Abstract

This study complements the literature on possible misreporting by hedge funds. Kernel density estimation shows that the likelihood of observing positive outliers in the first 3-month period is significantly larger than the likelihood of observing positive outliers in each of the following non-overlapping 3-month periods at the 99 per cent level of confidence. The outliers do not disappear if we control for systematic risks. The results presented in this article suggest that the average upward bias during the incubation period reported in previous studies may partly stem from hedge funds, actively jump-starting newly launched funds. Large positive outliers during the incubation period can result from both legal and illegal trading behavior.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

INTRODUCTION

Getmansky et al,1 Agarwal et al 2 and Bollen and Pool3, 4 present empirical evidence suggesting that a widespread misreporting phenomenon may exist in the widely unregulated hedge fund industry. Agarwal et al 2 argue that hedge fund investors face a principal-agent conflict like shareholders of corporate firms. Hedge funds only voluntarily submit return information to databases. Most hedge funds do not disclose their holdings to investors. As a result, hedge fund investors make investment decisions under incomplete and asymmetric information. High performance-linked incentive fees, typically 20 per cent of the annual fund performance, tend to align interests between investors and hedge fund managers. However, high incentive fees may not only motivate managers to act on behalf of their investors, but may also induce some managers to misreport returns in order to earn higher compensation.

Hedge fund managers have an interest to smooth returns in order to attract and retain investors. Return smoothing behavior leads to lower volatility and higher Sharpe ratios. Getmansky et al 1 present empirical evidence that hedge fund returns are often highly serially correlated, and argue that the high positive autocorrelation is due primarily to illiquidity and smoothed returns. Agarwal et al 2 observe that hedge fund returns during December are significantly higher than hedge fund returns during the rest of the year. They argue that hedge funds inflate December returns by underreporting returns earlier in the year and by borrowing from January returns in the next year. The latter can be achieved, for example, by placing large buy orders in illiquid securities at the end of December to artificially inflate prices. Bollen and Pool3 find that return series of hedge funds exhibit a high degree of serial correlation and argue that hedge funds are possibly engaged in fraudulent return smoothing behavior. They show empirically that high serial correlation is a leading indicator for fraud. Funds investigated for fraud by the SEC more likely exhibit higher positive serial correlation than other funds. Bollen and Pool4 observe that the number of small gains significantly exceeds the number of small losses reported by hedge funds. They argue that the discontinuity in the pooled distribution of hedge fund returns may result from hedge funds that avoid reporting losses in order to attract and retain investors.

Our findings complement the literature on possible misreporting by hedge funds. In this study, we analyze extreme realizations (outliers) in return series of long/short equity hedge funds. Analyzing the performance of 657 long/short equity hedge funds, we detect a significant amount of large positive outliers in the initial phase of their existence, an empirical measurable phenomenon for which we coined the term ‘jump-start effect’.

We develop the hypothesis, which we test in this article as follows. Our basic assumption is that a principal-agent conflict exists between investors and hedge fund firms and that the agency dilemma is most severe in the first few months after a new hedge fund is launched mainly for two reasons. First, hedge funds are often seeded with capital coming from the pockets of the funds’ managers, their friends and families, creating an incentive for the seed capital providers to allocate profitable trades to newly launched funds. Second, newly launched hedge funds compete with existing funds. Hedge funds that do not report outstanding returns in the first few months of their existence do not attract capital, do not break-even and therefore risk to go out of business sooner or later. We assume that most managers of newly launched hedge funds do not seek to smooth returns, but try to generate extraordinarily high returns to attract investors. We therefore focus on the analysis of outliers instead of mean returns and standard deviations of returns.

As hedge fund firms have strong incentives to report extraordinarily high returns during the incubation period, we hypothesize that some hedge fund managers deliberately jump-start newly launched funds. If hedge fund managers jump-start newly launched hedge funds during the incubation period, positive outliers occur more often in initial periods than in later periods. This hypothesis is testable. We use explorative data analysis (EDA) and multi-factor models to define unconditional and conditional outliers and apply kernel density estimation to examine whether the concentration of positive outliers during the incubation period is significant at the 99 per cent level of confidence.

