Abstract

Many drinking water utilities face immense challenges in supplying sustainable, drought-resilient services to households. Here we propose a quantified framework to perform drought risk analysis on ~5600 potable water supply utilities and evaluate the benefit of adaptation actions. We identify global hotspots of present-day and mid-century drought risk under future scenarios of climate change and demand growth (namely, SSP1-2.6, SSP3-7.0, SSP5-8.5). We estimate the mean rate of unsustainable or disrupted utility supply at 15% (interquartile range, 0–26%) and project a global increase in risk of between 30–45% under future scenarios. Implementing the most cost-effective adaptation action identified per utility would mitigate additional future risk by 75–80%. However, implementing the subset of cost-effective options that generate sufficient tariff revenue to provide a benefit-cost ratio that is greater than 1 would only achieve 5–20% of this benefit. The results underline the challenge of attracting the financing required to close the climate adaptation gap for water supply utilities.

Similar content being viewed by others

Introduction

Water supply utilities are responsible for among the most basic services for humanity. However, their services to households are highly vulnerable to the impacts of climate change due to their dependence on variable water resources1. Drought-induced disruptions to water supplies (hereafter: ‘drought-induced disruptions’) are commonplace in many parts of the world, particularly in low- and middle-income countries where water supply infrastructure typically lacks the capacity and storage to buffer against hydrological variability2,3,4,5. Drought-induced disruptions are also of increasing concern in higher income countries where water supply infrastructure depends upon over-exploited water resources and may compete with agricultural and industrial (including energy) water users6,7,8. The risk of water shortages is expected to increase under future climate change and growth scenarios9, requiring the development of more resilient utility-operated infrastructure networks.

However, many utilities, particularly in low- and middle-income countries, are caught in a vicious cycle of disrupted services, low rates of tariff collection and inadequate investments in infrastructure resilience10,11,12. Utilities that cannot cover operational and reinvestment costs typically have lower creditworthiness, hindering their ability to attract sufficient financing to provide a reliable service to existing customers, let alone to extend network coverage to unserved populations, and leading to a reliance on government subsidies13. This has contributed to a large and widening infrastructure gap in many countries14,15. However, global development targets in the water sector do not typically speak to service reliability, but rather focus on the expansion of safe water access. Previous studies estimate the gap between current water infrastructure investment flows and what would be required to keep pace with population growth and the SDG targets13,16,17. However, the level of investment required to improve the climate resilience of utility water supplies at a global scale has rarely been the focus of previous studies. Failure to integrate climate risk and resilience considerations into water sector development may undermine the financial performance of utilities, hindering the extension of network of services, and could lock-in development in hazard-prone areas, leading to maladaptation.

Drought risk analysis methods provide useful insights into meteorological and hydrological variability across space under present day conditions18,19 and future scenarios of climate change and socioeconomic growth9,20,21,22. Research on drought risk in terms of impacts to water supply utilities has largely been undertaken for individual utilities23,24,25,26. On the other hand, analyses of global drought risk to water supply are often conducted at the catchment scale, without capturing utility-level characteristics such as leakage losses, service areas and desalination inputs27,28,29,30. Capturing this information is essential for understanding the propagation of meteorological/hydrological droughts through utility networks to dependent households. The appropriate scale for water management has long been discussed and debated31, however, so far, the utility-scale has rarely been employed as the unit for climate risk analysis at a global scale. This has limited the rigour with which previous studies have identified adaptation benefits for the potable water sector, i.e., in terms of risk reduction potential30,32,33,34,35,36. As such, there is large research gap in our understanding of utility-level climate risks, which could help policymakers and utilities identify the most effective adaptation actions and estimate associated financing needs.

Here, we propose a risk assessment framework to (1) perform drought risk analysis of 5600 water supply utilities under present day and future climate change scenarios and (2) evaluate the benefit (i.e., risk reduction potential) of alternative infrastructure investment opportunities to identify the optimal option type per utility. A model of each utility’s water balance that represents supply inputs (from surface water, renewable groundwater, and desalination), municipal water usage and leakage losses is established to estimate the risk of utilities being unable to supply their full customer base sustainably, measured in terms of Unsustainable Water Supply Days (UWSD). UWSD describes the number of days in a year during which a utility’s supply is unsustainable (i.e., utilities tap non-renewable groundwater supply) or disrupted due to drought (i.e., demand restrictions and/or reallocation strategies are implemented). We estimate tariff revenue at risk by multiplying UWSD by the daily equivalent tariff revenue per capita per utility. By comparing the impact of three alternative infrastructure interventions on UWSD and associated tariff revenue at risk against each option’s cost, discounted over its lifespan, we estimate the Benefit-Cost Ratio (BCR) of each option type and identify the most cost-effective intervention per utility.

We find a global UWSD of 510 million per year, increasing by 30–45% under future scenarios between 2030–2060. Countries with the highest risk utilities include Botswana, Ecuador, Mexico, Morocco, South Africa and Pakistan. 90% of the utilities currently at risk from water shortages would benefit from at least one of the three adaptation options considered, with desalination, leakage reduction and increased storage capacity offering the most cost-effective option for 10%, 60% and 30% of all considered utilities, respectively. Implementing the most cost-effective climate adaptation action per utility would mitigate ~75–80% of future increase in risk levels. However, implementing options with benefit-cost ratios > 1 would achieve only ~5–20% of this benefit and would skew benefits towards higher-income countries that typically set higher tariff rates.

Results

Present-day and future utility drought risk

Water supply at a utility level depends on the renewable sources available within their utility service area (renewable groundwater, river discharge and lake and reservoir storage), long-range water transfers and desalination inputs. Here, we quantify the balance between available supply inputs at the utility level against customer demand, accounting for distribution losses through leakage (see Methods). We quantify the risk of utilities being unable to supply their full customer base sustainably, i.e., without tapping non-renewable groundwater or implementing demand restrictions/reallocation strategies, in terms of UWSD. We employ this modelling approach to infer utility-level changes in risk under three future scenarios (SSP1-2.6, SSP3-7.0 and SSP5-8.5), combining plausible futures in terms of climate change and socioeconomic growth between 2030–2060.

48% of all modelled utilities are subject to present day drought-induced water supply disruptions (i.e., have an annual expected risk greater than zero). We estimate the mean rate of unsustainable or disrupted utility supply at 15% (interquartile range, 0–26%) under present day conditions. Figure 1a provides the annual expected UWSD as a fraction of each utility’s customer base multiplied by the number of days in a year. Countries with the highest risk utilities include Botswana, Ecuador, Mexico, Morocco, South Africa and Pakistan.

a Present day annual expected drought risk per utility (utility headquarter location plotted) measured in terms of the annual expected UWSD per utility as a fraction of a year-round disruption of their full customer base. b Change in future annual expected UWSD - projected under the middle-of-the-road SSP3-RCP7.0 scenario - relative to the present-day annual expected UWSD. Areas that are not covered by the utility database used for our analysis are indicated with hatching.

Overall, variations in water stress and total hydrological supply variability are the main drivers of risk. The influence of water stress and hydrological variability on risk varies across regions and climate scenarios, as shown in Supplementary Fig. 1. Note that our UWSD metric classifies the tapping of non-renewable groundwater as a disruption, as such, risk hotspots align with areas that depend on unsustainable groundwater abstraction, for example in North Africa, Western USA, Mexico, Northern India, the Arabian Peninsula, and Northern China37. Further, our UWSD metric does not capture contingency measures implemented by utility operators during or preceding acute drought-induced disruptions, such as imposing demand restrictions and/or reallocating flows from farms to cities; practices that are well-established in California38, for example. This is to reflect the reality that, in many parts of the world, these practices are not mainstreamed or fail-safe39 due to a lack of enabling physical and operational infrastructure. Further, demand restrictions can come at a cost to the quality of life of customers, particularly during drought conditions which are often coupled with extreme heat events40. Thus, our results on the effect of adaptation actions on reducing UWSD, also reflect the benefit of adaptation actions on the livability of cities.

