Abstract

This article presents a Gaussian three-factor model of the term structure of interest rates which is Markov and time-homogeneous. The model captures the whole term structure and is particularly useful in forward simulations for applications in long-term swap and bond pricing, risk management and portfolio optimization. Kalman filter parameter estimation uses EU swap rate data and is described in detail. The yield curve model is fitted to data up to 2002 and assessed by simulation of yield curve scenarios over the next 2 years. It is then applied to the valuation of callable floating rate consol bonds as recently issued by European banks to raise Tier 1 regulatory capital over the subsequent period from 2005 to 2007.

Similar content being viewed by others

Notes

We use boldface throughout the paper to denote random or conditionally random entities.

This assumption implies that the conditional variance of yield changes is constant over time. A number of studies concerned with the relatively short term have found that yield changes are conditionally heteroscedastic, cf. Ball and Torous (1996). Fong and Vasicek (1991) introduced stochastic volatility to represent this situation, whose relevance to the long run is questionable, for pricing (see also Litterman et al, 1991 and Andersen et al, 2004).

Alternatively, De Jong (2000) presents a general way to obtain the exact discrete-time state distributions in affine class models. As the benefits are unclear for our purposes and simulation complexity increases, we have not pursued this approach here.

A par interest rate swap is a standard contract between two counterparties to exchange cash flows. At set time intervals termed reset dates, one pays a predetermined fixed rate of interest on the nominal value, the other a floating rate, until the maturity date of the contract. The floating leg of swap fixes the interest rates for each payment at the rate of a published interest rate. The fixed rate, known as the swap rate, is that interest rate, which makes the fair value of the par swap 0 at inception. Thus, the cash flows of the two legs of a par swap are those of a pair of bonds with face value the swap nominal, one fixed rate and the other floating rate.

But, see the section ‘Pricing consol bonds’ in which more recent data up to 2008 are used.

We also evaluated the quadratic interpolation but deemed the negligible improvement in accuracy not worth the considerable increase in computational burden.

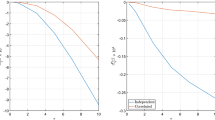

Given the relatively low yield volatilities depicted in Figure 6 and the yield levels in Figure 5 we concluded that the probability of negative yields with our Gaussian model under the market measure is negligible. Using values from the data of Figure 5 and 6, these correspond to a minus 10 standard deviation event. Our decision is borne out by the representative paths in Figures 7 and 8 and, in fact, none of the 500 scenarios simulated produced negative yields over the out-of-sample period. However, see Abu-Mostafa (2001) for a technique for reducing this probability over longer simulation horizons.

For example, in 2005 Deutsche Bank issued a €900 million tranche of bonds at par to face value or nominal. This revives an instrument that has not been in favour since the Russian Revolution, when Tsar Nicholas’ consols became worthless, although UK consols initiated in the eighteenth century are still in existence (with reduced fixed coupon). There is little current literature on their pricing when coupon rates are floating.

We use daily data for consol bond valuation to conform to market practice by issuers who value fixed income instruments incorporating yield curve data on (or just before) the day of sale. Our example here is representative of a number of consol bonds we have valued initially on different dates in the period 2004–2006.

Note that these fits on representative days do not always accurately capture the long end of the yield curve, which might require a fourth factor. They are, however, acceptably accurate up to 10-year maturity and in any event generally err on the conservative side, by producing lower discount rates.

This corresponds to the historical 4-year S&P cumulative default rate for the bond's A rating which suggests that the market was optimistic regarding the bank's possible default on the contract over possibly nearly two and a half centuries.

References

Abu-Mostafa, Y.S. (2001) Financial model calibration using consistency hints. IEEE Transactions on Neural Networks 12 (4): 191–223.

Andersen, L. (1999) A Simple Approach to Pricing Bermudan Swaptions in the Multi-Factor LIBOR Market Model. Geneva Re Financial Products. Working Paper.

Andersen, T.G., Benzoni, L. and Lund, J. (2004) Stochastic Volatility, Mean Drift, and Jumps in the Short-term Interest Rate. Minneapolis: Carlson School of Management, University of Minnesota. Working Paper.

Babbs, S.H. and Nowman, K.B. (1999) Kalman filtering of generalized Vasicek term structure models. Journal of Financial and Quantitative Analysis 34 (1): 115–130.

Ball, C.A. and Torous, W.N. (1996) Unit roots and the estimation of interest rate dynamics. Journal of Empirical Finance 3: 215–238.

Brigo, D. and Mercurio, F. (2007) Interest Rate Models – Theory and Practice, 2nd edn. Berlin: Springer.

Cairns, A.J.G. (2004) A family of term-structure models for long-term risk management and derivative pricing. Mathematical Finance 14 (3): 415–444.

Chan, K.C., Karolyi, G.A., Longstaff, F.A. and Sanders, A.B. (1992) An empirical comparison of alternative models of the short-term interest rate. Journal of Finance 47 (3): 1209–1227.

Chen, R. and Scott, L. (1993) ML estimation for a multifactor equilibrium model of the term structure. Journal of Fixed Income 3: 14–31.

Christensen, J.H.E., Diebold, F.X. and Rudebusch, G.D. (2007) PIER Working Paper 07-029. University of Pensylvania http://www.econ.upenn.edu/pier.

