Abstract

Many institutional investors claim to be leaders in their commitment to sustainability, yet their real impact is undetermined. We look at the relationship between the presence of foreign institutional owners and the firm’s environmental outcomes in terms of performance and innovation. We argue that foreign institutional owners seek to mitigate their exposure to reputational risks by encouraging their investee firms to move towards better environmental performance. However, these owners are less likely to engage in long-term investments derived from environmental innovations. We examine these paradoxical motivations in the context of multinational enterprises (MNEs) in the chemical industry across 33 countries in emerging and developed markets and further explore how these investee firms’ international diversification affects these relationships. Our findings contribute to international corporate governance and sustainability research by uncovering that, contrary to institutional owners’ popular claims, foreign institutional owners have a positive effect on their investees’ environmental performance, but their influence is not statistically significant on environmental innovation. Specifically, the influence of foreign institutional owners on environmental performance is strong for MNEs with a low level of international diversification and marginal for those with a higher level of internationalization; meanwhile, domestic institutional owners are committed to advancing both environmental performance and innovation in their MNE investees. In sum, we show that environmental concerns are still quite localized.

Résumé

De nombreux investisseurs institutionnels prétendent être des leaders dans leur engagement en faveur de la durabilité, mais leur impact réel reste indéterminé. Nous étudions la relation entre la présence de propriétaires institutionnels étrangers et les résultats environnementaux de l'entreprise en matière de performance et d'innovation. Nous argumentons que les propriétaires institutionnels étrangers cherchent à atténuer leur exposition aux risques de réputation en encourageant les entreprises dans lesquelles ils investissent à évoluer vers de meilleures performances environnementales. Néanmoins, ces propriétaires sont moins susceptibles de s'engager dans des investissements à long terme dérivés d'innovations environnementales. Nous examinons ces motivations paradoxales dans le contexte des entreprises multinationales (Multinational Enterprises -MNEs) de l'industrie chimique dans 33 pays marchés émergents et développés, et étudions également comment ces relations sont influencées par la diversification internationale des entreprises bénéficiaires d'investissements. Nos résultats contribuent à la recherche en gouvernance d'entreprise internationale et durabilité en révélant que, contrairement aux affirmations populaires des propriétaires institutionnels, les propriétaires institutionnels étrangers exercent un impact positif sur la performance environnementale des entreprises dans lesquelles ils investissent, mais leur impact sur l'innovation environnementale n'est pas statistiquement significatif. Plus spécifiquement, l'influence des propriétaires institutionnels étrangers sur la performance environnementale est forte pour les MNEs ayant un faible degré de diversification internationale et marginale pour celles ayant un degré d'internationalisation plus élevé ; en revanche, les propriétaires institutionnels domestiques s'engagent à faire progresser à la fois la performance et l'innovation environnementales dans les MNEs bénéficiaires de leurs investissements. En résumé, nous démontrons que les préoccupations environnementales sont encore très localisées.

Resumen

Muchos inversionistas institucionales aseguran ser líderes en su compromiso con la sostenibilidad, pero su impacto real es indeterminado. En este trabajo se mira la relación entre la presencia de dueños institucionales extranjeros y los resultados ambientales de la empresa en términos de desempeño e innovación. Sostenemos que los dueños institucionales extranjeros tratan de mitigar su exposición a los riesgos de reputación instando a las empresas en las que invierten a avanzar hacia un mejor desempeño ambiental. Sin embargo, es menos probable que estos dueños realicen inversiones a largo plazo derivadas de las innovaciones ambientales. Examinamos estas motivaciones paradójicas en el contexto de las empresas multinacionales (EMN) de la industria química en 33 países de mercados emergentes y desarrollados, y además exploramos cómo la diversificación internacional de estas empresas afecta a estas relaciones. Nuestros hallazgos contribuyen a la investigación sobre la gobernanza corporativa internacional y la sostenibilidad al desvelar que, en contradicción con las afirmaciones populares de los dueños institucionales, los dueños institucionales extranjeros tienen un efecto positivo en los resultados ambientales de las empresas en las que invierten, pero su influencia no es estadísticamente significativa en la innovación ambiental. Específicamente, la influencia de los dueños institucionales extranjeros sobre los resultados ambientales es fuerte para las EMN con un bajo nivel de diversificación internacional y marginal para las que tienen un mayor nivel de internacionalización; por su parte, los dueños institucionales nacionales se comprometen a promover tanto los resultados ambientales como la innovación en las empresas en que tienen inversiones. En resumen, demostramos que la preocupación por el medio ambiente sigue estando bastante localizada.

Resumo

Diversos investidores institucionais afirmam ser líderes em seu compromisso com a sustentabilidade, mas seu impacto real é indeterminado. Analisamos a relação entre a presença de proprietários institucionais estrangeiros e os resultados ambientais da empresa em termos de desempenho e inovação. Argumentamos que proprietários institucionais estrangeiros procuram diminuir sua exposição a riscos de reputação ao incentivar suas empresas investidas rumo a um melhor desempenho ambiental. No entanto, esses proprietários são menos propensos a se envolver em investimentos de longo prazo derivados de inovações ambientais. Examinamos essas motivações paradoxais no contexto de empresas multinacionais (MNEs) na indústria química em 33 países de mercados emergentes e desenvolvidos, e exploramos ainda mais como a diversificação internacional dessas empresas investidas afeta tais relacionamentos. Nossos achados contribuem para governança corporativa internacional e a pesquisa em sustentabilidade ao descobrir que, ao contrário das alegações comuns de proprietários institucionais, proprietários institucionais estrangeiros têm um efeito positivo no desempenho ambiental de suas investidas, mas sua influência não é estatisticamente significativa na inovação ambiental. Especificamente, a influência de proprietários institucionais estrangeiros no desempenho ambiental é forte para MNEs com baixo nível de diversificação internacional e marginal para aquelas com maior nível de internacionalização; enquanto isso, os proprietários institucionais domésticos estão comprometidos em promover o desempenho ambiental e a inovação em suas MNEs investidas. Em suma, mostramos que preocupações ambientais ainda são bem localizadas.

摘要

许多机构投资者声称在他们的可持续发展承诺方面处于领导者地位, 但他们的实际影响尚未确定。我们研究了外国机构所有者的存在与公司在绩效和创新方面的环境成果之间的关系。我们认为, 外国机构所有者试图通过鼓励其被投资公司向更好的环境绩效迈进, 从而减轻他们面临的声誉风险。然而, 这些所有者不太可能从事源自环境创新的长期投资。我们在新兴和发达市场的 33 个国家的化工行业跨国企业 (MNE) 的情境下研究了这些矛盾动机, 并进一步探讨了这些被投资公司的国际多元化是如何影响这些关系的。我们的发现有助于国际公司治理和可持续性研究, 因为与机构所有者的流行说法相反, 外国机构所有者对其被投资方的环境绩效产生积极影响, 但它们对环境创新的影响在统计上并不显著。具体而言, 对于国际多元化程度低的跨国公司, 外国机构所有者对环境绩效的影响力较强, 而对国际化程度较高的跨国公司而言, 其影响是微不足道的;与此同时, 国内机构所有者致力于在其跨国企业投资对象中提升环境绩效和创新。总之, 我们表明环境问题仍然相当本地化。

Similar content being viewed by others

Avoid common mistakes on your manuscript.

