Abstract

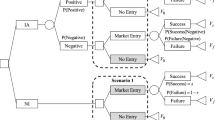

We develop new tests of the dividend signaling hypothesis by focusing on the role of liquidity. We allow for two different types of signaling models: one where current dividends signal firm value and the objective is to prevent current dilution, and the other where commitments to future dividends constitute the signal. We find that the results differ by the sign of the dividend surprise. Signaling models of the commitment type explain the market reaction to negative dividend surprises. Interestingly, this result is significant only for the earlier sub-period in our sample due, perhaps, to the well-documented increase in institutional investors with longer horizons. The market reaction to positive dividend surprises, on the other hand, is shown to be consistent with the over-investment and wealth transfer hypotheses. We show that the failure of the signaling model for these firms could be due to lower costs of dividend increases.

Similar content being viewed by others

References

Aharony, J. and I. Swary, “Quarterly Dividend and Earnings Announcements and Stockholders' Returns: An Empirical Analysis.” Journal of Finance 35(1), 1-12, (1980).

Bajaj, M. and A. Vijh, “Dividend Clienteles and the Information Content of Dividend Changes.” Journal of Financial Economics 26, 193-219, (1990).

Bar-Yosef, S. and O. H. Sarig, “Dividend Surprises Inferred from Option and Stock Prices.” The Journal of Finance, September, 1623-1640, (1992).

Benartzi, S., R. Michaely and R. Thaler, “Do Changes in Dividends Signal the Future or the Past?” Journal of Finance 52(3), 1007-1034, (1997).

Bernheim, B. D. and A. Wantz, “A Tax-Based Test of the Dividend Signaling Hypothesis.” American Economic Review 85(3), 532-551, (1995).

Best, R. J. and R. W. Best, “Earnings Expectations and the Relative Information Content of Dividend and Earnings Announcements.” Journal of Economics and Finance, Fall, 232-245, (2000).

Bhattacharya, S., “Imperfect Information, Dividend Policy, and the 'Bird-in-the-Hand' Fallacy.” Bell Journal of Economics 10, 259-270, (1979).

Bowen, R., D. Burgstahler and L. Daley, “Evidence on the Relationship between Earnings and Various Measures of Cash Flow.” The Accounting Review, October, 713-725, (1986).

Brancato, C. K., “Institutional Investors: Where the Growth Is.” Across the Board 33(5), 56, (1996).

Brook, Y., W. T. Charlton, Jr. and R. J. Hendershott, “Do Firms Use Dividends to Signal Large Future Cash Flow Increases.” Financial Management 27(3), 46-57, (1998).

Chhachhi, I. S. and W. N. Davidson, III, “A Comparison of the Market Reaction to Specially Designated Dividends and Tender Offer Stock Repurchases.” Financial Management 26(3), 89-96, (1997).

Compustat, 1998.

CRSP, 1996.

Damodaran, A., Corporate Finance: Theory and Practice, New York, NY: John Wiley, 1997.

DeAngelo, H., L. DeAngelo and D. Skinner, “Reversal of Fortune: Dividend Signaling and the Disappearance of Sustained Earnings Growth.” Journal of Financial Economics 40(3), 341-372, (1996).

Denis, D. J., D. K. Denis and A. Sarin, “The Information Content of Dividend Changes: Cash Flow Signaling, Overinvestment and Dividend Clienteles.” Journal of Financial and Quantitative Analysis 29(4), 567-588, (1994).

Dhillon, U. and H. Johnson, “Effect of Dividend Changes on Stock and Bond Prices.” Journal of Finance 49(1), 281-289, (1994).

Dyl, E. A. and R. A. Weigand, “The Information Content of Dividend Initiations: Additional Evidence.” Financial Management 27(3), 27-35, (1998).

Eades, K., “Empirical Evidence on Dividends as a Signal of Firm Value.” Journal of Financial and Quantitative Analysis 17, 471-500, (1982).

Eakins, S., “An Empirical Investigation of Monitoring by Institutional Investors.” American Business Review 13(1), 67-74, (1995).

Eakins, S., S. Stansell, R. D. Teer and P. Wertheim, “Earnings Forecasts and Institutional Demand for Common Stock.” Journal of Applied Business Research 14(1), 57-67, (1997).

