Abstract

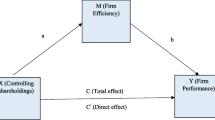

This study examines the effect of CEO ownership on firm performance. The findings suggest that CEO ownership and firm performance are jointly determined. Firm performance affects CEO ownership positively and in turn, CEO ownership has a positive effect on firm performance. Our results also show that firms managed by founder CEOs have better performance and that the CEO duality structure is beneficial in a turbulent environment.

Similar content being viewed by others

References

Agrawal, A. and C.R. Knoeber (1996). “Firm Performance and Mechanisms to Control, Agency Problems between Managers and Shareholders.” Journal of Financial and Quantitative Analysis 31, 377-397.

Barnhart, S.W., M.W. Marr, and S. Rosenstein (1994). “Firm Performance and Board Composition: Some New Evidence.” Managerial and Decision Economics 15, 329-340.

Baumol, William (1959). Business Behavior, Value and Growth. New York: MacMillan.

Berle, A.A. and G.C. Means (1932). The Modern Corporation and Private Property. New York: Macmillan.

Bourgeios, L.J. III and K.M. Eisenhardt (1987). “Strategic Decision Pocesses in Silicon Valley: The Anatomy of a 'Living Dead'.” California Management Review 30, 143-159.

Bourgeios, L.J. III and K.M. Eisenhardt (1988). “Strategic Decision Processes in High Velocity Environments: Four Cases in the Microcomputer Industry.” Management Science 34(7), 816-835.

Boyd, B.K. (1995). “CEO Duality and Firm Performance: A Contingency Model.” Strategic Management Journal 16, 301-312.

Carney, M. (1998). “A Management Capacity Constraint? Obstacles to the Development of the Overseas Chinese Family Business.” Asia Pacific Journal of Management 15, 137-162.

Chen, M. (1995). Asian Management Systems: Chinese Japanese and Korean Styles of Business. London: Routledge.

Cho, M-H. (1998). “Ownership Structure, Investment, and the Corporate Value: An Empirical Analysis.” Journal of Financial Economics 47, 103-121.

Chung, K.H. and S.W. Pruitt (1994). “A Simple Approximation of Tobin's Q.” Financial Management 23(3), Autumn 70-74.

Chung, K.H. and S.W. Pruitt. (1996). “Executive Ownership, Corporate Value, and Executive Compensation: A Unifying Framework.” Journal of Banking & Finance 20, 1135-1159.

Darrell, E.L. and James G. Tompkins (1999). “A Modified Version of the Lewellen and Badrinath measure of Tobin's Q.” Financial Management 28, 20-31.

Demsetz, Harold (1983). “Corporate Control, Insider Trading and Rates of Return.” American Economic Review 86, 313-316.

Demsetz, H. and K. Lehn (1985). “The Structure of Corporate Ownership: Cause and Consequences.” Journal of Political Economy 93, 1155-1177.

Dharwadkar, R., G. George, and Pamela Brandes (2000). “Privatization in Emerging Economies: An Agency Theory Perspective.” The Academy of Management Review 25(3), 650-669.

Eaton, J. and H.S. Rosen (1983). “Agency, Delayed Compensation, and the Structure of Executive Remuneration.” Journal of Finance 38, 1489-1505.

Finkelstein, S. and R.A. D”Aveni (1994). “CEO Duality as a Double-edged Sword: How Boards of Directors Balance Entrenchment Avoidance and Unity of Command.” Academy of Management Journal 37, 1079-1108.

Grossman, Sanford and Olver Hart (1980). “The Costs and Benefits of Ownership: A Theory of Vertical and Lateral Integration.” Bell Journal of Economics 11, 42-64.

Holmes, T.J. and J.A. Schmitz (1988a). “How Economics Pursue Opportunities: The Role of Specialization in Entrepreneurial and Managerial Tasks.” Working paper, University of Wisconsin.

Holmes, T.J. and J.A. Schmitz (1988b). “A Theory of Entrepreneurship and its Application to the Study of Business transfers.” Working paper, University of Wisconsin.

Jensen, M. and W. Meckling (1976). “Theory of the Firm: Managerial Behavior, Agency Costs, and Ownership Structure.” Journal of Financial Economics 3, 305-360.

La Porta, Rafael, Florencio Lopez-de-Silanes, and Andrei Shleifer (1999). “Corporate Ownership Around the World.” Journal of Finance 54(2), 471-518.

La Porta, Rafael, Florencio Lopez-de-Silanes, Andrei Shleifer, and Robert Vishny (1998). “Law and Finance.” Journal of Political Economy 106(4), 1113-1155.

Lang, L.H.P., R.M. Stulz, and R.A. Walkling (1989). “Managerial Performance, Tobin's Q and the Gains from Successful Tender Offers.” Journal of Financial Economics 24(1), 137-154.

Lewellen, W.G. and S.G. Badrinath (1997). “On the Measurement of Tobin's Q.” Journal of Financial Economics 44, 77-122.

Loderer, C. and K. Martin (1997). “Executive Stock Ownership and Performance. Tracking Faint Traces.” Journal of Financial Economics 45, 223-255.

McConnell, J.J. and H. Servaes (1990). “Additional Evidence on Equity Ownership and Corporate Value.” Journal of Financial Economics 27, 595-612.

McConnell, J.J. and H. Servaes (1995). “Equity Ownership and the Two Faces of Debt.” Journal of Financial Economics 39, 131-157.

McConaughy, D.L., M.C. Walker, G.V. Henderson, Jr., and C.S. Mishra (1998). “Founding Family Controlled Firms: Efficiency and Value.” Review of Financial Economics 7, 1-19.

Mehran, H. (1995). “Executive Compensation Structure, Ownership, and Firm Performance.” Journal of Financial Economics 38, 163-184.

Morck, R., A. Shleifer, and R.W. Vishny (1988). “Management Ownership and Market Valuation: An Empirical Analysis.” Journal of Financial Economics 20, 293-315.

Murdoch, J. (1991). “The Systematic Variation in Incentive Contracts: Identifying and explaining the pattern.” Manuscript, Charles River Associates.

Oswald, S.L. and J.S. Jahera, Jr. (1991). “Research Notes and Communications. The Influence of Ownership on Performance: An Empirical Study.” Strategic Management Journal 12, 321-326.

Poh, L.C. (1991). A study of the Relationship Between Board Ownership and Corporate Performance-With a Control of Size Effect. Academic Exercise, Faculty of Business Administration, National University of Singapore.

Shleifer, Andrei and Robert Vishny (1986). “Large Shareholders and Corporate Control.” Journal of Political Economy, 94, 461-488.

Smith, C.W., Jr. and R.L. Watts (1992). “The Investment Opportunity Set and Corporate Financing, Dividend and Compensation Policies.” Journal of Financial Economics 32(3), 263-292.

Whitley, R.D. (1992). Business Systems in East Asia: Firms, Markets and Societies. London: Sage.

Wong, K.A. and T.C. Yek (1991). “Shareholdings of Board of Directors and Corporate Performance: Evidence from Singapore.” Pacific-Basin Capital Markets Research VII, 211-225.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Tan, R.S.K., Chng, P.L. & Tan, T.W. CEO Share Ownership and Firm Value. Asia Pacific Journal of Management 18, 355–371 (2001). https://doi.org/10.1023/A:1010601912422

Issue Date:

DOI: https://doi.org/10.1023/A:1010601912422