Abstract

This study examines the effect of regional integration—specifically, that of the Economic Community of West African States (ECOWAS) as an economic integration agreement—on the survival rate of Ghana’s exports. It employs a discrete-time complementary log–log hazard model with a random effects estimation technique and Kaplan–Meier estimates of the survival function, using data spanning from 1996–2018. The findings from the study indicate that ECOWAS has a significantly negative impact on the hazard rate of Ghana’s exports, implying that ECOWAS as an economic integration agreement increases the survival rate of Ghana’s exports for both aggregate exports and commodity-specific ones. Additionally, the heterogeneity effect of other economic integration agreements on Ghana’s export survival was found to increase the survival rate of exports. From a policy perspective, efforts to ensure the smooth operation of trade agreement contracts among member countries within the ECOWAS sub-region are necessary for the long-lasting export survival of Ghana’s exports.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The advent of the African Continental Free Trade Agreement (AfCFTA) could be one of the most prioritized trade agreements in the history of African intratrade policy. The main aim of AfCFTA is to collapse several of Africa’s intratrade agreements into a single market for trade in goods and services. Since its implementation on 1 January 2021, several African countries have signed and ratified their participation in this agreement.Footnote 1 Optimism for the agreement stems from its delicate role in expanding economies and growth in exports by removing trade restrictions and making trade affordable.

Admittedly, several such regional integration agreements have been made in Africa, such as the Common Market for Eastern and Southern Africa (COMESA), the African Growth and Opportunities Act (AGOA), and European Union–African, Caribbean, and Pacific (EU-ACP) cooperation, among others. However, Africa has not seen a massive improvement in its export growth performance. This could be attributed to the inability of export relations to survive longer periods, especially in developing countries. According to Hess and Persson (2011), most developing countries thrive at forming markets and partners but fail woefully at maintaining such relations. Traditional export growth theories assume that trade relations will persist once they are formed. However, recent empirical studies have shown that export relations are often short-lived (Asche et al., 2018; Besedes & Blyde, 2010; Besedes & Prusah, 2006; Hess & Person, 2011; Nitsch, 2009; Pu & Li, 2018; Stefan & Imre, 2018; Wang et al., 2019). This means that the survival of a bilateral trade relation from the first year of its formation until it assumes a zero value for a particular product could generally be low (Hess & Persson, 2011).

Therefore, on account of the short duration of export relations, several trade scholars have tried to align the implementation of economic integration agreements (EIAs) as a possible factor in mitigating export relation failures, due to the popular assertion that EIAs help boost export growth. For instance, Martuscelli and Varela (2015) argued that EIAs improve the survival of export relations by reducing policy-related costs and offering information concerning the destination market. Blyde et al. (2015) posited that EIAs that remove nonproduction costs such as transportation, customs clearance, and other related charges can boost international production fragmentation across countries. They further asserted that these features of EIAs, as expected, increase the likelihood of export survival. Similarly, Redig and Olsson (2012) suggested that EIAs affect the duration of exports by reducing the sunk costs of exporting. However, Turkcan and Saygili (2018) found that EIAs only increase the survival of export relations that were initiated before the agreement.

As a developing economy, Ghana has seen far less encouraging growth in its exports of goods and services given its massive resource potential and its patronage in various EIAs. For instance, data from the World Bank’s World Development Indicators database indicate that export growth averaged 5.33% from 1996 to 2018, with the highest growth rate of 20.5% in 2000 and the lowest growth rate of − 2.6% in 2013. Several reasons have been offered to explain this. These are mostly macroeconomic explanations centered on the depreciation of the Ghanaian cedi and the fact that Ghana is an import-dependent country. However, the duration and survival of Ghana’s exports in various export markets have not received much attention. According to a preliminary analysis of Ghana’s exports over a 23-year period (1996–2018), the export failure rate was 83% by the 22nd period and more than 60% had failed by the 14th period. Further statistics within the same period showed that export relations start failing on average from the 5th period until the 19th period and beyond. Interestingly, aggregate exports from Ghana to EIA partners had a survival rate of just 25% by the 22nd period, and more than 60% failed between the 14th and 16th periods. Additionally, the survival rate of exports from Ghana was shown to be 14% in the Economic Community of West African States (ECOWAS) region, compared to 21% in non-ECOWAS regions during the period from 1996–2018. It is thus worth asking whether the various EIAs that Ghana has been involved in are having any impact on export survival. According to Osei-Assibey (2015), although the European Union (EU) was the top destination for Ghana’s exports overall, 34.8% of nontraditional goods were exported to ECOWAS member states, compared to 31.5% exported to the EU.

Interestingly, Kamuganga (2012) found that between 2009 and 2015, only 26% of export relations in the ECOWAS region survived their first year, an export failure rate of 74%. By the 15th year, all export relations had ceased. Mohammed (2018) used firm-level data to show that the average duration of Ghana’s manufacturing exports is merely 5–6 years. This means that it takes only 5–6 years for these exporters to maintain their export relations. However, his study used only firm-level export data and not product-level data. In addition, his study did not analyze any EIA that Ghana is involved in. The above observations provide us with the latitude to investigate the impact of ECOWAS as an EIA on the survival rate of Ghana’s exports using both aggregate and product-level export data.

Our study contributes to existing literature in the following ways: First, similar to Mohammed (2018), the scope of our study is limited to Ghana but our focus is on Ghana’s experience in the ECOWAS region. To better analyze the heterogeneous impact of EIAs and their subsequent impact on export duration in Ghana, we adopt the EIA-in-existence and EIA-in-effect dummies proposed by Turkcan and Saygili (2018). Second, Osei-Assibey (2015) found that in Ghana, nontraditional exports perform better than most traditional exports. Therefore, we analyzed the duration of various commodities (viz., plastic, paper, textiles, general machinery, and cocoa, coffee, and spices) and the influence of ECOWAS as an EIA on their survival.

