Abstract

Hedge funds, such as managed futures, typically use two different types of trading strategies: technical and macro/fundamental. In this article, we evaluate the impact of combining the two strategies, and focus on, in particular, two common foreign exchange trading strategies: momentum and carry. We find evidence that combining the strategies offers a significant improvement in risk-adjusted returns. Our analysis, which uses data spanning 20 years, highlights the potential benefits of achieving strategy-level diversification.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

INTRODUCTION

Technical strategies, such as momentum trading, and macro/fundamental strategies are both used by practitioners. Published research seems to study each strategy independently, of which Zhu and Zhou (2009) and Moskowitz et al (2012) are recent examples evaluating the profitability of using moving average and time series momentum strategies. The joint study of technical and macro/fundamental strategies appears to have received relatively little attention in the investment literature. For example, it is only recently that Neely et al (forthcoming) argue for a role in combining macroeconomic and momentum indicators to better forecast the stock market risk premium.

In this article, we will focus on the important question of whether there is real value in combining technical and macro/fundamental strategies. In an independent and concurrent study, Ahmerkamp and Grant (2013) also investigate a similar question. In contrast to their study, we focus on evaluating managed futures in a more realistic setting to clarify the points, and also to explore more combinations and their economic underpinnings.

Managed futures is an alternative investment style with a long track record of providing investors with returns that have little or no correlation to traditional investments. Landmark papers by Lintner (1983) and Schneeweis (1996), combined with decades of real-world results, have shown that adding managed futures to a traditional portfolio of stocks and bonds can enhance the overall return of the portfolio while also reducing its risk. As a result of this value-added diversification, investors have increasingly embraced managed futures as a valuable component of a well-diversified portfolio. In fact, investor enthusiasm for managed futures helped produce a nearly eightfold increase in assets under management during the 2001–2011 period (see sources from www.barclayhedge.com).

To illustrate the diversifying benefits of managed futures, we consider the returns of two indices: the S&P 500 index and the BTOP50 (a commonly referenced index of managed futures performance). The data we use for both indices are from April 1993 to March 2013, a total of 240 months, or 20 years. Table 1 reports the annualized return, standard deviation, worst monthly return, maximum drawdown, Sharpe ratio (assuming a zero interest rate) and Calmar ratio for the two indices, as well as that of an 80 per cent S&P 500/20 per cent BTOP50 combined portfolio. The Sharpe ratio and Calmar ratio are risk-adjusted measures of return. The Sharpe ratio measures annual return versus volatility (standard deviation), while the Calmar ratio measures annual return versus maximum drawdown.

As measured by the standard deviation, the risk of investing in the S&P 500 was about twice that of the managed futures index, or 15.16 per cent versus 8.44 per cent. Moreover, the worst monthly return for the S&P 500 was more than twice as large. In terms of the maximum drawdown, the S&P 500 suffered a loss of 50.94 per cent from its peak, while the managed futures index lost only 13.31 per cent from its maximum. Although the S&P 500 had a larger absolute return than the managed futures index, 8.52 per cent versus 6.06 per cent, the risk-adjusted measures tell a different story. With a Sharpe ratio of 0.72 versus 0.56 and a Calmar ratio that is more than double that of the S&P 500, managed futures provided far better return per unit of risk. The last column Table 1 shows that even a relatively small allocation to managed futures would have resulted in a meaningful improvement in the performance of an S&P 500 portfolio. For example, a 20 per cent allocation to managed futures would have increased the Sharpe ratio from 0.56 to 0.69. Looked at another way, an investor could have realized the same return as the S&P 500 with an annualized standard deviation of only 12.32 per cent instead of 15.16 per cent, a 18.73 per cent reduction in risk.

