Abstract

The Basel Committee on Banking Supervision sets the official confidence level at which a bank is supposed to absorb annual losses at 99.9 per cent. However, due to an inconsistency between the notion of expected losses in the Vasicek model, on the one hand, and the practice of Basel regulation, on the other hand, actual confidence levels are likely to be lower. This article calculates the minimal confidence levels that correspond to a worst case scenario in which a Basel-regulated bank holds capital against unexpected losses only. I argue that the probability of a bank failure is significantly higher than the official 0.1 per cent if, firstly, the bank holds risky loans and if, secondly, the bank was previously affected by substantial write-offs.

Similar content being viewed by others

Notes

I equivalently refer to a bank's portfolio value as the bank's total exposure at default.

Note that this list of implicit or explicit assumptions of the Basel VaR approach might not be complete. For example, in Da-Rocha Lopes, S. and Nunes, T. (2010) A simulation study on the impact of correlation between LGD and EAD on loss calculation when different LGD definitions are considered. Journal of Banking Regulation 11(2): 156–167, it is pointed out that the implicit Basel VaR assumption, according to which LGD and EAD are uncorrelated, might be violated in practice.

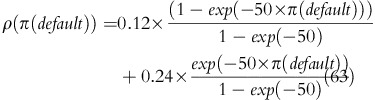

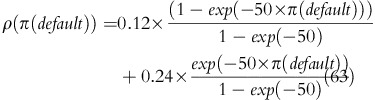

Throughout the article I neglect the Basel firm size adjustment according to which the correlation between small firms is (slightly) lower than the correlation between large firms. I also simplify the original Basel definition

because, for all practical purposes, exp(−50)=0.

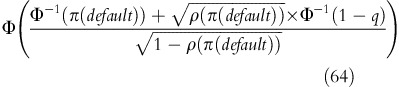

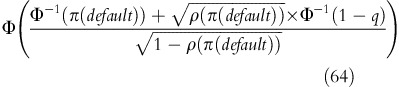

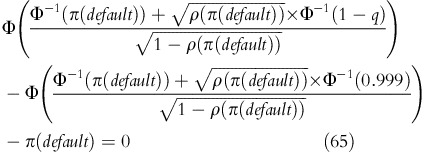

Fix π(default) and observe that

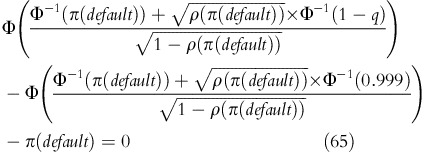

is strictly decreasing in q. To determine q* in (61) it is therefore sufficient to find the root q* of the univariate nonlinear equation

I solve this using Brent's method (cf., for example, Judd, K. (1999) Numerical Methods in Economics. Cambridge, MA: MIT Press, The Matlab code is provided at http://www.sfb504.uni-mannheim.de/126zimper/solveq.m.

References

Vasicek, O. (1991) Limiting loan loss probability distribution. KMV Corporation. http://www.moodysanalytics.com/126/media/Insight/Quantitative-Research/Portfolio-Modeling/91-08-09-Limiting-Loan-Loss-Probability-Distribution.ashx.

Vasicek, O. (2002) Loan portfolio value. Risk 15 (12): 160–162.

Schoenbucher, P.J. (2001) Factor models for portfolio credit risk. Journal of Risk Finance 3 (1): 45–56.

Gordy, M.B. (2003) A risk-factor model foundation for ratings-based bank capital rules. Journal of Financial Intermediation 12 (3): 199–232.

Thomas, H. and Wang, Z. (2005) Interpreting the internal ratings-based capital requirements in Basel II. Journal of Banking Regulation 6 (3): 274–289.

Björk, T. (2009) Arbitrage Theory in Continuous Time. Oxford, UK: Oxford University Press.

BCBS. (2009) Strengthening the Resilience of the Banking Sector: Consultative Document Issued for Comment by 16 April 2010. Basel, Switzerland: Bank for International Settlements.

Acerbi, C. and Tasche, D. (2002) On the coherence of expected shortfall. Journal of Banking & Finance 26 (7): 1487–1503.

BCBS. (2005) An Explanatory Note on the Basel II IRB Risk Weight Functions. Basel, Switzerland: Bank for International Settlements.

Standard Bank Group. (2011) Annual Integrated Report. Book II: Risk and Capital Management Report and Annual Financial Statements. Johannesburg, South Africa: Standard Bank Group.

Kashyap, A.K. and Stein, J.C. (2004) Cyclical implications of the Basel II capital standard. Economic Perspectives. Federal Reserve Bank of Chicago.

Van den Heuvel, S. (2008) The welfare cost of bank capital requirements. Journal of Monetary Economics 55 (2): 298–320.

Acharya, S. (2009) A theory of systemic risk and design of prudential bank regulation. Journal of Financial Stability 5 (3): 224–255.

Berka, M. and Zimmermann, C. (2011) Basel Accord and Financial Intermediation: The Impact of Policy. Federal Reserve Bank of St. Louis. Working paper 2011-042A.

Demirgüc-Kunt, A. and Detragiache, E. (2011) Basel core principles and bank soundness: Does compliance matter? Journal of Financial Stability 7 (4): 179–190.

Acknowledgements

I would like to thank Davy Corubolo, Guangling (Dave) Liu, an anonymous referee and the editor Dal Singh for helpful comments and suggestions. I am grateful to Alex Ludwig for helping me with the Matlab code.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

NUMERICAL VALUES FOR q*

The following table lists minimal confidence level values for selected default probabilities.

Rights and permissions

About this article

Cite this article

Zimper, A. The minimal confidence levels of Basel capital regulation. J Bank Regul 15, 129–143 (2014). https://doi.org/10.1057/jbr.2013.5

Published:

Issue Date:

DOI: https://doi.org/10.1057/jbr.2013.5