Cox, J.C., Ingersoll, J.E. and Ross, S.A. (1985) A theory of the term structure of interest rates. Econometrica 53 (2): 385–407.

Dai, Q. and Singleton, K.J. (2000) Specification analysis of affine term structure models. Journal of Finance 55 (5): 1943–1978.

De Jong, F. (2000) Time-series and cross-section information in affine term-structure models. Journal of Business and Economic Statistics 18 (3): 300–314.

De Jong, F. and Santa-Clara, P. (1999) The dynamics of the forward interest rate curve: A formulation with state variables. Journal of Financial and Quantitative Analysis 34 (1): 131–157.

Dempster, A.P., Larid, N.M. and Rubin, D.B. (1977) Maximum likelihood from incomplete data via the EM-algorithm. Journal of the Royal Statistical Society: Series B 39: 1–38.

Dempster, M.A.H., Germano, M., Medova, E.A., Rietbergen, M.I., Sandrini, F. and Scrowston, M. (2006) Managing guarantees. Journal of Portfolio Management 32 (2): 51–61.

Dempster, M.A.H., Germano, M., Medova, E.A., Rietbergen, M.I., Sandrini, F. and Scrowston, M. (2007) Designing minimum guaranteed funds. Quantitative Finance 7 (2): 245–256.

Dempster, M.A.H., Mitra, M. and Pflug, G. (eds.) (2009) Quantitative Fund Management, Financial Mathematics Series, Boca Raton, FL: Chapman & Hall CRC.

Duffee, G.R. (2002) Term premia and interest rate forecasts in affine models. Journal of Finance 57: 405–443.

Duffie, D. and Kan, R. (1996) A yield-factor model of interest rates. Mathematical Finance 6 (4): 379–406.

Fong, G. and Vasicek, O. (1991) Fixed income volatility management. Journal of Portfolio Management 17 (4): 41–46.

Geyer, A.L.J. and Pichler, S. (1999) A state-space approach to estimate and test Cox-Ingersoll-Ross models of the term structure. Journal of Financial Research 22 (1): 107–130.

Harvey, A.C. (1989) Forecasting, Structural Time Series Models and the Kalman Filter. Cambridge, UK: Cambridge University Press.

Heath, D., Jarrow, R. and Morton, A. (1992) Bond pricing and the term structure of interest rates: A new methodology for contingent claims valuation. Econometrica 60 (1): 77–105.

Ho, T.S.Y. and Lee, S. (1986) Term structure movements and pricing interest rate contingent claims. Journal of Finance 41 (5): 1011–1029.

Hull, J.C. and White, A.D. (1990) Pricing interest rate derivative securities. Review of Financial Studies 3 (4): 573–592.

James, J. and Webber, N. (2000) Interest Rate Modelling. Chichester, UK: Wiley.

Jones, D.R., Perttunen, C.D. and Stuckmann, B.E. (1993) Lipschitzian optimization without the Lipschitz constant. Journal of Optimization Theory and Applications 79 (1): 157–181.

Kim, D.H. and Orphanides, A. (2005) Term Structure Estimation with Survey Data on Interest Rate Forecasts. Board of Governors of the Federal Reserve System. Finance and Economics Discussion Series, No. 48.

Langetieg, T.C. (1980) A multivariate model of the term structure. Journal of Finance 35 (1): 71–97.

Litterman, R. and Scheinkman, J. (1991) Common factors affecting bond returns. Journal of Fixed Income 1: 54–61.

Litterman, R., Scheinkman, J. and Weiss, L. (1991) Volatility and the yield curve. Journal of Fixed Income 1: 49–53.

Medova, E.A., Rietbergen, M.I., Villaverde, M. and Yong, Y.S. (2006) Modelling the Long-term Dynamics of Yield Curves. Centre for Financial Research, Judge Business School Working Paper WP24/2006 http://www.cfr.statslab.cam.ac.uk.

Nelson, C.R. and Siegel, A.F. (1987) Parsimonious modelling of yield curves. Journal of Business 60: 473–489.

Powell, M.J.D. (1964) An efficient method of finding the minimum of a function of several variables without calculating derivatives. Computer Journal 11: 302–304.

Rebonato, R., Mahal, S., Joshi, M., Buchholz, L.-D. and Nyholm, K. (2005) Evolving yield curves in the real-world measures: A semi-parametric approach. Journal of Risk 7 (3): 29–61.

Vasicek, O. (1977) An equilibrium characterization of the term structure. Journal of Financial Economics 5 (2): 177–188.

Wilkie, A.D., Waters, H.R. and Yang, S. (2004) Reserving, pricing and hedging for policies with guaranteed annuity options. British Actuarial Journal 10 (1): 101–152.

Wu, L. (2009) Interest Rate Modelling: Theory and Practice, Financial Mathematics Series, Boca Raton, FL: Chapman & Hall CRC.

Acknowledgements

We thank Drs Yee Sook Yong, Muriel Rietbergen and Giles Thompson for analytical and computational assistance on the research reported herein. We also acknowledge helpful comments from Julian Roberts, Cambridge Finance Seminar participants and anonymous referees, which materially improved the paper.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Dempster, M., Medova, E. & Villaverde, M. Long-term interest rates and consol bond valuation. J Asset Manag 11, 113–135 (2010). https://doi.org/10.1057/jam.2010.7

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1057/jam.2010.7