Abstract

We apply the simulated method of moments to a lifecycle model to infer the impact of health insurance on life expectancy. The model features endogenous health risks, which are determined jointly by the natural law and one’s own decisions of medical care expenditures. Individual’s optimal decisions of consumption, saving, and medical care expenditure are solved, and life expectancies are calculated in the scenarios with and without health insurance. The comparison result shows that health insurance has a positive impact on life expectancy through its positive impact on medical care expenditures, but this impact is not quantitatively significant.

Similar content being viewed by others

Data availability

All data generated or analysed during this study are included in this article.

Notes

Data source: United Nations, Department of Economic and Social Affairs, Population Division (2022). World Population Prospects: The 2022 Revision. https://population.un.org/dataportal/data/indicators/61/locations/900 /start /1950/end/2023/table/pivotbylocation.

Data source: The coverage ratio 95% is released by China National Healthcare Security Administration, and the enrollment rate of critical illness insurance is calculated based on China Family Panel Studies (2018).

Our contribution compared to Frankovic and Kuhn (2023) is that this paper models the coverage of health insurance precisely. Frankovic and Kuhn (2023) do not distinguish health states and set mortality rates to be lowered by health care expenditures, which are covered by health insurance. However, health care expenditures include medical expenditures and preventive care expenditures that are not covered by health insurance. By distinguishing health states and setting transition probabilities from the sick state to be endogenous, this paper sets up health insurance to cover only medical expenditures, not preventive care expenditures, in order to discuss the impact of health insurance more precisely.

Generally, critical illness insurance is unavailable for sick applicants. Therefore, we assume that the individual is healthy at the time of applying for the insurance.

According to the natural law, the recovery rate decreases and case fatality rate increases as the individual becomes older. Medical care expenditure increases the natural recovery rates and decreases the natural case fatality rates. See, for example, Ehrlich (2000), Ehrlich and Yin (2005), Kuhn et al. (2011), and Guasoni and Huang (2019) for similar settings.

We assume that there is no medical expense if an individual is in a healthy state.

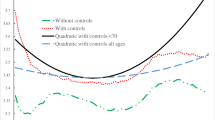

In the calibration section, we show that this is indeed a reasonable thing to assume (viz Fig. 1).

CFPS is a nationally representative, biennial longitudinal survey of Chinese communities, families and individuals launched in 2010 by the Institute of Social Science Survey of Peking University, China.

An introduction about health insurance and health care in China is available at https://www.internations.org.

According to the Organization for Economic Co-operation and Development (OECD) report of Pensions at a Glance 2019: OECD and G20 Indicators, the replacement rate ranges from 58.8% to 98.5%, varying across gender and earnings. We set it to 65% considering that there is a high deficit risk in the China Basic Pension System.

Although our model starts at age 45, we estimate the income process of individuals throughout the working period so that we can expand our age range if necessary.

As after-tax income is investigated in CFPS, we do not need to subtract the payroll tax of the health insurance program and social security and the income tax from the estimated income when calculating. In the later analysis, we approximate the individual’s wage to be 1.02 times the estimated value when CBMI is not considered.

Referring to Koijen et al. (2016), we set \({\omega }_{1}=1\).

We set that annuity prices are typically based on standard life tables and the individual takes annuity prices as given. This setting is consistent with reality but leads to annuity-related moral hazard according to Kuhn et al. (2015). But the conclusions of the robustness test will not be affected as long as annuities are priced in a consistent manner.

References

Ai, J., P.L. Brockett, L.L. Golden, and W. Zhu. 2017. Health State Transitions and Longevity Effects on Retirees’ Optimal Annuitization. Journal of Risk and Insurance 84: 319–343.

Black, B., A. Hollingsworth, L. Nunes, and K. Simon. 2019. The Effect of Health Insurance on Mortality: Power Analysis and What We can Learn from the Affordable Care Act Coverage Expansions. NBER Working Paper No. 25568.

Borgschulte, M., and J. Vogle. 2020. Did the ACA Medicaid Expansion Save Lives? Journal of Health Economics 72: 102333.

Card, D., C. Dobkin, and N. Maestas. 2009. Does Medicare Save Lives? The Quarterly Journal of Economics 124 (2): 597–636.

