Abstract

We analyse abnormal growth of premiums surrounding financial strength rating changes for a panel of life insurers in Japan during 2002–2009. Unlike the U.S. market, our regression results indicate that life insurance premiums do not show relevant change in connection with ratings changes in the Japanese market. However, insurance demand is not totally insensitive to the financial strength of insurers. We find that the demand for foreign life insurers has a positive relationship with solvency margin ratio. We also find that consumers cared more about insurers’ credit quality during the later sample period of 2006–2009 than the earlier sample period of 2002–2005.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Insurance is a financial contract promising a future payment contingent upon a specified financial loss. Insureds usually pay a premium in advance and transfer their risks to insurance companies. When an uncertain event specified in the insurance contract occurs and the insured sustain losses, the insurer indemnifies the insured as the contract specifies. However, in the event of insurer failure, the insured may not be able to recover their losses from the insolvent insurer. Therefore, insurance consumers are exposed to this insolvency risk when they purchase insurance products. In a perfect information market, financially sophisticated rational consumers should be sensitive to the insolvency probability of insurance companies. If this is the case, “market discipline” can exist. That is, sophisticated consumers “discipline” insurance companies by giving insurance companies incentive to reduce their insolvency risks in order to attract and retain more consumers.

Not all consumers are sophisticated enough to fully evaluate an insurer's insolvency risk, however. In order to protect policyholders, regulators generally use various measures to prevent insurance company insolvency. In addition, policyholder protection programmes, which guarantee insurance indemnity up to certain amounts, are also in place in many countries. With the presence of complete regulatory protection, where the regulatory body can guarantee the contract's terms even after the insurer has failed, consumers may not have any incentive to evaluate insurance company insolvency risks, potentially leading to risk-insensitive insurance demand. However, in most cases, complete regulatory protection is often neither feasible nor ideal because it is costly and a moral hazard problem of the insurance company may arise when the insurance demand is risk insensitive. With the presence of insolvency risk, whether market discipline exists or not is an important empirical question to regulators who need to understand the level of consumers’ financial sophistication.

Epermanis and HarringtonFootnote 1 and ZanjaniFootnote 2 provide evidence of market discipline in the U.S. insurance market. Epermanis and Harrington find significant risk sensitivity in non-life insurance demand, in particular for commercial lines of insurance. Zanjani examines the market discipline of life insurance and finds a strong positive relationship between the policy termination rate and insolvency risk. However, the market discipline found in the U.S. market may or may not be present in other markets. Japanese insurance comprises 12.44 per cent of world total direct premium written in 2009. It is the second largest insurance market in the world, after the U.S. market.Footnote 3 No study has examined the market discipline in Asian insurance markets, including Japan. Our study fills this gap by examining insurance demand sensitivity to the financial strength of insurers in the Japanese insurance market for the sample period of 2002–2009.

The Japanese economy experienced a long-lasting economic boom prior to the 1990s. Unlike many other countries, insurer failure was non-existent in Japan until recently. Therefore, consumers did not need to be concerned about the insolvency risk of insurers. However, the economic bubble burst in the early 1990s, and Japan entered into an economic recession. In April 1997, Nissan Mutual Life insurance company recorded the first insurer bankruptcy in Japan since the post-war period. Since 1997, ten insurance companies have declared bankruptcy.Footnote 4 Considering the fact that there are fewer than 100 insurers in Japan, this is not an insignificant number of bankruptcies. Therefore, insurance consumers in Japan who used to have a very low risk awareness now have an incentive to compare the insolvency risks of insurers when they purchase insurance products.

The purpose of this study is twofold. First, we review the credit ratings of both life and non-life insurance companies in Japan. Second, we examine whether the insurance demand in Japan has become risk sensitive in the 2000s. More specifically, this study analyses the relationship between insurance premium growth and observable financial strength measures for life insurance companies in Japan. We focus on the life insurance demand sensitivity due to a data limitation. In our analysis, we utilise the financial strength ratings as observable financial strength measures to insurance consumers. The insolvency probability of an insurance company is not directly observable to consumers. Ratings agencies evaluate the financial strength of insurance companies and release financial strength ratings. By reducing the information asymmetry between insurers and consumers, the ratings help consumers to understand the financial strength of insurers. The existence of the insurance-dedicated ratings agency A.M. Best in the U.S. points to the importance of financial strength and strength ratings in the insurance industry. Therefore, financial strength rating is usually used as a measure of the observable financial strength of insurance companies.Footnote 5

