Abstract

The vast majority of managers’ earnings forecasts are issued concurrently (i.e., bundled) with their firm’s current earnings announcement. We document a predictable bias in these forecasts—the forecasts fail to fully reflect the persistence of the current earnings surprise. Specifically, we find that managers issue (1) optimistically biased forecasts alongside negative earnings surprises and (2) pessimistically biased forecasts alongside large positive earnings surprises. Bayesian updating implies this bias could be unintentional, but we find that the bias is stronger when managers have greater incentives and fewer constraints to issue biased forecasts, suggesting that, to some extent, the bias might be intentional. Relatedly, although managers typically have better information about their firm’s earnings than analysts, we show that analyst reliance on these biased management forecasts represents a mechanism (and an alternative interpretation) for a similar analyst underreaction to current earnings attributed in the literature to analysts’ cognitive bias. We also find that, on average, investors do not appear to initially understand the bias in these forecasts but do unravel it over longer windows. However, investors more quickly unravel the bias when the manager has a history of issuing biased forecasts and when the firm has more sophisticated investors. Overall, we document that managers’ forecasts appear to repeatedly underweight the persistence of current earnings surprises, are biased in ways that improve investors’ perceptions of managers’ ability, and that this behavior concentrates in subsamples where outsiders have a harder time recognizing any bias.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Research shows that managers issue earnings forecasts to shape analysts’ and investors’ expectations about firm performance (Beyer et al., 2010). For example, Ajinkya and Gift (1984) find that managers issue forecasts prior to an earnings announcement to correct market expectations about a forthcoming earnings release. If managers credibly forecast to correct market expectations, the expected ex post forecast bias (i.e., management forecast minus subsequently released actual earnings) is zero. Subsequent studies examine managers’ use of forecasts prior to an earnings announcement to walk down market expectations to a beatable level (e.g., Cotter et al., 2006; Matsumoto, 2002; Skinner, 1994). If managers forecast to change expectations in a way such that subsequently released actual earnings meet or slightly beat those expectations, expected ex post forecast bias is also zero or slightly negative. The forecasts in the periods studied in these papers are predominantly issued in isolation before an earnings release. Therefore these forecasts exist to determine the earnings surprise and to strategically place the earnings surprise in the meet or just beat category (i.e., they convey zero or slightly negative ex post bias).

In contrast, in more recent times, nearly 90% of forecasts of earnings are released with or very soon after a current earnings announcement in a bundle (Billings et al., 2015; Gong et al., 2009). In this study, we consider Bayes Rule and the potential for managers’ cognitive or intentional bias (or both) to predict that the bundled management forecast’s ex post bias is conditional on the contemporaneous earnings surprise. Specifically, we examine three research questions. First, do managers issue bundled forecasts that end up being biased in the opposite direction of the current earnings announcement surprise? Second, if so, is this bias greater when managers have greater incentives and opportunity to do so? Finally, do investors respond to these forecasts as if they recognize any bias?

We expect that managers are likely to issue forecasts that are biased in the opposite direction of current earnings surprises (i.e., either a miss or a large beat of current earnings expectations). We develop this expectation based on Bayes Rule, or the idea that rational agents revise their expectations based on observing a signal and that belief revisions are weaker when the observed signal is weaker. Applied to our setting, managers have an anterior distribution about firm performance, observe a current signal of firm performance (i.e., the current earnings surprise), and revise their posterior distribution about firm performance (i.e., disclosed through a forecast of future earnings). If managers did not expect a given current earnings surprise (i.e., the manager believes that a miss or a large beat is a weak signal of future earnings), managers might rationally place a lower weight on the current signal when updating their beliefs about the firm performance. If they are cognitively biased and consistently underestimate the extent to which the current surprise will persist (or, alternatively stated, overestimate mean reversion in the earnings series), the resulting forecast will end up being biased in the opposite direction of the current earnings surprise. Thus we first examine whether this empirical relation holds.

Next, we attempt to understand whether any such empirical relation is the result of an unintentional bias where managers place greater weight on their ex ante beliefs and underreact to current earnings surprises, or if instead the behavior appears to be intentional at least to some degree. Research suggests managers could benefit from releasing forecasts that follow this empirical pattern. Specifically, Hermalin and Weisbach (2017) argue that investors evaluate a manager’s ability with Bayes Rule, in that they have an anterior distribution of beliefs about the manager’s type or ability, they observe a signal of the manager’s ability, and then update their beliefs about the manager’s ability—and this belief directly impacts the manager’s current and future compensation. Consequently, managers have an incentive to issue intentionally optimistically biased forecasts when the current earnings surprise is negative (to mitigate investors’ downward revisions about their ability and thus their compensation). Similarly, managers have an incentive to intentionally issue pessimistically biased forecasts when the current earnings surprise is large and positive (to ensure that the next period’s incentive compensation targets are not set unreasonably high, which would also negatively affect their compensation).

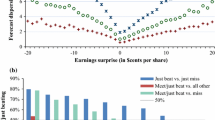

Our sample consists of 29,559 bundled forecasts of annual earnings provided by 1,927 unique firms between 2001 and 2019. We separate the sample into three broad categories based on the sign and magnitude of the current earnings news with which the forecast was released: (1) “missed expectations,” if the current earnings surprise is below consensus expectations; (2) “meet or just beat expectations,” if the current earnings surprise is between zero and 2 cents above expectations; and (3) “large beat expectations,” if the current earnings surprise is greater than 2 cents above consensus expectations. Consistent with our expectations, we document significant and positive management forecast bias for the missed expectations group, suggesting that managers release optimistically biased bundled earnings when current earnings news is negative. Furthermore and consistent with expectations, we document significant and negative management forecast bias for the large beat expectations group, suggesting that managers release pessimistically biased bundled forecasts when current earnings news is large and positive.

To shed light on whether this behavior is intentional, we test whether these results vary predictably in the cross-section based on managers’ constraints and motives. To proxy for constraints, we use (1) analyst monitoring (e.g., Cohen & Zarowin, 2010; Lang & Lundholm, 1993, 1996) (2) litigation risk (e.g., Francis et al., 1994), and (3) forecast horizon (e.g., Rogers & Stocken, 2005). To proxy for motives, we use managers’ career concerns (Baginski et al., 2018). We find that forecasts are more biased conditional on current earnings news when analyst following is lower, litigation risk is lower, the forecast is for a longer horizon, and when managers’ face greater career concerns. Taken together, these cross-sectional tests demonstrate that the bundled management forecast bias we detect relates predictably to managers’ constraints and motives, suggesting that the bias could be, at least to some degree, intentional.Footnote 1

To further examine whether the bias is intentional, we perform three additional tests. First, Chen et al. (2021) document that analysts also appear to underreact to new earnings information (i.e., underweight the persistence of current earnings surprises). Therefore we benchmark our results against analysts. Despite managers typically having better information about their firms’ earnings series, we find that management forecast bias is greater than that exhibited by analysts. Second, we find that the analyst bias appears to be largely driven by manager forecast bias—as analyst forecast bias is over 90% lower when managers do not provide a bundled forecast. Third, we find that the bias holds in a subset where managers are most likely to have an information advantage over analysts. Taken together with the cross-sectional tests above, the results of these tests suggest that the bias is likely to be, at least in part, intentional.

Next, using short-window market reactions to the forecast, we find that investors do not appear to react to the bias contained in these bundled forecasts. However, investors appear to eventually identify and unravel the bias over the 60 days after the forecast. Furthermore, we find that investors appear to identify and unravel the bias in the short window around its release if the manager has a history of issuing biased forecasts or if the firm’s investor base is comprised of proportionally more sophisticated investors.

To further assess the sensitivity of our results, we perform four additional sets of tests. First, because our sample begins with bundled guidance, we examine whether sample selection concerns resulting from the decision to provide bundled forecasts appear to drive our results. Specifically, is providing a bundled forecast driven by missing an earnings target or a large positive earnings surprise? We find no evidence that it is, suggesting that the more recent phenomenon of bundling forecasts with current earnings announcements is more likely driven by persistent investor demand for forecasts at the earnings date (e.g., Rogers & Van Buskirk, 2013).

