Abstract

Whereas IB has extensively studied MNEs’ generic (positive) impact on host economies, but rarely on employee wages, economics research has only shown an overall MNE wage premium. We ‘unravel’ this premium, considering multiple levels of analysis and accounting for host-country contextual contingencies, to unveil MNEs different (positive or negative) distributional effects. Using unique micro-level data from over 40,000 employees in 13 countries, we examine MNEs’ distributional effects for employees’ gender, experience, and immigrant status; the influence of host-country property rights protection and labor regulation; and interplays with region and industry effects. MNEs’ distributional effects show marked differences that largely depend on the host-country context, and that are positive for experienced and foreign-born employees in developed countries but negative for females working in developing countries. Whereas in developed countries the gender wage gap is smaller in MNEs than in domestic firms as hypothesized, we find evidence of a larger wage gap in developing countries. The analysis also reveals that the higher host-countries’ level of property rights protection, the lower the MNE wage premium. Our study points at the need to reassess statements about the generic positive impact of MNEs in host countries, particularly in developing countries, and discusses (further) research implications.

Resume

Alors que la recherche en International Business (IB) a largement étudié l’impact générique (positif) des EMN sur les économies d’accueil, mais rarement sur les salaires des employés, la recherche en économie n’a fait qu’identifier une prime salariale générale des EMN. Pour révéler les différents effets distributifs (positifs ou négatifs) des EMN, nous ‘démêlons’ cette prime en tenant compte de multiples niveaux d’analyse et des contingences contextuelles du pays hôte. À l’aide de données microéconomiques originales recueillies auprès de plus de 40 000 employés dans 13 pays, nous examinons les effets distributifs des EMN par rapport au genre, à l’expérience et au statut d’immigrant des employés ; l’influence de la protection des droits de propriété et de la réglementation du travail dans le pays hôte ; et les interactions avec les effets régionaux et industriels. Les effets de répartition des EMN montrent des différences marquées qui dépendent largement du contexte du pays d’accueil : ils sont positifs pour les employés expérimentés et nés à l’étranger dans les pays développés, mais négatives pour les femmes travaillant dans les pays en développement. Alors que dans les pays développés, l’écart salarial entre les hommes et les femmes est plus faible dans les EMN que dans les entreprises nationales, comme cela est attendu, nous constatons un écart salarial plus important dans les pays en développement. L’analyse révèle également que plus le niveau de protection des droits de propriété des pays d’accueil est élevé, plus la prime salariale des EMN est faible. Notre étude souligne la nécessité de réévaluer les déclarations sur l’impact générique positif des EMN dans les pays d’accueil, en particulier dans les pays en développement, et d’examiner les implications (futures) pour la recherche.

Resumen

Mientras que negocios internacionales ha estudiado extensivamente el impacto genérico (positivo) de las EMN en las economías anfitrionas, pero rara vez en los salarios de los empleados, la investigación en economía ha mostrado solamente una prima salarial general de las empresas multinacionales. “Resolvemos” esta prima, considerando múltiples niveles de análisis y contabilidades de las contingencias contextuales del país anfitrión, para resolver los diferentes (positivas o negativa) efectos distributivos de las empresas multinacionales s. Usando datos únicos a nivel micro de más de 40.000 empleados en 13 países, examinamos los efectivos distributivos de las empresas multinacionales para el género, experiencia y el estatus de inmigrante de los empleados; la influencia de la protección a los derechos de propiedad en el país anfitrión y la legislación laboral; y las interacciones con los efectos región e industria. Los efectos distributivos de las empresas multinacionales muestran diferencias marcadas que dependen en gran medida del contexto del país anfitrión, y que son positivos para empleados con experiencia y extranjeros nacidos en países desarrollados, pero negativos para mujeres trabajando en países en desarrollo. Mientras que en los países desarrollados la brecha salarial de género es menor en las empresas multinacionales que en las empresas nacionales, según la hipótesis encontramos evidencias de una brecha salarial mayor en países en desarrollo. El análisis también revela que a más altos niveles de protección de derechos de protección en países anfitriones, menor es la prima salarial de las empresas multinacionales. Nuestro estudio señala la necesidad de re-evaluar las declaraciones sobre el impacto positivo genérico de las empresas multinacionales en los países anfitriones, particularmente en países en desarrollo, y discute (aún mas) las implicaciones de la investigación.

Resumo

Enquanto IB tem extensivamente estudado o impacto genérico (positivo) de MNEs em economias anfitriãs, mas raramente no salário de funcionários, a pesquisa em economia mostrou apenas uma diferença salarial geral em MNEs. Nós ‘desvendamos’ essa diferença, considerando vários níveis de análise e contabilizando contingências contextuais do país anfitrião, para desvendar diferentes efeitos distributivos de MNEs (positivos ou negativos). Usando dados únicos a nível micro de mais de 40.000 funcionários em 13 países, examinamos os efeitos distributivos de MNEs para gênero, experiência e status de imigrante de funcionários; a influência da proteção a direitos de propriedade e da legislação trabalhista do país anfitrião; e a interação com efeitos da região e da indústria. Efeitos distributivos de MNEs mostram diferenças marcantes que dependem amplamente do contexto do país anfitrião e que são positivas para funcionários experientes e nascidos no exterior em países desenvolvidos, mas negativas para mulheres que trabalham em países em desenvolvimento. Enquanto em países desenvolvidos a diferença salarial de gênero é menor em MNEs do que em empresas domésticas, como hipotetizado, encontramos evidências de uma diferença salarial maior em países em desenvolvimento. A análise também revela que, quanto maior o nível de proteção aos direitos de propriedade nos países anfitriões, menor a diferença salarial em MNEs. Nosso estudo aponta para a necessidade de reavaliar declarações sobre o genérico impacto positivo das MNEs em países hospedeiros, particularmente em países em desenvolvimento, e discute (adicionais) implicações da pesquisa.

摘要

尽管IB广泛研究了跨国公司对东道国经济的普遍的(正面)影响, 但对员工工资的影响却很少研究, 经济学研究仅显示了跨国公司的总体工资溢价。考虑到多层次的分析和东道国情境的突发事件, 我们“解散”了这一溢价,以揭示跨国公司的不同的(积极或消极)分布效应。用来自13个国家/地区的40,000多员工的独特的微观数据, 我们研究了跨国公司对员工的性别、经验和移民身份的分布效应; 东道国财产保护和劳动法规的影响; 以及与地区和行业影响之间的相互作用。跨国公司的分布效应显示出明显的差异, 这些差异在很大程度上取决于所在国的情境, 且对发达国家里的经验丰富和国外出生的雇员是积极的, 而对在发展中国家里工作的女性是消极的。在发达国家, 跨国公司中的性别工资差距小于假设的国内公司, 但我们发现发展中国家里工资差距更大的证据。分析还揭示, 东道国的产权保护水平越高, 跨国公司的工资溢价则越低。我们的研究指出, 有必要重新评估关于跨国公司在东道国, 特别是在发展中国家的普遍积极影响的陈述, 并讨论(进一步)研究启示。

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

INTRODUCTION

The implications of multinational enterprises’ (MNEs) presence in a given host country has been a central topic of scholarly enquiry in the international business (IB) literature. Most prominently, an extensive body of IB research has investigated MNEs’ productivity spillovers to local actors since Caves’ first publication on the topic in 1974 (e.g., Giroud, 2007; Meyer & Sinani, 2009; Narula, 2014; Zanfei, 2012). This work has tended to emphasize the potential, often unintended, positive effects of MNEs on host-country economic development through these spillovers (Oetzel & Doh, 2009). Several other IB studies have focused on MNEs’ social role and responsibilities in host countries, highlighting the dilemmas faced when operating abroad, especially in emerging economies (for recent overviews see Kolk, 2016; Pisani, Kourula, Kolk, & Meijer, 2017). While, overall, this stream of research has contributed to enhancing our insight into MNEs’ influence on host countries and local firms, several themes have been understudied. Specifically, the IB literature has thus far only offered a very limited understanding of how MNEs affect local wages, which is a striking omission given the connections that are increasingly made between firms’ internationalization and growing wage differentials (Haskell, Lawrence, Leamer, & Slaughter, 2012; Kobrin, 2017), and the fact that MNEs can have a substantive ‘standard-setting’ influence through their wage payments (Bapuji, Husted, Lu, & Mir, 2018) – positively or negatively when seen from an inequality perspective (Giuliani, 2019).

