Abstract

This paper examines the relationship between air pollution levels and regulators’ enforcement levels and observes that air pollution levels in firms’ locations reduce enforcement from regulators. Moreover, regulators are more likely to suffer from type II errors when air pollution levels in firms’ locations are higher, verifying the effect of regulators’ unwillingness to travel due to air pollution. The cross-sectional analysis suggests that enforcement from regulatory authorities in areas with lower air pollution levels than in firms’ locations, positioned at great distances from firms’ locations, and with greater workloads is less strict when air pollution levels in firms’ locations are higher. We further test whether air pollution levels reduce the efficiency of regulators and find that firms with lower earnings quality and weaker corporate governance are less likely to be subjected to enforcement by regulators when air pollution levels in the firms’ locations are higher.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

According to a report issued by the European Topic Centre on Air and Climate Change, air pollution results in 455,000 deaths per year among the 27 EU member states. Furthermore, the number of deaths resulting from air pollution has reached 46,200 in the UK. Air pollution levels have been declining in developed countries but worsening in developing countries. China is thought to be a typical developing country, and air pollution problems in the country are always serious (Sun et al. 2022; Li et al. 2022; Zeng and He 2023). According to survey data from the World Bank, China’s airborne PM2.5 content is only less than that of Mauritania and thus ranks second among all countries. Prior studies have found that air pollution reduces employee productivity (Chang et al. 2014, 2016; Dong et al. 2019), investors’ investment behaviour (Li et al. 2020a, b; Huang et al. 2020), analysts’ forecast accuracy (Li et al. 2020a, b), and stock prices of polluting firms (Liu et al. 2021). However, the relationship between air pollution and regulation efficiency remains under-explored, and this paper investigates the impact of air pollution levels on enforcement from the China Securities Regulatory Commission (CSRC). Moreover, the severity of air pollution varies significantly across different regions in China (Sun et al. 2022; Li et al. 2022), providing a suitable setting for testing this research question.

As transportation facility becomes more and more convenient in modern society, travelling is typically important when regulators enforce securities law. For example, Kedia and Rajgopal (2011) suggest that firms positioned closer to SEC offices are more likely to experience SEC enforcement action and less likely to restate their financial statements. Defond et al. (2018) argue that non-Big 4 audit offices in proximity to SEC offices are more likely to issue going concern reports to distressed clients. The recent COVID-19 pandemic, which necessitated social distancing, also highlights the importance of face-to-face communication between firms and regulators. For example, Luo and Malsch (2020) indicate that computer-mediated communications only partially mitigate the disruption of face-to-face interactions between auditors and clients. Haaland and Olden (2021) find that fewer audits by the Tax Administration during the COVID-19 crisis affected support for an economic relief program. Air pollution has a negative effect on public health (Zivin and Neidell 2012; Neidell 2009; McDonnell et al. 1983) and further reduces people's willingness to engage in outdoor activities, leading to the disruption of face-to-face investigation and decreasing regulators’ enforcement. However, air pollution also has a negative impact on people’s cognition and induces cognitive bias (Fonken et al. 2011; Li et al. 2020a; Huang et al. 2020). Specifically, air pollution can reduce people's willingness to take risks, e.g. Li et al. (2020a) find that air pollution significantly increases investors’ disposition effects. Regulators’ investigation is a complicated mental task that involves making subjective judgments. The cognitive effects of air pollution may make regulators more cautious and rigorous and thus cause them to strictly enforce securities law.

Amiram et al. (2018) suggest that it is not uncommon for SEC and DOJ attorneys to suffer from type II (firm fraud exists, but no charge is made) or type I errors (a charge is made, but the firm has committed no fraud). A decrease in regulators’ visits to areas affected by air pollution could lead to insufficient enforcement, resulting in type II errors, while cognitive bias due to air pollution may trigger excessive enforcement, resulting in type I errors. Therefore, we attempt to raise the following research questions: How does air pollution in firms’ locations influence regulators’ enforcement level, unwillingness to travel or cognitive bias? Are regulators more likely to suffer from type I (a charge is made but no fraud has been committed) or type II errors (fraud exists but no charge is made) when air pollution in firms’ locations is more severe? Does air pollution indeed reduce regulators’ efficiency?