Second, we assess whether our results are likely to be explained by a time-invariant correlated omitted variable by separately including firm and manager fixed effects, and our results are unchanged. These results suggest that our findings are not due to, among other things, the firm’s information environment, the manager’s forecasting ability, or the manager’s inherent level of optimism or pessimism. To further consider the possibility of a (time-invariant or time-varying) correlated omitted variable, we use the statistical methods of Larcker and Rusticus (2010) and Oster (2019) to evaluate the impact that any such variable, if it were to exist, might have on our results. Both tests suggest that our results are unlikely to be driven by a correlated omitted variable.

Third, while our primary tests examine forecasts of annual earnings, we find our results hold using quarterly earnings forecasts, though they are economically less significant. The fact that the results are economically weaker is consistent with our horizon tests and suggest that there is less opportunity to issue biased forecasts when the forecast horizon is shorter. Finally, we acknowledge that forecasts are but one disclosure a manager could use to manage expectations after a current earnings surprise. Consistent with our findings related to forecasts, we find managers’ non-GAAP exclusions are negatively associated with the current earnings surprise (i.e., relative to periods where current earnings met expectations, managers add back more earnings-reducing items when current earnings missed expectations and “add back” fewer earnings-reducing items when current earnings beat expectations). We also examine whether the number, tone, and uncertainty of forward-looking textual statements differ based on the current earnings surprise. Consistent with an intentional bias explanation, we find that, when issuing optimistically biased forecasts with a missed current earnings surprise, managers use more certain and optimistically toned language.

Despite the robustness of our results to selection and correlated omitted variable concerns, an important caveat is that no archival study can definitively ascribe causality. Furthermore, an archival study can only document empirical regularities and cannot definitively ascribe managerial intent. What we can conclude from our results is that managers appear to repeatedly underweight the persistence of current earnings surprises, that their resulting forecasts are biased in ways that would improve investors’ perceptions of their ability, and that this behavior is concentrated in subsamples where outsiders would have a harder time recognizing bias.

Our study makes several contributions. First, we identify a new and distinct form of forecast bias in management forecasts—managers’ underweighting of current earnings surprise persistence. It is important to document a bias conditional on concurrent earnings surprise because of the pervasiveness of current earnings surprises as well as the pervasiveness with which bundled forecasts exhibit a bias in the opposite sign as the current earnings surprise. Specifically, a current miss or large beat earnings surprise occurs in 67% of the firm-quarters in our sample, and the bundled forecast bias is twice as likely to be of the opposite sign as the current earnings surprise than it is to be of the same sign as the current earnings surprise. Our setting stands apart from the literature in two ways. First, the literature on expectations management and the walk down phenomenon neither hypothesizes nor documents that management forecast bias is conditional on prior earnings surprises or predictably positive in the presence of large earnings surprises. Second, rather than a forecast bias around one-off events like a proxy contest or insider sales (Baginski et al., 2014; Cheng et al., 2013) or due to relatively consistent firm attributes, such as analyst following or litigation risk (Cohen & Zarowin, 2010; Francis et al., 1994; Lang & Lundholm, 1993; Rogers & Stocken, 2005; Warren, 2021), our setting is pervasive and time-varying, as the direction of the bias changes frequently at the firm level.

Second, our findings contribute to the literature documenting analyst underweighting of current earnings information. Chen et al. (2021) document that analysts underweight new information. We show that management forecasts are biased conditional on the sign of current earnings (in the way that understates the implications of current earnings changes for future earnings) and that analysts rely on these biased management forecasts. This evidence provides a mechanism for analyst underreaction to current earnings and suggests that manager forecasts appear to drive the time-series pattern observed in analysts.

Finally, we contribute to the literature examining multiple earnings signals released contemporaneously, a literature that is growing and will likely continue to grow, given that, in recent years, almost 90% of management forecasts are bundled with an earnings announcement and approximately 94% of earnings announcements contain an analyst forecast revision within one day of the earnings announcement (Gong et al., 2009; Lobo et al., 2017). By documenting predictable biased in bundled earnings forecasts, we potentially aid investors in processing bundled management disclosures more efficiently.

2 Hypothesis development

2.1 Management forecast bias conditioned on the contemporaneous earnings surprise (H1)

The literature examines the extent to which managers issue forecasts to shape analysts’ and investors’ expectations. Seminal papers, such as the work of Ajinkya and Gift (1984), suggest managers issue forecasts to correct market expectations, where a maintained assumption is that forecasts are “unbiased and symmetrical” (p. 426). Subsequent studies examine managers’ use of forecasts to walk down overly optimistic market expectations to a beatable level (e.g., Cotter et al., 2006; Matsumoto, 2002; Skinner, 1994). A defining feature of prior studies is that managers make the forecast decision in advance of an earnings announcement to guide the market to a beatable benchmark. However, managers now bundle their earnings guidance with the current earnings announcement, accounting for close to 90% of all forecasts in recent years (Billings et al., 2015; Gong et al., 2009). This represents an important shift in forecasting, as the majority of forecasts are now provided immediately after the announcement of current earnings news.

We examine whether this shift in forecast timing results in forecasts being predictably biased based on the sign of the current earnings news with which the forecast is released. In particular, we examine whether managers issue (1) optimistic forecasts when the concurrently released current earnings news is bad, and (2) pessimistic forecasts when the contemporaneously released current earnings news is large and positive. Theory suggests such a relation is possible because of cognitive reasons as well as managerial opportunism. We discuss each in turn.

Forecasts may end up being predictably inaccurate due to a cognitive bias of managers. Bayes Rule argues that rational agents have an anterior distribution of beliefs about firm value, observe a signal about firm performance, and then update their beliefs to form a posterior distribution of beliefs about firm value. The amount of revision in the distribution of beliefs depends on the strength of the current signal. By definition, the current performance is largely unexpected, so we predict that rational agents (i.e., managers) will place a lower weight on the current signal when updating their beliefs about firm value (or, in this case, long-run earnings performance). Accordingly, when the current signal is unexpectedly negative or positive, managers place a lower weight on how this impacts future performance and thus expect this surprise to be of lower persistence. The following pattern will emerge: (1) when the earnings surprise is negative, managers overestimate next period’s earnings (i.e., issue an optimistically biased bundled forecast), and, (2) when the earnings surprise is large and positive, managers underestimate next period’s earnings (i.e., issue a pessimistically biased bundled forecast).

The literature finds that analysts exhibit underweighting of current earnings information (Abarbanell & Bernard, 1992; Ali et al., 1992; Chen et al., 2021; Mendenhall, 1991; Zhang, 2006). However, managers generally have better information about their firm than analysts (Hutton et al., 2012), suggesting they should be less subject to a cognitive bias than analysts. However, managers stand to benefit from issuing bundled forecasts that are biased in the opposite direction the current earnings news, leading to the possibility that managers issue biased forecasts intentionally. The literature finds examples in which managers are willing to strategically inject bias into their forecasts, suggesting such an outcome is possible (e.g., to increase insider trading gains, as in Cheng et al., 2013, or during proxy contests, as in Baginski et al., 2014).

Managers could benefit from issuing forecasts biased in the opposite direction of the current earnings news because investors evaluate managers based on Bayes Rule as well (Hermalin & Weisbach, 2017). That is, investors have an anterior distribution of beliefs about the manager’s type or ability, they observe a signal of the manager’s ability in the current period, and then update their beliefs to form a posterior distribution of beliefs about the manager’s ability.

