Abstract

Studies show the inconclusive results regarding the relation between corporate social and environmental responsibility (CSR and CER) and expected returns. We argue that the reason for these mixed results is that the sustainability premium (i.e., the return difference of high-intensity minus low-intensity CSR/CER firms) is time-varying and correlated with investor sentiment. We find that high-intensity CSR (CER) firms have a monthly excess return that is 0.70 (0.88) p.p. higher following periods of low investor sentiment as compared to periods of high sentiment. Given that standard pricing factors cannot fully explain the abnormal returns caused by investor sentiment on the sustainability premium, we propose a sustainability pricing factor, estimated as the second principal component of portfolios sorted based on environmental and social variables, which corrects this mispricing.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Whether social and environmental responsibility have a positive, neutral, or negative effect on corporate financial performance (CFP)Footnote 1 has become a key question in finance, economics, and management. There are reasons to expect each of the three possibilities, and the empirical results are mixed.Footnote 2

In this study, we reassess the corporate social performance (CSP)-CFP relation by including an environmental dimension as well as a time dimension. First, by treating the corporate environmental responsibility (CER) investments as an integral area rather than as a subset of corporate social responsibility (CSR) studies, we expect to understand better the impact of environmental practices on firms’ expected returns. Furthermore, by including a time dimension, we aim to understand the dynamic relation between social and environmental responsibility investments and financial performance over time. In our view, the CSP-CFP nexus should be analyzed differently from a short-term and a long-term perspective.

By examining this relation from the shareholder’s view, we predict that the abnormal returns should be indistinguishable from zero in the long term. This prediction is consistent with the theory of the firm, which states that in the long term, in a competitive market, the economic profit of investments should be equal to zero.Footnote 3 That CSR activities have a neutral impact on financial performance is also in line with McWilliams and Siegel (2001), who argue that each firm should have an ideal level of CSR. We add to this argument that this ideal level is not static but should vary according to market conditions.

In the short term, however, we predict that CSR activities affect the firms’ expected returns conditional on investor sentiment. Our prediction is driven by the evidence that CSR activities seem to make the stocks costly to arbitrage and difficult to value. Among the studies that show that such activities lead to the costlier arbitrage, Becchetti et al. (2015) find evidence that the idiosyncratic risk of firms with high CSR intensity is higher than firms with lower intensity because of the budget constraint (i.e., if firms invest more in CSR activities, they should be less flexible in responding to productivity shocks). This is important evidence regarding arbitrage costs since idiosyncratic volatility may be the most important deterrent for arbitrage activity in the cross section (Pontiff 2006; Jacobs 2015; Stambaugh et al. 2015). Furthermore, CSR and CER practices are often difficult to measureFootnote 4 and prone to window-dressing activities undertaken by the firms, increasing the proportion of intangible assets and making the valuations more subjective.

To describe the impact of CSR/CER investments on the firm valuation and arbitrage costs, Fig. 1 displays the fitted values and the confidence intervals of pooled regressions of intangible assets and idiosyncratic risk on CSR and CER scores. The regressions include firm and year fixed effects. Consistent with the view that CSR/CER investments lead to more subjective valuations, we find that CSR or CER scores positively correlate with intangible assets. Furthermore, the positive correlation of variations of CSR/CER investments on the idiosyncratic volatility confirms the results from Becchetti et al. (2015) and is further evidence that CSR/CER firms tend to be harder to arbitrage.Footnote 5

By combining the evidence that CSR/CER scores seem to be correlated with variables making a firm difficult to value and costlier to arbitrage, with the results from Baker and Wurgler (2006, p. 1645),Footnote 6 who show that “a wave of investor sentiment should have larger effects in firms whose valuations are highly subjective and difficult to arbitrage,” we hypothesize that firms with high CSR/CER intensity are more prone to investor sentiment in the short term. Thus, we predict that following periods with high (low) investor sentiment, firms with a higher intensity of CSR and CER have lower (higher) subsequent returns because these firms tend to be costly to arbitrage and difficult to value, which makes it more difficult to correct the overpricing (underpricing) caused by the high (low) level of investor sentiment.

These figures show the fitted values and the confidence intervals (CI) from regressions including time and firm fixed effects. Figure a, b shows the results from a regression of intangible assets on the CSR (CER) score. Figure c, d shows the results of a regression of idiosyncratic volatility on the CSR (CER) score. Intangible assets is estimated as one minus the result from the property, plant and equipment—total (gross) scaled by total assets. Idiosyncratic volatility is estimated as one minus the r-squared from the regression of a stock’s returns in excess of the one-month Treasury bill rate on the Fama and French (2015) five-factor model estimated monthly using the previous 60 monthly returns. (We require a minimum of 24 months). Our sample covers annual observations from 1992 to 2016

In order to test the relation of CSR/CER and expected returns over time, we propose two proxies for the sustainability premium: the CSR premium and the CER premium. We estimate the CSR (CER) premium by forming zero-investment portfolios sorted on CSR (CER) scores. We start our analysis by testing whether the sustainability premium is positive, neutral, or negative in the long term. Our results show that the excess and abnormal returns of the CSR premium and the CER premium are indistinguishable from zero. These results are in line with our prediction that CSR and CER activities result in a neutral impact on financial performance in the long term.

We then test whether there is a time-varying impact at the investor sentiment level on subsequent CSR and CER premia in the short term. We find a negative and statistically significant relation between lagged investor sentiment and CSR/CER premia in all tests. These results are also robust at the firm level, where in periods with a low level of sentiment, we find a positive coefficient in the CSR/CER scores predicting returns.

To measure the magnitude of the effect of investor sentiment on subsequent returns of portfolios sorted on CSR and CER scores, we estimate the returns of portfolios following high and low investor sentiment.Footnote 7 In the same way as firms with more subjective valuations and costlier to arbitrage, the CSR premium has a positive average monthly return of 0.26% following periods with a low level of investor sentiment. In contrast, the CSR premium has a negative average return of − 0.44% following periods with a high investor sentiment level. Thus, the difference in returns for the CSR premium following low and high investor sentiment is, on average, 0.70 percentage points per month, statistically significant at the 0.01 level. This difference is even more pronounced for the CER premium, with a statistically significant average monthly return of 0.88 percentage points.

Finally, we evaluate whether the relation between the CSR/CER premia and investor sentiment is driven by mispricing or exposure to standard pricing factors. To do so, we estimate abnormal returns for the CSR and CER premia controlling for the Sharpe (1964), Lintner (1965), and Black (1972) (SLB) model, the Fama and French (1993) (F&F3) three-factor model, and the Fama and French (2015) (F&F5) five-factor model. For the CSR premium, the difference in abnormal returns following periods with high and low investor sentiment is significant after controlling for the SLB model and the F&F3 model, but they are indistinguishable from zero after we control for the F&F5 model.

For the CER premium, however, the results are striking. The difference in abnormal returns following high and low investor sentiment is significant even after controlling for the F&F5 model. Moreover, we find that the CER premium has a monthly average abnormal return of 0.47% following periods with a low investor sentiment. Thus, our results provide evidence that environmental responsibility investments are either difficult to value (which leads to mispricing) or can capture state variables that are not considered in the standard asset pricing models.

Since the standard asset pricing models are not able to fully explain the impact of investor sentiment in subsequent returns on CER investments, we construct a sustainability factor as the second component of twelve portfolios sorted based on six qualitative issue areas: environmental responsibility, community, human rights, employee relations, diversity, and product. Our results show that a sustainability factor can explain the impact of investor sentiment in CSR, as well as the CER premia since, after controlling for this factor, the level of investor sentiment becomes indistinguishable from zero to explain subsequent returns on these premia.

