Abstract

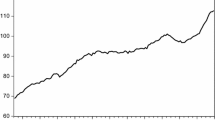

The housing market is one of the most cyclical parts of the U.S. economy and played a leading role in the Great Recession. While house prices have recovered, the extent of the recovery varies considerably across markets. We evaluate housing prices in 20 MSAs and find that 12 out of them show a consistent pattern of behavior relative to the nation, while eight cities’ house price indices (HPIs) are characterized as having inconsistent behavior. Our analysis found breaks in the time series behavior of all HPIs. Furthermore, some MSAs, such as New York and Miami, began to recover much sooner than others. Granger causality test results suggest that some MSAs lead the national average and most of the other MSAs. Thus, our study suggests that changes in housing prices in a number of MSAs would provide an early warning for price moves at the national and regional levels.

Similar content being viewed by others

Notes

The FOMC transcripts can be found at https://www.federalreserve.gov/monetarypolicy/fomc_historical.htm.

The national and MSA HPIs increased during the 2002–2006 period, and most of these indices peaked in 2006. Similarly, the national and most MSA HPI bottomed in 2012. We use the 2002–2006 period to show the boom, and 2007–2012 to estimate the bust. Specific month of the boom/bust may vary for different MSAs but, we believe, our conclusion would remain the same if we varied the specific peak/tough dates. Using a common boom/bust period helps us compare increases/drops between the national HPI and MSAs.

During the 2009–2011 period, the Miami HPI line stay very close to the national HPI—both HPIs show similar growth path.

The statistical techniques here are covered in more detail in Silvia et al. (2014).

References

Granger, C.W.J. 1969. Investigating Causal Relationships by Econometric Models and Cross-Spectral Methods. Econometrica 37 (3): 424–438.

Silvia, J.E., A. Iqbal, S. Bullard, S. Watt, and K. Swankoski. 2014. Economic and Business Forecasting: Analyzing and Interpreting Econometric Results. New York: Wiley.

Vitner, M., and A. Iqbal. 2013. Did Monetary Policy Fuel the Housing Bubble? The Journal of Private Enterprise 29 (1): 1–24.

Author information

Authors and Affiliations

Corresponding author

Additional information

This paper won NABE’s Contributed Paper Award for 2017 and was presented at the NABE Annual Meeting on September 24, 2017.

Rights and permissions

About this article

Cite this article

Iqbal, A., Vitner, M. Quantifying the housing recovery: which MSAs are experiencing bubbles?. Bus Econ 52, 250–259 (2017). https://doi.org/10.1057/s11369-017-0052-2

Published:

Issue Date:

DOI: https://doi.org/10.1057/s11369-017-0052-2