R. Hobbach (2022) ‘Disentangling institutional contestation by established powers: Types of contestation frames and varying opportunities for the re-legitimation of international institutions’, Global Constitutionalism: 1-25.

Kruck, A. and B. Zangl (2019) ‘Trading privileges for support: the strategic co-optation of emerging powers into international institutions’, International Theory 11(3): 318–43.

Kruger, M. (2001) ‘Harmonizing TRIPS and the CBD: A Proposal from India’, Minnesota Journal of International Law 10: 169 – 207.

Lake, D. A. (2009) ‘Relational authority and legitimacy in international relations’, American Behavioral Scientist 53(3): 331–53.

Lesage, D. and T. Van de Graaf, (eds). (2015) Rising powers and multilateral institutions, New York: Springer.

Li, J. (2016) ‘China and BEPS: From Norm-Taker to Norm-Shaker’, Bulletin for International Taxation 69.

Lipscy, P. Y. (2015) ‘Explaining institutional change: Policy areas, outside options, and the Bretton Woods institutions’, American Journal of Political Science 59(2): 341–56.

Lipscy, P. Y. (2017) Renegotiating the World Order: Institutional Change in International Relations, Cambridge: Cambridge University Press.

Mansfield, E. (1995) ‘Intellectual property protection, direct investment, and technology transfer: Germany, Japan, and the United States’, available at https://elibrary.worldbank.org/doi/abs/ (accessed 12 June 2019).

Mattli, W. (1999) The logic of regional integration: Europe and beyond, Cambridge: Cambridge University Press.

Morin, J. F. (2009) ‘Multilateralizing TRIPs‐Plus Agreements: Is the US Strategy a Failure?’, The Journal of World Intellectual Property 12(3): 175-97.

Murphy, S. (2009) ‘Free trade in Agriculture: A bad idea whose time is done’ Monthly Review 61(3): 78.

Ndikumana, L. (2015) ‘International tax cooperation and implications of globalization. Global Governance and Rules for the Post-2015 Era: Addressing Emerging Issues in the Global Environment’, Bloomsbury Academic: 73–106.

OECD (1998) ‘Harmful Tax Competition. An Emerging Global Issue.‘ OECD Secretariat, Paris.

OECD (2013) ‘China Signing Ceremony of the Multilateral Convention on Mutual Administrative Assistance in Tax Matters’, Opening Remarks of the OECD Secretary-General, Mr. Angel Gurría, 27 August 2013. available at https://www.oecd.org/tax/exchange-of-tax-information/chinasigningceremonyofthemultilateralconventiononmutualadministrativeassistanceintaxmatters.htm (accessed 4 April 2019).

OECD (2018) ‘Active with the People’s Republic of China. OECD Brochure’, available at https://www.oecd.org/china/active-with-china.pdf (accessed 25 August 2019).

OECD (2019a) ‘Statutory Corporate Income Tax Rates 2000–2019a’, available at http://www.oecd.org/tax/tax-policy/tax-database/ (accessed 21 July 2019).

OECD (2019b) ‘What is BEPS?’, available at http://www.oecd.org/tax/beps/about/ (accessed 31 October 2019b).

Orsini, A, J. F. Morin and O. Young (2013) ‘Regime Complexes: A Buzz, A boom or a Boost for Global Governance?’, Global Governance 19(1): 27–39.

Oye, K. A. (1985) ‘Explaining cooperation under anarchy: Hypotheses and strategies’, World Politics 38(1): 1–24.

Patnaik, J. K. (1992) ‘India And The TRIPS: Some Notes On The Uruguay Round Negotiations’, India Quarterly 48(4): 31–42.

Pratt, T. (2018) ‘Deference and hierarchy in international regime complexes’, International Organization 72(3): 561–90.

Raustiala, K. and D.G. Victor (2004) ‘The regime complex for plant genetic resources’, International Organization 58(2): 277–309.

Rixen, T. (2008) The political economy of international tax governance, New York: Springer.

Rixen, T. (2011) ‘From double TA to tax competition: Explaining the institutional trajectory of international tax governance’, Review of International Political Economy 18(2): 197–227.

Runge, C. F. (1984) ‘Institutions and the free-rider: The assurance problem in collective action’, The Journal of Politics 46(1): 154 - 81.

