Abstract

We calculate the ex-post, realised portfolio performance for an investor who diversifies among US stocks, bonds, real estate indirect investment vehicles (E-REITS), and cash. Simulations are performed for two alternative asset allocation frameworks — classical and Bayesian — and for scenarios involving two different samples and six different investment horizons. Interestingly, the ex-post welfare cost of restricting portfolio choice to traditional financial assets (ie, stocks, bonds, and cash) is only found to be positive in all scenarios for a Bayesian investor. On the contrary, substitution of E-REITS for stocks in optimal portfolios turns out to reduce ex-post portfolio performance over the nineties and for a Classical investor who ignores parameter estimation uncertainty.

Similar content being viewed by others

Notes

See Seiler et al. (1999) and Feldman (2003), among others, for evidence of low correlation between real estate and other assets.

For instance, Geltner and Rodriguez (1995) compute mean–variance portfolios on the basis of five-year return statistics. See Below and Stansell (2003) for a related analysis.

The notation r t f is meant to signal that on the interval [t−1, t] a short-term deposit investment is free of risk.

We also impose a further upper bound: ω t s+ω t b+ω t r<1 (j=s, b, r). This means that we allow ω t j and ω s t, ω t b and ω t r to go up to 0.9999 but prevent it from reaching 1. These restrictions are required to ensure that expected utility is defined.

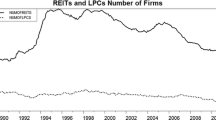

It covers all real estate investment trusts that are listed on the New York Stock Exchange, the American Stock Exchange, or the NASDAQ National Market List. Only trusts that satisfy a minimum capitalisation and turnover requirement are included.

We used other values (2 and 10), obtaining qualitatively similar results. These are available upon request from the Authors.

For instance, Chandrashakaran (1999) finds negligible optimal weights unless the investor accounts for predictable returns.

In our experiments, E-REIT optimal holdings exceed 30 per cent. This may turn out to be too large a share when one considers direct investments in private real estate, as in Karlberg et al. (1996), or in housing, as in De Roon et al. (2002).

Increases in Sharpe ratios may artificially be obtained from increasing negative skewness of portfolio returns, as in Goetzmann et al. (2007).

References

Barberis, N. (2000) ‘Investing for the Long Run When Returns Are Predictable’, Journal of Finance, 55, 225–264.

Bawa, V., Brown, S. and Klein, R. (1979) Estimation Risk and Optimal Portfolio Choice, North Holland: Amsterdam.

Below, S. and Stansell, S. (2003) ‘Do the Individual Moments of REIT Return Distributions Affect Institutional Ownership Patterns’, Journal of Asset Management, 4, 77–95.

Chandrashakaran, V. (1999) ‘The Time Series Properties and Diversification Benefits of REIT Returns’, Journal of Real Estate Research, 17, 91–112.

de Roon, F., Eichholtz, P. and Koedijk, K. (2002) ‘The Portfolio Implications of Home Ownership’, CEPR Discussion Paper No. 3501.

Feldman, B. (2003) ‘Investment Policy for Securitized and Direct Real Estate’, Journal of Portfolio Management, Special Real Estate Issue, 112–121.

Fugazza, C., Guidolin, M. and Nicodano, G. (2007) ‘Investing for the Long-Run in European Real Estate’, Journal of Real Estate Finance and Economics, 34, 35–80.

Geltner, D. and Rodriguez, J. (1995) ‘The Similar Genetics of Public & Private Real Estate and the Optimal Long-Horizon Portfolio Mix’, Real Estate Finance, 12, 71–81.

Goetzmann, W., Ingersoll, N., Spiegel, J. and Welch, I. (2007) ‘Portfolio Performance Manipulation and Manipulation — Proof Performance Measures’, Review of Financial Studies, 5, 1503–1546.

Guidolin, M. and Timmermann, A. (2005) ‘Economic Implications of Bull and Bear Regimes in UK Stock and Bond Returns’, Economic Journal, 115, 111–143.

Jobson, J., Korkie, B. and Ratti, V. (1979) ‘Improved Estimation for Markowitz Portfolios Using James-Stein Type Estimator’, in Proceedings of the American Statistical Association, American Statistical Association: Washington.

Jorion, P. (1985) ‘International Portfolio Diversification with Estimation Risk’, Journal of Business, 58, 259–277.

Kandel, S. and Stambaugh, R. (1996) ‘On the Predictability of Stock Returns: An Asset Allocation Perspective’, Journal of Finance, 51, 385–424.