From Europe to Australia, South America to China, Florida to Oregon, investors are asking how they should modify their portfolios. (…). Given the groundwork we have already laid engaging on disclosure, and the growing investment risks surrounding sustainability, we will be increasingly disposed to vote against management and board directors when companies are not making sufficient progress on sustainability-related disclosures and the business practices and plans underlying them. – Larry Fink, CEO and Chairman of BlackRock,1 2020

INTRODUCTION

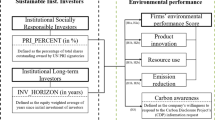

Institutional owners, also called institutional investors, hold the majority of firm equity across the globe and this share has been growing in the last decade (De La Cruz, Medina, & Tang, 2019; OECD, 2021). A recent OECD report finds that almost 70% of institutional owners state that they consider environmental aspects in their decision-making, and more are planning to do so (OECD, 2020). However, while institutional investors have issued multiple public statements about their firms’ environmental concerns, many analysts and executives consider that these initiatives are mere public relations campaigns with very limited bearing on their investees’ environmental strategies (Fancy, 2021; The Economist, 2021a). Business globalization and the climate emergency make understanding these investments’ environmental impact critical. Hence, we seek to unpack and analyze the relationship between foreign institutional owners (FIOs) and the two most relevant environmental outcomes of investee firms: short-term-oriented environmental performance and long-term-oriented environmental innovation. Moreover, we explore the effect of the firms’ degree of internationalization on these relationships.

Institutional owners seek to obtain value for their customers (Shi, Gao, & Aguilera, 2021), however there are differences between the strategic approaches of foreign and domestic institutional owners when it comes to accessing and interpreting information about investee firms because foreign investors typically experience higher information asymmetries: less familiarity with local values, economic environments, and regulatory evolution (Kim, Pevzner, & Xin, 2019; Shi et al., 2021). Consequently, FIOs take on increased costs to limit risks from their investments’ information asymmetries, including due diligence in monitoring executives to ensure they focus more on performance and less on opportunistic behavior (Boyd & Solarino, 2016). In addition, FIOs are highly sensitive to poor performance signals and react quickly to protect their investments, including an immediate willingness to exit the organization to avoid risks (David, O'Brien, Yoshikawa, & Delios, 2010). In this study, we analyze whether FIOs’ participation in an MNE is associated with distinct patterns of environmental performance and environmental innovation.

Environmental performance (EP) and environmental innovation (EI) entail two core dimensions of a firm’s environmental approach. On the one hand, a firm’s EP considers the organizational effectiveness in limiting the firm’s negative impacts on the planet, deriving mostly from air emissions, waste generation, and water discharges (e.g., El Ghoul, Guedhami, & Kim, 2017; Kassinis & Vafeas, 2006). On the other hand, a firm’s EI entails the funding, development, and implementation of “new designs and novel products and processes to reduce or eliminate the use and generation of hazardous substances” (Berrone, Fosfuri, Gelabert, & Gomez‐Mejia, 2013: 891). While an ambitious firm’s EI strategy usually reflects a long-term commitment that might influence employees and business partners along the firm’s global supply chain, a firm’s EP is related to the firm’s current impacts through its production and processes (Delmas & Toffel, 2008).

Risks arising from a poor EP include operational and reputational costs, such as legal fees, fines, and the inability to satisfy key stakeholders (Diestre & Rajagopalan, 2014; Eesley & Lenox, 2006); however, supporting EI to prevent future environmental damages may also call for additional, substantial internal and external commitments (Hawn & Ioannou, 2016) and financial risks (DesJardine, Marti, & Durand, 2021; The Economist, 2021b). In general, improvements to a firm’s EP may be achieved with limited investments in market initiatives, such as the acquisition of commercial end-of-pipe technologies or the outsourcing of polluting activities. Meanwhile, EIs usually require long-term-oriented investments and multiple internal and external commitments to prevent the sources of pollution (Bansal & Song, 2017; Hawn & Ioannou, 2016). Thus, given FIOs’ well-known aversion to risk (Kim et al., 2019), we argue that a higher presence of FIOs is positively associated with the investee firms’ EP in order to mitigate short-term legal and reputational risks but hinders EI strategies that require longer-term, riskier financial commitments and favorable local conditions.

Furthermore, MNEs have operations and stakeholders located across multiple countries (Marano & Kostova, 2016) and deal with unexpected cultural and normative environmental changes (Okhmatovskiy & Shin, 2019). In this context, demands made on more internationalized investees by certain groups, such as environmental activists and community advocates, may also be deemed more aggressive due to the added visibility (Eesley & Lenox, 2006). One of the consequences of this internationalization is that MNE executives gain discretion, incentives, and opportunities to prioritize environmental concerns (Maksimov, Wang, & Yan, 2022). Thus, we will examine how the MNEs’ degree of internationalization moderates the relationship between the presence of FIOs and the MNEs’ environmental outputs.

Our predictions are tested on an unbalanced panel dataset of 1200 firm-year observations from 197 MNEs in the chemical manufacturing sector for the period 2010–19. Our study makes two central contributions to the growing literature on the relationship between FIOs and MNE strategies (e.g., Aguilera, Marano, & Haxhi, 2019; Marano & Kostova, 2016; Shi et al., 2021). First, we shed light on the debate on how foreign owners impact firms’ environmental strategies (DesJardine & Durand, 2020; Dyck, Lins, Roth, & Wagner, 2019; Flammer, Toffel, & Viswanathan, 2021) by showing that FIOs demand enhanced EP, but not necessarily EI, from their investee firms. Second, we respond to calls for further research looking at the institutional challenges of international corporate governance mechanisms (Aguilera et al., 2019; Aragon-Correa, Marcus, & Vogel, 2020; Castañer, Goranova, Kavadis, & Zattoni, 2020) by discussing how low levels of investee firms’ international diversification reinforce FIOs’ positive influence on EP, while high levels of investee internationalization reduce the relevance of foreign institutional ownership on advanced EP. These results contrast with our complementary findings regarding the positive relationship between domestic institutional owners (DIOs) and EP (for any level of international diversification) and the positive relationship between DIOs and their investees’ EI (especially for highly internationally diversified firms). Our results are highly consequential for the design of MNEs’ global environmental strategies.

FOREIGN INSTITUTIONAL OWNERSHIP AND ENVIRONMENTAL OUTCOMES

The relationship between institutional ownership and firms’ environmental sustainability has received a growing amount of attention in recent years (e.g., see Gillan, Koch, & Starks, 2021). While other investors may find it difficult to impact the way in which their investees conduct business, institutional owners’ volume and legitimation allow them to not only react to MNEs’ strategies but also potentially influence their investees’ environmental initiatives (Nofsinger, Sulaeman, & Varma, 2019). Specifically, institutional investors usually share a preference for investing in “lower-risk and better-governed foreign markets with more informative disclosure and less opaque accounting practices” (Kim et al., 2019: 87). The recent and growing attention being paid to the influence of institutional owners on their investees’ environmental strategies has revealed some mixed evidence. Flammer et al. (2021) find that institutional investors’ proposals were highly effective in increasing the voluntary disclosure of climate change risk. However, others show that institutional investors only support social and environmental actions that yield short-term returns (Desender & Epure, 2021).

