Abstract

This paper investigates factors (exchange performance outcomes, perceptions of technological uncertainty and resource availability uncertainty) that are associated with customer choices to engage in relational exchanges with suppliers of process control equipment, and how these factors differ for small-, medium- and large-sized customers in the paper industry. The study involves a survey of 372 paper mills that investigates how these factors differ across differently sized customers. The results indicate that the variables associated with relational exchange choices are different for small-, medium- and large-sized customers, and suggest that marketing managers should develop alternative sales and marketing strategies and product and service offerings to effectively create relational exchanges with different segments of customers.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

INTRODUCTION

Marketing managers need to develop appropriate sales and marketing strategies, and to allocate resources to address an array of potential factors that are associated with customer-specific relational exchange choices.1, 2 Although some customers want lower prices through arm's-length transactional exchanges, other customers are demanding customised supplier products, supplier participation in customer product designs, access to supplier knowledge, and supplier integration of ordering, inventory and production systems with their customer's system through relational exchanges. As these relational exchanges can necessitate a significant increase in supplier investments in their customers, it is important that suppliers understand the specific factors associated with customers seeking closer supplier relationships. As noted by Morgan and Hunt3 and Schwepker,2 customers and suppliers need to align their complementary resources to achieve superior outcomes. As customer relational exchange needs differ, suppliers must be flexible in offering the appropriate mix of products and services and exchange strategies to complement differing customer requirements.

In the past two decades, relational exchange strategies have captured the attention of many marketing managers as a means to satisfy differing customer requirements. Academics have steadily built a body of knowledge on relational exchange strategies suggesting customers seek to manage environmental uncertainty4, 5, 6, 7 or enhance performance outcomes8, 9, 10, 11, 12 through relational exchanges. However, the cost–benefit ratio of relational exchange strategies remains controversial,13, 14 and suppliers' relational sales strategies are often based on their firms' strategies and individual intuition rather than on understanding the factor influencing customer relational exchange choices.15 This suggests that there is still much confusion on what factors are associated with customer relational exchange choices, and how these factors may differ for different segments of customers.

The objective of this research is to understand how the factors associated with relational exchange choices of small-, medium- and large-sized customers may differ. The results will provide marketing managers with insights into how to vary their sales and marketing strategies, resource allocations and product and service offerings to address different factors that are associated with customer relational exchange choices. The study draws on performance and environmental uncertainty constructs used in prior studies of relational exchanges, and investigates how these constructs vary in their association with relational exchanges for differently sized customers.

Prior research studies have been valuable in understanding a range of performance and environmental uncertainty factors associated with relational exchange choices, but have not offered much guidance in delineating which factors are related to different segments or sizes of customers. In developing relational exchange strategies and making significant relational investments, supplier marketing managers must understand the specific factors that are associated with customer choices of relational exchanges, and cannot assume that a common set of factors is related to all customers in their choice of relational exchanges.

This paper is based on the extensive experience of industry practitioners who have managed supplier relationships in the pulp and paper industry. The focal customer–supplier relationship investigated is the relationship between the pulp, paper and paperboard mills (the customers) and their process control equipment (PCE) suppliers. We selected this research setting for two reasons. First, there is considerable evidence of dyadic power variations between customers and suppliers in this industry. The pulp, paper and paperboard industry has over 270 firms, which have mills in approximately 526 locations. Second PCE purchases represent a significant and high-involvement purchase for the pulp, paper and paperboard mills (that is the customers), as they are used to manage critical operational processes.

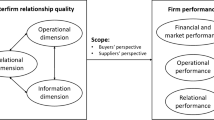

The conceptual framework for the research is illustrated in Figure 1. The framework specifies relationships between concepts that might explain customer relational exchange choices including improved customer performance, improved supplier performance and two types of environmental uncertainty – technological and resource availability. This framework will be used to summarise prior research in this area, and to discuss the research questions, methodology and research results. Finally, we address the implications of our investigation for marketing managers and future research in this field.

THEORY, RESEARCH FRAMEWORK AND LITERATURE REVIEW

In this section, we will discuss the theory and research relevant to the framework (Figure 1), and its value in expanding our understanding of customer relational exchange choices based on customer size. This discussion provides the basis for our proposed research questions to further our understanding about the relationship between customer size and performance and environmental uncertainty variables. Initially, we will discuss why studying the relationship between customer size and relational exchange choice is valuable, based on a resource-based theory (RBT) of the firm. Next, we will review how supplier and customer performance outcomes and environmental uncertainty are associated with customer relational exchange choices. Finally, we will summarise the use of relational norms as a means to measure relational exchanges.