The rest of the paper is organized as follows. Section 2 reviews related literature and studies. Section 3 describes the methodology and data. Section 4 discusses the results, and Sect. 5 concludes with policy suggestions.

2 Literature Review

To analyze the impact of EIAs on trade, most studies begin by using a gravity model and then introduce EIAs as dummies to measure the rate of participation of the pair of countries under study (e.g., Freund & Ornelas, 2010; Ghosh & Yamarik, 2004). By considering factors such as data aggregation, gravity equation specifications, the period under consideration, and a host of others, studies on the effects of EIAs on trade based on gravity models have yielded a variety of results (Freund & Ornelas, 2010). Nevertheless, later studies such as Ghosh and Yamarik (2004) and Clausing (2001) reached a consensus that EIAs indeed promote trade. Others, such as Egger and Larch (2008), Magee (2008), Baier and Bergstrand (2007), and Carrere (2006), addressed the common problem of endogeneity and reached similar conclusions that economic integration increases bilateral trade. As the debate continues over whether EIAs increase trade flows, other dimensions of empirical studies have emerged to clarify the impact of EIAs on trade flows.

One of these dimensions is based on the heterogeneous theory of trade developed by Melitz (2003). This theory highlights the relative contributions of two margins of trade—namely, extensive and intensive margins—to the dynamics of exports. Studies such as Foster et al. (2011), Egger et al. (2011), Baier et al. (2014), and Florensa et al. (2015) used disaggregated trade flow data to analyze the impact of EIAs on trade flows. These authors considered the role of extensive and intensive margins and concluded that EIAs have a significantly positive impact on both the extensive and intensive margins of trade.

Another dimension began with the empirical study of Besedes and Prusah (2006). Their study examined the survival of trade relations by employing duration analysis techniques. For instance, using Kaplan–Maier estimates of the survival function, they found that the duration of US imports is very short, with a median duration of 2–4 years. They explored the extensive and intensive margins of trade pertaining to export growth analysis in a follow-up paper (Besedes & Prusah, 2010) and concluded that most export relations were still short-lived, with a median duration of 1–2 years. However, they noted that export growth mostly occurred by the deepening and survival of already existing trade relations, rather than with the formation of new ones.

Interestingly, subsequent empirical studies have attempted to explain the various factors that influence the duration of trade relationships, from firm-, product-, and market-level characteristics to search and sunk costs and gravity variables (see Besedes & Prusah, 2006; Fugazza & Molina, 2016; Hess &Pearson, 2011; Nitsch, 2009; Obashi, 2010;). Apart from these determinants of trade duration, EIAs have been considered as a possible factor that can influence the duration of trade relations. As explained by Besedes and Blyde (2010), EIAs have the tendency not only to reduce the cost of trade but also to restrict the competition permeated by countries outside the agreement, thereby safeguarding the stability of the trade relations and subsequently increasing the likelihood of export survival. They analyzed the factors affecting the survival of exports in Latin American countries using four-digit product-level data from SITC revision 1, spanning from 1975 to 2005, and they used duration analysis techniques, specifically Kaplan–Meier survival estimates and the Cox proportional hazard model. They found that export relations are in general short-lived but that significant differences exist across regions like the US, the EU, East Asia, and Latin America. However, Latin America was found to exhibit the lowest survival rate. They tested a battery of determinants of export survival and concluded that countries with EIAs had higher survival rates than countries without them.

Other empirical studies, such as Kamuganga (2012), followed suit by studying intra-African trade cooperation and how it enhances export survival. Using a stratified Cox proportional hazard model on selected African countries from 1995–2009, he found that the depth of regional integration mattered in lowering Africa’s export hazard rates relative to countries without any integration. Again, he highlighted in his study that export experience within regions as well as in world markets increases the likelihood of Africa’s export survival. His study suggested that infrastructure-related trade frictions, such as the cost to export, the time to export, and custom procedures, have negative effects on the survival of Africa’s exports.

In addition, Redig and Olsson (2012) examined the effect of economic integration on trade by employing Kaplan–Meier estimates of survival function and a dataset spanning from 1996 to 2008. They argued that EIAs affect sunk costs, which in turn affect the duration of trade. They realized that because Germany is more integrated in the global economy, its markets have lower sunk costs relative to Russia, which lacks economic integration and therefore has high sunk costs. They concluded that EIAs affect the sunk costs of exporting, which in turn affect the duration of trade. Moreover, Besedes (2013) assessed the impact of the North American Free Trade Agreement (NAFTA) on the hazard of export-ceasing in the three member countries. Using discrete-time proportional hazard model and annual data from 1990 to 2007, he showed that, per speculation, NAFTA reduced the hazard rate of Canadian and US exports to fellow member countries in the agreement, while having no impact on the hazard rate of Mexican exports. On the contrary, his estimation results showed that once implemented, NAFTA increased the hazard rates of Mexican and US exports to other member states in the agreement but had an insignificant effect on the hazard rate of Canadian exports.

Further, Besedes (2014) used a discrete-time probit model with random effects to analyze the effect of European integration on the stability of international trade from 1996 to 2005 and found that persistent integration has negative effects on the stability of intra-EU trade relations, with the duration decreasing and the hazard of trade-ceasing increasing. He concluded that the reduction in the duration of intra-EU relations over the sustained course of European integration was not a negative development, but rather the result of a reduction in the cost of trade by the EU, enabling new relations that were previously cost-prohibitive. On the other hand, Besedes et al. (2018), in a related study, investigated the effect of EIAs on the duration of trade by using a sample of 180 countries from 1962 to 2005. Employing different duration analysis tools, they found that EIAs have a dual impact on the survival of trade relations. EIAs increase the survival of trade relations formed prior to the agreement, but they reduce the survival of trade relations formed after the agreement. They also found that additional relationships or trade spells are initiated once an agreement is signed. As such, they concluded that trade agreements initially increase trade along the intensive margin before the extensive margin.