If current earnings news is negative, rational investors will downwardly revise their perceptions about the manager’s ability, which could hurt things such as the manager’s compensation, job security, or both. Thus managers have an incentive to issue an optimistically biased forecast in the hopes that it will cause investors to place less weight on the current performance signal and end up with a higher posterior distribution of beliefs about the manager’s ability (Hughes & Pae, 2004), protecting the manager’s compensation and job security. In sum, the potential for cognitive bias when earnings surprises are unexpectedly negative and the existence of incentives to intentionally bias upward when earnings surprises are negative lead to our first prediction.

-

H1a: Managers issue bundled earnings forecasts that are optimistically biased when the contemporaneously released current earnings surprise is negative.

If current earnings news is unexpectedly good, rational investors will upwardly revise their perceptions about the manager’s ability. Whether managers will want to temper this revision is theoretically less clear. On one hand, research supports the argument that managers always want to present themselves in the best possible light (e.g., Merkl-Davies & Brennan, 2007). If so, managers would have no incentive to issue a pessimistically biased forecast when current earnings news is unexpectedly good.

On the other hand, the literature provides at least two reasons why managers would want to temper investors’ perceptions about their ability even when it is positive. First, if investors now accept the unexpectedly positive current performance as expected, then they will anticipate this level or growth in performance in future periods. Indjejikian et al. (2014) discuss this ratcheting up principle, stating that “current performance acts like a notched gear wheel in fixing point of departure for next period’s target (p. 1259).” This means that a manager’s bonus target in the next period might be unrealistically high and the manager runs the risk of losing compensation. Thus the manager will want to attribute at least a portion of the current period surprise to luck rather than skill so that they can have bonus targets in the next period that are more easily achievable. To do so, managers could issue a negatively biased forecast with the current earnings news.

Second, when evaluating a manager’s ability, investors likely not only consider the level of performance (i.e., positive or negative) but also the volatility in that performance (Beyer et al., 2010). If the current period earnings is positive, the manager has already enjoyed credit for an increase in the level of current earnings. Therefore that person might turn his or her focus toward the volatility of the overall earnings series, so that, if future performance mean reverts, the shock to investors will be less and, because they were warned, their revisions about the manager’s ability will be more favorable. In sum, the potential for cognitive bias when earnings surprises are unexpectedly positive and the existence of incentives to intentionally bias downward when earnings surprises are positive lead to our second prediction.

-

H1b: Managers issue bundled earnings forecasts that are pessimistically biased when the contemporaneously released current earnings surprise is large and positive.

2.2 Cross-sectional variation based on managers’ constraints and incentives (H2)

Despite incentives to bias their bundled earnings forecasts, managers face several constraints on their ability to do so. For example, they are constrained by analyst monitoring (e.g., Cohen & Zarowin, 2010; Lang & Lundholm, 1993, 1996; Warren, 2021), litigation risk (e.g., Francis et al., 1994), and investors’ ability to assess bias in forecasts (Ball et al., 2012; Rogers & Stocken, 2005). In addition, managers face greater incentives to manage investors’ perception of their ability when they face greater career concerns (i.e., concern over their current and future compensation levels). Accordingly, we predict bundled forecast bias will be greater when managers have less constraints and greater incentives to do so. This leads to a pair of hypotheses.

-

H2a: Managers with lower constraints and greater incentives have a greater tendency to optimistically bias their bundled forecasts when the contemporaneously released current earnings surprise is negative.

-

H2b: Managers with lower constraints and greater incentives have a greater tendency to pessimistically bias their bundled forecasts when the contemporaneously released current earnings surprise is large and positive.

2.3 Investor reaction to bundled forecasts (H3)

Finally, we examine whether investors react differently to biased forecasts that accompany a miss or large beat earnings surprise. Research suggests investors react more strongly to higher quality forecasts (e.g., Ball et al., 2012). If investors perceive bundled forecasts that accompany a miss or large beat earnings surprise to be lower quality, they might respond more weakly to them. However, research also suggests that investors cannot always identify low-quality forecasts (e.g., Rogers & Stocken, 2005). If so, investor reaction to these forecasts might not differ from those of other forecasts. Given this tension, we state H3 in the null form.

-

H3: Investors do not behave as if they identify the bias in bundled forecasts.

3 Research design and results

3.1 Research design for H1

We begin our analysis by separating our sample of bundled forecasts into groups based on the magnitude and sign of current earnings news (i.e., unexpected earnings) with which the forecast was released. Following the literature, we defined a forecast as bundled when it is released within a two-day window centered on the earnings release date. We create three categories of current earnings surprise based on the extent to which current earnings deviate from the consensus expectation: (1) “missed expectations,” where the current earnings surprise is below consensus expectations; (2) “meet or just beat expectations,” where the current earnings surprise is equal to zero, one, or two cents above expectations; and (3) “large beat expectations,” where the current earnings surprises was greater than two cents above consensus expectations.Footnote 2

To test H1, we estimate a pooled regression in which we regress the bundled management forecast bias on two indicator variables: (1) an indicator variable equal to one for MissedExpectations and (2) an indicator variable equal to one for LargeBeatExpectations. We define MEF_Bias as the signed difference between the management earnings forecast and the actual reported earnings for the period forecasted (scaled by price). The calculation of MEF_Bias is simple for point forecasts but complicated when the forecast is in a closed-range form. Accordingly, we use three alternative measures of the bias in range forecasts that vary the management forecast from which actual reported earnings are subtracted: (1) MEF_Bias_ub, (2) MEF_Bias_mp, and (3) MEF_Bias_range, which we describe more fully when we present our results. Our empirical model is as follows.

Recall that H1a predicts managers issue bundled earnings forecasts that are optimistically biased when the contemporaneously released current earnings surprise is negative (i.e., the coefficient on MissedExpectations is positive, or α1 > 0). Similarly, H1b predicts that managers issue pessimistically biased forecasts when the current earnings surprise is large and positive (i.e., the coefficient on LargeBeatExpectations is negative, or α2 < 0).

We include controls for firm characteristics, such as firm size (Size), market-to-book ratio (MB), institutional ownership (InstOwn), and analyst following (Afollow). We also control for analyst forecast dispersion (Dispersion) because Rogers and Stocken (2005) suggest managers bias their forecasts more when analyst forecast dispersion is higher. Next, we include industry concentration (Concentration), litigation risk (LitRisk), and research and development expense (R&D), as these variables likely correlate with the firm’s propriety costs of voluntary disclosure (e.g., Skinner, 1994). We also include accruals quality (AccrualQuality) to control for the firm’s general reporting quality. Next, to control for forecast difficulty, we include prior earnings volatility (EarnVol), forecast horizon (Horizon), and a loss indicator (Loss) (e.g., Hayn, 1995; Yang, 2012). We also include industry and year fixed effects, winsorize continuous variables at the first and 99th percentiles, and cluster standard errors by firm.Footnote 3

3.2 Research design for H2

H2 attempts to shed light on whether any biased forecasting we identify could be the result of intentional bias by managers. To test H2a and H2b, we estimate four cross-sectional tests based on managers’ constraints and incentives (three tests using proxies for constraints and one using a proxy for incentives). For each, we partition our sample into firms that have low versus high constraints/incentives. First, we partition on analyst following, as research suggests analysts play a monitoring role in disclosure, thus constraining managers from disclosing opportunistically. Second, we partition on litigation risk, because managers who face higher litigation risk are constrained from forecasting opportunistically. We measure litigation risk following Kim and Skinner (2012). Third, we partition on forecast horizon, because it is more difficult for investors to identify the bias in longer horizon forecasts. Finally, for our measure of incentives, we partition on career concerns. To proxy for career concerns, we follow Baginski et al. (2018) and use eight career concern measures to employ a principal component analysis that identifies managers who face higher career concerns.

We estimate Eq. (1) separately for each partition (defined as the upper and lower quartile of the sample) and compare the coefficients on MissedExpectations and LargeBeatExpectations across partitions. Following H2a and H2b, we expect the effect magnitudes in the low constraints/high incentives to bias partitions to be significantly greater than the high constraints/low incentives partitions.