The second measure of the observable financial strength used in this study is a solvency margin ratio. A solvency margin ratio is the ratio of solvency margin to the sum of risk. This ratio is similar to the risk-based capital (RBC) ratio in the U.S. and is used as a measure of capital adequacy.Footnote 6 This ratio is not as comprehensive as ratings because it only reflects current capital adequacy, but it is one of the most important indicators of insurer default risk. Like RBC, a solvency margin can provide an early warning for a capital inadequacy. The new Insurance Business Law in 1998 requires insurers to provide the solvency margin ratios to consumers from March 1998.Footnote 7 As a result of this Insurance Business Law, the solvency margin is provided to consumers through insurers’ various marketing media and financial reports. Furthermore, the solvency margin, in many cases, is the only easily observable measure of insurers’ financial strength for consumers because the financial strength ratings are not as prevalent in Japan as in the U.S. Therefore, we also use the solvency margin ratio as a secondary financial strength measure in this study.

We conduct ordinary least squares (OLS) and fixed-effect regression analyses for 112 life insurer firm-year observations. Our results provide some evidence that Japanese consumers care about the credit quality of insurance companies. The premium growth of life insurers is insensitive to rating changes but is sensitive to solvency margin ratio changes. Interestingly, statistically significant demand sensitivity was only found among foreign life insurers. We also find that the life insurance demand was more sensitive to the solvency margin ratio during the later sample period of 2006–2009 than the early 2000s, suggesting that market discipline has improved.

Premium growth reflects both coverage volume and price. Life insurers in Japan report the number of new policies and policy termination rates in addition to premiums written. Therefore, this allows us to examine the pure insurance demand change separated from the insurance price change. We conduct the same regression analysis using the number of new policies and policy termination rates instead of the direct premium written growth. The results are consistent with the previous findings. That is, termination rates are negatively associated with the solvency margin ratio changes, and the number of new policies has a positive relationship with the solvency margin ratio changes among foreign life insurers. Like the premium growth result, demand is not sensitive to ratings changes. The overall results provide some evidence that market discipline exists among foreign life insurers. However, unlike the U.S. market, our results suggest that ratings do not play an important role in a life insurance purchase decision.

The paper is organised as follows. The review on the Japanese insurance market is summarised next. The following section presents our data. Methodology and results are discussed in the penultimate section, and then the paper concludes.

The insurance industry in Japan

The Japanese insurance market is the second largest insurance market in the world after the U.S. market.3 Total direct premium written in 2009 is U.S.$506 billion, which corresponds to 12.44 per cent of world insurance premiums written.

The history of the insurance industry in Japan is fairly long. The first life insurance company in Japan was established in 1881, and the first non-life insurance company (a foreign company) was established in 1853, with the first domestic non-life company entering the market 25 years later. Some foreign insurers were allowed to do business in medical and cancer insurance lines, but the life insurance sector was traditionally dominated by domestic insurers until the late 1990s, when regulatory changes and collapses of domestic insurers allowed foreign insurers to step into the life insurance market.

Supported by an economic boom in Japan, the insurance industry grew drastically from the 1950s to the mid-1990s, with an average growth rate greater than 20 per cent per year.7 During this period, banks and insurance companies were strictly regulated under the so-called non-competitive “convoy system”. All banks offered the same interest rates, and all insurance companies offered the same premiums.Footnote 8 The risks were spread evenly across all banks and insurers under the supervision of the Ministry of Finance. Under this fully regulated, non-competitive system, not a single insurer in Japan collapsed, and thus insurance company failure was not something that consumers needed to worry about.