Eakins, S. and S. Sewell, “Do Institutions Window Dress? An Empirical Investigation.” Quarterly Journal of Business and Economics 33(2), 69-78, (1994).

Eakins, S. and S. Sewell, “Tax-Loss Selling, Institutional Investors, and the January Effect: A Note.” The Journal of Financial Research 16(4), 377-384, (1997).

Eng, L. L., “Comparing Changes in Stockholdings of Different Institutional Investors.” Journal of Investing 8(1), 46-50, (1999).

Jensen, M., “Agency Costs of Free Cash Flow, Corporate Finance, and Takeover.” American Economic Review 76, 323-329, (1986).

John, K. and J. Williams, “Dividends, Dilution and Taxes: A Signaling Equilibrium.” Journal of Finance 40(4), 1053-1070, (1985).

Judge, G. G., R. C. Hill, W. E. Griffiths, H. Lutkepohl and T.-C. Lee, Introduction to the Theory and Practice of Econometrics, New York, NY: John Wiley and Sons, 1982.

Kwan, C., “Efficient Market Tests of the Informational Content of Dividend Announcements: Critique and Extension.” Journal of Financial and Quantitative Analysis 16, 193-206, (1981).

Lang, L. H. P. and R. H. Litzenberger, “Dividend Announcements: Cash Signaling vs. Free Cash Flow Hypothesis?” Journal of Financial Economics 24(1), 181-191, (1989).

Lipson, M. L., C. P. Maquieira and W. Megginson, “Dividend Initiations and Earnings Surprises.” Financial Management 27(3), 36-45, (1998).

Maxwell, W. F., “The January Effect in the Corporate Bond Market: A Systematic Examination.” Financial Management 27(2), 18-30, (1998).

Mikkelson, W. H. and M. M. Partch, “Valuation Effects of Security Offerings and the Issuance Process.” Journal of Financial Economics 15, 31-60, (1986).

Miles, M. and J. Mahoney, “Is Commercial Real Estate an Inflation Hedge?” Real Estate Finance 13(4), 31-45, (1997).

Miller, M. and F. Modigliani, “Dividend Policy, Growth, and the Valuation of Shares.” Journal of Business 34, 411-433, (1961).

Miller, M. and K. Rock, “Dividend Policy under Asymmetric Information.” Journal of Finance 40, 1031-1051, (1985).

Myers, S. and N. S. Majluf, “Corporate Financing and Investment Decisions When Firms Have Information That Investors Do Not Have.” Journal of Financial Economics 13(2), 187-221, (1984).

Pettit, R. R., “Dividend Announcements, Security Performance, and Capital Market Efficiency.” Journal of Finance 27, 993-1007, (1972).

Prabhala, N. R., On Interpreting Dividend Announcement Effects: Free Cashflow, Clientele or Signaling. Working paper, New York University, 1993.

Ravid, S. A. and O. Sarig, “Financial Signaling by Committing to Cash Outflows.” Journal of Financial and Quantitative Analysis 26(2), 165-180, (1991).

Riley, J., “Information Equilibrium.” Econometrica 47, 331-359, (1979).

Ross, S., “The Determination of Financial Structure: The Incentive Signaling Approach.” Bell Journal of Economics 8, 23-40, (1977).

Thakor, A., “Game Theory in Finance.” Financial Management 20(1), 71-94, (1991).

Watts, R., “The Information Content of Dividends.” Journal of Business 46, 191-211, (1973).

White, G., A. Sondhi and D. Fried, The Analysis and Use of Financial Statements, New York: John Wiley and Sons, 1998.

Yoon, P. S. and L. Starks, “Signaling, Investment Opportunities, and Dividend Announcements.” The Review of Financial Studies 8(4), 995-1018, (1995).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Viswanath, P.V., Kim, Y.K. & Pandit, J. Dilution, Dividend Commitments and Liquidity: Do Dividend Changes Reflect Information Signaling?. Review of Quantitative Finance and Accounting 18, 359–379 (2002). https://doi.org/10.1023/A:1015453703511

Issue Date:

DOI: https://doi.org/10.1023/A:1015453703511