Although a few qualitative publications have shed some light on MNEs’ role concerning employees’ pay and work practices in the host countries in which they operate (e.g., Egels-Zandén, 2014; Tatoglu, Glaister, & Demirbag, 2016), we note that thus far the IB literature has paid scant attention to this topic. In the broader realm of wages, salaries, and compensation,1 there are studies on the link between culture and pay practices (e.g., Schuler & Rogovsky, 1998; Van de Vliert, 2003), the compensation of international executives and expats (e.g., Hon & Lu, 2015; Southam & Sapp, 2010; Van Essen, Heugens, Otten, & Van Oosterhout, 2012) and, more generally, on the convergence and divergence of human resource management practices across market economies (Farndale, Brewster, Ligthart, & Poutsma, 2017). However, only very few focus on MNEs’ wage payments to employees in their subsidiaries, such as Girma, Görg, and Kersting (2019) who examined how the proportion of foreign direct investment (FDI) in an industry cluster affects the wages paid by MNEs and domestic firms in China; and Clougherty, Gugler, Sørgard, and Szücs (2014) who studied how firms’ international activity affects wages, though restricted to the effect of cross-border mergers on wages in the US. Very recently, Doh (2019) reiterated the need for more research on the role of MNEs in contributing to inequality, with specific attention for wage inequality (cf. Narula, 2019).

In this paper, we aim to fill this gap in the existing body of knowledge and start from empirical findings of publications in international economics (e.g., Aitken, Harrison, & Lipsey, 1996; Hijzen, Martins, Schank, & Upward, 2013; Javorcik, 2014) that have consistently shown the existence of what has been called an MNE (or foreign ownership) wage premium. The dominant explanation of such premium, relying on the IB literature, is that MNEs derive a productivity advantage (over domestic firms) from firm-specific knowledge (Caves, 1996; Dunning, 1988; Rugman & Verbeke, 2001), and that this advantage may be eroded when knowledge spills over as a result of employees leaving the firm (Ben Hamida, 2013). To prevent these spillovers, MNEs therefore tend to pay a wage premium to retain their employees in host countries (Fosfuri, Motta, & Rønde, 2001; Glass & Saggi, 1999, 2002; Globerman, Ries, & Vertinsky, 1994). However, while these studies have contributed to identifying the very existence of the MNE wage premium, they have overlooked (a) the distributional effects associated with MNEs’ presence in the host-country context, (b) how institutional contingencies influence the MNE wage premium, and (c) the interplay between these effects. In other words, although extant research has shown that it ‘pays’ to work for a multinational in generic terms, we still do not know for whom and how more exactly, also in relation to types of countries and industries.

We zoom in on these aspects through a more in-depth investigation, focusing on foreign-owned subsidiaries of MNEs versus purely domestic firms (which neither have any activities in foreign countries nor any foreign ownership). This enables us to isolate the MNE wage effect to then unravel it. Our paper unveils the distributional effects associated with the MNE wage premium in relation to three key employees’ characteristics: their gender, experience, and immigrant status. Specifically, building on insights from different bodies of literature, and as explained in more detail in the theory and hypotheses section, we expect (1) the gender wage gap to be smaller in MNEs (than domestic firms), (2) the experience wage premium to be larger in MNEs; and (3) the immigrant wage gap to be smaller in MNEs. We also propose two key contingencies associated with the host-country institutional environment – property rights protection and labor freedom – and expect a smaller MNE wage premium when property rights are better protected and labor regulations stricter.

We test the hypothesized relationships with unique micro-level data from over 40,000 employees from 13 countries and 32 different industries. Our results show that the gender wage gap is smaller in MNEs than domestic firms, but only in developed countries. Contrary to our expectations, the gender wage gap turns out to be even larger in MNEs than domestic firms in developing countries. Our findings empirically validate that the experience wage premium is larger in MNEs; they also confirm that the immigrant wage gap is smaller in MNEs, but the difference vis-à-vis domestic firms is significant only for developed countries. In relation to the effect of host-country institutions, we find evidence that the higher the level of property rights protection, the lower the MNE wage premium. We also perform a number of post hoc analyses that reveal the interplay of MNEs’ distributional effects with host-country institutions and the presence of specific region and industry effects.

Our work contributes to the IB field in several ways. First, by ‘unraveling’ the MNE wage premium and clarifying specific MNE distributional effects – considering employees’ gender, experience, and immigrant status – our work generates new insights into MNEs’ influence on host countries. We show that these effects are not always positive, most notably that MNEs contribute to widening the gender wage gap in developing countries. In this way, our study adds important empirical evidence in support of earlier observations that, while IB research has tended to overly focus on the positive effects of FDI on development, reality seems much more nuanced as MNE activity is not a conditio sine qua non for development, especially in those regions where people are most in need (Dunning, 1994; Lall, 1980; Lall & Narula, 2004; Narula & Driffield, 2012; Narula & Dunning, 2010). We also uncover the influence of host-country institutions on the different components of the MNE wage premium. Linking our work to earlier insights from the IB literature, we illustrate the important role of property rights protection in moderating the effect of MNEs on employee wages. Furthermore, methodologically, ours is – to our knowledge – the first empirical study on wage differentials that uses a multilevel mixed effects method that allows us to account in our estimation for different sources of heterogeneity related to the MNE wage premium and thus properly model the interaction between MNEs’ distributional effects and host-country institutions.

THEORY AND HYPOTHESES

The Influence of MNEs on Host Countries

An extensive body of IB research has focused on the influence of MNEs’ presence in a given host country. This work has investigated a variety of relevant topics, such as the positive impact associated with MNEs’ active role in filling institutional voids (Kolk & Lenfant, 2015; Parmigiani & Rivera-Santos, 2015) and the development of better local institutions (Cantwell, Dunning, & Lundan, 2010; Kwok & Tadesse, 2006; Regnér & Edman, 2014). One of the most researched effects in this body of work involves the potential productivity advances of local firms benefiting from knowledge spillovers from MNEs’ subsidiaries based in their geographical proximity (e.g., Altomonte & Pennings, 2009; Buckley, Clegg, & Wang, 2007; Giroud, 2007; Ha & Giroud, 2015; Meyer & Sinani, 2009). This positive effect arises because MNEs possess firm-specific advantages (FSAs) – stand-alone resources such as technology and managerial processes, and higher-order FSAs such as the capacity to create, recombine, and (un)bundle these resources – that local firms in the host country do not have (Da Silva Lopes, Casson, & Jones, 2019; Narula, Asmussen, Chi, & Kundu, 2019; Narula & Verbeke, 2015; Strange & Humphrey, 2019).

MNEs can transfer FSAs to local firms within their supply chains through vertical linkages. Prior studies have shown that upstream backward linkages with local suppliers facilitate the transfer of knowledge and skills (Giroud, 2007; Jindra, Giroud, & Scott-Kennel, 2009), while downstream forward linkages with buyers and distributors lead to the transfer of knowledge embodied in products, processes, and technologies (Driffield, Munday, & Roberts, 2002; Miozzo & Grimshaw, 2008). Horizontal spillovers in favor of domestic firms – thus labeled as negative for the focal MNE – can occur as well, for instance through imitation by local competitors (Ben Hamida & Gugler, 2009), or when employees switch jobs and take their firm-specific knowledge out of the MNEs’ subsidiary (Ben Hamida, 2013). IB scholars have also unveiled the key role of contingencies in the creation of the above-mentioned spillovers between MNEs and local firms, for example with respect to the level of MNEs’ subsidiary autonomy (Ha & Giroud, 2015; Jindra et al., 2009), domestic firms’ absorptive capacity (Ben Hamida, 2013; Blalock & Simon, 2009; Zanfei, 2012), and the role of MNEs’ country of origin (Buckley et al., 2007), and host-country and industry characteristics (Giuliani & Macchi, 2014).