We acknowledge that some of the variables upon which our cross-sectional tests are based not only reflect instances where a manager has the ability or incentives to strategically bias the forecast but also might be less capable of forecasting accurately, either due to less feedback from analysts or less experience with forecasting. However, if a forecast is difficult to make or the manager is inexperienced, this would increase the error on either side of the forecast (i.e., less accurate forecasts), but it would not lead to our prediction that forecasts are biased in a particular direction. Furthermore, Rogers and Stocken (2005) argue that, when accurate forecasting is more difficult, this provides the manager with the ability to engage in intentional bias (because it is more difficult for outsiders to recognize it), so the literature argues these are exactly the scenarios where we would expect to find intentional bias if it exists.Footnote 4 Nevertheless, if managers with less experience are more likely to underweight the persistence of current earnings surprises, these patterns with respect to career concerns may reflect unintentional bias.

3.3 Research design for H3

We perform two tests to examine whether investors appear to recognize the bias contained in bundled forecasts: (1) the initial price reaction to earnings bundled with forecasts and (2) price drift following bundled management forecasts. To examine the initial price reaction to earnings bundled with forecasts, we begin with the regression model of Lobo et al. (2017).

where BHAR is the three-day buy-and-hold abnormal return centered on the earnings announcement, Earnsurp is the earnings surprise of the current earnings announcement (scaled by stock price), and MEF_News_Contra is an indicator variable equal to one if the bundled forecast contained forecast news in the opposite direction of the current earnings surprise and zero otherwise. Consistent with the earnings response coefficient (ERC) being lower when management issues guidance with forecast news in the opposite direction of the current earnings surprise, Lobo et al. (2017) document a negative and significant coefficient on α3. Because H3 depends on whether investors distinguish bundled forecasts that end up being biased when the eventual earnings are announced from those that accurately reflect future performance, we modify the Lobo et al. (2017) model as follows.

where MEF_Bias_Contra is an indicator variable equal to one if the bundled forecast contained forecast bias in the opposite direction of the current earnings surprise and zero otherwise. If investors fail to recognize the bias, we should find that ERCs are lower when current earnings are issued with a forecast of opposite news, whether or not it contains bias (i.e., a statistically insignificant α4). Alternatively, if investors recognize the bias, we should find that α4 is significantly positive (i.e., that the significantly negative coefficient of α3 is attenuated).

To examine whether investor reaction to the forecast is complete or delayed, we also estimate Eq. 2b using buy-and-hold returns starting at day +2 relative to the management forecast as the dependent variable. Given that it is not clear exactly when the market may learn about management’s forecast bias, we end the drift accumulation period at days +10, +20, +60, and through the date of the annual earnings release where the full bias is known.Footnote 5

3.4 Sample information and descriptive statistics

We initially sample all bundled management forecasts of annual earnings per share from 2001 to 2019, which yields 49,885 forecasts that have necessary firm identifiers.Footnote 6 As reported in Panel A of Table 1, after we delete open-ended and qualitative forecasts and observations with missing control variables, our sample consists of 29,559 bundled forecasts of annual earnings.

Panel B of Table 1 displays the distribution across industries. Consistent with prior research, the majority of the firms in our sample (42%) are in the manufacturing industry. Other significant industries include services (17%), retail (13%), and telecommunications (14%). The remaining industries each have less than 7% of the total observations. Panel C tabulates forecasts by fiscal quarter of the earnings announcement with which the forecast is issued, indicating the sample is evenly distributed across fiscal quarters. Finally, Panel D displays the number of forecasts issued per firm-year and indicates that over 95% of observations are from firms that issue four or less forecasts per year (i.e., an average of one per quarter).Footnote 7

Table 2, Panel A, reports descriptive statistics for the full sample. We consider three definitions of MEF_Bias: (1) MEF_Bias_ub, which uses the upper bound of the range to define management forecast bias (Ciconte et al., 2014); (2) MEF_Bias_mp, which uses the midpoint of the range to define bias; and (3) MEF_Bias_range, which uses the upper (lower) bound of the forecast when actual earnings are above (below) the range to compute bias and zero if actual earnings fall anywhere in the range.Footnote 8 Descriptive statistics for all three measures are consistent with expectations. For example, we report a mean of 0.22 for MEF_Bias_mp, compared to Rogers and Van Buskirk (2013), who report a mean bias of 0.20. Consistent with prior research (e.g., Billings et al., 2015), MissedExpectations has a mean of 21%. Our second variable of interest, LargeBeatExpectations, has a mean of 46%, suggesting firms can often beat expectations of current earnings by three cents per share or more. In other words, a current miss or large beat earnings surprise occurs in 67% of the firm-quarters in our sample.

Table 2, Panel B, displays descriptive statistics by earnings announcement news for our primary variables. For the three measures of management forecast bias, we find the most positive (most negative) amount of bias in the MissedExpectations (LargeBeatExpectations) group. This is consistent with H1a and H1b.

To illustrate that firms vary in the extent to which they miss, meet, and beat current earnings over time, Table 2, Panel C, presents the frequency of how often firms fall into each earnings surprise category in the current and prior quarter. While 52% of observations in our sample remain in the same earnings surprise category from the prior to current quarter (i.e., adding the three diagonals of Panel C), a meaningful 48% of observations switch earnings surprise categories from quarter to quarter (i.e., adding the off diagonals of Panel C).

Finally, Panel D presents the frequency of positively biased, negatively biased, and unbiased forecasts by earnings surprise category. Consistent with H1a, the majority (70.6%) of forecasts within the missed current earnings expectations category are positively biased. Consistent with H1b, the majority (57.7%) of forecasts within the large beat expectations group are negatively biased.

4 Results

4.1 Tests of H1a and H1b—Current earnings surprise and management forecast bias

Table 3 presents results from estimating Eq. (1) to test H1a and H1b. Recall that our variables of interest are (1) MissedExpectations, an indicator variable equal to one if the firm missed current earnings expectations, and zero otherwise, and (2) LargeBeatExpectations, an indicator variable equal to one if the firm beat current earnings by three cents or more, and zero otherwise. The three columns correspond to each measure of MEF_Bias.

Beginning with the upper bound-based definition of bias in Column 1 (MF_Bias_ub), consistent with H1a, we find a positive coefficient on MissedExpectations (coefficient = 0.382; p value <0.01); when current earnings announcement news is negative, managers issue more optimistically biased bundled earnings forecasts. Consistent with H1b, we find a negative coefficient on LargeBeatExpectations (coefficient = −0.464; p value <0.01); when current earnings announcement news is abnormally positive, managers issue more pessimistically biased bundled earnings forecasts. Columns 2 and 3 show that our inferences are similar if we use the midpoint of the range to define bias (MEF_Bias_mp) or use the alternative MEF_Bias_range measure.Footnote 9 These results are not only statistically significant but also economically meaningful. Specifically, the coefficient on MissedExpectations (LargeBeatExpectations) of 0.382 (−0.464) suggests that managers increase (decrease) forecast bias by 0.38% (0.46%) of stock price when the current earnings surprise is negative (abnormally positive).Footnote 10 For comparison purposes, a one standard deviation increase in firm size corresponds to a 0.42% decrease in forecast bias.

Our controls behave as expected. For instance, Size relates negatively to forecast bias, as larger firms issue less optimistically biased forecasts. InstOwn is significantly negative, suggesting that institutions also help monitor managers’ disclosures (e.g., Ayers et al., 2011; Boone & White, 2015). Finally, consistent with prior research (e.g., Rogers & Stocken, 2005), Horizon is positive and significant, suggesting that longer horizon forecasts are more optimistically biased on average.

4.2 Tests of H2a and H2b—Cross-sectional tests on managers’ constraints and incentives

To shed light on whether the documented bias behavior may be at least in part intentional, H2 examines whether managers are more likely to bias their forecasts when they face lower constraints and higher incentives to do so. We estimate four cross-sectional tests based on managers constraints and incentives (three tests using proxies for constraints and one using a proxy for incentives): (1) analyst following, (2) litigation risk, (3) forecast horizon, and (4) managers’ career concerns. For each measure, we consider firms in the upper and lower quartile to have high or low constraints/incentives. Table 4 presents our tests of H2a and H2b. For presentation purposes, we only report the coefficients on MissedExpectations and LargeBeatExpectations, although we estimate the full Eq. (1) for each partition.