One possible explanation for extraordinarily high returns, or positive outliers, during the incubation period is that factor returns are higher during the incubation period than in later periods. We conduct a detailed investigation of the possibility that risk factors explain the jump-start effect. Among others, Fung and Hsieh5, 6, 7, 8, 9 and Mitchell and Pulvino10 show that hedge funds exhibit significant exposures to systematic risks. Fung and Hsieh9 apply a 3-factor model proposed by Fama and French11, 12, 13, 14 to explain the variation in returns of long/short equity hedge fund indices. We apply the Fama and French model to a much larger sample of individual long/short equity funds than Fung and Hsieh.9 In addition, we apply a 5-factor model similar to the model proposed by Kuenzi and Shi15 and run rolling window regressions to neutralize the systematic risk of individual long/short equity funds. In this study, we concentrate on long/short equity hedge funds, as previous studies suggest that risk characteristics of hedge funds are style-specific.5, 6, 7, 8, 9, 10 Applying risk factor models, we show that the jump-start bias does not disappear if we control for systematic risks of long/short equity hedge funds.

It has been well-documented that hedge fund returns are severely upward biased in the first year of existence by a practice called backfilling. Hedge funds typically start reporting returns to databases after they have established a track record for several months. Data vendors usually backfill historical returns when they include a new hedge fund to their database. Unlike mutual funds, hedge funds only voluntarily report return information to investors and data vendors. It is reasonable to assume that hedge funds with good track records are more likely to report return information than do bad performing competitors. This creates the possibility of a backfilling bias. Previous researchers argue that the practice of backfilling may result in an upward bias for hedge funds in the first year of existence and recommend excluding the first 12 months of returns when analyzing hedge fund return series.16, 17 The backfilling bias in hedge fund databases has first been recognized by Park18 in his doctoral dissertation. Fung and Hsieh16 find that annual returns of hedge funds in the first year of existence are on average 1.4 per cent higher than hedge fund returns in subsequent years. Edwards and Caglayan17 estimate an instant history bias of around 1.2 per cent per year for hedge funds. Malkiel and Saha19 analyze the TASS database, and show that the difference between backfilled and contemporaneously reported returns was highly significant in the 1995–2003 period. They find that backfilled returns exceed not backfilled returns on average by more than 5 per cent per annum.

The results presented in this article suggest that the average upward bias during the incubation period reported in previous studies can partly be explained by a large, unusual concentration of positive outliers during the incubation period. The size and the concentration of the outliers during the first 3-month period are highly unusual. Large positive outliers during the incubation period can result from both legal and illegal trading behavior. It is possible that some hedge funds allocate profitable trades to newly launched hedge funds to purposefully jump-start these funds.

The remainder of this article is structured as follows. The data used in this article are described in the next section. The subsequent section discusses the concentration of unconditional outliers in return series of long/short equity funds during the incubation period. Kernel density estimation is used to determine whether the results are significant. In the penultimate section, we ask whether the high concentration of positive outliers disappears when controlling for systematic risks. The final section concludes.

DATA DESCRIPTION

In this article, we analyze the likelihood of observing positive outliers in return series of long/short equity hedge funds. Unfortunately, no universally accepted definition of the term ‘long/short equity hedge fund’ exists today. Data vendors and academics use different standards to classify hedge fund strategies. We obtained our data directly from MSCI.

Unlike other data vendors, MSCI uses multiple characteristics to classify hedge funds. According to MSCI, the primary characteristics of hedge funds are the ‘investment process’, the ‘asset class’ and the ‘geography’ of the funds. MSCI subdivides the process group ‘Security Selection’ into four different processes: ‘Long Bias’, ‘No Bias’, ‘Short Bias’ and ‘Variable Bias’. Other data vendors such as TASS differentiate among ‘Long/Short Equity Hedge’, ‘Equity Market Neutral’ and ‘Dedicated Short Bias’ funds. We define ‘Long/Short Equity Hedge Funds’ as those funds that belong to the MSCI asset class ‘Equity’ and the MSCI process ‘Long Bias’. As previous research shows that the sources of systematic risk differ among hedge fund strategies, we concentrate on one single hedge fund strategy: long/short equity. Measured by both the number of funds and assets under management, long/short equity represents the largest segment in the hedge fund universe.

The MSCI hedge fund database contains both surviving funds and defunct hedge funds, which stopped reporting data to MSCI. At the end of January 2006, the MSCI hedge fund database contains 466 surviving and 191 defunct long/short equity hedge funds.

Gregoriou20 calculates the median survival lifetime of hedge funds of 5.5 years. The median survival lifetime of our universe of long/short equity hedge funds is 54 months. Although EDA, which is mostly concerned with data visualization, can be applied to explore short time series, regression analysis and statistical tests require a sufficient amount of data. When applying EDA, we exclude only 11 return series with less than three data points from our analysis, which reduces our original universe from 657 to 646 funds (‘Sample A’). When performing regression analysis or statistical tests, we exclude an additional 181 return series with less than 36 monthly return observations and 26 return series starting before May 1992 from our universe.21 This reduces our original universe further from 646 to 450 long/short equity hedge funds (‘Sample B’).