Sandler, T. and J. Tschirhart (1997) ‘Club theory: Thirty years later’, Public Choice 93(3–4): 335–55.

Schwarzer, D. (2015) ‘Building the euro area’s debt crisis management capacity with the IMF’, Review of International Political Economy 22(3): 599-625.

Seelkopf, L., Lierse, H., & Schmitt, C. (2016) ‘Trade liberalization and the global expansion of modern taxes’, Review of International Political Economy 23(2): 208-31.

Sell S K (2017) ‘The politics of international intellectual property law’, in Sandholtz W and Whytock CA eds., Research Handbook on the Politics of International Law 307–35, Cheltenham: Edward Elgar Publishing.

Sending, O. J. (2017) ‘Recognition and liquid authority’, International Theory 9(2): 311–28.

Shaviro, D. (2001) ‘Some Observations Concerning Multijurisdictional Tax Competition’, in Esty, D. C. and D. Geradin (eds)., Regulatory Competition and Economic Integration: Comparative Perspectives, Oxford: Oxford University Press.

Sharman, J. C. (2011) Havens in a Storm, Ithaca, NY: Cornell University Press.

Sherwood, R. M. (1990) Intellectual property and economic development. Oxfordshire: Routledge.

Slapin J. B. (2009) ‘Exit, Voice, and Cooperation: Bargaining Power in International Organizations and Federal Systems’, Journal of Theoretical Politics 21(2): 187–211.

Slemrod, J. and J.D. Wilson (2009) ‘Tax competition with parasitic tax-havens’, Journal of Public Economics 93(11–12): 1261–270.

Snidal, D. (1979) ‘Public goods, property rights, and political organizations’, International Studies Quarterly 23(4): 532–66.

Treier, S. and S. Jackman (2008) ‘Democracy as a latent variable’, American Journal of Political Science 52(1): 201–17.

Urpelainen, J. and T. van de Graaf (2015), ‘Your Place or Mine? Institutional Capture and the Creation of Overlapping International Institutions’, British Journal of Political Science 45(4): 199-827.

Weiner J. M., and H.J. Ault (1998) ‘The OECD’s report on harmful tax competition’, National Tax Journal: 601–608.

World Health Organization (WHO) (2001) ‘Revised drug strategy - Report by the Secretariat’, available at: http://apps.who.int/medicinedocs/documents/s16337e/s16337e.pdf (accessed 22 September 2019).

World Health Organization (WHO) (2003) ‘Intellectual property rights, innovation and public health’, Fifty-Sixth World Health Assembly, available at: http://apps.who.int/gb/archive/pdf_files/WHA56/ea56r27.pdf (accessed 22 September 2019).

World Intellectual Property Organization (WIPO) (2019) ‘WIPO IP Statistic Data Center 1980–2017’, available at: https://www3.wipo.int/ipstats/index.htm?tab=patent (accessed 27 July 2019).

Zürn, M., M. Binder and M. Ecker-Ehrhardt (2012) ‘International Authority and its Politicization’, International Theory 4(1): 69–106.

Acknowledgements

I wish to thank the editors of JIRD, the three anonymous reviewers, the participants of the final conference ‘Overlapping Spheres of Authority and Interface Conflicts in the Global Order’ 2021 at the WZB, the participants of the IR colloquium at LMU Munich, and the participants of the DVPW IR Young Professionals Conference in March 2020. I am particularly grateful to Bernhard Zangl, Laura Seelkopf, Eyal Benvenisti, Andreas Kruck, Felix Biermann, Tim Heinkelmann-Wild, Moritz Weiß, Berthold Rittberger and Sebastian Schindler for their valuable comments on previous versions of this paper. Last but not least I want to thank Nadia El Ghali for her excellent research assistance.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix

Centralities by institution for both policy fields

Coefficient of variation of weighted references and betweenness centralisation

Rights and permissions

About this article

Cite this article

Daßler, B. Good(s) for everyone? Policy area competition and institutional topologies in the regime complexes of tax avoidance and intellectual property. J Int Relat Dev 25, 993–1019 (2022). https://doi.org/10.1057/s41268-022-00267-x

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41268-022-00267-x