Resource-based theory, relational exchanges and customer size

As stated by Morgan and Hunt,3 relational exchanges are often based on the integration of complementary customer and supplier resources to achieve a superior outcome or competitive advantage. This RBT of customers' choices of relational exchanges suggests that customers with different resources pursue relational exchanges to acquire different types of resources or to potentially obtain different performance outcomes. The division of labour and investment between customers and suppliers allows each to specialise in value-creation activities that support their own distinct competencies and resources.16, 17, 18 This specialisation often leads to increased interdependence to coordinate complex processes or to improve product and service offerings.5, 18

For example, smaller customers would potentially have fewer internal staff and less production expertise than larger customers, suggesting that knowledge transfer may be a more important factor influencing their choice of relational supplier exchanges. Alternatively, as large customers often have more resources and organisational slack to buffer them from external volatility, the influence of environmental uncertainty on relational exchange choice may also vary based on customer size.

The variation in resources associated with customer size indicates that different factors may be associated with customer relational exchange choices, and suggests that suppliers should develop different relational exchange strategies and offer different products and services based on customers' resources and size.19 As noted previously, prior research has associated relational exchanges with customer performance and management of environmental uncertainty; however, the variability among these factors for different segments or sizes of customers has received limited attention. This suggests that it would be valuable to explore the following research questions to understand how the prior research associating performance and environmental uncertainty to relational exchange choice may apply to different segments of customers based on customer size.

Research Question 1:

-

Does the relationship between supplier performance and customer relational exchange choices vary by customer size?

Research Question 2:

-

Does the relationship between customer performance and customer relational exchange choices vary by customer size?

Research Question 3:

-

Does the relationship between environmental uncertainty and customer relational exchange choices vary by customer size?

Relational exchange and performance

Creating value is the essence of sales and marketing strategies, and suppliers must understand desired customer performance outcomes in building customer relationships. The research framework (Figure 1) reflects how both supplier and customer performance outcomes may be associated with customer relational exchange choices. There have been many success stories of customers creating supplier relationships to reduce the cost of acquiring parts and raw materials, improve product quality, reduce delivery time, gain access to supplier knowledge, manage risk and uncertainty of complex or technology intensive tasks, and enhance manufacturing flexibility and time-to-market.9, 20, 21 However, limited attention has been given to how these outcomes vary by customer size and resources.

Academic research on customer performance outcomes associated with relational exchanges has emerged from multiple academic perspectives, including strategic management and marketing. In the strategic management area, researchers have identified a range of potential customer performance improvements. For instance, Cusumano and Takeishi9 explored the supplier relationship between US and Japanese automotive firms operating in the United States and Japan, and found that the Japanese firms had fewer suppliers, longer-term relationships, higher levels of information exchange and more joint product development efforts than their US counterparts. In addition, the Japanese firms reported superior purchasing and production performance over US firms, presumably because they sourced higher-quality products from their suppliers at substantially lower prices than their US competitors were able to negotiate within US markets.

Other strategy researchers have associated relational exchanges with improved customer purchasing performance, defined as the cost of the product obtained from the focal supplier22 or, alternatively, the reduction in administrative costs realised by customers working with specific suppliers.12, 23, 24 Customers' production performance, defined as the amount of improvement in the production processes realised by forging close relationships with specific suppliers, has been shown to improve due to either the focal suppliers' extant products and services or to the use of their specific knowledge. Performance benefits accruing in this fashion include better quality products10, 25 and improved supplier delivery time.24

Note that the direction of these relationships is from relational choice to improved performance. This is a relationship exactly opposite to the one we are studying, as we are interested in how performance shapes relational choices. To avoid confusion, let us point out that the research cited above examined performance after many supply relationships had been severed, and after the survivors had been well tested. The question Cusumano and Takeishi9 did not address is, ‘What qualified the supply partners in the eyes of their powerful customers?’ Performance may be one outcome of relational choice, but it is quite probable that performance on certain dimensions – for example, at a minimum, the ability to supply products that work as specified – is a necessary pre-qualifying achievement that a supplier must attain to be considered a suitable relational choice. As suggested by Beverland,15 the level of relational exchange may be influenced by prior supplier performance, and the supplier's ability to meet performance standards must be demonstrated before a customer's willingness to develop closer relationships.

In the marketing literature, Noordewier et al's8 investigation of the relationship among environmental uncertainty, relational exchanges and customer performance across a number of industries revealed that relational exchanges improved customer performance under conditions of high environmental uncertainty; however, no parallel improvements in customer performance were uncovered within more certain environmental contexts. They defined performance based on purchasing improvements, that is, lower product prices and acquisition costs. Fink, Edelman and Hatten,26 in a related study of the paper industry, revealed a relationship between improved customer performance and relational exchanges in both high- and low-uncertainty environments due to supplier knowledge transfer. Ulaga27 used a qualitative approach in interviewing 21 purchasing managers, and found relationships between closer relationships and supplier product quality, supplier on-time delivery, customer time-to-market, customer direct product costs and customer process costs. These results were similar to those from Cannon et al's10 study associating relational exchanges with improvements in supplier product quality and delivery. While these prior studies indicate an improvement in many customer performance measures that are associated with relational exchanges, Woodburn et al28 point out that lower pricing may not be associated, and state that ‘if you (customers) are always being driven to lowest price, it shows there is no loyalty’.