Panel A of Table 4 presents results for the analyst following constraint. Results are consistent with H2a and H2b. The coefficient on MissedExpectations (LargeBeatExpectations) is 0.708 (−0.559) in the low analyst following partition but 90% (51%) smaller in the high analyst following partition, and these differences are statistically significant. Panel B of Table 4 presents results for the litigation risk constraint. With respect to H2a, the coefficient on MissedExpectations is 0.622 in the low litigation risk partition but only 0.419 in the high litigation risk partition. This difference is significantly different (p value = 0.048). However, for H2b, although directionally consistent, there is no evidence of a significant difference between the coefficient on LargeBeatExpectations between partitions (p value = 0.115). This asymmetric finding with respect to litigation risk is perhaps not surprising, given that litigation risk is less likely to constrain managers from issuing a pessimistic forecast (i.e., managers are more likely concerned with being sued for issuing an optimistic forecast). Panel C of Table 4 presents results for our cross-sectional test on forecast horizon. For this test, we partition our sample into forecasts made for two or more quarters ahead versus those made for one quarter ahead. Consistent with H1a and H1b, we find statistically larger magnitude coefficients in the two or more quarters ahead subsample. Specifically, the coefficient on MissedExpectations (LargeBeatExpectations) is 0.418 (−0.533) in the 2+ Qtrs Ahead partition but 30% (60%) smaller in the one quarter ahead partition.Footnote 11

Finally, Panel D of Table 4 presents results for our cross-sectional test on managers’ incentives, which we proxy for with managers’ career concerns (using a principal component analysis to measure career concerns). With respect to H2a, the coefficient on MissedExpectations is 0.468 (p value <0.01) in the high career concerns partition, compared to only −0.028 (p value = 0.731) in the low career concerns partition. With respect to H2b, the coefficient on LargeBeatExpectations is −0.600 (p value <0.01), compared to only −0.310 (p value <0.01) in the high career concerns partition. Tests of differences for H2a and H2b are significant.

Overall, the totality of our results regarding H2a and H2b suggest that managers bias their bundled forecasts more when they have fewer constraints on doing so and when they have more incentives to do so. These results cast doubt on the idea that our documented results are purely the result of managers’ unintentional cognitive bias.

4.3 Test of H3—Investors’ response to bundled forecasts

H3 examines whether investors behave as if they identify the bias in bundled forecasts. If they do, we expect them to discount bundled forecasts that likely contain bias. Table 5, Panel A, presents the results of estimating Eq. 2b.Footnote 12 Column 1 presents results for the full sample. To separately evaluate the effect of earnings guidance when current earnings news is negative (i.e., our definitions of Missed Expectations) versus large and positive (i.e., our definition of Large Beat Expectations), we also estimate Eq. 2b separately for each group (columns 2 and 3). Consistent with the finding of Lobo et al. (2017), the coefficient on Earnsurp*MEF_News_Contra is negative and significant, suggesting investors react less to earnings announcements with a bundled forecast news in the opposite direction of the current earnings surprise. More importantly, the coefficient on Earnsurp*MEF_News_Contra*MEF_Bias_Contra is statistically insignificant in each column, suggesting that attenuation of ERCs by bundled earnings guidance of opposite news is not conditional on the presence of management forecast bias.Footnote 13 That is, investors appear unable to identify when managers issue a bundled management forecast that is biased ex post.

Although investors appear to, on average, not initially identify the bias in bundled forecasts, we expect situations exist in which they are more likely to do so. Accordingly, we also examine whether investors are more able to identify bias (1) when the manager has a history of issuing biased bundled forecasts, (2) when the investor base in made up of proportionately more sophisticated investors and (3) over a longer window return.

Panel B of Table 5 presents results for a test of Eq. 2b partitioned on managers’ past behavior. The high (low) past bias columns present results for managers in the upper (lower) quartile of the proportion of bundled forecasts issued over the past three years that were either optimistic when the current earnings surprise was negative or pessimistic when the current earnings surprise was large and positive. Interestingly, in the high past bias columns, investors partially unravel the bias in forecasts at the date of the bundled release. (Tests of differences are significant for the full sample and missed expectations sample, although not for the large beat expectations sample.)

Panel C of Table 5 shows results for the upper and lower quartiles of institutional ownership. Although statistically weaker, there is some evidence to suggest more sophisticated investors partially unravel the bias. (Tests of differences are significant in the full sample and large beat expectations sample, although not the missed expectations sample.)Footnote 14 Finally, Panel D examines buy-and-hold returns starting at day +2 relative to the management forecast. Given that it is not clear exactly when the market learns about management’s forecast bias, we end the drift accumulation period at days +10, +20, +60, and through the date of the annual earnings release where the full bias is known.Footnote 15 Consistent with the post-earnings announcement drift literature, we document a positive and significant value for EarnSurp, indicating the presence of return drift in the direction of the current earnings surprise. Second, we document a significantly negative value for EarnSurp*MEF_News_contra. As these forecasts are those without an ex post bias, this finding is consistent with the work of Zhang (2012), who finds that post-earnings announcement drift is attenuated for firms that issue high-quality earnings guidance. Finally and most importantly, Earnsurp*MEF_News_Contra*MEF_Bias_Contra is positive and increasing in both economic and statistical significance as we widen the return drift window from 10 to 60 days and through the subsequent earnings release when the bias is fully revealed. This result suggests that investors eventually unravel the bias in bundled earnings guidance as additional information about forecasted earnings is revealed.

5 Additional analysis and robustness

5.1 Comparison to analyst forecast bias

Research suggests analyst forecast bias appears to exhibit a similar pattern, relative to current earnings surprises (e.g., Chen et al., 2021). If the manager bias we document is unintentional, we would expect that it would be lower than the bias in analyst forecasts because managers should have better information about their firms. Thus we benchmark our results against analysts in three ways. First, we compare managers’ forecast bias to that of analysts and examine how analysts’ forecast bias changes after they observe a management forecast. Second, we compare analyst forecast bias when there is no manager forecast. Third, we re-examine managers’ forecast bias for a subset of the sample where it is most likely that managers have better information than analysts.

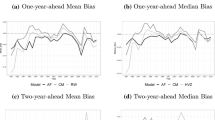

Our first test compares the management forecast bias documented in Table 3 to the same bias computed from analyst forecasts. Ideally, we would collect an analyst forecast after the analyst observes the current earnings signal but before the analyst observes the management forecast to be consistent with the manager who knows the current earnings realization prior to issuing guidance. However, because the current earnings news and the bundled management forecast are released together, this is not possible. Thus we follow Rogers and Van Buskirk’s (2013) approach developed specifically to address this issue and estimate the analyst’s forecast after accounting for the current earnings signal but before observing the bundled management forecast.Footnote 16AEF_Bias (pre) is computed as the difference between this estimated analyst forecast and actual earnings for the period forecasted (scaled price and multiplied by 100). We also compute the bias of analyst forecasts after observing the earnings announcement and management forecast, AEF_Bias (post), by comparing the most recent consensus analyst forecast after the bundled management forecast/earnings release to subsequently realized earnings.

