Abstract

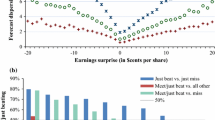

Prior archival studies of analysts' forecasts have found evidence for systematic underreaction, systematic overreaction, and systematic optimism bias. Easterwood and Nutt (1999) attempt to reconcile the conflicting evidence by testing the robustness of Abarbanell and Bernard's (1992) underreaction results to the nature of the information. Consistent with systematic optimism, forecasts are found to underreact to negative earnings information but overreact to positive information. However, Easterwood and Nutt are unable to distinguish between misreaction caused by incentives unique to analysts with misreaction caused by human decision bias that may be typical of investors. We address this issue by analyzing forecast reactions to positive versus negative information in the controlled experimental setting of Gillette, Stevens, Watts, and Williams (1999). The forecast data reveal systematic underreaction to both positive and negative information, and the underreaction is generally greater for positive information than negative information. This suggests that prior empirical evidence of forecast overreaction to positive information is unlikely to be attributable to human decision bias.

Similar content being viewed by others

References

Abarbanell, J. (1991). “Do Analysts' Forecasts Incorporate Information in Prior Stock Price Changes?” Journal of Accounting and Economics. 14, 147–165.

J. Abarbanell V. Bernard (1992) ArticleTitleTests of Analysts' Overreaction/Underreaction to Earnings Information as an Explanation for Anomalous Stock Price Behavior Journal of Finance 47 1181–1207

Abarbanell, J. and Lehavy, R. (2000). “Biased Forecasts or Biased Earnings? The Role of Earnings Management in Explaining Apparent Optimism and Inefficiency in Analysts' Earnings Forecasts.”Working paper, University of North Carolina.

Affleck-Graves, J., Davis, L., and Mendenhall, R. (1990). “Forecasts of Earnings Per Share: Possible Sources of Analyst Superiority and Bias.” Contemporary Accounting Research. 6(2), 501–517.

Ahmed, A., Lobo, G., and Zhang, X. (2001). “Do Analysts Under-React to Bad News and Over-React to Good News?” Working paper, Syracuse University.

Ali, A., Klein, A., and Rosenfeld, J. (1992). “Analysts' Use of Information About Permanent and Transitory Earnings Components in Forecasting Annual EPS.” The Accounting Review. 67, 183–198.

Barberis, N. and Thaler, R. (2002). “A Survey of Behavioral Finance.” Forthcoming in G. Constantinides, M. Harris, and R. Stulz (eds.), Handbook of the Economics of Finance.

Bernard,V. (1993). “Stock Price Reactions to Earnings Announcements:ASurvey of Recent Anomalous Evidence and Possible Explanations.” In R. Thaler (ed.), Advances in Behavioral Finance. New York: Russell Sage Foundation.

Biggs, S. (1984). “Financial Analysts' Information Search in the Assessment of Corporate Earning Power.” Accounting, Organizations and Society. 9, 313–323.

Bouwman, M., Frishkoff, P., and Frishkoff, P. (1987). “How Do Financial Analysts Make Decisions? A Process Model of the Investment Screening Decision.” Accounting, Organizations and Society. 12, 1–29.

Brown, L. (1993). “Earnings Forecasting Research: Its Implications for Capital Markets Research.” International Journal of Forecasting. 9, 295–320.

Brown, L. and Rozeff, M. (1979). “Univariate Time-Series Models of Quarterly Accounting Earnings Per Share: A Proposed Model.” Journal of Accounting Research. 17(Spring), 179–189.

Calegari, M. and Fargher, N. (1997). “Evidence That Prices Do Not Fully Reflect the Implications of Current Earnings for Future Earnings.” Contemporary Accounting Research. 14(3), 397–433.

Camerer, C. (1987). “Do Biases in Probability Judgment Matter in Markets? Experimental Evidence.” American Economic Review. 77(5), 981–997.

Camerer, C. (1995.) “Individual Decision Making.” In J. Kagel and A. Roth (eds.), The Handbook of Experimental Economics. Princeton: Princeton University Press.

Daniel, K., Hirshleifer, D., and Subrahmanyam, A. (1998). “Investor Psychology and Security Market Under-and Overreactions.” The Journal of Finance. 53(6), 1839–1885.

Darrough, M. and Russell, T. (2000). “A Positive Model of Earnings Forecasts: Top Down Versus Bottom Up.” Working paper, Baruch College, CUNY.

DeBondt, W. and Thaler, R. (1990). “Do Security Analysts Overreact?” The American Economic Review. 80, 52–57.