These prior strategic management and marketing studies have focused primarily on the relationship between customer performance and relational exchanges, but not specifically on whether these performance benefits and factors are associated with all customers of varying sizes and resources. The current research framework (Figure 1) offers an alternative perspective by incorporating the performance outcomes associated with relational exchanges in prior research, and suggests that other factors including supplier late deliveries, supplier product defects and customer production improvements derived from their supplier relationship may also be associated with a customer's desire to pursue relational exchanges. In addition, the current research addresses how these factors vary in their association with relational exchanges in small-, medium- and large-sized customers.

Relational exchange and environmental uncertainty

Several empirical studies on marketing and strategic management have focused on the association of technological and resource availability uncertainty with customer relational exchange choices,6, 8, 29, 30, 31 but again there has been limited attention given to how environmental uncertainty is associated with relational exchanges for different segments of customers, such as customers of varying sizes and resources. Heide and John's4 research on the relationships between electronic manufacturers and their downstream customers, the original equipment manufacturers (OEMs), found a positive relationship between customer continuity expectations and joint customer–supplier actions and transaction-specific assets. They found a negative relationship between joint actions and technological unpredictability, but no significant relationship between continuity expectations and volume unpredictability. Poppo and Zenger32 investigated the relationship between IT managers and their suppliers of (outsourced) IT services based on technological uncertainty, asset specificity and three relational norm variables. They reported that although asset specificity alone did not foster relational choices, the interaction of technological uncertainty and asset specificity was significantly related to the three relational norms they employed to represent relationalism.

These studies showed that the customer choice of relational exchanges can be explained in part by examining firms' perspectives on technological uncertainty. However, although Poppo and Zenger32 and Heide and John4 defined uncertainty based on product technological change, there is no consensus in the literature on the definition of environmental uncertainty or on the role size plays in corporate decisions when the environment is uncertain. For instance, Noordewier et al8 operationalised uncertainty as a composite variable that encompassed resource volatility, availability, uncertainty and resource supply stability in a manner conceptually closer to the definition of environmental uncertainty found within resource dependency theory,33 but they paid no attention to size.

Relational exchange norms

The current research uses relational norms as a means to understand relational exchanges. Relational exchange strategies based on relational norms have been conceptualised on a continuum, with transactional, arm's-length relationships at one end, and close, relational exchanges at the other.34, 35 At the transactional end of the continuum, exchange is defined as a single transfer of goods based on economic considerations. Here, the objects of exchange are easily monetised commodities or money, and the transaction is completed with little or no social interaction.36 In transactional exchanges, therefore, normative behavioural norms imply that individual actors will pursue strategies that are aimed at the attainment of their individual goals without deference to their partners' goals.4 At the other end of the continuum are relational exchanges in which customers and suppliers develop relational norms. Firms that develop relational norms as a part of their exchange strategy recognise that most economic exchanges occur in the context of social relationships.37, 38 These relational exchanges are characterised by a greater degree of trust and mutual obligation, the planning of exchange structures and processes, the sharing of benefits and burdens, the planning for relations among current and new participants, and a focus on mutual interests and joint conflict resolution.39, 40

Research framework summary

This research uses RBT of the firm, and builds upon prior studies by incorporating performance, environmental uncertainty and relational norms into a single model to investigate relational exchange choices for small-, medium- and large-sized paper mills. The approach is consistent with prior studies, which have each offered a unique but perhaps incomplete view of relational exchanges. The research framework (Figure 1) extends prior studies by investigating a wider range of performance outcomes by filling a gap in the literature by testing where differentials in performance associated with relational exchanges with suppliers may occur over customers of different sizes and resources. The framework includes both technological and resource environmental uncertainty to assess how these variables are associated with customer–supplier relational exchanges based on customer size and resources.

METHODOLOGY

Data collection

In an industrial survey, it is considered prudent to sample all corporate entities to ensure representativeness. Therefore, we initially compiled comprehensive national lists of (1) firms belonging to the pulp, paper and paperboard industry and (2) individuals most qualified to discuss their firms' relationships with their primary supplier of PCE (that is key informants). Our exploratory research suggested that, in this industry, individuals from three key departments (that is purchasing, technical support and engineering) had significant interactions with the PCE suppliers. Hence, we developed our list of potential respondents with the help of the Lockwood-Post Directory of Pulp, Paper and Allied Trades and the rosters of the Paper Industry Management Association. The initial list described a population of approximately 1800 names, representing 270 firms operating in 526 plant sites. Follow-up phone calls to each plant cleaned the list, resulting in 1170 valid names.