Table 6, Panel A, presents the results. The results using AEF_Bias (pre) as the dependent variable (Column 2) exhibit a pattern of underreaction, positive (negative) bias for missed expectations (large beat expectations), suggesting analysts forecasts exhibit the same bias as do those of managers. However, management bias (Column 1) is larger than analyst bias. If we construct a new dependent variable by taking the difference between managers and analysts (Column 3), the difference in behavior is significant for both missed expectations and large beat expectations. This result is puzzling if the management bias is purely unintentional, given that one would expect greater analyst bias (or, at a minimum, no difference in bias), relative to managers. Specifically, if managers have better information about their firm’s earnings process, they should be less likely (or at least no more likely) to exhibit unintentional bias. Finally, Column 4 examines how analyst bias is affected by the release of a management forecast. AEF_Bias (post) captures analyst bias computed from analyst forecasts after the release of the management forecast/earnings release bundle, while AEF_Bias (pre) captures analyst bias computed from the analyst forecast adjusted for the current earnings in the bundle but not the management forecast. AEF_Bias (post) minus AEF_Bias (pre) is significantly greater in the predicted directions for missed and large beat expectations, suggesting management forecast bias exacerbates analyst forecast bias.

Our second test further examines how management forecasts exacerbate analyst forecast bias. Specifically, we compare analyst forecasts issued for firms with versus without bundled guidance. Panel B of Table 6 presents the results. For comparison, column 1 repeats our primary result showing management forecast bias. Column 2 (3) presents results for analyst forecast bias for firms that do (do not) issue bundled forecasts. Consistent with the literature suggesting manager forecasts influence analyst forecasts, the coefficient on MissedExpectations and LargeBeatExpectations is much larger in the sample of firms that provide bundled earnings guidance, relative to those that do not. (The coefficients are 91% and 97% smaller in column 3 for MissedExpectations and LargeBeatExpectations, respectively.)

Our first two tests comparing managers to analysts implicitly assume that managers have better information about their firms and thus should be less subject to cognitive biases. While we believe this is on average true, in our third test, we identify cases where this is more likely to hold using the approach of Hutton et al. (2012) to identify cases in which managers have an information advantage over analysts. If our results are driven by cognitive bias, we would expect managers to exhibit less of this biased forecast behavior when they have better information than analysts.

Panel C of Table 6 presents the results. Not only do we find no difference between forecast bias in the high versus low manager knowledge partition, we find greater bias for both the MissedExpectations and LargeBeatExpectations coefficients in the high manager knowledge partition. Once again, this is a puzzling result if one believes the manager bias is purely unintentional.Footnote 17

5.2 The decision to issue bundled guidance and selection concerns

The sample in our main analyses captures all firms that issue bundled guidance. In this section, we examine whether this research design choice leads to selection bias. Specifically, Panel A of Table 7 presents the results of estimating a determinants model on the decision to issue bundled guidance. We include our variables of interest (MissedExpectations and LargeBeatExpectations) to examine whether the decision to bundle guidance is also determined by these conditions. All other variables are based on the work of Rogers and Van Buskirk (2013). A positive coefficient on MissedExpectations would indicate managers are more likely to bundle guidance if they miss current earnings expectations and LargeBeatExpectations would indicate managers are more likely to bundle guidance if they beat current earnings expectations by a large margin. We find no evidence of this behavior. The coefficient on MissedExpectations is actually negative and significant and the coefficient on LargeBeatExpectations is insignificant. We interpret these findings to suggest that managers do not necessarily decide to issue a bundled earnings forecast to strategically downplay current earnings news. (If anything, they seem to opt for silence when performance is not positive, consistent with the literature [Houston et al., 2010].)

Next we perform a Heckman (1979) two-stage selection model to address concerns over selection issues.Footnote 18 Panel B of Table 7 re-performs our primary test after including the Inverse Mills Ratio obtained from the first stage. Theoretically, the Inverse Mills Ratio captures unobservable characteristics associated with issuing management guidance that we did not explicitly control for. The coefficient on MissedExpecatations (LargeBeatExpectations) remains positive (negative) and significant in all three columns, consistent with our tests that do not address selection concerns.Footnote 19,Footnote 20

5.3 Systematic management forecast behavior and correlated omitted variables

Several studies document consistent (i.e., time-invariant) management forecasting behavior (e.g., Bamber et al., 2010; Hilary et al., 2014; Hribar & Yang, 2016), and, in addition, Gong et al. (2011) find serial correlation in management forecast bias. Manager effects are important because managers who are consistently overconfident (underconfident) can have consistently optimistic (pessimistic) forecasts and a greater propensity to miss (meet) current earnings expectations. Columns 1, 2, and 3 in Table 8 present results from estimating Eq. (1) using industry, firm, and manager fixed effects, respectively. Because we require manager identification from ExecuComp, our sample is smaller than in our main analyses, but, for comparison purposes, we use a constant sample in columns 1 through 3. Firm or manager fixed effects (or both) will purge our results of any consistent (i.e., time-invariant) forecasting behavior on the part of the manager. Consistent with our main analyses, the coefficient on MissedExpectations remains positive and significant in each of the three columns, and the coefficient on LargeBeatExpectations remains negative and significant in each of the three columns.

In columns 4 through 6, we re-estimate the regressions in columns 1 through 3 after excluding forecasts that exhibit serial correlation in forecast bias. We follow the methodology of Gong et al. (2011) to identify serial correlation. Specifically, for each firm, we identify a forecast as exhibiting serial correlation if the forecast has the same direction of forecast bias (either optimistic or pessimistic) as a forecast with a similar horizon that management issued in the previous period. Consistent with our main analyses, the coefficients on MissedExpectations and LargeBeatExpectations remain positive and negative, respectively, and significant in each column.

While these tests largely mitigate the concern of a time-invariant correlated omitted variable, they leave open the possibility of a time-varying omitted variable that we cannot identify. Therefore we use two additional methods to evaluating the impact that a (time-invariant or time-varying) correlated omitted variable might have on our results. First, following Frank (2000) and Larcker and Rusticus (2010), we examine how highly correlated an unobservable variable would have to be to change our inferences. Using the impact threshold for a confounding variable (ITCV), we determined that, if a correlated omitted variable were it to exist that could overturn the positive association between MissedExpectations and MEF_Bias_ub, it would have to have an effect that is 2.32 times larger than the effect of the most impactful control variable on that relation (i.e., Size). Similarly, if an omitted variable were it to exist that could overturn the negative association between LargeBeatExpectations and MEF_Bias_ub, it would have to have an effect that is 1.99 times larger than the effect of the most impactful control variable on that relation (i.e., EarnVol).Footnote 21 While not impossible, we consider it unlikely that an unidentified time-varying control variable has a much larger impact than Size and EarnVol. Second, following the methodology of Oster (2019), an omitted variable would need to be 1.53 times (for MissedExpectations) and 3.33 (for LargeBeatExpectations) times more important than the combined effect of our controls to alter our results. Although not impossible, we consider this to also be unlikely.

5.4 Considering management forecasts of quarterly earnings

Recall that our tests use management forecasts of annual earnings because managers are more likely to bias longer horizon forecasts (e.g., Rogers & Stocken, 2005). In addition, managers may use quarterly forecasts only to update an annual forecast (when needed) from earlier in the year. However, in this section, we examine whether our results hold with quarterly forecasts.

Table 9 presents a replication of our primary test (i.e., Table 3) using quarterly guidance.

Although our primary results hold using quarterly forecasts, the economic magnitude is markedly smaller. These results are consistent with our expectation that managers have less of an opportunity or incentive to bias their forecasts if the eventual earnings realization occurs in the next period. This is also consistent with our cross-sectional test of forecast horizon (i.e., Table 4, Panel C), which shows our results are stronger for longer horizon forecasts.

5.5 Considering other management disclosures

If managers want to signal less persistence of a current earning surprise, they might do so through a disclosure other than management forecasts. Thus we consider two other options available to them: (1) non-GAAP disclosures and (2) qualitative disclosure of forward-looking information in the earnings announcement. Managers could use non-GAAP disclosure to signal that large unexpected current earnings surprises are unlikely to persist (Curtis et al., 2014). Therefore, in Panel A of Table 10, we examine the sign and magnitude of non-GAAP exclusions, conditional on the current earnings surprise. Consistent with the pattern we find with management forecasts, we find managers have more non-GAAP exclusions that increase (decrease) GAAP earnings when the earnings surprise is negative (large and positive). This suggests non-GAAP exclusions follow the same pattern we find in forecasts—managers use non-GAAP exclusions to adjust GAAP earnings closer to the expected benchmark (in both directions), subject to frictions that might prevent them from using non-GAAP (i.e., the Regulation G requirement to reconcile non-GAAP to GAAP, the relatively strict rules around what items can be excluded, and scrutiny from regulators, auditors, and investors [Kolev et al., 2008]).