Dreman, D. and Berry, M. (1995). “Analyst Forecasting Errors and Their Implications for Security Analysis.” Financial Analysts Journal. 51, 30–40.

Dwyer, G., Williams, A., Battalio, R., and Mason, T. (1993). “Tests of Rational Expectations in a Stark Setting.” Economic Journal. 103, 586–601.

Easterwood, J. and Nutt, S. (1999). “Inefficiency in Analysts' Earnings Forecasts: Systematic Misreaction or Systematic Optimism?” Journal of Finance. 54(5), 1777–1797.

Elliot, J., Philbrick, D., and Wiedman, C. (1995). “Evidence from Archival Data on the Relation Between Security Analysts' Forecast Errors and Prior Forecast Revisions.” Contemporary Accounting Research. 11, 919–938.

Francis, J. and Philbrick, D. (1993). “Analysts' Decisions as Products of a Multi-Task Environment.” Journal of Accounting Research. 31, 216–230.

Fried, D. and Givoly, D. (1982). “Financial Analysts' Forecasts of Earnings: A Better Surrogate for Market Expectations.” Journal of Accounting and Economics. 4, 85–107.

Ganguly, A., Kagel, J., and Moser, D. (1994). “The Effects of Biases in Probability Judgments on Market Prices.” Accounting, Organizations, and Society. 19(8), 675–700.

Gillette, A., Stevens, D., Watts, S., and Williams, A. (1999). “Price and Volume Reactions to Public Information Releases: An Experimental Approach Incorporating Traders' Subjective Beliefs.” Contemporary Accounting Research. 16(3), 437–479.

Hirshleifer, D. (2001). “Investor Psychology and Asset Pricing.” Journal of Finance. 56(4), 1533–1598.

Hong, H. and Stein, J. (1998). “A Unified Theory of Underreaction, Momentum Trading and Overreaction in Asset Markets.” Working Paper, Stanford University.

Kahneman, D. and Tversky, A. (1972). “Subjective Probability: A Judgment of Representativeness.” Cognitive Psychology. 3, 430–454.

Kahneman, D. and Lovallo, D. (1993). “Timid Choices and Bold Forecasts: A Cognitive Perspective on Risk Taking.” Management Science. 39(1), 17–31.

Kang, S., O'Brien, J., and Sivaramakrishnan, K. (1994). “Analysts' Interim Earnings Forecasts: Evidence on the Forecasting Process.” Journal of Accounting Research. 32, 103–112.

Libby, R., Bloomfield, R., and Nelson, M. (2002). “Experimental Research in Financial Accounting.” Accounting, Organizations, and Society. 27(8), 775–810.

Lys, T. and Sohn, S. (1990). “The Association Between Revisions of Financial Analysts' Earnings Forecasts and Security Price Changes.” Journal of Accounting and Economics. 13, 341–364.

McNichols, M. and O'Brien, P. (1997). “Self-Selection and Analyst Coverage.” Journal of Accounting Research. 35(Suppl.), 167–199.

Maines, L. and Hand, J. (1996). “Individuals' Perceptions and Misperceptions of Time Series Properties of Quarterly Earnings.” Accounting Review. 71(3), 317–336.

Mear, R. and Firth, M. (1987). “Cue Usage and Self-Insight of Financial Analysts.” Accounting Review. 62, 176–182.

O'Brien, P. (1988). “Analysts' Forecasts as Earnings Expectations.” Journal of Accounting and Economics. 10, 53–83.

Schipper, K. (1991). “Analysts' Forecasts.” Accounting Horizons. 5, 105–121.

Smith, V., Suchanek, G., and Williams, A. (1988). “Bubbles, Crashes, and Endogenous Expectations in Experimental Spot Asset Markets.” Econometrica. 56, 1119–1151.

Taylor, S. (1991). “Asymmetric Effects of Positive and Negative Events: The Mobilization-Minimization Hypothesis.” Psychological Bulletin. 110(1), 67–85.

Tversky, A. and Kahneman, D. (1974). “Judgment Under Uncertainty: Heuristics and Biases.” Science. 185, 1124–1131.

Williams, A. (1987). “The Formation of Price Forecasts in Experimental Markets.” Journal of Money, Credit, and Banking. 19, 1–18.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Stevens, D.E., Williams, A.W. Inefficiency in Earnings Forecasts: Experimental Evidence of Reactions to Positive vs. Negative Information. Experimental Economics 7, 75–92 (2004). https://doi.org/10.1023/A:1026214106025

Issue Date:

DOI: https://doi.org/10.1023/A:1026214106025