Cho, Y., S. M. Li, and L. Uren. 2021. Investment Housing Tax Concessions and Welfare: Evidence from Australia. CAMA Working Papers 2021-02, Centre for Applied Macroeconomic Analysis, Crawford School of Public Policy, The Australian National University.

Crémieux, P.-Y., M.-C. Mieilleur, P. Ouellette, et al. 2005. Public and Private Pharmaceutical Spending as Determinants of Health Outcomes in Canada. Health Economics 14 (2): 107–116.

Ehrlich, I. 2000. Uncertain Lifetime, Life Protection, and the Value of Life Saving. Journal of Health Economics 19 (3): 341–367.

Ehrlich, I., and G.S. Becker. 1972. Market Insurance, Self-Insurance, and Self-Protection. Journal of Political Economy 80 (4): 623–648.

Ehrlich, I., and Y. Yin. 2005. Explaining Diversities in Age-Specific Life Expectancies and Values of Life Saving: A Numerical Analysis. Journal of Risk and Uncertainty 31 (2): 129–162.

Fanti, L., L. Gori, and F. Tramontana. 2014. Endogenous Lifetime, Accidental Bequests and Economic Growth. Decisions in Economics and Finance 37 (1): 81–98.

Fink, G., P.J. Robyn, A. Sié, and R. Sauerborn. 2013. Does Health Insurance Improve Health?: Evidence from a Randomized Community-Based Insurance Rollout in Rural Burkina Faso. Journal of Health Economics 32 (6): 1043–1056.

Finkelstein, A., and R. McKnight. 2008. What did Medicare Do? The Initial Impact of Medicare on Mortality and Out of Pocket Medical Spending. Journal of Public Economics 92 (7): 1644–1668.

Finkelstein, A., S. Taubman, B. Wright, et al. 2012. The Oregon Health Insurance Experiment: Evidence from the First Year. Quarterly Journal of Economics 127 (3): 1057–1106.

Fonseca, R., P.-C. Michaud, A. Kapteyn, and T. Galama. 2021. Accounting for the Rise of Health Spending and Longevity. Journal of European Economic Association 19 (1): 536–579.

Frankovic, I., and M. Kuhn. 2023. Health Insurance, Endogenous Medical Progress, Health Expenditure Growth, and Welfare. Journal of Health Economics 87: 102717.

Gaudette, É., G.C. Pauley, and J.M. Zissimopoulos. 2018. Lifetime Consequences of Early-Life and Midlife Access to Health Insurance: A Review. Medical Care Research and Review 75 (6): 655–720.

Ghosh, A., K. Simon, and B.D. Sommers. 2019. The Effect of Health Insurance on Prescription Drug Use among Low-Income Adults: Evidence from Recent Medicaid Expansions. Journal of Health Economics 63: 64–80.

Goldin, J., I.Z. Lurie, and J. McCubbin. 2021. Health Insurance and Mortality: Experimental Evidence from Taxpayer Outreach. The Quarterly Journal of Economics 136 (1): 1–49.

Goodman-Bacon, A. 2018. Public Insurance and Mortality: Evidence from Medicaid Implementation. Journal of Political Economy 126 (1): 216–262.

Gourinchas, P.-O., and J.A. Parker. 2002. Consumption over the Life Cycle. Econometrica 70 (1): 47–89.

Guasoni, P., and Y.-J. Huang. 2019. Consumption, Investment and Healthcare with Aging. Finance and Stochastics 23 (2): 313–358.

Hall, R.E., and C.I. Jones. 2007. The Value of Life and the Rise in Health Spending. Quarterly Journal of Economics 122 (1): 39–72.

Heathcote, J., F. Perri, and G.L. Violante. 2010. Unequal We Stand: An Empirical Analysis of Economic Inequality in the United States, 1967–2006. Review of Economic Dynamics 13 (1): 15–51.

Horneff, W., R. Maurer, and R. Rogalla. 2010. Dynamic Portfolio Choice with Deferred Annuities. Journal of Banking and Finance 34 (11): 2652–2664.

