Abstract

After the discovery of fractal structures of financial markets, fractional partial differential equations (fPDEs) became very popular in studying dynamics of financial markets. Available research results involves two key modelling aspects; firstly, derivation of tractable asset pricing models, those that closely reflects the actual dynamics of financial markets. Secondly, the development of robust numerical solution methods. Often times, most the effective models are of a nonlinear nature, and as such, reliable analytical solution methods are seldomly available. On the other hand, the accurate value of American options strongly lies on the unknown free boundaries associated with these types of derivative contracts. The free boundaries emanates from the flexibility of the early exercise features with American options. To the best of our knowledge, the approach of pricing American options under the fractional calculus framework has not been extensively explored in literature, and an obvious wider research gap still exist on the design of robust solution methods for pricing American option problems formulated under the fractional calculus framework. Therefore, this paper serve to propose a robust numerical scheme for solving time-fractional Black–Scholes PDEs for pricing American put option problems. The proposed scheme is based on the front-fixing algorithm, under which the early exercise boundaries are transformed into fixed boundaries, allowing for a simultaneous computation of optimal exercise boundaries and their corresponding fair premiums. Results herein indicate that, the proposed numerical scheme is consistent, stable, convergent with order \({\mathcal {O}}(h^2,k)\), and also does guarantee positivity of solutions under all possible market conditions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

At the centre of option pricing theory is the pioneering work of Black–Scholes–Merton [2, 3] whom were first to propose the most popular, and extensively used model in financial modeling, well known as the Black–Scholes (B–S) model. Though the B–S model has been a breakthrough in financial derivative pricing theory. There is empirical evidence suggesting that the BS model in its classical setup cannot fully describe the dynamics of certain asset returns as well unusual phenomenons observed in financial markets. This is so, because, the assumption of log-normality on asset returns, i.e, the underlying processes follow random walks or diffusions with deterministic drifts is somewhat oversimplifying the real underlying processes of asset returns.

The classical B–S model is governed by a volatile process called the geometric Brownian motion. This process is not adequate enough to model unusual dynamics observed in a number of financial markets. As such, a number of revised models have been suggested, leading to the development of more sophisticated models, those which are well suited in explaining unusual markets dynamics. A few examples of these revised models are but not limited to regime-switching and jump diffusion models [4,5,6], stochastic volatility models [7,8,9], and stochastic interest rates models [10,11,12] just to mention but a few.

An alternative and rather robust approach which is commonly used in modeling dynamics of financial markets involves replacing the standard Brownian motion in the underlying stock process with a non-Gaussian random fractal process. Under this approach, a family of Black–Scholes PDEs were born. These PDEs have now come to known as fractional Black–Scholes partial differential equations (fBS-PDEs). As evidenced, the name is certainly owed to the fact that, the involved derivative operators are of fractional nature i.e time-fractional BS (tfBS)—when the time derivative in the classical Black–Scholes model is replaced by a fractional order \(\alpha\), for (\(0<\alpha \le 1\)), space fractional BS (sfBS) when the two spatial derivatives in the classical Black–Scholes model are replaced with their corresponding fractional derivatives of order \(\alpha\) and \(\beta\) for (\(0<\alpha \le 1\)) and (\(1<\beta \le 2\)) respectively. And the other class is know as time-space fractional Black–Scholes (tsfBS) which cater for a combination of the other two cases. This approach has been a subject of active research both in its analogical setting and in using several other tractable derivations. Some the application can be found for example in [13,14,15] applied to pricing double barrier options, using models for which detailed were first documented in [16, 17]. Rezarei et. al. [15] generalized the constant elasticity of variance (CEV) model to a fractional-CEV model using the Jumarie’s [16] fractional model in order to capture long memory effects in stock dynamics. The generalized CEV model was used to price European double barrier knock-out call options.

Apart from financial modelling, fractional calculus models have been extensively utilized in modelling diseases, see for example [18,19,20,21] just to mention but a few. In [21] a fractional calculus framework was utilized in modelling intricate interactions of CD4+ T-cells and HIV viruses to aid investigations on how HIV infections behave under certain control interventions. Their findings jusftifies the chaotic and dynamical behaviour of the HIV virus under some control mechanisms. In [18] a fractional calculus based model was used in predicting the spread and control strategies for covid-19 in Namibia. Furthermore, in [20] the qualitative and dynamical behaviors of Monekeypox were analysed using a fractional calculus based model.