Recent literature uncovers how different types of institutional investors can have different objectives which will affect a variety of firms’ strategic outcomes (Boyd & Solarino, 2016). In this line, FIOs face higher levels of information asymmetry than domestic ones due to limited familiarity with local institutional requirements, such as cultural implications, regulatory evolution, or disclosure expectations (e.g., Aguilera, Desender, Lamy, & Lee, 2017; Kim et al., 2019; Okhmatovskiy & Shin, 2019). Bena, Ferreira, Matos and Pires (2017) are an exception to the popular view that foreign investors lead firms to adopt a short-term orientation and find a positive relationship with investees’ long-term investments in a sample of publicly listed firms. From a positive agency perspective (Eisenhardt, 1989), FIOs’ concern with the heightened risks linked to the ad hoc information asymmetries in their investments may have at least three consequences in relation to environmental strategies. First, the effects of increased information asymmetries lead to an amplified aversion to risks and reinforce FIOs’ interest in short-term profits versus long-term value (e.g., David, Yoshikawa, Chari, & Rasheed, 2006; Geng, Yoshikawa, & Colpan, 2016). Second, FIOs also place more emphasis on agency monitoring to reduce their information asymmetries (Aguilera et al, 2017; Kim et al., 2019). Recent evidence has shown that activist institutional investors influence voluntary environmental disclosure in firms (Flammer et al., 2021). Third, FIOs are highly sensitive to poor performance signals and react quickly to protect their investments, including an immediate willingness to exit the organization to avoid risks. In fact, FIOs trade shares more frequently (e.g., David et al., 2010), and firms with a higher proportion of FIOs react more strongly to negative media reports by replacing executive and board members (Okhmatovskiy & Shin, 2019). For example, BlackRock – the largest private equity firm in the world with a broad portfolio of assets under management in multiple countries – has attracted considerable attention by announcing its intentions to hold management and board directors accountable if their firms are not making progress in sustainability (see quote in our intro). Similar to BlackRock, Norges Bank Investment Management highlights in its document “Climate Change Expectations of Companies” how they expect their investees to address the climate emergency in a manner meaningful to their business models (Norges Bank Investment Management, 2021). As a consequence, executives need to pay closer attention to FIOs’ interests due to the intensity and credibility of their reactions to any perceived risk (Okhmatovskiy & Shin, 2019). Based on these characteristics, in the following sections, we develop arguments on how FIOs may have different interests on MNEs’ EP and EI.

Foreign Institutional Owners and Environmental Performance

FIOs are not usually involved in the day-to-day management of their investee firms, however their influence is relevant because they have been shown to quickly withhold their investments in response to different types of trust‐damaging information (Okhmatovskiy & Shin, 2019). For instance, Nordea Asset Management removed JBS from its €230 billion portfolio after the Brazilian company was linked to deforestation in the Amazon rainforest (Philips, 2020). Environmental risks for investors include any harmful environmental damage caused or penalties accrued by the firm that can generate a rapid negative impact on the firm’s reputation, financial performance, or stock price (Diestre & Rajagopalan, 2014). For example, Flammer (2013) studied news coverage of U.S. public companies over a period of two decades and found that environmentally responsible initiatives led to stock price increases, and environmentally irresponsible actions were followed by stock price decreases. Interestingly, over the last decades, the positive stock market reaction to environmentally friendly actions has generally declined while the negative stock market reaction to environmentally harmful events has been magnified (Durand, Paugam, et al., 2019; Flammer, 2013; Hawn, Chatterji, & Mitchell, 2018). Information asymmetries from investing abroad will particularly encourage FIOs to limit their reputational and legal environmental risks by influencing their investees to improve their environmental performance (EP). Although objective economic data may be available for any professional institutional investor, information about normative and cultural values, regulatory changes, or unexpected political developments may be more difficult to access and interpret from abroad (e.g., Aguilera et al., 2017; Kim et al., 2019; Shi et al., 2021). Consequently, FIOs may be particularly keen on highly visible environmental outputs and the related short-term initiatives to react to the demands of stakeholders, such as end-of-pipe filters, recycling initiatives, outsourcing pollution, or green certifications (Desender & Epure, 2021; Nofsinger et al., 2019). Hence, as FIOs are highly sensitive to reputational harm signals, they will try to reduce their information asymmetries by demanding that the MNEs in which they invest reinforce their EP, because failure to do so can quickly lead to negative repercussions on firm reputation and subsequent fall in share prices. Thus, we propose:

Hypothesis 1:

The percentage of an MNE’s shares held by FIOs is positively related to its EP.

Foreign Institutional Owners and Environmental Innovation

Due to FIOs’ traditional emphasis on short-term returns (e.g., David et al., 2010; Geng et al., 2016), it is reasonable to assume that MNEs with high percentages of FIO will be less interested in devoting their investments to long-term sources of potential benefits, such as improving their environmental innovation (EI) strategies. For example, the former Chief Investment Officer for sustainable investing at BlackRock has strongly criticized the recent proliferation of declarations by institutional investors of environmental intentions by stating that “it’s cheaper and easier to market yourself as green rather than do the long tail work of actually improving your sustainability profile” (Fancy, 2021: 1). This criticism highlights the difference between looking to avoid reputational and legal risks (as discussed in the previous section) and promoting EIs that are relevant for future sustainability but financially risky.

EI is based on investments that enable technical, commercial, or administrative changes to prevent polluting impacts and may be a source of competitive advantage in the long term (e.g., Bansal & Roth, 2000; Berrone et al., 2013). EIs demands both internal and external commitments (Diestre & Rajagopalan, 2014; Hawn & Ioannou, 2016) and may generate negative reactions from short-term-oriented institutional investors because they are also a source of immediate financial concern for them (DesJardine et al., 2021). Furthermore, while the reputational and legal costs of poor EP are immediate and certain, the consequences of limited EI strategies are uncertain and depend on the evolution of legal, commercial, and technical factors (Barnett & Salomon, 2012). Hence, FIOs’ short-term financial preferences are inconsistent with MNEs’ efforts to prevent future environmental risks by investing in uncertain EI. The reasons for FIOs’ skepticism about long-term EIs may include their relevant financial costs and the multiple external factors affecting the returns from these investments.

FIOs’ heightened effort to minimize the information asymmetries of their investments (Kim et al., 2019; Shi et al., 2021) further increases their interest in reducing the exposure to investments in EI. In fact, MNEs may gain more legitimation benefits from providing standardized information about their environmental impacts (i.e., environmental disclosure) than they do from realizing potential rewards from EIs that are highly dependent on local normative, political, and cultural conditions (Aragón-Correa, Marcus, & Hurtado-Torres, 2016). FIOs’ limited interest in long-term commitments and their focus on managerial monitoring (Kim et al., 2019) influences boards and CEOs’ on where they invest as regards to investments in EIs. For instance, the shareholders (via the board of directors) of Danone, one of the largest multinational food products companies, have recently fired its CEO, Emmanuel Faber, who had long championed the benefits of sustainability, because they were unhappy with the MNE’s languishing share price (Financial Times, 2021). Interestingly, almost 80% of Danone’s shares are held by institutional investors and 81% of those are international. Consistent with this example, Geng et al. (2016) show that in general, foreign owners place incentives and pressure on firms’ management to prioritize actions that increase stock prices and profitability.

Thus, managers in MNEs with a high proportion of FIOs may hold back from long-term strategic investments and direct their efforts towards meeting short-term performance goals to retain these owners (David et al., 2006), and executives have strong incentives to align their firms’ priorities with key investors (Geng et al., 2016). Hence, we expect FIOs are not attracted to, and discourage investee firms from engaging in, EI initiatives due to their longer-term investment horizons and the risky, uncertain outcomes. Consequently, we propose:

Hypothesis 2:

The percentage of an MNE’s shares held by FIOs is negatively related to its EI.

The Moderating Role of International Diversification

A firm’s international diversification defines its global supply chain, that is, the degree to which the firm expands its customer base, factors of production, and the capacity to create value across regional and national borders (Hitt, Hoskisson, & Kim, 1997; Lu & Beamish, 2004). A higher level of internationalization increases the multiple institutional logics that a firm must tackle with in the social and environmental arena (Kang, 2013; Marano & Kostova, 2016). Institutions determine the acceptable and approved way of conducting business functions in a particular society, not only in terms of regulations, but also the cultural, cognitive, and normative elements (Powell & DiMaggio, 1991; Scott, 1995).