Managers could also use textual disclosures to convey to investors that large current earnings surprises will be less persistent. Accordingly, we use textual analysis to examine the forward-looking statements in firms’ earnings announcements. To examine the textual forward-looking disclosure, we use the methodology of Bozanic et al. (2018). Specifically, we follow their methods to identify all forward-looking statements in our firms’ earnings announcements. We then explore three dependent variables: (1) the percentage of total sentences in the earnings announcement that are forward-looking, (2) the tone of these forward-looking sentences, and (3) the uncertainty of these forward-looking sentences.

Our analyses attempt to test whether managers with current missed earnings or large beat earnings that issue opposite signed forecasts (i.e., the treatment group or forecasts deemed to have the perception of strategic bias) also provide textual disclosures that have more forward-looking statements, have stronger tone in the direction of the biased forecast, use more certainty words to convince investors that their biased forecasts are true, or a combination of these. For each firm in the treatment group, we identify a control firm that had a similar level of bias in its forecasts but did not have an opposite signed current earnings miss or large beat. Then we create the variable, SuspectForecast, an indicator variable equal to one if the manager biased the forecast in the opposite direction of current earnings news (i.e., likely used their forecast strategically) and zero otherwise and examine variation in the three previously mentioned dependent variables.

Panel B of Table 10 presents results. Column 1 presents results for the percentage of total sentences in the earnings announcement that are forward-looking. We find insignificant coefficients for both interaction terms, indicating no evidence that managers use different amounts of forward-looking words, conditional on using a potentially strategic bundled forecast. Column 2 presents results for the tone of forward-looking words. We find some evidence that managers use more positively toned forward-looking language when issuing an optimistically biased forecast with a negative current earnings surprise (p value = 0.072). However, we find no such difference when managers issue a pessimistically biased forecast with a large beat earnings surprise. Finally, column 3 presents results using the uncertainty of forward-looking statements. The main effect of MissedExpectations is positive and significant, indicating managers talk about the future with more uncertainty when they miss current earnings expectations. However, our coefficient of interest, MissedExpectations*StrategicForecast is negative and significant, indicating managers talk about the future with more certainty when providing an optimistically biased forecast to potentially offset bad current earnings news.Footnote 22 Collectively, these results provide evidence that managers use avenues other than management forecasts to alter perceptions about current earnings surprises.

5.6 Walk-downs

Research suggests managers issue bad news forecasts (i.e., forecasts lower than the outstanding analysis consensus) to walk down expectations to a beatable level (e.g., Matsumoto, 2002). As such, one could argue our results for LargeBeatExpectations are simply a manifestation of this phenomenon. To address this concern, in an untabulated analysis, we restrict our sample of LargeBeatExpectations to those accompanied by a good news management forecast. Our conclusions are the same for this subsample. Specifically, these good news management forecasts are pessimistically biased. Given that managers do not use good news forecasts to walk down financial analysts, our results appear distinct from the walk-down phenomenon.

6 Conclusion

We document a predictable bias in bundled management forecasts—the forecasts fail to fully reflect the persistence of the current earnings surprise. Specifically, managers issue (1) optimistically biased forecasts alongside negative earnings surprises and (2) pessimistically biased forecasts alongside large positive earnings surprises. Bayesian updating implies this bias could be unintentional, but we find that the bias is stronger when managers have greater incentives and fewer constraints to issue biased forecasts, suggesting that, to some extent, the bias might be intentional. Relatedly, although managers typically have better information about their firms’ earnings than do analysts, we show that analyst reliance on these biased management forecasts represents a mechanism (and an alternative interpretation) for a similar analyst underreaction to current earnings attributed in the literature to analysts’ cognitive bias. We also find that, on average, investors do not appear to initially understand the bias in these forecasts but eventually unravel it over longer windows. Overall we document that managers’ forecasts appear to repeatedly underweight the persistence of current earnings surprises, are biased in ways that improve investors’ perceptions of managers’ ability, and that this behavior is concentrated in subsamples where outsiders have a harder time recognizing any bias.

Notes

A few of the variables upon which our cross-sectional tests are based not only reflect instances where a manager has the ability or incentives to bias the forecast but also might be less capable of forecasting accurately, due to less feedback from analysts or less experience with forecasting. We are less concerned with this interpretation because, if a forecast is difficult to make or the manager is inexperienced, this would increase the error on either side of the forecast (i.e., less accurate forecasts) but would not lead to our prediction that forecasts are biased in a particular direction. Nonetheless, in robustness tests, our results hold using firm or manager fixed effects (which capture time-invariant manager ability or firm information environment), confirming our interpretation of the cross-sectional tests and mitigating the concern that these tests reflect manager ability or the firm’s information environment.

The line of demarcation between meeting or just beating expectations and beating expectations by a large amount varies in the literature. Brown et al. (2009) and Davis and Tama-Sweet (2012) use greater than 2 cents as their measure of large beat (as we do). However, Doyle et al. (2013) use 3 cents as the upper bound in the meet or just beat category, and Koh et al. (2008), include 1 cent as the upper bound in the meet or just beat category and investigate a 2 cents upper bound in robustness tests. We chose the midpoint of these primary definitions, 2 cents, as the upper bound, thus defining the large beats as 3 cents or more. In untabulated analysis, we confirm our results hold if we define LargeBeatExpectations as greater than 3 cents, greater than 4 cents, the upper quartile of earnings surprises, or the upper quartile of positive earnings surprises.

We report detailed variable definitions in Appendix A.

As an additional test to examine whether forecast bias is greater when earnings are more difficult to predict, we examine the relative earnings volatility in our cross-sectional partitions. Inconsistent with these predictions reflecting difficulty in forecasting, we find that earnings volatility is actually higher for the analyst following, litigation risk, and forecast horizon partitions that are opposite to our predictions. However, there is some evidence that earnings volatility is higher for high career concerns, relative to low career concerns (p < 0.001 in a parametric t-test, but p = 0.310 in a nonparametric rank sum test), which is perhaps unsurprising because volatility is an input into the career-concerns principal components analysis.

Consistent with prior research, we find 77% of forecasts for this period are bundled with an earnings announcement.

Panel D shows that 4% of our firm-years issue five or more bundled forecasts per year, suggesting these firms issue multiple forecasts with one earnings announcement. In an untabulated results, our results are unaffected if we remove these observations.

The intuition is that, if actual earnings fall within or at a bound of the forecasted range, an argument could be made that the forecast is unbiased. For example, suppose a manager forecasts earnings per share to be between $2.05 and $2.10. If actual earnings for the period forecasted are revealed to be $2.06, then one could argue that the forecast was unbiased because actual earnings were within the forecasted range. In this example, MEF_Bias_range would be zero, while MEF_Bias_ub would be $0.04, and MEF_Bias_mp would be $0.015 (before scaling by price). We do not include open-interval or qualitative forecasts in our sample.

Given the consistency in results across the three definitions of MEF_Bias, for the remainder of the paper, we generally limit our discussion to results using MEF_Bias_ub and only present results using MEF_Bias_ub. However, untabulated results are consistent if we instead use either MEF_Bias_mp or MEF_Bias_range.

The average stock price in our sample is $48.16.

Relatedly, in untabulated analysis, we examine forecast bias if the bundled forecast is the first time a manager provided a forecast for a given period, compared to if it was the last time a manager provided a forecast for a given period. We find that—for both MissedExpectations and LargeBeatExpectations—managers’ forecasts are more biased when it is their first time forecasting for a given period, although a test of differences is not significant at conventional levels for the “MissedExpectations” variable.