SOURCES OF RETURN

It is well known that investors who purchase stocks receive long-term returns that are derived from three sources: dividends, growth in corporate earnings and changes in valuation. But what are the underlying forces that drive managed futures returns? Fung and Hsieh (2001) documented that most futures managers are trend followers who attempt to profit from the price momentum of various markets. In another study, Burghardt et al (2010) found that a simple momentum strategy does a good job of replicating the performance of a typical managed futures fund and generates a return history with a 0.67 correlation to a popular managed futures index. While a majority of managers use a systematic (non-discretionary) technical trading approach such as momentum, there are those who use a macro/fundamental approach that relies solely on non-price-based macroeconomic and fundamental factors. Such macro/fundamental strategies can be implemented using either a discretionary or systematic approach, but for our analysis we will focus on the systematic implementation of this type of strategy. It should be noted that most managers offer exclusively technical or macro/fundamental strategies, thus avoiding the need for multiple skill sets and research capabilities.

Next, we will focus on the important question of whether there is real value in combining the two strategies, something that seems to have received relatively little attention in academic literature. For example, it is only recently that Neely et al (forthcoming) argue for a role of combining macroeconomic and momentum indicators to better forecast the stock market risk premium, and Ahmerkamp and Grant (2013), in a more closely related study, advocate for the combination of momentum and macroeconomic strategies.

PORTFOLIO SELECTION

In this article we take a straightforward approach to evaluating the effect of combining technical and macro/fundamental strategies. Based on our desire for transparency and ease of replication, we focus on a single asset class within a typical managed futures portfolio – foreign exchange (FX). A key benefit in selecting FX is that there is a simple macro/fundamental strategy that is well known and readily available from Bloomberg.

To build our portfolio, we selected the following foreign exchange instruments: Australian dollar, British pound, Canadian dollar, euro (before its introduction in January 1999, the German deutsche mark is used), Japanese yen, New Zealand dollar, Swiss franc and US dollar. These currencies are commonly referred to as major currencies and are highly liquid. In fact, according to the 2010 Bank for International Settlements’ report on global foreign exchange market activity, these currencies made up 88 per cent of global foreign exchange market turnover in 2010.

While we limit our evaluation to foreign exchange only, it is reasonable to assume that the other primary asset classes included in a typical managed futures portfolio, namely, fixed income, commodities, and stock indices, would also benefit from a combination of momentum and macro/fundamental strategies.

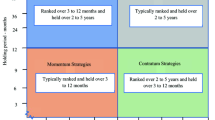

TRADING STRATEGY: MOMENTUM

What makes a momentum strategy profitable? Its profitability relies on the existence of sustainable price trends. If the price of a market has been rising, a momentum strategy expects that prices will continue to rise, and if prices have been falling, that they will continue to fall. This assumption is contrary to most traditional economic theories that assume that all agents in the economy have perfect information and that the current price reflects all known information. Under these and other unrealistic assumptions, asset prices should be unpredictable based on past prices, thus rendering a momentum strategy (and any other strategy that uses only past prices) theoretically useless. However, in the real world, it is clear that no one has perfect information, and rarely does everyone have the same information at the same time. Even if some traders have the same information at the same time, they will likely interpret and react differently according to their own preferences, expertise and circumstances. As summarized by Brunnermeier (2001), there are now quite a few theoretical studies that support the value of a momentum strategy based on the asymmetric information structure in the economy. Evidence suggests that a market can be efficient or in a rational equilibrium even if its prices follow predictable trends. Recently, Cespa and Vives (2012) show further that the presence of liquidity traders and asset payoff uncertainty will generate rational trends in a market. Intuitively, hedging demand also takes time to fulfill in the market. The greater the risk to be hedged the greater the demand, and thus the greater the persistence of a price trend. In addition, the build-up of large investment or speculative positions also results in large liquidity demands and promotes the presence of price trends. Recently, Zhou and Zhu (2013) show that not only does trend-following exist in rational equilibrium, but it can also forecast the market returns.

From a behavioral finance point of view, the rationale for price trends is even simpler. Investors or traders may initially under-react to news that leads to under-valuation of an asset. Subsequently, as the price goes up, the fundamental value will eventually be realized. However, as the price is going up, traders become over-confident and over-react to news, leading to an over-valuation of the asset and further strengthening of the trend until an inevitable price reversal occurs.