Back to finance, there is empirical evidence suggesting that, unlike classical models, fractional models accounts for a wide range of information on the underlying asset prices. One of the short-comings of classical models is that, they can only account for localised information about the underlying asset prices, making them inappropriate in modelling the chaotic nature obeserved in financial market dynamics, for detailed discussions see for example [22,23,24,25,26] and references therein. As such, scientific evidence suggests that fractional models are more appropriate in capturing unusual dynamics of financial markets.

The valuation of American options has long been a subject of active research in computational and mathematical finance. American option problems are non-linear in nature. The non-linearity is introduced by the early exercise features associated with American options, as such, it has been widely accepted that there exist no tractable analytical methods for solving such problems.

From a fractional point of view, apart from the nonlinearity of American option problems, the non-locality of the fractional derivatives pose yet another challenge in terms of mathematical complexity and the holistic holistic comprehesion of solution methods to such problems. For these reasons, analytical solutions for solving fBS-PDEs in pricing American options are almost non existent, necessitating the need for the development of robust numerical techniques for solving such models.

In designing numerical methods for solving American option problems, one ought to take note of the fact that the design of the involved model will lead to a free boundary value problem (FBVP) and as such, the location of the boundary is usually unknown. It is worth noting that, though the design of numerical methods for pricing American option problems under the classical B-S approach has been extensively explored and remain a subject of active research, the same cannot be said about those models developed under the fractional calculus framework. Hence, this work among others, aims to propose a robust numerical scheme that can simultaneously compute the location of the free boundary in addition to computing the actual option premium under the fractional calculus framework.

In this paper, we design and analyse a robust numerical scheme for solving American options PDEs under a tfBS framework. The proposed method follows a front-fixing algorithm under which option premiums and their corresponding optimal option exercise boundaries are computed. The front-fixing method has been applied successfully to a wide range of problems arising in population dynamics [27] and finance [28,29,30,31,32,33,34]. There are numerous other similar techniques used in solving American option problems, for example singularity separating method [32, 35] and Penalty methods [9, 34]. The idea behind the front-fixing approach is to use some change of variables to transform the problem from a moving boundary problem to a fixed boundary problem. The front-fixing transformation incorporates the early exercise boundaries into the original time-fractional Black–Scholes (tfBS)-PDE upto the design of the numerical scheme and its solution.

The rest of the paper is organized as follows. Sect. 2 presents a brief overview of some necessary preliminary concepts on fractional differentiation and definitions whilst specifying the involved tfBS-PDE and its transformed version for pricing American put options. In Sect. 3, we propose a finite difference discretization of the transformed tfBS-PDE while further elaborating on the construction of the numerical scheme. The theoretical analysis of the scheme are presented in Sect. 4, while in Sect. 5 we present some American option pricing numerical experiments. Concluding remarks as well as scope for further research are presented in Sect. 6.

2 The tfBS-PDE for American Put Options

In this section, we briefly discuss some fundamental concepts on fractional differentiation relevant to our model formulation. The section further specifies the involved non-linear tfBS-PDE for pricing American put option problems.

2.1 Preliminaries and Definitions

In this section we present preliminary fractional calculus definition. With keen interests, we will focus three definitions, namely; the Caputo, Reimann–Liouville and Jumarie (modified Reimann–Liouville) definitions. For a detailed discussion on different fractional derivatives definitions see [36]. Some other insightful discussions can also be found in [16, 17] among others literature.

Definition 2.1

Caputo Fractional Derivative

Suppose \(v:{\mathbb {R}}\times {\mathbb {R}}\rightarrow {\mathbb {R}}\) is a continuous function, but not necessarily differentiable. The Caputo fractional derivative of v(x, t) of order \(\alpha\) is defined as

Definition 2.2

Reimann–Liouville Fractional Derivative Suppose \(v:{\mathbb {R}}\times {\mathbb {R}}\rightarrow {\mathbb {R}}\) is a continuous, but not necessarily a differentiable function. Then, the Reimann-Liouville fractional derivative of v(x, t) of order \(\alpha\) is given by

Similar to the Caputo Derivative, the Reimann-Liouville Derivative has some drawbacks, some of which can be resolved by modifying the definition. Jumarie in [16] modified the Reimann–Liouville definition using the fractional differencing technique coupled with the fractional Taylor series theory to arrive at what is now referred to as the Jumarie definition. The Jumarie [16] definition address the issue of non-differentiability at the origin.