UNCONDITIONAL OUTLIERS

Empirical evidence suggests that the likelihood of outliers in return series of hedge funds is substantially higher than the normal distribution suggests. Brooks and Kat,22 Kat and Lu,23 Kat,24 Lamm,25 Brulhart and Klein26 and Eling27 find that hedge funds exhibit a significant degree of negative skewness and positive excess kurtosis.

Statistical tests confirm that hedge fund returns are not normally distributed. The JB test discussed in Jarque and Bera28 measures departure from normality. Eling,27 for example, calculates JB statistics for all strategy indices provided by CSFB Tremont over the January 1994–December 2004 period, and concludes that the return distribution of the CSFB Tremont Long/Short Equity index differs from normality at the 1 per cent level of significance. Unlike Eling,27 we perform JB tests for 450 individual long/short equity funds instead of hedge funds indices. We test the null hypothesis that the return series come from a normal distribution.

Table 1(a) shows that we can reject the null hypothesis at the 10 per cent (5 per cent, 1 per cent) level for 275 (247, 177) funds. We conclude that the return distributions of 61.1 per cent of all funds in Sample B do not resemble a normal distribution at the 10 per cent level of significance. The time series exhibit a high degree of positive excess kurtosis, as shown in Table 1(b). Looking at the empirical evidence, it is safe to conclude that the likelihood of observing outliers in return series of long/short equity funds is substantially higher than the normal distribution suggests.

Following Tukey,29 we use the term positive (negative) unconditional outlier for returns that are 1.5 interquartile ranges above (below) the third (first) quartile. In all 646 return series of Sample A, we detect 1195 (1892) positive (negative) unconditional outliers. The number of positive outliers is 8.2 times the number of positive outliers suggested by the normal distribution. The likelihood of observing a positive (negative) unconditional outlier in a single month is 2.85 per cent (4.52 per cent). The outlier likelihood over the complete observation period is calculated by dividing 1195 (1892) positive (negative) unconditional outliers by 41 873 monthly return observations. We calculate outlier likelihoods over 3-month non-overlapping periods to eliminate the more erratic behavior in the monthly data, which enables us to reveal more clearly how the outlier likelihood evolves over time. Table 2 documents that the likelihood of observing positive unconditional outliers in the first non-overlapping 3-month period substantially exceeds the likelihood of observing positive unconditional outliers in each of the following non-overlapping 3-month periods. The high number of positive unconditional outliers in the first non-overlapping 3-month period in return series of long/short equity funds is puzzling. The ‘outlier puzzle’ has severe implications for the evaluation of the performance of long/short equity hedge funds, as large outliers can substantially distort the mean and the standard deviation of a data set.

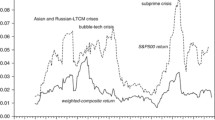

Figure 1 shows the outlier likelihood over the first 50 non-overlapping 3-month periods. The first non-overlapping 3-month period includes the first, second and third month of existence. The 50th data point represents the likelihood of observing a positive outlier in the 148th, 149th or 150th month of observation. The likelihood of a positive outlier is as high as 6.35 per cent during the first non-overlapping 3-month period and falls dramatically thereafter. Figure 1 documents that there is no single non-overlapping 3-month period in which the outlier likelihood is larger than in the initial 3-month period.

Likelihoods of observing positive unconditional outliers over 50 non-overlapping 3-month periods. Note: For each non-overlapping 3-month period, we calculate the likelihood of observing positive unconditional outliers by dividing the number of positive unconditional outliers by the number of total observations in each 3-month period. This figure shows the ‘typical outlier pattern’ of long/short equity funds: The likelihood of observing a positive outlier in the first non-overlapping 3-month period is substantially larger than the likelihood of observing a positive outlier in later non-overlapping 3-month periods. Over time, the outlier likelihood fades to the median outlier likelihood of roughly 2 per cent, represented by the dashed line, and fluctuates around the median in later periods.

The likelihood of observing an outlier during the initial 3-month period exceeds the median likelihood of all non-overlapping 3-month periods by the factor of 3.09. The high outlier likelihood during the initial 3-month period is clearly not representative for the entire lifetime of long/short equity funds.

