Abstract

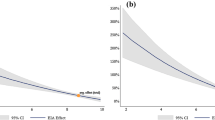

This paper examines the trade and trade-induced welfare effects of oil prices. Using a gravity model of trade, the paper finds that the distance elasticity of trade significantly increases with the oil price. This suggests that high oil prices make trade less global, as they affect longer shipping routes more. The paper estimates that an increase in the oil price from $100 to $200 (in 2014 US$) would have similar trade effects as an import tariff around 17 percent for two countries 10,000 km away. This is akin to a 55 percent increase in shipping distance. This trade reduction would lower welfare by 0.03 percent in the average non-oil-exporting country.

Similar content being viewed by others

Notes

Our gravity model also allows us to include country-pair fixed effects, leaving only the interaction of distance and oil prices as an explaining variable. This method is akin to Rajan and Zingales’ (1998) identification of the effect of financial development on growth via the interaction of sectoral finance-dependence with country-level financial-market developments.

Assche, Gangnes, and Ma (2011) run a similar regression for China for the years 1988–2008 and find that high oil prices do affect the sensitivity of China’s export to distance.

The expressions for the inward and outward multilateral resistance terms are P i =

∑

j

(t

ij

/Π

j

)εy

j

/y

w

∑

j

(t

ij

/Π

j

)εy

j

/y

w

1/ε and Π

j

=

1/ε and Π

j

= ∑

i

(t

ij

/P

i

)εy

i

/y

w

∑

i

(t

ij

/P

i

)εy

i

/y

w

1/ε.

1/ε.Both the two-way and three-way fixed effect models are estimated using the reghdfe Stata command. Only the results without county-pair fixed effects allow for estimates of the level of the distance elasticity, on top of its slope across oil prices. The −0.165 coefficient on the interaction yields distance elasticities between −1.1 and −1.6. The −0.106 coefficient is more precisely identified due to the inclusion of country-pair fixed effects and is closer to what was found for China’s exports by Assche, Gangnes, and Ma (2011) (−0.043).

The Poisson pseudo-maximum-likelihood estimator was suggested by Silva and Tenreyro (2006) to include all zero trade flows and correct for heteroscedasticity problems.

Note that the trade cost shock we take into account is the increase in distance elasticity, not the tariff equivalent, as the latter also involves tariff revenue that we would otherwise need to take into account.

The model of Arkolakis, Costinot, and Rodriguez-Clare (2012) builds on Eaton and Kortum (2002) who first computed real wages as a function of import shares and the trade elasticity in order to quantify the gains from trade in a Ricardian model.

The welfare effects we estimate are not the total welfare effects of higher oil prices but only those induced by higher trade costs and only for non-oil-exporting countries. We abstract from the losses due to higher energy costs not related to transport, such as heating costs in winter.

References

Anderson, J. E. and E. van Wincoop, 2003, “Gravity with Gravitas: A Solution to the Border Puzzle,” American Economic Review, Vol. 93, No. 1, pp. 170–92.

Arkolakis, C., A. Costinot, and A. Rodriguez-Clare, 2012, “New Trade Models, Same Old Gains?,” American Economic Review, Vol. 102, No. 1, pp. 94–130.

Assche, A. V., B. Gangnes, and A. Ma, 2011, “China’s Exports in a World of Increasing Oil Prices,” Multinational Business Review, Vol. 19, No. 2, pp. 133–51.

Asturias, J. and S. Petty, 2012, “Endogenous Transportations Costs,” Job Market Paper, University of Minnesota.

Barsky, R. B. and L. Kilian, 2004, “Oil and the Macroeconomy Since the 1970s,” Journal of Economic Perspectives, Vol. 18, No. 4, pp. 115–34.

Bergin, P. R. and R. Glick, 2007, “Global Price Dispersion: Are Prices Converging or Diverging?,” Journal of International Money and Finance, Vol. 26, No. 5, pp. 703–29.

Beverelli, C., 2010, Oil Prices and Maritime Freight Rates: An Empirical Investigation, Technical report by the UNCTAD secretariat.

Brun, J.-F., C. Carrère, P. Guillaumont, and J. de Melo, 2005, “Has Distance Died? Evidence from a Panel Gravity Model,” World Bank Economic Review, Vol. 19, No. 1, pp. 99–120.