Between 70–85% of at risk utilities are subject to increased risk in the future, depending on the choice of future scenario, increasing the global total UWSD by 30–45% between 2030–2060. Figure 1b shows the hotspots of elevated risk under the middle-of-the-road SSP3-7.0 projection. Future risk is driven by increasing hydrological variability and water stress (Supplementary Fig. 1), the latter, in turn, being driven by decreasing supply and increasing demand. Countries with utilities that are projected to be subject to the highest relative increase in risk in the future include the Philippines, Mozambique, India, Kenya, Australia and France, driven mainly by increasing water stress. However, there is substantial variation in future risk changes within countries (e.g., in China and India). This highlights the importance of local, utility-level characteristics (such as leakage losses and access to desalination) in determining their sensitivity to regional shifts in climate and hydrological processes. Figure 1b shows a clear negative risk signal in parts of Europe and Japan, where population growth is expected to decline across scenarios by the mid-century under SSP7.041. The change in future UWSD outputs per utility across other considered future scenarios is provided in Supplementary Fig. 2. The variation across considered future scenarios is driven more by changes in demand than by changes in supply, see Supplementary Fig. 3, with uncertainty in population growth inputs being responsible for the greatest uncertainty variation in results, see Supplementary Fig. 4.

The business case for adaptation

We utilise the risk framework to evaluate the impact of alternative climate adaptation actions - including increasing water storage capacity, desalination, and reducing leakage losses - on UWSD and associated tariff revenue at risk. By comparing the financial benefits (in terms of reduced tariff revenue at risk) and costs associated with a given option, discounted over its lifespan, we estimate the benefit-cost ratio (BCR) of each option type and identify the most cost-effective intervention per utility.

90% of the utilities currently at risk from water shortages would benefit from at least one of the three adaptation options considered. The remaining 10% of utilities are too water stressed and/or are too far from the coast for desalination to benefit from the maximum protection level we define for each adaptation option type considered in this study. For example, we assume that the maximum desalination and reservoir storage adaptation option design capacities cannot exceed 90% of utility customer demand, and leakage rates cannot fall below 10% of demand, see Supplementary Table 1. For these utilities, alternative adaptation options would have to be implemented, such as reducing upstream or customer demand. Implementing the most cost-effective, or utility-optimal, adaptation intervention for each of these utilities (i.e., the option with the greatest BCR) (Fig. 2a) would mitigate ~75–80% of additional future risk levels. The total estimated net cost (including reduced operational costs thanks to leakage reduction) of all utility-optimal adaptation options equates to 20 billion USD per year, discounted over a 30-year asset lifetime, equating to a quarter of the total annual tariff revenue received by benefitting utilities. As we have only considered the costs of implementing one option (where utilities would typically seek to implement a portfolio of climate adaptation options to reduce risk to what managers and operators deem to be a tolerable level24) and employ an incomplete utility database, this cost figure does not represent the global climate adaptation investment needs in water supply utilities.

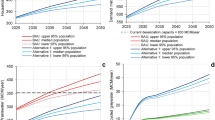

a BCR of optimal option identified per utility. BCR is measured as the mitigated tariff revenue at risk divided by the cost of each adaptation option. Utilities that were found not to benefit from adaptation are plotted in grey. Areas that are not covered by the utility database used for our analysis are indicated with hatching. b Present day annual expected risk, measured as the percentage of the region’s customer base at risk (in the present day), is plotted in light pink. Future risk (calculated as a mean of considered future scenarios) is plotted in dark red. The residual risk that could be achieved by implementing all utility-optimal adaptation options is plotted in light blue. The residual risk that could be achieved only by adaptation options with BCRs > 1 is represented in dark blue. Error bars indicate the range of results produced across considered future scenarios. Note that all future and residual risk values are taken as an average over the 2030–2060-time horizon projected for the adaptation analysis.

Overall risk and the risk mitigation potential of adaptation varies across regions, as summarised in Fig. 2b. South Asia and Sub-Saharan Africa regions have the greatest fraction of water supply utility customers at risk, with climate change and socioeconomic growth projections driving the greatest relative increase in risk in the Middle East and North Africa and Sub-Saharan Africa. Water stress is the main driver of risk in South Asia and Sub-Saharan Africa, leading to the greatest fraction of customers at risk on a chronic basis, see Supplementary Fig. 1. Future projections point to declining water supply trends and increasing demand in the Middle East and North Africa and Sub-Saharan Africa, as shown in Supplementary Fig. 3, increasing levels of stress and driving the relative increase in risk. Further details on the specifics of each scenario of climate change and socioeconomic growth are provided in Methods, under section ‘Drought hazard data’. Residual risk after implementing the optimal adaptation option falls to or below present-day risk in East Asia and the Pacific, Europe and Central Asia and Latin America and the Caribbean. Whereas in the Middle East and North Africa, Sub-Saharan Africa, North America and South Asia, the optimal option is insufficient to reduce risk to present day levels: a portfolio of adaptation options would be required to mitigate future increase in risk. This is substantially influenced by regional trends in population growth: regions including the Middle East, North Africa, Sub-Saharan Africa and South Asia have high population growth up to mid-century, making it more challenging for considered adaptation options to mitigate future risk below current levels. We find that implementing all utility-optimal options would also achieve a total reduction in tariff revenue at risk of 5–25 billion USD per year and, therefore, an overall BCR of 0.4–1.4. However, implementing options with BCRs > 1 would achieve only ~5–20% of this benefit. Options with BCRs > 1 are concentrated in countries that set higher tariff rates, which is typically the case in higher income countries such as in North America and Europe. As a result, the difference between residual risk and residual risk only with options with BCR > 1 is lower in higher income countries than for lower income countries in Fig. 2b. See the relationship between unit tariff rates and GDP per capita in Supplementary Fig. 5.

Optimal adaptation investment

Figure 3a shows the optimal option type identified per utility and Fig. 3b shows the regional breakdown of preferred option types. Error bars in Fig. 3b reflect the uncertainty around in our selection of each utility’s optimal option type. By factoring option costs for each option type in turn (e.g., desalination) by −/+25%, we compare the minimum/maximum BCR against the maximum/minimum BCR of the other two options (e.g., storage and leakage reduction) (factoring costs by +/−25%) and quantify the change in proportion of utility-optimal option type selected per region. For 60% of all utilities, leakage reduction would be the most cost-effective means of reducing water shortages. Indeed, the average utility loses more than a quarter of its distributed water supply42 and improving efficiency would reduce the costs of disruptions as well as the costs of operations. This makes reducing leakage a highly attractive and necessary climate adaptation investment opportunity, despite occasionally being overlooked in research30,35 and (in some cases) practice, in favour of supply-side options. Leakage reduction is most frequently selected to be the most cost-effective option across all but two regions, particularly in Latin America and the Caribbean and South Asia where leakage rates are relatively high42. For most coastal utilities, and 10% of utilities overall, desalination is the highest priority option, even when the high operation costs of desalination are considered. Desalination is the preferred option for the highest fraction of utilities in the Middle East and North Africa, aligning with trends in market growth for desalination in this region43, as well as East Asia and Pacific, North America and Europe and Central Asia. Greater storage is found to be a priority option in the remaining 30% of cases, where there is sufficient excess surface water available to capture and distribute. Reservoir storage is the preferred option for the highest fraction of utilities in the Middle East and North Africa and Sub-Saharan Africa, where countries typically have relatively low reservoir storage volumes per capita44.

a Optimal option type identified per utility. Utilities for which the adaptation options considered were ineffective at reducing risk are plotted in grey. Areas that are not covered by the utility database used for our analysis are indicated with hatching. b % fraction of all utilities where the optimal option is identified to be storage (navy), desalination (pink) and leakage reduction (orange) per region. Error bars represent the uncertainty in the optimal option type selection, induced by uncertainty in each option type’s cost.

Discussion

By implementing a generalised framework to perform drought risk analysis under present-day and future scenarios, we have, for the first time, evaluated the risk-reducing benefits and costs of alternative climate adaptation investments for water supply utilities at a global scale.