We apply kernel density estimation to show that the likelihood l 1=6.35 per cent of observing a positive outlier in the first 3-month period is significantly larger than the outlier likelihood in the following non-overlapping 3-month periods. Let L 1, L 2, …, L n be a sequence of independent and identically distributed (i.i.d.) random variables with continuous probability density functions. If the observed outlier likelihoods l 1, l 2, …, l 50, shown in Figure 2, are a sample from a common probability density function, kernel density estimation can be applied to construct an estimate of the unknown density function f. Applying kernel density estimation, we do not assume that the data are drawn from a parametric distribution. The kernel estimator with kernel K and smoothing parameter h is defined by30:

where x i , n and h represent the observed realizations, the number of observations and the smoothing bandwidth, respectively. We apply the normal rule suggested by Silverman30 to estimate the optimal bandwidth. As the optimal bandwidth h opt tends to oversmooth the density, we perform kernel density estimations with three different smoothing parameters. In addition to the Gaussian kernel, we apply the Epanechnikov kernel with the optimal smoothing bandwidth for the Epanechnikov kernel h 4.30 Figure 2 illustrates that the choice of the kernel K and variations in the bandwidth h does not materially impact the results.

Estimated cumulative probability density function L 1 (Test 1). Note: Applying kernel density estimation, density estimates L 1 are constructed from the observed outlier likelihoods l i in the periods i=2, …, 50. We apply the Gaussian kernel and the Epanechnikov kernel with different bandwidth h 1, h 2, h 3 and h 4 to construct different estimates of the cumulative probability density function L 1. Figure 2 shows that the probability p of observing an outlier likelihood l 1 equal to or larger than 6.35 is less than 1 per cent given L 1. The choice of the kernel and variations in the optimal smoothing bandwidth h opt do not materially impact the density estimation. The estimated cumulative probability density function L 1 is truncated as likelihoods are by definition distributed in the range [0, 1].

Given the estimated cumulative probability density function L 1 shown in Figure 2, the probability p of observing an outlier likelihood equal to or greater than 6.35 per cent in the first 3-month period is less than 1 per cent. We conclude that the observed outlier likelihood l 1=6.35 per cent is significantly larger than L 1 at the 99 per cent level of confidence. It is worth noting that l 1 is also significantly larger than L 1 at the 99.9 per cent level of confidence.

In order to validate our results, we introduce an alternative outlier definition and conduct a second test to check whether we can confirm our finding that the number of outliers in the first 3 months of existence is significantly larger than the number of outliers in the following months. Our alternative outlier definition is widely used by statisticians: We assume that an outlier is present if a return observation lies outside of a ϕ per cent confidence interval of an estimated density function. For each fund included in Sample B, we separate the respective return series in two parts. The first part ζ 1 contains the first three monthly returns, ζ 1=[r 1, r 2, r 3], the second part ζ 2 includes the remaining returns ζ 2=[r 4, …, r n ].

Applying kernel density estimation with a Gaussian kernel and an optimal bandwidth, we estimate the unknown density function f n (r i ∣ζ 2). We then count how many returns included in ζ 1 are larger than the ϕ=99 per cent (97.5 per cent, 95 per cent) quantile q(f n ,ϕ) of the estimated distribution f n (r i ∣ζ 2). We find that the number of returns included in ζ 1, which are larger than q(f n , ϕ) is 36 (74, 116), which is much larger than the expected number of 12.75 (31.88, 63.75) given f n (r i ∣ζ 2). Again, we conclude that the jump-start effect in return series of long/short equity funds is significant at the 99 per cent (97.5 per cent, 95 per cent) level of significance. We examine whether our conclusion holds if empirical densities instead of kernel density estimates are applied. Analyzing empirical densities, we count 51 (85, 140) observed outliers at the 99 per cent (97.5 per cent, 95 per cent) level of confidence, far exceeding the expected number of 12.75 (31.88, 63.75). The conclusion that the jump-start effect is significant holds at even higher levels of confidence if empirical densities are applied instead of kernel density estimates, as kernel density estimation tends to overestimate the density at the tails of the distribution.

In addition, we calculate the differences between subsequent returns to remove the systematic return component and possible first-order autocorrelation in the return data. Applying return differences instead of returns also reduces the backfilling bias reported in previous papers. We will discuss the impact of the backfilling bias on the jump-start effect in the last section in more detail. Applying return differences, however, also reduces the jump-start effect if two outliers follow each other in adjacent periods. The number of observed outliers 42 (65, 91) is higher than the number of expected outliers 12.6 (31.5, 63) at the 99 per cent (97.5 per cent, 95 per cent) level of confidence if the difference method is applied. We conclude that the jump-start effect is significant if unconditional outliers are calculated on the basis of both returns and return differences. In the next section, we examine whether the jump-start effect disappears if we analyze conditional outliers instead of unconditional outliers.