Huang, H.Y., J.F. Shi, L.W. Guo, Y.N. Bai, X.Z. Liao, G.X. Liu, A.Y. Mao, J.S. Ren, X.J. Sun, X.Y. Zhu, L. Wang, B.B. Song, L.B. Du, L. Zhu, J.Y. Gong, Q. Zhou, Y.Q. Liu, R. Cao, L. Mai, L. Lan, X.H. Sun, Y. Ren, J.Y. Zhou, Y.Z. Wang, X. Qi, P.A. Lou, D. Shi, N. Li, K. Zhang, J. He, and M. Dai. 2017. Expenditure and Financial Burden for the Diagnosis and Treatment of Colorectal Cancer in China: A Hospital-Based, Multicenter, Cross-Sectional Survey. Cancer Communications 36: 1–15.

Hugonnier, J., F. Pelgrin, and P. St-Amour. 2013. Health and (Other) Asset Holdings. Review of Economic Studies 80 (2): 663–710.

Hugonnier, J., F. Pelgrin, and P. St-Amour. 2020. Closing Down the Shop: Optimal Health and Wealth Dynamics near the End of Life. Health Economics 29 (2): 138–153.

Hurd, M.D., and K. McGarry. 1997. Medical Insurance and the Use of Health Care Services by the Elderly. Journal of Health Economics 16 (2): 129–154.

İmrohoroğlu, A., and K. Zhao. 2018. The Chinese Saving Rate: Long-Term Care Risks, Family Insurance, and Demographics. Journal of Monetary Economics 96: 33–52.

Koijen, R.S.J., S. Van Nieuwerburgh, and M. Yogo. 2016. Health and Mortality Delta: Assessing the Welfare Cost of Household Insurance Choice. The Journal of Finance 71 (2): 957–1010.

Kuhn, M., S. Wrzaczek, A. Prskawetz, and G. Feichtinger. 2011. Externalities in a Life Cycle Model with Endogenous Survival. Journal of Mathematical Economics 47 (4–5): 627–641.

Kuhn, M., S. Wrzaczek, A. Prskawetz, and G. Feichtinger. 2015. Optimal Choice of Health and Retirement in a Life-Cycle Model. Journal of Economic Theory 158: 186–212.

Leng, A., J. Jing, S. Nicholas, and J. Wang. 2019. Geographical Disparities in Treatment and Health Care Costs for End-of-Life Cancer Patients in China: A Retrospective Study. BMC Cancer 19 (1): 39.

Levy, H., and D. Meltzer. 2008. The Impact of Health Insurance on Health. Annual Review of Public Health 29: 399–409.

Miller, S., N. Johnson, and L.R. Wherry. 2021. Medicaid and Mortality: New Evidence from Linked Survey and Administrative Data. The Quarterly Journal of Economics 136 (3): 1783–1829.

Obrizan, M., and G.L. Wehby. 2018. Health Expenditures and Global Inequalities in Longevity. World Development 101: 28–36.

Sommer, K. 2016. Fertility Choice in a Life Cycle Model with Idiosyncratic Uninsurable Earnings Risk. Journal of Monetary Economics 83: 27–38.

Strulik, H. 2022. Medical Progress and Life Cycle Choices. The Journal of the Economics of Ageing 23: 100415.

Tauchen, G. 1986. Finite State Markov-Chain Approximations to Univariate and Vector Autoregressions. Economics Letters 20 (2): 177–181.

Tonetti, C. 2011. Notes on Estimating Earnings Processes. Unpublished manuscript.

Wherry, L.R., and B.D. Meyer. 2016. Saving Teens: Using a Policy Discontinuity to Estimate the Effects of Medicaid Eligibility. The Journal of Human Resources 51 (3): 556–588.

Wolfe, B., and M. Gabay. 1987. Health Status and Medical Expenditures: More Evidence of a Link. Social Science and Medicine 25 (8): 883–888.

Wu, Q., M. Jia, H. Chen, S. Zhang, Y. Liu, K. Prem, M. Qian, and H. Yu. 2020. The Economic Burden of Cervical Cancer from Diagnosis to One Year After Final Discharge in Henan Province, China: A Retrospective Case Series Study. PLoS ONE 15 (5): e0232129.

Zhao, K. 2015. The Impact of the Correlation Between Health Expenditure and Survival Probability on the Demand for Insurance. European Economic Review 75: 98–111.

Acknowledgements

The authors express sincere gratitude to the editor-in-chief, and the two anonymous reviewers for their insightful comments on the manuscript.

