Abstract

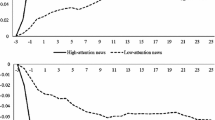

We examine market responses to changes in the Nasdaq 100 index membership and find asymmetric stock price and investor awareness reactions. Stocks added to the Nasdaq 100 index for the first time experience permanent price gains and significant increases in investor awareness, whereas repeated additions and new deletions exhibit temporary stock price changes and no significant changes in investor awareness. Stock liquidity improves for new additions and repeated additions but worsens for new deletions. Importantly, investor awareness proxies are significantly related to cumulative abnormal returns around the Nasdaq 100 reconstitution even in the presence of liquidity and other controlling factors. Taken together, the observed results are consistent with the investor awareness hypothesis.

Similar content being viewed by others

Notes

Financial instruments benchmarked to the Nasdaq 100 index are available in 28 countries, exchange-traded products tracking the index account for over $60 billion in assets, and the notional value of derivatives benchmarked to the index exceeds $1 trillion (Smith and Slen 2018).

To avoid any potential bias associated with unscheduled index changes, we do not examine 91 additions that occurred at different times throughout a year during the sample period.

By way of comparison, Yu et al. (2015) report a similar increase of 1.80 analysts for regular, year-end additions in the six months after the Nasdaq 100 index change announcement from the six months before for the 1994–2009 period.

As robustness checks, we also used 90-day and 270-day periods. The results are qualitatively unchanged.

References

Afego, P.N. 2017. Effects of changes in stock index compositions: A literature review. International Review of Financial Analysis 52: 228–239.

Amihud, Y. 2002. Illiquidity and stock returns: Cross-section and time-series effects. Journal of Financial Markets 5(1): 31–56.

Amihud, Y., and H. Mendelson. 1986. Asset pricing and the bid-ask spread. Journal of Financial Economics 17(2): 223–249.

Becker-Blease, J.R., and D.L. Paul. 2006. Stock liquidity and investment opportunities: Evidence from index additions. Financial Management 35(3): 35–51.

Beneish, M.D., and J.C. Gardner. 1995. Information costs and liquidity effects from changes in the Dow Jones Industrial Average list. Journal of Financial and Quantitative Analysis 30(1): 135–157.

Bessembinder, H., and H.M. Kaufman. 1997. A comparison of trade execution costs for NYSE and NASDAQ-listed stocks. Journal of Financial and Quantitative Analysis 32(3): 287–310.

Biktimirov, E.N., A.R. Cowan, and B.D. Jordan. 2004. Do demand curves for small stocks slope down? Journal of Financial Research 27(2): 161–178.

Chen, H., G. Noronha, and V. Singal. 2004. The price response to S&P 500 index additions and deletions: Evidence of asymmetry and a new explanation. Journal of Finance 59(4): 1901–1929.

Corrado, C.J. 1989. A nonparametric test for abnormal security-price performance in event studies. Journal of Financial Economics 23(2): 385–395.

Corrado, C.J., and T.L. Zivney. 1992. The specification and power of the sign test in event study hypothesis tests using daily stock returns. Journal of Financial and Quantitative Analysis 27(3): 465–478.

Corwin, S.A., and P. Schultz. 2012. A simple way to estimate bid-ask spreads from daily high and low prices. Journal of Finance 67(2): 719–759.

Cowan, A.R. 1992. Nonparametric event study tests. Review of Quantitative Finance and Accounting 2(4): 343–358.

Denis, D.K., J.J. McConnell, A.V. Ovtchinnikov, and Y. Yu. 2003. S&P 500 index additions and earnings expectations. Journal of Finance 58(5): 1821–1840.

Elliott, W.B., B.F. Van Ness, M.D. Walker, and R.S. Warr. 2006. What drives the S&P 500 inclusion effect? An analytical survey. Financial Management 35(4): 31–48.

Elliott, W.B., and R.S. Warr. 2003. Price pressure on the NYSE and Nasdaq: Evidence from S&P 500 index changes. Financial Management 32(3): 85–99.

Erwin, G.R., and J.M. Miller. 1998. The liquidity effects associated with addition of a stock to the S&P 500 index: Evidence from bid/ask spreads. Financial Review 33(1): 131–146.

Fama, E.F., and K.R. French. 1993. Common risk factors in the returns on stocks and bonds. Journal of Financial Economics 33(1): 3–56.