CONDITIONAL OUTLIERS

In this section, we apply multi-factor models to neutralize systematic risks of long/short equity hedge funds, analyze conditional outliers instead of unconditional outliers and ask whether the likelihood of observing positive conditional outliers in the first 3-month period is significantly larger than the likelihood of observing positive conditional outliers in each of the subsequent non-overlapping 3-month periods after adjusting for systematic risks. Previous research suggests that systematic risks explain some of the variation in hedge fund returns. Fung and Hsieh5 apply an asset class model proposed by Sharpe31 to analyze 3327 mutual funds and 409 hedge funds and find that the returns of hedge funds have lower correlations to standard asset classes than mutual funds. The explanatory power of the model increases when style factors are introduced capturing the strategy-specific risk of hedge funds.

Previous researchers have identified strategy-specific style factors for different hedge funds strategies. Fung and Hsieh,6 for example, demonstrate that trend-following strategies generate high returns when markets increase or decrease substantially, and suggest that their returns can be replicated by lookback straddles. Mitchell and Pulvino10 find that merger arbitrage returns are generally uncorrelated with the overall equity market but positively correlated with equity market returns when the market declines severely.

Despite substantial research efforts, the systematic risks of long/short equity funds are not as well understood as the common risks of trend-following and merger arbitrage strategies. Fung and Hsieh9 apply a 3-factor model proposed by Fama and French11, 12, 13, 14 to explain the variation in returns of three diversified long/short equity hedge fund indices. According to Fama and French, the expected return on a portfolio of stocks E(r p ) in excess of the risk-free rate r f can be explained by the expected return of a well-diversified market portfolio in excess of the risk-free rate [F 1=E(r m )−r f ], the expected return spread between small capitalization and large capitalization stocks [F 2=SMB], and the expected return spread between high book-to-market (‘value’) and low book-to-market (‘growth’) stocks [F 3=HML]:

The terms β p,1, β p,2 and β p,3 represent the factor sensitivities or loadings to the three explanatory factors of the model. Applying the Fama and French model, Fung and Hsieh9 find that long/short equity funds are positively correlated with the equity market and statistically significantly exposed to the return spread between small and large capitalization stocks. According to Fung and Hsieh,9 the HML factor is not statistically significant. They introduce a momentum factor that is statistically significant but does not add much additional explanatory power.

We apply the Fama and French model to neutralize the systematic risk of individual long/short equity hedge funds instead of equity hedge fund indices. To derive the first explanatory variable, F 1, the 1-month US LIBOR is subtracted from the monthly returns on the S&P500 index. The second factor, F 2, is calculated by subtracting the monthly returns of the MSCI US Large Cap 300 index from the MSCI US Small Cap 1750 index. The third explanatory variable, F 3, is estimated as the difference between the monthly returns on the MSCI US Value index and the returns on the MSCI US Growth index.32

To set the stage, the monthly returns on the 450 individual long/short equity hedge funds included in Sample B are regressed on our three explanatory variables. Table 3 shows that three simple style factors capture on average 38 per cent of the variation in the returns of long/short equity funds. Investing in long/short equity hedge funds is obviously not free of systematic risks. We construct 95 per cent confidence intervals around the regression coefficients to test the null hypothesis that the regression coefficients are equal to zero (H 0: β p,I =0). For 72 per cent of all 450 individual regressions, we can reject the null hypothesis and conclude that the first regression coefficient is statistically significant at the 95 per cent level of confidence. The second regression coefficient measuring the sensitivity to the return spread between small and large caps (SMB) is significant for 65 per cent of all regressions at the 95 per cent level of confidence. The third regression coefficient quantifying the sensitivity to the return spread between value and growth stocks (HML) is significant for 42 per cent of all regressions at the 95 per cent level of confidence. Our results confirm the findings of Fung and Hsieh9 that long/short equity hedge funds are on average positively correlated with the excess return on the market, E(r m )−r f , and the return spread between small cap and large cap stocks, SMB.

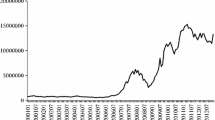

To define conditional outliers, we analyze the residuals, the differences between the observed and predicted values, of the time series regressions. We define positive (negative) conditional outliers as residual returns that are above (below) zero at the 95 per cent level of confidence. In all time series of Sample B, we detect 1145 (759) positive (negative) conditional outliers. The likelihood of observing a positive conditional outlier in a single month is 3.47 per cent. The outlier likelihood is calculated by dividing 1145 positive conditional outliers by 33 044 monthly return observations. Figure 3 shows that the likelihood of observing a positive conditional outlier in the first 3-month period is substantially higher than in each of the following 49 non-overlapping 3-month periods. The conditional outlier likelihood in the first 3-month period of 9.04 per cent exceeds the median outlier likelihood of 1.92 per cent over the first 50 non-overlapping 3-month periods by the factor of 4.71.

