Abstract

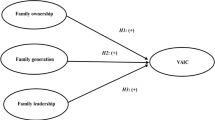

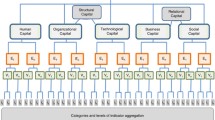

The intellectual capital-based view of the firm along with the literature about family firms serve as the basis for the present paper, which seeks to elaborate an intellectual capital model that can be applied to family firms. More precisely, our study identifies the main intangibles usually owned by family firms classifying those intangibles into human capital, structural capital and relational capital. In addition, the paper provides empirical evidence and gives examples of these intangibles through the analysis of external data from international family firms. The research question that we are trying to answer is: Which intangibles are owned by family firms for the mere fact of being family firms? Knowing the nature of the intangibles inherent to family firms can help improve their management, making the most of the intellectual capital owned by these firms when it comes to exploit their knowledge strengths.

Similar content being viewed by others

References

Amit R and Schoemaker PJ (1993) Strategic assets and organizational rent. Strategic Management Journal 14 (1), 33–46.

Astrachan JH and Kolenko TA (1994) A neglected factor explaining family business success: human resource practices. Family Business Review 7 (3), 251–262.

Bacardi (2012) Bacardi & Company Limited [WWW document] http://www.bacardi.com/#/spain/es/historia (accessed 6 March 2012).

Barney J (1991) Firm resources and sustained competitive advantage. Journal of Management 17 (1), 99–120.

Benetton Group (2012) Benetton Group SpA [WWW document] http://www.benettongroup.com/ (accessed 8 March 2012).

Blake CG and Saleh SD (1995) A model of family owned small business performance. Family Business Annual 1 (1), 22–31.

Block JH (2012) R&D investments in family and founder firms: an agency perspective. Journal of Business Venturing 27 (2), 248–265.

Bontis N (1999) Managing organisational knowledge by diagnosing intellectual capital: framing and advancing the state of the field. International Journal of Technology Management 18 (5–8), 433–462.

Bosch (2012) Robert Bosch GmbH [WWW document] http://www.bosch.com/en/com/home/homepage.html (accessed 8 March 2012).

Brooking A (1996) Intellectual Capital: Core Asset for the Third Millennium Enterprise. International Thomson Business Press, London.

Burgman RJ, Roos G, Ballow JJ and Thomas RJ (2005) No longer ‘out of sight, out of mind’: intellectual capital approach in AssetEconomics Inc. and Accenture LLP. Journal of Intellectual Capital 6 (4), 588–614.

C&A (2012) C&A [WWW document] http://www.c-and-a.com/uk/en/corporate/company/ (accessed 7 March 2012).

Carrefour Group (2012) Carrefour [WWW document] http://www.carrefour.com/cdc/group/ (accessed 6 March 2012).

Chrisman JJ, Chua JH and Sharma P (2003) Current trends and future directions in family business management studies: toward a theory of the family firm. Coleman Foundation and U.S. Association of Small Business and Entrepreneurship. Coleman White Paper Series, Madison, WI.

Chrisman JJ, Chua JH and Sharma P (2005) Trends and directions in the development of a strategic management theory of the family firm. Entrepreneurship: Theory and Practice 29 (5), 555–575.

Chua JH, Chrisman JJ and Sharma P (1999) Defining the family business by behaviour. Entrepreneurship: Theory and Practice 23 (4), 19–39.

Churchill NC and Hatten KJ (1997) Non-market-based transfers of wealth and power: a research framework for family businesses. Family Business Review 10 (1), 53–67.

Daily CM and Dollinger MJ (1993) Alternative methodologies for identifying family- versus nonfamily-managed business. Journal of Small Business Management 31 (2), 79–90.

Davis P (1983) Realizing the potential of the family business. Organizational Dynamics 12 (1), 47–56.

Denison D, Lief C and Ward JL (2004) Culture in family-owned enterprises: recognizing and leveraging unique strengths. Family Business Review 17 (1), 61–70.

Donckels R and Fröhlich E (1991) Are family businesses really different? European experiences from STRATOS. Family Business Review 4 (2), 149–160.

Donnelly RG (1964) The family business. Harvard Business Review 42 (4), 93–105.

Dyer WG (1986) Cultural Change in Family Firms: Anticipating and Managing Business and Family Transitions. Jossey-Bass, San Francisco.

Edvinsson L and Malone MS (1997) Intellectual Capital. Harper, New York.