This paper contributes to the literature in several ways. First, we show that the investor sentiment is an important driver to solve the CSP and CFP relation puzzle. By showing that investor sentiment matters when analyzing CSP-CFP relation, we find an essential reason for the mixed results in previous studies. For instance, El Ghoul et al. (2011) find that CSR leads to a decrease in expected returns by using a sample between 1992 and 2007, where most of the time, the level of investor sentiment is high. On the other hand, Lins et al. (2017) show that during periods of crisis, the expected returns are higher, which are usually periods with a low level of investor sentiment.

Second, we contribute to the literature on the impact of environmental responsibility commitment and financial performance. Among all studied qualitative issue areas, we show that the intensity of investments in environmental responsibility practices is responsible for making the valuations more subjective and, consequently, returns are more affected by investor sentiment. The relation between CER and CFP is becoming more relevant as the impact of climate change is becoming more evident to society. Investment in CER can have an extraordinary effect on climate change, and knowing how to evaluate these investments is crucial for firms’ engagement.

Furthermore, we provide insight on the findings from Naughton et al. (2019), who show that the level of investor sentiment of CSR can affect the CSR firms’ expected returns. We reveal that a "side-effect" inherent to CSR investments is that firms become harder to value and costlier to arbitrage, making these firms prone to the general level of investor sentiment. Thus, we find evidence that what drives the CSR returns is not only the investors’ taste (e.g., Fama and French 2007) and degree of investor awareness of CSR (e.g., Pedersen et al. 2021), but also the general level of investor sentiment.

Finally, given the lack of standard pricing factors that correctly price socially and environmentally responsible investments, we contribute to the literature by suggesting a sustainability factor. This factor shows the promising results in explaining the impact of investor sentiment on the stock returns of CSR/CER firms since it overcomes the limitations of standard asset pricing models. Furthermore, the sustainability factor can fill the gap of an ”environmental, social, and corporate governance (ESG) factor,” as proposed by Pastor et al. (2021), which can be combined with the market portfolio in a two-factor model.

The paper is organized as follows. In Section “CSR/CER investments and investor sentiment,” we review empirical studies investigating CSR/CER and investor sentiment. In Section “Data and methodology,” we describe our sample selection and provide details on the investor sentiment and the estimation of the CSR and CER scores. In Section “Excess and abnormal returns of CSR and CER Premia,” we assess whether the excess and abnormal returns of CSR and CER premia are different from zero. We examine in Section “CSR/CER investments and firms’ characteristics” whether variations in CSR/CER scores affect firms’ profitability, asset growth, intangible assets, and idiosyncratic volatility. Section “CSR/CER premia and investor sentiment” provides evidence of whether investor sentiment drives the returns of CSR and CER premia. We analyze the impact of a sustainability factor on investor sentiment level and CSR and CER premia in Section “Sustainability factor.” Finally, we conclude in Section “Conclusion.”

CSR/CER investments and investor sentiment

CSR/CER intensity and financial performance

The relation between CSP and CFP is an ongoing debate, and there are reasons to believe that it is positive, negative, or even neutral. Among the arguments for a positive relation, the stakeholder theory is one of the most widely cited. Deng et al. (2013) argue that according to the stakeholder value maximization view, CSR activities have a positive effect on shareholder wealth because focusing on other stakeholders’ interests results in increasing their willingness to support a firm’s operation. Among the arguments for a negative relation, Waddock and Samuel (1997) explain that there are costs in CSR investments that could otherwise be avoided or taken by others, such as the government. This argument is in line with the well-known article from Friedman (1970), who argues that there are a few easily measured benefits for these investments and numerous costs. The third possibility (neutral relation) is that there is no reason to believe that CSR activities and financial performance are linked, and any relation between them might be driven by model misspecification or chance. Another reason for a neutral relation is that, at the aggregate level, the positive impacts of CSR investments in intangible assets (such as reputation, better relation with stakeholders, and human capital) in some firms could be canceled out by other firms where CSR represents private benefits, which the managers extract at shareholders expense (e.g., Jiao 2010).

The empirical results on the relation between CSR activities and CFP are also mixed. Among the studies that find a negative relation between CSR and expected returns, El Ghoul et al. (2011) find that an increase in CSR leads to a lower cost of capital. Among those that find a positive association, Lins et al. (2017) report that high-intensity CSR firms have higher returns in periods of crisis. Furthermore, by analyzing CSR proposals that pass or fail by a small margin of votes, Flammer (2015) finds that the adoption of CSR proposals that pass by a small margin of votes leads to positive announcement returns. Among the studies that find a neutral relation, McWilliams and Siegel (2000) show that after controlling for capital expenditures, the CSP-CFP nexus is zero.

The mixed results regarding financial performance are found not only for socially responsible firms but also for CER firms. On the one hand, Derwall et al. (2005) find that a portfolio with high environmental investments has a higher abnormal return. By analyzing the impact of firms’ carbon dioxide (CO2) emissions and expected returns, Bolton and Kacperczyk (2019) find a positive association between firms’ CO2 emissions and stock returns. On the other hand, Chava (2014) finds that an increase in environmental responsibility investments decreases the cost of capital. Furthermore, In et al. (2018) show that carbon-efficient firms tend to earn higher abnormal returns than firms that do not meet this criterion.

Another line of studies examines the CSP-CFP relation using a time dimension. Lu et al. (2014) review 84 empirical studies from 2002 to 2011 that test the relation between CSP and CFP. They conclude that the CSP and CFP link remains inconclusive, because this link changes over time. Consistent with this view, recent papers that analyze the CSP-CFP relation in finance also assume a dynamic relation between CSP and CFP. Pastor et al. (2021) derive a theoretical model where, in equilibrium, agents are willing to pay more for greener firms, which causes a reduction in the firms’ cost of capital. However, their model predicts that green assets outperform brown assets when positive shocks hit an ESG factor, capturing shifts in customers’ tastes for green products and investors’ tastes for green holdings. In other words, this dynamic relation between CSP and CFP can affect the market equilibrium. In an attempt to estimate the market equilibrium by including the ESG dimension, Pedersen et al. (2021) propose a four-fund separation theory, where portfolios that span the frontier are based on a combination of the risk-free asset, the tangency portfolio, the minimum-variance portfolio, and an ESG-tangency portfolio. Interestingly, their theory predicts that the taste of ESG-aware investors could drive the CFP-CSP relation. So, even if there is a positive correlation between ESG investments and profits, the impact on returns might be neutral because the ESG-aware investors would adjust the stock prices to the profits caused by the ESG activities.

Motivated by the view that investors change their CSR appetite over time, Naughton et al. (2019) estimate the investor sentiment of CSR as the difference of the logs of the average market-to-book ratios between top and bottom quintiles portfolios sorted on CSR activity. They find that the investor sentiment for CSR activities is time-varying and that firms respond by boosting CSR performance in periods with high investor sentiment of CSR. Although they assess the impact of investor sentiment of CSR on firms’ performance, the relation between CSR/CER investments and the general level of investor sentiment is largely unknown.

