Abstract

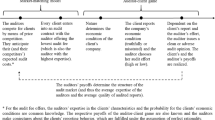

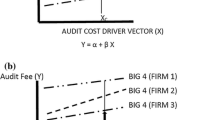

This paper examines the pricing of business risk by homogeneous auditors in a two period model. Incumbent auditors learn the client's business risk type during the course of the engagement. They subsequently compete in prices with prospective auditors. In such an environment, we show that equilibrium audit fees do not fully reflect the cost of business risk. Moreover, there exists differential auditor turnover between high and low risk firms; cross-subsidization of the audit fees of high risk firms by low risk firms; and low-balling by auditors.

Similar content being viewed by others

References

Amann, E., and W. Leininger. (1996). “Asymmetric All-Pay Auctions.” Games and Economic Behavior 14, 1-18.

American Institute of Certified Public Accountants (AICPA). (1992). “Audit Risk Alert.” The CPA Letter 72. New York: AICPA.

American Institute of Certified Public Accountants (AICPA). (1993). The Expectation Gap Standards: Progress, Implementation Issues, Research Opportunities. New York: AICPA.

American Institute of Certified Public Accountants (AICPA). (1995). “New Jersey Adopts Strict Privity Standard.” The CPA Letter 75, 2.

American Institute of Certified Public Accountants (AICPA). (1996). “Securities Litigation Reform Bill Now Law: Veto Overridden.” The CPA Letter 76, 1.

Arthur Andersen & Co., Coopers & Lybrand, Deloitte & Touche, Ernst & Young, KPMG Peat Marwick, and Price Waterhouse. (1992). The Liability Crises in the United States: Impact on the Accounting Profession.

Bell, T. B., W. R. Landsman, and D. A. Shackelford. (1995). “Legal Liability and Audit Fees: An Empirical Study.” Working paper, University of North Carolina, Chapel Hill, NC.

Berton, L. (1995). “Big Accounting Firms Weed Out Risky Clients.” Wall Street Journal June 26, B1.

Brumfield, C. A., R. K. Elliott, and P. D. Jacobson. (1983). “Business Risk and the Audit Process.” Journal of Accountancy 155, 60-68.

Commission on Auditors' Responsibilities. (1978). Reporting Conclusions and Recommendations. The Commission on Auditors' Responsibilities. New York: AICPA.

DeAngelo, L. E. (1981a). “Auditor Independence, ‘Low-Balling’, and Disclosure Regulation.” Journal of Accounting and Economics 3, 113-127.

DeAngelo, L. E. (1981b). “Auditor Size and Audit Quality.” Journal of Accounting and Economics 3, 183-199.

Dye, R. A. (1991). “Informationally Motivated Auditor Replacement.” Journal of Accounting and Economics 14, 347-374.

Dye, R. A. (1995). “Incorporation and the Audit Market.” Journal of Accounting and Economics 19, 75-114.

Eichenseher, J. W., and D. Shields. (1983). “The Correlates of CPA-Firm Change for Publicly Held Corporations.” Auditing: A Journal of Practice & Theory 2, 23-37.

Engelbrecht-Wiggans, R., P. R. Milgrom, and R. J. Weber. (1983). “Competitive Bidding and Proprietary Information.” Journal of Mathematical Economics 11, 161-169.

Ettredge, M., and R. Greenberg. (1990). “Determinants of Fee Cutting on Initial Audit Engagements.” Journal of Accounting Research 28, 198-210.

Fudenberg, D., and J. Tirole. (1991). “Perfect Bayesian Equilibrium and Sequential Equilibrium.” Journal of Economic Theory 53, 236-260.

Glezen, G., and M. Elser. (1996). “The Auditor Change Process.” Journal of Accountancy 181, 73-77.

Kanodia, C., and A. Mukherji. (1994). “Audit Pricing, Low-Balling and Auditor Turnover: A Dynamic Analysis.” The Accounting Review 69, 593-615.

Kothari, S. P., T. Lys, C. W. Smith, and R. L. Watts. (1988). “Auditors Liability and Information Disclosure.” Journal of Accounting, Auditing, and Finance 3, 307-339.

Lambert, W. (1994). Law Note. Wall Street Journal 10, B5.

Lochner, P. R. (1993). “Accountants' Legal liability: A Crisis that Must be Addressed.” Accounting Horizons 7, 92-96.

Lys, T., and R. L. Watts. (1994). “Lawsuits against Auditors.” Journal of Accounting Research 32Supplement, 65-93.

Magee, R. P., and M. Tseng. (1990). “Audit Pricing and Independence.” The Accounting Review 65, 315-336.

O'Malley, S. F. (1993). “Legal Liability is Having a Chilling Effect on the Auditor's Role.” Accounting Horizons 7, 82-87.

Osborne, M. J., and A. Rubinstein. (1994). A Course in Game Theory. Cambridge, MA: The MIT Press.

Pratt, J., and J. D. Stice. (1994). “The Effects of Client Characteristics on Auditor Litigation Risk Judgments, Required Audit Evidence, and Recommended Audit Fees.” The Accounting Review 69, 639-656.

Rubin, M. A. (1988). “Municipal Audit Fee Determinants.” The Accounting Review 63, 219-236.

Schatzberg, J. W. (1994). “A New Examination of Auditor ‘Lowball’ pricing: Theoretical model and Experimental Evidence.” Auditing: A Journal of Practice & Theory 13 Auditing Symposium, 33-55.

Schatzberg, J. W., and G. R. Sevcik. (1994). “A Multiperiod model and Experimental Evidence of Independence and ‘Lowballing’.” Contemporary Accounting Research 11, 137-174.

Schuetze, W. P. (1993). “The Liability Crisis in the U.S. and its Impact on Accounting.” Accounting Horizons 7, 88-91.

Schwartz, K. B., and K. Menon. (1985). “Auditor Switches by Failing Firms.” The Accounting Review 60, 248-261.

Simon, D., and J. Francis. (1988). “The Effects of Auditor Changes on Audit Fees: Tests of Price Cutting and Price Recovery.” The Accounting Review 63, 255-269.

Simunic, D. A. (1980). “The Pricing of Audit Services: Theory and Evidence.” Journal of Accounting Research 18, 161-190.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Morgan, J., Stocken, P. The Effects of Business Risk on Audit Pricing. Review of Accounting Studies 3, 365–385 (1998). https://doi.org/10.1023/A:1009687101871

Issue Date:

DOI: https://doi.org/10.1023/A:1009687101871