Over the years, often as part of their corporate social responsibility (CSR) policies, MNEs have started to communicate more actively about the various types of impact they have when operating abroad, including not only social and environmental but also economic dimensions such as jobs created and figures on total taxes and (cash) value added for different stakeholder groups (e.g., Fortanier & Kolk, 2007). Although this information is usually self-reported, it has helped to raise attention to the broader implications of MNEs’ activities in developing countries, considering the economy (e.g., the special issue edited by Ghauri & Yamin, 2009), as well as the environment, stakeholders, and ethics (cf. Giuliani & Macchi, 2014; Meyer, 2004). And while IB research has maintained a strong focus on the social role and responsibilities that MNEs have when operating abroad – for instance investigating the relationship between MNEs and stakeholders, including NGOs, in host countries (Kourula & Laasonen, 2010; Oetzel & Doh, 2009; Pisani et al., 2017) – IB scholarly efforts have increasingly focused on furthering our understanding of the effect of MNEs’ presence in host economies including a broader set of dimensions in their analyses.

It is important to note that, whereas IB research has tended to overwhelmingly focus on the positive effects of MNEs’ presence in host countries (such as the ones discussed in the preceding paragraphs), scholars such as Dunning (1958, 1981, 1994) have emphasized that not all outcomes from the participation of MNEs in the host economy may be positive. For example, when MNEs only locate low-value adding activities in the host country, they thereby restrict the potential for positive spillovers. Such negative effects can even turn into an overall negative net effect associated with MNEs’ presence, which materializes for instance when the benefits from MNE spillovers (and other factors contributing to host-country development) are smaller than the negative effects, or when the investment in local capabilities necessary to absorb and internalize MNE spillovers is larger than the payoff by itself (Narula & Driffield, 2012; Narula & Dunning, 2010; Zanfei, 2012). Moreover, even similar acts by the same MNE could generate very different outcomes in different host countries, as effects also depend on several specificities of the local context, which include host-country capabilities and associated absorptive capacity, institutions and industrial structures (Dunning, 1994; Lall, 1980; Lall & Narula, 2004; Meyer & Peng, 2005).

This body of work has thus suggested – different from predominant IB attention on the positive effects of FDI to development – that the whole range of possible impacts, including negative ones, need to be taken into account and that MNE activity is not a conditio sine qua non for development as such. Yet, we still have a limited understanding, both conceptually and empirically, of the nature and magnitude of the negative effects of MNE presence for host countries (Narula & Dunning, 2010). While partly due to a perhaps somewhat overly optimistic view on the influence of MNEs in host countries, there has also been a relative paucity of data and concomitant difficulties to examine such effects in more detail (Giuliani & Macchi, 2014; Narula & Driffield, 2012). Recent publications in IB journals have, however, pointed at the need for more research also on the possible negative effects, such as the role of resource-seeking MNEs in depleting natural resources (Narula, 2018), the impact of FDI in land in agriculture on host-country food security (Santangelo, 2018), and more generally, to include more dimensions of sustainable development, including poverty, human and labor rights, and working conditions (Kolk, 2016).

However, besides a few studies that have shed light on the existence of differences in work practices across countries (Ollo-Lopez, Bayo-Moriones, & Larraza-Kintana, 2011) and more specifically on MNEs’ effect on employees’ working conditions in their international supply chains, particularly in the case of developed-country MNEs (e.g., Egels-Zandén, 2014), we note that thus far the IB literature has paid scant attention to the distributional effects of MNEs’ presence in host countries, especially in relation to the wages paid by MNEs to their own employees. We find this particularly striking because understanding MNEs’ influence on wages in the host countries in which they operate is highly relevant for the field, especially when it comes to contributing to scholarly debates about the potentially negative effects of MNEs’ activities just mentioned. Several recent publications have also emphasized the link between globalization and wage differences (Bourguignon, 2015; Chen, Ge, & Lai, 2011; Haskell et al., 2012; Kobrin, 2017; Lee & Wie, 2015; Milanovic, 2016).

As indicated in the Introduction, there is hardly any IB research on wages and the more generic management literature has merely examined gender gaps in wages within organizations (e.g., Abraham, 2017; Briscoe & Joshi, 2017; Cardador, 2017). None of these studies has empirically investigated MNEs’ distributional effects in host countries and their interplay with host-country institutions, a gap that we aim to fill with this study.

The MNE Wage Premium

Particularly the international economics literature has investigated whether MNEs pay higher wages than domestic firms. The empirical evidence accumulated largely supports this claim (e.g., Almeida, 2007; Chen et al., 2011; Girma et al., 2019; Heyman, Sjöholm, & Tingvall, 2007; Hijzen et al., 2013). Specifically, the MNE wage premium found in these studies, which focus mostly on manufacturing industries, ranges between 2 and 20%. The majority of these earlier works have relied on efficiency arguments to explain the MNE wage premium, especially linked to MNEs’ need to retain employees in order to prevent spillovers. Through training and experience, MNEs’ local employees become familiar with firm-specific technology and management practices (Martin & Salomon, 2003), and this knowledge and skills are at risk of spilling over when employees switch employers or start their own companies in the host country (Ben Hamida, 2013; Blomström & Kokko, 2002; Meyer, 2004; Sinani & Meyer, 2004). In order to prevent these spillovers, MNEs, deriving a larger productivity advantage from firm-specific knowledge (Caves, 1996; Dunning, 1988; Javorcik, 2014; Javorcik & Poelhekke, 2017; Rugman & Verbeke, 2001), are more likely than domestic firms to pay a wage premium to retain their employees (Fosfuri et al., 2001; Glass & Saggi, 1999, 2002; Globerman et al., 1994).

Other efficiency wage mechanisms leading to an MNE wage premium include search frictions: due to relatively limited local networks and knowledge of the local labor market, MNEs may have to pay more to identify and attract good workers (Hijzen et al., 2013; Lipsey & Sjöholm, 2004). MNEs may also be inclined to use better pay to motivate employees to overcome problems arising from the different legal and cultural traditions of their home country, or to attract and retain employees who possess specific qualities to bridge these differences (Hijzen et al., 2013). Prior studies have shown that MNEs are indeed able to attract these employees from their local counterparts through higher wages (Fortanier & Van Wijk, 2010). Another possible explanation offered by extant research is that, as firms share part of their profits with their employees (“rent-sharing”), an MNE wage premium can be expected because MNEs are more profitable than domestic firms while facing the same rent-sharing preferences of local employees (Budd, Konings, & Slaughter, 2005; Dunning, 1988; Egger & Kreickemeier, 2013; Helpman, Itskhoki, & Redding, 2010; Martins & Yang, 2015; Rugman & Verbeke, 2001). Building on the above, we can therefore conclude that a substantial body of empirical work has shown that, all else equal, MNEs are expected to pay a higher wage than domestic firms.

However, while research in economics has offered consistent support in favor of the existence of the MNE wage premium, we recognize several limitations of the reviewed studies. First, we lack insight into the distributional effects associated with MNEs’ presence in the host-country context, especially in relation to three key employees’ characteristics: their gender, experience, and immigrant status. Second, the literature has to date predominantly focused on individual country settings (or at most a small number of countries in comparative analyses), limiting our understanding of the important role of host country-level heterogeneities in determining how MNEs pay their employees and thus influencing the magnitude of their wage premia. Third, from a methodological standpoint, the multilevel nature of the phenomenon under scrutiny has been neglected. Whereas IB scholars have emphasized the importance of accounting for the possible variation in estimated effects at different levels of analysis (Andersson, Cuervo-Cazurra, & Nielsen, 2014; Peterson, Arregle, & Martin, 2012) – i.e., considering differences at the firm, industry, and country level – international economics studies have not embraced a multilevel approach to study MNEs’ wage premia in host countries.

We argue that these drawbacks have prevented us from gaining insights into how MNEs’ distributional effects interplay with country-level (institutional) heterogeneities, thus limiting our understanding of this phenomenon. The next subsections address the main theoretical arguments with regard to expected wage differentials and important host country-level contingencies, leading to a set of hypotheses. As pointed out in the Introduction, we emphasize that the theoretical development that follows focuses on foreign-owned subsidiaries of MNEs versus purely domestic firms (which have neither activities in foreign countries nor any foreign ownership), thus enabling us to develop (and subsequently test) hypotheses on distributional effects that are unique to MNEs.2 The methodological drawback mentioned above (as third limitation of studies in economics) will be discussed further in the subsequent section when presenting the data and the mixed effects model analysis used to test our hypotheses.