Geppert, J.M., S.I. Ivanov, and G.V. Karels. 2011. An analysis of the importance of S&P 500 discretionary constituent changes. Review of Quantitative Finance and Accounting 37(1): 21–34.

Haensly, P.J. 2003. How did the Dow do today? Journal of Asset Management 4(4): 258–276.

Harris, L., and E. Gurel. 1986. Price and volume effects associated with changes in the S&P 500 list: New evidence for the existence of price pressures. Journal of Finance 41(4): 815–829.

Hegde, S.P., and J.B. McDermott. 2003. The liquidity effects of revisions to the S&P 500 index: An empirical analysis. Journal of Financial Markets 6(3): 413–459.

Jain, P.C. 1987. The effect on stock price of inclusion in or exclusion from the S&P 500. Financial Analysts Journal 43(1): 58–65.

Jain, P.K., and J.-C. Kim. 2006. Investor recognition, liquidity, and exchange listings in the reformed markets. Financial Management 35(2): 21–42.

Kadlec, G.B., and J.J. McConnell. 1994. The effect of market segmentation and illiquidity on asset prices: Evidence from exchange listings. Journal of Finance 49(2): 611–636.

Kappou, K., C. Brooks, and C. Ward. 2010. The S&P500 index effect reconsidered: Evidence from overnight and intraday stock price performance and volume. Journal of Banking & Finance 34(1): 116–126.

Lesmond, D.A., J.P. Ogden, and C.A. Trzcinka. 1999. A new estimate of transaction costs. Review of Financial Studies 12(5): 1113–1141.

Li, M., T. McCormick, and X. Zhao. 2005. Order imbalance and liquidity supply: Evidence from the bubble burst of NASDAQ stocks. Journal of Empirical Finance 12(4): 533–555.

Mama, H.B., S. Mueller, and U. Pape. 2017. What’s in the news? The ambiguity of the information content of index reconstitutions in Germany. Review of Quantitative Finance and Accounting 49(4): 1087–1119.

Mase, B. 2007. The impact of changes in the FTSE 100 index. Financial Review 42(3): 461–484.

Marciniak, M. 2012. Information effects of announced stock index additions: Evidence from S&P 400. Journal of Economics and Finance 36(4): 822–849.

Masulis, R.W., and L. Shivakumar. 2002. Does market structure affect the immediacy of stock price response to news? Journal of Financial and Quantitative Analysis 37(4): 617–648.

Merton, R.C. 1987. A simple model of capital market equilibrium with incomplete information. Journal of Finance 42(3): 483–510.

Nasdaq. Nasdaq 100. (2018). https://www.nasdaq.com/markets/indices/nasdaq-100.aspx. Accessed 2 January 2018.

Opong, K., and A. Siganos. 2013. Compositional changes in the FTSE100 index from the standpoint of an arbitrageur. Journal of Asset Management 14(2): 120–132.

Rahman, S., C. Krishnamurti, and A.C. Lee. 2005. The dynamics of security trades, quote revisions, and market depths for actively traded stocks. Review of Quantitative Finance and Accounting 25(2): 91–124.

Shleifer, A. 1986. Do demand curves for stocks slope down? Journal of Finance 41(3): 579–590.

Smith, J. W., & Slen, E. (2018). The Nasdaq-100: Tracking innovation in large cap growth. http://n.nasdaq.com/GIG_WP_N100. Accessed 13 March 2018.

Weston, J.P. 2000. Competition on the Nasdaq and the impact of recent market reforms. Journal of Finance 55(6): 2565–2598.

Wurgler, J., and E. Zhuravskaya. 2002. Does arbitrage flatten demand curves for stocks? Journal of Business 75(4): 583–608.

Yu, S., G. Webb, and K. Tandon. 2015. What happens when a stock is added to the Nasdaq-100 index? What doesn’t happen? Managerial Finance 41(5): 480–506.

Zhou, H. 2011. Asymmetric changes in stock prices and investor recognition around revisions to the S&P 500 index. Financial Analysts Journal 67(1): 72–84.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Biktimirov, E.N., Xu, Y. Asymmetric stock price and investor awareness reactions to changes in the Nasdaq 100 index. J Asset Manag 20, 134–145 (2019). https://doi.org/10.1057/s41260-019-00108-6

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41260-019-00108-6