Our drought risk formulation reflects the combined effects of chronic water stress, hydrological variability and utility-level characteristics (e.g., leakage losses). Previous global drought risk studies typically employ drought hazard metrics that describe hydrological variability (e.g., through the Standard (Effective) Precipitation Index45) or water stress, and intersect this with a geospatial representation of the exposed population30,46. The problem with such approaches is that drought hazard metrics do not necessarily predict the likelihood of physical drought impacts47. The strength of hazard-impact relationships varies across sectors48, however, in the potable water sector, this relationship is strongly mediated by the resilience of infrastructure systems. Further, they do not provide a platform to quantify the benefits of adaptation measures in quantified terms using tangible, meaningful metrics for decision makers. As such, existing global analysis of drought risk to, and adaptation planning in, the municipal water sector is limited for two main reasons: (1) lack of consideration of utility-specific operating scales and infrastructure characteristics, (2) lack of risk-based approaches for identifying benefits of adaptation options and optimal investments. Speaking to the first limitation around scale, previous studies typically adopt the catchment as the unit scale for drought analysis27,28,29,30. However, this scale does not necessarily speak to the way that water is managed by utilities. Speaking to the second limitation around risk-based approaches, existing studies have indicated the suitability of adaptation options across geographies based on qualitative criteria30,32,33,34,35,36 or a long term balance between supply and demand17. However, there is scope to undertake more rigorous risk analysis procedures, inspired by approaches typically undertaken at a smaller scale49,50, to prioritise options based on their risk reduction potential.

Our proposed approach builds upon existing research to dynamically capture how chronic water stress undermines the capacity of utilities to buffer against acute droughts. We note that our UWSD metric is strongly influenced by the availability of renewable groundwater. Indeed, risk hotspots largely align with areas where there is known to be a high level of dependence on depleted/overexploited aquifers, for example in North Africa, Western USA, Mexico, Northern India, the Arabian Peninsula and Northern China37. Further, the effects of acute droughts are simulated without considering catchment-level demand restrictions and should, therefore, be interpreted as worst-case outcomes. Our results largely align with the state-of-the-art study of water shortage exposure to cities undertaken by ref. 30. He et al.30 do not pick up the West Coast of Latin America (e.g., Bolivia) or South-eastern Australia, despite strong evidence of these regions being at risk51,52. This may be because this study did not dynamically simulate monthly demand and supply, accounting for upstream users, such as agriculture. Rather they employ a monthly and annual water stress value per climate scenario, at the catchment scale, and intersect this with the presence of major cities.

Our analysis is designed to illustrate the distribution of present-day risks to municipal water supplies and how this may increase in the future, serving as a platform for adaptation planning. We use UWSD to estimate tariff revenue at risk, however, we acknowledge the wider economic and social implications associated with water supply disruptions. For example, utilities often serve industrial and commercial entities, disruptions to which may result in economic losses53,54. Further, customers often suffer financial, welfare and productivity losses in acquiring water supplies from alternative sources (e.g., bottled water or tanker trucks)55,56. The costs of acquiring alternative water sources are often far beyond what the relative cost of receiving water from a functioning piped water supply system: for example, in Ghana, water distribution by road tanker costs 14 times as much as distribution through the pipe networks10. This may represent a substantial additional household expense, particularly for low-income households57. Indeed, one study undertaken in Kathmandu, Nepal, analysed the costs of substituting disrupted water supply with alternative sources (including tanker trucks and bottled water) relative to household income, to find that this cost represented 56% and 34% of overall coping costs for poor and rich households, respectively57. Further work is required to quantify the impacts of these losses across geographies, particularly for customers in low-income groups. We note that residential per capita demand is typically higher in more developed countries, as greater volumes of water are often used for non-essential purposes, such as lawn irrigation58. Therefore, in high-income countries, disruption events may include demand restrictions for less essential purposes, such as hosepipe bans. Whereas, in lower income countries with lower residential demand per capita, disruption events are likely to entail cuts in more essential water uses, such as for drinking, cooking and hygiene applications.

We find desalination to be the most cost-effective option for 10% of utilities for which at least one adaptation option was found to be effective. Indeed, the market for desalination is expected to double over the next decade59. Desalination can be less disruptive in many places compared to large reservoir construction or expansion. Further, desalination provides an opportunity to tap a source of supply that is practically unlimited and not susceptible to droughts, unlike reservoir storage and leakage reduction measures. However, for many utilities, or systems within utilities, seawater desalination would not be considered cost-efficient due to their distance from the sea60. Further, best practices would deem it necessary to address network efficiencies before investing in desalination plants, given the environmental impacts of brine effluents and high energy requirements (and associated greenhouse gas emissions), particularly in countries located on enclosed or semi-enclosed seas with less potential for brine dispersal and with a high reliance on fossil fuel-dependent energy generation61,62. For quantified risk and optioneering assessments, it is challenging to capture intangible constraints, such as social acceptance, to the implementation of certain options. However, given the large and growing number of people dependent on desalinated water with, unlike treated wastewater, relatively little social objection, we don’t consider social acceptance to present a major barrier to desalination, particularly in water stressed areas where there is limited scope for alternative options. We estimate operational energy costs based on national average data; however, many desalination plants have dedicated, stand-alone energy generation capacity. Thus, we do not account for the full costs of supplying electricity for desalination in our model. On the other hand, minimising leakage offers a two-fold benefit of adaptation and mitigation, by improving network resilience to droughts and reduction energy consumption. It is, therefore, an important first step for utilities with large inefficiencies towards realising a more financially sustainable and climate resilient operating model. However, reducing leakage losses can only go so far in future-proofing utilities to future water stress and drought risk, and the costs involved in reducing leakage are also highly variable and context-specific. Desalination and reservoir storage can offer utilities a chance to not only improve resilience of existing networks, but also to expand network access to serve unserved areas.

The analysis has illustrated that there is a strong business case, in terms of avoided tariff revenue loss thanks to reduced UWSD, for adaptation interventions in many but not all locations. In places where interventions are justified in narrow cost-benefit terms, further examination is required around the barriers to investment. In places where adaptation is not justified on narrow cost-benefit terms, there needs to be wider consideration of the economic and social case for resilient water supplies (e.g., reduced health care costs and time savings for customers16), and exploration of appropriate forms of finance, e.g., concessionary finance.

Water supply utilities face financing problems in most parts of the world13. Reflecting on the growing importance of climate adaptation finance in the banking sector, there is an opportunity to capitalise on this alignment between investor incentives and climate adaptation needs in the water sector63. Climate-resilient water supply utilities provide a material contribution towards adaptation goals by managing variable hydrology and climatic uncertainty to provide safe, reliable, and affordable drinking water services to households. This makes the water sector an important channel for climate adaptation finance. However, a range of barriers exist in attracting the necessary financing for capital improvements and in incentivising adequate levels of network maintenance, the latter being particularly important for achieving long term reductions in leakage losses to strengthen the operational, financial and climate resilience of services. There is no single solution in overcoming these barriers; financing must be coupled with technical capacity building and institutional reform activities. However, risk quantification and adaptation optioneering frameworks can be useful tools for decision makers to allocate limited financial resources and demonstrate the impacts of investments towards the global climate adaptation agenda. Quantifying climate adaptation benefits can also be effective in unlocking concessional financing from the range of climate funds and investors. Our analytical framework provides a valuable starting point for quantifying the contribution of adaptation investments in the potable water sector towards the global climate adaptation agenda.

Although we focus on three hard infrastructure options (leakage reduction, reservoir storage and desalination) these options are not necessarily the most cost-effective in all cases. Soft options, such as inter-sectoral reallocation39,64 or drought mitigation-targeted nature-based solutions, such as managed aquifer recharge65, could be the focus of future developments of this framework. Indeed, in many contexts, in both developed and developing contexts, soft options may be preferred over hard infrastructure options. In lower-income countries, soft options are typically less costly and, therefore, more feasible to finance66. In a higher-income country context, many countries already have heavily engineered water supply systems, with large volumes of storage, low leakage losses and access to desalination plants. These countries may be approaching the limit at which further investments in hard infrastructures would be cost-effective67. Further, social acceptability can also be a limiting factor in infrastructure development, particularly when developing large reservoirs that displace communities; managed aquifer recharge or other nature-based storage solutions offer alternative actions to explore in future applications of the framework.

