Abstract

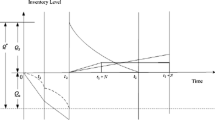

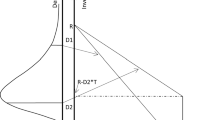

In this paper, considering the empirical trend for sales and price of fashion apparels as prototype, optimal ordering policy for a single period stochastic inventory model is investigated. The impact of the presence of random lead time and declining selling price on the profitability of the retailer is explored. Existence of unique optimal solutions for net profit functions is proved. Numerical examples are presented to illustrate the method of identifying profitable levels of inventory holding and penalty costs. Percentage profit per unit investment in inventory is obtained in order to assist managers in taking business decisions, specifically to the extent of whether or not to take up a particular business under known constraints. It is demonstrated that the optimal inventory policy in the absence of price decline and lead time differs considerably from that when lead time and price decline are simultaneously considered.

Similar content being viewed by others

References

Arcelus FJ, Kumar S and Srinivasan G (2005). Retailer's response to alternate manufacturer's incentives under a single period, price-dependent, stochastic-demand framework . Decision Sci 36(4): 599–625.

Buzacott JA (1975). Economic order quantities with inflation . Opl Res Quart 26: 553–558.

Chaouch BA (2007). Inventory control and periodic price discounting campaigns . Naval Res Logist 54: 94–108.

Erel E (1992). The effect of continuous price change in the EOQ . Omega 20: 523–527.

Hill AV and Khosla IS (1992). Models for optimal lead time reduction . Prod Opns Mngt 1(2): 185–197.

Hsu P-H, Teng H-M, Jou Y-T and Wee H-M (2008). Coordinated ordering decisions for products with short life cycle and variable selling price . Comput Indust Eng 54(3): 602–612.

Kaplan RS (1970). A dynamic inventory model with stochastic lead times . Mngt Sci 16(7): 491–507.

Khouja M (1995). The newsboy problem under progressive multiple discounts . Eur J Opl Res 84: 458–466.

Khouja M (1996). A note on the newsboy problem with an emergency supply option . J Opl Res Soc 47: 1530–1534.

Khouja M (1999). The single-period (news-vendor) problem: Literature review and suggestions for future research . Omega 27(5): 537–553.

Khouja MJ (2000). Optimal ordering, discounting and pricing in the single period problem . Int J Prod Econ 66: 201–216.

Khouja M and Park S (2003). Optimal lot sizing under continuous price decrease . Omega 31: 539–545.

Kim JG, Sun D, He HJ and Hayya JC (2004). The (s,Q) Inventory model with Erlang lead-time and deterministic demand . Naval Res Logist 51: 906–923.

Kogan K and Spiegel U (2006). Optimal policies for inventory usage, production and pricing of fashion goods over selling season . J Opl Res Soc 57: 304–315.

Miller R (1997). Does everyone have a price. Marketing (April): 30–33.

Petruzzi NC and Dada M (1999). Pricing and the newsvendor problem: A review with extensions . Opns Res 74: 183–194.

Su X (2007). Intertemporal Pricing with strategic customer behaviour . Mngt Sci 53(5): 726–741.

Acknowledgements

We are thankful to Professor T. Krishna Kumar, Director, Samkhya Analytica Pvt. Ltd, Bangalore, India for his helpful comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Banerjee, S., Meitei, N. Effect of declining selling price: profit analysis for a single period inventory model with stochastic demand and lead time. J Oper Res Soc 61, 696–704 (2010). https://doi.org/10.1057/jors.2009.28

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/jors.2009.28