However, the economic bubble burst and Japan entered into an economic recession beginning in the early 1990s. Insurance companies’ assets deteriorated rapidly due to the persistently low interest rates, sluggish stock prices and high termination rates. Insurers struggled to provide guaranteed interest rates embedded in many savings-type policies during the “lost decade”. The guaranteed interest rate problem caused more serious problems for life insurers, but this problem was not limited to life insurers, since non-life products also have a saving feature in Japan. To revive the Japanese financial market, a large-scale financial system reform was done in Japan between 1996 and 2001. “The convoy system” of financial institutions was reformed into a competitive market system. The Insurance Business Law was also revised substantially.Footnote 9

To promote competition, the insurance rates of non-life insurance products were liberalised.Footnote 10 Traditionally, medical and cancer insurance products were only sold by foreign insurers, and the life insurance market was fully dominated by domestic life insurance companies. The law also allowed cross-industry business: life insurance companies were allowed to enter the non-life insurance market and vice versa. Foreign insurers could enter into the life insurance market, selling life and annuity products in addition to medical and cancer insurance.

In April 1997, the Nissan Mutual Life Insurance Company recorded the first insurance company bankruptcy in Japan during the post-war period. As mentioned, since 1997 ten insurance companies have declared bankruptcy. Sixteen out of 31 registered life insurers in 1996 remained unchanged in 2006, and the rest either failed or went through mergers and acquisitions.Footnote 11 After the first insurer failure, the Non-life Insurance Policyholder Protection Corporation of Japan and the Life Insurance Policyholder Protection Corporation of Japan were established in 1998 to provide benefit protections to the policyholders of insolvent insurers. The two corporations protect benefits (with certain limitations) in the event of insurer failure.Footnote 12 Although most companies were taken over by other insurers or joint ventures, and the policyholder protections were in place, benefits on more than 10 million policies were reduced as a result of the series of bankruptcies from 1997 to 2001. Guaranteed interest rates, which reached around 6–7 per cent, were reduced by 0.3 per cent to 2.75 per cent and a surrender penalty was imposed.Footnote 13

Before 1998, insurers reported their solvency margin ratios to the Ministry of Finance but were not required to disclose it to consumers. Similarly, most Japanese insurers did not have financial strength ratings. With the lack of consumer risk awareness and under a bankruptcy-free environment, consumers did not request this information either. Therefore, we can expect that market discipline did not exist until the 2000s. However, the series of bankruptcies and benefit reductions that followed resulted in a loss of confidence in the insurance companies. The Insurance Business Law in 1998 required all insurers to publicly disclose solvency margin ratios. Insurance agents and commercial brokers started to mention solvency margin ratios starting in the early 2000s. The demand for credit ratings also increased. As a result, the number of insurers with financial strength ratings increased rapidly in the 2000s.

During the late 1990s and early 2000s, many foreign insurers entered into the Japanese market and took over Japanese insurance companies during the time following the deregulation that accompanied the revision of the 1996 Insurance Business Law. Some existing foreign insurers, who previously only concentrated on medical and cancer insurance, now entered the life insurance sector. This was mostly done by taking over the failed Japanese domestic insurers. These new foreign insurers were free from the distress of the burst insurance bubble, so they could attract consumers who were concerned about the quality of insurers. In the early 2000s, foreign insurers aggressively promoted themselves through commercials massively emphasising their solid credit ratings and solvency margin ratios. As a result, foreign insurers rapidly gained market share in the 2000s.7 Knowing that the competitive advantage of foreign insurers in Japan is a strong capital position unburdened by high assured interest rates, it could be that those consumers with better risk awareness were attracted to foreign insurers. Therefore, we conjecture that the risk sensitivity of foreign insurance demand can be higher for foreign insurers than domestic insurers.

Data

We hand-collected the annual reports of all non-life and life insurers in Japan for the 2001–2009 period.Footnote 14 The initial sample includes 299 non-life insurer firm-year observations and 325 life insurer firm-year observations. We collect solvency margin ratios and all other firm-specific variables used in our study from the annual reports. Annual reports also disclose financial strength ratings if available. We also collected ratings information from various other sources such as the Moody's website (Moodys.com), but most ratings are collected from annual reports. Table 1 shows that the number of companies with financial strength ratings increased during the 2001–2009 sample period. The percentage of insurers with credit ratings increased from 44 per cent to 58 per cent in the non-life insurance industry and 60 per cent to 82 per cent in the life insurance industry.Footnote 15 This rise may indirectly indicate the increased consumer demand for insurer financial quality in Japan.

Insurers in our sample receive ratings from four global ratings agencies (S&P, Moody's, Fitch and A.M. Best) and two domestic ratings agencies (R&I and JCR). Table 1 shows that most rated insurers have ratings from S&P, and some of them have second or third ratings from other agencies. Only 4 per cent of the rated non-life insurers and 20 per cent of the rated life insurers had ratings from other rating agencies without an S&P rating.