Of course, the viability of utility service provision may be influenced by climate-related variations in water quality as well as quantity. Flood-induced spikes in water pollution and turbidity can exceed the treatability limits for the production of municipal water supply68,69 or may require increased dilution70, potentially leading to water supply disruptions. The reason we do not consider water quality risk in the current framework is that utilities’ treatability thresholds are highly variable globally. For example, in many countries water treatment processes are highly sensitive to turbidity compared to others where processes are more robust to turbidity variations. The risks that climate-related water quality variations pose to water supply services globally could be explored in future research.

As with any large-scale assessment with future projections, we acknowledge a range of uncertainties associated with the analysis and affecting the results. The accuracy of the global hydrological model is constrained by the quality of underlining global datasets and limited availability of data for calibration. Further, hydrological projections under climate change up to the end of the century are subject to uncertainties in climate models’ ability to accurately predict population growth, land use changes and future changes in precipitation and evapotranspiration71. We have applied a general rule that utilities would source water from within their service area, unless sources are explicitly included in the utility water sources database72. Further, we assume that all water supply within the utility service area would be available, whereas, in reality, utility water supply is constrained by the capacities of their respective infrastructures, e.g., for abstraction and treatment. Another limitation is the imperfect coverage and accuracy of the utility dataset, which is particularly sparse in certain geographies such as in Africa, although this also reflects the lower levels of network coverage of utilities in the less developed world.

Despite these limitations, our approach provides an early step towards achieving a global drought risk assessment of household water supply under present day and future climate change scenarios, adopting the utility scale as the unit for analysis to support climate adaptation planning. The framework provides a platform for identifying the most cost-effective infrastructure investment pathways for water supply utilities by quantifying the contribution of adaptation towards metrics that would be relevant to both investors and/or utilities.

Given the exposure and vulnerability of their services to climate hazards, water utilities are uniquely positioned to deliver climate adaptation services for society. However, the importance of water utilities in strengthening society’s climate resilience is disproportionate relative to the attention received at the high-level dialogue on climate finance. With the climate agenda rapidly gaining momentum, there is an opportunity to strengthen recognition that the utilities receive in high level dialogue on climate finance and channel greater financial flows towards closing the climate adaptation gap for water supply utilities.

Methods

Overview

Here, we combine a global hydrological modelling approach with local utility information, which allows us to estimate global water utility climate risk and adaptation needs and explore the cost-effectiveness of alternative adaptation option types. We do this by constructing a water balance between supply and demand for 5,600 water supply utilities under present day and three future scenarios available from the ISIMIP73 and CMIP674 experiments (combined RCP75 and SSP76 scenarios between 2030–2060). This allows us to quantify the risk of utilities being unable to supply their full customer base sustainably. We define this risk in terms of Unsustainable Water Supply Days (UWSD); a metric describing number of customer-days where utility supply is unsustainable (i.e., renewable water supply is insufficient to meet a utility’s demand) or disrupted (i.e., where implementing demand restrictions and/or reallocation strategies becomes necessary). Our metric effectively combines the concept of reliability (percentage of time an asset/system is operational)49 and exposure (people affected)30 into one metric, improving its relevance for decision-making. Apart from the UWSD, we also quantify the associated tariff revenue at risk caused by each supply disruption based on utility-level tariff rates. We use this framework to simulate the potential benefit of three alternative infrastructure interventions: namely, increased water storage capacity, desalination, and leakage reduction. By simulating the impact of alternative adaptation interventions on the risk over each project’s lifespan, we quantify the cost-effectiveness of each option type in terms of mitigated UWSD and mitigated tariff revenue loss. Per utility, the optimal (or most cost-effective) option type is identified, as well as the overall benefit that it achieves.

Water supply utility database

Here we use global data on the headquarter location, population served (\(P\)) and non-revenue water rates of approximately 5,600 water supply utilities offering water supply services provided by Global Water Intelligence42. We estimate that the database covers over 60% of the global population supplied by piped water estimated by the Joint Monitoring Programme for the year 201977. The data coverage is not uniform across the globe, as shown in the map of the rate of utility data coverage per country in Supplementary Fig. 6.

A water supply utility is a formal entity that supplies water to households, commercial or industrial entities. Utility water supply contrasts to sourcing water supply from a private well, tanker truck, surface water, springs or other sources, for private, industrial or agricultural use. Some utilities will abstract, treat and distribute water, whereas others will operate across only a fraction of the value chain: for example, bulk water utilities, may abstract water to serve a network of utilities that go on to distribute this to households. In structures such as this, as we are concerned with the balance of water supply and demand, we group bulk water providers with their respective distributors.

Water utility demand

Monthly water consumption (\(C\)) per person, at present and in the future, is assigned to each utility based on national average data58. A database of per capita water consumption was collected per country for 124 countries, for which a regression formulation is set up using GDP per capita, percentage urbanisation, temperature, precipitation and regional dummy as explanatory variables to gap-fill domestic water consumption for countries without data. This regression formulation is also used to construct future per capita water demand projections using different combinations of SSP-RCP scenarios as adopted in this work. Results of this are provided in Supplementary Fig. 7. Although utilities may also service industrial and commercial customers, we neglect this additional demand based on the assumption that municipal customers would be prioritised during drought events. We estimate the future population served per utility by scaling in proportion to national population growth estimates provided by each SSP scenario78. This is a simplification of the complex ways in which utilities will respond to future demographic and economic changes in reality: some may expand at a faster or slower rate relative to growth; some new utilities may appear in new locations; and others may be abandoned. We also do not account for the possibility of utilities that operate seasonally, but rather assume that all utilities operate year-round.

Leakage effectively increases the demands on the utility, as operators must account for the network losses incurred during distribution to meet customer consumption needs. Therefore, the demand is quantified as the sum of the customer consumption need and the network losses (\(L\), %). However, the data we collected provides the non-revenue water rate which is the combination of leakage losses and the rate of tariff collection42. Here, we assume that the non-revenue water rate is equivalent to the leakage loss rate, which is an impactful limitation, but necessary due to data limitations.

Thus, the demand (m3) that is exposed to drought for each utility is provided by the following equation.

Note that we assume that monthly demand is constant throughout the year.

Water utility service areas

To map out the area each utility serves (SA), we first map the utility headquarter locations which we assume aligns with its central demand location. We then map the global population at 1 km resolution79 and overlay this with the rate of piped water access globally. Piped water access was derived by disaggregating JMP rural versus urban estimates80 based on a gridded urbanisation layer81. The SA per utility was mapped by iteratively expanding radially from the utility headquarters, incorporating more of the population served, until the utility customer base was equal to the population within the SA. Note that the grid cell size of the population layer (1 km) based on which the service areas were assigned, is smaller than that of the hydrological model (CWatM). Where utility service areas do not cover an entire CWatM grid cell, we factor the supply input to the utility by the fraction of the grid cell covered. For overlapping utility service areas, we extract the total supply within overlapping grid cells, and apportion it between the utilities in proportion to the number of customers they serve. We do not determine how utility service area size may change and assume they remain fixed under future population growth scenarios.

Desalination

We use an up-to-date database of desalination plants used for municipal supply59 to find the fraction of demand that is supplied by desalination (\({DS}\)) per utility by assigning each desalination plant to each utility based on its main service city.

The component of demand that is vulnerable, or the Vulnerable Demand \(({VD})\) (m3) per utility, is therefore provided by the following equation.

Drought risk method

To estimate drought risk, a simulation of the supply (monthly river discharge, groundwater volume and reservoir storage) available to each utility is balanced against the volume of customer demand that would be vulnerable to drought-induced water shortages. Where shortages occur, the utility customer base that would be disrupted is approximated in terms of UWSD by applying the fraction of demand unmet, to the population served. This section outlines the simulation of supply (including how demands are abstracted for other sectors), followed by the utility-level water balance and the risk analysis procedure.