Eisenhardt K (1989) Building theories from case study research. Academy of Management Review 14 (4), 532–550.

Estée Lauder (2012) Estée Lauder Inc [WWW document] http://www.esteelauder.com/index.tmpl (accessed 6 March 2012).

Family Business (2012) Family Business Online magazine http://www.familybusinessmagazine.com/ (accessed 6 March 2012).

Gallo MA and Sveen J (1991) Internationalizing the family business: facilitating and restraining factors. Family Business Review 4 (2), 181–190.

Grant R (1991) The resource-based theory of competitive advantage: implications for strategy formulation. California Management Review 33 (3), 114–135.

Habbershon TG and Williams ML (1999) A resource-based framework for assessing the strategic advantages of family firms. Family Business Review 12 (1), 1–25.

Habbershon TG and Williams ML (2000) A model for understanding the competitiveness of family-controlled companies. In Proceedings of the 11th Annual Family Business Network World Conference (Poutziouris PZ, Ed), Academic Research Forum, London.

Habbershon TG, Williams M and MacMillan IC (2003) A unified systems perspective of family firm performance. Journal of Business Venturing 18 (4), 451–465.

Hollander B and Elman N (1988) Family-owned businesses: an emerging field of inquiry. Family Business Review 1 (2), 145–164.

Hyundai (2012) Hyundai Motor Company [WWW document] http://worldwide.hyundai.com/WW/Main/index.html# (accessed 7 March 2012).

Ibrahim AB, Dumas C and McGuire J (2001) Strategic decision making in small family firms: an empirical investigation. Journal of Small Business Strategy 12 (1), 80–90.

Ibrahim AB, McGuire J, Soufani K and Poutziouris P (2004) Patterns in strategy formation in a family firm. International Journal of Entrepreneurial Behaviour & Research 10 (1/2), 127–140.

I.U. EUROFORUM ESCORIAL (1998) Medición del Capital Intelectual. Modelo Intelect. I.U. Euroforum Escorial, Madrid.

Johnson WHA (1999) An integrative taxonomy of intellectual capital: measuring the stock and flow of intellectual capital components in the firm. International Journal of Technology Management 18 (5–8), 562–575.

Kellogg's (2010) Corporate Responsibility Report, [WWW document] http://www.kelloggcompany.com/.

Kellogg's (2012) Kellogg Co [WWW document] http://www.kelloggcompany.com/ (accessed 6 March 2012).

Kets de Vries MFR (1993) The dynamics of family controlled firms: the good and the bad news. Organizational Dynamics 21 (3), 59–71.

KSRC (2003) Model for the Measurement and Management of Intellectual Capital: ‘Intellectus Model’ Intellectus Documents, 5 Research Team Knowledge Society Research Centre (KSRC), Madrid.

Lansberg I, Perrow E and Rogalsky S (1988) Family business as an emerging field. Family Business Review 1 (1), 1–8.

Lev B and Daum J (2004) The dominance of intangible assets: consequences for enterprise management and corporate reporting. Measuring Business Excellence 8 (1), 6–17.

Meliá Hotels International (2012) Meliá Hotels International S.A. [WWW document] http://es.solmelia.com/home.htm (accessed 6 March 2012).

Michelin (2012) Michelin Group [WWW document] http://www.michelin.com/corporate/group (accessed 6 March 2012).

Miller D and Le Breton-Miller I (2003) Challenge versus advantage in family business. Strategic Organization 1 (1), 127–134.

Miller D, Le Breton-Miller I and Lester RH (2010) Family and lone founder ownership and strategic behaviour: social context, identity, and institutional logics. Journal of Management Studies 48 (1), 1–25.

Nestlé (2012) Nestlé Group [WWW document] http://www.nestle.com/Pages/Nestle.aspx (accessed 7 March 2012).

Neubauer F and Lank AG (1998) The Family Business: Its Governance for Sustainability. Mcmillan Press, London.

Peteraf M (1993) The cornerstones of competitive advantage: a resource-based view. Strategic Management Journal 14 (3), 179–191.

Pike S, Fernström L and Roos G (2005) Intellectual capital. Management approach in ICS Ltd. Journal of Intellectual Capital 6 (4), 489–509.

PSA Peugeot-Citroën (2012) PSA Peugeot-Citroën Group [WWW document] http://www.psa-peugeot-citroen.com (accessed 6 March 2012).