Funding

This research was funded by Beijing Social Science Fund (Grant No. 19YJC043), National Natural Science Foundation of China (Grant No. 12071498) and Higher Education Discipline Innovation Project (Grant No. B17050).

Author information

Authors and Affiliations

Contributions

PL contributed the central idea, analysed most of the data, and finalized this paper. JL contributed to refining the ideas, carrying out additional analyses and writing the initial draft of the paper.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Appendix: Numerical solution and simulation algorithm

Appendix: Numerical solution and simulation algorithm

Here, we provide a detailed description of the numerical solution algorithm and simulation method, based on the life-cycle model with annuities.

1.1 Discretization

We first discretize the state spaces for critical illness insurance, annuity, savings, medical care expenditure, and income and restrict optimal choices on these grids. For convenience, we take 10,000 RMB as the unit.

State space for age (\({{\varvec{\Omega}}}_{\mathbf{a}}\)) and health state (\({{\varvec{\Omega}}}_{\mathbf{z}}\)) The age ranges from 45 to 90, which we standardize as 1 to 46 in the program, that is, \({\Omega }_{a}=\left\{{1,2},\dots 46\right\}\). The state space for the health state is already discrete, that is, \({\Omega }_{z}=\left\{{1,2},3\right\}\).

State space for critical illness insurance (\({\boldsymbol{\Omega }}_{{\varvec{B}}}\)) We set 21 optional sum assureds for critical illness insurance, with the minimum sum assured as 0 and the maximum sum assured as 100, that is, \(B\in {\Omega }_{B}=\left\{{0,5},\dots ,100\right\}\).

State space for annuity (\({\boldsymbol{\Omega }}_{{\varvec{n}}}\)) In the model, we set the non-refundable premium \({A}_{t}\) as the control variable. To reduce the number of variables, we set \({A}_{t}=\left({n}_{t}-{n}_{t-1}\right){h}_{t}\) and take the annual annuity payout \({n}_{t}\) after retirement as the state variable as well as the control variable. We assume 21 optional payouts for annuity at each period, ranging from 0 to 10. In addition, the annuity is non-refundable, that is \({n}_{t}\ge {n}_{t-1}\) for \(t\in \left[0,T\right]\). Therefore, \({n}_{t}\in {\Omega }_{n,t}=\left\{{n}_{t-1},{n}_{t-1}+0.5,\dots ,10\right\}\) for \(t\in \left[0,T\right]\), where \({n}_{-1}\) is appointed to be 0, and \({\Omega }_{n}=\left\{{0,0.5},\dots ,10\right\}\).

State space for saving (\({\boldsymbol{\Omega }}_{{\varvec{s}}}\)) The relationship between cash wealth \({G}_{t}\) and savings \({s}_{t}\) has been established in the model, that is, \({G}_{t+1}=\left(1+{r}_{{f}}\right){s}_{t}\). Therefore, the state space for \({G}_{t}\) is known if we set the state spaces for \({s}_{t}\). We assume there are 100 optional points for saving at each period, ranging from 0 to 101. Then, \({s}_{t}\in {\Omega }_{s,t}={\Omega }_{s}=\left\{0, {1.01,2.02},\dots ,101\right\}\) for \(t\in \left[0,T\right]\).

State space for medical care expenditure (\({\boldsymbol{\Omega }}_{{\varvec{e}}}\)) We assume 100 optional points for medical care expenditure at each period if the individual is sick, ranging from 0 to 101. Then, \({e}_{t}\in {\Omega }_{e,t}={\Omega }_{e}=\left\{0, {1.01,2.02},\dots ,101\right\}\) for \(t\in \left[0,T\right]\).

State space for income process (\({\boldsymbol{\Omega }}_{{\varvec{w}}}\)) According to Tauchen (1986), we approximate the continuous-valued income process using a three-state Markov chain \({\widetilde{\rho }}_{{a,t}}\) to reduce the numerical burden, that is, \({\widetilde{\rho }}_{x+t,t}\in \left\{-0.5{\sigma }_{\rho },0, 0.5{\sigma }_{\rho }\right\}\), where \({\sigma }_{\rho }={\left({\sigma }_{\upsilon }^{2}/\left(1-{\vartheta }^{2}\right)+{\sigma }_{\varepsilon }^{2}\right)}^{0.5}\). As in Tauchen (1986), we define \({\widetilde{\rho }}^{(1)}=-0.5{\sigma }_{\rho }\), \({\widetilde{\rho }}^{(2)}=0\),\({\widetilde{\rho }}^{(3)}=0.5{\sigma }_{\rho }\), and \({w}={\widetilde{\rho }}^{(2)}-{\widetilde{\rho }}^{(1)}=0.5{\sigma }_{\rho }\); then,

and

Inserting the values of \({\sigma }_{\upsilon }^{2}\), \({\sigma }_{\varepsilon }^{2}\), and \(\vartheta\), we have \({\sigma }_{\rho }=0.7168\) and the transition matrix as follows:

1.2 Numerical solution

We solve our model using backward induction. The iterations involve the following steps.

Step 1: We first solve the problem in period \(T\). For all the grids in state space \({{\Omega }_{s}\times {\Omega }_{n}\times \Omega }_{z}\) and a given sum assured \(B\) for critical illness insurance in state space \({\Omega }_{B}\), we solve Eqs. (14) and (20) using the grid search method. For convenience, we transcribe these equations as follows:

In detail, for any grid in \({{\Omega }_{s}\times {\Omega }_{n}\times \Omega }_{z}\) and the given \(B\), we calculate the lifelong utilities in the brace on the right for all possible grids of \({s}_{{T}}\) (\({s}_{{T}}\in {\Omega }_{s}\)). We find the maximum value \({V}_{{T}}^{*}\left({G}_{{T}},{n}_{T-1},{B}_{{T}},{z}_{{T}}\left|B\right.\right)\) and the corresponding optimal grid \({s}_{{T}}^{*}\left({G}_{{T}},{n}_{T-1},{B}_{{T}},{z}_{{T}}\left|B\right.\right)\).

Step 2: We then solve the problems backing to the first period of retirement (\(t=T-1,T-2,\dots ,Tr\)). In the same way, we calculate the lifelong utilities in period \(t\) for all possible grids of \(\left({s}_{t},{e}_{t}\right)\in {\Omega }_{s}\times {\Omega }_{e}\) when sick or \({s}_{t}\in {\Omega }_{s}\) when healthy, based on any grids in \({{\Omega }_{s}\times {\Omega }_{n}\times \Omega }_{z}\), the given \(B\), and the solved maximum values \({V}_{t+1}^{*}\left({G}_{t+1},{n}_{t},{B}_{t+1},{z}_{t+1}\left|B\right.\right)\) in period \(t+1\). We find the maximum value \({V}_{t}^{*}\left({G}_{t},{n}_{t-1},{B}_{t},{z}_{t}\left|B\right.\right)\) and the optimal grids of \({s}_{t}^{*}\left({G}_{t},{n}_{t-1},{B}_{t},{z}_{t}\left|B\right.\right)\) and \({e}_{t}^{*}\left({G}_{t},{n}_{t-1},{B}_{t},{z}_{t}=2\left|B\right.\right)\) for a given combination of states and the given \(B\).

Step 3: We further solve the problems in the working period (\(t=Tr-1,Tr-2,\dots ,1\)) employing the same method. However, the possible grids are \(\left({s}_{t},{n}_{t}\right)\in {\Omega }_{s}\times {\Omega }_{n}\) when healthy and \(\left({s}_{t},{n}_{t},{e}_{t}\right)\in {\Omega }_{s}\times {\Omega }_{n}\times {\Omega }_{e}\) when sick. In addition, the state space becomes \({{\Omega }_{s}\times {\Omega }_{n}\times {\Omega }_{w}\times \Omega }_{z}\) in the working period. Then, the maximum value \({V}_{t}^{*}\left({G}_{t},{n}_{t-1},{w}_{t},{B}_{t},{z}_{t}\left|B\right.\right)\) and optimal grids of \({s}_{t}^{*}\left({G}_{t},{n}_{t-1},{w}_{t},{B}_{t},{z}_{t}\left|B\right.\right)\), \({n}_{t}^{*}\left({G}_{t},{n}_{t-1},{w}_{t},{B}_{t},{z}_{t}\left|B\right.\right)\), and \({e}_{t}^{*}\left({G}_{t},{n}_{t-1},{w}_{t},{B}_{t},{z}_{t}=2\left|B\right.\right)\) are found for a given combination of states and the given B. Further, \({V}_{1}^{*}\left({G}_{1},{n}_{0},{w}_{1},{B}_{1},{z}_{1}\left|B\right.\right)\) in the algorithm equals to \({V}_{0}\left({G}_{0},{n}_{-1}=0,{w}_{0},{B}_{0},{z}_{0}\left|B\right.\right)\) in the model.