Investor sentiment

Investor sentiment can be defined as a belief about future cash flows and investment risks that are not fully justified by the fundamentals (Baker and Wurgler 2007). Investor sentiment is based on two assumptions. The first assumption is that (at least) part of the investors are noise (or sentimental) traders, who are subject to investor sentiment (De Long et al. 1990). In the second assumption, betting against sentimental investors is risky and costly, as emphasized by Shleifer and Vishny (1997). In other words, the actions of noise (or sentimental) traders who deviate the prices from fundamentals, combined with the high cost and risk to bet against investor sentiment, might cause persistent deviations from efficient prices.

Among the first attempts to find a proxy for investor sentiment, Baker and Stein (2004) use liquidity measures, such as the bid-ask spread, turnover, and price impact of trade as proxies for investor sentiment. However, investor sentiment could not be completely explained only by liquidity measures. Thus, Baker and Wurgler (2006) propose a broader measure of investor sentiment using principal component analysis to isolate the common component of measuresFootnote 8 related to investor sentiment. An adaptation of the Baker–Wurgler (BW) sentiment index is also possible for international markets, as proposed by Baker et al. (2012).

The cross section is an important dimension to understand the impact of investor sentiment on returns. Baker and Wurgler (2006) predict that a wave of investor sentiment has cross-sectional effects (the prices of stocks do not move equally) when sentiment-based demands or arbitrage constraints vary across stocks. The authors explain that these two distinct channels lead to similar predictions because stocks that are likely to be most sensitive to speculative demand, those with highly subjective valuations, also tend to be the riskiest and costliest to arbitrage. In line with their prediction, when beginning-of-period proxies for sentiment are low (high), subsequent returns are relatively high (low) for small, young, unprofitable, non-dividend-paying, extreme growth, distressed, and high volatility stocks. Given the evidence that stocks with high CSR/CER intensity have characteristics similar to firms that are hard to value and difficult to arbitrage, we predict that the level of investor sentiment has a negative effect on subsequent returns of firms with high intensity in CSR/CER investments.

Data and methodology

Sample selection

We obtain return data from the Center for Research in Security Prices (CRSP), accounting data from Compustat fundamentals annual, and firms’ CSR ratings from MSCI ESG KLD Stats. We use the MSCI ESG KLD Stats database to construct our CSR ratings for many reasons. First, this dataset is also used in many of the studies that motivate our work (e.g., El Ghoul et al. 2011; Lins et al. 2017; Albuquerque et al. 2019), which enables a more precise comparison of results. Second, this dataset has a US coverage that is more complete than other datasets (e.g., Asset4) in terms of time span and firms’ coverage (Khan et al. 2016). Finally, this dataset provides standardized information about performance on each qualitative issue area rather than the absence or presence of disclosure.

We first merge the Compustat data with the CRSP database, where we apply a reporting lag of 120 days for annual accounting data. Then, we use the six-digit CUSIP to merge MSCI ESG KLS Stats into our dataset. We limit our analysis to the period from July 1992 to June 2017.Footnote 9 Our proxy for the risk-free rate is the yield on the US 10-year government bond, which we obtain from Thomson Reuters Datastream.

CSR ratings

The ESG Stats has two categories of CSR-related items: qualitative issue areas and controversial business issues. Our study focuses on the qualitative issue areas, which contain yearly ratings on seven categories: community, corporate governance, diversity, employee relations, environmental, human rights, and product. Like El Ghoul et al. (2011), we do not include firms’ corporate governance in our CSR score since this category is not included in our CSR definition.

For each of the six qualitative issue areas we consider, ESG Stats assigns binary (0/1) ratings to set strengths and concerns. To ensure that our results are not driven by (possible) outliers or mistakes in the database, we manually double-check the scores given to strengths and concerns. As we study both elements, our CSR and CER measures are estimated by adding the strengths and subtracting the concerns. Given that the number of strengths and concerns for each category varies over time, following Lins et al. (2017), we scale strengths and concerns by the maximum number of strengths and concerns, respectively. Thus, for each firm year, the CSR rating is estimated as the number of strengths divided by the maximum number of strengths subtracted by the number of concerns scaled by the maximum number of concerns in all six qualitative issue areas. For the CER rating, we only consider the strengths and concerns of the environmental area. Thus, our CER and CSR ratings can range from − 1 to 1.

Table 1 shows the description of CSR and CER scores as well as the scores from other qualitative issue areas. We provide details on the ratings of strengths and concerns in “Appendix.” An important aspect of the CSR scores over time is that the coverage until 2000 is restricted to stocks on the S&P 500 Index, and afterward, the coverage increased considerably. In order to ensure that this variation in coverage does not drive the results, we run the analysis again with the CSR score estimated with a sample restricted to the S&P 500 Index, and the inferences are unchanged.

Sustainability premium construction

We estimate two alternative proxies for a sustainability premium (CSR premium as well as CER premium). To construct the CSR and CER premia, we sort stocks at the end of June yearly from 1992 to 2016 into 30th and 70th percentilesFootnote 10 based on the most recent CSR, as well as the CER ratings. We then estimate the value-weighted return for each portfolio from July of year t to June of year t+1. The CSR (CER) premia are estimated as the difference in returns of the portfolio with a high score minus the portfolio with a low CSR (CER) score. The sample covers the period from July 1992 to June 2017.

Proxy for investor sentiment

We use as a proxy for investor sentiment the monthly based sentiment series estimated by Baker and Wurgler (2006). The BW sentiment index is one of the most commonly used proxies for investor sentiment (e.g., Stambaugh et al. 2012; Walther and Willis 2013; Stambaugh et al. 2014; Huang et al. 2015; Shen et al. 2017). We choose this proxy for investor sentiment because of its robust methodology and easily accessible data,Footnote 11 and because its time span covers the entire sample period of this study.

The BW sentiment index is based on fiveFootnote 12 (standardized) sentiment measures: value-weighted dividend premium, first-day returns, IPO volume, closed-end fund discount, and equity share in new issues. Then, each of these measures is orthogonalized by six macroeconomic variables: the industrial production index, nominal durables consumption, nominal nondurables consumption, nominal services consumption, employment, and the consumer price index.

Each of these (orthogonalized) measures might include a sentiment component and idiosyncratic components, which are non-sentiment related. Accordingly, the BW sentiment index is estimated using a principal component analysis, which filters out idiosyncratic noise in the measures and isolates their common component. In the sample period, the BW sentiment index ranges from − 0.89 (April 2009) to 3.20 (February 2001), has a mean of 0.242, and a standard deviation of 0.638.

Excess and abnormal returns of CSR and CER Premia

We start our analysis with the relation between CSP and CFP in the long term. Previous studies show the mixed results regarding the correlation between CSR/CER intensities and CFP (see, e.g., El Ghoul et al. 2011; Lu et al. 2014; Lins et al. 2017). To examine this correlation over the long term, we analyze the excess returns, the abnormal returns, and the pricing factor loadings of CSR and CER premia over time. We estimate the abnormal returns based on the Sharpe (1964), Lintner (1965), and Black (1972) (SLB) model; the Fama and French (1993) three-factor model; and the Fama and French (2015) five-factor model.Footnote 13

Table 2 shows that the CSR and CER premia have neither average excess returns nor abnormal returns indistinguishable from zero. These results are consistent with Dorfleitner et al. (2020), who also find that the CSR intensity does not affect value-weighted returns. Furthermore, our results are aligned with the model proposed by Pedersen et al. (2021), where ESG-aware investors can adjust the stock prices to the profits or losses caused by the ESG activities, making ESG intensity have a neutral impact on returns.

