Abstract

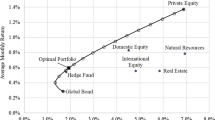

Over the last decade, various new asset classes have emerged as alternatives to the more traditional investments. Although they appear attractive at a first glance, there exists hardly any historical performance track record, and experience with the return generating variables is limited. For ship funds and the valuation of shipping projects, the prevailing freight rates are important price-determining factors. Therefore, knowledge about the time series properties of spot and forward freight rates is essential for a better understanding of the return generating process of ship funds. There are, however, several peculiarities. Because shipping is a nonstorable service, forward prices need not to be linked to spot prices by any direct arbitrage relationship. We test the implications of this notion by using data for Panamax size bulk carriers and find that even in informationally efficient markets spot freight rates are highly autocorrelated. In addition, spot and forward freight rates are cointegrated, and the equilibrium is established by spot rates converging to forward rates. An extension of the standard vector error correction model reveals time-variation in the adjustment speed. Overall, our empirical findings suggest that the time series properties of freight rates need to be well understood before investing in ship funds. Another important aspect is whether ship funds should hedge their freight rate exposure in the forward market to reduce the return volatility or whether investors can achieve the same outcome by holding ship funds in a portfolio context.

Similar content being viewed by others

Notes

Recently, however, several German initiators have established secondary markets, where ship fund participations can be traded (Drobetz et al., 2008).

For a similar argument applied to the airline industry, see Shleifer and Vishny (1992).

The cash flow position of a ship fund investor is strongly influenced by changes in the vessel price. The contribution of ‘asset plays’ to the ship owner's profitability can be greater than the operation of the vessel itself.

The literature on corporate risk management suggests that firms can benefit from hedging market risk. Bessembinder (1991), Froot et al. (1993), and Stulz (1990) present models suggesting that a policy of hedging market risks can result in more efficient capital investments. Smithson and Simkins (2005) provide a recent survey. Whether the results from this literature can be applied to the shipping industry has not yet been addressed.

See Heijdra and von der Ploeg (2003) for a textbook treatment. Kawai's (1983) model looks at futures prices, but in what follows we assume that his implications also apply to forward markets.

With increasing freight rates, there is no lay up of vessels and new vessels are not available at short notice. In this case, the supply curve for freight services is almost vertical. See Kavussanos and Visvikis (2006a).

In contrast, Garbade and Silber (1983) and Purcell and Hudson (1985) argue that the lack of storage facilities casts suspicion on the price discovery function in nonstorable futures markets.

This result does not depend on whether the underlying asset is storable or not. Their findings are in contrast to those in Fortenbery and Zapata (1993) and Covey and Bessler (1995). They argue that cointegration should be expected between cash and forward prices of storable commodities, but not for nonstorable commodities.

Moreover, because the FFA market is a ‘paper’ market rather than a physical market and allows for arbitrage, the forward rate should instantaneously incorporate all relevant information. Possible obstacles, however, are the thinness of the FFA market and the absence of strong speculative forces.

Expectations for the magnitude of the average adjustment speed can be derived from the spread between spot and forward rates. The biggest deviation between spot rates and the +1A FFA rates occurred in March 2005, with spot rates being about $17,000 above FFA rates. At that time, the number of days until the middle of the FFA settlement period was about 650 days, implying an adjustment speed of $26 per day (or 0.154 per cent (=1/650) in terms relative to the deviation). The reciprocal value of the remaining days, however, is only a first-order estimation.

Using the estimated cointegration vector does not qualitatively change our empirical results.

According to the Baltic Exchange, route 4 is defined as follows: delivery for the Japan/South Korea range for a trip via US West Coast–British Columbia range, redelivery Skaw–Gibraltar range, duration 50/60 days, size of vessel 70.000 dwt. This route has a weight of 15 per cent in the Baltic Panamax Index (BPI).

The aim of a constant underlying is only partly accomplished. The series +2A and +1A reflect the market expectation of the average spot rates in 2006, while the series +3Q, +2Q, and +1Q reflect the expected average spot rates in the last quarter of the year. We choose this approach to obtain a sufficient number of observations.

In contrast, looking at electricity, which is also a nonstorable commodity, Shawky et al. (2003) find that volatility in the spot price series is significantly higher than the volatility in the future price series. They also do not find autocorrelation in the spot return series, a result they interpret as evidence for weak-form market efficiency. An explanation could be that the supply in the electricity market is much more elastic than in the shipping market.