Drought hazard data

The Community Water Model (CWatM) is a state-of-the-art hydrological model which simulates river discharge, renewable groundwater supply, and lake and reservoir storage among other variables, at a monthly time step, at a 0.5-degree resolution71. Please find a full description and validation of CWatM in ref. 71, with a brief description provided in Supplementary Text 1. Each utility was allocated the total available reservoir storage within the perimeter of the utility’s SA. We select the cell recording the maximum river discharge per month within the utility SA most frequently over the timeseries, for the river discharge input. Available renewable groundwater supply is found as the average monthly volume totalled across the area of coverage of the utility (Utility service area). Note that, abstracting from non-renewable groundwater is common practice for many utilities37. Therefore, discounting non-renewable groundwater from the supply available utilities does not reflect current practices. Rather, we provide a formulation of risk as a basis for decision making; under the assumption that utilities would wish to adapt away from unstainable practices such as non-renewable groundwater abstraction.

We collect the historical model output (1980–2010) and investigate the effects of climate change scenarios and socioeconomic growth projections (2030–2060) across SSP1-2.6, SSP3-7.0 and SSP5-8.5 on supply (river discharge, reservoir storage and renewable groundwater supply) each simulated across the 5 climate models included in the Coupled Model Intercomparison Project (CMIP6) experiment74: GFDL-ESM482, IPSL-CM6A-LR83, MPI-ESM1-2-HR84, MRI-ESM2-085, UKESM1-0-LL86. This selection of future projections is simulated under different scenarios of anthropogenic climate change and global socio-economic development as per phase 6 of the CMIP687. The RCP scenarios represent transient scenarios for increasing radiative forcing75 and SSP scenarios outline five alternative scenarios of future global development trajectories, contingent on different levels of fossil-fuel dependency76. SSP1-2.6 represents an optimistic, sustainability-focused scenario of growth with a strong reduction of CO2 emissions and an associated increase in temperature of 1.8 °C by the end of the 21st century88. SSP3-7.0 represents a medium-high emissions scenario where the average temperature is projected to rise by 3.6 °C88. SSP5-8.5 represents a fossil fuel-driven scenario of the future where, by 2100, average global temperature would increase by 4.4 °C88. All considered scenarios of supply were run through the same balance to quantify the change in likelihood of drought-induced utility UWSD in the future relative to the present-day.

City water sources

We account for long-range water transfers through the use of a database which identifies the major water source for a set of ~1600 sources for ~270 large cities72. We assigned the major city water sources to each utility based on the matching utility headquarter location. Supplementary Fig. 8 provides the spatial distribution of utilities for which a long-distance transfer has been identified. The water sources database indicates whether the source is a desalination plant, a river extraction point, a storage dam or reservoir or a borehole. Thus, the relevant supply type (i.e., river discharge, renewable groundwater or lake and reservoir storage) from CWatM was extracted from the coordinates of the source and combined with the total supply available within each utility service area. Note that we extract the supply within the grid cell that overlaps with the source location.

Allocation rules

Here, we assume that in each month, the supply available in each utility’s SA is available and prioritised above all other sectors. However, in preceding months, we assume that upstream abstractions are fully met by all dependent sectors, such as irrigation. We adopt this approach to capture the risk that over abstraction, now and in the future, poses to essential water utility services. As such, the model of water supply variations is run based on a global, standard, allocation scheme89, however, locally, utility sources are prioritised for municipal use. This introduces an inconsistency into the method because municipal demand inputs are integrated with the model of supply (see ref. 90), but also input as a function of utility characteristics (see Demand). Note that the inconsistency between CWatM municipal demand versus our utility level demand inputs would have a negligible effect on the results, as the model adopts a return flow assumption of 90% for municipal withdrawals.We adopt a threshold for environmental flows of Q10 of monthly river discharge under baseline climate conditions (the flow exceeded 90% of the time), a widely held assumption91.

Drought risk formulation

We simulate a monthly balance between total supply (m3 month-1) \((S)\) - which is the sum of available reservoir storage (\({RS}\)), river discharge (\({RI}\)) and available renewable groundwater supply (\({GW}\)), minus the environmental flow (\({EF}\)) - and the demand that is vulnerable to droughts (m3 month-1), accounting for leakage losses (\({VD}\)). Where the supply is not sufficient to meet the demand, a Deficit (m3 month-1) \(({Def})\), greater than zero is recorded.

This formulation is used to derive the first benefit metric, \({UWSD}\) (customer-days for a given month). To estimate the population that would be disrupted by a given monthly deficit, we apply the equivalent fraction of demand that is unmet by the supply to the population served by a given utility and multiply by the number of days in a month (\(d\)).

We merge the utility-level tariff rates (per m3) from the IBNet tariff benchmarking database92 with the GWI utility database. Where ulities included in the GWI utility database were missing from IBNet, we apply the national average. Thus, equivalent tariff revenue loss (USD/month) (\({TRL}\)) (Eq. 6) associated with the reduced volumetric sale of water was estimated, where \(t\) is the tariff rate for water supply42,92. Given the strong relationship between tariff rates and GDP per capita (r2, 0.6), see Supplementary Fig. 5, we use this linear relationship to estimate future tariff rates based national level data on GDP and population under alternative SSPs78.

For many utilities, tariff revenue would not be elastic to the volumetric sale of water, and disruptions may not be reflected in the utility’s balance sheet. This depends on the type of arrangement the utilities have in place; for example, whether they are able to monitor disruptions and adjust tariff charges accordingly. Some utilities may also be subject to fines imposed by regulators, which are not considered here. However, the proposed approach enables a globally consistent estimation of potential financial losses incurred by utilities during droughts.

The monthly disruption is summed per year, and the annual average loss at the utility level in terms of \({\overline{{UWSD}}}_{u}\) (customer-days/year) and \({\overline{{TRL}}}_{u}\) (USD year-1) is estimated by integrating each loss across the annual exceedance probabilities of events (\({p}_{y}\)) (based on drought event ranks) and for a given climate scenario, as shown in Eq. (5).

Climate adaptation optioneering

We use the above drought risk to understand the marginal benefits - i.e., the reduction in risk for a given dollar investment - of alternative infrastructure investments. Thus, the costs of climate adaptation can be weighed against the benefits. This is done by rerunning the risk analysis using model runs between 2030–2060 under future scenarios by simulating the effect of a range of 10 designs of each adaptation option type \(P=\left\{\min \ldots \max \right\}\). The range of designs are established based on equal intervals between the minimum and maximum design limits of each option type, as outlined in Supplementary Table 1. We discount benefits and costs over the option’s lifetime (conservatively assumed to be 30 years, although typically much longer) to derive cost effectiveness in terms of mitigated UWSD and lost tariff revenue. Thus, assuming that the date of implementation would be 2030, we simulate the benefits that would accumulate over the duration of 30 years.

We assume that if a section of a utility’s service area is within 50 km from the coastline, it would be eligible for seawater desalination. This transfer distance threshold is established based on the database of water transfers for major cities72; Supplementary Fig. 9 illustrates the distribution of transfer distances for major cities. We acknowledge that there are other factors that would determine the eligibility of a utility for desalination, such as the continuity of electricity supply and the source of electricity in the context of green energy transitions62. Here the only eligibility factor we consider is the proximity of a utility’s service area to the coastline due to data limitations. Note that we only consider coastal desalination, as opposed to inland brackish water desalination due to data limitations on the availability of brackish water globally.

Adaptation option costs

The costs of each option are provided in Supplementary Table 2. For desalination, we apply the cost per volumetric unit to the equivalent change in capacity93. We also estimate the transfer costs that would be required to transfer desalinated water to the headquarter location of the utility93. We then re-run Eq. 2 with the new desalination capacity to simulate the effect of increasing desalination capacity on risk.

For leakage, we first estimate the volume of leakage lost per km of network, where both the rate of leakage and the length of the network are provided in the utility database42. Where the length of the piped water network is missing from the database, we employ a linear regression model (r2 = 0.8) to predict values based on the population served, population density of the service area, per capita water consumption, piped water access rate77 and national GDP per capita78. We thus estimate the length of pipeline that would have to be renovated for a given reduction in leakage and apply the unit cost per m93, as provided in Supplementary Table 2. We then re-run Eq. 1 with the new leakage rate to simulate the effect of reducing leakage losses on risk.