We use Lobo et al.’s (2017) control variables. We lose some observations due to these controls requirements (28,324 observations for this test versus 29,559 in our main analyses). However, inferences are unchanged if we instead estimate a more parsimonious model (i.e., only control for size, market-to-book, and leverage).

High variance inflation factors (VIF) could bias a coefficient downward, making an insignificant coefficient difficult to interpret. However, the VIF on our coefficient of interest (α4) is less than 5, below the accepted threshold of 20 (e.g., Belsley et al., 1980).

In untabulated analysis, we also find investors are more able to detect bias in forecasts issued by managers with greater career concerns, consistent with investors expecting managers with greater incentives to bias forecasts more.

Because we use trading days rather than calendar days, the drift window for 60 days could include the next earnings announcement. However, we find this to be the case in less than 1% of our observations.

Rogers and Van Buskirk (2013) estimate what analysts would forecast after observing the earnings signal but before observing the management forecast. As such, we recognize it is possible these estimates (based on conditional average expectations) are less likely to exhibit bias than individual analyst forecasts.

An earnings surprise also may have been caused by something outside of managers’ control, such as a macroeconomic or industry shock (about which managers might know less than analysts). However, in an untabulated analysis, we confirm our primary results hold if we use industry-by-year/quarter fixed effects.

A Heckman estimation requires an excludable variable that relates to the decision to issue a bundled forecast (first stage) but not to forecast bias (second stage). Following the literature, we use analyst following (e.g., Feng et al., 2009; Ittner & Michels, 2017). Consistent with the first stage requirement, analyst following relates significantly to the decision to issue a bundled forecast. Regarding the second-stage requirement, we note that we do include analyst following in our primary tests (see Table 3) following several prior studies. However, the association between bias and analyst following is generally not significant at conventional levels, suggesting that—consistent with the literature—it is an acceptable instrumental variable in the Heckman estimation approach.

Our inferences are similar if we model the decision for managers to issue any earnings forecast, bundled or unbundled.

As an alternative to a Heckman model, we also examine a sample of consistent bundled forecasting firms. The idea is that consistent forecasters have an established policy of issuing bundled guidance, so there is less likely a choice as to whether to issue a forecast in any given period, thus reducing concerns over selection bias. In an untabulated analysis, our results hold after restricting our sample to firms that have issued bundled guidance in the prior one, two, or three years.

Specifically, the ITCV suggests that a correlated omitted variable would have to have an impact of 0.0302 to overturn the positive association between MissedExpectations and MEF_Bias_ub in Table 3. Size has an impact of 0.0130, so 0.0302/0.0130 = 2.32 times. Similarly, the ITCV suggests that a correlated omitted variable would have to have an impact of 0.0564 to overturn the negative association between LargeBeatExpectations and MEF_Bias_ub in Table 3. The control variable with the highest impact on the coefficient for LargeBeatExpectations is EarnVol, with an impact of 0.0283, meaning that a correlated omitted variable would have to have an effect that is 1.99 times larger than the effect that EarnVol has on the association between LargeBeatExpectations and MEF_Bias_ub to overturn their negative association.

Insignificant results suffer from a joint hypothesis problem—that there really is no difference in forward-looking statements for firms with large current earnings surprises, or there is a difference but the empirical data and models lack the power to detect it. By its nature, textual analysis is difficult to execute across large samples, and our variables are simple counts of the number of forward-looking sentences rather than a detailed account of their content. Thus a relation may exist, but we could not document it.

References

Abarbanell, J., and V. Bernard. 1992. Tests of analysts’ overreaction/underreaction to earnings information as an explanation for anomalous stock price behavior. Journal of Finance 47: 1191–1207.

Ajinkya, B., and M. Gift. 1984. Corporate managers’ earnings forecasts and symmetrical adjustments of market expectations. Journal of Accounting Research 22 (2): 425–444.

Ali, A., A. Klein, and J. Rosenfeld. 1992. Analysts’ use of information about permanent and transitory earnings components in forecast annual EPS. The Accounting Review 67: 183–198.

Ayers, B., S. Ramalingegowda, and E. Yeung. 2011. Hometown advantage: The effects of monitoring institution location on financial reporting discretion. Journal of Accounting and Economics 52 (1): 41–61.

Baginski, S., J. Campbell, L. Hinson, and D. Koo. 2018. Do career concerns affect the delay of bad news disclosure? The Accounting Review 93 (2): 61–95.

Baginski, S., S. Clinton, and S. McGuire. 2014. Forward-looking voluntary disclosure in proxy contests. Contemporary Accounting Research 31 (4): 1008–1046.

Ball, R., S. Jayaraman, and L. Shivakumar. 2012. Audited financial reporting and voluntary disclosure as complements: A test of the confirmation hypothesis. Journal of Accounting and Economics 53 (1/2): 136–166.

Bamber, L., J. Jiang, and I. Wang. 2010. What’s my style? The influence of top managers on voluntary corporate financial disclosure. The Accounting Review 85 (4): 1131–1162.

Bebchuk, L., A. Cohen, and A. Ferrell. 2009. What matters in corporate governance? Review of Financial Studies 22 (2): 783–827.

Belsley, D., E. Kuh, and R. Welsch. 1980. Regression diagnostics: Identifying influential data and sources of collinearity. Journal of Applied Econometrics 4 (1): 97–102.

Bentley, J., T. Christensen, K. Gee, and B. Whipple. 2018. Disentangling managers’ and analysts’ non-GAAP reporting. Journal of Accounting Research 56 (4): 1039–1081.

Beyer, A., D. Cohen, T. Lys, and B. Walther. 2010. The financial reporting environment: Review of the recent literature. Journal of Accounting and Economics 50 (2/3): 296–343.

Billings, M., R. Jennings, and B. Lev. 2015. On guidance and volatility. Journal of Accounting and Economics 60 (2/3): 161–180.

Boone, A., and J. White. 2015. The effect of institutional ownership on firm transparency and information production. Journal of Financial Economics 117 (3): 508–533.

Bozanic, Z., D. Roulstone, and A. Van Buskirk. 2018. Management earnings forecasts and other forward-looking statements. Journal of Accounting and Economics 65 (1): 1–20.

Brown, S., S. Hillegeist, and K. Lo. 2009. The effect of earnings surprises on information asymmetry. Journal of Accounting and Economics 47 (3): 208–225.

Chen, P., G. Narayanamoorthy, T. Sougiannis, and H. Zhou. 2021. Analyst underreaction and post-forecast revision drift. Journal of Business Finance and Accounting 47: 1151–1181.

Cheng, Q., T. Luo, and H. Yue. 2013. Managerial incentives and management forecast precision. The Accounting Review 88 (5): 1575–1602.

Ciconte, W., M. Kirk, and J. Tucker. 2014. Does the midpoint of range earnings forecasts represent managers’ expectations? Review of Accounting Studies 19 (2): 628–660.

Cohen, D., and P. Zarowin. 2010. Accrual-based and real earnings management activities around seasoned equity offerings. Journal of Accounting and Economics 50 (1): 2–19.

Cotter, J., I. Tuna, and P. Wysocki. 2006. Expectations management and beatable targets: How do analysts react to explicit earnings guidance? Contemporary Accounting Research 23 (3): 593–624.

Curtis, A., S. McVay, and B. Whipple. 2014. The disclosure of non-GAAP earnings information in the presence of transitory gains. The Accounting Review 89 (3): 933–958.

Daniel, K., M. Grinblatt, S. Titman, and R. Wermers. 1997. Measuring mutual fund performance with characteristic-based benchmarks. Journal of Finance 52 (3): 1035–1058.

Davis, A., and I. Tama-Sweet. 2012. Managers’ use of language across alternative disclosure outlets: Earnings press releases versus MD&a. Contemporary Accounting Research 29 (3): 804–837.