Based on firms’ data between 2013 and 2017, this paper finds that air pollution makes regulators less likely to initiate investigations. Furthermore, the decrease in regulators’ visits to areas affected by air pollution can lead to insufficient enforcement, while cognitive bias due to air pollution may trigger excessive enforcement. The empirical results also show that a regulator is more likely to make type II errors and less likely to suffer from I errors.

This paper also uses a cross-sectional analysis to enhance our study. First, air pollution makes regulators unwilling to investigate firms, especially when regulators expect the air pollution in firms’ locations to be comparatively severe. The results show that regulators are less likely to investigate firms when the pollution in firms’ locations is more severe than where the regulators are located. Second, geographic distance is crucial to enforcement by regulators, e.g., regulators tend to supervise companies (Kedia and Rajgopal 2011) and audit firms (Defond et al. 2018) located in proximity to SEC offices. Proximity to SEC locations may mitigate the likelihood of the results being driven by regulators not wanting to travel, and we find that the relationship between air pollution and regulators’ enforcement is more significant when the geographic distance between enterprises and regulators exceeds 240 km. Third, air pollution increases travelling costs, leading regulators to perform fewer investigations when they engage in more other business activities. We find that the impact of air pollution on regulators’ enforcement is more significant when regulators are busier.

This paper finally examines whether air pollution reduces the efficiency of regulators’ enforcement by considering the impact of corporate governance. When firms’ corporate governance is weak, regulators do not identify firms’ violations, suggesting that enforcement by regulators is inefficient. Instead, when firms’ corporate governance is weak, regulators identify firms’ violations, indicating that enforcement by regulators is efficient. The results show that companies with higher earnings management and poor corporate governance are less likely to be subject to regulators’ enforcement in areas affected by air pollution, suggesting that air pollution reduces the efficiency of regulators’ enforcement.

We introduce instrumental variables to alleviate the omitting variables problem. Natural ecosystems can absorb air pollution and thus decrease air pollution levels. At the same time, it takes hundreds of years for a natural ecosystem to form, so its effect on air pollution is relatively exogenous. After considering instrumental variables, our results remain robust.

The contributions of this paper are as follows. First, prior studies have explained the impact of air pollution on the decision-making behaviour of economic agents from the perspective of cognitive bias (Li et al. 2020a, b; Huang et al. 2020). However, this paper finds that air pollution affects people’s travel costs rather than their cognitive biases and further affects the efficiency of enforcement by regulators. Second, the existing literature has examined the effect of an agency’s enforcement budget on SEC enforcement actions (Kedia and Rajgopal 2011; Defond et al. 2018; Choi et al. 2012; Parsons et al., 2018). However, there is conflicting evidence on whether proximity to SEC regional offices affects enforcement. For example, Amiram et al. (2018) suggest that we know relatively little about the SEC’s objective functions pertaining to financial misconduct enforcement and detection. This paper describes this enforcement from the perspective of air pollution, further supplementing the existing literature. Finally, our empirical results also have some policy implications. For example, to incentivize the regulator’s enforcement level in serious pollution regions, it’s necessary to provide efficient subsidies to compensate the negative effects of air pollution. The results provide the link between air pollution and regulatory efficiency. The local government should balance the high quality development and environment government.

The remainder of this paper proceeds as follows. Section 2 describes institutional background of China's Securities Regulatory Commission. Section 3 presents hypothesis. Section 4 presents research design. Section 5 presents empirical results. Section 6 performs and discusses further analyses.

2 Institutional background of China's Securities Regulatory Commission

The functions of the China Securities Regulatory Commission (CSRC) are similar to those of the SEC in the US. The CSRC is responsible for revising and setting securities’ rules and laws and organizing investigations of firms’ misconduct. The CSRC is headquartered in Beijing, China and manages 38 agencies in various provinces. Several procedures are adopted when the CSRC investigates misconduct in firms. First, the inspection department of the CSRC conducts an informal investigation when indications of misconduct are identified. Second, if a firm is suspected of violating securities laws and regulations, the inspection bureau will issue a formal investigation and send an investigation notice to the firm. Third, a formal investigation can have three outcomes: closure of the investigation, administrative punishment, or transfer to criminal proceedings. The regulators then communicate the conclusion made to the firm, and the firm publishes the notice on a specific website.