For our purposes, we consider a relatively simple momentum strategy. Following Burghardt et al (2010), we use a 20/120 day moving average crossover strategy. This strategy is long a currency when the 20-day (roughly 1-month) moving average of closing prices is above the 120-day (roughly 6-month) moving average, and short when the 20-day is below the 120-day. This is often referred to as a pure reversal strategy because it is always fully long or short each market in the portfolio – it does not have a flat or neutral zone. Trading is done using exchange-cleared futures contracts and all markets receive an equal volatility weighting. Positions are sized and actively managed such that they are equal to the inverse of each market’s volatility as measured by a rolling 1-month standard deviation. In addition, all transactions include reasonable commission and slippage costs. In short, unlike academic studies such as Ahmerkamp and Grant (2013), our selected momentum strategy is designed to be implementable in a very realistic setting so that the associated returns would have been achievable had the strategy been followed in real-time.

Table 2 reports the summary statistics for the FX momentum strategy. The performance is similar to that of the BTOP50 managed futures index, suggesting that FX is an important component of the index. The result also echoes the finding of Burghardt et al (2010) that a simple 20/120 day moving average crossover is representative of the time frame used by many managed futures funds.

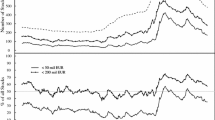

Figure 1 plots the cumulative daily performance of the FX momentum strategy. Although recent performance has been relatively weak, the strategy has provided attractive long-term returns.

TRADING STRATEGY: CARRY

What are the advantages and disadvantages of a macro/fundamental strategy such as FX carry? Ultimately, prices are determined by factors affecting the fundamentals of supply and demand. Unlike a momentum strategy that waits for changes in price to determine position changes, a macro/fundamental strategy such as FX carry can change positions immediately upon changes in fundamentals. However, such strategies are not without limitations. Since they are based on factors other than the price of the market being traded, their greatest weakness is that they can get out of sync with the market for long periods of time. As economic conditions change, factors that are viewed as important by market participants will often come in and out of vogue. For example, during some market cycles weak commodity prices may be viewed as a positive for equity prices whereas in other cycles they are viewed as negative. Because of this, even the most effective macro/fundamental strategy requires constant monitoring to ensure that the selected factor is still relevant.

It is important to note that a momentum strategy can be defined by formulas that are applied to the price stream of a market. A macro/fundamental strategy, on the other hand, is less straightforward as macroeconomic and fundamental data can be used in a number of different ways. First, the impact of macro/fundamental data on prices is not straightforward and is therefore open to interpretation by an analyst or trader. Second, a factor that impacts the price of one market or asset class will typically impact a different market or asset class in another manner, if at all. As a result, selecting one macro/fundamental factor for all asset classes is not reasonable. We deal with this issue by selecting one asset class, FX, and one macro/fundamental strategy, FX carry.

Carry is a simple, commonly used strategy in foreign exchange markets that involves buying currencies with higher yields and selling currencies with lower yields. One variation of this strategy can be easily accessed using Bloomberg’s Forward Rate Bias (or FX carry) function.Footnote 1 The strategy, as we implemented it, ranks each currency based on that country’s three-month deposit rate yield and takes long positions in the three highest-yielding currencies and short positions in the three lowest-yielding currencies. Theoretically, as argued by Burnside et al (2011), the carry-trade bears fundamental economic risks and therefore should earn positive expected returns.

Table 3 summarizes the return characteristics for the FX carry strategy over the past 20 years. As expected, FX carry did earn a sizable positive return over time. Although the carry strategy performs well, its overall performance during this time period was worse than that of the momentum strategy. The carry strategy particularly suffered during the 2008–2009 financial crisis. Conceptually, however, a more sophisticated carry strategy or one using a different portfolio may have performed even better. Figure 2 plots the cumulative daily performance of the FX carry strategy.