As a robustness check, we also tested an ARIMA model on the differences of the logarithmic spot rates. In this specification, however, the moving average terms were never significant.

Attenuation measures the time period within which the amplitude of a distortion from equilibrium is reduced to 1/e times its original value, where e denotes Euler's number.

Results from the KPSS-test (Kwiatkowski et al., 1992) support this conclusion. In this case, the null hypothesis of stationarity cannot be rejected for all contracts.

The results do not change qualitatively if the estimated cointegration vectors from Table 4 are used. Our results are also robust when we use Johansen's (1991) one-step maximum likelihood approach to estimate bivariate error correction models.

See Jüttner (1984, p. 460).

References

Batchelor, R., Alizadeh, A. and Visvikis, I. (2007) ‘Forecasting Spot and Forward Prices in the International Freight Market’, International Journal of Forecasting, 23, 101–114.

Bessembinder, H. (1991) ‘Forward Contracts and Firm Value: Investment Incentive and Contracting Effects’, Journal of Financial and Quantitative Analysis, 26, 519–532.

Black, F. (1976) ‘The Pricing of Commodity Contracts’, Journal of Financial Economics, 3, 167–179.

Brenner, R. and Kroner, F. (1995) ‘Arbitrage, Cointegration, and Testing the Unbiasedness Hypothesis in Financial Markets’, Journal of Financial and Quantitative Analysis, 30, 23–42.

Covey, T. and Bessler, D. (1995) ‘Asset Storability and the Information Content of Intertemporal Prices’, Journal of Empirical Finance, 2, 103–115.

Dickey, D. A. and Fuller, W. A. (1979) ‘Distribution of the Estimators for Autoregressive Time Series with a Unit Root’, Journal of the American Statistical Association, 74, 427–431.

Drobetz, W., Tegtmeier, L. and Topalov, M. (2008) ‘Handelsplattformen für Schiffsbeteiligungen: Analyse und Vergleich von Zweitmärkten für Schiffsbeteiligungen unter Effizienzgesichtspunkten’, Der Finanzbetrieb, 1/2008, 57–67.

Engle, R. and Granger, C. (1987) ‘Cointegration and Error Correction: Representation, Estimation, and Testing’, Econometrica, 55, 251–276.

Fondsmedia (2006), ‘Potenzielle Portfolio-Effekte moderner Schiffsfonds’.

Fondsmedia (2007), ‘Performanceanalyse GHF-Schiffsportfolio Edition II/2007’.

Fortenbery, T. and Zapata, H. (1993) ‘An Examination of Cointegration Relations between Futures and Local Grain Markets’, Journal of Futures Markets, 13, 921–932.

Froot, K., Scharfstein, D. and Stein, J. (1993) ‘Risk Management: Coordinating Corporate Investment and Financing Policies’, Journal of Finance, 48, 1629–1658.

Garbade, D. and Silber, W. (1983) ‘Price Movements and Price Discovery in Futures and Cash Markets’, Review of Economics and Statistics, 65, 289–297.

Haigh, M. (2000) ‘Cointegration, Unbiased Expectations, and Forecasting in the BIFFEX Freight Futures Market’, Journal of Futures Markets, 20, 545–571.

Heijdra, B. and von der Ploeg, F. (2003) ‘The Foundations of Modern Macroeconomics’, Oxford University Press: Oxford.

Hull, J. (2006) ‘Options, Futures, and Other Derivatives’, Prentice-Hall: Englewood Cliffs, NJ.

International Maritime Organization (2006) http://www.marisec.org/worldtradeflyer.pdf.

Jarque, C. M. and Bera, A. K. (1980) ‘Efficient Tests for Normality, Homoscedasticity and Serial Independence of Regression Residuals’, Economics Letters, 6, 255–259.

Johansen, S. (1991) ‘Estimation and Hypothesis Testing of Cointegration Vectors in Gaussian Vector Autoregressive Models’, Econometrica, 59, 1551–1580.

Jüttner, D. J. (1984) ‘Information and Futures Trading — Some Missing Facts and Consequences’, Jahrbuch für Nationalökonomie und Statistik, 199/5, 460–463.

Kamara, A. (1982) ‘Issues in Futures Markets: A Survey’, Journal of Futures Markets, 2, 261–294.

Kavussanos, M., Visvikis, I. and Menachof, D. (2004) ‘The Unbiasedness Hypothesis in the Freight Forward Market: Evidence from Cointegration Tests’, Review of Derivatives Research, 7, 241–266.

