Abstract

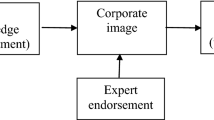

This study explores the role of advertising strategies (informational versus transformational) in consumers’ purchase intentions related to mutual funds. Moreover, this study investigates the possible moderating role of gender and financial literacy in advertising strategy. Findings of the experimental approach applied in this study suggest that advertisement strategy does influence investment intention related to the mutual funds. We also found that females are less likely to purchase mutual funds when exposed to transformational advertisements. Moreover, investors with higher financial literacy prefer informational advertisements. The results also indicate that the informational advertisements are more useful and increase awareness levels among investors.

Similar content being viewed by others

References

Abernethy, A.M. and Franke, G.R. (1996) The information content of advertising: A meta-analysis. Journal of Advertising 25 (2): 1–17.

Ahn, H., Song, Y.A. and Sung, Y. (2011) When the going gets tough, ads become straightforward but multi-appealed: The influence of the recession on financial services advertising appeals. Journal of Financial Services Marketing 16 (3): 230–243.

Anagol, S., Marisetty, V., Sane, R. and Venugopal, B. (2013) Distribution Fees and Mutual Fund Flows: Evidence from a Natural Experiment in the Indian Mutual Funds Market, No. 2013-004, Mumbai, India: Indira Gandhi Institute of Development Research.

Bajtelsmit, V. and Bernasek, A. (1996) Why do women invest differently than men? Financial Counselling and Investing 7 (1): 1–10.

Barber, B. and Odean, T. (1999) Boys will be Boys: Gender Overconfidence and Common Stock Investment. Working Paper, University of California – Davis, Davis, CA.

Barber, B.R., Odean, T. and Zheng, L. (2005) Out of sight, out of mind: The effects of expenses on mutual fund flows. Journal of Business 78 (6): 2095–2119.

Barrett, P.M., Duffy, A.L., Dadds, M.R. and Rapee, R.M. (2001) Cognitive–behavioral treatment of anxiety disorders in children: Long-term (6-year) follow-up. Journal of Consulting and Clinical Psychology 69 (1): 135.

Benyamini, Y., Leventhal, E. and Leventhal, H. (2000) Gender differences in processing information for making self-assessments of health. Psychosomatic Medicine 63 (3): 354–364.

Bergstresser, D., Chalmers, J.M.R. and Tufano, P. (2009) Assessing the costs and benefits of brokers in the mutual fund industry. Review of Financial Studies 22 (10): 4129–4156.

Birnbaum, D.W., Nosanchuk, T.A. and Croll, W.L. (1980) Children’s stereotypes about sex differences in emotionality. Sex Roles 6 (3): 435–443.

Burns, A.C., Biswas, A. and Babin, L.A. (1993) The operation of visual imagery as a mediator of advertising effects. Journal of Advertising 22 (2): 71–85.

Butler, D.D. and Abernethy, A.M. (1994) Information consumers seek from advertisements: Are there differences between services and goods? Journal of Professional Services Marketing 10 (2): 75–92.

Capon, N., Fitzsimmons, G.J. and Prince, R.A. (1996) An individual level analysis of the mutual fund investment decision. Journal of Financial Services Research 10 (1): 59–82.

Cronqvist, H. (2006) Advertising and Portfolio Choice. Working Paper, Social Science Research Network, http://ssrn.com/abstract=920693.

Cui, G., Liu, H., Yang, X. and Wang, H. (2013) Culture, cognitive style and consumer response to informational vs. transformational advertising among East Asians: Evidence from the PRC. Asia Pacific Business Review 19 (1): 16–31.

Darley, W.K. and Smith, R.E. (1995) Gender differences in information processing strategies: An empirical test of the selectivity model in advertising response. Journal of Advertising 24 (1): 41–56.

Dichter, E. (1964) Handbook of Consumer Motivation. New York: McGraw-Hill.

Dube, L. and Morgan, M.S. (1998) Capturing the dynamics of in-process consumption emotions and satisfaction in extended service transactions. International Journal of Research in Marketing 15 (4): 309–320.

