Abstract

Since a few years the worldwide demand for biopolymers is increasing significantly. Many firms are trying to avoid the price spiral of fossil fuels by utilising renewable resources and simultaneously aim to contribute to the fight against climate change. Although market reports on biopolymer technology propose that with technological progress, economies of scale in manufacturing and hence lower costs the potential to substitute petrobased polymers by biopolymers will grow in the coming years, the extent of corporate strategies for industry-wide development of biopolymer technology are not well understood. This article evaluates the chances and risks of biopolymers by presenting results of a case study conducted with 10 German and Swiss firms active in the polymer industry. On the one hand the article demonstrates which importance biopolymers have gained meanwhile in the industry. On the other hand it also shows the different strategies firms apply in order to develop biopolymer technology successfully.

Similar content being viewed by others

INTRODUCTION

With a global polymer production of over 250 million tons in 2008, the plastics industry is one of the major sectors within the chemical industry.1 Up till now, petrobased polymer technology has dominated the market over other production technologies for plastics.2 As a consequence, the plastics industry tends to endorse incremental process-oriented innovations.3 However, in the coming years radical change in the plastics industry might be inevitable:4 As most polymers are produced from fossil-fuel raw materials, their depletion is a widely perceived issue in the industry.5 Some studies estimate oil reserves to run dry in approximately 30–50 years.6, 7, 8 However, the economic impact of oil depletion could hit the plastics industry much earlier, for example if the cost increase owing to rising oil prices cannot be passed on to customers.9, 10

To gain independence from crude oil, the plastics industry has started to focus on the development of technologies that substitute for petrobased polymers. In line with a ‘green chemistry’ orientation and an emphasis on renewable resources, considerable research and development efforts for so-called biopolymers or bioplastics currently take place. These materials are processed from renewable feedstock like starch and the end products may or may not be biodegradable.11, 12

Although market reports on biopolymer technology suggest that with technological progress, economies of scale in production and thus lower costs the potential to substitute petrobased polymers by biopolymers will increase in the years ahead,10, 13 the extent of the industry-wide development of biopolymer technology are not well understood.14, 15, 16 However, the market introduction of biopolymers not only depends on scientific progress, but also on strategic management decisions of the involved firms. Some pioneering firms are already on the market while others are still waiting. By applying a case study method, the aim of this article is, therefore, to explore the different reasons firms have for market entry. Furthermore, the various corporate strategies that firms apply for biopolymer technology development are analysed.

BIOPOLYMERS: DEFINITION AND CLASSIFICATION

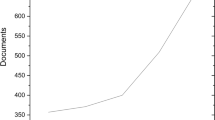

Currently, three classes of biopolymers can be distinguished4,5,9: (1) biodegradable polymers based on renewable resources, (2) biodegradable polymers based on petrobased resources, and (3) non-biodegradable polymers based on renewable resources. Figure 1 shows the annual worldwide production capacity for these materials.

Annual worldwide bioplastics production capacity.12

Currently, three different kinds of biopoly-mers have reached the commercialisation stage and are available on the market: (1) starch materials, (2) polylactic acid, and (3) cellulose materials.17 A promising fourth class of biopolymers are so-called polyhydroxyal-kanoates, which are processed using fermentation processes. However, up till now polyhydroxyalkanoates are commercially available only in very limited quantities.10

In comparison to petrobased polymers, biopolymers have a number of novel material characteristics such as antistatic properties, good printability and high degree of water permeability which make them suitable for a wide range of applications in agriculture, medicine and packaging. Initial applications such as loose foils, bottles, trays, crockery and so on have already established themselves successfully in important markets.4,15 Next to these short-lived applications there are also durable applications, for example injection moulded parts from polylactic acid which can be found in first products in the automotive and electronics industry.10,17

The production chain for biopolymers consists in general of three steps: (1) agricultural crop production, harvest and processing, (2) production of basic materials, and (3) final processing of end products.10,15 Whereas in the value chain of petrobased polymers the petrochemical industry is the supplier for raw materials, in the value chain of biopolymers this role is taken by agricultural producers and the biotechnology sector.10 These firms derive starch, sugar and cellulose from renewable raw materials and convert them to chemical basic materials with the help of thermocatalytic or biotechnological processes (step 1). In a next step these materials are processed to biopolymers through polymerisation or polycondensation (step 2). Depending on the desired properties of the biopolymers, additives from fossil or renewable resources are added.17 Finally, the biopolymers are delivered to converters in the form of pellets or fibres and are manufactured with injection moulding of extrusion processes to finished products (step 3). Conventional production machinery is used which after slight modification can be charged with biopoly-mers. Thus, the processing of biopolymers is comparable to petrobased polymers.