Likelihood of observing conditional positive outliers over 50 non-overlapping 3-month periods. Note: For each non-overlapping 3-month period, we calculate the likelihood of observing positive conditional outliers. The likelihood of observing a positive outlier in the first non-overlapping 3-month period is substantially higher than the likelihood of observing a positive outlier in any later non-overlapping 3-month period. Over time, the outlier likelihood fades to the median outlier likelihood represented by the dashed line. The fluctuations around the median become more erratic at the end of the observation period since the number of funds decreases over time.

We apply kernel density estimation with a Gaussian kernel and three different smoothing parameters and an Epanechnikov kernel to estimate probability density functions L 1, L 2 , L 3, L 4 of the observed likelihoods as discussed in the previous section. The probability of observing an outlier likelihood equal to or larger than 9.04 per cent is less than 1 per cent given L 1, L 2 , L 3, L 4. We conclude that the jump-start effect is statistically significant at the 99 per cent level of confidence and does not disappear if we control for factor risks. Table 4 reflects the likelihoods of observing positive and negative conditional outliers in the first 20 non-overlapping 3-month periods. The likelihood of observing a positive conditional outlier exceeds the likelihood of observing a negative conditional outlier by the factor of 2.9 in the first 3-month period. Over time, the ratio between the likelihoods of observing positive conditional outliers and the likelihoods of observing negative conditional outliers falls below 1. In the 20th non-overlapping 3-month period, the ratio between the two likelihoods is 0.7.

Hedge funds employ dynamic trading strategies. Attempting to capture the time-varying risk exposures of long/short equity funds, we apply rolling window regressions using 18-month, 24-month and 36-month windows. We regress the monthly returns on all funds included in Sample B on the three Fama and French factors. In addition, we run rolling window regressions with window lengths of 18, 24 and 36 months using a 5-factor model similar to the model proposed by Kuenzi and Shi15 to assess whether our results are robust if two additional factors are introduced, which potentially explain the variation in returns of long/short equity hedge funds:

E(r p ) is the expected return on long/short equity fund p. The explaining factors of the model include the monthly returns on the market (S&P), the return differentials between small capitalization and large capitalization stocks (SMB), and the return differentials between value and growth stocks (HML). In addition, we add a volatility factor (VOL) to our model, as previous research suggests that volatility explains some of the return variation of long/short equity strategies.15 Unlike Kuenzi and Shi,15 we use the monthly changes of the CBOE SPX Volatility Index (VIX) as volatility factor. As hedge funds exhibit significant exposures to style-specific risks,5, 6, 7, 8, 9, 10 we also add a style factor, the monthly returns on the Credit Suisse Tremont long/short equity index, which is available since January 1994, as the fifth explanatory variable to our model. The median coefficients of determination of the rolling window regression models calculated for each fund separately are summarized in Table 5.

On average, the median R 2 of our six rolling window regression models vary between 0.44 and 0.61. In addition, we experiment with a large number of alternative spread factors and momentum factors and find that these factors are either not statistically significant or do not increase the explanatory power of the regression model meaningfully. We therefore do not include these results in this article. In a second step, we calculate the likelihood of observing conditional outliers during the first 50 non-overlapping 3-month periods for all funds included in Sample B. The results for our six rolling window regression models are shown in Figure 4.

Conditional positive outlier likelihoods (rolling window regressions). Note: This figure visualizes the likelihood of observing a conditional positive outlier in the first 50 non-overlapping 3-month periods. We apply six rolling window regression models to identify conditional outliers. FF18, FF24 and FF36 represent rolling window Fama and French (FF) 3-factor models with 18-month, 24-month and 36-month windows. 5F18, 5F24 and 5F36 denote our rolling window 5-factor models (5F) with 18-month, 24-month and 36-month windows. For each of the six rolling window regression models, we calculate conditional outlier likelihoods by dividing the number of positive conditional outliers in each non-overlapping 3-month period by the number of total return observations in the respective non-overlapping 3-month period. Figure 4 shows that the likelihood of observing positive conditional outliers in the first 3-month period is substantially higher than the likelihood of observing positive conditional outliers in subsequent non-overlapping 3-month periods for all six rolling window regression models.

To conclude our analysis, we apply kernel density estimation to construct probability density estimates. Applying the methodology discussed in the previous section, we find that the probability of observing a positive conditional likelihood equal to or greater than the positive conditional likelihood in the first non-overlapping 3-month period is less than 1 per cent for all six regression models. We conclude that the jump-start effect is significant at the 99 per cent level of confidence.