Definition 2.3

Jumarie (modified Reimann–Liouville) derivative Let \(v:{\mathbb {R}}\times {\mathbb {R}}\rightarrow {\mathbb {R}}\) be a continuous, but not necessarily a differentiable function, and suppose v(x, t) is

-

(i)

a constant K, then its Jumarie fractional derivative of order \(\alpha\) is given by

$$\begin{aligned} D_{J}^\alpha K= \left\{ \begin{array}{lr} \frac{K}{\Gamma (1-\alpha )}t^{-\alpha }, &{} \alpha \le 0,\\ \\ 0, &{} \alpha > 0, \end{array} \right. \end{aligned}$$(3) -

(ii)

not a constant, then

$$\begin{aligned} D^\alpha _J v(x,t)=\frac{1}{\Gamma (1-\alpha )}\frac{\partial }{\partial t} \int ^{t}_{0} \frac{(v(x,\tau )-v(x,0))}{(t-\tau ) ^{\alpha }}d\tau , \, 0< \alpha < 1. \end{aligned}$$(4)

Definition 2.4

Generalized Taylor Series Suppose \(v:{\mathbb {R}}\times {\mathbb {R}}\rightarrow {\mathbb {R}}\) is a continuous function such that v(x, t) its’ fractional derivative of order \(\alpha j\), for some positive integer j and \(0<\alpha \le 1\) exist, then, the following equality is true

2.2 American Option Problem

Suppose v(S, t) denote the value of an American put option, S the price of the underlying stock and K the option’s strike price. Similar to [14] we assume the stock price dynamics (S) follows the following fractional stochastic process,

which is driven by a fractal process \(\beta _{\alpha }(t)\) governed by Gaussian white noise \(\omega (t)\) such that

where r is the risk-free interest rate, \(\delta\) the dividend yield, and \(\omega (t)\) is the Gaussian white noise. As explained in [14] in the fractional stochastic process (6), the standard Brownian motion is generalised by \(\beta _{\alpha }(t)\) defined in (7). Furthermore, when \(\alpha =1,\) Equations (6) and (7) become the usual standard stochastic process and the standard Brownian motion respectively.

Equation (6) coupled with results from the fractional Itô calculus and the Generalized Taylor series expansion (5) of v(S, t) leads to the following tfBS-PDE with initial and boundary conditions for American put option:

With a change of variable \(\tau =T-t\) (time to maturity), the Eq. (8) become

where \(b(\tau )\) is the moving exercise boundary.

It is worth noting that, when \(S\le b(\tau )\), it is optimal to exercise a put option. Whereas, when \(b(\tau )<S\), the optimal strategy would be to hold the option as it is worthless to exercise a put when \(b(\tau )<S\)

The value matching condition \(v(b(\tau ),\tau )=K-b(\tau )\) and the smooth pasting condition \(\frac{\partial v}{\partial S}\left( b(\tau ),\tau \right) =-1\) are necessary for preserving the financial interpretation of the continuity of \(v(b(\tau ),\tau )\) and \(\frac{\partial v}{\partial S}\left( b(\tau ),\tau \right)\) across the optimal exercise boundary \(b(\tau )\). This is done to avoid arbitrage opportunities, because, after purchasing an American put an investor can exercise the option once the asset price falls below \(b(\tau )\), or purchase it back whenever the asset price rises above \(b(\tau )\). Since the transactions of converting a put option into holding of cash plus a short position in the asset and vice versa all occur on the early exercise boundary, we require the value matching and smooth pasting conditions in order to ensure that these transactions are self-financing, i.e., each portfolio revision undertaken is exactly financed by the proceeds from the sale of the previous position ([30]).

The underlying concept of the front-fixing approach is therefore to remove the moving exercise boundary \(b(\tau )\) using change of variables which then leads to a non-linear tfBS-PDE posed on a fixed domain. With this formulation, the position of the boundary is given but some of the boundary conditions remain unknown and must be simultaneously computed with the value of the option.

To transform the tfBS-PDE (10) and for the convenience of numerical implementation, we consider the following change of variables

Using the Landau ([37]) transformation of the asset price variable (\(x=ln\left( \frac{S}{b_{f}}\right)\)) serves to ensure that \(x=0\) whenever \(S = b(\tau )\), which help in transforming the free boundary conditions to fixed boundary conditions. Using this transformation, the free boundary \(S = b(\tau )\) is then transformed to a fixed boundary \(x = 0\). Under the transformed variable x, the underlying stock dynamics in (6) will then change to

By using (13), the tfBS-PDE (10) is transformed into the following fractional linear complementary problem (FLCP) under a new random variable x

This FPDE can further be simplified into

with initial and boundary conditions for an American put option

where \(b'_{f}\) is the derivative (of the free boundary \(b_{f}\)) with respect to \(\tau\).