MNEs' Distributional Effects

The gender wage gap

An important key source of inequality is the gender wage gap, which corresponds, all else equal, to a lower wage paid to females compared to males. Prior research has shown that such a gap exists, although in varying degrees, in almost every country in the world (Blau & Kahn, 2017; ILO, 2018). For considering this macro-level phenomenon at the firm level, and specifically for MNEs (as compared to domestic firms), it is important to note that human resource management (HRM) systems and practices are commonly standardized across MNEs’ subsidiaries. This standardization may stem from the need to realize an effective and efficient control of the organization in executing MNEs’ global strategy (Chung, Park, Lee, & Kim, 2015; Edwards & Kuruvilla, 2005), to ensure that similar systems are followed as other MNEs in view of international competitive pressures (Ferner, Quintanilla, & Varul, 2001), or even stand out if one perceives HRM as constituting an FSA (Kim, Pathak, & Werner, 2015; Rugman & Verbeke, 2003) or as supporting the exploitation of an FSA (Taylor, Beechler, & Napier, 1996). Prior research has therefore suggested that internally transferred HRM in MNEs’ subsidiaries is likely to be more formalized and standardized compared to the ones adopted in domestic firms (Björkman, Fey, & Park, 2007; Mellahi, Demirbag, Collings, Tatoglu, & Hughes, 2013; Pudelko & Harzing, 2007).

A formal structure guiding wage levels and increases linked to objective output criteria can be expected to reduce the likelihood of a gender wage gap compared to a situation in which, for example, one individual (‘traditional’ male) manager has discretion to decide about payments and promotions. While this may have to do with gender-specific preferences and managers’ gender, both areas in which research has shown male–female manager differences (e.g., Abraham, 2017; Festing, Knappert, & Kornau, 2015), findings overall seem to suggest thus far that managerial ‘biases’ negatively affecting the allocation of wages/resources to women reflect broader social or corporate cultural beliefs (Artz, Goodall, & Oswald, 2018; Elvira & Graham 2002; England, 2017). These might include perceptions of females being less productive than males (England, 2017), undervaluation of work done by women (Elvira & Graham 2002; Festing et al., 2015), or (socialized) negative feelings that are aroused when women ask or negotiate for higher wages (Artz et al., 2018). Standardized systems that aim to objectivize and contain formalized criteria for performance evaluation and rewards, as used in MNEs, reduce managerial discretion and thus the potential of biases affecting wages (Abraham, 2017; Elvira & Graham, 2002; Festing et al., 2015); they might also offer less room for biases regarding the role and characteristics of parents which lead to the so-called ‘motherhood penalty’ and/or ‘fatherhood premium’, two phenomena both reported by social scientists (Budig & England, 2001; Budig & Hodges, 2010; Fuller & Cooke, 2018; Killewald & García-Manglano, 2016).

In addition to formalization, there is another factor that leads us to expect that the female wage gap will be lower in MNEs than in domestic firms. As pointed out by Maggioni, Santangelo, and Koymen-Ozer (2019), ownership specificities represent critical factors influencing firms’ sensitivity to reputational and operating considerations. Specifically, the authors focus on the distinction between foreign versus local owners, positing that foreigners tend to face more severe reputational and operating costs associated with labor standards than locals. As already highlighted by Kostova and Zaheer (1999), foreign investors are expected to do more than local ones in building their reputation and goodwill in the host country. They will also be more vulnerable to reputational and legitimacy concerns, given their larger public exposure, in case of labor standards infringements. Therefore, as mentioned above, MNEs have become rather active in disclosing information, including on equal opportunity and diversity, and adhere to global guidelines containing these principles, for example, issued by the OECD and UN agencies, leading to upward harmonization (e.g., Einwiller, Ruppel, & Schnauber, 2016; Fortanier, Kolk, & Pinkse, 2011). Considering the above, we therefore expect MNEs to be more sensitive to gender equality than domestic firms. Accordingly, we formulate the following hypothesis:

Hypothesis 1:

All else equal, the gender wage gap is smaller in MNEs than in domestic firms.

The experience wage premium

The experience wage premium refers to the higher wages paid to employees with greater (versus lower) experience (Katz & Revenga, 1989). There are two mechanisms through which the reward for experience is expected to be different between MNEs and domestic firms. First, MNEs need to pay a premium to attract and retain experienced employees with the specific skills and competences necessary to work in an MNE’s subsidiary in the often complex context of an international firm with multiple interests across geographies, and to help the exploitation of FSAs (Collings, Mellahi, & Cascio, 2019; Guthridge & Komm 2008; Meyer & Xin, 2018; Morris, Snell, & Björkman, 2016; Tarique, Schuler, & Gong, 2006; Tatoglu, Glaister, & Demirbag, 2016). Experienced employees who meet the MNE’s relatively higher criteria tend to be scarcer because of the greater difficulty to acquire such skills and competences, and thus command a wage premium (Collings et al., 2019; McDonnell, Lamare, Gunnigle, & Lavelle, 2010; Mellahi & Collings, 2010). Moreover, to attract entry-level employees (with thus low to no experience) there is less (or even no) need for MNEs to pay a premium given that their brand, reputation, and career opportunities constitute important pull factors; as a result, MNEs are less likely to pay a wage premium for entry-level employees as there is likely no shortage or even an abundance of candidates for entry-level jobs (Ready, Hill, & Conger, 2008). Thus, MNEs are more likely than domestic firms to pay a wage premium to experienced employees.

Second, and directly related to the above, MNEs invest relatively more in internal talent development (Meyer & Xin, 2018; Morris et al., 2016; Tatoglu et al., 2016). Their formal HRM systems allow them to monitor the performance of employees throughout the company, helping to select and develop those with the most potential to take on larger responsibilities within the MNE network (Mäkelä, Björkman, & Ehrnrooth, 2010). MNEs’ firm-specific knowledge and resources allow them to train these talents more extensively and effectively (Chang, Chung, & Moon, 2013; Görg, Strobl, & Walsh, 2007). Concurrently, thanks to MNEs’ international spread, their employees have greater opportunities to benefit from their growing experience, developing the high-level skills and competences that are crucial for MNEs’ success, for instance by leveraging the enhanced exposure to multiple geographies (Bossard & Peterson 2005; Harzing, 2001; Le & Kroll, 2017; Li & Scullion, 2010; Sarabi, Froese, & Hamori, 2017). In this way, these employees’ knowledge of and contribution to MNEs’ FSAs accumulate, further increasing the importance of retaining them. As a result, experienced employees working in MNEs’ subsidiaries are, in the end, the ones who play a crucial role in helping bridge the distance between home and host countries and execute MNE’s strategy globally (Rickley, 2019; Le & Kroll, 2017). This explains why over the years, and with increasing training and experience, a wage premium can be expected for such employees in MNEs compared to domestic firms. This thus leads us to expect the following:

Hypothesis 2:

All else equal, the experience wage premium is larger in MNEs than in domestic firms.

The immigrant wage gap

Besides gender and experience, we also examine MNEs’ distributional effects in host countries in terms of the different status and concomitant wage gap for foreign-born compared to locally born employees. While various terms are being used for foreign-born citizens, so-called immigrants are often categorized as “outgroup” members – as defined in social identity theory (see below) – and frequently have an associated lower social status than locals in society and, more specifically, in the workplace. This phenomenon has been widely studied, for example in the US context (Akresh, 2008; Frank, Akresh, & Lu, 2010), but recent developments, particularly the emergence of vocal populist (political) movements, seem to have increased resentment in a wide range of countries “against outside groups who allegedly pose a threat to the popular will” (Rodrik, 2018, p. 24). In combination, these factors have been shown to often lead to lower pay for immigrant workers (Frank et al., 2010, Harrison, Harrison, & Shaffer, 2019; The Economist, 2018).3

According to social identity theory, self-image is not only derived from personal identity but also from a person’s identification with groups, in which a person self-categorizes to denote her/his sense of belonging (Tajfel & Turner, 1986; Turner, 1982). A substantial body of research has shown that even trivial group categorizations (e.g., the preference for an abstract painter in Tajfel’s (1978) experiments) can lead to favoritism and more positive attitudes towards “ingroup” members; and discrimination, stereotyping, and reduced tolerance for mistakes or violations of social rules towards “outgroup” members, also within organizations (Haslam & Ellemers, 2005; Hogg & Terry, 2000; Reiche, Harzing, & Pudelko, 2015). Although identification with a group can be based on a myriad of factors, studies find that cultural background, race, and ethnicity are particularly salient cues that influence whether people categorize themselves and others in “ingroup” versus “outgroup” in an organizational context (Hogg & Terry, 2000; Jiang, Chua, Kotabe, & Murray, 2011).