Recalde et al. (2016) examined whether deeper EIAs improve the survival of trade relations relative to shallow agreements. They used export data from 1962 to 2009 on Latin American exports to 150 countries. Their study was similar to that of Besedes et al. (2018), but the magnitude and sign of the impact of EIAs differed significantly. The estimated results from the study showed that shallower economic EIAs reduced the survival of export relations for trade spells formed before the agreement, whereas the deeper agreements increased the survival of export relations. They concluded that the impact of EIAs on the survival of trade relations vary significantly across different regions and depending on nature of the agreement.

Accordingly, Turkcan and Saygili (2018) assessed the impact of EIAs on the survival of exports with a focus on Turkey’s participation in different agreements. They used a discrete-time probit model with random effects on export data from 1998 to 2013. Their results showed that EIAs increased the survival of export relations in Turkey. Socrates et al. (2020) explored export duration in Kenya by employing a discrete-time random effects logit regression model and the difference-in-differences estimation technique. They used disaggregated data spanning from 1995 to 2016 to establish the factors that affect the survival of exports from Kenya to different regions, trade agreements, the factor intensity of products, and their level of heterogeneity. They found that the first year of export survival of Kenya’s exports was 39%, with a median duration of one year. Also, the AGOA was found to enhance the survival of apparel exports especially. COMESA was found to increase the survival rate of exports from Kenya. However, EACs were found to have a dampening effect even in SSA regions. Differentiated products, unlike capital-intensive ones, on the other hand, were found to improve export survival.

The studies reviewed above clearly show the effects of EIAs on aggregate trade flows, trade margins, and trade survival alike. But the arguments in each study differ significantly: some support a common consensus, and others give varied arguments altogether. However, the effects of EIAs on export survival in any member state of the ECOWAS region, particularly Ghana, have not been thoroughly investigated, a gap this study intends to fill.

3 Methodology and Data

3.1 Data

This study used commodity-level data (HS six-digit bilateral trade flows) and total exports from Ghana to 28 countries for the period spanning from 1996–2018. The basic unit of analysis in this study is the exporter-commodity-market level. This implies an in-depth exploit of bilateral trade flows between Ghana and 28 selected trading partners, of which 14 countries are from the ECOWAS region and 14 countries are not. The choice of the selected trading partners was based on data availability, and the relevance of the export relation. All of the data were obtained from the BACI-CEPII international trade database, based on the UN-COMTRADE.

3.2 Theoretical Framework

The introduction of EIAs as a possible determinant of export survival stems from the heterogeneous theory of trade (Melitz, 2003), which highlights the relative contributions of the intensive and extensive margins of trade to trade flows. The theory specifically asserts that trade liberalization and EIAs generally lead to reallocations among more heterogeneous producers in a sector such that less productive producers are forced to exit. That is, EIAs do not only reduce the cost of entry into the market but also enhance the competition that exists in the market, thereby allowing only the most efficient producers to export while simultaneously causing the less productive ones to exit. The theory provides an effective link between EIAs and export survival. As such, our study aimed to determine the impact of EIAs on export survival based on the aforementioned theory and its augmentation to include other trade determinants. The following economic model is derived from the heterogeneous theory of trade:

where \({h}_{it}\), which denotes the probability of an export relation ceasing (export failure), is expressed as a function of EIAs and a host of other explanatory variables (\({x}_{it}\)).

3.3 Empirical Model Specification

This study employs a discrete-time complementary log–log model with random effects estimation. Discrete-time hazard models can be specified in terms of the conditional probabilities of the termination of a particular trade relation in a given time interval. Using the same notations and definitions as in Mohammed (2018), the survival rate of trade relations between Ghana and its export partners are modeled given that such trade relations have survived up to a particular period. The export data at hand are organized in a discrete (yearly) form, though they may be continuous in nature. Thus, in this study, survival times are treated as discrete intervals of time (that is, in number of years).

In addition, time takes only positive integers \(t=1, 2, 3, \dots\) and the interval \(t\) is \((t-1, t).\) A total of \(n\) independent export partners \((i=1, \dots , n)\) are observed, with observations beginning at some starting point \(t=1\). The observations continue until \({t}_{i}\), at which point either the particular trade relation ceases or is censored. There is a dummy variable, \({c}_{i}\), which equals 1 if a trade spell is terminated and 0 if it is censored. There is also a vector of covariates, \({X}_{it}\), whose values may differ at different discrete time periods. The discrete-time hazard rate, λ, which is the probability that a trade relation ceases at time t, given that it has not yet ceased, is defined as

where \(T\) is a discrete random variable given the occurrence of the uncensored time event.

According to Holford (1976) and Prentice and Gloecker (1978), if the data are assumed to be a continuous proportional hazard model such that \(\mathrm{log}\lambda \left(t,x\right)={\gamma }_{j}+xb\) from the general form \(\lambda \left(t,x\right)={\lambda }_{0}{e}^{xb}\), then the corresponding discrete-time proportional hazard function could be defined as.

Equation 3 can be solved by a linear log transformation to yield a complementary log–log function of the form.

A maximum likelihood estimation is also possible for a discrete-time model without placing any restrictions on \({\gamma }_{j}\). According to Jenkins (2005), the likelihood distribution for a censored export trade spell is given by the following survival function:

This means that the likelihood function for the entire sample can be written as

Taking the logarithm of Eq. 6 gives

Similarly, the discrete-time models used in literature start with a survival function, which can be expressed in a proportional hazard framework as

where \(S\left({t}_{j}|{x}_{it}\right)\) is the probability that a particular trade relation with covariate values \({x}_{it}\) will survive up to time \({t}_{j}\), and \({S}_{0}({t}_{j})\) is the baseline survival function. One interesting result is that the survival function at time \({t}_{j}\) can be written in terms of the hazard at all prior times \({t}_{1},\dots , {t}_{j-1}\) as.