METHODOLOGY

The research design is a multiple-case, inductive study of 10 German and Swiss companies active in the plastics industry. Selected cases had to meet two requirements: First, firms had to be either raw material suppliers or plastics converters, as these are the most affected by the new biopolymer technology. Furthermore, by focusing on raw material suppliers and converters the majority of the polymer value chain was included in the analysis. Second, firms had to be in the process of developing or already have developed biopolymer technology.

Data were collected from two main sources: archival data and semi-structured interviews.18 Over 100 public documents, including newspapers, press releases, market reports, trade publications, company accounts and annual reports were collected and analysed. Additionally, full-text queries on the databases Business Source Premier and LexisNexis on the name of the companies along with the keywords ‘biopolymer’ or ‘bioplastics’ and 15 similar terms, for example product names or chemical raw materials were run.

In total 37 semi-structured interviews were conducted. The interviewees were represen-tatives from different functional units such as general management, sales, research and development, and sustainability ( Table 1).

This allowed a comprehensive overview on the decision situation on the development of biopolymer technology in the company. The interviews were approximately 60–90 min in length and started with a brief description of the interviewees’ professional background and their role in the organisation. General questions on fossil resource scarcity and its implication for the company and on the reasons to adopt biopolymer technology were asked in order to better understand the decision situation the companies were in. Subsequently, the focus shifted to capabilities and competencies that were utilised to develop biopolymer technology. For instance, interviewees were requested to describe the innovation process and illustrate their specific role in it. The interviewees then explained from their point of view the routines and methods that lead to the development of biopolymer technology.

Each interview was taped and then subsequently converted it into an interview protocol for use in the data analysis. Interview protocols were verified for accuracy by the interviewees. Follow-up questions were asked by phone or via e-mail when clarification was needed. For data analysis, first an in-depth examination of the initial interview data was conducted to uncover key themes and individual case studies based on interview protocols and archival data were thoroughly scrutinised.19 Second, a cross-case analysis was conducted to compare and analyse the data for competence patterns.20

RESULTS

Reasons for the increased acceptance of biopolymers

Raw material suppliers as well as converters confirmed that fossil fuel scarcity and hence the increased prices for crude oil are one of their major strategic challenges. One reason is strong competition from petrobased polymers on a highly price-driven market. Therefore, increased costs for raw materials can only be passed to the customer with great difficulty. Hence, all examined firms are trying to secure their fossil raw material base by developing specific sourcing strategies such as long-term supplier agreements. Parallel to this strategy, especially raw material suppliers are scanning the market for alternatives to petrobased polymers and are focusing their research efforts on biopolymers.

Interestingly, fossil fuel scarcity is not for every firm the trigger to shift the attention towards biopolymers. Some firms are motivated by increasing queries by customers. For example, converters are confronted by a rising demand for biopolymers by brand owners and end consumers. Another reason for raw material suppliers as well as converters to enter the still very young market for biopolymers is the activities of competitors. Raw material suppliers see biopolymers as a distinguishing feature from competition. Hence, many firms have expanded to include biopolymers to their petrobased polymers portfolio. Market and technology leadership is especially for large raw material suppliers and firms active in the automobile sector important and a declared corporate goal that is also communicated accordingly internally. All firms view also the ‘green image’ of biopolymers as a very positive side effect, yet difficult to quantify.

Corporate strategies for biopolymers

All studied firms were active in the market for petrobased polymers before the development of biopolymer technology. Over the years petrobased polymer technology has achieved market dominance and firms in the sample have evolved to suit a specific set of requirements for it, such as specific processing machinery or adequate business processes necessary for petrobased polymer production. These deadlocked processes resulted in inertia, as many divisions and departments refrained from sharing knowledge or manpower. Inertia often hindered proposed changes and innovations which was particularly the case if they demanded radical modifications to currently successful activities. The main reasons for inertia were firm-internal power and politics issues, complex bureaucratic processes such as time-consuming formal procedures and large number of management hierarchies that resulted in delayed decision-making. For example, at a large automobile manufacturer several different business units were working on biopolymer technology. However, these units were not allowed to share their results and experiences without prior formal consent of a number of their superiors. Since these formal approvals were very time consuming, many researchers were reluctant to go through these bureaucratic processes. As a consequence, the decision to actively pursue biopolymer technology and enter the market was unnecessarily delayed. In a firm active in the packaging sector formalised responsibilities as well as bureaucratic and centralised procedures left no room for explorative spirit and innovative culture and, as a result, many employees only focused on their regular work and did not ‘go beyond the usual’.

