Abstract

This paper aims to assess banking stability and its determinants in Portugal during the period of 2010—2019. The empirical study starts with the construction of an index, which reflects the aggregated banking stability index (ABSI), using financial soundness indicators (FSI) over the period of 2010–2019, on a quarterly basis. The ABSI is then used as the dependent variable to assess the determinants of the Portuguese banking stability. The independent variables were classified into macroeconomic and financial variables, respectively, and the ARMA conditional least square method was considered. The findings suggest an improvement in stability since 2017, and point to significant macroeconomic early warning indicators, such as the growth rate of the consumer price index (%ΔCPI), as well as financial ones, such as the ratio of the second money multiplier (M2) to gross domestic product (GDP). This paper contributes to the banking stability literature by examining the Portuguese case for the first time. The results put in evidence that both macroeconomic and financial indicators can be useful predictors of banking instability.

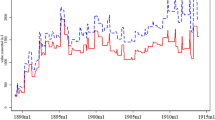

Source: Eurostat

Similar content being viewed by others

Notes

Which has been gaining greater influence in the economy. According to Haldane et al. [37] the “growth in the financial sector value added has been more than double that of the economy as a whole since 1850” in the U.K., similar trend were observed for the U.S. and Europe.

For more information, see box 4.1 [5].

For more information, see box 4.1 [6].

For more information see box 3 [10].

For more information see box 2 [12].

Where C stands for capital adequacy, A for asset quality, M for management soundness, E for earnings, and L for liquidity.

A level indicator, a rate of change indicator, and a correlation indicator.

The Monetary Conditions Index were previously developed by central banks to assess monetary policy transmission in the 1990s.

Type I errors represent the probability of failing to signal a crisis, whereas Type II errors are the probability of falsely signalling a crisis.

Insolvency risk, credit risk, profitability, liquidity risk, and currency risk.

The Ifo index is an index developed by the Ifo institute for Economic Research, which measures expectations based on a survey of manufacturers, builders, wholesalers, and retailers.

This restriction was highly influenced by the sovereign debt crisis.

Results available from the authors upon request.

Results available from the authors upon request.

"Results available from the authors upon request.

A negative skewness indicates a left-sided tail, which means a larger number of observations below the average.

References

Albulescu, C.T. 2010. Forecasting the Romanian financial system stability using a stochastic simulation model. Romanian Journal of Economic Forecasting 13 (1): 81–98.

Banco de Portugal (2000). Official Bulletin.

Banco de Portugal (2004). Financial Stability Report.

Banco de Portugal (2006). Financial Stability Report.

Banco de Portugal (2007). Financial Stability Report.

Banco de Portugal (2008). Financial Stability Report.

Banco de Portugal (2010). Official Bulletin.

Banco de Portugal (2011). PORTUGAL EU / IMF FINANCIAL ASSISTANCE PROGRAMME 2011- 2014

Banco de Portugal (2012). Financial Stability Report - November.

Banco de Portugal (2014). Financial Stability Report - November.

Banco de Portugal (2015). Financial Stability Report - November

Banco de Portugal (2016). Financial Stability Report - May.

Banco de Portugal (2019). Official Bulletin.

Basel Committee on Banking Supervision International (2005). Convergence of Capital Measurement and Capital Standards - a revised framework. In Bank for International Settlements.

Basel Committee on Banking Supervision International. (2010). Basel III: A global regulatory framework for more resilient banks and banking systems. In Bank for International Settlements.

Bats, J., and Houben, A. (2017). Bank-based versus market-based financing: implications for systemic risk. In De Nederlandsche Bank Working Papers (No. 577).

Bekaert, G., M. Hoerova, and M. Lo Duca. 2013. Risk, uncertainty and monetary policy. Journal of Monetary Economics 60 (7): 771–788.

Betz, F., S. Oprică, T.A. Peltonen, and P. Sarlin. 2014. Predicting distress in European banks. Journal of Banking and Finance 45: 225–241.

Black, L., R. Correa, X. Huang, and H. Zhou. 2016. The systemic risk of European banks during the financial and sovereign debt crises. Journal of Banking & Finance 63: 107–125.

Borio, C., and Drehmann, M. (2009). Assessing the risk of banking crises–revisited. BIS Quarterly Review, (March), 29–46.

Borio, C., and Lowe, P. (2002a). Assessing the risk of banking crises. BIS Quarterly Review, (December), 43–54.

Borio, C., and Lowe, P. (2002b). Asset prices, financial and monetary stability: exploring the nexus. In BIS Working Papers (No. 114).

Cheang, N., and I. Choy. 2011. Aggregate financial stability index for an early warning system. Macao Monetary Research Bulletin 21 (October): 27–51.

Christensen, I., and F. Li. 2014. Predicting financial stress events: A signal extraction approach. Journal of Financial Stability 14: 54–65.

Davis, E.P., and D. Karim. 2008. Comparing early warning systems for banking crises. Journal of Financial Stability 4 (2): 89–120.

Demirgüç-Kunt, A., and E. Detragiache. 1998. The determinants of banking crises in developing and developed countries. IMF Staff Papers 45 (1): 81–109.

Demirgüç-Kunt, A., and Detragiache, E. (2005). Cross-country empirical studies of systemic bank distress: a survey. In IMF Working Papers 05/96.

Diamond, D.W. 1984. Financial Intermediation and Delegated Monitoring. The Review of Economic Studies 51 (3): 393–414.

Diamond, D.W., and P.H. Dybvig. 1983. Bank runs, deposit insurance, and liquidity. Journal of Political Economy 91 (3): 401–419.

