Abstract

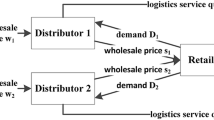

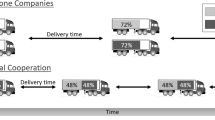

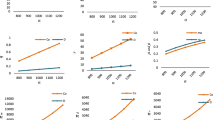

As the third party logistics partners (carriers) taking a more and more significant role in supply chain practices and customer service performance improvement, there is an emerging need for the studies on optimal channel coordination policies for business processes involving not only supplier and buyer (retailer), but also transportation partners. In this paper, we explicitly add a transportation partner with concave cost functions into the analysis for supplier–buyer channel coordination policies, and analyse the impact of coordination and pricing policies on supply chain profitability. The market demand is assumed to be a decreasing convex function of buyer's selling price (x), D(x)=d/x 2. Under this assumption, we quantify the improvement on total supply chain profitability when moving from a non-cooperative environment to a fully cooperative environment, and show that the joint annual profit of three partners in a cooperative environment can be at least twice of what may be achieved by three independently operated companies in a leader–follower business game. While in a real-world business environment, a perfect collaboration is hard to achieve, this result can be used to provide a quick estimation on the upper bound on the budget for profit sharing or discount offers among the supply chain partners.

Similar content being viewed by others

References

Carter JR and Ferrin BG (1995). The impact of transportation costs on supply chain management. J Bus Logist 16(1): 189–212.

Lynch K (2003). The missing link in the prefect order cycle. Inbound Logist 23(1): 44.

Harps LH (2003). The nature of change. Inbound Logist 23(1): 76–132. Editor's Report. Inbound Logist 23(7): 49–51.

Kerr J (2004). How to read between the lines. Logist Mngt July 2004: 50–54.

Goyal SK (1976). An integrated inventory model for a single supplier–single customer problem. Int J Prod Res 15: 107–111.

Goyal SK (1988). A joint economic lot size model for purchaser and vendor: a comment. Decis Sci 19: 236–241.

Monahan JP (1984). A quality discount pricing model to increase vendor's profits. Mngt Sci 30: 720–726.

Lee HL and Rosenblatt MJ (1986). A generalized quantity discount model to increase supplier profit. Mngt Sci 32: 1177–1185.

Banerjee A (1986). A joint economic lot size model for purchaser and vendor. Decis Sci 17: 292–311.

Abad PL (1988). Determining optimal selling price and the lot size when the supplier offers all-unit quantity discounts. Decis Sci 19: 622–634.

Goyal SK and Gupta YP (1989). Integrated inventory models: the buyer–vendor coordination. Eur J Opl Res 41: 261–269.

Benjamin J (1990). An analysis of mode choice for shippers in a constrained network with applications to just-in-time inventory. Transport Res (Part B) 24B(3): 229–245.

Anupindi R and Akella R (1993). Diversification under supply uncertainty. Mngt Sci 39: 944–963.

Kohli R and Park H (1994). Coordinating buyer–seller transactions across multiple products. Mngt Sci 40: 45–50.

Lau HS and Lau AHL (1994). Coordination of two suppliers with offsetting lead time and price performance. J Opns Mngt 11: 327–337.

Weng ZK (1995). Channel coordination and quantity discount. Mngt Sci 41: 1509–1522.

Weng ZK (1995). Modeling quantity discounts under general price-sensitive demand functions: optimal policies and relationships. Eur J Opl Res 86: 300–314.

Weng ZK (1997). Pricing and ordering strategies in manufacturing and distribution alliances. IIE Trans 29: 681–692.

Weng ZK (2004). Coordinating order quantities between the manufacturer and the buyer: a generalized newsvendor model. Eur J Opl Res 156: 148–161.

Li SX and Huang Z (1995). Managing buyer-seller system cooperation with quantity discount considerations. Comp Opns Res 22(9): 947–958.

Corbett CJ and de Groote X (2000). A supplier's optimal quantity discount policy under asymmetric information. Mngt Sci 46: 444–450.

Chen F, Federgruen A and Zheng YS (2001). Coordination mechanisms for a distribution system with one supplier and multiple retailers. Mngt Sci 47: 693–708.

Cheung KL and Lee H (2002). The inventory benefit of shipment coordination and stock rebalancing in a supply chain. Mngt Sci 48: 300–306.

Abad PL and Jaggi CK (2003). A joint approach for setting unit price and the length of the credit period for a seller when end demand is price sensitive. Int J Prod Econ 83: 115–122.

Abad PL (2003). Optimal price and lot size when the supplier offers a temporary price reduction over an interval. Comp Opns Res 30: 63–74.

Shinn SW and Hwang H (2003). Optimal pricing and ordering policies for retailers under order-size-dependent delay in payments. Comput Opl Res 30: 35–50.

Viswanathan S and Wang Q (2003). Discount pricing decisions in distribution channels with price-sensitive demand. Eur J Opl Res 149: 571–587.

Lei L, Wang Q and Fan C . On the Optimal Three-partner Coordination policies with Price-Sensitive Demand Working paper, (2004). Rutgers Business School, Rutgers University, USA.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Lei, L., Wang, Q. & Fan, C. Optimal business policies for a supplier–transporter–buyer channel with a price-sensitive demand. J Oper Res Soc 57, 281–289 (2006). https://doi.org/10.1057/palgrave.jors.2602000

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/palgrave.jors.2602000