The employed managerial activities were mostly based on large-scale businesses in relatively stable business environments. Furthermore, the traditional polymer business promotes administrative rather than innovative and explorative activities. Innovation is, therefore, often incremental with the aim to achieve cost reductions via process improvements and upgrades of existing products. For example, innovation activities at converters focus on the reduction of cycle times in the injection moulding process of semi-finished or end products. At raw material suppliers, a lot of research efforts are aimed at modifying the material properties such as heat stability or viscosity of existing petrobased polymers for better processing performance.

The studied firms acknowledged the need of a different approach for the development and adoption of biopolymer technology. In order to avoid opposition in the main business there need to be separate activities regarding biopolymer technology development. Furthermore, these activities need to develop their own set of processes that tackle the uncertainty that surrounds biopolymers. Against this background the results of the study show three interesting examples of how firms of different sectors develop biopolymer technology.

Bootleg research

In many studied companies, scientists were encouraged to conduct so-called bootleg research on biopolymers. Bootleg research is defined as research in which motivated employees, sometimes secretly, organise a part of the corporate innovation process.21,22,23 Normally, it is a bottom-up research activity, often not authorised by the management, but nonetheless with the intent to create benefits for the firm. Bootleg research is not in the companies' budget plans and has no official firm resources allocated to it. It can be mainly found in pre-research, product and process improvements, troubleshooting, and purely scientific research.22,24

The results of the case studies showed two main mechanisms by which bootleg research helped firms to develop biopolymer technology successfully. In most firms, researchers who worked in the field of polymers had become aware of the new biopolymer technology through conferences, workshops or scientific publications. However, often research on biopolymers was not in line with neither the traditional nor the officially planned technology trajectory of their firm. An official bootleg research policy helped scientists to start first informal research on this new technology without having to undergo approval processes to gain official legitimisation. This way researchers often conducted small-scale experiments in order to prove the feasibility of their experiments before submitting large-scale research proposals in order to avoid possible failure beforehand. This option gave bootleg researchers the possibility to challenge existing technology strategies within the firm without having to ask for corporate resources or being stopped by bureaucratic red tape.

Another mechanism by which bootleg research helped firms to develop biopolymer technology was to anticipate and solve technological difficulties once the firm had decided on the development of biopolymers. These difficulties mainly stemmed from the fact that biopolymer technology required a very specific set of resources and capabilities, for example profound knowledge in biotechnology and process engineering. However, these resources and competencies were previously unknown to the firms as they used to work on petrobased polymers. Yet, bootleg researchers had partly already developed these new capabilities in their unofficial research. This helped to solve technological difficulties the firms had encountered and sometimes also reduced time to market.

Research alliances

Most of the companies studied were confronted by technical difficulties and market uncertainty during their development process of biopolymer technology. Under these conditions, especially the smaller firms in the sample seemed less likely to succeed in independently developing, processing and marketing this new technology. One strategy for addressing this problem was for these companies to form research alliances with other organisations.

Some firms closely collaborated with their customers and suppliers, mostly in form of R&D consortia, to increase their knowledge on future market requirements and possible technologies to fulfil these requirements. For example, when the management of one firm intended to increase revenues, they sent out a team of engineers to various potential customers. They aimed to understand and solve the customers' problems by developing new petrobased products, but also questioned them on their wider market needs. In this way the firm got to know of their customers' interest in and need for products made out of biopolymers. Another firm worked very closely with suppliers that were considered innovative. This way the management learned about new technologies that were unknown to the firm before.

Furthermore, the establishment of official or de-facto standard-setting or – promoting associations was important.25 The findings of the study showed that several firms formed alliances in order to agree with other firms on common standards for biopolymers. This helped firms especially with respect to reducing technological uncertainty: the activities and commitments of other firms increased the confidence of the management that biopolymers were indeed a promising field to invest in. The agreement on common standards also helped to focus research activities and avoid getting side tracked. As a consequence, it allowed firms to spend their R&D resources more efficiently.

A common characteristic of all reported alliances was their explorative nature, as the firms were confronted by unfamiliar terrain and had to develop and adopt biopolymer technology that was often substantially different from either partner's current technology. In order to capitalise on the potentially distinct knowledge bases of these other firms, companies engaged in a learning process of trial, feedback and evaluation. These alliances also enabled the firms to collectively reduce costs and risks while enhancing at the same time technological predictability.