Kavussanos, M., Goulielmou, M. and Visvikis, I. (2005) ‘An Investigation of the Use of Risk Management and Shipping Derivatives: The Case of Greece’, International Association of Maritime Economists (IAME) Conference, Limassol, Cyprus.

Kavussanos, M. and Nomikos, N. (1999) ‘The Forward Pricing Function of the Shipping Freight Futures Market’, Journal of Futures Markets, 19, 353–376.

Kavussanos, M. and Visvikis, I. (2004) ‘Market Interactions in Returns and Volatilities Between Spot and Forward Shipping market’, Journal of Banking and Finance, 28, 2015–2049.

Kavussanos, M. and Visvikis, I. (2006a) ‘Derivatives and Risk Management in Shipping’, Witherby Publishing, London.

Kavussanos, M. and Visvikis, I. (2006b) ‘Shipping Freight Derivatives: A Survey of Recent Evidence’, Maritime Policy & Management, 33 (3), 233–255.

Kawai, M. (1983) ‘Spot and Futures Prices of Nonstorable Commodities Under Rational Expectations’, Quarterly Journal of Economics, 98, 235–254.

Koopmans, T. (1939) ‘Tanker Freight Rates and Tankship Building’, De Evren Bohn, Haarlem.

Kwiatkowski, D., Phillips, P., Schmidt, P. and Shin, Y. (1992) ‘Testing the Null Hypothesis of Stationarity Against the Alternative of a Unit Root’, Journal of Econometrics, 54, 159–178.

Ljung, G. and Box, G. (1978) ‘On a Measure of Lack of Fit in Time Series Models’, Biometrika, 65, 297–303.

Loipfinger, S. (2007) ‘Marktanalyse der Beteiligungsmodelle’, www.fondstelegramm.de.

Peck, E. (1985) ‘The Economic Role of Traditional Commodity Futures Markets’, in E. Peck (ed.), Futures Markets and Their Economic Roles, American Enterprise Institute for Public Policy Research, Washington.

Phillips, P. C. B and Perron, P. (1988) ‘Testing for a Unit Root in Time Series Regression’, Biometrika, 75, 335–346.

Purcell, W. and Hudson, M. (1985) ‘The Economic Roles and Implications of Trade in Livestock Futures’, in A. Peck (ed.), Futures Markets: Regulatory Issues, American Enterprise Institute for Public Policy Research, Washington.

Scope (2007) ‘Geschäftsklima bei geschlossenen Fonds’, www.scope.de.

Shawky, H., Marathe, A. and Barrett, C. (2003) ‘A First Look at the Empirical Relation Between Spot an Futures Electricity Prices in the United States’, Journal of Futures Markets, 23, 931–955.

Shleifer, A. and Vishny, R. (1992) ‘Liquidation Values and Debt Capacity: A Market Equilibrium Approach’, Journal of Finance, 47, 1343–1366.

Smithson, C. and Simkins, B. (2005) ‘Does Risk Management Add Value? A Survey of the Evidence’, Journal of Applied Corporate Finance, 17, 8–17.

Stein, J. (1981) ‘Speculative Price: Economic Welfare and the Idiot of Chance’, Review of Economics and Statistics, 63, 223–232.

Stopford, M. (1997) ‘Maritime Economics’, Taylor & Francis, London.

Stulz, R. (1990) ‘Managerial Discretion and Optimal Financing Policies’, Journal of Financial Economics, 26, 3–28.

Yang, J., Bessler, D. and Leatham, D. (2001) ‘Asset Storability and Price Discovery in Commodity Futures Markets: A New Look’, Journal of Futures Markets, 21, 279–300.

Author information

Authors and Affiliations

Corresponding author

Additional information

2holds the chair for Corporate Finance and Ship Finance at the University of Hamburg. Previously, he taught at the University of Basel, the University of St Gallen, and the WHU Otto Beisheim Graduate School. His research interests are corporate finance, asset pricing, and asset management. He serves as a member on the editorial board of various international finance journals and consults firms in the financial services industry.

Rights and permissions

About this article

Cite this article

Bessler, W., Drobetz, W. & Seidel, J. Ship funds as a new asset class: An empirical analysis of the relationship between spot and forward prices in freight markets. J Asset Manag 9, 102–120 (2008). https://doi.org/10.1057/jam.2008.14

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1057/jam.2008.14