3 Discretization of the tfBS-PDE and Construction of the Numerical Scheme

In this section, we introduce a finite difference method for approximating solution to the tfBS initial boundary value problem (IBVP) (15) with a free boundary \(b_{f}(\tau )\). Not only do we compute the solution to the fractional IBVP (15) but simultaneously compute the position of the free boundary \(b_{f}(\tau )\).

3.1 Discretization of the tfBS-PDE

Let L and N be positive integers and define \(h=x_{max}/L\) and \(k=T/N\) as the space and time step-sizes, respectively. Define \(x_{l}=lh; \, l=1,2,...,L\) and \(\tau _{n}=nk; \, n=0,1,2,...,N\), such that \(x_{l} \in [x_{min}, x_{max}]\) and \(\tau _{n} \in [0, T]\). Furthermore, define \(u_{l}^{n}=u(x_{l},\tau _{n})\) as the solution at the grid point \((x_{l},\tau _{n})=(lh,nk)\).

Since the Jumarie fractional derivative definition (4) and the Caputo derivative definition (1) coincides when the function under consideration is differentiable, we will evaluate the \(\alpha\)-derivative in (12) using definition (1), similar results can be obtained using any of the other definitions above.

For \(m=1\), to obtain

where

and

such that, \(1=\beta _{1}>\beta _{2}> \beta _{3}> \cdots > \, \rightarrow 0\) as \(j \rightarrow n\).

The \(\alpha\)-derivative in (21) can therefore be represented by

Since \(k^\alpha < k\), then we have \({\mathcal {O}}(k)\) in the time direction. Moreover, it is trivial to show that, for \(j=1\) and \(\alpha =1\), (24) reduces to the classical backward difference formula.

We approximate the other derivatives in (21) by

3.2 Construction of the Numerical Scheme

To obtain the full numerical scheme, we substitute (24), (25), (26) and (27) into (15). After simplifying, we obtain

for \(n=1\)

and for \(n \ge 2\)

where

where

and

From boundary conditions in (16), we obtain

Consider (15) for \(x_{0}=0, \tau >0\) and substitute (33) into (15) at \((0,\tau )\) to obtain

with its central discretization given by

Equation (35) follows directly from the definition of a fractional derivative of a differentiable function \(u(x,\tau )\) at \(x=0\).

Now (33) implies

After some algebraic manipulations, we obtain the following expression in terms of \(u_{1}^n\):

whereby

Using scheme (28)–(29) for \(l=1\), and evaluating (39) at \(n^{th}\) step, the free boundary \(b_{f}^{n}\) can be expressed as

where

Therefore, the final schemes for \(u_{l}^{n}\) and \(b_{f}^{n}\) are given by

for

with initial and boundary conditions

The above scheme can be represented in the following tridiagonal matrix system:

and

where

and

4 Theoretical Analysis

This section present theoretical deductions on the positivity and non-spatial monotonicity properties of the numerical solution as well as those of the moving boundary which then establish the stability results. To begin, we prove that the coefficients a, b, and c satisfy the two conditions below.

4.1 Positivity of the Solution and Boundary Conditions

Lemma 4.1

The positivity conditions for the coefficients a, b, and c in the schemes (28) and (29), with regards to descritization stepsizes h and k are

-

Cond. 1.

\(\frac{3\sigma ^2}{2}\ge |r-\delta |\), for any \(h >0,\) and

-

Cond. 2.

\(k \le {\left( \tau ^{1-\alpha }r-\frac{\sigma ^2}{2\,h}\frac{\Gamma (1+\alpha )^2}{(T-\tau )^{\alpha }}\right) }^{-\alpha }\).

Proof

From equation (34), the non-negativity of a, implies

Therefore, the positivity condition for coefficient a is that

whereas for the one for b, we have

Therefore the positivity condition for b is that

and the positivity of c follows directly from (34) when

To establish results on positivity of the numerical solution \(u_{l}^{n}\) and the moving boundary \(b^{n}\), we propose lemma 4.2 and its proof together with other subsequent results therein leads to the desired positivity results.

Lemma 4.2

Let \(\{u^{n}_{l}, b_{f}^{n}\}\) be the numerical solution to the scheme (42)-(46) for the American put option problem in (15) and let \(\psi _{n}\) be defined as in (41). Then from lemma 4.1, for any \(h>0\) we obtain that

-

1).

For every fixed n,

$$\begin{aligned} 0 < \psi _{n} \le 1. \end{aligned}$$(57) -

2).

\(u_{l}^{n}\ge u_{l+1}^{n}\) for \(l=0,\cdots , L; n=0,\cdots , N-1\).

-

3).