Reed KK, Lubatkin M and Srinivasan N (2006) Proposing and testing an intellectual capital-based view of the firm. Journal of Management Studies 43 (4), 867–893.

Roos G, Pike S and Fernström L (2005) Managing Intellectual Capital in Practice. Butterworth-Heinemann, Oxford.

Rue LW and Ibrahim NA (1996) The status of planning in smaller family-owned business. Family Business Review 11 (1), 29–43.

Schutt R (2006) Investigating the Social World. Sage, Boston, MA.

SC Johnson (2012) SC Johnson & Son Inc [WWW document] http://www.scjohnson.com/es/home.aspx (accessed 7 March 2012).

Shanker MC and Astrachan JH (1996) Myths and realities: family businesses’ contribution to the US economy – a framework for assessing family business statistics. Family Business Review 9 (2), 107–123.

Sharma P, Chrisman JJ and Chua JH (1997) Strategic management of the family business: past research and future challenges. Family Business Review 10 (1), 1–35.

Sirmon DG and Hitt MA (2003) Managing resources: linking unique resources, management and wealth creation in family firms. Entrepreneurship: Theory and Practice 27 (4), 339–358.

Sol Meliá Sustainability Report (2010) [WWW document] http://es.solmelia.com/home.htm.

Stavrou ET (1999) Succession in family businesses: exploring the effects of demographic factors on offspring intentions to join and take over the business. Journal of Small Business Management 37 (3), 43–61.

Stewart TA (1997) Intellectual Capital: The New Wealth of Organizations. Doubleday Currency, New York.

Strauss A and Corbin J (1990) Basics of Qualitative Research: Grounded Theory Procedures and Techniques. Sage, Newbury Park, CA.

Subramaniam M and Youndt MA (2005) The influence of intellectual capital on the nature of innovative capabilities. Academy of Management Journal 48 (3), 450–464.

Sudarsanam S, Sorwar G and Marr B (2006) Real options and the impact of intellectual capital on corporate value. Journal of Intellectual Capital 7 (3), 291–308.

Sveiby K (1997) The New Organizational Wealth. Managing and Measuring Knowledge-Based Assets. Berret-Koehler Publishers Inc, San Francisco.

Swartz S (1989) The challenges of multidisciplinary consulting to family-owned businesses. Family Business Review 2 (2), 329–339.

Tagiuri R and Davis J (1992) On the goals of successful family companies. Family Business Review 5 (1), 43–62.

Tagiuri R and Davis J (1996) Bivalent attributes of the family firm. Family Business Review 11 (2), 199–208.

The Nestlé Corporate Business Principles (2010) [WWW document] http://www.nestle.com/Pages/Nestle.aspx.

Viedma JM (2000) ICBS intellectual capital benchmarking system. In Perspectivas sobre dirección del conocimiento y capital intellectual (Bueno E and Salmador MP, Eds), pp 137–144, I.U. Euroforum Escorial, Madrid.

Ward JL (1987) Keeping the Family Business Healthy: How to Plan for Continuing Growth, Profitability, and Family Leadership. Jossey-Bass, San Francisco.

Ward JL (1988) The special role of strategic planning for family businesses. Family Business Review 1 (2), 105–117.

Ward JL (1997) Growing the family business: special challenges and best practices. Family Business Review 10 (4), 323–337.

Ward JL (1999) Crecimiento de la empresa familiar: los retos especiales y las mejoras practices. In La empresa familiar 6 (Gallo MA, Ed), pp 143–163, Ediciones IESE S.L, Barcelona.

Wernerfelt B (1984) A resource-based view of the firm. Strategic Management Journal 5 (2), 171–180.

Yin R (1994) Case Study Research: Design and Methods, 2nd edn, Sage Publications, Newbury Park, CA.

Youndt MA, Subramaniam M and Snell SA (2004) Intellectual capital profiles: an examination of investments and returns. Journal of Management Studies 41 (2), 335–361.

Zahra SA, Hayton J and Salvato C (2004) Entrepreneurship in family versus non-family firms: a resource-based analysis of the effect of organizational culture. Entrepreneurship Theory and Practice 28 (4), 363–381.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Claver-Cortés, E., Molina-Manchón, H. & Zaragoza-Sáez, P. Intellectual capital model for family firms. Knowl Manage Res Pract 11, 184–195 (2013). https://doi.org/10.1057/kmrp.2013.14

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/kmrp.2013.14