Fennis, B.M., Das, E. and Fransen, M.L. (2012) Print advertising: Vivid content. Journal of Business Research 65 (6): 861–864.

FINRA Investor Education Foundation (2013) National Financial Capability Study, http://www.usfinancialcapability.org/quiz.php.

Fishbein, M. and Ajzen, I. (1975) Belief, Attitude Intention and Behavior: An Introduction to Theory and Research. Reading, MA: Addison-Wesley.

Fisher, R.J. and Dubé, L. (2005) Gender differences in responses to emotional advertising: A social desirability perspective. Journal of Consumer Research 31 (4): 850–858.

Fox, J., Bartholomae, S. and Lee, J. (2005) Building the case for financial education. Journal of Consumer Affairs 39 (1): 195–214.

Geer, J.F. (1997) Brand war on wall street – Financial services firms are spending millions on their brand names to coral your invested assets. Fortune World 20 (May): 54–63.

Graham, J.F., Stendardi Jr., E.J., Myers, J.K. and Graham, M.J. (2002) Gender differences in investment strategies: An information processing perspective. International Journal of Bank Marketing 20 (1): 17–26.

Haslem, A. (2012) Mutual funds and individual investors: Advertising and behavioral issues, 3 October. Available at SSRN: http://ssrn.com/abstract=2146632 or http://dx.doi.org/10.2139/ssrn.2146632.

Haslem, J.A. (2010) Mutual funds and investor choice. Journal of Indexes 16 (6): 42–44, 58.

Hastings, J. and Tejeda-Ashton, L. (2008) Financial Literacy, Information, and Demand Elasticity: Survey and Experimental Evidence from Mexico. NBER Working Paper No. 14538.

Hilgert, M., Hogarth, J. and Beverly, S. (2003) Household financial management: The connection between knowledge and behavior. Federal Reserve Bulletin 89: 309–322.

Howard, D.J. and Gengler, C. (2001) Emotional contagion effects on product attitudes. Journal of Consumer Research 28 (2): 189–201.

Huhmann, B.A. and Bhattacharyya, N. (2005) Does mutual fund advertising provide necessary investment information? International Journal of Bank Marketing 23 (4): 296–313.

Jones, M.A. and Smythe, T. (2003) The information content of mutual fund print advertising. Journal of Consumer Affairs 37 (1): 22–41.

Kozup, J. and Hogarth, J.M. (2008) Financial literacy, public policy, and consumers’ self-protection – More questions, fewer answers. Journal of Consumer Affairs 42 (2): 127–136.

Kozup, J., Howlett, E. and Pagano, M. (2008) The effects of summary information on consumer perceptions of mutual fund characteristics. Journal of Consumer Affairs 42 (1): 37–59.

Kring, A.M. and Gordon, A.H. (1998) Sex differences in emotion: Expression, experience, and physiology. Journal of Personality and Social Psychology 74 (3): 686–703.

Kuhnen, C.M. and Knutson, B. (2011) The influence of affect on beliefs, preferences and financial decisions. Journal of Financial and Quantitative Analysis 46 (3): 605–626.

Lee, A.Y. and Aaker, J.L. (2004) Bringing the frame into focus: The influence of regulatory fit on processing fluency and persuasion. Journal of Personality and Social Psychology 86 (2): 205.

Lee, T.D., Chung, W. and Taylor, R.E. (2011) A strategic response to the financial crisis: An empirical analysis of financial services advertising before and during the financial crisis. Journal of Services Marketing 25 (3): 150–164.

Lee, T.D., Yun, T. and Haley, E. (2013) Effects of mutual fund advertising disclosures on investor information processing and decision-making. Journal of Services Marketing 27 (2): 104–117.

Lord, K.R. and Putrevu, S. (2009) Informational and transformational responses to celebrity endorsements. Journal of Current Issues and Research in Advertising 31 (1): 1–13.