Research has shown that foreign-born employees are likely categorized in the “outgroup” in organizations, and consequently perceived as less competent, trustworthy, and cooperative than locally born employees (Brewer, 1979; Harrison et al., 2019; Tajfel, 1982). For example, as found by Tsui and O’Reilly (1989), subordinates from “outgroup” demographic minorities may, on average, compared to “ingroup” subordinates (from the demographic majority), receive worse performance evaluations by “ingroup” managers. Research has also suggested that the negative effects of group categorization are especially pronounced in those organizations where the workforce is primarily composed of “ingroup” locally born employees (Brewer, 1996; Brewer, Von Hippel, & Gooden, 1999; McDonald, Keeves, & Westphal, 2018) and organizational values on how to act, dress, and interact are heavily based on local societal norms (Hogg & Terry, 2000; Reiche et al., 2015). These mechanisms are of particular relevance in the IB context. For instance, Campbell, Eden, and Miller (2012) elaborate inter alia on the related notion of empathy – i.e., the feeling resulting from an individual imagining her- or himself to be in another person’s position – to posit that smaller cultural distance, associated with higher perceived similarity, increases the likelihood of an empathetic response, which also translates into monetary contributions.

Building on the above, and given MNEs’ multi-country embeddedness, we expect that in MNE subsidiaries, foreign-born employees are less likely to be perceived as “outgroup” members than in purely domestic firms whose activities are exclusively confined to the geographic borders of their home country. This is because MNEs have been shown to actively support the creation of a firm-level “ingroup” social identity and prevent the prevalence of national culture or ethnicity-based “ingroups” (Reiche et al., 2015). MNEs need to effectively filter and interpret the knowledge that is continuously transferred to them by their headquarters (and/or other geographically dispersed subsidiaries) and adapt this knowledge to the local setting, which requires a nuanced understanding of the different contexts, languages, and cultures characterizing the multiple organizational units (Achcaoucaou, Miravitlles, & León-Darder, 2014; Figueiredo, 2011; Meyer, Mudambi, & Narula, 2011; Vora et al., 2019). Thus, the creation of a firm-level “ingroup” social identity that goes beyond geographical boundaries facilitates the absorption and adaptation of knowledge by its international subsidiaries (Reiche et al., 2015). That an MNE creates such a firm-level social identity that is less sensitive to the geographic location of its activities is expected to weaken the social differentiation between foreign-born and locally born employees in its subsidiaries, independent from their role within the organization.

Relatedly, MNEs tend to rely on a relatively more diverse workforce (Rosenzweig, 1998; Tatoglu et al., 2016) and foster the development of organizational values reflecting their pluralistic multicultural context spanning beyond the subsidiary location, as MNE subsidiaries are embedded in their headquarters’ (international) networks as well as in their (host-)country context (Reiche et al., 2015; Rosenzweig, 1998). The social identification associated with being a foreign- versus locally born employee is therefore likely to be less pronounced in an MNE subsidiary than in a purely domestic firm in which the separation between what can be labeled as “foreign” versus “local” tends to be more marked and thus a more likely source of group identification. Based on these considerations, our expectation is that, all else equal, the wage differential between immigrants and local workers is smaller in MNEs compared to domestic firms. Accordingly, we formulate the following hypothesis:

Hypothesis 3:

All else equal, the immigrant wage gap is smaller in MNEs than in domestic firms.

The Effect of Host-Country's Institutional Development

Institutional environments play a fundamental role in shaping MNEs’ strategies and behaviors (e.g., Peng, Wang, & Jiang, 2008). Traditionally, institutions have been viewed as affecting MNEs in a multitude of ways, for example in their performance (Brouthers, 2013; Chacar, Newburry, & Vissa, 2010; Dau, 2018), governance practices (Aguilera, Judge, & Terjesen, 2018), the pricing of initial public offerings (Boulton, Smart, & Zutter, 2010), CSR reporting (Kolk & Fortanier, 2013; Marano, Tashman, & Kostova, 2017), the likelihood of successfully completing acquisitions (Dikova, Sahib, & Van Witteloostuijn, 2010), and the transfer of organizational practices (Kostova & Roth, 2002). As the level of institutional development is multi-dimensional (e.g., Young, Welter, & Conger, 2018), we consider specifically those components that seem most relevant for our study: the strength of property rights protection, because it safeguards firms from spillovers (e.g., Zhao, 2006), and labor regulation, which influences firms’ freedom and flexibility in setting wages (cf. Alvaredo, Chancel, Piketty, Saez, & Zucman, 2017; Kostova, Roth, & Dacin, 2008). We discuss property rights and labor freedom consecutively below.

Property rights protection

Property rights protection signals stronger institutional environments with legal, formal guarantees and concomitant systems (Young et al., 2018). The risk of firm-specific knowledge and property being appropriated by others is highest when institutional constraints are few or weak (Berry, 2017; Pisani & Ricart, 2018; Sugathan & George, 2015; Zhao, 2006), when the quality of contract enforcement is weak (Acemoglu & Johnson, 2005) or when judicial systems are not effective (Jandhyala, 2013). In such a situation, imitative local firms can learn about an MNE’s firm-specific knowledge by hiring key employees and working with supplier firms of the MNE (Javorcik, 2004). When countries lack strong institutional protection for property rights, the risk of spillovers of firm-specific knowledge is especially high (Berry, 2017; Pisani & Ricart, 2018; Zhao, 2006). These countries are characterized by poorly conceived and ineffectively enforced employment contracts and property rights (Li & Qian, 2013; Meyer & Peng, 2016), with a need for MNEs to rely on relationships rather than institutions (Batjargal, 2007; Chen, Chen, & Huang, 2013; Meyer & Peng, 2016; Parmigiani & Rivera-Santos, 2015; Smith, Torres, Leong, Budhwar, Achoui, & Lebedeva, 2012). Employee confidentiality agreements and non-compete clauses, which are commonly used in developed countries to prevent knowledge spillovers (Cheng, Zhang, & Zhou, 2018), are therefore less likely to be an effective measure in these countries, and the need to prevent employees from leaving by building good relationships with them are thus more pressing for MNEs (cf. Berry, 2017). Based on the above, we formulate the following hypothesis:

Hypothesis 4a:

All else equal, the greater the host country’s property rights protection, the smaller the MNE wage premium.

Labor freedom

Labor freedom reflects how flexible (as opposed to rigid) a country’s labor market is, considering various aspects of its legal and regulatory framework, including standards for minimum wages, laws inhibiting layoffs, restrictions on hiring and firing employees, and the administrative and financial consequences of dismissals such as severance requirements (Alimov, 2015; Miller, Holmes, & Feulner, 2013; Young et al., 2018). Wages are strongly institutionally constrained by labor regulations. In a highly regulated labor market, MNEs thus have little discretion in setting wages and executing global compensation and wage-bargaining practices (Farndale et al., 2017). Moreover, labor regulations may also include collective bargaining agreements and bonus caps, which have been shown to drive a convergence in wages in developed countries (Alvaredo et al., 2017). Furthermore, in an environment characterized by a highly regulated labor market, stronger pressures for legitimacy lead to isomorphism, i.e., the convergence of firm behavior (Kostova et al., 2008; Meyer & Peng, 2016). In such stakeholder-mandated settings (Testa, Boiral, & Iraldo, 2018; Verbeke, 2009), firms are faced with, for example, NGO, customer and media scrutiny (Bapuji et al., 2018; Conyon, Fernandes, Ferreira, Matos, & Murphy, 2011; Kolk, 2010), and often a formal role for trade unions and/or work councils, and concomitant bargaining mechanisms (Barrows, 2017). They further limit the possibility for MNEs to set wages and thus deviate from domestic firms. Based on these considerations, we hypothesize:

Hypothesis 4b:

All else equal, the greater the host country’s labor freedom, the larger the MNE wage premium.