When operating in complex international settings, executives might need additional capabilities and frequently wider managerial discretion to make decisions. In fact, previous findings have confirmed that international diversification strengthens managerial entrenchment because institutional complexity relies heavily on executives’ idiosyncratic capabilities and experience to deal with changing and potentially conflictive situations (Kim, Pathak, & Werner, 2015). When it comes to environmental approaches, highly internationally diversified MNEs also tend to be highly idiosyncratic adjusting to the complex and often conflicting country expectations, i.e., multiple regulatory and normative pressures generate risks of incompatible expectations (Kang, 2013; Marano & Kostova, 2016). An advanced and forward-looking firm-level standard of environmental performance offers reinforced legitimation to deal with the risks of multiple and changing levels of international stringency (Christmann, 2004). Hence, internationally diversified MNEs tend to strengthen their firms’ environmental performance to mitigate future reputational and legal environmental risks which are exacerbated by the multi country institutional complexity (Christmann, 2004; Wang & Li, 2019).

Under conditions of high international diversification, FIOs’ monitoring of environmental risks has a more limited influence on their investees’ environmental performance because the implicit international pressure towards environmental issues is already driving MNEs’ attention towards environmental performance. Consequently, we propose:

Hypothesis 3a:

A higher level of international diversification of an MNE weakens the positive relationship between FIOs and EP.

Regarding environmental innovation (EI), MNEs with greater global connectedness in terms of international diversification enjoy extra resources to increase their EI with a more limited risk than firms operating in domestic environments. On the one hand, a higher level of international diversification offers more diverse resources and information sources (Wan, Hoskisson, Short, & Yiu, 2011) and has a positive effect on innovation intensity and, indirectly, on productivity (Castellani, Montresor, Schubert, & Vezzani, 2017). For example, MNEs can obtain knowledge from around the world allowing for the development of more dynamic innovative green capabilities (Maksimov et al., 2022).

On the other hand, operating in more countries creates opportunities for achieving economies of scale and scope and may drive down the costs of investment in critical long-term innovative activities (Hitt, Li, & Xu, 2016). Additionally, at higher levels of international diversification, MNEs often gain greater visibility in stakeholders’ eyes, which in turn brings corporate attention to external expectations (Eesley & Lenox, 2006). In fact, environmental demands made on MNEs by certain stakeholders, such as activists and community advocates, can be more strategic and effective because they can converge their actions on a single target and, through the process of contagion, reach and affect other organizations associated with that said target (Daudigeos, Roulet, & Valiorgue, 2020; Eesley & Lenox, 2006). Hence, an MNE’s reinforced effort in environmental innovation may alleviate some of the executives’ concerns about being targeted by stakeholders in unfamiliar contexts and, indirectly, it also opens the FIOs’ acceptance of the investment risks of being environmentally innovative.

In conclusion, internationally diversified MNEs will have more opportunities to implement environmental innovations because they enjoy greater knowledge inputs and there are fewer risks involved in acting on them. Due to more limited risks and reinforced short-term reputational rewards, FIOs will also increase their willingness to accept that their investees in a context of high international diversification will increase their EIs versus those investees operating with low levels of international diversification. Hence, we expect that a high level of international diversification will reduce the negative effect of FIOs on firms’ EI strategies. Thus, our hypothesis is:

Hypothesis 3b:

A higher level of international diversification of an MNE weakens the negative relationship between FIOs and EI.

METHODS

Sample and Data

We test our hypotheses on an unbalanced panel dataset of chemical sector MNEs between 2010 and 2019. We chose the chemical manufacturing sector as the context for our study because of its vast impact on the environment and human health. The chemical industry is the second largest manufacturing industry in the world, amounting to over US$ 4 trillion in revenue (International Council of Chemical Associations, 2019). The industry’s production processes generate considerable amounts of greenhouse gas emissions, waste and chemical releases to air, water, and soil (United Nations Environment Programme, 2019); for instance, it is responsible for 18.6% of the particulate matter (PM10) in the air (European Environment Agency, 2019). The chemical industry is also becoming more global and reliant on complex global supply chains (U.N. Environment Programme, 2019).

We selected all firms belonging to the chemical manufacturing sector, NAICS code 325, as available in the Refinitiv Eikon database, which includes information on the largest firms in the world for each industry. The initial sample size was 3785 firms. Because of our interest in analyzing firms with international operations (MNEs), we collected data using Bureau van Dijk’s Orbis database on the subsidiaries of the firms in our sample and included only those firms that were parent companies of at least one foreign subsidiary. We collected information for each year and sampled MNE from 2010 to 2019. In addition, we collected country-level control variables from the World Economic Forum and the World Bank. Due to the lack of availability of key data points for some firms, our final sample consisted of 197 chemical MNEs headquartered in 33 countries. This led to an unbalanced dataset of 1200 firm-year observations.

To address the issue of sample selection bias, we performed tests to compare our final sample to the original population in terms of average firm size, average profitability, and the distribution of firms across countries and regions. We did not find any statistically significant differences for average profitability or regional profile. The average firm size in our sample was somewhat higher than that of the full population of chemical firms as a consequence of larger firms being more likely to report on their environmental actions. Our sampled MNEs account for 61% of the industry’s total revenues and 65% of its total market capitalization, which means that our findings regarding the environmental approaches of MNEs in the chemical sector capture well the strategies in the industry. We provide additional details about our sample in the Online Appendix.

Measures

Dependent variables

Similar to recent studies on MNEs’ environmental strategies (e.g., Maksimov et al., 2022), we obtained data for the dependent environmental variables from the Refinitiv Eikon ESG database. We chose two dimensions of firms’ environmental approaches for our study: EP and EI – the relatively low correlation (0.315) indicates that they capture distinctive internal strategic initiatives.

Environmental performance (EP) was measured using four items of the Refinitiv Eikon ESG Emissions Reduction Score (Refinitiv, 2020: 22). Our selection sought to avoid the extensive use of metrics that do not explicitly capture EP (e.g., the Emissions Reduction Score includes nine items regarding the disclosure of various initiatives) and to ensure comparability across MNEs of different sizes.2 Thus, the four items included are: the amount of CO2 emissions as a percentage of revenue, the amount of total waste as a percentage of revenue, the existence of emission reduction policies and the existence of emission targets (see the Online Appendix for a detailed description of items). The two continuous variables were transformed to a scale from 0.00 to 1.00 and then reverse scored by deducting each value from 1 so that higher values reflect lower emission and waste ratios; we also calculated the natural logarithm before transforming the values. At the same time, the two binary items were coded 0 (false) or 1 (true). The four values were then aggregated and divided by the number of items (4). Thus, the values of our index range from 0.00 to 1.00, with a higher score of EP indicating more effectiveness toward reducing the MNE’s (negative) environmental impacts.

We built an index measure for environmental innovation (EI) using six items of the Refinitiv Eikon ESG Environmental Innovation Score (Refinitiv, 2020: 22). Our selection of items uses two key selection criteria: relevance as a measure of EI and availability of data for the sample firms. Our index includes the existence of initiatives to reduce the potential risks of products entering the environment and policies regarding the environmentally responsible use of products (see the Online Appendix for more details about the selected six items). Each item was first coded 0 (false) or 1 (true) and the aggregate value for each firm was then divided by the total number of items (6) to arrive at a new variable with values ranging from 0.00 to 1.00. A high score on EI means that an MNE is more active than its peers in developing and implementing new environmental technologies, processes, and products.