\(u_{l}^{n}\ge 0\) for \(l=0,\cdots , L-1; n=0,\cdots , N-1\).

Proof

Consider \(n=0\), then from initial conditions in (48), we have \(u_{l}^{0}\ge 0\) and \(b_{f}^0 \ge 0\), and from (39), (41), (47) and Cond.1. of lemma 4.1, we obtain

since

Note that from (42)–(44) and (58) we have

and from (45) and (48) we have \(u_{j}^{1}\ge 0\) for all \(j=2,\cdots ,L\).

Now

which implies that \(0 < \psi _{1}\le 1\).

To show that \(u_{2}^{2}=0\), we consider (46) for \(n=2\) and \(l=2\), which give

Since \({\bar{a}}^{2}\) and b are positive we have \(u_{2}^{2}=0\), hence

Let \(n>2\) and by induction hypothesis, we assume the conclusions holds true for \(n-1\), such that

Now let us define

and

which yields

When \(l=2\), combining the Taylor expansion of (34) with (68) coupled with the value matching and smooth pasting conditions ((17) and (18)), we obtain

Using Eqs. (36), (38) and (70) into (68), we obtain

and

To show the positivity of the solution \(\{ u^{n}\}\) and consequently that of \(\psi _{n}\) as well as it’s boundedness, it suffices to show that, the coefficients \({\bar{a}}^{n}\) and \({\bar{c}}^{n}\) in (47) are positive.

The coefficients are positive because

and by induction assumption \(0 <\psi _{n-1}\le 1\), then \(0<1-\psi _{n-1}\le 0\). Combining this with the already established positivity results of coefficient a in Lemma 4.1, we obtain

Similarly, for \({\bar{c}}^{n}\) we have

therefore,

Moreover, the solution \(\{u_{l}^{n}\}\) is an increasing function of l since a put option become worthless as it approach maturity.

The following theorem follows from the results above

Theorem 4.3

Under the assumptions of Lemma 4.2, the scheme (42)–(46) guarantees the following properties about the free boundary condition and the numerical solution

-

i.

monotonicity and positivity of \(b_{f}^{n}, \, n=0, \cdots , N;\)

-

ii.

monotonicity and positivity of the solution \(u^{n}=(u_{0}^{n}, \cdots ,u_{l}^{n})\) for \(n=0,\cdots ,N.\)

4.2 Numerical Stability and Consistency Analysis

In this section, we study the stability and consistency of the Scheme (42)–(46).

4.2.1 Numerical Stability

We note that

Definition 4.4

The numerical scheme (42)-(46) with initial and boundary conditions (16) is said to be \(\left\| .\right\| _\infty\) stable in the fixed domain \([ 0,x_{\infty }]\times [0,T]\), if for every partition with \(k=1/N, \, h=1/L\) and \((L+1)h=x_{\infty }\),

where \(\left\| .\right\| _\infty\) is the supremum norm of \({\mathbb {R}}^{N+1}\) and M some constant independent of h, k and N.

Theorem 4.5

Under assumptions of lemma 4.2, the numerical scheme (42)-(46) for solving the tfBS PDE (15) is \(\left\| .\right\| _\infty\)-stable.

Proof

Since for each fixed n, the sequence of solutions \({u_{l}^{n}}\) is non-increasing with respect to l, then according to the boundary condition (43) and based on the positivity results of \(b_{f}^{n}\) established under lemma 4.1, we get

Therefore, the numerical scheme (42)–(46) is \(\left\| .\right\| _\infty\)-stable.

4.2.2 Consistency of the Numerical Schemes

To analyze for numerical consistency of a numerical scheme to a partial differential equation, one look at how well the numerical solution approximate the exact theoretical solution as the discretization stepsizes approach zero. In our case however, on top of matching the behaviour of the numerical scheme (45)–(46) to the tfBS PDE (15), we also extend the approach to the moving boundary condition (17)–(18) with its numerical scheme (40).

To assess the numerical consistency of the scheme (45)–(46) we first define \({\hat{u}}_{l}^{n}={u}(x_{l},\tau _{n})\) and \({\hat{b}}_{f}^{n}=b_{f}(\tau _{n})\) as the exact solutions to the tfBS PDE (15) and moving boundary at time \(\tau _{n}\), respectively. Redefine the scheme to (15) as follows:

The scheme (78) is consistent with Eq. (79) below

iff its local truncation error is given by

such that

Suppose \(u(x,\tau )\) is \(\alpha\)-differentiable up to order \(2\alpha\) \((0< \alpha \le 1)\) in time, and differentiable up to order four in space then, applying the the generalized Taylor expansion (5) of \(T_{l}^{n}({\hat{u}},{\hat{b}}_{f}^{n})\) about \((x_{l},\tau _{n})\) yield

where

From (82)–(83) we observe that the local truncation error of the numerical scheme (45)–(46) for the tfBS-PDE (15) is of order \({\mathcal {O}}(k)\) in time and \({\mathcal {O}}(h^2)\) in space.