Our study examines the relationship between financial strength changes, as measured by solvency margin ratio changes and ratings changes, and insurance demand change, as measured by direct premium written growth. Table 2 shows the number of ratings changes during the sample periods for life and non-life insurers. The first and second rows in Table 2 show the number of upgrades and downgrades by any ratings agencies. Some firm-year observations are double counted here because they received upgrades or downgrades from multiple rating agencies in the same year. So we also present the number of upgrades and downgrades of the S&P rating only in the third and fourth rows. Table 3 shows the correlation between ratings changes by different rating agencies. Some correlations, such as the correlation between A.M. Best and Moody's, are not available because none of the insurers had ratings from both agencies. The correlation between the S&P ratings changes and ratings changes of other agencies are all greater than 0.3. In order not to double count the same firm-year observations in our analysis, we only use the sample to the insurers rated by S&P, the most prevalent ratings in Japanese insurance industry. We limit our attention to life insurance demand from this point because there were only four non-life insurer rating downgrades during the sample period.Footnote 16 Because we use the change in rating variable in our analysis, we exclude those insurers with only 1-year rating information. Our final sample consists of 28 life insurers in Japan. The list of insurers used in this study is provided in Appendix C.

Table 4 shows the S&P ratings of both non-life and life insurers. Financial strength ratings for rated insurers were fairly strong during the sample period. None of the non-life insurers in Japan had an AAA rating, but fewer than two rated insurers have an S&P rating lower than A– in both the life and non-life industry during the sample period of 2001–2009.

Methodology and results

We run the following regression model to examine the relationship between financial strength change and life insurance demand growth.

where Growthi(t,t−1) is the insurance demand growth estimated as the log direct premium written growth from year t−1 to year t. UP i,t is a dummy variable equal to one when there is a rating upgrade in year t. DOWN i,t is a dummy variable for a rating downgrade. SOLi,t−1 is a solvency margin ratio change from year t−2 to t−1. One year lagged solvency margin ratio change is used in this model because the solvency margin ratios become public at the end of the year and thus insurance demand in year t should be related to the solvency margin in year t−1. DPWi,t−1 is a log direct premium written in year t−1. D Year and D firm are arrays of year and firm dummy variables used to control time and firm fixed effect. ɛ it is an error term for firm i in year t. The summary statistics of variables used in the regression are shown in Table 5.

The regression results are presented in Table 6. We provide both OLS and fixed effect regression results. Year and firm fixed effects are included but not reported in the table. In columns (1) and (5), we present a regression result without the solvency margin ratio change. The insignificantly negative coefficients of UP and DOWN imply that the direct premium written is insensitive to the ratings upgrades and downgrades. In order to test whether ratings provide extra information to policyholders after controlling for solvency margin ratio changes, we add solvency margin ratio changes in columns (2) and (6). Solvency margin ratio changes are insignificant in both regressions, and the coefficients of ratings change variables are robust to this addition.

Columns (3) and (7) include two additional variables: Foreign and S. Margin Change-Foreign. Foreign is a dummy variable equal to one when an insurer is a subsidiary of a foreign insurer or is established by foreign capital. S. Margin Change-Foreign is an interaction variable of solvency margin ratio change and the Foreign dummy variable. These two variables are included in the base model in order to examine whether a different level of market discipline exists for foreign insurers. Similarly, we include Up-Foreign and Down-Foreign interaction variables in columns (4) and (8). The result confirms our conjecture that the insurance demands of foreign insurers are more sensitive to financial strength. The S. Margin-Foreign is significantly positive in both regressions. The result implies that life insurance demands on domestic insurers are not sensitive to the financial strength, but the insurance demands on foreign life insurers are sensitive to solvency margin ratio changes. To sum up, only the demand for foreign life insurers is credit sensitive and Japanese consumers react to the solvency margin changes but not to the rating changes.