Independent variables

Our independent variable, foreign institutional owners (FIOs), reflects the percentage of an MNE’s shares held by non-domestic institutional investors. In the same way, domestic institutional owners (DIOs) reflects the percentage of shares held by institutional investors located in the MNE’s home country. To calculate the percentages, we collected detailed shareholder portfolios from the Refinitiv Eikon database for each sampled firm at each calendar year-end date from 2010 to 2019. For our classification of institutional investors, we excluded those shareholders that were regarded as strategic investors by Refinitiv Eikon, i.e., corporations, holding companies, government agencies, and individuals. We then followed Aguilera et al. (2017) and, for each firm and year, we computed the percentage of total outstanding shares that were held by institutional investors domiciled in a country that is different from (FIOs) or equal to (DIOs) the country in which the MNE is headquartered. The average percentage of total shares held by FIOs was 35.58%.

Moderating variable

We measured international diversification using an entropy measure that considers both the extent and geographic distribution of MNEs’ international presence based on the number of subsidiaries each firm has in foreign countries (see Hitt et al., 1997; Hitt, Tihanyi, Miller, & Connelly, 2006). For more details, please see the Appendix.

Control variables

We included multiple control variables to account for firm-level and country-level characteristics that have a potential influence on a firm’s environmental strategies (Berrone et al., 2013; Duanmu, Bu, & Pittman, 2018; Lin, Moon, & Yin, 2014). At the firm level, we used five control variables. First, firm size was measured by computing the natural logarithm of total annual sales. Second, firm profitability was measured with return on assets (ROA). Third, because of the potential influence of resource availability on firms’ opportunities to develop advanced environmental approaches, we controlled for organizational slack, calculated by dividing a firm’s total current assets with its total current liabilities. Fourth, considering that MNEs may follow different internationalization paths, we controlled for the effect that firms’ focus on developed countries (developed country focus) has on their environmental approaches. This was measured as the percentage of foreign subsidiaries located in developed countries divided by the total number of foreign subsidiaries. Fifth, in an effort to take into account corporate governance, we included a control variable for board tenure, indicating the average number of years that directors have served.

Furthermore, we included three country-level control variables to account for the impact that larger, better governed or more innovative home countries might have on our findings. We used two pillars from the World Economic Forum’s Global Competitiveness Report: Pillar 10 for market size and Pillar 12 for innovation capability and an item from the World Bank’s Worldwide Governance Indicators, rule of law (The World Bank, 2021).

RESULTS

Table 1 presents the descriptive statistics for the sampled MNEs. Given that our dependent and independent variables are continuous, and our data is longitudinal in nature, we opted for generalized least squares (GLS) regressions. In order to identify potential omitted-variable bias in our data, we designed sequential models in which each regression adds variables to the previous one (Nichols, 2007). Based on the result of the Hausman test (Hausman, 1978), we used fixed-effects estimators in all our statistical models. As fixed-effects estimators do not exploit cross-sectional differences across groups (in our case, firms), they allow us to control for any time-invariant omitted variables. In addition, we employed robust standard errors clustered at the firm-level, which can be considered “de rigeur in panel models to allow for errors that may be correlated within group and not identically distributed across groups” (Nichols, 2007: 514). In this way, we also controlled for heteroscedasticity and autocorrelation (Cameron & Miller, 2015).

Tables 2 and 3 present our results. Models 1 and 6 show the effects of all control variables on the two dependent variables – EP and EI. In Models 2 and 7, we included FIOs and DIOs into the regression models with control variables and the two dependent variables. In Model 2, we uncover a positive significant effect (b = 0.282, p = 0.027) of FIOs on EP as predicted in Hypothesis 1, while in Model 7 we did not find a significant influence of FIOs on EI (b = 0.086, p = 0.394), hence we could not support Hypothesis 2.

Although our hypotheses focus on the effects of FIOs, we also explored the overall effect of institutional investors by including DIOs as a separate variable in our models, to unpack the relative relevance of FIOs in our findings. Model 2 shows a positive significant effect (b = 0.309, p = 0.030) of DIOs on EP and Model 7 shows a positive significant effect (b = 0.273, p = 0.003) of DIOs on EI. These results confirm the distinct role of foreign and domestic institutional investors. FIOs effectively may influence their investees to mitigate the short-term reputational and legal risks of a poor EP, but their influence is not statistically significant on EI for the sampled firms. Meanwhile, the prevalence of DIOs is important for both EP and EI.

We analyze whether a higher level of MNEs’ international diversification influences the relationship between FIOs and environmental outcomes. Model 4 in Table 2 shows a significant moderating effect of international diversification on the relationship between FIOs and EP (b = − 0.187, p = 0.068). Figure 1 confirms an overall tendency of firms with higher levels of FIOs to be associated with higher values of EP, in line with Hypothesis 1. However, it is revealing that Figure 1 uncovers that the effect of FIOs on EP is stronger for MNEs with a low level of international diversification and weaker for MNEs with higher levels of internationalization. As shown in Model 5, the influence of DIOs on EP is always positive and significant and it does not depend on the international diversification of the investees.

When looking at EI (Model 9), we did not find any significant moderating influence of international diversification on the relationship between FIOs and EI (b = 0.003, p = 0.964). On the other hand, Model 10 shows a significant effect (b = 0.133, p = 0.061) of international diversification on the relationship between DIOs and EI. Figure 2 confirms an overall tendency of MNEs with higher levels of DIOs to be associated with higher values of EI. Interestingly, at the same time, it shows that the positive effect of DIOs on EI is more pronounced for MNEs with higher levels of international diversification. In other words, while we could not find a significant influence of FIOs on EI in the sampled MNEs, DIOs make a positive and significant influence on EI, especially for the most internationally diversified investees.

Figure 3 provides an overview of our findings and shows that institutional ownership plays an important role in EP and EI. However, while FIOs are highly relevant for EP, DIOs are important for both EP and EI. In addition, we can conclude that the effect of FIOs on EP depends on the level of international diversification, and we advance a trade-off between international diversification and the relevance of FIOs on environmental changes. However, DIOs’ critical influence on MNEs’ EI is even stronger when these MNEs are more internationally diverse.

In order to exemplify our results, we selected from our sample two pairs of matched firms from two different geographical contexts and were able to confirm changes in environmental outputs following the increase of foreign institutional investors’ shares in these MNEs. Specifically, we began by identifying a U.S. MNE and a European MNE that have seen a significant increase in shares held by FIOs in the period analyzed in this study. After that, we compared them with other MNEs in the same subsector and region where shares held by FIOs have remained stable. These examples show that a progressive increase in shares held by FIOs has been accompanied by improvements in the environmental outcomes of the selected firms but remain relatively stable in the matched firms in which FIOs have not increased their shares.

The U.S. company in our example is Church & Dwight Co. Inc., a leading U.S. producer of sodium bicarbonate and cleaning products. In 2010, FIOs held 7.62% of the Church & Dwight Co. Inc 's shares, while by 2018 this percentage more than doubled to 17.19%. This progressive increase was accompanied by substantial improvements in environmental performance (EP). Specifically, the firm’s EP was 0.56 in 2010, while it increased by more than 56% to reach a value of 0.83 in 2019. We also see a similar evolution in Sika AG, a leading Swiss chemical company that processes materials to protect and reinforce load-bearing structures. At Sika AG, the percentage of shares held by FIOs increased from 29.87% in 2010 to 69.26% in 2018. Similarly, its EP more than doubled, reaching 0.84 in 2019 compared to 0.33 in 2010.

