Abstract

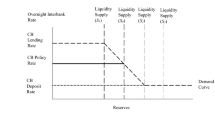

This paper analyzes the role of standing facilities in the determination of the demand for reserves in the overnight money market. The paper shows how central banks could use the position of the main refinancing rate with respect to the deposit and lending rates as a policy tool to control the demand for excess reserves by depository institutions. Furthermore, it illustrates how the existence of fine-tuning operations at the end of the reserve maintenance period significantly affects the ability of the central bank to influence the demand for reserves.

Similar content being viewed by others

Notes

As defined by the ECB, a fine-tuning operation is a nonregular open market operation executed mainly to deal with unexpected liquidity fluctuations in the market.

See also Baltensperger (1980) for a survey and references to the early literature on this subject.

Bindseil and Jablecki (2011b) document the observed positive relation between the width of the corridor and the volatility of overnight market rates.

See Bindseil and Jablecki (2011a) for a review of the merits of an active interbank market.

Throughout the paper we will use indistinctly, the terms “depository institutions,” “commercial banks,” or “banks,” for short.

For the euro area the variable shown is the use of the deposit facility.

This value was reached on September 9, 2008 which was the end of a reserve maintenance period.

On June 25, 2009, the ECB started conducting liquidity-providing main refinancing operations with a year maturity. The larger use of the deposit facilities could be because of expectations of future rate increases.

Effective December 16, 2008, the U.S. Federal Reserve started to report its target rate as a range. From that date we used the rate paid on excess reserve balances as a reference for the federal funds rate.

Notice floor systems can be seen as a particular case of corridor systems in which central banks flood the market with reserves so as to push market rates to the lower edge of the band.

We make this assumption for simplicity but capitalization of interests only has a second-order effect and will not affect the results below significantly.

The reader should remember that trading in the market is done with an overnight maturity. This means that the intertemporal evolution of reserves for an individual bank does not depend on the decision made about m t j or b t j but only on the realization of the shock ɛ t j.

In what follows, capital letters refer to aggregate variables.

Computations are done in the Appendix.

This expression assumes an interior solution. If b̂ 2 j represents the solution of that expression, the decision on supply of funds have to satisfy b 2 j=min[b̂ 2 j, max(0, a 2 j)].

Remember we are conditioning on the event of an aggregate liquidity shortage so that the fine-tuning operation is liquidity providing.

Expressions of this sort, by which the rate of the open market operation equals the expected average of market rates throughout the reserve maintenance period, are a typical result in this literature. See, among others, Valimaki (2003).

See the Appendix for a proof of this statement.

Intuitively, this level should coincide with the middle of the corridor. However, as Pérez Quirós and Rodríguez Mendizábal (2006) show, the probabilities of ending the maintenance period with an excess or shortage of reserves are not symmetric. This is because being locked-in is an absorbing state while having a reserve shortage is not. The slight move of the elastic part to the upper side of the corridor is a consequence of this result.

References

Baltensperger, E., 1980, “Alternative Approaches to the Theory of the Banking Firm,” Journal of Monetary Economics, Vol. 6, pp. 1–37.

Berentsen, A., and C. Monnet, 2008, “Monetary Policy in a Channel System,” Journal of Monetary Economics, Vol. 55, pp. 1067–1080.

Bindseil, U., 2004, Monetary Policy Implementation. Theory, Past and Present (New York: Oxford University Press).

Bindseil, U., and J. Jablecki, 2011a, “A Structural Model of Central Bank Operations and Bank Intermediation,” ECB Working Paper 1312.

Bindseil, U., and J. Jablecki, 2011b, “The Optimal Width of the Central Bank Standing Facilities Corridor and Banks’ Day-to-Day Liquidity Management,” ECB Working Paper 1350.

Bowman, D., E. Gagnon, and M. Lehay, 2010, “Interest on Excess Reserves as a Monetary Policy Instrument: The Experience of Foreign Central Banks,” Board of Governors of the Federal Reserve System, International Finance Discussion Papers 996.

Dudley, W., 2009, “The Economic Outlook and the Fed's Balance Sheet: The Issue of ‘How’ versus ‘When’,” Remarks at the Association for a Better New York Breakfast Meeting, Grand Hyatt, New York. Available via the Internet: www.newyorkfed.org/newsevents/speeches/2009/dud090729.html.

Ennis, H., and A.L. Wolman, 2010, “Excess Reserves and the New Challenges for Monetary Policy,” Richmond Fed Economic Brief 10-03.

Feldstein, M., 2010, “What Powers for the Federal Reserve?” Journal of Economic Literature, Vol. 48, No. 1, pp. 134–145.