Chinn, M., 2008, “De-Globalization? Musing about Oil Prices and Trade Costs,” Econbrowser, 20 March, http://econbrowser.com/archives/2008/03/deglobalization.

Costinot, A. and A. Rodriguez-Clare, 2013, “Trade Theory with Numbers: Quantifying the Consequences of Globalization,” Handbook of International Economics, Vol. 4, p. 197.

Cristea, A., D. Hummels, L. Puzzello, and M. Avetisyan, 2013, “Trade and the Greenhouse Gas Emissions from International Freight Transport,” Journal of Environmental Economics and Management, Vol. 65, No. 1, pp. 153–73.

Eaton, J. and S. Kortum, 2002, “Technology, Geography, and Trade,” Econometrica, Vol. 70, No. 5, pp. 1741–79.

Eaton, J. and S. Kortum, 2012, “Putting Ricardo to Work,” Journal of Economic Perspectives, Vol. 26, No. 2, pp. 65–90.

Economist. 2012, “Seores, Start Your engines,” From the Print Edition, 24 Nov.

EIA. 2013, US Energy Information Administration, Annual Energy Outlook 2013 Early Release Overview, Tech. rep., US Energy Information Administration.

Feyrer, J., 2009, “Distance, Trade, and Income: The 1967 to 1975 Closing of the Suez Canal as a Natural Experiment,” NBER Working Papers 15557 (National Bureau of Economic Research, Inc).

Fishman, C., 2012, “The Insourcing Boom,” The Atlantic.

Head, K. and T. Mayer, 2013, “Gravity Equations: Workhorse, Toolkit, and Cookbook,” CEPR Disussion Paper 9322.

Hummels, D., 2007, “Transportation Costs and International Trade in the Second Era of Globalization,” Journal of Economic Perspectives, Vol. 21, No. 3, pp. 131–54.

Kilian, L., 2008, “Exogenous Oil Supply Shocks: How Big Are They and How Much Do They Matter for the U.S. Economy?,” The Review of Economics and Statistics, Vol. 90, No. 2, pp. 216–40.

Kleinert, J. and J. Spies, 2011, “Endogenous Transport Costs in International Trade,” IAW Discussion Papers 74, Institut fr Angewandte Wirtschaftsforschung (IAW).

Krijgman, P., 2008, “The World Gets Bigger,” The Conscience of a Liberal, 17 June, http://krugman.blogs.nytimes.com/2008/06/17/the-world-gets-bigger/.

Levinson, M., 2006, The Box: How the Shipping Container Made the World Smaller and the World Economy Bigger. (Princeton: Princeton University Press).

Mirza, D. and H. Zitouna, 2010, “Oil Prices, Geography and Endogenous Regionalism: Too Much Ado About (Almost) Nothing,” CEPREMAP Working Papers (Docweb) 1009, CEPREMAP.

Rajan, R. G. and L. Zingales, 1998, “Financial Dependence and Growth,” American Economic Review, Vol. 88, No. 3, pp. 559–86.

Rochter, L., 2008, “Shipping Costs Start to Crimp Globalization,” New York Times.

Rubin, J. and B. Tal, 2008, “Will Soaring Transport Costs Reverse Globalization?” StrategEcon, CIBC World Markets.

Silva, J. M. C. S. and S. Tenreyro, 2006, “The Log of Gravity,” The Review of Economics and Statistics, Vol. 88, No. 4, pp. 641–58.

Sletmo, G. and E. Williams, 1981, Liner Conferences in the Container Age (Basingstoke, UK: Macmillan).

Storeygard, A., 2012, “Farther on Down the Road: Transport Costs, Trade and Urban Growth in Sub-Saharan Africa,” mimeo.

Additional information

*David von Below works as an Economist at Copenhagen Economics, with a focus on energy, climate change and macroeconomics.Pierre-Louis Vézina is Lecturer in Economics at King’s College London.

∑

j

(t

ij

/Π

j

)εy

j

/y

w

∑

j

(t

ij

/Π

j

)εy

j

/y

w

1/ε and Π

j

=

1/ε and Π

j

= ∑

i

(t

ij

/P

i

)εy

i

/y

w

∑

i

(t

ij

/P

i

)εy

i

/y

w

1/ε.

1/ε.