By analyzing the factor loading, we can see that both the CSR premium and the CER premium have positive loadings on market beta according to the SLB and the F&F3 models, both significant at the 0.01 level. The F&F3 model also produces a negative loading of HML on the CER and CSR premia, significant at the 0.01 level. For the CER premium, we also find a positive and statistically significant loading on size. Thus, our analysis shows that although we do not see a difference in average returns, we find important variations in the pricing factors. The CSR premium and the CER premium seem to be formed by growth firms with higher systematic risk. The positive loading on SMB for the CER is evidences that the high-intensity environmental responsibility firms are smaller than firms that do not meet this criterion.

Panel C of Table 2 presents the results for the Fama and French (2015) five-factor model. For the CSR premium, we find a negative and significant loading on RMW (t-stat of 2.92). Furthermore, we can see significant loadings on the market risk premium, RMW, and CMA for the CER premium. These results indicate that firms with high CSR and CER scores have lower exposure to profitability. Moreover, the negative loading on CMA for the CER premium indicates that these firms have a higher asset growth.

In sum, our results are consistent with the view that CSR/CER has a neutral effect on financial performance in the long term. This result is aligned with our prediction that the market adjusts to an ideal CSR/CER intensity level, and the economic profit becomes zero in the long term. Furthermore, based on the Pedersen et al. (2021) model, even if the economic profit does not become zero for CSR/CER investments, ESG-aware investors can adjust stock prices to have a neutral effect on returns.

CSR/CER investments and firms’ characteristics

In order to evaluate whether CSR and CER investments lead to changes in firms’ characteristics that make firms harder to arbitrage and more difficult to value, we analyze whether variations of CSR and CER scores are correlated with variations in profitability, asset growth, intangible assets, and idiosyncratic volatility. The regressions include firm and year fixed-effects, and for each predictor, we include specifications with and without control variables. We include size, book-to-market ratio, momentum, and CAPEX as control variables. The variables definition are in “Appendix.”

We predict that a higher CSR or CER intensity is associated with: lower profitability in the short-term because most of the investments in these practices have a long-term horizon; a higher asset growth since at least part of these investments should be financed with an increase in assets instead of a reduction in other investments; and a higher level of intangible assets because a large part of CSR and CER investments is considered as intangible assets. In line with Becchetti et al. (2015), we predict that the higher the CSR/CER intensities, the higher the idiosyncratic risk due to budget constraints (i.e., if firms invest more in CSR activities, they should be less flexible in responding to productivity shocks).

Consistent with our prediction, Table 3 shows that variations in CSR or CER scores have a negative correlation with gross profitability and a positive correlation with asset growth and intangible assets. Concerning gross profitability, all negative coefficients are significant at the 0.05 level. Economically, a one-standard-deviation (0.103) increase in the CSR score is associated with a 0.285 percentage point decrease in gross profitability. Concerning asset growth, CSR and CER scores are significant at the 0.01 level for the specifications without control variables. However, the t-stat of the CSR score explaining asset growth becomes 1.92 when adding the control variables, particularly because asset growth can be partially explained by size and momentum. When CSR and CER scores explain variations in intangible assets, we find a strong relation, which in most specifications is significant at the 0.01 level. Economically, a one-standard-deviation increase in the CSR score is associated with a 0.59 percentage point increase in intangible assets. In sum, all the results point to the direction that an increase in CSR and CER activity is associated with a higher subjectivity in valuation, making firms that meet these criteria prone to the level of investor sentiment.

Concerning idiosyncratic volatility, a one-standard-deviation increase in the CSR score leads to a 0.3 percentage point increase (significant at the 0.05 level). In contrast, a one-standard-deviation increase in the CER score leads to a 0.229 percentage point increase in idiosyncratic volatility (significant at the 0.10 level). These results are in line with Becchetti et al. (2015) and are important evidence that CSR/CER activity leads to higher arbitrage costs.

CSR/CER premia and investor sentiment

Thus far, our results show that an increase in CSR/CER scores leads to lower profitability, and higher asset growth, intangible assets, and idiosyncratic volatility. In this section, we test our hypothesis that firms with higher CSR/CER scores have more subjective valuations and costly arbitrage and, accordingly, should have higher (lower) expected returns following a low (high) level of investor sentiment.

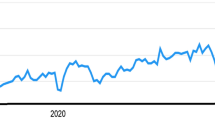

In Fig. 2, we plot the CSR premium over time following periods with a low level of investor sentiment (shaded areas). We can see that in periods where sentiment is low, the subsequent returns of the CSR premium are usually positive.Footnote 14 The only exception is the global financial crisis, where the CSR premium started to recover before the sentiment reached the median, which was also the case for the aggregate market return.

CSR Premium and Investor Sentiment. This figure shows the CSR premium from July 1992 to June 2017. CSR premium is estimated as the difference in excess returns of the value-weighted portfolio sorted on CSR scores. The shaded areas indicate the periods where the investor sentiment is below the median. We use as a proxy for investor sentiment the monthly based sentiment series estimated by Baker and Wurgler (2006)

To analyze whether investor sentiment drives returns from social and environmentally responsible firms, we conduct regressions of one-month ahead excess returns of portfolios sorted on CSR/CER and qualitative areas scores regressed on investor sentiment. Following the CSR and CER premium construction, we use the third and seventh deciles from end-June scores as breakpoints to form portfolios sorted on the other qualitative issue areas.

We find that investor sentiment level has a negative impact on the subsequent excess returns of the portfolios formed with firms with a high score for CSR, CER, and other qualitative issue areas. The portfolio with a high CSR score has a slope of − 1.05 (t-stat of 2.03). Thus, a one-standard-deviation increase in the investor sentiment level (0.638) leads to a 0.67% decrease of subsequent returns. For a portfolio with a high CER score, a one-standard-deviation increase in the investor sentiment level results in a decline of 0.61% in returns (t-stat of 1.96). For the other qualitative issue areas, the slopes range from − 0.88 (t-stat − 1.90) for portfolios sorted on community score, and − 1.06 (t-stat of − 1.91) for portfolios sorted with product score.

When we analyze CSR and CER premia (portfolio of high-minus-low), we find that an increase in investor sentiment leads to lower expected returns for both proxies. Investor sentiment has a slope of − 0.57 (t-stat of 2.12) predicting the CSR premium and a slope of 0.69 (t-stat of 2.20) predicting the CER premium. By analyzing the portfolio sorted on the qualitative issue areas, we find that investor sentiment has predictability power only for the portfolio sorted on human rights. From these results, we can see that investor sentiment has a significant predictability power, especially in portfolios with stocks with high intensity in environmental responsibility. The environmental responsibility dimension also affects the CSR premium since it is part of the CSR score construction. These results are in line with Baker and Wurgler (2006), who show that periods with a high (low) level of investor sentiment are followed by lower (higher) returns for firms with subjective valuations and costly to arbitrage. In particular, the investments in social and environmental responsibility practices seem to lead to subjectivity in valuations.

We then analyze the relation between CSR and CER returns following periods with high and low investor sentiment. Like Stambaugh et al. (2012), we use the median of sentiment to classify the level of investor sentiment as high or low. We perform the analysis at both the firm level and portfolio level.