The demand sensitivity of foreign insurers could have several interpretations. First, eight out of ten bankrupt insurers in Japan were life insurers. Most of the failed insurers were taken over by foreign insurers, which means that more than 10 million contracts that experienced benefit cuts were concentrated in foreign life insurers. The policyholders who experienced this once could be more sensitive to financial strength. Second, those foreign insurers which did not take over failed domestic life insurers were mostly new to the Japanese life insurance industry, as prior to the Business Insurance Law change in 1996, they were only allowed to sell medical and cancer insurance. In order to expand their business into the new market, they aggressively advertised their strong solvency margin ratios and credit ratings more than domestic insurers who already had established their brand name in Japan did. However, it is still unclear why foreign life insurance demand is sensitive to the solvency margin ratio changes and not the rating changes. It could be that not all Japanese insurers have ratings yet and the regulators and practice have emphasised solvency margin ratios more than ratings in Japan.

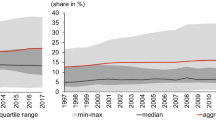

In Table 7, we investigate whether the market discipline strengthened during the later sample period than the earlier period. We run the same sets of regressions as in Table 6 with two sample periods spanning 2002–2005, and 2006–2009. Up-Foreign and Down-Foreign variables could not be included due to a very limited number of observations. The coefficients are mostly robust, except for one noticeable change: the coefficient of S. Margin Change-Foreign is insignificant in the 2002–2005 regression, whereas the same coefficient is significant and the magnitude is slightly increased in the 2006–2009 regression. The coefficients suggest that market discipline has improved in Japanese market in more recent years compared to the early 2000s.

Robustness tests

Alternative demand measures

As a robustness check, we utilise termination rates and the number of new policies as measures of insurance demand changes. Policy termination rates and the number of new policies can be better insurance demand measures than direct premium written because direct premium written shows a total effect of insurance demand and price. However, we used direct premium written as a main dependent variable because termination rates and the number of new policies are only available for life insurers. The results are shown in Table 8. The robustness checks confirm the conclusion in Table 6: life insurance demand is not sensitive to ratings changes, but foreign life insurer demand is sensitive to solvency margin ratio changes. Termination rates for foreign life insurers decrease following the solvency margin ratio increase, and the number of new policies increases following the solvency margin ratio increase. This result also implies that life insurance demand sensitivity is not only realised by new sales but also by policy surrender.

Robustness tests for endogeneity

Our main analysis in this section on Robustness tests assumes that ratings changes may affect insurance demand but not the other way around. That is, the model assumes that demand change does not drive ratings change. However, it is possible that ratings agencies may upgrade or downgrade an insurer when the premiums of the insurer grow or decline. If this is the case, our main regression model is not free from the endogeneity problem.

The dependent variable in the regression model is the insurance demand change from year t−1 to year t. The demand information in year t becomes available at the beginning of each calendar year t+1. The ratings change variables are the ratings changes during year t. The year t rating is mostly based on the accounting and operation results in year t−1. Therefore, we expect that the demand change from year t−1 to year t may lead year t+1's rating and not year t's rating. However, if the ratings agencies have access to quarterly operations performance information, the endogeneity could be present.

In order to examine whether this possible endogeneity biases our results and leads to the wrong conclusion, we conduct two robustness check tests in this section. First, we run the 2SLS model where we instrument the DOWN and Down-Foreign variables with a solvency margin change from year t−1 to t, an operating income change from t−1 to t, and the interaction of these two variables with a Foreign dummy variable. We did not include UP and UP-Foreign in this model because we cannot include four endogenous variables due to the lack of instrument variables. Both UP and UP-Foreign are insignificant in the main regression model.

Alternatively, we conduct regressions without the potentially problematic ratings variables. The solvency margin is less likely to have the endogeneity problem because the solvency margin in the model is the solvency margin change from year t−2 to t−1, which is announced at the end of year t−1 or at the beginning of year t. The demand in year t cannot affect the solvency margin change from year t−2 to t−1.

The results of these two robustness tests are presented in Table 9. The results confirm the findings in the previous section. The Solvency Margin Change-Foreign variable is significantly positive in the life insurance demand regression.

Conclusion and discussions

Financial institutions in Japan changed from the “convoy system” to a competitive market in the 1990s. Insurance company failure did not exist until the first company bankruptcy (Nissan Mutual Life Insurance Company) in 1997. Insurance company insolvency risk awareness among consumers in Japan, therefore, was low before this event. After a series of insurer bankruptcies and the Insurance Business Law revision, we expect that insurer insolvency risk awareness among consumers increased. In this study, we empirically test the market discipline of Japanese life and non-life insurance companies in the years 2002–2009.