Given the expression in Eq. 3, a similar relationship for the complement of the hazard function can be obtained as \(1-\lambda \left({t}_{j}|{x}_{it}\right)=[1-{\lambda }_{0}({t}_{j}{)]}^{\mathrm{exp}\{xb\}}\), so that, solving for the hazard for a trade relation \(i\) at time \({t}_{j}\), we obtain the following model:

For any transformation that makes the right-hand side of Eq. 10, a linear function of the parameters gives the complementary log–log model. Applying a log linear transformation, we obtain the following expression:

where \({\mathsf{\gamma }}_{{\varvec{j}}}=\mathrm{log}(-\mathrm{log}\left(1-{\lambda }_{0}\left({t}_{j}\right)\right)\) is the complementary log–log transformation of the baseline hazard. The baseline hazard summarizes the pattern of duration dependence in the discrete-time hazard. It can be introduced into a given discrete-time model as a dummy or as a quadratic, cubic, or at times linear form. According to Esteve-Pérez et al. (2007), introducing unobserved heterogeneity into Eq. 11 gives.

where \({\mathsf{\mu }}_{{\varvec{i}}}={\varvec{l}}{\varvec{o}}{\varvec{g}}({{\varvec{\upsilon}}}_{{\varvec{i}}})\), and \({{\varvec{\upsilon}}}_{{\varvec{i}}}\) enters the proportional hazard model in a multiplicative manner such that \(\lambda \left({t}_{j}|{x}_{it}\right)={\lambda }_{0}({{t}_{j})}^{\mathrm{exp}\{xb)}{\upsilon }_{i}\). Here, \({{\varvec{\upsilon}}}_{{\varvec{i}}}\) is assumed to follow a gamma distribution with a mean of 1 and variance of \({\sigma }^{2}\), which is mostly estimated from the data. Also, \({\mathsf{\mu }}_{{\varvec{i}}}\) performs the function of every normal stochastic error term. In addition, capturing the unobserved heterogeneity helps address over- or under-estimation issues related to the impact of the various regressors on the hazard rate of an export relation ceasing. Finally, \({\varvec{x}}\) is a vector of covariates, and \({\varvec{b}}\) is a vector of coefficients to be estimated.

3.4 Estimation Strategy

To examine the impact of EIAs on the survival of exports from Ghana, we adopt a discrete-time complementary log–log model with random effects estimation to identify the parameters, as defined in Eq. 12, in the following way:

where \({h}_{jit}\) is a dependent variable representing the hazard rate of an export relation ceasing (export failure). The subscript \(i\) denotes the countries employed in the study, \(t\) represents the time periods used in the study, and \(j\) denotes commodity-specific exports. \({Duration}_{j}\) denotes the baseline hazard function, which shows the dependence of exports over time. There are several ways to introduce the duration variable in a model that includes a linear form, quadratic form, and dummies. The study employs both the linear form and dummies, depending on the nature of the commodity under study, to check whether there are variations in the results.

In addition, \({EIA}_{i}\) is a variable at the disaggregated level, which we label ECOWAS. This variable is a dummy that takes a value of 1 if the export is from Ghana to any ECOWAS member state, and zero otherwise. At the pooled level, two additional variables—namely, EIA-in-existence, and EIA-in-effect—are introduced. The EIA-in-existence variable is a dummy that takes a value 1 if there exists any trade agreement between Ghana and the importing partner, and zero otherwise. Similarly, the EIA-in-effect is a dummy variable with 1 indicating that a trade agreement between Ghana and the importing partner is still effective, and zero otherwise. Furthermore,\({Spell}_{i}\) is assigned a value of 1 to multiple export relations, and zero to a one-time relation. Here, \(GDP\) is importer’s gross domestic product, \(REER\) is the real effective exchange rate, and \(Comlang\) is a common language, which is a dummy variable that take a value of 1 if importing countries share the same official language as Ghana, and zero otherwise. Furthermore, \(distance\) is distance, and \(iniexpval\) is the initial value of exports. Again, \(regquality\) is the regulatory quality, \(govteffec\) is the government effectiveness, and \(corruption\) c is the control of corruption.

4 Results and Discussion

4.1 Kaplan–Meier Survival Estimation

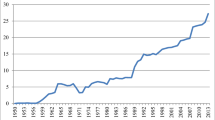

Analyzing export survival requires the use of both nonparametric and semi-parametric estimation techniques. The discrete-time complementary log–log model with random effects semi-parametric estimation was employed to analyze the main results. On the descriptive statistics, use is made of the Kaplan–Meier survival estimate, a nonparametric duration technique, to provide evidence of the survival rate of exports from Ghana at different periods for both aggregate exports and commodity-specific exports. Kaplan–Meier survival estimates are reported in Figs. 1 and 2, with their subdivisions providing further details on the survival of exports when all the cross-sectional units (importing countries) are pooled together and when they are subdivided into ECOWAS and non-ECOWAS regions. Here, we discuss the Kaplan–Meier survival estimates for aggregate exports from Ghana, and we report those for commodity-specific exports in Figs. S1–S5 in the Supplementary information.

The Kaplan–Meier survival estimate results on the survival rate of aggregate exports from Ghana showed that 100% of the export relations survived in the first period until the fifth period, at which point about 11% of the export relations had failed. There was a further decline in the survival of export relations up to the 22nd period, where approximately 18% of the export relations survived. All export relations had ceased by the end of the 23rd period (see Fig. 1). An additional breakdown of the results shows that the survival of export relations in the ECOWAS region stood at 14% by the end of the 22nd period, while that of the non-ECOWAS region stood at approximately 21%. Again, all exports relations had ceased by the 23rd period (see Fig. 2). This implies that the time that elapsed before export relations ceased in the sub-region is moderately low.