Investor sentiment, CSR/CER scores, and the expected returns at the firm level

We next analyze whether subsequent returns are affected by the variations in CSR/CER scores and the level of investor sentiment at the firm level. In order to ensure that the results are not driven by time-invariant unobserved variables or by factors that differ across entities but are constant over time, our regressions include time and firm fixed effects. Panel A of Table 4 reports the results based on the CSR score and Panel B reports the results with the CER score. In specifications 1 and 2, we regress one-month forward returns on the CSR and CER scores. In specifications 3 and 4, we split the CSR and CER scores into two interaction terms: The first (CSR Score * High Sentiment) is the multiplication of the CSR or CER score by a dummy variable that is equal to one in periods where the level of the investor sentiment is high (zero otherwise), while the second dummy (CSR Score * Low Sentiment) is the interaction term with a low level of investor sentiment. In specifications 2 and 4, we include size, book-to-market ratio, gross profitability, asset growth, and previous returns as control variables.

The results of the CSR score are in line with our predictions. The variations of the CSR score per se have no significant impact on the average returns (see specifications 1 and 2 in Panel A of Table 4). However, the effect of the CSR scores on subsequent returns becomes significant after we disentangle these variations into periods with high and low investor sentiment. Following periods with high sentiment, an increase in the CSR score leads to a lower average return. Economically, a one-standard-deviation variation in the CSR score during periods with high sentiment leads to a 0.133% per month decrease in returns (roughly 1.6% per year) in the regression without control variables (significant at the 0.01 level), and a 0.094% decrease in the regression including control variables (significant at the 0.05 level). The interactions between CSR score and a high level of investor sentiment (CSR Score * High Sentiment) have positive coefficients, but the significance of the coefficients does not reach the 0.10 level.

The results are similar for the CER score. In the regression where we use the CER score to predict one-month forward returns, the CER score is significant at the 0.10 level in the regression without control variables (see specification 1 in Panel B of Table 4). Economically, the effect is not substantial since a one-standard-deviation increase in the CER score leads to a 0.034% increase in average returns. After we include control variables, the coefficient of the CER score becomes indistinguishable from zero.

Concerning the interaction between the CER score and the high and low levels of investor sentiment, we find that in periods with low investor sentiment, the coefficients are positive and significant at the 0.05 level (with and without control variables). However, the CER score variations in periods with high investor sentiment have the mixed results. In the regression without control variables, the coefficient is negative but indistinguishable from zero, whereas in the regression with control variables, the coefficient is negative and statistically significant at the 0.05 level. The effect of investor sentiment on subsequent returns is more pronounced in periods with high investor sentiment conditional on CSR scores than periods with a low sentiment conditional on CER scores. We further discuss these results in the next section.

CSR/CER portfolios following high and low investor sentiment

The fixed-effect regression results in Table 4 show that investor sentiment affects investors’ perceptions of expected returns and CER/CSR practices. However, these regressions weigh all observations equally, and consequently, the results may be driven by small companies. Moreover, as there is not much variation in the CSR and CER scores within the firm, and we include firm dummies (fixed-effects) in the regression, the results of the fixed-effect regressions might underestimate the real effect of CSR and CER on firms’ financial performance. We address these issues by considering the performance of value-weighted portfolios sorted on scores in a non-parametric setting.

Table 5 shows the excess returns of value-weighted portfolios sorted on not only the CSR and CER scores (Panel A) but also on the scores of other qualitative issue areas (Panel B). To compute the excess returns, we use the one-month Treasury bill rate. We sort stocks into three portfolios at the end of June yearly using the third and seventh deciles. The sample covers the period from July 1992 to June 2017.

By analyzing the long-short strategies of portfolios sorted on CSR score (CSR premium), we find an average of − 0.44% monthly returns following a high level of investor sentiment; the difference is significant at the 0.05 level (t-stat of 2.19). Following periods with low investor sentiment, there is a positive average of 0.26% per month, but the return is not statistically different from zero. By comparing the difference in mean returns between periods with low and high investor sentiment, we can see that the CSR premium has a 0.70% higher average return following periods of low sentiment than following periods of high sentiment, where the excess return is significant at the 0.01 level. These results align with the fixed-effect regression results, where high-intensity CSR firms tend to outperform (underperform) the market following periods of low (high) sentiment.

The implications of these results help us to understand why previous studies find the mixed results regarding the relation between CSP and CFP. For instance, Lins et al. (2017) find that following periods of crisis, firms with high social capital have average returns four to seven percentage points higher than firms with low social capital. These results can also be explained by investor sentiment since we usually have low investor sentiment during periods of crisis. Furthermore, El Ghoul et al. (2011) show a negative relation between the cost of capital and CSR practices. The authors use a sample from 1992 to 2007, and, as shown in Fig. 2, in most of the studied period, the sentiment level is high since the sample ends before the global financial crisis. Thus, our results are also in line with their study.

The results of the CER premium are also driven by investor sentiment. The CER premium has a 0.88% higher return following periods with a low sentiment compared to periods with a high level of investor sentiment; this difference is statistically significant at the 0.01 level. However, in contrast to the CSR premium, which has negative and significant returns following only periods of high investor sentiment, the CER premium reports a 0.59% (t-stat of 3.04) average returns following periods with low investor sentiment and returns indistinguishable from zero following periods with high investor sentiment.

Among the reasons the CSR premium is more pronounced following periods of high investor sentiment, while the CER premium is more pronounced following low sentiment periods, we argue that CSR is a broader concept. Thus, following periods of high investor sentiment, the investors might be willing to have a lower expected return for firms that address many CSR dimensions (employees, products, environmental responsibility, and human rights). The CER premium results seem to be driven either by risks inherent to periods with low investor sentiment, such as budget constraints, or simply mispricing during these periods. To ensure that our results are not driven by the global financial crisis, we run a robustness check excluding the period from August 2008 to March 2009, and, as a result, the main inferences are unchanged. We follow Lins et al. (2017) to define the financial crisis period.

Regarding long-short portfolios sorted on the other qualitative issue areas (i.e., community, human rights, employee relations, diversity, and product), we do not find any excess return significant at the 0.05 level. By analyzing the results significant at the 0.10 level, we find that the portfolio with human rights has returns that are 0.31% (t-stat of 1.85) higher following periods of low sentiment than high sentiment. When we compare the difference in relative returns of periods with high and low investor sentiment, we find that the portfolio sorted on employee relations has an average return of − 0.32% (t-stat of 1.73) and on community has an average return of − 0.43% (t-stat of 1.74), which is an indication that other qualitative areas (in addition to the environmental responsibility dimension) might also be prone to investor sentiment.

CSR/CER premia and abnormal returns following high and low investor sentiment

The results in Table 5 indicate that investments in environmental responsibility efforts seem to be the main driver of the difference in CSR returns conditional on the level of investor sentiment. However, by only looking at the excess returns, it is unclear whether the results are driven by mispricing or exposure to pricing factors. In order to analyze these factors, we estimate abnormal returns based on the SLB model (Panel A), the F&F3 model (Panel B), and the F&F5 model (Panel C). We sort stocks at the end of June from 1992 to 2016 into 30th and 70th percentiles based on the scores.

The results in Panel A of Table 6 show that market beta does not seem to be the main driver for the impact of investor sentiment in the CSR and CER premia. Following periods of high investor sentiment, the CSR (CER) premium has an average return of 0.48% (0.35%) lower than firms that do not meet the criteria, the t-stat of the CSR premium is 2.43, while it is 1.81 (significant only at the 0.10 level) for the CER premium. In periods of low sentiment, only the CER premium reports significant returns with an average return of 0.38 (t-stat of 1.96). Finally, when we compare the returns of both proxies for sustainability premium following periods of high and low investor sentiment, the CSR (CER) premium has an average monthly return of 0.62% (0.73%) with a t-stat of 2.43 (2.71) higher following periods of low sentiment compared to periods with high investor sentiment.