EMPIRICAL ANALYSIS

The Sample

To test the hypothesized relationships, we rely on the “WageIndicator”, which provides data on the individual characteristics and employment conditions of employees across a wide variety of firms, industries, and countries. The “WageIndicator” project was initiated in the Netherlands in 1999 and is managed by the WageIndicator Foundation, a coalition of AIAS, the University of Amsterdam Institute for Labour Studies, and local trade unions in 92 countries, which aims to improve labor market access and transparency. Previous studies have compared wages reported in WageIndicator samples and the distribution of samples across industries to the data of national statistics offices and found no inconsistencies (Fortanier, 2008; Tijdens, Beblavý, & Thum-Thysen, 2018). A further, extensive explanation of the dataset, which is very suitable for our purposes, and its possibilities and limitations, can be found in the Appendix. We took the most recent surveys available, which were the ones completed between January 1, 2013 and December 31, 2014.4 These surveys were either filled out online, on paper, or completed with the help of an interviewer (in countries with low literacy rates). We used data from the 13 countries with the most respondents for which data on institutional development and cultural traits were available, namely Argentina, Belgium, Brazil, Czech Republic, Germany, India, Indonesia, Mexico, The Netherlands, Russia, Slovakia, South Africa, and Ukraine. The total sample includes 40,258 employees, with each country contributing at least 2100 respondents. The employees work in 32 narrowly defined industries that include agriculture (e.g., forestry), manufacturing (e.g., pharmaceutics), and services (both private, e.g., real estate, and public sectors). Of the respondents, 58.5% were male and the average age in the sample was 36 years (SD = 11 years) at the time of completion of the survey (for a detailed description of the dataset, including information on representativeness, see the Appendix).

Methodology

Through econometric analysis, we first aimed to estimate the effect of being an employee of an MNE (versus a domestic firm) on wage to determine the existence of the MNE wage premium in our empirical setting. For estimating such effect, a multilevel mixed effects model is required as each individual employee (level one) is hierarchically nested within only one industry (level two) and country (level three) and we expect level two and level three variables to predict the means of the level one variables (Peterson et al., 2012). This approach allows us to account for observable and unobservable characteristics influencing wages that originate at the employee, industry, and country level (Briscoe & Joshi, 2017). In particular, we used the mixed command available in Stata 14, thereby allowing the random intercept and MNE coefficient to vary at the employee, industry, and country level (Andersson et al., 2014).

To determine whether employee-level variables did vary significantly between industries, we calculated the ICC. The industry ICC was 0.39, which implies that 39% of the total variance in wages is at the industry level, therefore corroborating the need to use a multilevel model that includes the industry level in our estimation. The country ICC was 0.35 – i.e., 35% of the total variance in wages is at the country level – therefore confirming the need to include a separate country level in our analysis as well. A relevant aspect of the dataset used is that individual employees are also hierarchically nested in firms (which are then nested in industries and countries). However, to ensure anonymity, the individual employee surveys are not linked to specific firms.

To establish whether the inclusion of the firm level was necessary in our estimation, we combined variables on firm characteristics (firm size, industry, country, typology – MNE versus domestic firm – and private/public sector) and thus identified groups of respondents that could potentially work for the same firm. As a result of this calculation, we obtained that the average (firm) group size was only 2.5. Moreover, when calculating the firm-level ICC based on this firm-level grouping, we obtained 0.11, thus confirming that only 11% of the total variance in wages is at the firm level. As 0.11 is lower than 0.15 – considered to be the threshold for high ICCs (Peterson et al., 2012) – this result corroborated that the inclusion of an additional firm level was not needed in our estimation. As a result, in view of the fact that in our empirical setting we are not able to identify individual firms with certainty and the ICC obtained based on the above-mentioned firm-level grouping remains low, we restricted our focus to the industry and country levels in our estimations. Further analyses, aimed at determining whether the inclusion of a firm level may influence our results (reported in the robustness checks subsection below), lend additional support to our conclusions.

We estimated a series of multilevel models to test our hypotheses. First, we constructed a baseline model with Wage as dependent variable and including only the control variables and a dummy variable (MNE) separating employees working for an MNE versus a domestic firm, so as to estimate the direct effect of MNE on wages and thus determine the existence of the MNE wage premium in our setting. We then tested three models including interaction terms between MNE and the employee’s gender (Female), level of experience (Experience), and immigrant status – thus comparing the country of birth versus the country of work (Immigrant) – to precisely test MNEs’ distributional effects as postulated in Hypotheses 1, 2, and 3. In order to test the moderating effect of the host-country level of institutional development as posited in Hypotheses 4a and 4b, we included two variables that specifically measure the level of property rights protection (Property Rights) and labor freedom (Labor Freedom) of the host country and interacted them with MNE.

To test whether the variances of the slopes of the variables in the random models were significantly different from zero, we used likelihood ratio tests. Because variances cannot be lower than zero, we followed standard practice and divided p values by two. Variance–covariance between the random effects was assumed to be unstructured, i.e., not zero (Rabe-Hesketh & Skrondal, 2008).

Variables

In this subsection, we provide a detailed description of the variables used in our analysis.

Dependent variable

For all models, our dependent variable Wage corresponds to the employee’s gross hourly wages in US dollars at purchasing power parity (PPP). The mean hourly wage (at PPP) was $12.53 with a standard deviation of $2.78. As data were skewed, we performed a log transformation to approximate a normal distribution.

Explanatory variable

We measure whether an employee is employed by an MNE with a dummy variable MNE (1 = employed by a foreign-owned subsidiary of an MNE; 0 = employed by a purely domestic firm which has neither activities in foreign countries nor any foreign ownership). This dummy variable was constructed from the WageIndicator survey question asking whether the respondent is employed by a multinational firm and thus allowed us to identify all employees who worked for an MNE as opposed to a domestic firm.

Moderating variables – distributional effects

To empirically determine whether and, if so, how the gender wage gap, experience wage premium, and immigrant wage gap vary in MNEs versus domestic firms, we use three moderating variables. Gender is measured by a dummy variable (Female: 0 = male, 1 = female); experience is measured through a combined variable of the employee’s age and work experience (factor Eigenvalue = 1.26; Cronbach’s alpha = 0.80); the immigrant status by a dummy variable (Immigrant) that scores 0 if the employee’s country of birth corresponds to the country of work and 1 if the surveyed employee is working in a country that is not her/his country of birth.

Moderating variables – host-country institutions

Following the recent study by Young et al. (2018), we draw the moderating variables from the Heritage Index of Economic Freedom (HFI), also known as the Index of Economic Freedom or EFI (Miller, Kim, & Roberts, 2019).5 There are three other commonly used measures for institutional development – i.e., the Political Constraints Index, the Corruption Perception Index, and the Worldwide Governance Indicators – but they are similar and highly correlated to the HFI as their correlation coefficients vary between 0.89 and 0.94 (Garrido, Gomez, Maicas, & Orcos, 2014). This result corroborates the notion that these indices measure the same underlying concept. The HFI consists of ten variables measuring rule of law, regulatory efficiency, open markets, and limited government; it has been used in previous research as a measure of the level of institutional development and strength of market-supporting institutions of a given country (e.g., Gubbi, Aulakh, Ray, Sarkar, & Chittoor, 2010; Kalasin, Dussauge, & Rivera-Santos, 2014; Marano, Arregle, Hitt, Spadafora, & Van Essen, 2016; Mauri, Song, & Neiva de Figueiredo, 2017; Meyer & Sinani, 2009). To operationalize our key variables of interest that allow us to test for the moderating effects of the host country’s level of property rights protection and labor freedom, we built on the two corresponding HFI variables and constructed the following variables:

Property Rights measures the degree to which a country’s legislation protects both physical and intellectual property and investments, and the degree to which these laws are enforced in case of violation. Scores are calculated by using five sub-factors regarding physical, intellectual, and land property rights, risk of expropriation, and strength of investor protection. Higher scores represent greater legal protection from theft, counterfeiting, or expropriation of firm (intellectual) property.

Labor Freedom measures the flexibility of a country’s labor market and labor laws. Scores are calculated by using seven sub-factors regarding minimum wages, flexibility in hiring and firing employees, rigidity of working hours, and the labor force participation rate. Higher scores indicate a greater flexibility for firms in setting wages and working conditions for their employees (Miller et al., 2019).