COMBINING FX MOMENTUM AND CARRY

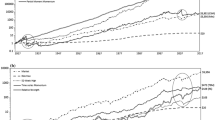

We now address the question of whether a combination of the FX momentum and carry strategies offers significant value to investors. Generally, combining two return streams with a relatively low correlation will provide a diversification benefit and result in a portfolio that has a better risk-adjusted return. Figure 3 illustrates the rolling 3-year correlation of the two return streams. The correlation is positive but relatively low throughout most of the 20-year period, suggesting that a combination of the two will provide additional value.

Our next step is to determine how to combine the two strategies. To do so, we will focus on constructing new portfolios that are based on the weights or returns of each strategy. There are two reasons for this. First, it is straightforward to implement. Second, it can be thought of as assigning capital to two managers who independently specialize in momentum and macro/fundamental strategies. To evaluate different combinations we consider three approaches.

PORTFOLIO CONSTRUCTION APPROACH NO. 1: THE EQUAL-WEIGHTED PORTFOLIO

We first consider an equal-weighted portfolio,

where R1 and R2 are the daily returns of the momentum and carry strategies, respectively. This strategy is also used by Ahmerkamp and Grant (2013) in their independent and concurrent study. Interestingly, despite its simplicity, the equal-weighted portfolio often performs well in many applications.

PORTFOLIO CONSTRUCTION APPROACH NO. 2: THE MINIMUM RISK PORTFOLIO (MIN VAR)

Our second approach is to form a portfolio with the minimum variance risk,

with

where σ21 and σ22 are the variances of the momentum and carry strategies, respectively. For simplicity, the above formula assumes zero correlation between the strategies, which we have shown is close to the case in reality. In its implementation, we use 20 trading days (roughly 1 month) of data to estimate the volatilities. In the first 20 days before volatility estimates are available, we use the equal-weighted portfolio. The formula makes intuitive sense – as the risk of one strategy picks up, more weight is allocated to the other.

PORTFOLIO CONSTRUCTION APPROACH NO. 3: THE MEAN-VARIANCE MAXIMIZATION (MAX UTI)

Our third approach is to maximize the mean-variance utility,

where τ is the coefficient of relative risk aversion, that is, the trade-off parameter between risk and return. Then,

with

where μ1 and μ2 are the expected returns of the two strategies and we continue to assume zero correlation between the strategies. Since the expected returns are known to be very difficult to estimate accurately and the estimation often requires a long time series, we use all the past data available for a day when combining the strategies on that day. We set τ=3, a typical value in our calculations.

COMPARING THE THREE DIFFERENT PORTFOLIO CONSTRUCTION METHODS

The last three columns of Table 4 report the return characteristics for the three approaches of combining momentum and carry. Two of the three produced risk-adjusted return measures that are superior to those of either of the two single strategies. Both the equal-weighted approach and the minimum risk approach resulted in a significant improvement in both measures of risk-adjusted return. Only the utility maximizing portfolio performed poorly, likely due to estimation errors.

The empirical results exhibit substantial economic value, particularly on a risk-adjusted basis. Independently, the momentum and carry strategies have a Sharpe ratio of 0.79 and 0.63, respectively. With an equal-weighted combination, the Sharpe ratio improves to 0.98, a 24 per cent improvement over the momentum strategy and a 56 per cent improvement over the carry strategy. Perhaps more compelling, the equal-weighted combination has a Calmar ratio of 0.70, which is a 71 per cent improvement over the momentum strategy and a 289 per cent improvement over the carry strategy.

Figure 4 illustrates the benefit of using the equal-weighted portfolio construction method. It plots the cumulative returns of the two independent strategies over the entire 20-year test period, and also includes the equal-weighted combination, which has been scaled to a volatility that is equal to the average of the two independent strategies. Given similar volatility, the equal-weighted combination clearly outperforms both independent strategies.

Perhaps the most visible benefit of combining the two strategies is the overall improvement in drawdown for the combined portfolio. Figure 5 plots the drawdown profile of the two strategies independently. As the strategies generally experience significant drawdowns at different times, it is reasonable to expect that a combination of the two will result in a smaller maximum drawdown and a higher Calmar ratio.

