Abstract

Customers continuously migrate from legacy products to new substitutes as new technologies and products emerge. This article analyzes the migration of customers from a legacy product to a new technological substitute, based on customers’ historical activity data. The analysis constructs individual migration profiles and forecasts future migration behavior of each customer, as well as segmenting customers based on their migration patterns. Companies can use this analysis to forecast demand for legacy products and new substitutes, and to identify customers for targeted marketing campaigns. A case study illustrates the analysis.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

INTRODUCTION

Telecommunication, computer, pharmaceutical and financial industries suffer significant losses from their legacy products and services owing to the constant emergence of new technological substitutes. Well-known examples of such substitutes include (i) content distribution via downloading as a substitute for distribution via physical storage (for example CDs, DVDs and books); (ii) Voice-over-Internet Protocol (VoIP) as a substitute for fixed-line telephony; and (iii) generic drugs as substitutes for brand drugs, to name just a few. In fact, new substitutes inevitability affect the supply-and-demand curve of corresponding legacy products and services. For example, Sound Partners Research Group 1 predicted that by 2015, cellular VoIP will carry 28 per cent of all fixed and mobile voice minutes in the United States and 23 per cent in Western Europe. In addition, according to TeleGeography's May 2008 press release,2 since the beginning of 2005, the three Regional Bell Operating Companies, AT&T, Verizon and Qwest, have lost 17.3 million residential telephone lines equivalent to billions of dollars in revenue. In contrast, VoIP service providers have gained 14.4 million new customers. In the entertainment service industry, the well-known DVD rental providers Blockbuster and Hollywood Video have lost customers to Netflix, Apple and multiple other companies providing movies via mail and/or real-time download. As a result, Blockbuster lost US$1.2 billion in 2004 and over $500 million in the subsequent year,3 and Movie Gallery Inc., the parent of Hollywood Video, filed for bankruptcy in October 2007.4 Standard & Poor's estimated that brand drugs such as Risperdal, Topamax, Fosamax, Depakote and Zyrtec will loose approximately $20 billions in sales owing to migration of patients to generic drugs.5

Although it is common for companies providing legacy products to view the emergence of new technological substitutes as potential losses, they can also gain from additional opportunities created by these new technologies. To remain competitive in such rapidly changing markets, companies can either improve their legacy products and services and thus retain the existing customers via marketing campaigns, or can upgrade the infrastructure to satisfy customer demand for new technologies. For example, after Blockbuster realized that Netflix was a serious competitor and threat, it improved its existing service by increasing merchandize assortment and in-stock availability, reducing prices, modifying in-store merchandize layout and canceling late fees. However, these actions were not sufficient to regain market share from Netflix.6 Blockbuster realized that embracing the new online technology was necessary to remain competitive. Thus, Blockbuster introduced the ‘total access’ service enabling customers to rent and return DVDs across different channels.7 In addition, it purchased the digital movie-download service Movielink for real-time downloading of high-definition quality movies, and opened self-service DVDs kiosks. These new initiatives and diversification policies have made Blockbuster the first serious rival to the original online market leader, Netflix.8

Substitution of legacy products with new technological substitutes has been and continues to be an important subject in marketing research, particularly because decision making relies on its analysis. In general, service substitution can be analyzed at the macro level (company or country) as well as at the micro level (individual customer). Macro-level analysis is used for long-term strategic planning, and most of the existing research in this direction is based on Bass's model,9 which generates an S-shaped curve. Mahajan et al10 reviewed more than one hundred different extensions of this model. For example, one of the extensions analyzed several generations of substitutions on Korea's mobile communication service market.11 Also using an S-shaped curve, Fisher and Pry12 suggested that if a new technology reaches 10 per cent market share it will conquer the whole market. However, the S-shaped curve, introduced by Bass, is an increasing function that may capture only successful substitutions, when new products are accepted by customers, and it is not applicable to analysis of unsuccessful substitutions. Several Bayesian statistical models were also used to forecast the substitution of old durable products13 and old movies14 with new ones. Some studies suggested that the rates of substitution of a legacy product with new technological substitutes depend on the cultural values of each nation.15, 16, 17 Table 1 presents a summary of the literature analyzing substitution of legacy products at a macro level.