When we add size (SMB) and value (HML) factor (see Panel B of Table 6), the difference in abnormal returns is smaller following periods of high and low sentiment. We have a difference of 0.45% per month for the CSR premium, which is significant only at the 0.10 level (t-stat of 1.86). For the CER premium, we have a difference of 0.57% (t-stat of 2.20).

Finally, we find that the difference in returns following periods with a high or low investor sentiment level is no longer statistically significant for the CSR premium when we use the F&F5 model. However, for the CER premium, the results are striking. The subsequent mean abnormal returns of the CER premium following periods with low investor sentiment are 0.47% (t-stat of 2.54). Furthermore, the difference in abnormal returns following periods of low and high investor sentiment is 0.53% (t-stat of 2.08).

To summarize, we can see that the impact of investor sentiment on the CSR premium can be explained by pricing factors, especially after controlling for profitability (RMW) and investments (CMA), which we have shown in Table 2 have significant effects on the CSR premium. In other words, the fact that CSR firms have a negative loading on RMW and CMA helps to explain why these firms have different excess returns following periods with high or low investor sentiment. However, CER abnormal returns following periods with high and low investor sentiment are still significant after controlling for the F&F5 model, which is evidence that standard pricing models cannot fully explain the impact of investor sentiment on CER investments.

Sustainability factor

The results in Table 6 reveal that standard asset pricing models have limited explanatory power for the impact of investor sentiment on CSR and CER premia. These results indicate that investors have difficulty valuing social and environmentally responsible investments (which leads to mispricing) and/or that these investments capture state variables that are not taken into account in the standard asset pricing models. To overcome the limitations of standard pricing models in explaining the abnormal returns of CSR and CER investments, we estimate a pricing factor based on a common orthogonal variation of portfolios sorted on six qualitative issue areas. To construct a sustainability factor, we first form 12 portfolios sorted on the scores of six qualitative issue areas (environmental responsibility, community, human rights, employee relations, diversity, and product). Similar to the estimation of the CSR premium, we use the third and seventh deciles as breakpoints. Thus, each qualitative issue area has two portfolios with high and low scores formed in June of each year. We then estimate the value-weighted returns of each portfolio from July from year t to June from year t+1. Finally, we use principal component analysis (PCA) to isolate the common components.

PCA is also used in other studies to construct asset pricing factors (e.g., Gandhi and Lustig 2015). Among the advantages of using PCA, in comparison with having one factor for each CSR domain (e.g., Becchetti et al. 2018), is that it can reduce data from many dimensions into (a reduced number of) linearly independent components. In other words, by using PCA, we can identify the weights of each qualitative issue areas to construct the sustainability factor.

When we estimate the PCA of the twelve portfolios sorted on six qualitative issue areas, the first principal component is the market risk premium, with roughly equal weights in each of the twelve portfolios. The weights range from 0.272 (environmental low) to 0.296 (human rights high). The first principal component explains 92.4% of the common variance in the twelve portfolios. The second component is orthogonal to the first component and is a good candidate for a sustainability factor. This principal component explains roughly 3% percentFootnote 15 of the common variance of the twelve portfolios and gives opposite signs for the portfolios with a high and low score in each qualitative issue area. The area with the highest weight is environmental responsibility, which gives a weight of 0.58 for the portfolio with a low score and − 0.297 for the portfolio with a high score. The sustainability factor is estimated by multiplying each portfolio’s excess returns by the weights of the second component.Footnote 16 To have the interpretation as a high-minus-lowFootnote 17 sustainability score, we multiply the sustainability factor by minus one.Footnote 18 The sustainability pricing factor has an average monthly return of 0.04% and a standard deviation of 2.52%. The low average return is consistent with Görgen et al. (2020), who propose a green-minus-brown factor. Although the authors use a different methodology since their factor is based on carbon risk, the results confirm that environmental responsibility returns tend to be close to zero in the long term.

Table 7 shows the results for the sustainability factor explaining the CSR premium. Panel A provides the abnormal returns of the CSR premium regressed on a sustainability factor and standard asset pricing models (SLB, F&F3, and F&F5 models). Panel B shows the significance of the investor sentiment coefficients after controlling for the sustainability factor and the above-mentioned factor models. Panel C shows the abnormal returns of the CSR premium following periods of high and low investor sentiment after controlling for the sustainability factor and other pricing factors.

As we can see in Panel A of Table 7, the abnormal returns of the CSR premium remain indistinguishable from zero after including a sustainability factor. These results are also in line with the perspective of the theory of the firm since CSR investments should not provide either positive or negative economic profit in the long term. In a competitive market, if CSR investments result in positive economic profits, the competitors should also increase investments until the economic profit is zero. With this perspective, we also should expect abnormal returns indistinguishable from zero. This argument does not necessarily imply that the firms should not invest in CSR. It just implies that each firm has an ideal level of CSR (see, e.g., McWilliams and Siegel 2001), and the level can be adjusted according to the market conditions.

In terms of pricing factor loadings, we find that the sustainability factor is strongly significant in explaining the CSR premium. The coefficients range from 0.68 to 0.74 and are statistically significant at the 0.01 level. The SMB factor also shows significance with negative coefficients of − 0.17 (FF&3 + sustainability factor) and − 0.19 (FF&5 + sustainability factor). Unlike the regression without sustainability factor (see Table 2), neither HML nor RMW is significant after including a sustainability factor, which is evidence that the sustainability factor can overcome these pricing factors to explain the CSR premium.

The results in Panels B and C of Table 7 show that the sustainability factor helps to explain the impact of investor sentiment on subsequent returns of the CSR premium. Unlike our findings in Section “CSR/CER premia and investor sentiment” that show a negative statistically significant coefficient for investor sentiment predicting the returns of the CSR premium, the coefficients of the investor sentiment become indistinguishable from zero after including a sustainability factor (see Panel B). Furthermore, the relative returns of the CSR premium following periods with high and low investor sentiment also become indistinguishable from zero after controlling for the sustainability factor.

Our results show that a sustainability factor helps us to understand the relation between investor sentiment and the returns of the CSR premium. We next perform similar tests that include the CER premium. The results in Table 6 show that there is a statistically significant correlation between investor sentiment and the CER premium even after we control for the FF&5 model.

As shown in Table 8, after including the sustainability factor, the abnormal returns of the CER premium remain indistinguishable from zero. The abnormal returns range from 0.11 (t-stat of 1.62) after controlling only for the sustainability factor to 0.05 (t-stat of 0.83) after controlling for the FF&5 model plus the sustainability factor.

The promising results of the sustainability factor helping to explain the impact of investor sentiment on the CSR premium also hold for the CER premium. Unlike our previous results that show a strong and statistically significant relation even after controlling for the FF&5 model, Panels B and C of Table 8 show that once we include the sustainability factor, the impact of investor sentiment on the returns of environmentally responsible firms is not statistically significant. The difference in the average excess returns of the CER premium following periods with low and high investor sentiment, which is 0.88% (t-stat of 3.06) (see Table 5), becomes indistinguishable from zero after controlling for the sustainability factor. In addition, the abnormal returns for the CER premium following periods with low investor sentiment that are significant after controlling for the FF&5 model (0.47% per month and t-stat of 2.54) also become indistinguishable from zero after including the sustainability factor. Hence, our results show that the sustainability factor helps us to understand the relation between CSR and CER premia and investor sentiment. Thus, the subjectivity in valuation driven by CSR and CER investments seems to be explained by the sustainability factor.

