Abstract

This paper empirically investigates credibility of inflation targets in Poland. It proposes a new methodology to estimate the impact of policy announcements on survey-based inflationary expectations. Credibility of inflation targets in Poland have been high – the public seems to have attached greater weight to policy announcements than to past macroeconomic developments, particularly after the formal introduction of inflation targeting. The proposed Bayesian approach makes efficient use of available information to provide an intuitive, time-varying measures of credibility.

Similar content being viewed by others

Notes

More recently, the concept of marginal credibility was investigated by Walsh (1999).

The announcements are informative even if the central bank deliberately attempts to manipulate private sector expectations.

Several studies empirically analyse average credibility, defined by Cukierman and Meltzer (1986) as a distance between targets and expectations, and further analysed in Faust and Svensson (2001). See Bernanke et al. (1999) for examples. Most of the empirical work finds a slow convergence of inflationary expectations to the targets.

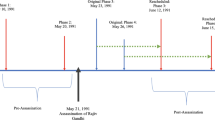

The extrapolation procedure assumes an asymptotic decline in the targeted inflation to a level consistent with price stability. The disinflation path is approximated by an AR1 process. Two data points needed to calibrate parameters of this process are given by the initial inflation and the terminal ‘price-stability’ rate, assumed at 2.5%. In all the calculations we use information sets currently available to economic agents. Targets were usually announced in September economic agents knew July inflation rates at the time of announcements.

2002–2003 targets implied temporary increases in inflation from prevailing levels to above the assumed ‘price-stability’ rate. The applied extrapolation procedure does not allow for such increases. Hence the line for 2002–2003 is at the assumed ‘price-stability’ level of 2.5%.

Inflationary expectations of other groups in the society are not analysed. Households' expectations may rely on the views of professional forecasts (Carroll, 2003); hence the effect of the target on these expectations may be delayed and indirect.

Since the CPI data are released with a lag, 12-month-ahead forecasts were effectively 13 months ahead starting from the previous month. After November 2000 the respondents were asked about 12-month-ahead forecasts starting from the previous month. The number of respondents reporting projections for December-to-December inflation gradually declined, potentially affecting the precision of estimates.

Estimating the model on levels with seasonal dummies produces similar results, but generates higher average RMSE for inflation forecasts. Stationarity of the variables is not tested, as we do not impose co-integration restrictions (short samples), and Bayesian predictive densities are valid irrespective of stationarity properties of the data.

See Ottaviani and Sorensen (2001) and references cited there for the analysis of strategic behaviour in forecasting.

Changes in the forecast horizon do not pose a problem for the applied estimation method, as it is based on a comparison of predictive densities, which are available for all forecast horizons.

After November 2000 the paper analyses the credibility of 11-month-ahead implicit targets to be consistent with changes in the Reuters survey (see footnote 7). The standard deviation of the distribution around the target in the second approach is assumed to be the same as for end-of-year targets.

The target was similarly adjusted at the beginning of 1999 to reflect low inflation in the first months of this year. Data-based forecast, however, remains significantly higher in this period, limiting the identification problem.

References

Bernanke, BS, Laubach, T, Mishkin, FS and Posen, AS . 1999: Inflation targeting: Lessons from the international experience. Princeton University Press: Princeton.

Bernanke, BS and Woodford, M . 1997: Inflation forecasts and monetary policy. NBER Working Paper 6157. National Bureau of Economic Research.

Carroll, C . 2003: Macroeconomic expectations of households and professional forecasters. Quarterly Journal of Economics 118 (1): 269–298.

Cukierman, A and Meltzer, AH . 1986: The credibility of monetary announcements. In: Neumann, MJM (ed). Monetary Policy and Uncertainty. Nomos Verlagsgesellschaft: Baden-Baden.

Faust, J and Svensson, LEO . 2001: Transparency and credibility: Monetary policy with unobservable goals. International Economic Review 42 (2): 369–397.

Johnson, D . 2002: The effect of inflation targeting on the behavior of expected inflation: Evidence from an 11 country panel. Journal of Monetary Economics 49 (8): 1521–1538.

Johnson, D . 2003: The effect of inflation targets on the level of expected inflation in five countries. The Review of Economics and Statistics 85 (4): 1076–1081.

Kadiyala, KR and Karlsson, S . 1997: Numerical methods for estimation and inference in Bayesian VAR-models. Journal of Applied Econometrics 12: 99–132.

Leiderman, L . 1995: Inflation targeting in Israel. In: Leiderman, L and Svensson, LEO (eds). Inflation Targets. Centre for Economic Policy Research: London.

Ottaviani, M and Sorensen, PN . 2001: The strategy of professional forecasting Discussion Papers 01-09. Institute of Economics, University of Copenhagen.

Walsh, CE . 1999: Announcements, inflation targeting and central bank incentives. Economica 66: 255–269.

Weber, AA . 1991: Reputation and credibility in the European Monetary System. Economic Policy 6: 57–102.

Zarnowitz, V and Lambros, LA . 1987: Consensus and uncertainty in economic prediction. Journal of Political Economy 95: 591–621.

Author information

Authors and Affiliations

Appendix

Appendix

BAYESIAN VAR MODEL

Following Kadiyala and Karlsson (1997), the VAR system has the following form:

where z t ={x t , yt−1, …, yt−p}, with y t a 1 × m vector of endogenous variables and x t a 1 × q vector of exogenous variables at time t. Γ is k(=q−pm) × m matrix of parameters. Stacking vectors y t , z t and u t for t=1, …, T into Y, Z and U gives a multivariate regression model:

Allowing the subscript i to denote the ith column vector, the equation for a variable i is y i =Zγ i +u i . By stacking the columns of Y, Γ and U into y, γ, u, it can be written as

Assuming that u∼N(0, Ψ⊗I) and using conjugate (Normal-Wishart) priors,

posterior distributions are given by

where  and

and

In the paper, prior means make each endogenous variable an AR1 process with autoregressive parameter α:

Other parameters of the Normal-Wishart prior are set so that elements of  coincide with elements of the variance–covariance matrix specified for parameters in equation i:

coincide with elements of the variance–covariance matrix specified for parameters in equation i:

where k is the lag length and σ i is a scale factor accounting for different variability in endogenous variables, set to the residual standard error from p-lag univariate autoregression for variable i.

Priors for the baseline forecasting model used in the paper are π1=0.1, π2=10e5 and α=0.95, resembling Minnesota priors, but assuming stationary and persistent processes for all series. An alternative specification makes this prior close to diffuse by setting π1=10e5.

Rights and permissions

About this article

Cite this article

Maliszewski, W. Credibility of Inflation Targets in Poland. Comp Econ Stud 50, 494–510 (2008). https://doi.org/10.1057/ces.2008.25

Published:

Issue Date:

DOI: https://doi.org/10.1057/ces.2008.25