Furthermore, Figure 6 looks at this in a different way by showing the 10 worst monthly declines for the FX momentum strategy and the corresponding monthly return for the FX carry strategy. During the 10 worst monthly declines for the FX momentum strategy, the FX carry strategy was profitable in six of those months and outperformed in nine of the 10 months.

Viewing it the other way around, Figure 7 shows the 10 worst monthly declines for FX carry and the corresponding monthly return for FX momentum. In this case, the FX momentum strategy was profitable in five of those months and outperformed in all 10 months.

CONCLUSION

In this article we provide both strategies and evidence that combining technical and macro/fundamental strategies, namely, momentum and carry, could have generated a significant improvement in risk-adjusted performance when compared to the two strategies independently. For simplicity, our approach evaluated two easy-to-replicate strategies and applied them to a portfolio of highly liquid foreign exchange markets. Further research into more sophisticated strategies, and across other asset classes, could be expected to provide even more improvement.

The benefits of adding managed futures to a traditional portfolio have been well known for quite some time and have helped spark a large increase in the number of managed futures products offered to investors. Although most managed futures funds offer portfolio-level diversification by holding positions across a broadly diversified portfolio of markets, these funds typically offer a single trading strategy (often momentum-based). Our work provides evidence that moving beyond momentum and achieving strategy-level diversification may offer substantial long-term value to investors in funds with diversified strategies.

Notes

We are grateful to the research team at Bloomberg who kindly permitted us to use their Forward Rate Bias strategy and the associated data created with command FXFB.

References

Ahmerkamp, J.D. and Grant, J. (2013) The Returns to Carry and Momentum Strategies. United Kingdom: Imperial College Business School. Working Paper.

Brunnermeier, M.K. (2001) Asset Pricing under Asymmetric Information: Bubbles, Rashes, Technical Analysis, and Herding. Oxford: Oxford University Press.

Burghardt, G., Duncan, R. and Liu, L. (2010) Two Benchmarks for Momentum Trading. Newedge Prime Brokerage. Research Report.

Burnside, C., Eichenbaum, M., Kleshchelski, I. and Rebelo, S. (2011) Do Peso problems explain the returns to the carry trade? Review of Financial Studies 24 (3): 853–891.

Cespa, G. and Vives, X. (2012) Dynamic trading and asset prices: Keynes vs. Hayek. Review of Economic Studies 79 (2): 539–580.

Fung, W. and Hsieh, D. (2001) The risk in hedge fund strategies: Theory and evidence from trend followers. Review of Financial Studies 14 (2): 313–341.

Lintner, J. (1983) The Potential Role of Managed Commodity-Financial Futures Accounts (and/or Funds) in Portfolios of Stocks and Bonds. Harvard University. Working Paper.

Moskowitz, T.J., Ooi, Y.H. and Pedersen, L.H. (2012) Time series momentum. Journal of Financial Economics 104 (2): 228–250.

Neely, C., Rapach, D., Tu, J. and Zhou, G. (forthcoming) Forecasting the equity risk premium: The role of technical indicators. Management Science.

Schneeweis, T. (1996) The Benefits of Managed Futures. Alternative Investment Management Association.

Zhou, G. and Zhu, Y. (2013) An Equilibrium Model of Moving-Average Predictability and Time Series Momentum. Washington University in St Louis and Tsinghua University in China. Working Paper.

Zhu, Y. and Zhou, G. (2009) Technical analysis: An asset allocation perspective on the use of moving averages. Journal of Financial Economics 92 (3): 519–544.

Author information

Authors and Affiliations

Additional information

The online version of this article is available Open Access

Rights and permissions

This work is licensed under a Creative Commons Attribution 3.0 Unported License. To view a copy of this license, visit http://creativecommons.org/licenses/by/3.0/

The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

About this article

Cite this article

Olszweski, F., Zhou, G. Strategy diversification: Combining momentum and carry strategies within a foreign exchange portfolio. J Deriv Hedge Funds 19, 311–320 (2013). https://doi.org/10.1057/jdhf.2013.16

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1057/jdhf.2013.16