To assess the robustness of these findings, we apply the alternative outlier definition discussed in the previous section assuming that a conditional outlier is present if a residual return observation lies outside of an ϕ per cent confidence interval of an estimated density function. Unlike in the previous section, we now separate the time series of residual returns instead of absolute returns in two parts. We apply the two static factor models and the six rolling window factor models discussed above to determine residual returns. The first part ζ 1 includes the first three monthly residuals, ζ 1=[res 1, res 2, res 3], the second part ζ 2=[res 4, …, res n ] contains the remaining residuals. Kernel density estimation is then used to estimate the unknown density function f n (res i ∣ζ 2).

Table 6 documents that the number of observed positive conditional outliers is substantially larger than the number of expected positive conditional outliers for all factor models at the 99 per cent (97.5 per cent, 95 per cent) level of significance. Applying the static Fama and French model discussed above, for example, we find that the number of observed positive conditional outliers exceeds the number of expected positive conditional outliers by the factor of 4.1 at the 99 per cent level of confidence.

In addition, we calculate the differences between subsequent residual returns to remove any remaining systematic return component and possible first-order autocorrelation in the return data. Applying residual return differences instead of residual returns also reduces the backfilling bias reported in previous papers. Table 6 shows that the jump-start effect does not disappear if conditional outliers are calculated on the basis of return differences instead of returns. Applying the difference method, we find that the number of positive conditional outliers in the first 3-month period is larger than the estimated number of positive conditional outliers for all models at almost all confidence levels.

Our main conclusion that the jump-start effect in return series of long/short equity funds is substantial is robust in at least three respects: First, the jump-start effect does not disappear if we adjust for well-known sources of risk. Second, the jump-start effect is significant for different outlier definitions. Third, the jump-start effect also does not disappear if outliers are calculated on the basis of return differences instead of returns.

CONCLUDING REMARKS

Time series of long/short equity funds are significantly distorted by large positive outliers during the initial 3-month period. The likelihood of observing positive unconditional outliers during the first 3-month period is significantly larger than the likelihood of observing positive outliers during a later non-overlapping 3-month period at the 99 per cent level of confidence. Even after adjusting for well-known sources of systematic risks of long/short equity strategies, the likelihood of observing positive conditional outliers in the first 3-month period is significantly larger than the likelihood of observing positive conditional outliers in any of the following non-overlapping 3-month periods at the 99 per cent level of confidence. In this study, we concentrate on long/short equity hedge funds, as the risks of hedge funds are strategy-specific. Future research is required to analyze whether the jump-start bias can be observed in return series of other hedge fund strategies.

During the incubation period, newly established hedge funds often trade on money coming from the pockets of the funds’ managers, their friends and relatives. Insiders providing seed capital can benefit at the expense of outside investors by allocating successful trades to recently launched funds and loss making trades to larger more established funds. High performance-linked incentive fees may not only motivate managers to act on behalf of their investors, but may also induce some managers to misreport returns in order to earn higher compensation. While we do not claim that anyone is acting illegally, we point out that illegal behavior could possibly be an explanation for the large number of positive outliers in return series of long/short equity hedge funds during the incubation period.

Hedge funds typically start reporting returns after they have established a track record for several months. Previous researchers have argued that the average upward bias in hedge fund returns during the first 12-month period results from data vendors backfilling historical return data to their databases. This study suggests that contemporaneous and backfilled returns included in hedge fund databases exhibit a large number of extreme outliers in the first 3-month period, which cannot be explained by common sources of hedge fund risks. The practice of backfilling is an important but not necessarily the only reason for the average upward bias in hedge fund returns during the first 12 months. The practice of backfilling does not explain how hedge funds generate extreme positive returns during the first 3-month period, which often deviate several standard deviations from the mean.

Without more transparency, investors, regulators and academics cannot analyze whether the statistically significant concentration of positive outliers during the first 3-month period stems from legal or illegal trading behavior. Taken together, the discontinuity in the pooled distribution of hedge funds, the December spike, the return smoothing effect (reported in previous studies), and the jump-start effect (documented in this study) indicate that a widespread misreporting phenomenon may exist in the widely unregulated hedge fund industry.

REFERENCES AND NOTES

Getmansky, M., Lo, A.W. and Makarov, I. (2004) An econometric model of serial correlation and illiquidity in hedge fund return. The Journal of Financial Economics 74 (3): 529–609.

Agarwal, V., Daniel, N.D. and Naik, N.Y. (2007) Why is Santa So Kind to Hedge Funds? The December Return Puzzle. Georgia State University. Working Paper.

Bollen, N.P.B. and Pool, V.K. (2008) Conditional return smoothing in the hedge fund industry. Journal of Financial and Quantitative Analysis 43 (2): 267–298.