Our research reviews the current status of credit rating of life and non-life insurance companies in Japan and examines the relationship between financial strength changes and insurance demand growth. We run OLS and fixed effect regressions on an unbalanced panel of data. The dependent variable is log direct premium written growth. We utilise ratings changes and solvency margin ratio changes as measures of financial strength changes. Life insurance premiums are irrelevant with ratings changes but demand for foreign life insurers has a positive relationship with solvency margin ratio changes. We also find that the market discipline has become stronger during the later sample periods than the earlier periods.

In addition, we examine the termination rates and the number of new policies after life insurers’ financial strength changes. Both termination rates and the number of new policies are insensitive to ratings changes, but foreign life insurers’ termination rates and the numbers of new policies have a significantly positive relationship with solvency margin ratio changes. The results imply that foreign life insurer demand sensitivity to solvency margin ratio changes is due to a combination of the change in termination rates and change in new contracts.

Overall, our empirical findings confirm that limited market discipline exists in Japan. We find that more insurers receive credit ratings from both domestic and global rating agencies. However, it seems that Japanese consumers do not pay much attention to the ratings yet. Although limited, market discipline exists in Japanese market as can be seen in the results that the demands for foreign life insurance companies were sensitive to the solvency margin ratio changes. Our results also indicate improving market discipline: the demand sensitivity became stronger in the later 2000s than the earlier 2000s. The reason for rating insensitivity could be that not all insurers have ratings yet and the regulations and practices have emphasised solvency margin ratios more than ratings. It will be interesting to see how the demand sensitivity changes in the future as more insurers receive financial strength ratings from rating agencies, which are more comprehensive measures for the default risks of insurers than the solvency margin ratios, and as consumer risk awareness keeps increasing.

Notes

4 The list of these ten bankrupt insurers is provided in Appendix A.

6 More information on the solvency margin ratio in Japan can be found here: www.sonpo.or.jp/en/regulations/002.html.

8 The Property and Casualty Insurance Rating Organization (PCIRO) and the Automobile Insurance Rating Organization of Japan (AIRO) determined the rate for non-life insurance products. There was no ratings organisation in the life insurance sector, but all of the insurance companies offered the same rates to customers because of the Ministry of Finance's adoption of the “convoy system”, which resulted in insurers needing permission from or approval by the Ministry of Finance for any rate changes.

Non-life insurers have become able to set a rate 10 per cent below or above the set rate by PCRIO or AIRO. For large fire insurance policies, insurers had the freedom to set their own rates (Yamori and Okada, 2007).

The summary of policyholder protection for life and non-life insurance is provided in Appendix B.

All insurers in our sample disclose their annual reports on their company websites.

The ratings data of Table 1 is solely based on the ratings information provided in insurers’ annual reports. Not all annual reports were available to us, especially for the earlier years. As a result, the number of observations increases, but this does not mean the number of insurers increased during the sample period.

We did the same analysis with non-life insurance companies as well. The final sample has 16 non-life insurers. We do not report the results here because we find that the results are not statistically reliable as the sample size for rating changes are too limited. The fixed effect regression results suggest that non-life insurance demand is sensitive to rating downgrades but OLS results indicate that the insurance demand is insensitive to rating changes. In both cases, demands are insensitive to solvency margin changes. Results are available upon request.

A life insurance policy is considered as a high assumed interest rate policy when a policy has an assumed interest rate constantly over the base rate in the past 5 years. Base rate may change over time.

References

Epermanis, K. and Harrington, S.E. (2006) ‘Market discipline in property/casualty insurance: Evidence from premium growth surrounding changes in financial strength ratings’, Journal of Risk, Credit, and Banking 38 (6): 1515–1544.

Freeman, M. and Fujiki, M. (2001) ‘Why some Japanese insurers are failing’, Emphasis 2001/3. Available at: http://www.towersperrin.com/tp/getwebcachedoc?webc=TILL/U.S.A/2001/200109/2002041809.pdf.

Hotta, K. (2007) ‘Insurance system and safety net’, Mita Business Review, Keio University, 50 (4): 97–119.

Insurance Study Group, (ed.) (1996) Explanation of Insurance Business Law, Tokyo: Taisei Shuppansya.