However, companies cannot rely only on the macro-level analysis. Usually, the success of companies’ short-term decisions depends on detailed insight into the behavior of their existing customers, achieved only by micro-level analysis.21 Roger E.M.22 was one of the first researchers to discuss the substitution of a legacy product with a new one at the individual customer level. As a plausible approach, he suggested surveying customers at random and studying their personal and demographical characteristics along with their migration behavior. Constantiou and Kautz23 surveyed customers in Denmark and explored the effects of consumer perceptions of key economic factors on the substitution of traditional telephony with Internet telephony (IP) telephony. Similarly, IBM surveyed 600 consumers in the United States, China and the United Kingdom and studied their mobile Internet preferences,24 and Allenet and Barry25 surveyed over 1000 French pharmacists and studied substitution of brand drugs with generic drugs. Customer surveying is extremely time-consuming and expensive, however, and customers sometimes provide hasty and misleading responses.26 Johnson and Bhatia27 used regression analysis to study substitution on the land mobile radio (wireless) market. They suggested five stages of substitution at the micro level: awareness, interest, evaluation, trial, and adoption or rejection. Meuter et al28 introduced multiple and logistic regression models for studying the substitution of clerk-based services with self-service technologies, such as telephone banking, automated hotel checkout and online investment trading. Prins29 used the split-hazard approach to model a substitution of fixed-lined phones with a new mobile service in the Dutch consumer market. A partitioned fuzzy integral multinomial logit model was applied to study substitution on the Taiwan Internet telephony market.30 The existing literature suggests that risk, complexity and ease-of-use of a new product, along with the demographic characteristics of customers (for example, young males with high income), have the highest impact on a success of substitution.17, 31, 32 Table 2 presents the summary of the literature analyzing substitution of legacy products with new ones at a micro level.

In summary, the existing literature lacks analysis of activity profiles in application to customer migration as a result of product substitution, including analysis of common migration patterns, causes of migration, identification of segments for marketing campaigns and so on. This article bridges the gap.

This article analyzes customer migration from a legacy service or product to a new substitute at the micro level, based on the new substitute's usage share data. The analysis includes forecasting of future migration behavior of each customer, construction of a confidence interval for the forecast via bootstrapping, estimation of a probability distribution of the new substitute's usage share of the entire customer sample, and segmentation of customers based on their migration behavior.

The article is organized as follows. The next section presents an analysis of the customer's migration from a legacy product to a new technological substitute at a customer level (micro level), the penultimate section considers case study; and the final section presents the practical implications and concludes the article.

ANALYSIS

This section analyzes customer migration from a legacy product to a new technological substitute at a micro level. Consider a sample consisting of m random customers, who use at least one of the following: the legacy product or the new technological substitute. Let z i =(zi1, …, z iT ) be the historical activity data of customer i, where z it =y it /(x it +y it ) is the customer's usage share of the new substitute at time t with x it and y it representing the customer's usages of the legacy product and its substitute, respectively, at time t, for t=1, …, T and i=1, …, m.

The analysis consists of the following three steps. The first step fits z i into an individual migration profile f i . The second step uses f i to forecast the future migration behavior of customer i, ẑ i and estimates a probability distribution for ẑ i , i=1, …, m. It also uses the bootstrapping algorithm to construct an α-confidence interval for ẑ i . Finally, the third step segments customers by similar migration profiles for targeted marketing campaigns. The remainder of this section discusses each step in detail.

Profiling

The first step fits the activity data z i into a migration profile f i , with the Adbudg S-shaped function

where parameters 0⩽a i ,b i ⩽1, c i ∈ℝ, d i ∈ℝ minimize the total quadratic error

The Adbudg function, introduced by Little33 for advertising budgeting, is flexible enough to describe any increasing or decreasing S-shaped function: f

i

(t) is an increasing S-shaped curve on [0, ∞] if (a

i

−b

i

)c

i

, d

i

>0 and d

i

(c

i

−1)/(c

i

+1)⩾0 (see Figure 1 (a)), and f

i

(t) is a decreasing S-shaped curve on [0, ∞], if (a

i

,−b

i

)c

i

d

i

<0 and d

i

(c

i

−1)/(c

i

+1)⩾0 (see Figure 1 (b)). In the first case, f

i

(t) has the upper asymptote f(t) → a

i

as t → ∞ and in the second case f(t) has a lower asymptote at f(t) → b

i

as t → ∞. The inflexion point of f

i

(t) is at  . Finally, f

i

(t) is constant if a

i

=b

i

and is concave if d

i

(c

i

−1)/(c

i

+1)<0.

. Finally, f

i

(t) is constant if a

i

=b

i

and is concave if d

i

(c

i

−1)/(c

i

+1)<0.