The survey resulted in 372 completed, usable questionnaires, or a realised response rate of 32 per cent. The questions were framed in terms of individual respondent's perceptions of the relationship between his/her department and its primary supplier. We did not aggregate or average responses within customer sites or across multiple customer sites to develop a customer perspective for two reasons. First, as discussed in the subsequent section on Measures – Relational Norms, we used scales previously tested by Kaufmann and Dant39 and Li41 that measured individual perceptions of customer–supplier relationships. This both justified the scales used in this study and allowed us to compare the validity of our scales to prior studies. Second, aggregating multiple responses within one customer assumes that each respondent has equal power and authority within the organisation. As individual power and authority constructs were beyond the scope of this study, and equal weighting would inappropriately specify an aggregate customer perspective, individual perceptions were measured.

Manova comparisons contrasted the responses of purchasing departments' personnel with those of technical support and engineering departments, and yielded nonsignificant results (P=0.427), suggesting the absence of systematic response biases. In a similar vein, the non-response bias was evaluated by comparing early and late respondents,42 again using Manova, across a series of constructs. All Manova runs were again statistically insignificant (P values ranged from 0.13 to 0.92). Finally, additional checks for non-response bias were carried out by random follow-up telephone interviews. The non-respondents pointed to a range of reasons for not responding, such as insufficient time, receipt of too many surveys, inability to recall receiving the survey and feeling unqualified to respond. However, no systematic pattern of reasons for non-response could be uncovered.

Measures

The measurement models employed in this study follow the latent measures approach to tapping customer performance, environmental uncertainty and relational norm variables. We asked 2–5 questions to measure independent variables production performance due to supplier products and services and supplier knowledge, technological uncertainty, resource availability uncertainty and relational norms to ensure the identification (that is specification) of the measurement models (see Appendices A and B). Subsequently, composite measures (based on means) were derived for each variable once the reliability and psychometric properties of the measures had been ascertained. One question was used to measure both late supplier deliveries and supplier product defects. Table 1 presents the Cronbach α assessment of performance, environmental uncertainty and relational norm variables, and Appendix C contains the descriptive statistics and correlation matrix for these variables.

Performance

As evident in the research framework (Figure 1), supplier performance was operationally measured in terms of (1) per cent late supplier deliveries and (2) per cent supplier defects, and customer performance was measured by (1) production performance derived from suppliers' products and services and (2) production performance derived from suppliers' knowledge transfer. As adequate performance measures for these constructs could not be identified, new questions and measures for these performance constructs were developed for this study. The questions were pre-tested with both industry practitioners and academics, and were deemed clear and appropriate. The Cronbach α's for production performance resulting from both supplier products and services and knowledge were 0.80.

Environmental uncertainty

Following Heide and John4 and Walker and Weber,43 technological uncertainty, as defined by Perrow,44 was employed as a proxy for environmental uncertainty in the present investigation. Withey et al45 originally developed a technological uncertainty scale consistent with Perrow's definition. This scale was subsequently used by Walker and Webber43 and Heide and John.4 Heide and John4 reported a reliability of 0.68 for this scale, which improved to 0.82 in this study with the elimination of two questions. For resource availability uncertainty, we used Noordewier et al's8 operationalisation of resource availability uncertainty construct in our investigation.

Relational exchange norms

The relational exchange norms measures used in this study, as explained earlier, are based on Macneil's34, 46 definitions of discrete and relational exchange, and their subsequent use by other researchers.8, 40, 47 As already noted, the specific scales employed herein were operationalised and validated by Kaufmann and Dant39 and Li.41 Kaufmann and Dant39 validated seven norms – relational (0.71), solidarity (0.73), power restraint (0.65), role integrity (0.78), conflict resolution (0.72), flexibility (0.62) and mutuality (0.72) – in their survey of 106 sales and purchasing professionals. Li41 subsequently validated the same norms in a study of the relationship between photocopy distributors and manufacturers – relational, (0.70) solidarity (0.76), power restraint (0.70), role integrity (0.65), conflict resolution (0.69), flexibility (0.78) and mutuality (0.83). As Li's41 scales performed better on four of seven norms measured, these scales were adopted for this study.

All relational exchange measures were provided with five-point response anchors of Strongly Agree to Strongly Disagree, with a defined neutral point. In all cases, Strongly Agree was numerically coded as 5.0, whereas Strongly Disagree anchor was coded as 1.0. Four items were used for measuring six of the norms, and five items were used for measuring one of the norms – conflict resolution. An aggregate of all 29 questions with a Cronbach α of 0.85 was used to measure relational norms.