Conclusion

Whether socially responsible firms have a higher, lower, or neutral financial performance compared to firms that do not meet these criteria has become a key question in finance, economics, and management. We reassess this question by adding an environmental responsibility dimension and a time dimension by analyzing the long-term and the short-term relation between CSR and CER activities and CFP.

We find that CSR and CER premia have a neutral relation to financial performance in the long term. These results support the view that the market adjusts the level of investment in social and environmental practices and, accordingly, the expected economic profit in the long term is equal to zero. Although the results do not show that CSR and CER commitment affects returns, this finding could be seen as an encouragement for CSR and CER practices since the firms that practice social and environmental responsibility can have a better relationship with stakeholders without having a negative impact on financial performance in the long term.

In the short term, we find that CSR and CER premia are time-varying and, more importantly, they have a strong relation to investor sentiment in the studied period. These results align with our prediction that CSR/CER investments make the valuations more subjective, and investors have difficulty pricing these investments correctly. After adjusting the returns for pricing factors, the relation between investor sentiment and CSR financial performance disappears, but it is still strongly significant for the CER investments, suggesting mispricing.

Given our results, we propose a sustainability factor, estimated as the second principal component of twelve portfolios sorted on six qualitative issue areas. After including the sustainability factor, investor sentiment level becomes indistinguishable from zero for explaining the subsequent returns of CSR and CER premia following periods of high and low investor sentiment. The sustainability factor helps us understand the relation between CSR and CER premia by spanning CSR/CER-related risks that traditional factor models cannot.

Our findings are relevant to practitioners and academics. For practitioners, we show that firms with a high intensity of CSR and CER tend to have higher (lower) expected returns after periods of low (high) investor sentiment. This evidence can be used in investment decisions, such as adjustment of loadings on socially and environmentally responsible firms conditional to the level of investor sentiment. Moreover, the variations in the cost of capital driven by the level of investor sentiment should also be considered in firms’ CSR and CER investment decisions. For academics, we show that there are crucial differences in the CSP-CFP relation when analyzed over the short and long term. We help solve the puzzle of the CSP-CFP relation by showing that it is time-varying and that investor sentiment has significant implications on socially and environmentally responsible firms’ expected returns. Finally, the sustainability factor provides insight on the importance of pricing factors that can be used to evaluate intangible assets related to CSR and CER investments.

As a suggestion for further studies, we propose using the sustainability factor as a proxy for the ESG factor proposed by Pastor et al. (2021). The sustainability factor could be combined with the market portfolio in a two-factor model.

Notes

In this study, we use stocks (abnormal) returns as a proxy for CFP.

We discuss the hypotheses and empirical results on the relation between social performance and CFP in Section “CSR/CER investments and investor sentiment.”

If we analyze only the dimension of CSR investments, supposing a given investment has a positive economic profit in the short-term, the competitors would also increase investments in this type of investment until the economic profit disappears. In the same vein as monopolistic competition, with rare exceptions, there is no reason to believe that a positive or negative economic profit driven by CSR investments should remain in the long term. Similar to what is expected for economic profits, CSR investments should have a neutral impact on the abnormal returns in the long term.

In a recent paper, Cao et al. (2020) find that firms owned by socially responsible institutions tend to exacerbate the mispricing (i.e., the anomalies returns are more pronounced in these firms).

We further explore the relation of CSR and CER scores and proxies for arbitrage cost and subjective valuation in Section “CSR/CER investments and firms’ characteristics.” The results confirm the evidence that CSR/CER investments lead to costly arbitrage and subjective valuations.

Baker and Wurgler (2006) classify small stocks, young stocks, unprofitable stocks, high volatility stocks, non-dividend-paying stocks, extreme growth stocks, and distressed stocks as stocks with subjective valuations and difficult to arbitrage.

We provide more details on the estimation of the BW sentiment index in Section “Proxy for investor sentiment.”

In order to ensure that the data provided by MSCI ESG KLD Stats is publicly available, we assume a reporting lag of 180 days. Thus, for instance, the scores from MSCI ESG KLD Stats referring to 1991 are merged into our sample from June 1992.

We downloaded the sentiment index by Jeffrey Wurgler’s website (http://people.stern.nyu.edu/jwurgler/).

Unlike in Baker and Wurgler (2006), turnover was dropped as one of the six sentiment indicators. According to the authors, turnover does not have the same meaning as in the past, given the significant increase in high-frequency institutional trading and the migration of trading to a great variety of venues.

The Fama-French risk factors have been downloaded from Kenneth French’s website (https://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html). SMB (small-minus-big) in the three-factor (five-factor) model is the average return on three (nine) small portfolios minus the average return on three (nine) big portfolios; HML (high-minus-low) is the average return on two value portfolios minus the average return on two growth portfolios; RMW (robust-minus-weak) is the average return on two robust operating profitability portfolios minus the average return on two weak operating profitability portfolios; and CMA (conservative-minus-aggressive) is the average return on two conservative investment portfolios minus the average return on two aggressive investment portfolios. RMRF (market excess returns) is the value-weighted returns of the sample, including all CRSP firms listed on the NYSE, AMEX, or NASDAQ and incorporated in the USA that have a non-missing return and CRSP share code of 10 or 11 at month t minus the one-month Treasury bill rate.

As shown in Fig. 2, the degree of CSR awareness does not seem to explain the CSR premium since the CSR premium has ups and downs, while the awareness seems to increase over time. In particular, since 2008, there seems to be an important increase in the awareness about CSR activities and climate change, while the CSR premium remains basically at the same level.

The relatively low variance explained by the second principal component compared to the first is driven by the capacity of the first component in capturing the movements of the systematic risk in the stock market. The second component aims to explain the common variation of the returns that are related to CSR.

The weights for the second principal components are − 0.291 (environmental high), 0.580 (environmental low), − 0.199 (community high), 0.389 (community low), − 0.227 (human rights high), 0.295 (human rights low), − 0.277 (employee relations high), 0.092 (employee relations low), − 0.194 (diversity high), 0.023 (diversity low), − 0.297 (product high), and 0.198 (product low).

Note that the second principal component gives positive weights for portfolios with low scores and negative weights for portfolios with high scores.

The sum of weights of portfolios with high scores is 148.5%, while low scores are equal to 157.7%. Accordingly, the sustainability factor does not consist of a zero-investment portfolio, and the factor has leverage.

References

Albuquerque, R., Y. Koskinen, and C. Zhang. 2019. Corporate social responsibility and firm risk: Theory and empirical evidence. Management Science 65(10): 4451–4469.

Baker, M., and J.C. Stein. 2004. Market liquidity as a sentiment indicator. Journal of Financial Markets 7(3): 271–299.

Baker, M., and J. Wurgler. 2006. Investor sentiment and the cross-section of stock returns. Journal of Finance 61(4): 1645–1680.

Baker, M., and J. Wurgler. 2007. Investor sentiment in the stock market. Journal of Economic Perspectives 21(2): 129–151.

Baker, M., J. Wurgler, and Y. Yuan. 2012. Global, local, and contagious investor sentiment. Journal of Financial Economics 104(2): 272–287.

Becchetti, L., R. Ciciretti, and A. Dalò. 2018. Fishing the corporate social responsibility risk factors. Journal of Financial Stability 37: 25–48.