Lusardi, A. and Mitchell, O.S. (2006) Financial Literacy and Planning: Implications for Retirement Wellbeing. Working Paper, Pension Research Council, Wharton School, University of Pennsylvania.

Lusardi, A. and Mitchell, O.S. (2007) Baby boomer retirement security: The role of planning, financial literacy, and housing wealth. Journal of Monetary Economics 54 (1): 205–224.

Lusardi, A. and Mitchell, O.S. (2009) How Ordinary Consumers Make Complex Economic Decisions: Financial Literacy and Retirement Readiness. NBER Working Paper 15350.

Lusardi, A. and Tufano, P. (2009) Debt Literacy, Financial Experiences, and Overindebtedness. NBER Working Paper No. 14808.

Meyers-Levy, J. and Loken, B. (2014) Revisiting gender differences: What we know and what lies ahead. Journal of Consumer Psychology.

Meyers-Levy, J. and Maheswaran, D. (1991) Exploring differences in males’ and females’ processing strategies. Journal of Consumer Research 18 (1): 63–70.

Meyers-Levy, J. and Sternthal, B. (1991) Gender differences in the use of message cues and judgments. Journal of Marketing Research 28 (1): 84–96.

Monticone, C. (2010) How much does wealth matter in the acquisition of financial literacy? Journal of Consumer Affairs 44 (2): 403–422.

Mortimer, K. (2008) Identifying the components of effective service advertisements. Journal of Services Marketing 22 (2): 104–113.

Muller, S. and Weber, M. (2010) Financial literacy and mutual fund investments: Who buys actively managed funds? Schmalenbach Business Review 62 (2): 125–153.

Perry, V.G. and Morris, M.D. (2005) Who is in control? The role of self‐perception, knowledge, and income in explaining consumer financial behavior. Journal of Consumer Affairs 39 (2): 299–313.

Petty, R.E. and Cacioppo, J.T. (1981) Attitudes and Persuasion: Classic and Contemporary Approaches. Dubuque, IA: William C. Brown Company.

Puto, C.P. and Wells, W.D. (1984) Informational and transformational advertising: The differential effects of time. Advances in Consumer Research 11 (1): 638–643.

Rogers, T.B. (1983) Emotion, imagery, and verbal codes: A closer look at an increasingly complex interaction. In: J.C. Yuille (ed.) Imagery, Memory and Cognition. Hillsdale, NJ: Erlbaum.

Rossiter, J.R. and Percy, L. (1980) Attitude change through visual imagery in advertising. Journal of Advertising 9 (2): 10–16.

Sisodia, S. and Chowdhary, N. (2012) Use of illustrations in recruitment advertising by service companies. Journal of Services Research 12 (2): 81–109.

Stango, V. and Zinman, J. (2007) Fuzzy Math and Red Ink: When the Opportunity Cost of Consumption is Not What It Seems. Working Paper, Dartmouth College.

Van Rooij, M., Lusardi, A. and Alessie, R. (2011) Financial literacy and stock market participation. Journal of Financial Economics 101 (2): 449–472.

Wiener, J. and Doescher, T. (2008) A framework for promoting retirement savings. Journal of Consumer Affairs 42 (2): 137–164.

Wonder, N., Wilhelm, W. and Fewings, D. (2008) The financial rationality of consumer loan choices: Revealed preferences concerning interest rates, down payments, contract length, and rebates. Journal of Consumer Affairs 42 (2): 243–270.

Wilcox, R.T. (2003) Bargain hunting or star gazing? Investors’ preferences for stock mutual funds. Journal of Business 76 (4): 645–663.

Yim, C.K.B., Chan, K.W. and Hung, K. (2007) Multiple reference effects in service evaluations: Roles of alternative attractiveness and self-image congruity. Journal of Retailing 83 (1): 147–157.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Dey, D., Chauhan, Y. & Chakraborti, R. Does advertising strategy matter in influencing mutual fund purchase?. J Financ Serv Mark 20, 23–33 (2015). https://doi.org/10.1057/fsm.2014.29

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1057/fsm.2014.29