Karlberg, J., Liu, C. and Greig, W. (1996) ‘The Role of Real Estate in the Portfolio Allocation Process’, Real Estate Economics, 24, 359–377.

Ling, D., Naranjo, A. and Ryngaert, M. (2000) ‘The Predictability of Equity REIT Returns: Time Variation and Economic Significance’, Journal of Real Estate Finance and Economics, 20, 117–136.

Seiler, M., Webb, J. and Myer, F. (1999) ‘Diversification Issues in Real Estate Investment’, Journal of Real Estate Literature, 5, 163–179.

Ziobrowski, A., Caines, R. and Ziobrowski, B. (1999) ‘Mixed-Asset Portfolio Composition with Long-Term Holding Periods and Uncertainty’, Journal of Real Estate Portfolio Management, 2, 139–144.

Author information

Authors and Affiliations

Corresponding author

Additional information

1obtained her PhD in 2004 from Turin, Italy and is a post-doc at University of Turin and research fellow at Collegio Carlo Alberto. Since 2004 she has been involved in the project ‘Asset Classes for Long Run Investors’. Her research on real estate diversification has recently appeared in the Journal of Real Estate Finance and Economics.

2obtained his PhD in 2000 from University of California and is a Chair Professor of Finance at Manchester Business School. He also served as an Asst. Vice-President and Senior Policy Consultant (Financial Markets) within the US Federal Reserve system (2004–2007), where he still covers advising roles. From August 2008 he will be in charge of the programme ‘Asset Classes for Long Run Investors’ at the Center for Research on Pensions and Welfare (CeRP). His research focuses on predictability and non-Iinear dynamics in financial returns, with applications to portfolio management. He has published papers in the American Economic Review, the Review of Financial Studies, the Journal of Business and the Journal of Econometrics, among others.

3obtained her PhD in 1993 from Princeton and is a Professor of Financial Economics at University of Turin, Italy. She is also research fellow at Collegio Carlo Alberto and founding member of CeRP. She has been the leading researcher for the programme ‘Asset Classes for Long Run Investors’ at CeRP between 2004 and 2008. Her research interests focus on corporate governance and optimal asset allocation in the presence of innovative and alternative asset classes. Her research has been published in the Journal of Finance, the European Economic Review and the Journal of Banking and Finance.

Appendix

Appendix

Classical buy-and-hold investor

Let θ be the vector collecting all the parameters, that is, θ≡[μ′ vech(Σ)′]′. From the assumption in (5), the conditional distribution of cumulative future returns zt, T≡∑k=1Tzt+k is multivariate normal with mean and covariance matrix given by:

Since the parametric form of the predictive distribution of zt, T is known, it is simple to approach the problem in (1), or equivalently

where φ(E t [zt, T], Var t [zt, T]) is a multivariate normal with mean E t [zt, T] and covariance matrix Var t [zt, T], by simulation methods. This means evaluating the integral by drawing a large number of times (N) from φ(E t [zt, T], Var t [zt, T]) and then maximising the functional (6). At this stage, the portfolio weight non-negativity constraints are imposed by using a simple two-stage grid search algorithm that sets ω t j to 0, 0.01, 0.02, …, 0.99, 0.9999 for j=s, b, r.

Bayesian buy-and-hold investor

Given the problem

the task is somewhat simplified by the fact that predictive draws can be obtained by drawing from the posterior distribution of the parameters and then, for each set of parameters drawn, by sampling one point from the distribution of returns conditional on past data and the parameters drawn in the first stage. If we consider the following standard uninformative diffuse prior:

then the posterior distribution for the coefficients in θ, p(μ, Σ−1∣Z̈ t ) can be characterised as:

where Ŝ is the sample covariance of the residuals and μ̂ is the sample mean. Also for the Bayesian case, we adopt a simulation method by which: first, we draw N independent variates from p(μ, Σ−1∣Z̈ t ). This is done by first sampling from a marginal Wishart for Σ−1 and then (after calculating Σ) from the conditional N(vec(μ̂), Σ). Second, for each set (μ, Σ) obtained, the algorithm samples cumulated returns from a multivariate normal with mean vector and covariance matrix given by first-round draws.

Rights and permissions

About this article

Cite this article

Fugazza, C., Guidolin, M. & Nicodano, G. Diversifying in public real estate: The ex-post performance. J Asset Manag 8, 361–373 (2008). https://doi.org/10.1057/palgrave.jam.2250089

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1057/palgrave.jam.2250089