4.2 Complementary Log–Log regression results

The complementary log–log regression results are presented in Tables 1, 2, 3, 4, 5, 6 on both aggregate exports and commodity-specific exports from Ghana to some selected trading partners. The dependent variable, the hazard rate of an export relation ceasing (export failure), was regressed on a set of country-specific macroeconomic variables (namely, importers’ gross domestic product, initial value of exports, real effective exchange rate, and distance) with a host of other controls, notably institutional quality indicator variables (i.e., control of corruption, regulatory quality, and government effectiveness). Each result had three different specifications. The first specification included the analysis of ECOWAS, the main variable of interest, on the hazard rate of export relations ceasing, and thus covered the first two columns of each regression results in Tables 1, 2, 3, 4, 5, 6. The second and third specifications analyzed the impact of the pooled EIAs on the hazard rate of an export relation ceasing. Similar to Turkcan and Saygili (2018), the EIA-in-existence and EIA-in-effect dummies were included in these specifications to analyze the overall impact of the EIAs. These specifications covered the last four columns of each regression result in Tables 1, 2, 3, 4, 5, 6. Also, each specification had two forms: instances where the impact of institutional quality variables were not controlled for (see columns 1, 3, and 5), and instances where institutional quality variables were allowed in the regression (see columns 2, 4, and 6.).

A positive sign in the regression results denotes an increase in the hazard rate of an export relation ceasing (short duration or survival of an export). A negative sign for a given result signifies an increase in the duration or survival of aggregate exports or exports of a particular commodity. Duration was introduced to capture the baseline hazard function, and it was subsequently used to show the effect of duration on the hazard rate of an export relation ceasing. A trade spell dummy was also included in each of the regressions, with the exception of paper exports (Table 3) because of a multicollinearity issue.

From a generalized perspective, ECOWAS as an EIA was found to significantly reduce the hazard rate of an export relation ceasing, thereby increasing the survival rate of exports. The magnitude and the significance, however, differed in relation to the nature of the commodity and the form of the specification under consideration. That is, from the first form of the specification, ECOWAS was found to significantly reduce the hazard rate of an export relation ceasing in aggregated exports at the 1% significance level by 1.590, implying that exports from Ghana to the ECOWAS region has a higher survival rate than exports to non-ECOWAS regions (see column 1 in Table 1). Narrowing this observation down to commodity-specific exports, ECOWAS was found to significantly reduce the hazard rate of an export relation ceasing at the 1% significance level by 1.601, 2.415, 3.437, 1.811, and 1.073 in plastic, textile, paper, general machinery, and cocoa, coffee and spices exports, respectively (see column 1 in Tables 1, 2, 3, 4, 5, 6). This shows that exports from Ghana to the ECOWAS region relative to non-ECOWAS regions survive longer in terms of paper exports compared to other commodity-specific exports.

Similar results were recorded in the second form of specification, where institutional quality indicators were allowed in the regression (see column 2 in Tables 1, 2, 3, 4, 5, 6). The magnitudes differed not only among the commodities but also relative to the magnitudes obtained under the first form of specification. For instance, ECOWAS was found to reduce the export failure rate of aggregated exports by 1.364, which in absolute terms is lower than the 1.590 in the first specification (see column 2 in Table 1). The significance level was also different, at 5% and 1% under the second and first forms of specification, respectively. Regarding commodity-specific exports, ECOWAS was found to significantly reduce the hazard rate of plastic exports by 1.950 relative to 1.601 under the first form of specification (see column 2 in Table 2). The magnitude of paper exports, however, was found to be lower in the second form of specification than in the first. The other commodity-specific exports had similar increases in magnitude and all were significant at the 1% level (see column 2 in Tables 1, 2, 3, 4, 5, 6). These results from the second form of specification implied that well-functioning institutions (institutional quality) alter the survival rate of exports for both aggregated and commodity-specific exports from Ghana.

Two major reasons could be attributed to the realization of such significant results. First, the significant impact of ECOWAS in reducing the failure of exports of Ghana can be attributed to the depth of ECOWAS. EIAs can be classified into five major agreements based on depth. Ranking from the shallowest to the deepest, EIAs can be grouped into preferential trade agreements, free-trade agreements, custom unions, custom markets, and economic and monetary unions. Generally, deeper EIAs improve export survival relative to shallower ones. ECOWAS has several characteristics of a custom union, and it is a relatively deep EIA. Second, the implementation of the ECOWAS levy as an administrative and operational check that shields ECOWAS members from invasion by non-ECOWAS members could be a contributing factor. The community levy of a 0.5% tax imposed on goods from non-member states increases the cost of market entry for non-ECOWAS members and thereby enhances trade and protects the markets of member states. Such tax impositions guard markets of ECOWAS members from intense competition and safeguard the continual exportation of certain products.

The last four columns of each of the complementary log–log regression results in Tables 1, 2, 3, 4, 5, 6 analyze the effect of the pooled EIAs on the hazard rate of an export relation ceasing. This was done by introducing EIA-in-existence and EIA-in-effect dummies. Similar to the findings on ECOWAS, the significance and the magnitude of the pooled EIAs differed with regard to the nature of the commodity and the specification type, but they all had the expected signs. For instance, controlling for the effects of institutional quality, both the EIA-in-existence and EIA-in-effect dummies were found to significantly reduce the hazard rate of an export relation ceasing in aggregated exports by 1.574 and 1.583, respectively (see columns 3 and 5 in Table 1). However, allowing for the effects of institutional quality caused a reduction in the magnitude of both dummies, but the significance and signs remained unchanged (see columns 4 and 6 in Table 1).