Gaspar, V., G. Pérez Quirós, and H. Rodríguez Mendizábal, 2008, “Interest Rate Dispersion and Volatility in the Market for Daily Funds,” European Economic Review, Vol. 52, No. 3, pp. 413–440.

González Páramo, J.M., 2011, “Lessons from the Crisis for Monetary Policy and Financial Stability,” speech at Annual Money, Macro and Finance Conference, Limassol, Cyprus. Available via the Internet: www.ecb.int/press/key/date/2010/html/sp100903.en.html.

Goodfriend, M., 2002, “Interest on Reserves and Monetary Policy,” Federal Reserve Bank of New York Economic Policy Review, Vol. 8, No. 1, pp. 13–29.

Goodhart, C., 2009, “Liquidity Management,” Conference on Financial Stability and Macroeconomic Policy, Jackson Hole, Wyoming.

Hilton, S., and J. McAndrews, 2011, “Challenges and Lessons of the Federal Reserve's Monetary Policy Operations during the Financial Crisis,” Proceedings of the Sixth ECB Central Banking Conference: Approaches to Monetary Policy Revisited—Lessons from the Crisis.

Keister, T., A. Martin, and J. McAndrews, 2008, “Divorcing Money from Monetary Policy,” Federal Reserve of New York Economic Policy Review, Vol. 14, No. 2, pp. 41–56.

Poole, W., 1968, “Commercial Bank Reserve Management in a Stochastic Model. Implications for Monetary Policy,” The Journal of Finance, Vol. 23, pp. 769–791.

Pérez Quirós, G., and H. Rodríguez Mendizábal, 2006, “The Daily Market for Funds in Europe: What Has Changed with the EMU?” Journal of Money, Credit and Banking, Vol. 38, No. 1, pp. 91–118.

Valimaki, T., 2003, “Central Bank Tenders: Three Essays on Money Market Liquidity Auctions,” Bank of Finland Studies E:26.

Whitesell, W., 2006, “Interest Rate Corridors and Reserves,” Journal of Monetary Economics, Vol. 53, pp. 1177–1195.

Woodford, M., 2003, Interest and Prices: Foundations of a Theory of Monetary Policy (Princeton NJ: Princeton University Press).

Additional information

*Gabriel Perez Quiros has a PhD in Economics from the University of California, San Diego. He is Unit Head of Macroeconomic Research at the Bank of Spain. He previously worked at the Federal Reserve Bank of New York, the European Central Bank and the Economic Bureau of the Spanish Prime Minister. Hugo Rodriguez Mendizabal holds a PhD in Economics from the university of Chicago. Currently, he is Tenured Scientist at the Institute for Economic Analysis, CSIC and Affiliated Professor at the Barcelona GSE. The authors thank Juan Ayuso, Roberto Blanco, José Manuel Marqués, Arturo Mesón, an anonymous referee of the Working Paper series at the Bank of Spain, and participants at the internal seminar of the Bank of Spain for helpful suggestions. They also appreciate very valuable comments from the editor, Pierre-Olivier Gourinchas, and two anonymous referees. Rodríguez Mendizábal acknowledges the financial support of the Spanish Ministry of Science and Innovation through grant ECO 2009-07958, of the Barcelona GSE Research Network and of the Government of Catalonia.

Appendix

Appendix

A.I. Analytical Derivations in the Paper

Expected profits at period t=2, can be derived, when there is an aggregate liquidity shortage, A 2−R 2<0, substituting Equations (1) and (6) in Equation (7). This yields the expression

Taking derivatives with respect to b 2 j produces the first-order condition (8). The rest of the cases are handled similarly.

In addition, for period t=1, using Equation (1) and taking expectations produces the expected value of profits

To compute the second term in Equation (17), we make use of the distribution of r 2 j. Then,

Furthermore, using Equations (8), (11), (14), and (19), we can see how the demand for reserves at the OMO is independent of the spread between the lending and deposit rates. From Equations (8), (11), and (14), we can write, respectively,

where both A 2 and R 2 depend on A 1 and are defined in Equations (4) and (5), respectively. On the other hand, from Equation (19), we can write

Define the asymmetry coefficient of the interest rate corridor as

From Equations (22), (A.1), (A.2), (A.3), and (A.4), it is easy to see that the demand for funds at the initial OMO, A 1, that satisfies Equation (22) only depends on α and not on the spread (i l−i d). For that, take Equation (24)

From Equation (A.4)

But from Equations (A.1), (A.2), and (A.3), we have respectively that

Thus, all these equations are independent of the spread (i l−i d) so that the only variable that matters is the asymmetry index α.