In contrast to these two MNEs, we can point out the cases of Ecolab Inc., an American company in the soap and other detergent manufacturing industry (NAICS 325611) – same as that of Church & Dwight Co. Inc. – and German Henkel AG & Co KgaA, which operates in the same industry (adhesive manufacturing, NAICS 325520) and region as Sika AG. In both cases the percentage of shares held by FIOs has remained fairly stable between 2010 and 2018. In 2010, FIOs held 13.95% of Ecolab 's shares, while in 2018, this percentage was 19.42%. During this period, its EP remained almost the same (0.86 in 2010 and 0.84 in 2019). At Henkel AG & Co KgaA, the percentage of shares held by FIOs increased only slightly from 2010 to 2018, and its EP remained unchanged in the value of 0.50 in both 2010 and 2019. Although we cannot exclude the possibility of FIOs simply selecting the MNEs showing an improvement in environmental performance, these examples illustrate that FIOs’ increased participation in their investees’ capital is positively related to and may be a strong positive influence on the improvements in their environmental performance.

Robustness Checks

As a robustness test of our main results, we re-ran Models 2 and 7 using composite scores from Refinitiv Eikon: Emissions Reduction Score for EP and Environmental Innovation Score for EI (see details in the Online Appendix). Our results remain broadly unchanged. When running Model 2 using an alternative measure of EP, the direct relationship between FIO and EP is positive and significant. Thus, we confirm that our findings remain unchanged with respect to higher levels of FIOs being associated with better EP, providing further support for Hypothesis 1. In the same way, the relationship between FIO and EI is not significant when using an alternative measure of EI.

Given the various countries in our sample, some concerns could be raised about their influence on the results. While we included various control variables for this purpose, we also ran additional robustness tests. Our main results remain similar when excluding U.S. firms in our sample or when excluding countries with only one or two firms in our sample (translating to the elimination of 18 firms). This means that neither firms from the largest country nor firms from the outlier countries drive our results.

DISCUSSION, IMPLICATIONS, AND CONCLUSION

This study seeks to understand the relationships between foreign institutional owners (FIOs) in MNEs and the two most relevant dimensions of a firm’s environmental approach: environmental performance (EP) and environmental innovation (EI). Our results provide support for the positive influence of FIOs on MNEs’ EP whereas domestic institutional owners (DIOs) are important for both EP and EI. Furthermore, interestingly, the influence of FIOs on EP is strong when MNEs are less internationally diverse and weak when MNEs are more internationally diverse. Meanwhile, international diversification reinforces the positive influence of DIOs on MNEs’ EIs. We believe that our findings contribute to several streams of research.

First, we join existing research on the role of FIOs (e.g., Aguilera et al., 2019; Shi et al., 2021). Specifically, we extend the analyses of investors’ reactions to firms’ environmental and social initiatives (Durand, Paugam, et al., 2019; Flammer, 2013; Hawn et al., 2018) by adding to the emergent research in analyzing foreign investors’ influence on their investees’ environmental strategies (DesJardine & Durand, 2020; Dyck et al., 2019; Flammer et al., 2021). Previous anecdotal evidence has raised questions about how FIOs might reconcile their aversion to financial losses and long-term uncertain commitments with their concerns about the potential risks from climate change (e.g., The Economist, 2021a). Our findings confirm that FIOs drive their investee firms to improve their EP in order to reduce reputational and legal risks in a context of information asymmetries. As FIOs are more interested in short-term profits than long-term value (e.g., Aguilera et al., 2017; David et al., 2010; Geng et al., 2016), a larger presence of FIOs in a firm may enhance its EP but not necessarily improve the firm’s EI, which necessitates longer-term, riskier, and costlier financial investments. Furthermore, executives’ increased attention to EP in the sampled chemical industry confirms the importance of issue salience in organizational responses to normative pressures (Durand, Hawn, et al., 2019). Our detailed attention to the relationship between FIOs and their investees’ environmental outputs has also confirmed the explanatory power of an institutional view of corporate governance (e.g., Aguilera et al., 2019; Marano & Kostova, 2016; Shi et al., 2021).

Second, we respond to calls in the international corporate governance literature (Aguilera et al., 2019; Castañer et al., 2020) to analyze how a firm’s institutional context influences the relationship between principals’ and agents’ decisions in the firm. In that regard, our supplementary analyses lend support to the argument that a firm’s international diversification might provide extra discretion, incentives, and opportunities for executives to react to the international institutional complexity by increasing the attention they pay to environmental issues (e.g., Montiel, Husted, & Christmann, 2012). Hence, MNEs are exposed to a dynamic and wide-ranging set of environmental demands from stakeholders around the globe (e.g., Maksimov et al., 2022; Marano & Kostova, 2016), and are under constant scrutiny by multiple governments (Wang & Li, 2019). Thus, our findings show the importance of exploring the level of international diversification in ownership studies in MNEs.

Our findings highlight the need for managers to better understand the specific concerns of their firm’s FIOs so they can develop approaches that align with these investors’ interests. Frequently, practitioners mistakenly believe that FIOs will not be interested in environmental initiatives. Our results clearly show that FIOs are interested in ensuring that the environmental practices of the firms in which they invest are sufficient to avoid any legal and social risks. However, FIOs might be reluctant to accept approaches related to more risky and long-term innovative investments. Furthermore, as firms advance in their internationalization and become more internationally diversified, this increases the pressure for executives to reinforce their firms’ EP and reduces the importance of the FIOs’ presence; however, we uncover that FIOs’ influence on EP is particularly strong when international diversification is low. For governments and policy makers, our findings suggest that helping the processes of international diversification in local firms is not only good for the local economy but can also be good for the environment.

Although we did not find statistical support to confirm a relationship between FIOs and EI strategy, we uncovered that DIOs are supportive of long-term EIs. This finding highlights the different interests of FIOs and DIOs regarding EIs. The lack of statistical significance to confirm a negative relationship between FIOs and EI strategy might be explained by the industry context of our sample where it is difficult to achieve improved environmental results without undertaking at least certain innovative initiatives. In other words, while in other industry sectors it may be easier to guarantee a good EP with only a limited level of investment in EIs, this approach may prove difficult in the chemical sector. Future research in a different industry setting could help us to better understand whether the choice of industry may have played a role in our results.

We recognize that future research may address complementary dimensions of our findings. First, our sample includes mostly publicly listed chemical sector firms, and hence our results may not apply to privately-owned firms or firms in different sectors. Second, while our sample firms account for a large share of the chemical manufacturing industry worldwide, smaller firms are underrepresented due to the limited availability of environmental data for these firms. Future studies could collect primary data from SMEs to analyze the impact that FIOs may have on local firms’ environmental approaches. Third, our results reveal a limited relevance of the investees’ home countries and the owners’ countries of origin; however, analyses of particular regulatory dimensions might uncover the importance of certain additional geographical dimensions. Fourth, and finally, recent research has shown the significance of offshore outsourcing of polluting activities (e.g., Berry, Kaul, & Lee, 2021; Li & Zhou, 2017). We would need additional data to analyze whether EP improvements in the firms with presence of institutional investors might come from offshoring some of the pollution instead of reducing it. In any case, our results show the strong interest of institutional investors in avoiding the risks of investees with bad pollution records and the limited interest of FIOs in being involved with firms with significant investments in EI.

In sum, our study confirms that the presence of institutional investors has implications for the environmental outputs of their investees. However, the improvements linked to FIOs are much more limited than the public statements made by executives of global institutional owners.

NOTES

-

1

BlackRock is a multinational investment firm and the world's largest asset manager, with $8.67 trillion in assets under management as of January 2021.

-

2

We are grateful to two of our reviewers for this suggestion.

Change history

24 December 2023

A Correction to this paper has been published: https://doi.org/10.1057/s41267-023-00671-6

References

Aguilera, R. V., Desender, K. A., Lamy, M. L. P., & Lee, J. H. 2017. The governance impact of a changing investor landscape. Journal of International Business Studies, 48(2): 195–221.

Aguilera, R. V., Marano, V., & Haxhi, I. 2019. International corporate governance: A review and opportunities for future research. Journal of International Business Studies, 50(4): 457–498.