The results for commodity-specific exports were similar to those for aggregate exports in terms of the signs and level of significance. However, not all the commodity-specific exports had a reduction in magnitude with regards t the specification form. For example, the EIA-in-existence and EIA-in-effect dummies were found to reduce the hazard rate of export failures in paper exports by 1.267 and 1.955, respectively, when institutional quality effects were controlled. However, these magnitudes increased to 1.570 and 2.074 (in absolute terms), respectively, when the effects of institutional quality were allowed (see columns 3–6 in Table 3). Similar increases in magnitude were recorded for general machinery, cocoa, coffee and spices, and plastic exports. Only textile exports had a reduction in magnitude when the effects of institutional quality were allowed (see columns 3–6 in Table 4).

These observations generally mean that exports from Ghana to countries with which there exist an EIA and with the agreement still in effect increase the survival rate of exports, but the impact can differ in the presence of well-functioning institutions. However, the adoption of an EIA, regardless of the level of institutional quality, significantly increases the survival rate of Ghana’s exports in terms of both aggregated and commodity-specific exports. These findings are in line with the results in Besedes et al. (2018) and Turkcan and Saygili (2018). Our results further implied that the existence of an EIA reduces the cost of market entry and the cost of existing trade agreements, and that these align to improve the survival rate of exports.

In addition, most of the country-specific and commodity-specific variables had the expected (significant) effect on the export hazard rate. The common language variable, however, was found to be insignificant. This is contrary to the findings of Turkcan and Saygili (2018), who found that common language is highly significant, as the ability to communicate in a similar language promotes a sense of trust and eases transactions, especially under custom-union trade agreements. The real effective exchange rate, on the other hand, was found to be insignificant. This is contrary to the findings of Kamuganga (2012), who found the exchange rate to be positive and significant. These differences in observations could be due to different measurements of the exchange rate in the respective studies, as Kamuganga (2012) employed exchange rate volatility, whereas we used the real effective exchange rate. Turkcan and Saygili (2018) also found distance to be positive and highly significant, especially under EIAs and custom unions, partly due to the cost involved in transporting across far distances and the nature of the commodity. However, a contrary finding was observed under the results of aggregated exports.

Further, the results were relatively similar in context to both ECOWAS and the pooled EIA specifications. Intuitively, importer GDP was found to significantly reduce the hazard rate of export failure in aggregate exports by 0.468, which was slightly different from the magnitudes of the second and third specifications and their respective forms. These results imply that, as the importer country’s economy grows in the long run, the survival rate of exports to such an economy increases, due to the increase in demand for certain commodities. Similar results were recorded in the commodity-specific export specifications. The magnitudes differed as a result of the nature of the commodity being exported, but the signs and the significance levels were the same under the different specifications. Also, the initial value of the export, which basically assesses the trust, knowledge, and experience of a country in terms of exports, was also found to reduce the hazard rate of export failure in aggregate exports. The signs and significance were the same, pertaining to the different specifications. These results imply that the rich experience of a country like Ghana, in terms of exports and the subsequent knowledge that comes with such experience, significantly increases the survival rate of Ghana’s exports.

Turning to other country-specific variables, common language was found to significantly reduce the hazard rate of export failure in all the commodity-specific exports under all three specifications. This means that exports from Ghana to countries with which they share a common language have a higher survival rate. On the other hand, distance was found to significantly increase the hazard rate of export failure in all commodity-specific exports. That is, exporting a commodity over a long distance comes with extra costs, and this reduces the survival rate of exports. Also, the nature of the commodity is a possible factor. Transporting more fragile or bulky commodities over far distances is problematic. This particular assessment can be seen from the difference in the magnitudes in each of the commodity-specific exports results. For instance, the impact of distance on the survival rate of plastic exports under all specifications and forms was seen to be higher in absolute terms than that of paper. This makes intuitive sense, as plastic is more fragile and delicate than paper. Similar results on all of the above observations were reported by Hess and Persson (2011), and Turkcan and Saygili (2018).

Accordingly, Hess and Persson (2011) asserted that institutions have the ability to ease economic processes such as trade by reducing uncertainty and transaction costs. They further provided evidence that such functions can only be achieved by improving on the efficiency and quality of institutions. Thus, well-functioning institutions can shape the desirable behavior of economic agents and subsequently help them adjust to regulations and abide by contracts. This has massive implications on the survival of exports. Therefore, institutional quality indicators were introduced as part of the regression analysis to help ascertain the relevance of institutions in helping to shape the survival of Ghana’s exports.

Regulatory quality as an institutional quality indicator captures the perception of the ability of government to formulate and implement sound policies and regulations that promote development. From the regression results, however, it was found to have a significantly positive impact on the hazard rate of an export relation ceasing in both aggregated and commodity-specific exports, with the exception of cocoa and coffee and spices under the three different specifications with differing magnitudes. Regulatory quality was found to increase the hazard rate of export failure in aggregate exports by around 1.072 given the three specifications (see columns 2, 4, and 6 in Table 2). However, the results for commodity-specific exports showed that the impact of regulatory quality on the hazard rate of plastic export failure was highly significant (at the 1% level) relative to that of paper and textile exports (each at the 10% level), with magnitudes ranging from 0.933 to 1.052 for plastic exports, compared to 0.469 for paper exports and 0.451–0.469 for textile exports (see columns 2, 4, and 6 in Tables 2, 3, 4). This means that regulatory quality reduces the survival rate of Ghana’s exports. This can be attributed to the fact that the degree of enforceability of contracts or regulations is low even when such regulations are implemented. The crucial component of regulatory quality as an institutional quality indicator does not lie in the formulation and implementation of sound policies, but rather in the ability to enforce these policies. This has been missing in the ECOWAS region for decades now. Similar results were found by Kamuganga (2012). In his study, the polity index was found to be positive and highly significant. He explained that most African countries have poor institutions and contract enforceability and cannot guarantee a predictable standard from the supplier side, as such this may affect the volume of trade in the network.