Our approach using a subset of Macneil's norms based on Kaufmann and Dant's research is consistent with prior marketing studies. As reported by Ivens and Blois,48 98 of the 100 papers they reviewed that explored the effects of Macneil's norms on other variables had drawn on Kaufmann and Dant's work. In addition, although Ivens and Blois48 and Blois and Ivens49, 50 raised some issues about the validity of the Kaufmann's scales, their research suffers from methodological and analytical shortcomings. Their use of students in classes studying relationship marketing raises concerns regarding demand characteristics and external validity.51 In addition, their study design confounds sample and treatment, which is presumably why they used t-tests rather than analysis of variance. Blois and Ivens49 view the fact that the Kaufmann and Dant-based scales showed greater dispersion as a shortcoming, when it can just as easily be argued that they provide a greater ability to discriminate. Despite these concerns, therefore, we decided that the extensive testing and validity assessment of Kaufmann and Dant's39 scales and their use in so many field studies measuring practitioner perceptions of relational norms supports our use of their measures and Macneil's norms in this study.

As indicated in Table 1, all the measures performed well from a reliability–validity perspective. Relational norms had a reliability (as measured by Cronbach's α) of 0.85, whereas the reliabilities for technological uncertainty and resource availability uncertainty were 0.82 and 0.85, respectively. The performance reliabilities were 0.80 for both production performance constructs (Table 1). It should be noted that four scale items were deleted in this measure-purification process (that is two each from the technological uncertainty and resource availability uncertainty measures); however, no items were eliminated from relational norms and performance measures. Therefore, based on the above Cronbach α evaluation, the pedigree of the scales and the development of new performance scales, individual scale items under each construct were collapsed and combined as mean scores to create single composite indices corresponding to the respective theoretical constructs. These indices were used for all subsequent analyses.

Customer size

In the paper industry, plant (customer) size is defined based on the daily production of paper. Therefore, survey responses were categorised by size so that approximately one-third of the responses fit into each size category: Small – defined as customers producing 570 or fewer tons of paper per day, Medium – as customers producing 571 to 1300 tons of paper per day, and Large – as customers producing over 1300 tons of paper per day.

RESULTS

The focus of this research is the relationships among customer relational exchange choice, per cent late deliveries, per cent defects, production performance, resource availability uncertainty and technological uncertainty for three groups of customers: small-, medium- and large-sized paper mills. Size was represented in the regression model by dummy variables. Following normal practice in ordinary least squares regression studies when using dummy variables, we omitted one group, the medium-sized group, a choice that made interpretation of the results easier. We tested mean differences (intercepts) and slope differences among groups.

As shown in Table 2, slope differences were significant between the small- and medium-sized groups of customers, positive for per cent late deliveries (P=0.055) and ‘customer production performance – knowledge’ (P=0.003) and negative for per cent defective (P=0.002), and technological uncertainty (P=0.008). For large-sized customers, the slope differences between them and medium-sized customers were significant only for ‘customer production performance – products and services’ (positive with P=0.014), although ‘customer production performance – knowledge’ (negative, P=0.084) was marginally significant. Note that this last variable was positive, with P=0.003 for the ‘small’ group. (The two results are significantly different from each other (t=4.96 P< 0.001.) Relationships between relational choice and the study variables in the small and large groups are, therefore, different from each other, as well as being different from the medium group. The significant variables in this study differ across the three groups. Small differ from the medium, as do the large, and the large differ from the small.

As the significant variables for the small group are different from those that are significant for the large group (with the one exception noted above), the evidence indicates that the factors associated with customer relational choices vary with customer size, and suggests that our research questions are appropriate in enhancing our understanding of relational exchanges and choices.

To summarise, regression analysis reveals that the relationships among supplier performance, customer performance and relational exchange choice vary by customer size. However, it is also of some note that technology uncertainty was only significant for the small group.

DISCUSSION AND MANAGERIAL IMPLICATIONS

Our primary finding is that the factors associated with customer relational exchanges vary by customer size and presumably customer resources. Customer size, therefore, appears to be an important factor in developing reliable explanations for relational choice, although our literature review has established that, up to now, the question of how these factors are associated with relational exchanges of different size customers has been largely ignored. The current study, therefore, shows for the first time, so far as we have been able to discover, that the relationships among supplier performance, technological uncertainty and relational choice depend on the customer's size, at least in the paper industry.

Different types of customer performance are also shown to be associated with factors shaping the relational choices of small- and large-sized customers. As relational exchanges shift from small to large customers, the evidence is that production performance improvements stimulated and shaped by tapping suppliers' expertise, that is, through supplier knowledge transfer, fade in importance. In the small group, it appears that the need for knowledge can intensify commitments to a relational strategy. Yet for the large group, the marginally significant and (so, possibly) negative β suggests that the large-sized customers would be put at a distance by supplier efforts to relate. Although future research is needed to understand why these relationships exist, we can speculate that small companies with limited staff resources to develop their own knowledge base are eager to tap their suppliers for their know-how. In contrast, the larger mills may have the expertise they need to run their business in-house, and have little need of supplier know-how.