Becchetti, L., R. Ciciretti, and I. Hasan. 2015. Corporate social responsibility, stakeholder risk, and idiosyncratic volatility. Journal of Corporate Finance 35: 297–309.

Black, F. 1972. Capital market equilibrium with restricted borrowing. The Journal of Business 45(3): 444–455.

Bolton, P. and M. T. Kacperczyk. 2021. Do investors care about carbon risk? Journal of Financial Economics (forthcoming).

Cao, J. J., S. Titman, X.E. Zhan, and W.E. Zhang. 2020. ESG preference, institutional trading, and stock return patterns. SSRN Electronic Journal, 1–42.

Chava, S. 2014. Environmental externalities and cost of capital. Management Science 60(9): 2223–2247.

De Long, J.B., A. Shleifer, L.H. Summers, and R.J. Waldmann. 1990. Noise trader risk in financial markets. The Journal of Political Economy 98(4): 703–738.

Deng, X., Jk. Kang, and B.S. Low. 2013. Corporate social responsibility and stakeholder value maximization: Evidence from mergers. Journal of Financial Economics 110(1): 87–109.

Derwall, J., N. Guenster, R. Bauer, and K. Koedijk. 2005. The premium puzzle. Journal of Financial Analysts 61(2): 51–63.

Dorfleitner, G., C. Kreuzer, and C. Sparrer. 2020. ESG controversies and controversial ESG: About silent saints and small sinners. Journal of Asset Management 21: 393–412.

El Ghoul, S., O. Guedhami, C.C.Y. Kwok, and D.R. Mishra. 2011. Does corporate social responsibility affect the cost of capital? Journal of Banking and Finance 35(9): 2388–2406.

Fama, E.F., and K.R. French. 1993. Common risk factors in the returns on stocks and bonds. Journal of Financial Economics 33(1): 3–56.

Fama, E.F., and K.R. French. 2007. Disagreement, tastes, and asset prices. Journal of Financial Economics 83(3): 667–689.

Fama, E.F., and K.R. French. 2015. A five-factor asset pricing model. Journal of Financial Economics 116(1): 1–22.

Flammer, C. 2015. Does corporate social responsibility lead to superior financial performance? A regression discontinuity approach. Management Science 61(11): 2549–2568.

Friedman, M. 1970. Social responsibility of business is to increase its profits. New York Times, September 13: 122-126.

Gandhi, P., and H. Lustig. 2015. Size anomalies in U.S. bank stock returns. Journal of Finance 70(2): 733–768.

Görgen, M., A. Jacob, M. Nerlinger, R. Riordan, M. Rohleder, and M. Wilkens. 2020. Carbon risk. SSRN Electronic Journal, 1–78.

Huang, D., F. Jiang, J. Tu, and G. Zhou. 2015. Investor sentiment aligned: A powerful predictor of stock returns. Review of Financial Studies 28(3): 791–837.

In, S., K. Park, and A. Monk. 2018. Is "being green" rewarded in the market? An empirical investigation of decarbonization risk and stock returns. Stanford Global Projects Center Working Paper, 1–53.

Jacobs, H. 2015. What explains the dynamics of 100 anomalies? Journal of Banking and Finance 57: 65–85.

Jiao, Y. 2010. Stakeholder welfare and firm value. Journal of Banking and Finance 34(10): 2549–2561.

Khan, M., G. Serafeim, and A. Yoon. 2016. Corporate sustainability: First evidence on materiality. Accounting Review 91(6): 1697–1724.

Lins, K.V., H. Servaes, and A. Tamayo. 2017. Social capital, trust, and firm performance: The value of corporate social responsibility during the financial crisis. Journal of Finance 72(4): 1785–1824.

Lintner, J. 1965. The valuation of risk assets and the selection of risky investments in stock portfolios and capital budgets. The Review of Economics and Statistics 47: 13–37.

Lu, W., K.W. Chau, H. Wang, and W. Pan. 2014. A decade’s debate on the nexus between corporate social and corporate financial performance: A critical review of empirical studies 2002–2011. Journal of Cleaner Production 79: 195–206.

McWilliams, A., and D. Siegel. 2000. Corporate social responsibility and financial performance: Correlation or misspecification? Strategic Management Journal 21(5): 603–609.

McWilliams, A., and D. Siegel. 2001. Corporate social responsibility: A theory of the firm perspective. Academy of Management Review 26(1): 117–127.

Naughton, J.P., C. Wang, and I. Yeung. 2019. Investor sentiment for corporate social performance. Accounting Review 94(4): 401–420.

Pastor, L., R. F. Stambaugh, and L. A. Taylor. 2021. Sustainable investing in equilibrium. Journal of Financial Economics (forthcoming).

Pedersen, L. H., S. Fitzgibbons, and L. Pomorski. 2021. Responsible investing: The ESG-efficient frontier. Journal of Financial Economics (forthcoming).

Pontiff, J. 2006. Costly arbitrage and the myth of idiosyncratic risk. Journal of Accounting and Economics 42(1–2): 35–52.

Sharpe, W.F. 1964. Capital asset prices: A theroy of market equilibrium under conditions of risk. Journal of Finance 19(3): 425–442.

Shen, J., J. Yu, and S. Zhao. 2017. Investor sentiment and economic forces. Journal of Monetary Economics 86: 1–21.

Shleifer, A., and R.W. Vishny. 1997. The limits of arbitrage. Journal of Finance 52(1): 35–55.

Stambaugh, R.F., J. Yu, and Y. Yuan. 2012. The short of it: Investor sentiment and anomalies. Journal of Financial Economics 104(2): 288–302.

Stambaugh, R.F., J. Yu, and Y. Yuan. 2014. The long of it: Odds that investor sentiment spuriously predicts anomaly returns. Journal of Financial Economics 114(3): 613–619.

Stambaugh, R.F., J. Yu, and Y. Yuan. 2015. Arbitrage asymmetry and the idiosyncratic volatility puzzle. Journal of Finance 70(5): 1903–1948.

Waddock, Sandra A., S.B. Graves, and B. Samuel. 1997. The corporate social performance-financial performance link. Strategic Management Journal 18(4): 303–319.

Walther, B., and R. Willis. 2013. Do investor expectations affect sell-side analysts’ forecast bias and forecast accuracy? Review of Accounting Studies 18: 207–227.

Acknowledgements

We thank Rocco Ciciretti, Jake Thomas, and Zhaobo Zhu for insightful discussions and helpful comments. We acknowledge the French Finance Association (AFFI) annual meeting and the CONSOB/ESMA/Bocconi conference of Securities Markets: Trends, Risks, and Policies for helpful comments. The paper has previously circulated with the title “Investor Sentiment and the Expected Returns of Socially and Environmentally Responsible Firms.” The authors also thank the National Council for Scientific and Technological Development (CNPq) and the Science without Borders Program for financial support, including a research scholarship.

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

This section contains additional details on the variables and tables that supplement the paper. Table 9 displays the qualitative issue areas used to estimate the CSR and CER scores.

Table 10 shows the details on the estimation of the variables used in the study.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Azevedo, V., Kaserer, C. & Campos, L.M.S. Investor sentiment and the time-varying sustainability premium. J Asset Manag 22, 600–621 (2021). https://doi.org/10.1057/s41260-021-00233-1

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41260-021-00233-1

Keywords

- Sustainability

- Corporate social responsibility

- Corporate environmental responsibility

- Expected returns

- Financial performance

- Investor sentiment