Abstract

Using Granger causality test, we investigate the lead-lag relation between volume and volatility in 14 Chinese ADRs and those of their underlying H-shares. We consider volume as denoting liquidity. We model and forecast volatility using a TARCH model and find evidence of leverage effect and persistence in volatility among the ADRs and H-shares. We document significant but asymmetric bidirectional Granger causality between volume and volatility in ADRs and their underlying H-shares. The asymmetry seems to have declined in recent years, during the latter half of the sample period. We conclude that the relation between liquidity denoted by volume and volatility are time- varying and asymmetric between ADRs and their underlying H-shares.

Similar content being viewed by others

Notes

For a comprehensive, albeit a little outdated survey of the literature on volume-volatility relations including causality, please refer to Chen and Daigler (2009). Briefly, on causality, the Sequential Information Arrival hypothesis proposed by Copeland (1976, 1977) and Jennings et al. (1981) suggest a positive bidirectional causal lead lag relation between trading volume and volatility. Using data on broad US markets, Hiemstra and Jones (1994), Brooks (1998) find causality between trading volume and volatility, albeit the direction of such causality is mixed. Lee and Rui (2002) find expected trading volumes Granger cause return variances in USA, UK, and Japan.

As of September 2010, there are 51 Chinese ADRs listed on NYSE but only 14 of them have underlying H-shares listed on the Stock Exchange of Hong Kong (SEHK). The seemingly low sample size is dictated by the actual number of dual-listing Chinese H-shares and is common in published research on the subject (please refer to Xu and Fung 2002; Kutan and Zhou 2006; Poshakwale and Aquino 2008; He and Yang 2012; Dey and Wang 2012, 2021).

Due to the unavailability of current data since its delisting in 2021, we could not update China Unicom (CHU) sample and leave the pre-updated sample ending in 2012.

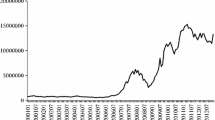

We follow Dey and Wang (2021) and detrend volume with a linear and a quadratic time trend filter.

We compare TARCH (1,1) and EGARCH (1,1) results and find little differences between the parameter estimates. The likelihood ratios of both models reported in Table 3 show that for most securities TARCH (1,1), values are slightly higher than those related to EGARCH (1,1). We do not report comparative LL estimates corresponding to TARCH and EGARCH models in Table 4.

References

Admati, Anat, and Paul Pfleiderer. 1988. A theory of intraday patterns: volume and price variability. Review of Financial Studies 1: 3–40.

Al-Ajmi, J. 2017. Trading volume and volatility in the Boursa Kuwait. British Accounting Review 10: 0890–8389.

Alusubaie, A., and M. Najand. 2009. Trading volume, time-varying conditional volatility, and asymmetric volatility spillover in the Saudi stock market. Journal of Multinational Financial Management 19: 169–181.

Avramov, D., T. Chordia, and A. Goyal. 2006. The impact of trades on daily volatility. Review of Financial Studies 19: 1241–1277.

Babikir, A., R. Gupta, C. Mwabutwa, and E. Owusu-Sekyere. 2012. Structural breaks and GARCH models of stock return volatility: The case of South Africa. Economic Modeling 29: 2435–2443.

Bajo, E. 2010. The information content of abnormal trading volume. Journal of Business Finance and Accounting 37: 950–978.

Bedowska-Sojka, B., and A. Kliber. 2019. The causality between liquidity and volatility in the Polish stock market. Finance Research Letters 30: 110–115.

Bollerslev, T., R. Chou, and K. Kroner. 1992. ARCH modeling in finance: A review of the theory and empirical evidence. Journal of Econometrics 52: 5–59.

Bose, S. and H. Rahman. 2015. Examining the relationship stock return volatility and trading volume: New evidence from an emerging market. Applied Economics 47: 1899–1908.

Brooks, C. 1998. Predicting stock index volatility: Can market volume help?. Journal of Forecasting 17: 59–80.

Brown, Jeffrey, D. Crocker, and S. Forester. 2009. Trading volume and stock investments. Financial Analyst Journal 65: 67–84.

Chen, Z., and R. Daigler. 2009. An examination of the complementary volume-volatility information theories. Journal of Futures Markets 28: 963–992.