For storage, we simulate the river discharge balance as follows in Eqs. 9–13, to estimate the volume that would be available for storage per month for each utility. We then cumulatively sum the available river discharge to simulate the maximum available additional supply (m3) (\({STM}\)) that could be available per month, given sufficient storage capacity. We then define a range of additional storage capacities (m3) (\({{SC}}_{a}\)) as a fraction (\({a}_{s}\)) of the maximum capacity that could be stored, with the maximum fraction being defined based on that which would provide a maximum release equivalent to 90% of demand. We then re-run Eq. 3 with the additional reservoir storage (m3 month-1) (\({{ST}}_{m}\)) to simulate the effect of increasing storage capacity on risk.

We estimate the change in energy costs before and after the implementation of each considered leakage reduction, storage capacity and desalination capacity increase option, as well as other general O&M costs, such as equipment maintenance. To quantify this change in energy costs, we first estimate the overall annual energy requirement per utility (kWh year-1) (\({{ER}}_{u}\)), Eq. 14.

Where \(v\), \(e\) and \(n\) are the global average unit energy consumption in kWh m-3 year-1 required to treat water (not from desalination), to desalinate water and to transport water, respectively42. \(D\) and \({DS}\) represent the annual volume of non-desalinated and desalinated water treated per year (m3 year-1) per utility.

Thus, the change in energy costs \(({EC})\) associated with each type of adaptation option are as follows. Note that the change in energy costs associated with leakage reduction would be negative and result in efficiency gains.

Where \(l\) denotes the new leakage rate (fraction), \(d\) denotes the increase in desalination capacity (m3) and \(s\) denotes the increase in storage capacity (m3). \({c}_{n}\) is the national average unit cost of energy for industrial users ($ kWh-1) per nation94.

As noted above, we apply different adaptation options to present and future drought risks for the set of designs \(P=\left\{\min \ldots \max \right\}\). Assuming that the discount rate of \(r,\) estimated at 6%, is applied over the adaptation planning horizon. The discounted cost (USD) \(({{DC}}_{s}(p))\) for applying the adaptation option of a given design (\(p\)) to a utility is estimated in terms of the sum of initial investment costs (USD) \(({{CI}}_{j0}(p))\) at \(t=0\) and the sum of the subsequent asset level discounted annual operations and maintenance costs, accounting for increased/decreased energy costs, \({{CM}}_{{jt}}(p)\) over the planning horizon. This is formulated in Eq. (18).

Benefit of adaptation

Depending on the level of protection provided, the chosen adaptation option will mitigate utility risk to a certain extent. These new risks associated with the protection level provided by each adaptation option (\({\overline{{UWSD}}}_{u}\left(p\right),{\overline{{TRL}}}_{u}(p)\)) are obtained by rerunning the risks analysis, using Eqs. (2–8).

Similar to the costs, the risks before and after the adaptation option are estimated at annual timescales over the planning horizon. As noted above, the future risks are driven by the climate change driven hazard events and the customers dependent on the water systems. The discounted benefit (USD) (\({{DB}}_{s}(p)\)) of risk reduction due to the adaptation option is estimated by discounting the annual timeseries of marginal risk reduction (\({\overline{{TRL}}}_{{st}}-{\overline{{TRL}}}_{{st}}(p)\)) over the planning horizon, Eq. (19).

The effectiveness of the option is assessed in terms of the benefit-cost ratio \(({{BCR}}_{u}(p))\), given by Eq. (20).

The optioneering solution involves finding the optimal intervention (\({{OI}}_{u}\)) per utility, identified as the option where the ratio between benefit and cost (\({BCR}\)) is greatest, see Eq. (21).

Data availability

CWatM data are openly available at the following source data link: https://zenodo.org/records/352809871. The utility data is provided by GWI42 under a license which restricts us from distributing the data to the public or research community. Software used for the project include Python (https://www.python.org/) and QGIS (https://www.qgis.org/en/site/), both of which are open-access. Source data underlying main text figures is provided via Zenodo https://doi.org/10.5281/zenodo.10154550.

Code availability

Code involved in performing the analysis will be made available via Zenodo https://doi.org/10.5281/zenodo.10154550.

References

Danilenko, A., Dickson, E. and Jacobsen, M. Climate change and urban water utilities: challenges and opportunities. The World Bank Group. https://documents.worldbank.org/en/publication/documents-reports/documentdetail/628561468174918089/climate-change-and-urban-water-utilities-challenges-and-opportunities (2010).

Bakker, K. Privatizing Water. https://doi.org/10.7591/9780801463617 (2017).

Salehi, M. Global water shortage and potable water safety; Today’s concern and tomorrow’s crisis. Environ. Int. https://doi.org/10.1016/j.envint.2021.106936 (2022).

Grey, D. & Sadoff, C. W. Sink or Swim? Water security for growth and development. Water Policy. https://doi.org/10.2166/wp.2007.021 (2007).

Hall, J. W. et al. Coping with the curse of freshwater variability. Science (80-.). https://doi.org/10.1126/science.1257890 (2014).

Di Baldassarre, G. et al. Water shortages worsened by reservoir effects. Nat. Sustain. https://doi.org/10.1038/s41893-018-0159-0 (2018).

Van Loon, A. F. et al. Drought in the Anthropocene. Nat. Geosci. https://doi.org/10.1038/ngeo2646 (2016).

Flörke, M., Schneider, C. & McDonald, R. I. Water competition between cities and agriculture driven by climate change and urban growth. Nat. Sustain. https://doi.org/10.1038/s41893-017-0006-8 (2018).

Pokhrel, Y. et al. Global terrestrial water storage and drought severity under climate change. Nat. Clim. Chang. https://doi.org/10.1038/s41558-020-00972-w (2021).

Rouse, M. Institutional governance and regulation of water services: the essential elements. 2nd edn. Water Intell. Online https://doi.org/10.2166/9781780404516 (2013).

Libey, A., Adank, M. & Thomas, E. Who pays for water? Comparing life cycle costs of water services among several low, medium and high-income utilities. World Dev. https://doi.org/10.1016/j.worlddev.2020.105155 (2020).

Briscoe, J. The financing of hydropower, irrigation and water supply infrastructure in developing countries. Int. J. Water Resour. Dev. https://doi.org/10.1080/07900629948718 (1999).

Winpenny, J. Water: Fit to Finance? Catalyzing National Growth through Investment in Water Security, report of the High Level Panel on Financing Infrastructure for a Water-Secure World. (2015).

Hutton, G. & Varughese, M. The Costs of Meeting the 2030 Sustainable Development Goal Targets on Drinking Water, Sanitation, and Hygiene. The Costs of Meeting the 2030 Sustainable Development Goal Targets on Drinking Water, Sanitation, and Hygiene. https://doi.org/10.1596/k8543 (2016).

OECD. Financing a Water Secure Future, OECD Studies on Water, OECD Publishing, Paris, https://doi.org/10.1787/a2ecb261-en (2022).

Hutton, G. Global costs and benefits of reaching universal coverage of sanitation and drinking-water supply. J. Water Health https://doi.org/10.2166/wh.2012.105 (2013).

Ward, P. J. et al. Partial costs of global climate change adaptation for the supply of raw industrial and municipal water: a methodology and application. Environ. Res. Lett. https://doi.org/10.1088/1748-9326/5/4/044011 (2010).

Hammond, J. C. et al. Going beyond low flows: streamflow drought deficit and duration illuminate distinct spatiotemporal drought patterns and trends in the U.S. during the last century. Water Resour. Res. https://doi.org/10.1029/2022WR031930 (2022).

Carrão, H., Naumann, G. & Barbosa, P. Mapping global patterns of drought risk: An empirical framework based on sub-national estimates of hazard, exposure and vulnerability. Glob. Environ. Chang. 39, 108–124 (2016).

Vicente-Serrano, S. M. et al. Global drought trends and future projections. Philos. Trans. R. Soc. A Math. Phys. Eng. Sci. https://doi.org/10.1098/rsta.2021.0285 (2022).

Duan, W. et al. Changes in temporal inequality of precipitation extremes over China due to anthropogenic forcings. npj Clim. Atmos. Sci. https://doi.org/10.1038/s41612-022-00255-5 (2022).