JETRO (2005) ‘Ongoing change in Japan's life insurance industry’, Business Topics (c) JETRO Japan Economic Monthly August 2005. Available at: http://www.jetro.go.jp/en/reports/market/pdf/2005_48_m.pdf.

Swiss Re (2010) ‘World Insurance in 2009’, Sigma No 2/2010.

Yamori, N. and Okada, T. (2007) ‘The Japanese insurance market and companies: Recent trends’, in J.D. Cummins and B. Venard (eds.) Handbook of International Insurance between Global Dynamics and Local Contingencies, Huebner International Series on Risk, Insurance and Economic Security, Vol. 26, XXIX, Springer: New York, pp. 147–204.

Zanjani, G. (2002) Market discipline and government guarantees in life insurance, Unpublished Working Paper, Federal Reserve Bank of New York.

Author information

Authors and Affiliations

Appendices

Appendix A

Insurance company insolvency history in Japan from 1997–2010

Non-life insurance industry

- 1. 2000 May:

-

Dai-ichi Mutual Fire and Marine Insurance Company

- 2. 2001 Nov:

-

Taisei Fire and Marine Insurance Company

Life/health insurance industry

- 1. 1997 Apr:

-

Nissan Mutual Life Insurance

- 2. 1999 Jun:

-

Toho Mutual Life Insurance

- 3. 2000 May:

-

Dai-Hyaku Mutual Life Insurance

- 4. 2000 Aug:

-

Taisho Mutual Life Insurance

- 5. 2000 Oct:

-

Chiyoda Mutual Life Insurance

- 6. 2000 Oct:

-

Kyoei Life Insurance

- 7. 2001 Mar:

-

Tokyo Mutual Life Insurance

- 8. 2008 Oct:

-

Yamato Life Insurance

Appendix B

Policyholder protection in the Japanese insurance industry

Non-life Insurance Policyholders Protection Corporation of Japan (NPPCJ)

The Non-life Insurance Policyholders Protection Corporation of Japan (NPPCJ) was established in 1998 as part of an amendment of the Insurance Business Law to protect policyholders in insolvent non-life insurers. The NPPCJ assists a reliever company willing to take over an insolvent insurer or undertake insurance contracts if a takeover is unsuccessful. By law, all non-life insurers must join the NPPCJ.

Some insurance policies such as auto liability and earthquake insurance are 100 per cent protected, but other protections are incomplete. The list of compensation rates are summarised in the following table. In Japan, non-life insurance policies also have a saving feature, thus they have a cash value.

Life Insurance Policyholders Protection Corporation of Japan (PPCJ)

In April 1996, the policyholders’ protection fund was established as an internal organisation within the Life Insurance Association. Member companies of the Life Insurance Association could opt in to the fund. The fund provides assistance in the transfer of funds and insurance policies to other insurers smoothly in case of insurer bankruptcy.Footnote 17 The PPCJ was established in 1998, along with the NPPCJ, to protect the policyholders of insolvent life insurers. All life insurers operating in Japan automatically become members of PPCJ. The PPCJ protects the benefits of all life insurance and annuity contracts, except for investment-linked life policies and life insurance company-operated corporate pension plans. The protection is also limited for covered insurance contracts. When a life insurance company becomes insolvent, the liability reserve is reduced and the assumed and guaranteed interest rates are adjusted downwards. Originally, a uniform 90 per cent of technical provisions protection was applied to all life insurance policies without significant investment features. However, a “bill for partial revision of the Insurance Business Law, etc.”, was passed by the House in April 2005. The new changes now cut the protected benefit for life insurance policies with high assumed rates of interest.Footnote 18 Specifically, the compensation ratio of high assumed interest rate policies will be “90 per cent—the sum of (each assumed interest rate in the past 5 years—the base rate)/ 2”.

(Source: www.seihohogo.jp/; www.seiho.or.jp/english/Publication/2007-2008/33.pdf).

Appendix C

Appendix D

Rights and permissions

About this article

Cite this article

Park, S., Tokutsune, Y. Do Japanese Policyholders Care About Insurers’ Credit Quality?. Geneva Pap Risk Insur Issues Pract 38, 1–21 (2013). https://doi.org/10.1057/gpp.2012.32

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/gpp.2012.32