Indeed, when the customer is large, a different factor arises: performance from supplier products and services is significant and positive. Here it seems that the large mills may have the know-how to specify what they want, and the power to get it. The alternative supply choices available to them, and their size, may yield them buying power or, alternatively, they have the staff to ensure that they get what they buy, and that their PCE works. It should also be noted that our study is a survey of customers, and our questions relate to their ‘surviving’ or continuing suppliers. Supplier failures – failures of their PCE equipment – may disqualify them from further consideration.

In this regard, note that for the large group, defective and late deliveries are not significant. In contrast, for the small, defectives are highly significant and negative. It seems, then, that defective deliveries really turn small companies away. Again, while we offer possible explanations for the relationship between these variables, more research is needed to fully understand the reasons why these variable relationships exist.

Clearly, the influence of environmental uncertainties of different types on relational choice also deserves continued research. For example, the regression results indicated that technological uncertainty was significant and negative for small customers. Note that prior studies focused on technology uncertainty have reported conflicting results with respect to technological uncertainty and relational choice. Poppo and Zenger32 reported a positive relationship between these variables, whereas Heide and John's4 research indicated a negative relationship between technological uncertainty and their relational variables. The findings of this study suggest that the different and conflicting results reported in the two studies cited above could be due to the unknown effects of overlooked variables such as customer size and resources. Of course, variations in construct measurements and the fact that the studies of Poppo and Zenger32 and Heide and John4 were conducted at different times on different products and industries could also afford explanations for the reported results and conflicts between them.

The managerial implications of this research are also important. The research is based on a survey of customers who have experience ranging from very little to over 20 years managing exchanges with their primary suppliers of PCE. Their responses to our survey show that relational choices are related to different performance outcomes for small- versus medium- versus large-sized customers as they make their relational exchange decisions. These results imply that marketing managers need to become considerably more discriminating when they decide to enter into relational exchanges. For example, they need to appreciate that not all customers have the same objectives and resources when they seek relational exchanges. These research results, therefore, may help marketing managers to understand potential customer needs in their relational exchanges and, so, in turn, give them the information they need to decide how to segment potential relational exchange customers, and whether their company has the capabilities to economically satisfy varying customer needs.

The results reported here also suggest that marketing managers need to assess how their own company's and their customers' resources might influence relational choice. For example, the results point to the possibility of threshold effects – for example, that customers may have to possess (a yet to be determined) minimum level of staff resources to effectively tap supplier knowledge and improve their own performance. In small customer exchanges to acquire PCE in this industry, supplier knowledge transfer was significant, presumably because small companies have limited resources to acquire, structure, store and use such knowledge independently. The results reported here suggest that large customers may possess sufficient staff resources with sufficient process knowledge of their own to be entirely self-reliant, so that knowledge transfer is not a goal in their relational exchange strategies.

LIMITATIONS AND FUTURE RESEARCH

The results and limitations of this study suggest several opportunities for further research. First, studies in several industries are needed in order to learn how performance and environmental uncertainty are associated with relational exchange across customers of varying size. Much of the prior empirical research exploring customer performance and relational exchanges is based on satisfaction with cost and supplier quality, commitment, and continuity expectations. Owing to the limits of these measures and lack of appropriate performance scales, new performance measures were created for this study. As researchers have attributed many potential benefits to relational exchanges, more effort needs to be placed on developing and testing empirically valid scales to measure purchasing, production, time-to-market, quality, profitability and competitively advantageous performance outcomes associated with relational exchanges. As suggested by Ryals52 and Woodburn and McDonald,53 other measures of price decreases, customer lifetime value and customer profitability need to be developed and tested across a range of customers and industries. There is a particular need for tangible, hard performance measures to help us appreciate just what the real impacts of relational exchanges and performance are across time.

Second, this research suggests that knowledge transfer is an important contingency variable that deserves further exploration in studies of relational choice and performance. There has been little research to define or understand the influence of both customer and supplier knowledge on both relational exchange and performance. This research investigated the role of supplier knowledge in improving customer performance for customers of different sizes and resources, and in this particular industry, at least, gains from knowledge transfers were associated with relational exchanges for small-sized customers only. If these findings were to be replicated in other industries, it would suggest that inter-organisational knowledge transfers are appealing and of value only to customers of a certain size, perhaps with particular resources. Determining whether this is the case, and why, appears to be an important question for both researchers and managers. Thus, future research might focus more emphatically on the relationships among supplier knowledge and resources, customer knowledge and resources, duration, trust and relational choices, their governance and the details of those relationships as they evolve.

Third, this research suggests that differently sized customers have varying resources, and points to the need for further RBT studies of customer–supplier relational exchanges. As noted in the Literature Review section, Morgan and Hunt3 stated that relational exchanges are often based on integrating complementary customer and supplier resources to achieve superior performance, and others16, 17, 18 have suggested that the division of labour and investment between customers and suppliers allows each to specialise in value-creation activities that support their distinct resources. RBT studies of relational exchanges appear to be limited.