Cross-functional cooperation

The study showed that the majority of the firms rely on cross-functional cooperation for the development of biopolymer technology. Many studies suggest that improved cross-functional integration leads to improved development and adoption of radical innovations in terms of improved manufacturability and quality, reduced production costs, and fewer ramp-up problems.26,27

In all the firms studied, two main mechanisms by which cross-functional cooperation helped to develop biopolymer technology were found. One mechanism is the accelerated interexchange of information and its processing within the firms. In eight firms the cross-functional team consisted of representatives from R&D, marketing and production which were able to tap a broad array of external information and new know-how. Particularly, involving marketing and production representatives in the team facilitated knowledge transfer, the hand-off of the newly developed biopolymer innovation to manufacturing for production, and to marketing and sales for distribution to the customers. This was achieved by bringing employees with expertise about the proposed innovation in face-to-face meetings together. The close cooperation between the different functions involved lead to common understanding in the team of the requirements and the content of what was eventually the development focus. At converters, for example, the teams often also included employees from external suppliers such as raw material producers. However, they acted rather as consulting team members than as core team members as they did not participate in the daily work.

Generally, team members learned more about other disciplines and units in the firm and tended to develop new technical and other work-related skills faster, as they worked across job functions. In the studied firms, teams were able to work on several issues in parallel regarding the development of biopolymer technology. Many firms confirmed that in previous innovation projects centralised established decision processes were one of the main problems in innovation processes. Decision making took a lot of time during which projects got delayed and deadlines could not be kept. Accordingly, another mechanism by which the set up of a cross-functional project team helped to successfully develop biopolymer technology was the decentralisation of decision making. This was mainly done through the use of lateral decision processes, which were able to cut across the traditional vertical hierarchies of functional authority. In most firms, for instance, the project leader reported directly to the divisional head which increased the chance of cooperation from all affected departments. Furthermore, by not having to report to various hierarchy levels the decision-making process was accelerated. Successful teams had high levels of internal and external decision-making authority and were not caught up by slow bureaucratic processes particularly in the large firms of our sample.

Most of the cross-functional project teams tended to be more effective and efficient in the biopolymer technology development process owing to their decision-making authority. Team members were more committed to their work as they were able to negotiate with steering committees on all final decisions. In general, the organisation of product development teams across different functional units prevented them from developing a ‘not-invented-here’ syndrome that subsequently reduced inertia.

DISCUSSION AND CONCLUSION

The proliferation of biopolymer technology is a worldwide phenomenon that has increased rapidly since the early 1980s. In the past, biopolymers have been in general significantly more expensive and less efficient owing to their processing properties than their petrobased counterparts. However, increasing oil prices have made biopolymers more cost competitive and have spurred interest in research in molecular science and genetic engineering to improve the technology and technical performance of biopolymers.

There are promising market developments that biopolymers are about to leave their market niche in the near future. At a time when environmental laws are being strengthened worldwide, corporate environmental consciousness is increasing, public pressure for environmental technologies and fossil fuel scarcity are high, the strong increase in biopolymer research activities indicates the important role of these factors in helping this new technology gaining acceptance in various industrial sectors.

However, with regard to price and processing properties biopolymers have still to improve. Later is especially important for automotive applications. Furthermore, as there are only a few suppliers with relatively small production volumes on the market, the overall availability of biopolymers has to increase. Therefore, many market players see the raw material suppliers through a technology push responsible for the commercial breakthrough of biopolymers. But, as products made of biopolymers are still niche applications, large investments in research and development mean considerable financial risks for raw material suppliers as well as for converters.

However, applications made of renewable resources are not anymore a mere lip service in the industry. Innovative firms see biopolymers as a chance to establish themselves as leading players in the new market. Therefore, to utilise the advantages of biopolymers, further research is required in order to optimise the production by increasing the efficiencies of the different chemical and biotechnical processes involved. Concluding, while depleting oil reserves, biodegradability and the use of legislative instruments are significant driving forces for the use of biopolymers, the suitability of material properties for converters, the technical feasibility of processing options, the versatility of applications and ultimately, commercial viability of production and processing are the key factors, which are going to decide the market prospects of biopolymer in the coming years.

References

Plastics Europe. (2008) Business data and charts 2008, http://www.plasticseurope.org/Content/Default.asp?PageID=989, accessed 7 June 2009.

Vellema, S., van Tuil, R. and Eggink, G. (2003) Sustainability, agro-resources and technology in the polymer industry. In: A. Steinbüchel (ed.) Biopolymers. Weinheim, Germany: Wiley, pp. 339–363.