Controlling corruption, on the other hand, was found to have a significantly negative impact on Ghana’s export survival only in the case of plastic exports. Thus, according to the analysis, the control of corruption tends to increase the survival rate of plastic exports from Ghana (see columns 2, 4, and 6 in Table 2). However, the impact of government effectiveness on the survival of Ghana’s export was found to be counterintuitive. Government effectiveness had a significantly negative effect on the survival of general exports from Ghana but a significantly positive impact on the export failure of general machinery exports. This means that while government effectiveness increases the survival rate of general exports from Ghana, it consequently reduces the survival rate of general machinery exports. This finding could stem from the fact that government effectiveness, among other things, pertains to the perception of the quality of policy formulations and their implementation and to the credibility of the government’s commitment to such policies (Kaufmann et al., 2010). This implies that perceptions concerning government effectiveness regarding aggregate exports as a whole could be a promising by way to increase the survival rate of general exports from Ghana. However, at the individual commodity-specific level of exports (specifically exports of general machinery), government effectiveness is lacking, and this increases the failure rate of exports of general machinery.

5 Conclusion and Policy Recommendations

The main objectives of this paper were to explore the survival of exports from Ghana and analyze the role of economic integration agreements. Specifically, we examined the relevance of EIAs (defined in terms of ECOWAS) in Ghana’s export survival using annual bilateral trade flow data. In particular, we extracted HS six-digit bilateral trade flow data at the product level from BACI-CEPII on 28 importing countries, of which 14 were ECOWAS members and the remaining 14 were non-ECOWAS members from 1996 to 2018.

The results on export duration generally showed that 100% of export relations survived from the first year to the fifth year, but by the 22nd year, roughly 83% of export relations had failed, meaning that only 17% survived. We also found that close to 14% of export relations survived by the 22nd period if the exports were to member states in the ECOWAS region, compared to the 21% export survival rate at the end of the same period in non-ECOWAS regions. However, the results of the discrete-time complementary log–log model with random effects estimation showed that trade agreements improved the survival of exports from Ghana. The model revealed that trading under ECOWAS increased the survival rate of Ghana’s exports. Custom unions are much deeper than preferential and free-trade agreements. As such, the results for ECOWAS make sense, given that it has the characteristics of a custom union. Other reasons for these results include the implementation of the ECOWAS levy.

The key policy recommendations based on the results of our study center on the enforceability of policy and regulations pertaining to contracts in the ECOWAS region. The results indicate that institutions play a crucial role in export survival. But the inability of policymakers and regulators to enforce contracts and regulations negatively affects the sustainability and survival of export relations, thereby affecting the growth of exports. Also, the export promotion authority of Ghana should pay sufficient attention to nontraditional exports such as coffee and spices, plastic, paper, and machinery, by ensuring their productivity and exports.

Data Availability Statement

The data that support the findings of this study are available from the corresponding author, POT, upon request.

Notes

The AfCFTA is characterized by two major phases. The first phase deals with negotiations on prominent issues such as rules of origin for goods, tariff concessions, and service schedules of special commitments on the trade of goods and services. The second phase centers on competition policies, investment, and intellectual property rights protocols.

Abbreviations

- AfCFTA:

-

African Continental Free Trade Agreement

- COMESA:

-

Common Market for Eastern and Southern Africa

- AGOA:

-

African Growth and Opportunities Act

- EU-ACP:

-

European Union–African, Caribbean, and Pacific cooperation

- EIA:

-

Economic Integration Agreement

- ECOWAS:

-

Economic Community of West African States

- EU:

-

European Union

- NAFTA:

-

North American Free Trade Agreement

- SSA:

-

Sub-Saharan Africa

- UN-COMTRADE:

-

United Nations Commodity Trade statistics database

- BACI:

-

International trade database at the product level

- CEPII:

-

Centre d’Etudes Prospectives d’Informations Internationales

- HS:

-

Harmonized system

- GDP:

-

Gross domestic product

References

Asche, F., Cojocaru, A. L., Gaasland, I., & Straume, H. M. (2018). Cod stories: Trade dynamics and duration for Norwegian cod exports. Journal of Commodity Markets, 12, 71–79.

Baier, S. L., & Bergstrand, J. H. (2007). Do free trade agreements actually increase members’ international trade? Journal of International Economics, 71(1), 72–95.

Baier, S. L., Bergstrand, J. H., & Feng, M. (2014). Economic integration agreements and the margins of international trade. Journal of International Economics, 93(2), 339–350.

Besedes, T. (2013). The role of NAFTA and returns to scale in export duration. Cesifo Economic Studies, 59(2), 306–336.

Besedes, T., (2014). The effects of European integration on the stability of international trade: A Duration Perspective. MPRA Paper No. 59626. Online at https://mpra.ub.uni-muenchen.de/59626/

Besedes, T., & Blyde, J. (2010). What drives export survival? An analysis of export duration in Latin America. Inter-American Development Bank, Mimeo, 1, 1–43.

Besedes, T., Moreno-Cruz, J., & Nitsch, V. (2018). Trade integration and the fragility of trade relationships: Theory and empirics. Online at https://cpn-us-w2.wpmucdn.com/sites.gatech.edu/dist/5/322/files/2019/06/besedes-eia.pdf.

Besedes, T., & Prusa, T. J., (2006). Ins, outs, and the duration of trade. Canadian Journal of Economics, 39(1), 266–295.

Blyde, J., Graziano, A., & Volpe Martincus, C. (2015). Economic integration agreements and production fragmentation: Evidence on the extensive margin. Applied Economics Letters, 22(10), 835–842.

Carrere, C. (2006). Revisiting the effects of regional trade agreements on trade flows with proper specification of the gravity model. European Economic Review, 50(2), 223–247.