To complete the consistency analysis of the solution of the free boundary, we rewrite the boundary conditions (17)–(18) and (34) in the following form

and their respective numerical approximations are as follow

Using Taylor expansion it is trivial to show that

Therefore, the local truncation error for the boundary condition is of order two in space. The above deductions read together with the those in (21) and (26) suffice as proof to the following theorem.

Theorem 4.6

Suppose the solution \(u(x,\tau )\) to the tfBS-PDE (15) with initial and boundary conditions (16)–(20) is \(\alpha\)-differentiable up to order \(2\alpha\) in time as well as differentiable up to order four in space, then, the numerical solution obtained via the scheme(42)–(46) is consistent with the tfBS-PDE (15) with initial and boundary conditions (16)–(20). Therefore, from the Lax equivalence theorem, the scheme is second-order accurate in space (\({\mathcal {O}}(h^2)\)) and first-order accurate in time (\({\mathcal {O}}(k)\)).

5 Numerical Experiment

Example 5.1

Consider an American put option with the following market parameters \(\delta =0.02\, \& \, 0.2,\,\, r=0.10,\,\, \sigma =0.2,\,\, \text {and}\,\, K=150.\)

The maximum norm of the errors presented in Tables 1 and 2 above indicates that, the numerical method converges with increase in \(\alpha\) as well as N. These observations validates our theoretical observations that, the method is indeed convergent. It can also be observed from Tables 3 and 4 above, that, in all considered parameterisation, the method converges at least up to first-order in time. Furthermore, the order of convergence of the proposed method in asset direction, which is 2, is verified through the results presented in Tables 5, 6.

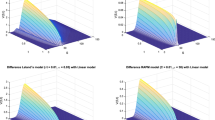

Our results from Fig. 1 through to Fig. 2 suggest that the approach is more effective for larger values of \(\alpha\) (\(\alpha > 0.5\)). This is not surprising because, \(\alpha > 0.5\) represent the case when the underlying stock increments are persistently positively correlated.

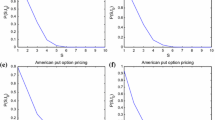

Figure 3 shows the early exercise boundaries for the four considered combinations of \(\alpha\) and \(\delta\). It is evident from the results that, the option holder must keep track of specific points in time and for a specific price of the stock to maximise the benefit of holding these specific stock option. These results indeed confirms the theoretical results, that, that the associated optimal exercise boundaries are positive and monotone under all possible market conditions.

6 Concluding Remarks and Scope for Future Direction

Over the past decade, the financial modelling literature has proposed a multitude of mathematical models to explain dynamics of financial markets. Utilization of fractional calculus based models has proven to be effective in striking the right balance between explaining the desired properties of stock markets’ evolutions as well as preserving mathematical tractability. Since the mathematical complexity involving in the design of tractable analytic solutions to fractional calculus models is still an undeniable challenge, in the current work, we proposed a robust numerical scheme for solving time-fractional Black–Scholes equations on pricing American put option contracts. The proposed scheme is based on the front-fixing algorithm. Under the front-fixing algorithm, the early exercise boundaries are transformed into fixed boundaries, allowing for a simultaneous computation of the optimal exercise boundaries while also quatifying the corresponding fair option premiums to be charged on the contract. Results herein indicate that, the proposed scheme is consistent, stable, convergent upto order \({\mathcal {O}}(h^2,k)\), and also does guarantee positivity and monotonicity of the option premium solution \(u_{l}^{n}\) and that of the moving boundary \(b^{n}\) under all possible market conditions. In addition to theoretical deductions on convergence, stability, positivity and monotonicity properties of the solutions, through a numerical ecperiment, we demonstrated and validated the deduced theoretical deductions. We consider a practical American option problem with the following market parameters: Interest rate( \(r=0.10\)), volatility (\(\sigma = 0.20\)) divident yield (\(\delta = 0.02\, \& \, 0.2\)). Numerous simulations with different combinations of real market parameters were considered, and overall, the results are in a good agreement. From a fractional calculus application point of view, the results indeed confirm the general consense that, the fractional calculus framework is a robust and effective approach for capturing and explaining stylized globalized facts about underlying market dynamics, something that may not be possible under the classical approach. Results herein are well in agreement with those observed in other literature on the subject. Overall, our results suggest that the approach is very robust, effective and efficient for pricing American options, however, the regime under \(\alpha > \frac{1}{2}\) presented more accurate results as compared to when \(\alpha \le \frac{1}{2}\). The results not surprising but rather re-affairm the long held view that, markets have memory. When \(\alpha > \frac{1}{2}\), the underlying fractal process (6) has increments which are persistent and positively correlated, depicting the long memory properties of the process. Which in essence confirm our prior assumption that, markets are driven by fractal processes. In future works, the calibration of similar models to real-time market data and design of high order robust numerical schemes for solving American and exotic options will be explored.