Chiang, T., Z. Qiao, and W.K. Wong. 2010. New evidence on the relation between return volatility and trading volume. Journal of Forecasting 29: 502–515.

Chuang, W., H. Liu, and R. Susmel. 2012. The bivariate GARCH approach to investigating the relation between stock returns, trading volume, and volatility. Global Finance Journal 23: 1–15.

Copeland, T. 1976. A model of asset trading under the assumption of sequential information arrival. Journal of Finance 31: 1149–1168.

Copeland, T.E. 1977. A probability model of asset trading. Journal of Financial and Quantitative Analysis 12: 563–578.

Darrat, A.F., S. Rahman, and M. Zhong. 2003. Intraday trading volume and return volatility of the DJIA stocks: A note. Journal of Banking & Finance 27: 2035–2043.

Dey, M.K., and C. Wang. 2021. Volume decomposition and volatility in dual-listing H-shares. Journal of Asset Management 22: 301–310.

Dey, M. and C. Wang. 2012. Return spread and liquidity: Evidence from Hong Kong ADRs. Review of International Business and Finance 26: 164–180.

Girard, E., and R. Biswas. 2007. Trading volume and market volatility: Developed vs. emerging stock markets. Financial Review 42: 429–459.

Glosten, L.R., R. Jagannathan, and D.E. Runkle. 1993. On the relation between the expected value and the volatility of the nominal excess return on stocks. Journal of Finance 48: 1779–1801.

Gold, Nathan, Qiming Wang, Melanie Cao, and Huaxiong Huang. 2017. Liquidity and volatility commonality in the Canadian stock market. Mathematics-in-Industry Case Studies 8 (1): 1–20.

Harris, M., and A. Raviv. 1993. Differences of opinion makes a horse race. Review of Financial Studies 6: 473–506.

Hautsch, N., and V. Jeleskovic. 2009. High frequency volatility and liquidity. In Applied quantitative finance, 2nd ed, ed. W. Hardle, N. Hautsch, and L. Overbeck. Springer.

He, H. and J. Yang. 2012. Day and night returns of Chinese ADRs. Journal of Banking and Finance 36: 2795–2803.

Hiemstra, C., and J. Jones. 1994. Testing for linear and non-linear Granger causality in the stock price-volume relationship. Journal of Finance 49: 1639–1664.

Holden, C., and A. Subrahmanyam. 1992. Long lived private information and imperfect competition. Journal of Finance 47: 247–270.

Hsieh, H.C. 2014. The causal relations between stock returns, trading volume, and volatility: Empirical evidence from Asian listed real estate companies. International Journal of Managerial Finance 10: 218–240.

Jennings, R., L. Starks, and J. Fellingham. 1981. An equilibrium model of asset trading with sequential information arrival. Journal of Finance 36: 143–161.

Kutan, A. and H. Zhou. 2006. Determinants of return and volatility of Chinese ADRs at NYSE. Journal of Multinational Financial Management 16: 1–15.

Lee, B.S., and O.M. Rui. 2002. The dynamic relationship between stock returns and trading volume: Domestic and cross-country evidence. Journal of Banking and Finance 26: 51–78.

Naik, P., R. Gupta, and P. Padhi. 2018. The relationship between stock market volatility and trading volume: Evidence from South Africa. Journal of Developing Areas 52: 99–114.

Ong, M. 2015. An information theoretic analysis of stock returns, volatility and trading volume. Applied Economics 47: 3891–3906.

Poshakwale, S., and K. Aquino. 2008. The dynamics of volatility transmission and information flow between ADRs and their underlying stocks. Global Finance Journal 19: 187–201.

Rashid, A. 2007. Stock prices and trading volume. Journal of Asian Economics 18: 595–612.

Sabbaghi, O. 2011. Asymmetric volatility and trading volume: The G5 evidence. Global Finance Journal 22: 169–181.

Xu, X. and H. Fung. 2002. Information flows across markets: Evidence from China backed stocks dual listed in Hong Kong and New York. Financial Review 37: 563–588.

Author information

Authors and Affiliations

Corresponding authors

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Dey, M.K., Wang, C. Asymmetric volume volatility causality in dual listing H-shares. J Asset Manag 23, 419–428 (2022). https://doi.org/10.1057/s41260-022-00275-z

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41260-022-00275-z