Clausing, K. A. (2001). Trade creation and trade diversion in the Canada-United States free trade agreement. Canadian Journal of Economics/revue Canadienne D’économique, 34(3), 677–696.

Egger, P., & Larch, M. (2008). Interdependent preferential trade agreement memberships: An empirical analysis. Journal of International Economics, 76(2), 384–399.

Egger, P., Larch, M., Staub, K. E., & Winkelmann, R. (2011). The trade effects of endogenous preferential trade agreements. American Economic Journal: Economic Policy, 3(3), 113–143.

Esteve-Pérez, S., Mánez-Castillejo, J. A., Rochina-Barrachina, M. E., & Sanchis-Llopis, J. A. (2007). A survival analysis of manufacturing firms in export markets. Entrepreneurship, industrial location and economic growth (pp. 313–332). Elgar: Cheltenham etc.

Florensa, L. M., Márquez-Ramos, L., & Recalde, M. L. (2015). The effect of economic integration and institutional quality of trade agreements on trade margins: Evidence for Latin America. Review of World Economics, 151(2), 329–351.

Foster, N., Poeschl, J., & Stehrer, R. (2011). The impact of preferential trade agreements on the margins of international trade. Economic Systems, 35(1), 84–97.

Freund, C., & Ornelas, E. (2010). Regional trade agreements: blessing or burden? (No. 313). Centre for Economic Performance, LSE.

Fugazza, M., & Molina, A. C. (2016). On the determinants of exports survival. Canadian Journal of Development Studies, 37(2), 159–177.

Ghosh, S., & Yamarik, S. (2004). Are regional trading arrangements trade creating? An application of extreme bounds analysis. Journal of International Economics, 63(2), 369–395.

Hess, W., & Persson, M. (2011). Exploring the long-term evolution of trade survival. IFN Working Paper, No. 880. Online at http://hdl.handle.net/10419/81384

Holford, T. R. (1976). Life tables with concomitant information. Biometrics, 32, 587–597.

Jenkins, S. P. (2005). Survival analysis. Unpublished manuscript, Institute for Social and Economic Research, University of Essex, Colchester, UK. Online at http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.176.7572&rep=rep1&type=pdf.

Kamuganga, D. N. (2012). Does intra-Africa regional trade cooperation enhance Africa's export survival? (No. 16/2012). Graduate Institute of International and Development Studies Working Paper.

Kaufmann, D., Kraay, A., & Mastruzzi, M. (2010). Response to ‘what do the worldwide governance indicators measure?’. The European Journal of Development Research, 22(1), 55–58.

Magee, C. S. (2008). New measures of trade creation and trade diversion. Journal of International Economics, 75(2), 349–362.

Martuscelli, A., & Varela, G. (2015). Survival is for the fittest: export survival patterns in Georgia. The World Bank Policy Research Working Paper 7161.

Melitz, M. J. (2003). The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica, 71(6), 1695–1725.

Mohammed, A. R. A. (2018). Determinants of export survival: The case of Ghanaian manufacturers. Journal of Quantitative Methods, 2(1), 37–61.

Nitsch, V. (2009). Die another day: Duration in German import trade. Review of World Economics, 145(1), 133–154.

Obashi, A. (2010). Stability of production networks in East Asia: Duration and survival of trade. Japan and the World Economy, 22(1), 21–30.

Osei-Assibey, E. (2015). Export promotion in Ghana. African Center for Economic Transformation (ACET), Department of Economics, University of Ghana.

Prentice, R. L., & Gloeckler, L. A. (1978). Regression analysis of grouped survival data with application to breast cancer data. Biometrics, 34, 57–67.

Pu, H., & Li, T. (2018). A cross-countries research on the duration of export trade relationships in manufacturing industry. American Journal of Industrial and Business Management, 8(04), 850.

Recalde, M.L., Florensa, L.M., & Pedro Gabriel, D. (2016). Latin American integration and the survival of trade relationship. In: 17th European Trade Study Group (ETSG) Conference, Helsinki (Finland). Online at https://www.etsg.org/ETSG2016/Papers/248.pdf

Redig, J., & Olsson, C. (2012). The effect of economic integration on the duration of trade. https://lup.lub.lu.se/luur/download?func=downloadFile&recordOId=2297841&fileOId=2297853

Socrates, M. K., Moyi, E., & Gathiaka, K. (2020). Explaining export duration in Kenya. South African Journal of Economics, 88(2), 204–224.

Stefan, B., & Imre, F. (2018). Drivers of the duration of comparative advantage in the European Union’s agri-food exports. Agricultural Economics, 64(2), 51–60.

Turkcan, K., & Saygılı, H. (2018). Economic integration agreements and the survival of exports. Journal of Economic Integration, 33(1), 1046–1095.

Wang, P., Tran, N., Wilson, N. L., Chan, C. Y., & Dao, D. (2019). An analysis of seafood trade duration: The case of ASEAN. Marine Resource Economics, 34(1), 59–76.

Acknowledgements

We thank the anonymous referee and the editor of the journal.

Funding

This study was not funded by any organization or institution.

Author information

Authors and Affiliations

Contributions

All authors equally and jointly worked on data curation, formal analysis, conceptualization, and the writing of the entire manuscript.

Corresponding author

Ethics declarations

Conflict of Interest

We have no affiliations with or involvement in any organization or entity with any financial interest or nonfinancial interest in the subject matter or materials discussed in this manuscript.

Ethical Approval

We confirm that all ethical approval was obtained for the materials used in this manuscript.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Nkansah, K., Takyi, P.O., Sakyi, D. et al. Economic Integration Agreements and Export Survival in Ghana. J Afr Trade 9, 1–22 (2022). https://doi.org/10.1007/s44232-022-00001-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s44232-022-00001-z