Forecast

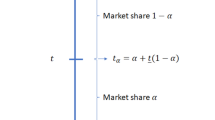

The analysis assumes that the forecast for the usage share of new product by customer i at time T+k, ẑ i , is equal to the value of the migration profile at time T+k, that is, ẑ i =f i (T+k). Construction of a confidence interval for the forecast ẑ i requires knowledge of its probability distribution. Often it is assumed that ẑ i is normally distributed. This is not the case, as there is heterogeneity across all customers, and there is no consensus on what distribution is reasonable.

The probability distribution can be estimated via the bootstrapping algorithm (Casella and Berger 2001)34 The main idea of the bootstrapping algorithm is that activity data sample {(zi1, 1), …, (z iT , T)} is treated as if the data points in this sample are a whole population. Re-sampling T1<T data points at random from the proxy population {(zi1, 1), …, (z iT , T)} creates L<T!/T1!(T−T1)! data sets z i l for l=1, …, L, and for each ẑ i l, migration profile f i l (t) yields forecast ẑ i l. The mean μ i and the standard deviation σ i of ẑ i are then estimated by

Finally, Chebyshev's inequality P(|X−μ

iT

|⩾kσ

i

)⩽1/k2, with k being a constant, implies that the conservative α confidence interval for ẑ

i

is

Segmentation

The shapes of the Adbudg function suggest the following seven customer segments.

-

1

New customers use only the new substitute and have never used the legacy product (see Figure 2 (a)). This group corresponds to the constant migration profile f i (t) with a i =b i =1.

-

2

Balanced customers use both products; and usage share of the new substitute does not change throughout the entire period of observation (see Figure 2 (b)). This group corresponds to the constant migration profile f i (t) with a i =b i <1.

-

3

Early adopters use mostly the new substitute, and usage of the legacy product constantly declines (see Figure 2 (c)). This group has an increasing S-shaped migration profile f i (t) with (a i −b i )c i ,d i >0, d(c−1)/(c+1)⩾0 and 1⩽t infl ⩽T′, where T′ is a predetermined threshold.

-

4

Late adopters are similar to the early adopters but are still in the migration process (see Figure 2 (e)). This group has an increasing S-shaped migration profile f i (t) with (a i −b i )c i ,d i >0, d(c−1)/(c+1)⩾0 and t infl ⩾T′.

-

5

Returning customers use mostly the legacy product; and usage of the new substitute continuously decreases (see Figure 2 (d)). This group has a decreasing S-shaped migration profile f i (t) with (a i −b i )c i d i <0 and d(c−1)/(c+1)⩾0.

-

6

Conservative customers use mostly the legacy product (see Figure 2 (f)).

-

7

Others are not in any of the above segments.

This segmentation provides an insight into customer migration patterns and helps companies to target customers for marketing campaigns.

CASE STUDY

This section presents a case study that illustrates the customer migration analysis. The case study uses monthly data for substitute service usage shares of 1000 customers (m=1000) over a 13-month period. The first 10 months of data are used for analysis analysis (T=10) and the remaining 3 months are used for testing (k=3). Optimal values a i , b i , c i and d i in (1) for each customer i=1, …, 1000 are obtained in Mathematica. Figure 3 shows activity data and the migration profile of a randomly chosen customer (let it be customer 1, i=1), and also shows the 3-months-ahead forecast for the substitute service usage share for 13th month, that is, ẑ 1 =f1(13)=0.8661. The bootstrapping algorithm is implemented in Mathematica for T1=7 and L=100. Figures 3 and 4 show the estimated probability distribution and the 95 per cent confidence interval for the forecast ẑ i , respectively. The actual value of the substitute service usage share for the 13th month, z1 13=0.8626, lies within the 95 per cent confidence interval. The absolute error of the forecast for the customer is equal to 0.0035. The same procedure is applied for all customers: in 87 per cent of all cases zi 13-s lies within the forecasted 95 per cent confidence interval, and the mean absolute error of the forecasts for the entire customer sample is equal to 0.039. These results suggest that the obtained forecasts are reasonably accurate.

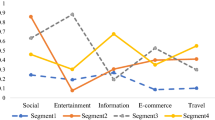

Figures 5 (a) and (b) show the distribution of the substitute service usage share z it for t=1 and t=10, respectively for i=1, …, 1000 and illustrate migration of customers from the legacy service to its substitute. Figure 5 (c) shows the estimate for the probability distribution of the forecast ẑ i for i=1, …, 1000, and suggests that customer migration from the legacy service to the substitute will continue for the next 3 months. Figure 5 (d) shows the actual empirical distribution of the substitute service usage share z it for t=13 and validates the suggestion. Table 3 presents the percentage of customers in each segment, and Figure 6 presents examples of customer profiles for each segment. The analysis shows that the majority of customers have migrated to the new substitute or are still in the process of migration. The company should expand its infrastructure to satisfy customer demand for the new substitute service. The balanced and conservative customer segments are the most appropriate candidates for the targeted retention campaigns.