Step 4: We find the optimal \(B\) at last. For every value in \({\Omega }_{B}\), we repeat Steps 1–3 to calculate \({V}_{1}^{*}\left({G}_{1},{n}_{0},{w}_{1},{B}_{1},{z}_{1}\left|B\right.\right)\). We then compare the values of \({V}_{1}^{*}\) with different \(B\) and find the optimal \({B}^{*}\left({G}_{1},{n}_{0},{w}_{1},{B}_{1},{z}_{1}\right)\), which maximizes \({V}_{1}^{*}\).

1.3 Simulation

The life cycle decisions are not constant values, depending on the states in the future. Monte Carlo simulations are finally carried out to generate the optimal actions (consumption, savings, medical care expenditure when sick, and critical illness insurance purchase in the initial and annuity purchase before retirement) from the first period forward to the end of life. The simulations involve the following steps.

Step 1: The income path is first drawn using the three-state Markov income process. The process is replicated 10,000 times to produce 10,000 paths, which are said to be the income processes of 10,000 individuals.

Step 2: We calculate the space of transition probabilities. The probabilities from the sick state \({\pi }_{t,t+1}^{2j}\) are endogenous and determined jointly by the natural law and the individual’s own decision of medical care expenditure \({e}_{t}\) (\({e}_{t}\ge 0\)). This is because we do not know the decision of medical care expenditure before we know the states. Therefore, we calculate all of the possible \({\pi }_{t,t+1}^{2j}\). That is, for any \({e}_{t}\in {\Omega }_{e}\) and \(t\in \left[{1,2},\dots ,T\right]\), we calculate \(\left\{{\pi }_{t,t+1}^{2j}\left({e}_{t}\right)\right\}\).

Step 3: We conduct simulations from the first period forward to the second period. For individual \(i\), the initial states and optimal critical illness insurance are known, and the corresponding optimal decisions in the first period can be determined in \({s}_{1}^{*}\left({G}_{1},{n}_{0},{w}_{1},{B}_{1},{z}_{1}\left|{B}^{*}\right.\right)\) and \({n}_{1}^{*}\left({G}_{1},{n}_{0},{w}_{1},{B}_{1},{z}_{1}\left|{B}^{*}\right.\right)\) by matching the states. Then, the states in the second period can be further produced; that is, \({G}_{2}\) and \({n}_{1}\) are decided by the optimal decisions in the first period, \({w}_{2}\) is cited from the second value on the income path of individual \(i\), and \({B}_{1},{z}_{1}\) are generated according to the exogenous probabilities from healthy state \({\pi }_{t,t+1}^{1j}\).

Step 4: We conduct simulations from the second period forward to the end of life. The corresponding optimal decisions in period \(t\) (\(t={2,3},\dots , T\)) can be determined by matching \({G}_{t},{n}_{t-1},{w}_{t},{B}_{t},{z}_{t}\), and the states in period \(t+1\) can be further produced. It is worth mentioning that \({B}_{t+1},{z}_{t+1}\) are generated according to the endogenous probabilities from the sick state \({\pi }_{t,t+1}^{2j}\left({e}_{t}\right)\), which is determined in the space of transition probabilities calculated in Step 2, with \({e}_{t}={e}_{t}^{*}\left({G}_{t},{n}_{t-1},{w}_{t},{B}_{t},{z}_{t}=2\left|{B}^{*}\right.\right)\).

Step 5: Steps 3 and 4 are replicated 10,000 times, and then the income path, path of healthy states and life cycle planning of every individual are simulated. The results are calculated by averaging the life cycle planning of all individuals.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Liao, P., Liu, J. Does health insurance extend life expectancy? Evidence from a structural estimation. Geneva Risk Insur Rev (2023). https://doi.org/10.1057/s10713-023-00089-y

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s10713-023-00089-y

Keywords

- Endogenous health risk

- Medical care expenditure

- Health insurance

- Life expectancy

- Simulated method of moments