Availability of Data and Material

Data available on request.

References

Nuugulu, S.M.: Fractional Black-Scholes equations and their robust numerical simulations. Available at https://etd.uwc.ac.za/handle/11394/7217 (2020)

Black, F., Scholes, M.: The pricing of options and corporate liabilities. J. Polit. Econ. 81, 637–654 (1973)

Merton, R.C.: On the pricing of corporate debt: the risk structure of interest rates. J. Finance 29, 449–470 (1974)

Cont, R., Tankov, P.: Financial Modelling with Jump Processes. Chapman & Hall, Boca Raton (2004)

Duy-Minh, D., Duy, N., Granville, S.: Numerical schemes for pricing Asian options under state-dependent regime-switching jump-diffusion models. Comput. Math. Appl. 71, 443–458 (2016)

Song-Ping, Z., Alexander, B., Xiaoping, L.: A new exact solution for pricing European options in a two-state regime-switching economy. Comput. Math. Appl. 64, 2744–2755 (2012)

Bollersleva, T., Gibson, M., Zhoud, H.: Dynamic estimation of volatility risk premia and investor risk aversion from option-implied and realized volatilities. J. Economet. 160, 235–245 (2011)

Rana, U.S., Ahmad, A.: Numerical solution of pricing of European option with stochastic volatility. Int. J. Eng. 24, 189–202 (2011)

Deng, G.: Pricing American continuous-installment options under stochastic volatility model. J. Math. Anal. Appl. 424, 802–823 (2015)

Flavio, A., Stefano, H.: Delta hedging in discrete time under stochastic interest rate. J. Comput. Appl. Math. 259, 385–393 (2014)

Rana, U.S., Ahmad, A.: Numerical solution of European call option with dividends and variable volatility. Appl. Math. Comput. 218, 6242–6250 (2012)

Xu, W., Wu, C., Xu, W., Li, H.: A jump-diffusion model for option pricing under fuzzy environments. Insurance Math. Econom. 44, 337–344 (2009)

Chen, W., Xu, X., Zhu, S.: Analytically pricing double barrier options based on a time-fractional Black-Scholes equation. Comput. Math. Appl. 69, 1407–1419 (2015)

Nuugulu, S.M., Gideon, F., Patidar, K.C.: An efficient numerical method for pricing double-barrier options on an underlying stock governed by a fractal stochastic process. Fractal Fract. 7, 389 (2023)

Rezaei, M., Yazdanian, A.R., Ashrafi, A., Mahmoudi, S.M.: Numerical pricing based on fractional Black-Scholes equation with time-dependent parameters under the CEV model: double barrier options. Comput. Math. Appl. 90, 104–111 (2021)

Jumarie, G.: Stock exchange fractional dynamics defined as fractional exponential growth driven by (usual) Gaussian white noise. Application to fractional Black-Scholes equations. Insur. Math. Econ. 42, 271–287 (2008)

Jumarie, G.: Derivation and solutions of some fractional Black-Scholes equations in coarse-grained space and time. Application to Merton’s optimal portfolio. Comput. Math. Appl. 59, 1142–1164 (2010)

Nuugulu, S.M., Shikongo, A., Elago, D., Salom, A.T., Owolabi, K.M.: Fractional SEIR model for modelling the spread of COVID-19 in Namibia. In: Shah, N.H., Mittal, M. (eds.) Mathematical Analysis for Transmission of COVID-19. Springer, Singapore (2021)

Rashid, J., Khan, A., Boulaaras, S., Zubair, S.A.: Dynamical behaviour and chaotic phenomena of HIV infection through fractional calculus. Discrete Dyn. Nat. Soc. 2022, 5937420 (2022)

Rabab, A., Rashid, J., Sultan, A., Yousif, A., Ziad, K.: Mathematical modelling and stability of the dynamics of Mokeypox via fractional calculus. Fractals 30, 2240266 (2022)