Dumičić, M. 2016. Financial Stability Indicators – The Case of Croatia. Journal of Central Banking Theory and Practice 5 (1): 113–140.

European Central Bank. (2019). Financial Stability Review - May.

Gadanecz, B., and K. Jayaram. 2009. Measures of financial stability – a review. IFC Bulletin No 31: 365–380.

Gaytán, A., and Johnson, C. (2002). A review of the literature on early warning systems for banking crises. In Central Bank of Chile Working Papers (No. 183).

Gersl, A., and Hermanek, J. (2006). Financial Stability Indicators: Advantages and Disadvantages of their Use in the Assessment of Financial System Stability. Czech National Bank Financial Stability Review.

Gramlich, D., G.L. Miller, M.V. Oet, and S.J. Ong. 2010. Early warning systems for systemic banking risk: Critical review and modeling implications. Banks and Bank Systems 5 (2): 199–211.

Gulija, B., Russo, C., Singh, D. (2022). ECB Significant-Bank Risk Profile and COVID-19 Crisis Containment: What Approach in the Transitioning Phase? International Association of Deposit Insurers. IADI Sponsored Paper Series No. 2.

Haldane, A., Brennan, S., and Madouros, V. (2010). What is the contribution of the financial sector: Miracle or mirage? In The Future of Finance: The LSE Report.

Hanschel, E., and Monnin, P. (2005). Measuring and forecasting stress in the banking sector: evidence from Switzerland. BIS Working Papers, 22(April), 441–449.

Hardy, D.C., and C. Pazarbaşioğlu. 1999. Determinants and leading indicators of banking crises: Further evidence. IMF Staff Papers 46 (3): 247–258.

Hoggarth, G., P. Jackson, and E. Nier. 2005. Banking crises and the design of safety nets. Journal of Banking Finance 29 (1): 143–159.

Hutchison, M., and K. McDill. 1999. Are all banking crises alike? The Japanese experience in international comparison. Journal of the Japanese and International Economies 13 (3): 155–180.

Illing, M., and Y. Liu. 2006. Measuring financial stress in a developed country: An application to Canada. Journal of Financial Stability 2 (3): 243–265.

International Monetary Fund. (2006). Financial soundness indicators: compilation guide.

International Monetary Fund. (2019). Financial soundness indicators: compilation guide.

Jahn, N., and Kick, T. (2012). Determinants of Banking System Stability: A Macro-Prudential Analysis. Finance Center Münster, University of Münster

Kaminsky, G.L., and C.M. Reinhart. 1999. The twin crises: The causes of banking and balance-of-payments problems. American Economic Review 89 (3): 473–500.

Kaminsky, G. (1999). Currency and banking crises: the early warnings of distress.

Kliesen, K.L., M.T. Owyang, and E.K. Vermann. 2012. Disentangling diverse measures: A survey of financial stress indexes. Federal Reserve Bank of St Louis Review 94 (5): 369–397.

Kočišová, K. (2014). Banking Stability Index : A Cross-Country Study Banking Stability Index : A Cross-Country Study. Proceedings of the 15th International Conference on Finance and Banking, 197–208. Prague, Czech Republic.

Lainà, P., J. Nyholm, and P. Sarlin. 2015. Leading indicators of systemic banking crises: Finland in a panel of EU countries. Review of Financial Economics 24: 18–35.

Misina, M., and G. Tkacz. 2009. Credit, asset prices, and financial stress. International Journal of Central Banking 5 (4): 95–122.

Nelson, W. R., and Perli, R. (2005). Selected indicators of financial stability. 4th Joint Central Bank Research Conference: Risk Measurement and Systemic Risk, 344–373. Frankfurt am Main: European Central Bank Frankfurt am Main, Germany.

Pedro, C.P., J.J.S. Ramalho, and J.V. da Silva. 2018. The main determinants of banking crises in OECD countries. Review of World Economics 154 (1): 203–227.

Petrovska, M., and E.M. Mihajlovska. 2013. Measures of financial stability in Macedonia. Journal of Central Banking Theory and Practice 2 (3): 85–110.

Puddu, S. (2013). Optimal weights and stress banking indexes (No. 13–02). Neuchâtel: IRENE Working Paper.

Segoviano, M. A. (2006). The Consistent Information Multivariate Density Optimizing Methodology. In Financial Markets Group, Discussion Paper (No. 557).

Segoviano, M. A., and Goodhart, C. (2009). Banking Stability Measures. In Financial Markets Group Working Papers.

Shijaku, G. 2016. Banking stability and its determinants: A sensitivity analysis on methodological changes. Bank of Albania, The Economic Review 2016 (H1): 18–30.

Van den End, J. W. (2006). Indicator and Boundaries of Financial Stability. In De Nederlandsche Bank Working Papers (No. 97).

Wong, J., Wong, T. C., and Leung, P. (2007). A Leading Indicator Model of Banking Distress-Developing an Early Warning System for Hong Hong and Other EMEAP Economies. In Hong Kong Monetary Authority Working Papers (No. 22).

Acknowledgements

The authors acknowledge financial Support from FCT—Fundação para a Ciência e Tecnologia (Portugal), national funding through research grant UIDB/05069/2020.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Garcia, M.T.M., Abreu, S.R. Banking stability determinants: evidence from Portugal. J Bank Regul (2023). https://doi.org/10.1057/s41261-023-00222-x

Accepted:

Published:

DOI: https://doi.org/10.1057/s41261-023-00222-x

Keywords

- Banking system stability

- Time series regression

- Stability index

- Financial soundness indicators

- Macroprudential indicators

- Portugal