Kaplan, D.L. (1998) Introduction to biopolymers from renewable resources. In: D.L. Kaplan (ed.) Biopolymers from Renewable Resources. Berlin and Heidelberg, Germany: Springer, pp. 1–3.

Sartorius, I. (2003) Biodegradable plastics in the social and political environment. In: A. Steinbüchel (ed.) Biopolymers. Weinheim, Germany: Wiley, pp. 453–472.

Mohanty, A.K., Misra, M. and Drzal, L.T. (2002) Sustainable bio-composites from renewable resources: Opportunities and challenges in the green materials world. Journal of Polymers and the Environment 10 (1–2): 19–26.

International Energy Agency. (2007) World Energy Outlook 2007. Paris: OECD.

Energy Information Administration. (2008) Forecasts and analyses, http://www.eia.doe.gov/oiaf/forecasting.html, accessed 11 June 2009.

Busch, T. and Hoffmann, V. (2007) Emerging carbon constraints for corporate risk management. Ecological Economics 62 (3–4): 518–528.

Ren, X. (2003) Biodegradable plastics: A solution or a challenge. Journal of Cleaner Production 11 (1): 27–40.

Platt, K.D. (2006) Biodegradable Polymers. Shawbury, UK: Rapra Technology.

Mohanty, A.K., Misra, M. and Hinrichsen, G. (2000) Biofibres, biodegradable polymers and composites: An overview. Macromolecular Materials and Engineering 267 (1): 1–24.

European Bioplastics. (2009) European bioplastics leaflet, http://www.european-bioplastics.org/, accessed 2 June 2009.

Crank, M. and Patel, M. (2005) Techno-economic Feasibility of Large-scale Production of Bio-based Polymers in Europe. Sevilla, Spain: European Commission.

Michael, D. (2004) Bioplastics Supply Chains: Implications and Opportunities for Agriculture. Barton, UK: Rural Industries Research and Development Corporation.

Paster, M., Pellegrino, J.L. and Carole, T.M. (2003) Industrial Bioproducts: Today and Tomorrow. Columbia, SC: Energetics.

Runge, W. (2006) Innovation, Research and Technology Intelligence in the Chemical Industry. Stuttgart, Germany: Fraunhofer IRB Verlag.

Bastioli, C. (2005) Handbook of Biodegradable Polymers. Shawbury, UK: Rapra Technology.

Eisenhardt, K.M. and Graebner, M.E. (2007) Theory building from cases: Opportunities and challenges. Academy of Management Journal 50 (1): 25–32.

Miles, M.B. and Hubermann, A.M. (1994) Qualitative Data Analysis: An Expanded Source Book. Thousand Oaks, CA: Sage Publications.

Eisenhardt, K.M. (1989) Building theories from case-study research. Academy of Management Review 14 (4): 532–550.

Single, A. and Spurgeon, W.M. (1996) Creating and commercializing innovation inside a skunk works. Research Technology Management 39 (1–2): 38–42.

Augsdorfer, P. (2005) Bootlegging and path dependency. Research Policy 34 (1): 1–11.

Knight, K.E. (1967) A descriptive model of the intra-firm innovation process. The Journal of Business 40: 478–496.

Augsdorfer, P. (1996) Forbidden Fruit: An Analysis of Bootlegging, Uncertainty, and Learning in Corporate R&D. Avebury, UK: Aldershot.

Anand, B.N. and Khanna, T. (2000) Do firms learn to create value? The case of alliances. Strategic Management Journal 21 (3): 295–315.

Karagozoglu, N. and Brown, W.B. (1993) Time-based management of the new product development process. Journal of Production Innovation Management 10: 204–216.

Song, X.M., Neeley, S.M. and Zhao, Y. (1996) Managing R and D-marketing integration in the new product development process. Industrial Marketing Management 25: 545–554.

Author information

Authors and Affiliations

Corresponding author

Additional information

1holds diplomas in polymer engineering and business administration from RWTH Aachen, Germany. In 2009 he completed his PhD at the Swiss Federal Institute of Technology (ETH) Zurich, Switzerland. His research interests include environmental technologies, especially polymers made from renewable resources and the management of radical innovation processes. His research work has been presented at the European Group for Organizational Studies (EGOS) as well as the Academy of Management conference. Since 2008, he works as the executive assistant to the CEO of Hoerbiger Holding, Zug, Switzerland.

Rights and permissions

About this article

Cite this article

Chadha, A. From carbon to carbohydrates: Corporate strategies for biopolymer technology development. J Commer Biotechnol 16, 159–167 (2010). https://doi.org/10.1057/jcb.2009.30

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1057/jcb.2009.30