Rashid, J., Boulaaras, S., Shah, S.A.A.: Fractional-calculus analysis of human immunodeficiency virus and CD4+ T-cells with control interventions. Commun. Theor. Phys. 74, 105001 (2022)

Alvaro, C., del-Castillo-Neqrete, D.: Fractional diffusion models of option prices in markets with jumps, Birkeck University, School of Economics, Mathematics and Statistics, Working paper in economic & finance (2006)

Garzareli, F., Cristelli, M., Zaccaria, A., Pietronero, L.: Memory effects in stock price dynamics: evidence of technical trading. Sci. Rep. 4, 4487 (2014)

Shah, Z., Bonyah, E., Alzahrani, E., Jan, R., Aedh Alreshidi, N.: Chaotic phenomena and oscillations in dynamical behaviour of financial system via fractional calculus. Complexity 2022(1), 8113760 (2022)

Wei-Gou, Z., Wei-Lin, X., Chun-Xiong, H.: equity warrants pricing model under Fractional Brownian motion and an empirical study. Expert Syst. Appl. 36, 3056–3065 (2009)

Panas, E.: Long memory and chaotic models of prices on the London metal exchange. Resour. Policy 4, 485–490 (2001)

Company, R., Piqueras, M.-A., Jodar, L.: A front-fixing numerical method for a free boundary nonlinear diffusion logistic population model. J. Comput. Appl. Math. 308, 473–481 (2017)

Company, R., Egorova, V.N., Jodar, L.: Constructing positive reliable numerical solution for American call options: a new front-fixing approach. J. Comput. Appl. Math. 291, 422–431 (2016)

Kwok, Y.-K., Wu, L.: A front fixing method for the valuation of American options. J. Financ. Eng. 6, 83–97 (1997)

Kwok, Y.-K.: Mathematical Models of Financial Derivatives. Springer, Berlin (2008)

Nuugulu, S.M., Gideon, F., Patidar, K.C.: A robust numerical solution to a time-fractional Black-Scholes equation. Adv. Differ. Equ. 2021, 123 (2021)

Tangman, D.Y., Gopaul, A., Bhuruth, M.: A fast high-order finite difference algorithm for pricing American options. J. Comput. Appl. Math. 222, 17–29 (2008)

Zhu, S.P., Chen, W.-T.: A predictor-corrector scheme based on the ADI method for pricing American puts with stochastic volatility. Comput. Math. Appl. 62(1), 1–26 (2011)

Nielsen, B.F., Skavhaug, O., Tveito, A.: Penalty and front-fixing methods for the numerical solution of American option problems. J. Comput. Finance 5, 69–97 (2002)

Han, H., Wu, X.: A fast numerical method for the Black-Scholes equation of American options. SIAM J. Numer. Anal. 41, 2081–2095 (2003)

Atangana, A., Secer, A.: A note on fractional order derivatives and table of fractional derivatives of some special functions. Abstr. Appl. Anal. 2, 1–8 (2013)

Landua, H.G.: Heat conduction in a melting solid. Q. Appl. Math. 8, 81 (1950)

Acknowledgements

We thank the unanimous reviewers for their constructive and helpful comments and recommendations, which have significantly improved the quality and clarity of our manuscript.

Funding

The research of S.M. Nuugulu was supported by the University of Namibia (Staff Development Program) and NCRST (Postgraduate research grant). Research for K.C. Patidar was supported by South African National Research Foundation, and F. Gideon was supported by the South African National Research Foundation under NRF-KIC grant of K.C. Patidar.

Author information

Authors and Affiliations

Contributions

S.M.N: Conceptualization, Methodology, Software, Formal analysis, Investigation, Data Curation, Visualization, Writing (Original Draft), Writing (Review and Editing). K.C.P: Conceptualization, Methodology, Validation, Formal analysis, Investigation, Resources, Data Curation, Writing (Original Draft), Writing (Review and Editing), Supervision. F.G: Validation, Formal analysis, Investigation, Resources, Writing (Review and Editing), Visualization, Supervision

Corresponding author

Ethics declarations

Competing interest

No Conflict of interest to declare.

Additional information

Part of this work was derived from the corresponding author’s PhD work which can be found in [1].

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Nuugulu, S.M., Gideon, F. & Patidar, K.C. A Robust Numerical Simulation of a Fractional Black–Scholes Equation for Pricing American Options. J Nonlinear Math Phys 31, 40 (2024). https://doi.org/10.1007/s44198-024-00207-y

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s44198-024-00207-y

Keywords

- Time-fractional Black–Scholes equation

- Free boundary conditions

- American options

- Front-fixing transformations