Aragón-Correa, J. A., Marcus, A., & Hurtado-Torres, N. 2016. The natural environmental strategies of international firms: Old controversies and new evidence on performance and disclosure. Academy of Management Perspectives, 30(1): 24–39.

Aragon-Correa, J. A., Marcus, A. A., & Vogel, D. 2020. The effects of mandatory and voluntary regulatory pressures on firms’ environmental strategies: A review and recommendations for future research. Academy of Management Annals, 14(1): 339–365.

Bansal, P., & Roth, K. 2000. Why companies go green: A model of ecological responsiveness. Academy of Management Journal, 43(4): 717–736.

Bansal, P., & Song, H. C. 2017. Similar but not the same: Differentiating corporate sustainability from corporate responsibility. Academy of Management Annals, 11(1): 105–149.

Barnett, M. L., & Salomon, R. M. 2012. Does it pay to be really good? Addressing the shape of the relationship between social and financial performance. Strategic Management Journal, 33(11): 1304–1320.

Bena, J., Ferreira, M. A., Matos, P., & Pires, P. 2017. Are foreign investors locusts? The long-term effects of foreign institutional ownership. Journal of Financial Economics, 126(1): 122–146.

Berrone, P., Fosfuri, A., Gelabert, L., & Gomez-Mejia, L. R. 2013. Necessity as the mother of ‘green’ inventions: Institutional pressures and environmental innovations. Strategic Management Journal, 34(8): 891–909.

Berry, H., Kaul, A., & Lee, N. 2021. Follow the smoke: The pollution haven effect on global sourcing. Strategic Management Journal, 42(13): 2420–2450.

Boyd, B. K., & Solarino, A. M. 2016. Ownership of corporations: A review, synthesis, and research agenda. Journal of Management, 42(5): 1282–1314.

Cameron, A. C., & Miller, D. L. 2015. A practitioner’s guide to cluster-robust inference. Journal of Human Resources, 50(2): 317–372.

Castañer, X., Goranova, M., Kavadis, N., & Zattoni, A. 2020. Call for papers: Corporate Governance: An International Review special issue on “Ownership and corporate governance across institutional contexts”. Corporate governance: An international review. Retrieved on May 30, 2021 from the journal webpage.

Castellani, D., Montresor, S., Schubert, T., & Vezzani, A. 2017. Multinationality, R&D and productivity: Evidence from the top R&D investors worldwide. International Business Review, 26(3): 405–416.

Christmann, P. 2004. Multinational companies and the natural environment: Determinants of global environmental policy. Academy of Management Journal, 47(5): 747–760.

Daudigeos, T., Roulet, T., & Valiorgue, B. 2020. How scandals act as catalysts of fringe stakeholders’ contentious actions against multinational corporations. Business & Society, 59(3): 387–418.

David, P., O’Brien, J. P., Yoshikawa, T., & Delios, A. 2010. Do shareholders or stakeholders appropriate the rents from corporate diversification? The influence of ownership structure. Academy of Management Journal, 53(3): 636–654.

David, P., Yoshikawa, T., Chari, M. D., & Rasheed, A. A. 2006. Strategic investments in Japanese corporations: Do foreign portfolio owners foster underinvestment or appropriate investment? Strategic Management Journal, 27(6): 591–600.

De La Cruz, A., Medina, A., & Tang, Y. 2019. Owners of the world’s listed companies. Paris, France: OECD Capital Market Series.

Delmas, M. A., & Toffel, M. W. 2008. Organizational responses to environmental demands: Opening the black box. Strategic Management Journal, 29(10): 1027–1055.

Desender, K., & Epure, M. 2021. The pressure behind corporate social performance: Ownership and institutional configurations. Global Strategy Journal, 11(2): 210–244.

DesJardine, M. R., & Durand, R. 2020. Disentangling the effects of hedge fund activism on firm financial and social performance. Strategic Management Journal, 41(6): 1054–1082.

DesJardine, M. R., Marti, E., & Durand, R. 2021. Why activist hedge funds target socially responsible firms: The reaction costs of signaling corporate social responsibility. Academy of Management Journal, 64(3): 851–872.

Diestre, L., & Rajagopalan, N. 2014. Toward an input-based perspective on categorization: Investor reactions to chemical accidents. Academy of Management Journal, 57(4): 1130–1153.

Duanmu, J. L., Bu, M., & Pittman, R. 2018. Does market competition dampen environmental performance? Evidence from China. Strategic Management Journal, 39(11): 3006–3030.

Durand, R., Hawn, O., & Ioannou, I. 2019. Willing and able: A general model of organizational responses to normative pressures. Academy of Management Review, 44(2): 299–320.

Durand, R., Paugam, L., & Stolowy, H. 2019. Do investors actually value sustainability indices? Replication, development, and new evidence on CSR visibility. Strategic Management Journal, 40(9): 1471–1490.

Dyck, A., Lins, K. V., Roth, L., & Wagner, H. F. 2019. Do institutional investors drive corporate social responsibility? International evidence. Journal of Financial Economics, 131(3): 693–714.

Eesley, C., & Lenox, M. J. 2006. Firm responses to secondary stakeholder action. Strategic Management Journal, 27(8): 765–781.

El Ghoul, S., Guedhami, O., & Kim, Y. 2017. Country-level institutions, firm value, and the role of corporate social responsibility initiatives. Journal of International Business Studies, 48(3): 360–385.

Eisenhardt, K. M. 1989. Agency theory: An assessment and review. Academy of Management Review, 14(1): 57–74.

European Environment Agency. 2019. Industrial pollution in Europe. Retrieved May 6, 2020 from https://www.eea.europa.eu/data-and-maps/indicators/industrial-pollution-in-europe-3/assessment.

Fancy, T. 2021. Opinion: Financial world greenwashing the public with deadly distraction in sustainable investing practices. USA Today Opinion, March 16. Retrieved May 30, 2021 from https://eu.usatoday.com/story/opinion/2021/03/16/wall-street-esg-sustainable-investing-greenwashing-column/6948923002/.

Financial Times. 2021. The fall from favour of Danone’s purpose-driven chief: Ousting of Emmanuel Faber underlines challenge of pursing profits and ESG goals. Financial Times, March 17. Retrieved May 30, 2021 from https://www.ft.com/content/2a768b96-69c6-42b7-8617-b3be606d6625.

Flammer, C. 2013. Corporate social responsibility and shareholder reaction: The environmental awareness of investors. Academy of Management Journal, 56(3): 758–781.

Flammer, C., Toffel, M. W., & Viswanathan, K. 2021. Shareholder activism and firms’ voluntary disclosure of climate change risks. Strategic Management Journal, 42(10): 1850–1879.

Geng, X., Yoshikawa, T., & Colpan, A. M. 2016. Leveraging foreign institutional logic in the adoption of stock option pay among Japanese firms. Strategic Management Journal, 37(7): 1472–1492.

Gillan, S. L., Koch, A., & Starks, L. T. 2021. Firms and social responsibility: A review of ESG and CSR research in corporate finance. Journal of Corporate Finance, 66: 101889.

Hausman, J. A. 1978. Specification tests in econometrics. Econometrica, 46: 1251–1271.

Hawn, O., Chatterji, A. K., & Mitchell, W. 2018. Do investors actually value sustainability? New evidence from investor reactions to the Dow Jones Sustainability Index (DJSI). Strategic Management Journal, 39(4): 949–976.

Hawn, O., & Ioannou, I. 2016. Mind the gap: The interplay between external and internal actions in the case of corporate social responsibility. Strategic Management Journal, 37(13): 2569–2588.