Control variables – host-country culture

The control variables measuring national culture are drawn from Hofstede’s (1980) dimensions of culture. Out of the many measures for national culture (e.g., House, Hanges, Javidan, Dorfman, & Gupta, 2004; Trompenaars, 1993), Hofstede’s dimensions are commonly used, despite the limitations (Beugelsdijk, Kostova, & Roth, 2017; Kirkman, Lowe, & Gibson, 2017), and they are suitable for our purposes. Moreover, countries’ relative (to other countries) scores have been found to be stable over time (Beugelsdijk, Maseland, & Van Hoorn, 2015), meaning that while individualism, e.g., has increased, it has done so at a similar rate across all societies. Accordingly, we include in our analysis a country’s measure of Individualism, Power distance, Uncertainty Avoidance, and Masculinity, with each dimension being measured on a scale from 0 to 100. Individualism measures the degree to which members of society see themselves as members of a tightly knit group (corresponding to a score of 0) or primarily as individuals expected to take care of only their own interests (corresponding to a score of 100). Power Distance measures the degree to which people expect and accept that power is distributed unequally, with a score of 0 indicating members of society prefer an equal distribution of power and inequalities of power need to be justified, and a score of 100 indicating members of society accept hierarchy and large power inequalities without further justification. Uncertainty Avoidance measures the degree to which members of society are comfortable in unstructured situations; a score of 0 indicates that they value practice over principles, while a score of 100 indicates that they prefer a high level of control through inflexible codes of belief, and are intolerant to unorthodox behavior and ideas. Finally, Masculinity measures the degree to which members of society prefer achievement over nurture, with a score of 0 indicating a preference for cooperation, modesty and caring, and a score of 100 indicating a preference for competition, success, heroism, assertiveness, and material rewards (Hofstede, 1980).

Control variables – host-country cultural diversity

We follow the recommendations of Kirkman et al. (2017) and Beugelsdijk et al. (2017) to also consider within-country cultural diversity to further account for cultural differences, as the homogeneity of the cultural values may differ widely. We therefore include Dow, Cuypers, and Ertug’s (2016) indices of within-country Language Diversity and Religious Diversity in our models. The scales measure the incidence of respectively a country’s main languages and religions as a proportion of the total population. These scores are then subtracted from 1, resulting in a scale from 0 to 1 where 0 represents a completely homogenous culture and 1 a completely heterogeneous one.

Control variable – host-country level of institutional development

We include the overall score of the HFI, which ranges from 0 to 100, to control for the overall level of institutional development encountered by the MNE in the focal host country (Overall HFI). Accordingly, a higher value of Overall HFI implies a higher level of institutional development and stronger market-supporting institutions (Garrido et al., 2014; Young et al., 2018).

Control variables – employee, firm, and industry levels

We include the employee’s managerial position and education, as well as firm size, and industry import and export intensity as controls in our models. Managerial position (Supervisor) is measured by the number of subordinates of the employee (where 0 = no supervising role) with wage expected to increase with the number of people supervised (Abraham, 2017; Briscoe & Joshi, 2017). The control variable Education is based on the employee’s ISCED-1997 education level and measured on a scale from 0 (no education) to 6 (upper tertiary education), with an expected higher wage for employees with higher levels of education (Márquez-Ramos, 2018). Firm Size is measured in classes ranging from 0 (self-employed without personnel) to 10 (5000 or more employees) with individuals working for larger firms expected to earn more (Mueller, Ouimet, & Simintzi, 2017).

At the industry level, we used Export Intensity and Import Intensity as control variables because the extent to which a given industry is exposed to international trade has been shown to affect the wage distribution within that industry (Greenaway & Kneller, 2007; Rodrik, 2018). We used an industry-, not a firm-level control, because trade affects wages in the entire industry through the rationalization and reallocation of labor and production of goods and services (Artuc, Chaudhuri, & McLaren, 2014; Pavcnik, Blom, Goldberg, & Schady, 2004). We measured both Export Intensity and Import Intensity as the value-to-GDP ratio (Anderson, 2005) – the ratio between the value of the industry’s exports or imports and the industry’s total value added:

Industry export (import) value was calculated on a two-digit NACE industry level. For agricultural and manufacturing industries, we retrieved trade-related data from the UN Comtrade database on a six-digit HS industry level, which was then converted to two-digit NACE level using OECD conversion tables. For services, we used the WTO’s I-TIP services database as the main source of data. We retrieved the industry value added data from the OECD STAN database for the OECD countries in the sample, and from the UN for the other (non-OECD) countries. The UN data did not specify value added data on a two-digit NACE level for the manufacturing industry, therefore export and import intensities are aggregated to one-digit NACE level for the manufacturing industries of non-OECD countries. Following standard practice in economics studies on the effect of import and export intensity, a time lag between trade-related measures and our dependent variable was introduced as wages are generally sticky and a delayed effect of trade values on wages can therefore be expected (Hall, 2005).

RESULTS

Table 1 gives an overview of all variables in our models, while Table 2 provides the correlation matrix and the descriptive statistics of the variables employed in our models. We estimated the variance inflation factors (VIF) to check for potential multicollinearity problems. The only issue encountered is the very high correlation between Individualism and Overall HFI (r = 0.84), and between Individualism and Power Distance (r = – 0.80) in our empirical setting, resulting in high VIFs. We therefore decided to drop Individualism from our model estimations. After excluding Individualism, all VIFs values were well below the severest limit of 5.3 proposed by Hair, Anderson, Tatham, and Black (1998), with the highest being 3.29 for Import Intensity.

Results of the Main Analysis

To test for the presence of an MNE wage premium in our empirical setting in light of the nested nature of our data, we estimate a multilevel mixed effects regression model analyzing the direct effect of MNE on Wage (model 1 in Table 3):

where i is the individual employee, j is the industry, k is the country and ε, ζ, and η are the error terms.

To test our Hypothesis 1, i.e., the moderating effect of Female, we estimate the following regression model (model 2 in Table 3):

Similarly, we test the moderating effects of Experience and Immigrant in models 3 and 4 in Table 3, respectively. To test our Hypothesis 4a, i.e., the moderating effect of Property Rights on the relationship between MNE and Wage, we estimate the following regression model (model 1 in Table 5):

In the same way, we test the moderating effect of Labor Freedom (Hypothesis 4b) in model 2 in Table 5.

Results on MNEs’ distributional effects

Model 1 in Table 3 corresponds to our fully specified model, including all our control and explanatory variables. As expected, we find evidence of an MNE wage premium. MNEs’ employees earn significantly more than employees of domestic firms (p value = 0.00). All else equal, our findings show that the wage premium associated with working for an MNE is 32.3% (e0.28 − 1). All control variables, except Import Intensity, are significant and have the expected signs, with, e.g., highly educated employees earning more than lower educated ones on average. Our findings show that industry Import Intensity is not related to Wage in our sample. The positive (i.e., non-zero) variance of the constants at industry and country levels corroborate that industry and country characteristics have a (expected) significant (p value = 0.00) effect on wages and the relationship between MNE and Wage.

Models 2–4 test the moderating effects of Female, Experience, and Immigrant on the relationship between MNE and Wage. First, we note that our results show evidence of both a gender wage gap and experience wage premium in our empirical setting as Female’s coefficient is negative and significant while the one of Experience is positive and significant. There is instead no evidence of an immigrant wage gap as Immigrant’s coefficient is not significant. With respect to the moderations tested, only the interaction term associated with Experience is significant (and positive; p value = 0.00), while the other two associated with Gender and Immigrant are not. Thus, while we find empirical evidence in support of our second hypothesis, our first and third are not supported.

Results on MNEs’ distributional effects in developed versus developing countries

One possible explanation for the above-mentioned result may be that the interactions are antipodal at opposite levels of (institutional) development, and therefore not significantly different from zero on average. We therefore split our sample based on the level of development of the host country, distinguishing between developed and developing countries in our sample (based on the World Bank country classification)6 and repeated the analysis; its results are shown in Table 4.

Models 1 and 2 in Table 4 test Female’s moderating effect on the relationship between MNE and Wage in developing and developed countries, respectively. The results indeed show the interaction is antipodal: there is a significant (p value = 0.05) and negative interaction in developing countries, while the interaction is also significant (p value = 0.03) but positive in developed countries. Thus, while our Hypothesis 1 predicted the gender wage gap to be smaller in MNEs, our results show empirical support for our postulation only in developed countries. Contrary to our expectations, in developing countries the gender wage gap instead turns out to be larger in MNEs. Models 3 and 4 empirically validate that the moderating effect of Experience on the relationship between MNE and Wage is positive and significant (p value = 0.01 in developing; p value = 0.03 in developed) in both country groupings, thereby showing support for our Hypothesis 2. Models 5 and 6 show that there is a significant (p value = 0.09) and positive moderating effect of Immigrant on the relationship between MNE and Wage only in developed countries (it is non-significant in developing countries). Thus, we find evidence in support of our Hypothesis 3 only in our developed-country empirical setting.