Fourth, this study focused on the exchange of one product, PCE, which is capital equipment used to monitor and control manufacturing processes. Future research needs to investigate the relationships among internal and external uncertainty, performance, and relational exchange constructs for other products such as spare parts and ‘consumed’ products and materials that are ultimately incorporated into the customer's end product.

Fifth, future customer–supplier research needs to investigate both sides of the relationship dyad, and needs to understand how these relationships evolve over time. Suppliers are not passive partners that merely adapt to customer exchange requirements. Both customers and suppliers have the ability to select partners with whom to develop relational exchanges, and neither party is always in a position to dictate the relationship. It is also important to note that relationships are interactive over time, and more longitudinal studies are needed to understand how these interactions either foster or hinder the development of closer customer–supplier relationships.

References

Arnett, D. B. and Badrinarayanan, V. (2005) Enhancing customer-needs-driven CRM strategies: Core selling teams, knowledge management competence, and relationship marketing competence. Journal of Personal Selling and Sales Management 25: 329–343.

Schwepker Jr, C. H. (2003) Customer-oriented selling: A review, extension, and directions for future research. Journal of Personal Selling and Sales Management 23 (2): 151–171.

Morgan, R. M. and Hunt, S. D. (1994) The commitment–trust theory of relationship marketing. Journal of Marketing 58: 20–38.

Heide, J. B. and John, G. (1990) Alliances in industrial purchasing: The determinants of joint action in buyer–supplier relationships. Journal of Marketing Research 27: 24–36.

Andersen, P. H. (2002) A foot in the door: Relationship marketing efforts towards transaction-oriented customers. Journal of Market-Focused Management 5 (2): 91–108.

Brown, J. R., Dev, C. S. and Lee, D. (2000) Managing marketing channel opportunism: The efficacy of alternative governance mechanisms. Journal of Marketing 51: 51–65.

Fink, R. C., Edelman, L. F., Hatten, K. J. and James, W. L. (2006) Transaction cost economics, resource dependency theory and customer–supplier relationships. Journal of Industrial and Corporate Change 15 (3): 497–529.

Noordewier, T. G., John, G. and Nevin, J. R. (1990) Performance outcomes of purchasing arrangements in industrial buyer-vendor relationships. Journal of Marketing 54 (4): 80–93.

Cusumano, M. A. and Takeishi, A. (1990) Supplier relations and management: A survey of Japanese, Japanese-transplant, and US auto plants. Strategic Management Journal 12 (8): 563–588.

Cannon, J. P., Achrol, R. S. and Gundlach, G. T. (2000) Contracts, norms and plural form of governance. Journal of Academy of Marketing Science 28: 180–194.

Reinartz, W. J. and Kumar, V. (2000) On the profitability of long-life customers in a non-contractual setting: An empirical investigation and implications for marketing. Journal of Marketing 64 (4): 269–278.

Cannon, J. P. and Homburg, C. (2001) Buyer–seller relationships and customer firm costs. Journal of Marketing 65: 29–43.

Yim, F. H., Anderson, R. E. and Swaminathan, S. (2004) Customer relationship management: Its dimensions and effect on customer outcomes. Journal of Personal Selling and Sales Management 24 (4): 263–278.

Goerzen, A. (2007) Alliance networks and firm performance: The impact of repeated partnerships. Strategic Management Journal 28: 487–509.

Beverland, M. (2001) Contextual influences and the adoption and practice of relationship selling in a business-to-business setting: An exploratory study. Journal of Personal Selling and Sales Management 21 (3): 207–215.

Jarillo, J. C. (1988) On strategic networks. Strategic Management Journal 9: 31–41.

Kogut, B. (2000) The network as knowledge: Generative rules and the emergence of structure. Strategic Management Journal 21: 405–525.

Moller, K. and Svahn, S. (2006) Role of knowledge in value creation in businessnets. Journal of Management Studies 42 (5): 985–1007.

Lin, Y., Su, H. and Chien, S. (2006) A knowledge-enabled procedure for customer relationship management. Industrial Marketing Management 35: 446–456.

Bertrand, K. (1986) Crafting ‘win-win situations’ in buyer–supplier relationships. Business Marketing 71 (6): 42–50.

Casciaro, T. (2003) Determinants of governance structure in alliances: The role of strategic, task and partner uncertainties. Industrial and Corporate Change 12 (6): 1223–1251.

Berggren, C. (1992) Changing Buyer–Seller Relations in the Australian Automotive Industry: Innovative Partnership or Intensified Control, Sydney, Australia: Center for Corporate Change, Australian Graduate School of Management.

Harrigan, K. R. (1988) Strategic Alliances and Partner Asymmetries. In: F.J. Contractor and P. Lorange (eds.) Cooperative Strategies in International Business. Lexington, MA: Lexington Books.