Bollen, N.P.B. and Pool, V.K. (2009) Do hedge fund managers misreport returns? Evidence from the pooled distribution. The Journal of Finance 64 (5): 2257–2288.

Fung, W. and Hsieh, D.A. (1997) Empirical characteristics of dynamic trading strategies: The case of hedge funds. Review of Financial Studies 10 (2): 275–302.

Fung, W. and Hsieh, D.A. (2001) The risk in hedge fund strategies: Theory and evidence from trend followers. Review of Financial Studies 14 (2): 313–341.

Fung, W. and Hsieh, D.A. (2002) Risk in fixed-income hedge fund styles. Journal of Fixed Income 12 (2): 6–27.

Fung, W. and Hsieh, D.A. (2004) Hedge fund benchmarks: A risk-based approach. Financial Analysts Journal 60 (5): 65–80.

Fung, W. and Hsieh, D.A. (2004) Extracting portable alphas from equity long/short hedge funds. Journal of Investment Management 2 (4): 57–75.

Mitchell, M. and Pulvino, T. (2001) Characteristics of risk and return in risk arbitrage. The Journal of Finance 56 (6): 2135–2175.

Fama, E.F. and French, K.R. (1992) The cross-section of expected stock returns. The Journal of Finance 47 (2): 427–465.

Fama, E.F. and French, K.R. (1993) Common risk factors in the returns on stocks and bonds. Journal of Financial Economics 33 (1): 3–56.

Fama, E.F. and French, K.R. (1995) Size and book-to-market factors in earnings and returns. The Journal of Finance 50 (1): 131–155.

Fama, E.F. and French, K.R. (1996) Multifactor explanations of asset pricing anomalies. The Journal of Finance 51 (1): 55–84.

Kuenzi, D.E. and Shi, X. (2007) Asset based style analysis for equity strategies: The role of the volatility factor. The Journal of Alternative Investments 10 (1): 10–23.

Fung, W. and Hsieh, D.A. (2000) Performance characteristics of hedge funds and commodity funds: Natural vs. spurious biases. Journal of Financial and Quantitative Analysis 35 (3): 291–307.

Edwards, F.R. and Caglayan, M.O. (2001) Hedge fund performance and manager skill. Journal of Futures Markets 21 (11): 1003–1028.

Park, J.M. (1995) Managed futures as an investment set. PhD dissertation, Columbia University.

Malkiel, B.G. and Saha, A. (2005) Hedge funds: Risk and return. Financial Analysts Journal 61 (6): 80–88.

Gregoriou, G.N. (2002) Hedge fund survival lifetimes. Journal of Asset Management 3 (3): 237–252.

We use MSCI US investable market indices to construct explanatory variables for the regression model used in this article. Unfortunately, MSCI has calculated total return index levels for its MSCI US investable market indices backwards only until May 1992.

Brooks, C. and Kat, H.M. (2002) The statistical properties of hedge fund index returns and their implications for investors. The Journal of Alternative Investments 5 (2): 26–44.

Kat, H.M. and Lu, S. (2002) An Excursion into the Statistical Properties of Hedge Fund Returns. Alternative Investment Research Centre, Cass Business School. Working Paper.

Kat, H.M. (2003) 10 things that investors should know about hedge funds. Journal of Wealth Management 5 (4): 72–81.

Mc Fall Lamm, R. Jr., (2003) Asymmetric returns and optimal hedge fund portfolios. The Journal of Alternative Investments 6 (2): 9–21.

Brulhart, T. and Klein, P. (2005) Faulty hypotheses and hedge funds. Canadian Investment Review 18 (2): 6–13.

Eling, M. (2006) Autocorrelation, bias and fat tails: Are hedge funds really attractive investments? Derivatives Use, Trading & Regulation 12 (1/2): 28–47.

Jarque, C.M. and Bera, A.K. (1987) A test for normality of observations and regression residuals. International Statistical Review 55 (2): 163–172.

Tukey, J.W. (1977) Explorative Data Analysis. Reading, MA: Addison-Wesley.

Silverman, B.W. (1986) Density Estimation for Statistics and Data Analysis, Monographs on Statistics and Applied Probability 26. London: Chapman & Hall.

Sharpe, W.F. (1992) Asset allocation: management style and performance measurement. Journal of Portfolio Management 18 (2): 7–19.

The calculation of the MSCI US equity style indices is explained in detail in: MSCI, MSCI US Equity Indices: Index Construction Objectives and Methodology for MSCI US Equity Indices.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Viebig, J., Poddig, T. The jump-start effect in return series of long/short equity hedge funds. J Deriv Hedge Funds 16, 191–211 (2010). https://doi.org/10.1057/jdhf.2010.14

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1057/jdhf.2010.14