Abstract

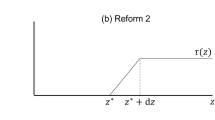

We analyze optimal income taxes with deductions for work-related or consumptive goods. We consider two cases. In the first case (called a complex tax system) the tax authorities can exactly distinguish between consumptive and work-related expenditures. In the second case (called a simple tax system) this distinction is not exact. Assuming additively separable utility functions, we show that work-related expenditures should be fully deductible in the first case while deduction rates should be less than 100 percent in the second case. Under further simplifying assumptions, we also show that the simple system can be characterized by higher tax burdens on low income earners and less redistribution.

Similar content being viewed by others

References

Atkinson, A. B. (1995). Public Economics in Action.The Basic Income/Flat Tax Proposal. Oxford: Clarendon Press.

Atkinson, A. B. and J. E. Stiglitz. (1976). “The Design of Tax Structure: Direct Versus Indirect Taxation.” Journal of Public Economics 6, 55–75.

Cooter, R. (1978). “Optimal Tax Schedules and Rates: Mirrlees and Ramsey.” American Economic Review 68, 756–768.

Ebert, U. (1992). “A Reexamination of the Optimal Nonlinear Income Tax.” Journal of Public Economics 49, 47–73.

Kaplow, L. (1990). “Optimal Taxation with Costly Enforcement and Evasion.” Journal of Public Economics 43, 221–236.

Mirrlees, J. A. (1971). “An Exploration in the Theory of Optimum Income Taxation.” Review of Economic Studies 38, 175–208.

Mirrlees, J. A. (1976). “Optimal Tax Theory: A Synthesis.” Journal of Public Economics 6, 327–358.

Seade, J. K. (1977). “On the Shape of Optimal Tax Schedules.” Journal of Public Economics 7, 203–236.

Seade, J. K. (1982). “On the Sign of the Optimum Marginal Income Tax.” Reviewof Economic Studies 49, 637–643.

Slemrod, J. (1994). “Fixing the Leak in Okun's Bucket. Optimal Tax Progressivity When Avoidance can be Controlled.” Journal of Public Economics 55, 41–51.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Baake, P., Borck, R. & Löffler, A. Complexity and Progressivity in Income Tax Design: Deductions for Work-Related Expenses. International Tax and Public Finance 11, 299–312 (2004). https://doi.org/10.1023/B:ITAX.0000021973.38388.da

Issue Date:

DOI: https://doi.org/10.1023/B:ITAX.0000021973.38388.da