Milly, P. C. D. et al. Climate change: stationarity is dead: Whither water management? Science https://doi.org/10.1126/science.1151915 (2008).

Kingsborough, A., Borgomeo, E. & Hall, J. W. Adaptation pathways in practice: mapping options and trade-offs for London’s water resources. Sustain. Cities Soc. https://doi.org/10.1016/j.scs.2016.08.013 (2016).

Borgomeo, E., Mortazavi-Naeini, M., Hall, J. W., O’Sullivan, M. J. & Watson, T. Trading-off tolerable risk with climate change adaptation costs in water supply systems. Water Resour. Res. https://doi.org/10.1002/2015WR018164 (2016).

Herman, J. D., Reed, P. M., Zeff, H. B. & Characklis, G. W. How should robustness be defined for water systems planning under change? J. Water Resour. Plan. Manag. https://doi.org/10.1061/(asce)wr.1943-5452.0000509 (2015).

Li, J. et al. Water supply risk analysis of Panjiakou reservoir in Luanhe River basin of China and drought impacts under environmental change. Theor. Appl. Climatol. https://doi.org/10.1007/s00704-018-2748-2 (2019).

McDonald, R. I. et al. Urban growth, climate change, and freshwater availability. Proc. Natl. Acad. Sci. USA https://doi.org/10.1073/pnas.1011615108 (2011).

Hanasaki, N. et al. A global water scarcity assessment under Shared Socio-economic Pathways - Part 2: Water availability and scarcity. Hydrol. Earth Syst. Sci. https://doi.org/10.5194/hess-17-2393-2013 (2013).

Padowski, J. C. & Gorelick, S. M. Global analysis of urban surface water supply vulnerability. Environ. Res. Lett. https://doi.org/10.1088/1748-9326/9/10/104004 (2014).

He, C. et al. Future global urban water scarcity and potential solutions. Nat. Commun. https://doi.org/10.1038/s41467-021-25026-3 (2021).

What scale for water governance? Science https://doi.org/10.1126/science.349.6247.478-a (2015).

Krueger, E., Rao, P. S. C. & Borchardt, D. Quantifying urban water supply security under global change. Glob. Environ. Chang. https://doi.org/10.1016/j.gloenvcha.2019.03.009 (2019).

Greve, P. et al. Global assessment of water challenges under uncertainty in water scarcity projections. Nat. Sustain. https://doi.org/10.1038/s41893-018-0134-9 (2018).

Larsen, T. A., Hoffmann, S., Lüthi, C., Truffer, B. & Maurer, M. Emerging solutions to the water challenges of an urbanizing world. Science https://doi.org/10.1126/science.aad8641 (2016).

Wada, Y., Gleeson, T. & Esnault, L. Wedge approach to water stress. Nat. Geosci. https://doi.org/10.1038/ngeo2241 (2014).

Buurman, J., Mens, M. J. P. & Dahm, R. J. Strategies for urban drought risk management: a comparison of 10 large cities. Int. J. Water Resour. Dev. https://doi.org/10.1080/07900627.2016.1138398 (2017).

Gleeson, T., Wada, Y., Bierkens, M. F. P. & Van Beek, L. P. H. Water balance of global aquifers revealed by groundwater footprint. Nature https://doi.org/10.1038/nature11295 (2012).

Mini, C., Hogue, T. S. & Pincetl, S. The effectiveness of water conservation measures on summer residential water use in Los Angeles, California. Resour. Conserv. Recycl. https://doi.org/10.1016/j.resconrec.2014.10.005 (2015).

Marston, L. & Cai, X. An overview of water reallocation and the barriers to its implementation. Wiley Interdisciplinary Reviews: Water https://doi.org/10.1002/wat2.1159 (2016).

Libonati, R. et al. Assessing the role of compound drought and heatwave events on unprecedented 2020 wildfires in the Pantanal. Environ. Res. Lett. https://doi.org/10.1088/1748-9326/ac462e (2022).

World Bank. Population growth (annual %). (2021). Available at: https://data.worldbank.org/indicator/SP.POP.GROW.

GWI. GWI WaterData. https://www.gwiwaterdata.com/ (2022).

KAS. Desalination as an alternative to alleviate water scarcity and a climate change adaptation option in the MENA region. Available at: https://www.kas.de/documents/264147/264196/kas_remena_studie_meerwasserentsalzung_web.pdf. (Accessed: 4th February 2023).

Lehner, B. et al. Global Reservoir and Dam Database, Version 1 (GRanDv1): Reservoirs, Revision 01. NASA Socioeconomic Data and Applications Center (SEDAC) (2011).

Spinoni, J. et al. A new global database of meteorological drought events from 1951 to 2016. J. Hydrol. Reg. Stud. https://doi.org/10.1016/j.ejrh.2019.100593 (2019).

Blauhut, V. et al. Estimating drought risk across Europe from reported drought impacts, drought indices, and vulnerability factors. Hydrol. Earth Syst. Sci. https://doi.org/10.5194/hess-20-2779-2016 (2016).

Bachmair, S., Kohn, I. & Stahl, K. Exploring the link between drought indicators and impacts. Nat. Hazards Earth Syst. Sci. https://doi.org/10.5194/nhess-15-1381-2015 (2015).

Stagge, J. H., Kohn, I., Tallaksen, L. M. & Stahl, K. Modeling drought impact occurrence based on meteorological drought indices in Europe. J. Hydrol. https://doi.org/10.1016/j.jhydrol.2015.09.039 (2015).

Brown, C., Ghile, Y., Laverty, M. & Li, K. Decision scaling: Linking bottom-up vulnerability analysis with climate projections in the water sector. Water Resour. Res. https://doi.org/10.1029/2011WR011212 (2012).

Borgomeo, E. et al. Risk-based water resources planning: Incorporating probabilistic nonstationary climate uncertainties. Water Resour. Res. https://doi.org/10.1002/2014WR015558 (2014).

Reuters. Bolivia declares state of emergency due to drought. (2016). Available at: https://www.arabnews.com/node/1013801/amp. (Accessed: 6th February 2023).

Barbour & Lewis. Country towns at ‘greater risk’ of running dry when drought returns despite recent floods. (2022). Available at: https://www.abc.net.au/news/2022-12-08/flooded-rural-towns-at-risk-of-running-dry-when-drought-returns/101644790. (Accessed: 6th February 2023).

Jenkins, K., Dobson, B., Decker, C. & Hall, J. W. An Integrated Framework for Risk-Based Analysis of Economic Impacts of Drought and Water Scarcity in England and Wales. Water Resour. Res. https://doi.org/10.1029/2020WR027715 (2021).

Freire-González, J., Decker, C. & Hall, J. W. The economic impacts of droughts: a framework for analysis. Ecol. Econ. https://doi.org/10.1016/j.ecolecon.2016.11.005 (2017).

Buck, S., Auffhammer, M., Hamilton, S. & Sunding, D. Measuring welfare losses from urban water supply disruptions. J. Assoc. Environ. Resour. Econ. https://doi.org/10.1086/687761 (2016).

Baisa, B., Davis, L. W., Salant, S. W. & Wilcox, W. The welfare costs of unreliable water service. J. Dev. Econ. https://doi.org/10.1016/j.jdeveco.2008.09.010 (2010).

Pattanayak, S. K., Yang, J. C., Whittington, D. & Bal Kumar, K. C. Coping with unreliable public water supplies: Averting expenditures by households in Kathmandu, Nepal. Water Resour. Res. https://doi.org/10.1029/2003WR002443 (2005).

FAO. AQUASTAT. (2020). Available at: http://www.fao.org/aquastat/statistics/query/index.html. (Accessed: 10th March 2021).

GWI. GWI DesalData. https://www.desaldata.com/ (2022).

Stillwell, A. S., King, C. W. & Webber, M. E. Desalination and long-haul water transfer as a water supply for Dallas, Texas: a case study of the energy-water nexus in Texas. Texas Water J. 1, 33–41 (2010).

Lattemann, S. & Höpner, T. Environmental impact and impact assessment of seawater desalination. Desalination https://doi.org/10.1016/j.desal.2007.03.009 (2008).

