Abstract

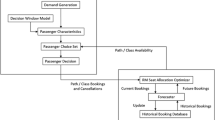

The paper describes a methodology that has been implemented in a major British airline to find the optimal price to charge for airline tickets under one-way pricing. An analytical model has been developed to describe the buying behaviour of customers for flights over the selling period. Using this model and a standard analytical method for constrained optimization, we can find an expression for the optimal price structure for a flight. The expected number of bookings made on each day of the selling period and in each fare class given these prices can then be easily calculated. A simulation model is used to find the confidence ranges on the numbers of bookings and these ranges can be used to regulate the sale of tickets. A procedure to update the price structure based on the remaining capacity has also been developed.

Similar content being viewed by others

References

Bitran GR and Mondschein SV (1997). Periodic pricing of seasonal products in retailing. Mngt Sci 43: 64–79.

Gallego G and van Ryzin G (1994). Optimal dynamic pricing of inventories with stochastic demand over finite horizons. Mngt Sci 40: 999–1020.

Anjos MF, Cheng RCH and Currie CSM (2003). Optimal pricing policies for perishable products. Research Report OR106, Faculty of Mathematical Studies, University of Southampton, UK.

Nelder JA and Mead R (1965). A simplex method for function minimization. Comput J 7: 308–313.

Kincaid WM and Darling DA (1963). An inventory pricing problem. J Math Anal Appl 7: 183–208.

Zhao W and Zheng YS (2000). Optimal dynamic pricing for perishable assets with nonhomogeneous demand. Mngt Sci 46: 375–388.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Anjos, M., Cheng, R. & Currie, C. Maximizing revenue in the airline industry under one-way pricing. J Oper Res Soc 55, 535–541 (2004). https://doi.org/10.1057/palgrave.jors.2601721

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/palgrave.jors.2601721