Kogut, B. (1988) Joint ventures: Theoretical and empirical perspectives. Strategic Management Journal 9: 319–332.

Buckley, P. J. and Casson, M. (1976) The Future of the Multinational Enterprise. New York: Holmes & Heier.

Fink, R. C., Edelman, L. F. and Hatten, K. J. (2006) Relational exchange strategies, performance, uncertainty and knowledge. Journal of Marketing Theory and Practice 14 (3): 139–153.

Ulaga, W. (2003) Capturing value creation in business relationships: A customer perspective. Industrial Marketing Management 32: 677–693.

Woodburn, D., Holt, S. and McDonald, M. (2004) Key Customer Profitability: Making Money in Strategic Customer Partnerships. Cranfield. Report by the Cranfield Key Account Management Best Practice Club.

Anderson, E. and Weitz, B. (1989) Determinants of continuity in conventional industrial channel dyads. Marketing Science 8: 310–323.

Dwyer, F. R., Schurr, P. H. and Oh, S. (1987) Developing buyer–seller relationships. Journal of Marketing 51: 11–27.

Heide, J. B. and John, G. (1992) Do norms matter in marketing relationships. Journal of Marketing 56: 32–44.

Poppo, L. and Zenger, T. (2002) Opportunism Routines and Boundary Choices: A Comparative Test of Transaction Cost and Resource Based Explanations for Make-or-Buy Decisions. Academy of Management Conference Proceedings, pp. 42–46.

Pfeffer, J. and Salancik, G. (1978) The External Control of Organizations: A Resource Dependence Perspective. New York: Harper and Row.

Macneil, I. R. (1978) Contracts: Adjustments of long-term economic relations under classical, neo-classical and relational contract law. Northwestern University Law Review 72: 854–905.

Macneil, I. R. (2000) Relational construct theory: Challenges and queries. Northwestern University Law Review 94 (3): 877–907.

Bagozzi, R. P. (1978) Causal Models in Marketing. New York: Wiley.

Granovetter, M. (1986) Economic action and social structure: The problem of embeddedness. American Journal of Sociology 91 (3): 481–510.

Macaulay, S. (1963) Non-contractual relations in business: A preliminary study. American Sociological Review 28: 55–67.

Kaufmann, P. J. and Dant, R. P. (1992) The dimensions of commercial exchange. Marketing Letters 3 (2): 171–185.

Kaufmann, P. J. and Stern, L. W. (1988) Relationship exchange norms, perceptions of unfairness and retained hostility in commercial litigation. Journal of Conflict Resolution 3: 534–552.

Li, Z. G. (1994) Antecedents of relationalism in manufacturer-distributor relationships: An empirical study. Unpublished doctoral dissertation, Boston University, Boston, MA.

Armstrong, J. S. and Overton, T. S. (1977) Estimating nonresponse bias in mail surveys. Journal of Marketing Research 14: 396–402.

Walker, G. and Weber, D. (1984) A transaction cost approach to make-or-buy decisions. Administrative Science Quarterly 29: 373–391.

Perrow, C. (1967) A framework for the comparative analysis of organizations. Administrative Science Quarterly 21: 398–419.

Withey, M., Daft, R. L. and Cooper, W. H. (1983) Measures of Perrow's work unit technology: An empirical assessment of a new scale. Academy of Management Journal 26: 45–63.

Macneil, I. R. (1980) The New Social Contract: An Inquiry into Modern Contractual Relations. New Haven, CT: University Press.

Dant, R. P. and Schul, P. (1992) Conflict resolution processing in contractual channels of distribution. Journal of Marketing 56: 38–54.

Ivens, B. S. and Blois, K. J. (2004) Relational exchange norms in marketing: A critical review of Macneil's contribution. Marketing Theory 4 (3): 239–263.

Blois, K. J. and Ivens, B. S. (2006) Measuring relational norms: Some methodology issues. European Journal of Marketing 40 (3/4): 352–365.

Blois, K. J. and Ivens, B. S. (2007) Method issues in the measurement of relational norms. Journal of Business Research 60: 556–565.

James, W. L. and Sonner, B. S. (2001) Just say no to traditional student samples. Journal of Advertising Research 41 (5): 63–71.

Rydal, L. (2006) Profitable relationships with key customers: How suppliers manage pricing and customer risk. Journal of Strategic Marketing 14 (2): 101–113.

Woodburn, D. and McDonald, M. (2001) Key Customers – World-Leading Key Account Management: Identification and Development of Strategic Relationships. Cranfield. Report by the Cranfield Key Account Management Best Practice Club.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Fink, R., James, W. & Hatten, K. An exploratory study of factors associated with relational exchange choices of small-, medium- and large-sized customers. J Target Meas Anal Mark 17, 39–53 (2009). https://doi.org/10.1057/jt.2008.27

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1057/jt.2008.27