PRACTICAL IMPLICATIONS AND CONCLUSIONS

At present, companies face migration of customers from their legacy products and services to new technological substitutes on a daily basis. Solving this problem requires a number of tactical decisions. It is not enough to analyze only aggregate characteristics of customer migration; detailed analysis of the migration patterns of each individual customer is also required. This article analyzes historical activity data for each individual customer and forecasts customer migration behavior. Customer migration profiles are segmented according to their migration patterns. The following segments are identified: new customers, conservative customers, early adopters, late adopters, returning customers, balanced customers and customers with mixed behavior.

To illustrate the segments, consider wireless telephony as a substitute for fixed-line telephony. Wireless telephony has become an integral part of everyday life all over the world. However, customers have different patterns of migration to this technology. For example, young adults with high incomes constituting the early adopters segment migrated to wireless telephony once it emerged. They have been followed by late adopters – adults who seek convenience in business and personal communication. At present, most of the adult adopters of wireless telephony keep their fixed-line phone subscription, and thus belong to the balanced customer segment. Senior customers are used to fixed-line telephony and are not interested in new technologies. This group of customers belongs to the conservative customer segment. On the other hand, today's high school and college students have grown up with wireless technology firmly integrated in their day-to-day experience. They use mostly wireless telephony and belong to the new customers segment.

Managers can use the analysis presented in this article to make decisions with regard to adoption of new technologies, infrastructure planning and targeting customers for marketing campaigns. For example, if the segment of returning customers is the largest, technological substitute is no threat to the legacy product. However, if the majority of customers are early or late adopters, the company's infrastructure should be upgraded to satisfy customer demand for new technologies. The segments of conservative and balanced customers are the most appropriate candidates to be targeted for retention campaigns.

References

Sound Partners Research Press release. (2007) Cellular VoIP in the USA and Western Europe will generate more revenue than all fixed VoIP services by 2012, http://www.soundpartners.ltd.uk/pressrelwirelessVoIPforecasts.aspx.

TeleGeography. A research division of PriMetrica Inc, http://www.telegeography.com.

Reisinger, D. (2008) Opinion: Can Blockbuster be saved, http://arstechnica.com/news.

Roy, B. (2007) Movie Gallery files bankruptcy. Wichita Business Journal, http://www.moviegallery.com/reorganization/default.html.

Edwards, J. (2008) Drug marketing poised for historic decline, http://www.brandweek.com.

Reisinger, D. (2007) Say goodbye to Blockbuster, http://news.cnet.com.

Randolph, N. (2007) Blockbuster to broaden entertainment reach. ContentAGenda Connecting Entertainment & Technology, http://www.contentagenda.com.

Daily News. (2008) Netflix sails past $1 billion in e-commerce revenue in 2007. Internet Retailer. Strategies for multi-channel retailing, http://www.internetretailer.com.

Bass, F. M. (1969) A new product growth model for consumer durables. Management Science 15 (January): 215–227.

Mahajan, V., Muller, E. and Bass, F. M. (1990) New product diffusion models in marketing: A review and directions for research. Journal of Marketing 51 (January): 1–36.

Kim, Y.B., Seo, S.Y. and Lee, Y.T. (1999) A substitution and diffusion model with exogenous impact: Forecasting of IMT-2000 subscribers in Korea. Vehicular Technology Conference Proceedings, IEEE Vol. 2, pp. 948–952.

Fisher, J. C. and Pry, R. H. (1971) A simple substitution model of technological change. Technological Forecasting and Social Changes 3: 75–88.

Lenk, P. J. and Rao, A. G. (1990) New models from old: Forecasting product adoption by hierarchical bayes procedures. Marketing Science 9 (1): 42–53.

Neelamegham, R. and Chintagunta, P. (1999) A Bayesian model to forecast new product performance in domestic and international markets. Marketing Science 18 (2): 115–136.

Dekimpe, M. G., Parker, P. M. and Sarvary, M. (1998) Staged estimation of international diffusion models: An application to global cellular telephone adoption. Technological Forecasting and Social Change 57 (1–2): 105–132.