Panagopoulos, A. Water-energy nexus: desalination technologies and renewable energy sources. Environ. Sci. Pollut. Res. https://doi.org/10.1007/s11356-021-13332-8 (2021).

Ranger & Mullan. Mobilizing Finance for Adaptation at COP27: Next Steps in Aligning Finance and Investment with Climate-Resilient Development Goals (2022).

Garrick, D. et al. Rural water for thirsty cities: a systematic review of water reallocation from rural to urban regions. Environ. Res. Lett. https://doi.org/10.1088/1748-9326/ab0db7 (2019).

Dillon, P. et al. Sixty years of global progress in managed aquifer recharge. Hydrogeol. J. https://doi.org/10.1007/s10040-018-1841-z (2019).

World Bank. Nature-based Solutions: a Cost-effective Approach for Disaster Risk and Water Resource Management. (2019). Available at: https://www.worldbank.org/en/topic/disasterriskmanagement/brief/nature-based-solutions-cost-effective-approach-for-disaster-risk-and-water-resource-management (Accessed: 4th February 2023).

Del Moral Ituarte, L. & Giansante, C. Constraints to drought contingency planning in Spain: The hydraulic paradigm and the case of Seville. J. Contingencies Cris. Manag. https://doi.org/10.1111/1468-5973.00128 (2000).

Nyman, P. et al. Probability and consequence of postfire erosion for treatability of water in an unfiltered supply system. Water Resour. Res. https://doi.org/10.1029/2019wr026185 (2021).

Mortazavi-Naeini, M., Bussi, G., Elliott, J. A., Hall, J. W. & Whitehead, P. G. Assessment of risks to public water supply from low flows and harmful water quality in a changing climate. Water Resour. Res. https://doi.org/10.1029/2018WR022865 (2019).

Van Vliet, M. T. H., Florke, M. & Wada, Y. Quality matters for water scarcity. Nat. Geosci. https://doi.org/10.1038/NGEO3047 (2017).

Burek, P. et al. Development of the Community Water Model (CWatM v1.04) - A high-resolution hydrological model for global and regional assessment of integrated water resources management. Geosci. Model Dev. https://doi.org/10.5194/gmd-13-3267-2020 (2020).

McDonald, R. I. et al. Water on an urban planet: Urbanization and the reach of urban water infrastructure. Glob. Environ. Chang. https://doi.org/10.1016/j.gloenvcha.2014.04.022 (2014).

Warszawski, L. et al. The inter-sectoral impact model intercomparison project (ISI-MIP): Project framework. Proc. Natl. Acad. Sci. USA https://doi.org/10.1073/pnas.1312330110 (2014).

O’Neill, B. C. et al. The Scenario Model Intercomparison Project (ScenarioMIP) for CMIP6. Geosci. Model Dev. https://doi.org/10.5194/gmd-9-3461-2016 (2016).

van Vuuren, D. P. et al. The representative concentration pathways: an overview. Clim. Change https://doi.org/10.1007/s10584-011-0148-z (2011).

Riahi, K. et al. The Shared Socioeconomic Pathways and their energy, land use, and greenhouse gas emissions implications: An overview. Glob. Environ. Chang. https://doi.org/10.1016/j.gloenvcha.2016.05.009 (2017).

JMP. Data. (2017). Available at: https://washdata.org/data. (Accessed: 10th March 2021).

Richters et al. NGFS Climate Scenarios Data Set. Zenodo https://zenodo.org/record/7198430 (2022).

Lloyd, C. T. et al. Global spatio-temporally harmonised datasets for producing high-resolution gridded population distribution datasets. Big Earth Data https://doi.org/10.1080/20964471.2019.1625151 (2019).

UNICEF & WHO. WHO/UNICEF Joint Monitoring Programme (JMP). Available at: https://washdata.org/data (2020).

Gao, J. & O’Neill, B. C. Mapping global urban land for the 21st century with data-driven simulations and Shared Socioeconomic Pathways. Nat. Commun. https://doi.org/10.1038/s41467-020-15788-7 (2020).

Dunne, J. P. et al. The GFDL Earth System Model Version 4.1 (GFDL-ESM 4.1): Overall Coupled Model Description and Simulation Characteristics. J. Adv. Model. Earth Syst. https://doi.org/10.1029/2019MS002015 (2020).

Boucher, O. et al. Presentation and evaluation of the IPSL-CM6A-LR climate model. J. Adv. Model. Earth Syst. https://doi.org/10.1029/2019MS002010 (2020).

Gutjahr, O. et al. Max Planck Institute Earth System Model (MPI-ESM1.2) for the High-Resolution Model Intercomparison Project (HighResMIP). Geosci. Model Dev. https://doi.org/10.5194/gmd-12-3241-2019 (2019).

Yukimoto, S. et al. The Meteorological Research Institute Earth system model version 2.0, MRI-ESM2.0: Description and basic evaluation of the physical component. J. Meteorol. Soc. Japan https://doi.org/10.2151/jmsj.2019-051 (2019).

Sellar, A. A. et al. UKESM1: Description and evaluation of the U.K. earth system model. J. Adv. Model. Earth Syst. https://doi.org/10.1029/2019MS001739 (2019).

Eyring, V. et al. Overview of the coupled model intercomparison project phase 6 (CMIP6) experimental design and organization. Geosci. Model Dev. https://doi.org/10.5194/gmd-9-1937-2016 (2016).

Meinshausen, M. et al. The shared socio-economic pathway (SSP) greenhouse gas concentrations and their extensions to 2500. Geosci. Model Dev. 13, 3571–3605, (2020).

Wada, Y., Wisser, D. & Bierkens, M. F. P. Global modeling of withdrawal, allocation and consumptive use of surface water and groundwater resources. Earth Syst. Dyn. 5, 15–40, (2014).

Huang, Z. et al. Reconstruction of global gridded monthly sectoral water withdrawals for 1971–2010 and analysis of their spatiotemporal patterns. Hydrol. Earth Syst. Sci. 22, 2117–2133, (2018).

Pastor, A. V., Ludwig, F., Biemans, H., Hoff, H. & Kabat, P. Accounting for environmental flow requirements in global water assessments. Hydrol. Earth Syst. Sci. 18, 5041–5059, (2014).

IBNET. IBNET English | The International Benchmarking Network. Available at: https://www.ib-net.org/ (2022).

Kahil, T. et al. A continental-scale hydroeconomic model for integrating water-energy-land nexus solutions. Water Resour. Res. 54, 7511–7533, (2018).

Global Petrol Prices. Electricity prices for businesses. Available at: https://www.globalpetrolprices.com/electricity_prices/. (2022).

Acknowledgements

O.B. acknowledges funding from the Engineering and Physical Sciences Research Council (EPSRC) under grant number EP/T517811/1. The authors would like to thank Global Water Intelligence (GWI) for access to the utility database. This first author would also like to thank the International Institute for Applied Systems Analysis, as this work was the focus of IIASA’s Young Scientist Summer Programme.

Author information

Authors and Affiliations

Contributions

Olivia Becher conceptualised the research, conducted the analysis and wrote the manuscript. Prof Jim Hall from the University of Oxford assisted with the conceptualisation and structuring of the paper, as well as with review and feedback on the manuscript. Dr Mikhail Smilovic from the International Institute of Applied Systems Analysis provided the Community Water Model inputs and advised on their methodological application for the paper. Dr Raghav Pant and Dr Jasper Verschuur from the University of Oxford and Dr Sylvia Tramberend from the International Institute of Applied Systems Analysis assisted with review and feedback on the manuscript.

Corresponding authors

Ethics declarations

Competing interests

The authors declare no competing interests.

Peer review

Peer review information

Communications Earth & Environment thanks Min Han and the other, anonymous, reviewer(s) for their contribution to the peer review of this work. Primary Handling Editors: Ana Teresa Lima, Heike Langenberg. A peer review file is available.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Becher, O., Smilovic, M., Verschuur, J. et al. The challenge of closing the climate adaptation gap for water supply utilities. Commun Earth Environ 5, 356 (2024). https://doi.org/10.1038/s43247-024-01272-3

Received:

Accepted:

Published:

DOI: https://doi.org/10.1038/s43247-024-01272-3

- Springer Nature Limited