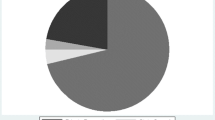

Given that our sample is large, the likelihood of finding statistically significant coefficients is high (Ziliak & McCloskey, 2004). Thus, it is of particular relevance for the purpose of our study to offer an explicit discussion and interpretation of the effect sizes of relevant estimated coefficients (Bettis, Ethiraj, Gambardella, Helfat, & Mitchell, 2016; Meyer, Van Witteloostuijn, & Beugelsdijk, 2017). To do so, we plotted the results of our interaction tests in Figure 1 below. Specifically, we estimated the average marginal effects of Female, Experience, and Immigrant on the full range of Wage for both MNEs and domestic firms and then accordingly plotted the gender wage gap, experience wage premium, and immigrant wage gap (only for developed countries).

MNEs’ distributional effects in developing versus developed countries. (1) To make the interpretation more informative, we transformed the marginal effects calculated – given that the dependent variable Wage corresponds to the natural logarithm of the employee’s hourly wage at PPP – to be able to compute the average wage gap/premium in US dollars for each case as shown in the figure. (2) The immigrant wage gap for developing countries is not shown as the moderating effect of Immigrant on the relationship between MNE and Wage is not significant in developing countries (see model 5 in Table 4). (3) The gender wage gap is the difference between Wage for females and males. (4) The experience wage premium is the difference between Wage at − 1 and + 1 standard deviation of Experience. Given that the variable Experience is continuous, we also calculated the marginal effects at the minimum and maximum values. The results obtained corroborate the significance of the interaction – e.g., for developing countries the experience wage premium in domestic firms is $13.6 while it goes up to $31.66 in MNEs. (5) The immigrant wage gap is the difference between Wage for immigrants and non-immigrants.

As shown in Figure 1, the gender wage gap is ($0.55) larger in domestic firms than in MNEs in developed countries – i.e., nearly 25% larger as it goes from − $2.23 to − $2.78. However, in developing countries we obtain the opposite result as the (substantially) larger gender wage gap is found for MNEs and not for domestic firms (− $2.53 versus − $1.20). Figure 1 also shows that in both developed and developing countries the experience wage premium is larger in MNEs than domestic firms, being largest for MNEs based in developed countries ($6.93). Finally, in relation to the immigrant wage gap in developed countries, we find that there is a very small wage difference in domestic firms ($0.21), while for MNEs there is evidence in support of an immigrant wage premium ($1.72). Overall, these results corroborate the economic relevance of the moderations obtained.

Results on the moderating roles of host-country’s institutional development

Models 1 and 2 in Table 5 test the moderating effects of Property Rights and Labor Freedom on the relationship between MNE and Wage. Model 1 shows the negating moderating effect of Property Rights, therefore empirically validating Hypothesis 4a in our setting; Model 2 shows instead no significant interaction when focusing on Labor Freedom, thus failing to validate Hypothesis 4b. This result suggests that MNEs’ wages tend to be more sensitive to the security of property rights in a given host environment rather than to the specific flexibility of its labor regulations.

As for our previous set of findings, we plotted the results of our interaction tests in Figure 2, which shows the MNE wage premium as calculated based on the average marginal effects of MNE on the full range of Wage at − 1 and + 1 standard deviations of Property Rights. Figure 2 thus helps to visualize the economically significant impact of Property Rights on the underlying relationship between our main predictor MNE and Wage, and further corroborates our expectation that in the presence of stronger institutions supporting the protection of property rights, the MNE wage premium is significantly smaller.

MNE wage premium and its interaction with host-country’s level of property rights protection. (1) We transformed marginal effects as detailed in footnote 1, Figure 1, to make their interpretation more informative. (2) The moderating effect of Labor Freedom on the relationship between MNE and Wage is not significant (see model 2 in Table 5). Hence the figure is solely focused on the moderating effect of Property Rights. (3) We calculated the MNE wage premium based on the average marginal effects of MNE on the full range of Wage at − 1 and + 1 standard deviations of Property Rights (corresponding to a low and a high level of Property Rights, respectively). Given that the variable Property Rights is continuous, we also calculated the marginal effects at the minimum and maximum values. The results obtained corroborate the significance of the interaction as the MNE wage premium at the highest level of property rights protection is $1.07, while it goes up to $3.95 at the lowest level of property rights protection.

Overall, the results we obtained when distinguishing between developed and developing countries as well as the ones resulting from our analysis on the moderating role of host-country’s level of property rights protection emphasize the relevance of focusing on the specificities and heterogeneities of host-country locations. Our findings showing that MNEs’ distributional effects in terms of gender, experience, and immigrant status all differ by level of institutional development corroborate the role of institutional development on MNEs’ behavior. Moreover, the analysis reveals that the MNE wage premium is particularly sensitive to changes in property rights protection – as shown in Figure 2, the MNE wage premium goes from approximately $1.00 to slightly over $3.50 when property rights move from high to low. This further corroborates the importance of focusing on the safeguarding of property rights, especially in the context of developing countries that need to upgrade their institutional environments on this point (cf. Brandl, Darendeli, & Mudambi, 2019).

Results of the Post Hoc Analysis

As a post hoc analysis, we examined the interplay between MNEs’ distributional effects and the influence of host-country institutions. Thus, we estimated mixed effects models to test for three-way interactions – e.g., for the gender wage gap and the effect of Property Rights, we included the following interaction terms: MNExFemale, MNExProperty Rights, FemalexProperty Rights, and MNExFemalexProperty Rights – and then calculated the average marginal effects of MNE on Wage. This allowed us to compute the average gender wage gaps in domestic firms and MNEs at − 1 and + 1 standard deviations of Property Rights (thus corresponding to a high and low level of Property Rights, respectively). We repeated the same analysis for the experience wage premium and the immigrant wage gap and for each of the three did the same calculations for Labor Freedom. Table 6 shows the results obtained, with highlighted in bold the differences between domestic firms and MNEs that are statistically significant at the 0.05 level.

The findings show that while for domestic firms the gender wage gap oscillates between − $1.69 and − $2.43 across the different types of host-country institutions, we observe greater variation when looking at MNEs. Specifically, the gender wage gap is smallest (− $1.26) in MNEs based in countries characterized by a high rigidity of the labor market, while it is largest (− $4.35) in country contexts in which labor flexibility is high. These findings suggest that MNEs are more sensitive (and not always in a virtuous way) to the local institutional environment when it comes to reducing wage differences between males and females. Looking at the results for the experience wage premium, we find that MNEs pay higher wages than domestic firms independent from the host-country institutional environments. Having said that, the greatest experience wage premium that we observed is again in correspondence to a high flexibility of the labor market ($9.86). This is the likely consequence of the fact that in such environments MNEs have more room for maneuver in the hiring process and performance appraisal of their employees, and they are not bound to strong union-driven collective bargaining agreements for existing employees. Thus, they have greater opportunities to better remunerate their more experienced employees. Moving to MNEs’ distributional effects concerning the immigrant status of their employees, the findings reported in Table 6c show that the immigrant wage gap turns into a premium under certain host-country institutional conditions, with the highest premium ($1.78) observed in MNEs based in countries with high property rights protection.

In Table 7 we evaluated the presence of region and industry effects and thus analyzed MNEs’ distributional impacts relative to employees’ gender, experience, and immigrant status distinguishing between three key regions represented in our sample (i.e., Asia, Latin America, and Europe). We then repeated the same analysis for the three main industrial groupings included in our empirical setting. The results provided in Table 7 show that the gender wage gap is largest in MNEs in Latin America (where traditional gender roles prescribe women to fulfill a private, family role as discussed by e.g., Hermans et al., 2017) while it is lowest in Asia (although the three-way interaction is not significant). As for the industry groupings analyzed, the largest gap is again observed in MNEs, specifically the ones active in agriculture, manufacturing, and construction.