Hitt, M. A., Hoskisson, R. E., & Kim, H. 1997. International diversification: Effects on innovation and firm performance in product-diversified firms. Academy of Management Journal, 40(4): 767–798.

Hitt, M. A., Li, D., & Xu, K. 2016. International strategy: From local to global and beyond. Journal of World Business, 51(1): 58–73.

Hitt, M. A., Tihanyi, L., Miller, T., & Connelly, B. 2006. International diversification: Antecedents, outcomes, and moderators. Journal of Management, 32(6): 831–867.

International Council of Chemical Associations. 2019. The global chemical industry: Catalyzing growth and addressing our world’s sustainability challenges. Retrieved May 30, 2020 from https://www.icca-chem.org/wp-content/uploads/2019/03/ICCA_EconomicAnalysis_Report_030819.pdf.

Kang, J. 2013. The relationship between corporate diversification and corporate social performance. Strategic Management Journal, 34(1): 94–109.

Kassinis, G., & Vafeas, N. 2006. Stakeholder pressures and environmental performance. Academy of Management Journal, 49(1): 145–159.

Kim, J. B., Pevzner, M., & Xin, X. 2019. Foreign institutional ownership and auditor choice: Evidence from worldwide institutional ownership. Journal of International Business Studies, 50(1): 83–110.

Kim, K. Y., Pathak, S., & Werner, S. 2015. When do international human capital enhancing practices benefit the bottom line? An ability, motivation, and opportunity perspective. Journal of International Business Studies, 46(7): 784–805.

Li, X., & Zhou, Y. M. 2017. Offshoring pollution while offshoring production? Strategic Management Journal, 38(11): 2310–2329.

Lin, L., Moon, J. J., & Yin, H. 2014. Does international economic integration lead to a cleaner production in China? Production and Operations Management, 23(4): 525–536.

Lu, J. W., & Beamish, P. W. 2004. International diversification and firm performance: The S-curve hypothesis. Academy of Management Journal, 47(4): 598–609.

Maksimov, V., Wang, S. L., & Yan, S. 2022. Global connectedness and dynamic green capabilities in MNCs. Journal of International Business Studies, 53(4): 723–740.

Marano, V., & Kostova, T. 2016. Unpacking the institutional complexity in adoption of CSR practices in multinational enterprises. Journal of Management Studies, 53(1): 28–54.

Montiel, I., Husted, B. W., & Christmann, P. 2012. Using private management standard certification to reduce information asymmetries in corrupt environments. Strategic Management Journal, 33(9): 1103–1113.

Nichols, A. 2007. Causal inference with observational data. The Stata Journal, 7(4): 507–541.

Nofsinger, J. R., Sulaeman, J., & Varma, A. 2019. Institutional investors and corporate social responsibility. Journal of Corporate Finance, 58: 700–725.

Norges Bank Investment Management. 2021. Climate change: Expectations of companies. Retrieved August 1, 2022 from https://www.nbim.no/contentassets/acfd826a614145e296ed43d0a31fdcc0/climate_change_2021_web.pdf.

OECD. 2020. OECD business and finance outlook 2020: Sustainable and resilient finance. Paris, France: OECD Publishing. https://doi.org/10.1787/eb61fd29-en.

OECD. 2021. Mobilising institutional investors for financing sustainable development in developing countries emerging evidence of opportunities and challenges. Retrieved March 6, 2022 from https://www.oecd.org/dac/financing-sustainable-development/Mobilising-institutional-investors-for-financing-sustainable-development-final.pdf.

Okhmatovskiy, I., & Shin, D. 2019. Changing corporate governance in response to negative media reports. British Journal of Management, 30(1): 169–187.

Philips, D. 2020. Investors drop Brazil meat giant JBS. The Guardian, July 28. Retrieved Mar 27, 2021 from https://www.theguardian.com/environment/2020/jul/28/investors-drop-brazil-meat-giant-jbs.

Pisani, N., Garcia-Bernardo, J., & Heemskerk, E. 2020. Does it pay to be a multinational? A large-sample, cross-national replication assessing the multinationality–performance relationship. Strategic Management Journal, 41(1): 152–172.

Powell, W. W., & DiMaggio, P. J. 1991. The new institutionalism in organizational analysis. Chicago: University of Chicago Press.

Refinitiv. 2020. Environmental, Social and Governance (ESG) scores from Refinitiv. Retrieved May 6, 2020 from https://www.refinitiv.com/content/dam/marketing/en_us/documents/methodology/esg-scores-methodology.pdf.

Scott, W. R. 1995. Institutions and organizations: Foundations for organizational science. London: Sage.

Shi, W., Gao, C., & Aguilera, R. V. 2021. The liabilities of foreign institutional ownership: Managing political dependence through corporate political spending. Strategic Management Journal, 42(1): 84–113.

The Economist. 2021a. It is not so easy being green: A burst of skeptical noise about sustainable investing. The Economist, March 27: 55–56.

The Economist. 2021b. The bottlenecks which could constrain emission cuts. The Economist, June 29: 40–48.

The World Bank. 2021. Rule of law. Retrieved February 20, 2022 from http://info.worldbank.org/governance/wgi/pdf/rl.pdf.

United Nations Environment Programme. 2019. Global chemicals outlook II. From legacies to innovative solutions: Implementing the 2030 agenda for sustainable development. Retrieved May 6, 2020 from https://wedocs.unep.org/bitstream/handle/20.500.11822/27651/GCOII_synth.pdf.

Wan, W. P., Hoskisson, R. E., Short, J. C., & Yiu, D. W. 2011. Resource-based theory and corporate diversification: Accomplishments and opportunities. Journal of Management, 37(5): 1335–1368.

Wang, S. L., & Li, D. 2019. Responding to public disclosure of corporate social irresponsibility in host countries: Information control and ownership control. Journal of International Business Studies, 50(8): 1283–1309.

ACKNOWLEDGEMENTS

The University of Granada authors recognize the partial funding from PID2019-106725GB-I00 and PID2019-107767GA-I00 research grants (Spanish State Research Agency—Innovation and Science Ministry, 10.13039/501100011033), and the A-SEJ-291-UGR18 grant (Regional Government of Andalucia, European FEDER funds, and University of Granada).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Accepted by Yadong Luo, Senior Editor, 27 September 2022. This article has been with the authors for two revisions.

The original online version of this article was revised due to a retrospective Open Access order.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendix

Appendix

Measure of International Diversification

We measured international diversification using an entropy measure that considers both the extent and geographic distribution of MNEs’ international presence based on the number of subsidiaries each firm has in foreign countries (see Hitt et al., 1997, 2006). We began by using Bureau van Dijk’s Orbis database to collect information on the country locations of each of the 36,985 subsidiaries of the 197 MNEs in our sample. Prior studies have also used this database to measure firms’ international orientation (e.g., Pisani, Garcia‐Bernardo, & Heemskerk, 2020). We included those subsidiaries in which one of our sample firms was the global ultimate parent company, owning at least 50% of the entity either directly or indirectly, and, for each subsidiary, recorded the country location and establishment date. We then applied the following formula from Hitt et al. (1997) to compute international diversification:

where Pi is the percentage of foreign subsidiaries a firm has in country i, and ln(1/Pi) is the weight given to each country. We considered a total of 138 countries, including all countries in which at least one of the sampled MNEs had a subsidiary. For each firm, we excluded domestic subsidiaries from the equation, based on the firm’s home country.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Ellimäki, P., Aguilera, R.V., Hurtado-Torres, N.E. et al. The link between foreign institutional owners and multinational enterprises’ environmental outcomes. J Int Bus Stud 54, 910–927 (2023). https://doi.org/10.1057/s41267-022-00580-0

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41267-022-00580-0