Tellis, G. J., Stremersch, S. and Yin, E. (2003) The international takeoff of new products: The role of economics, culture, and country innovativeness. Marketing Science 22 (2): 188–208.

Steenkamp, J. B., Hofstede, F. T. and Wedel, M. (1999) A cross-national investigation into the individual and national cultural antecedents of consumer. Journal of Marketing 63: 55–69.

Nader, F. H. and Jimenez, L. A. (2005) Substitution patterns. A Pitney Bowes Background paper for the project ‘Electronic Substitution for Mail: Models and Results, Myth and Reality’, http://www.postinsight.com.

Chopra, V. (2005a) Emergence of electronic alternatives. A Pitney Bowes Background paper for the project ‘Electronic Substitution for Mail: Models and Results, Myth and Reality’, http://www.postinsight.com.

Chopra, V. (2005b) The internet and mail. A Pitney Bowes Background paper for the project ‘Electronic Substitution for Mail: Models and Results, Myth and Reality’, http://www.postinsight.com.

Kumar, V. and Petersen, J. A. (2008) Using a customer-level marketing strategy to enhance firm performance: A review of theoretical and empirical evidence. Journal of the Academy of Marketing Science 33 (4): 504–519.

Rogers, E. M. (1976) New product adoption and diffusion. Journal of Consumer Research 2: 290–301.

Constantiou, I. D. and Kautz, K. (2008) Economic factors and diffusion of IP telephony: Empirical evidence from an advanced market. Telecommunications Policy 32: 197–211.

IBM (2008) IBM study finds consumers prefer a mobile device over the PC. Press release, Armonk, NY, http://www-03.ibm.com/press/us/en/pressrelease/25737.wss, accesed 22 October 2008.

Allenet, B. and Barry, H. (2003) Opinion and behaviour of pharmacists towards the substitution of branded drugs by generic drugs: survey of 1000 French community pharmacists. Pharmacy World & Science 25 (5): 197–202.

Marsland, N., Wilson, I., Abeyasekera, S. and Kleih, U. (2000) A methodological framework for combining quantitative and qualitative survey methods. An output from the DFID-funded Natural Resources Systems Programme (Socio-Economic Methodologies Component) project R7033 titled Methodological Framework Integrating Qualitative and Quantitative Approaches for Socio-Economic Survey Work, the University of Reading.

Johnson, W. C. and Bhatia, K. (1997) Technological substitution in mobile communication. Journal of Business and Industrial Marketing 12 (6): 383–386.

Meuter, M. L., Bitner, M. J., Ostrum, A. L. and Brown, S. W. (2005) Choosing among alternative service delivery modes: An investigation of customer trial of self-service technologies. Journal of Marketing 69 (April): 61–83.

Prins, R. (2008) Modeling consumer adoption and usage of value-added mobile services. PhD Series Research in Management 128, Erasmus University Rotterdam.

Tseng, F. M. and Yu, C. Y. (2004) Partitioned fuzzyintegral multinomial logit model for Taiwan's internet telephony market. Omega 33: 267–276.

Manning, K. C., Bearden, W. O. and Madden, T. J. (1995) Consumer innovativeness and the adoption process. Journal of Consumer Psychology 4 (4): 329–345.

Steenkamp, J. B. E. M. and Burgess, S. M. (2002) Optimum simulation level and exploratory consumer behavior in an emerging consumer market. International Journal of Research in Marketing 19: 131–150.

Little, J. D. C. (1970) Models and managers: The concept of a decision calculus. Management Science 16: 466–485.

Efron, B. (1979) Bootstrap methods: Another look at the jackknife. Annals of Statistics 7: 1–26.

Casella, G. and Berger, R. L. (2001) Statistical Inference. Belmont, CA: Duxbury Press.

Author information

Authors and Affiliations

Corresponding author

Additional information

3was an assistant professor at the School of Systems and Enterprises at Stevens Institute of Technology from 2003 to 2008, holds Bachelor's and Master's degrees in Applied Mathematics, and a Doctoral degree in Industrial Engineering and Engineering Management. His areas of research include knowledge discovery and business intelligence, quality control and management, and process control and modeling. Dr Jiang has written over 30 journal articles and has conducted funded research in these areas. He is a member of the Data Mining subdivision of INFORMS. He worked on this article during his time at Stevens.

Rights and permissions

About this article

Cite this article

Murynets, I., Ramirez-Marquez, J. & Jiang, W. Migration of customers owing to a service substitution. J Target Meas Anal Mark 17, 297–306 (2009). https://doi.org/10.1057/jt.2009.21

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1057/jt.2009.21