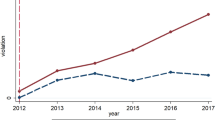

The CSRC’s funds revenues and expenditures are included in national budget management. According to statistics from the annual report of the CSRC, from 2011 to 2017, supervision expenditures and the number of employees increased by 15% and 12.45%, respectively, while the number of companies increased by 46.79% in the same period, suggesting that growth in the number of companies has significantly exceeded growth in regulatory expenditures and human resources. In addition, there were approximately 10 regulators available to investigate cases in 2011, but the number of regulators decreased to 5 in 2017. This evidence indicates that the CSRC faces serious resource constraints.

3 Hypothesis

It is important for regulators to travel to company locations to collect evidence. The disruption of face-to-face investigation decreases enforcement by regulators. For example, the COVID-19 pandemic resulted in social distancing measures and limited travel, reducing the audit efficiency of auditors and regulators (Luo and Malsch 2020; Haaland and Olden 2021). Although a network has been effectively developed, visits to firms by regulators are also indispensable. This is the case because regulators often emphasize the importance of first-hand evidence over second-hand evidence such as photocopies, and the collection of first-hand evidence often requires regulators to travel the firms’ locations. However, due to the incompleteness of contracts, there is a conflict of interest between regulators’ personal interests and incentives. Regulators do not always carry out regulatory activities according to incentive objectives when they obtain more private benefits from enforcement. For example, Correia (2014) suggests that politically connected firms are less likely to be involved in SEC enforcement actions and face fewer penalties if they are prosecuted by the SEC.

Air pollution has a negative impact on human health. Zivin and Neidell (2012) noted that air pollution can cause health problems. Ozone in the air affects respiratory morbidity by stimulating the respiratory tract, which further reduces lung function and worsens respiratory symptoms. Neidell (2009) argued that the concentration of ozone in the air significantly increases the frequency of medical visits for respiratory diseases. As air pollution has serious health effects on humans, it should have important impacts on people's willingness to work. Hanna and Oliva (2015) find that the closure polluting factories causes workers to increase their working hours by 1.3 h per week. Chang et al. (2016) indicated that a decline in worker productivity results from employees being reluctant to work in a highly polluted environment. Thus, air pollution increases personal costs and reduces regulators’ private benefits, and the incentive for regulators to travel to polluted areas will then decline, which reduces regulators’ enforcement.

Hypothesis 1a: As air pollution levels in firm locations increase, regulators’ enforcement of such firms decreases.

Air pollution can affect human cognitive behaviour by influencing the human brain. More specifically, air pollution easily causes infections of the upper and lower respiratory tracts, which can trigger a systemic inflammatory response and release inflammatory mediators. These mediators can reach the human brain and further affect brain function. Fonken et al. (2011) found that PM2.5 mainly reduces people's spatial learning and memory abilities by altering neuroinflammation and hippocampal dendrites. Archsmith et al. (2016) find that professional baseball referees exposed to higher levels of air pollution are more likely to make mistakes. Air pollution makes people more conservative and cautious and less willing to take risks. Li et al. (2020b) find that investors exposed to air pollution are more likely to show a disposal effect, which means that investors are more inclined to prioritize income over losses. Huang et al. (2020) argue that air pollution leaves investors more susceptible to the disposition effect. Li et al. (2020a, b) suggest that air pollution leads analysts to make pessimistic earnings forecasts. Similarly, air pollution may make regulators more cautious and risk averse. Thus, when regulators visit firms based in areas where air pollution is more severe to collect evidence, they will increase their enforcement.

Hypothesis 1b: As air pollution in firms’ locations increases, regulators’ enforcement of those firms increases.

4 Research design

4.1 Sample and data source

Our sample period begins in 2013, as air quality data are not available before this date, and ends in 2017. We also exclude financial companies, ST companies and companies with missing data. We obtain air quality data from a Chinese research database. We identify firms’ locations from their headquarter locations using data from the CSMAR database, and the remaining data are drawn from the CSMAR database.

4.2 Model specification

To verify our hypothesis, we employ the following regression equation:

where i indicates the firm, and t indicates the year. Penai,t is the dependent variable, which equals 1 if the company has been investigated by the CSRC and 0 otherwise. AQ_Indexi,t is a measure of air quality and is a comprehensive index based on five main pollution indicators: ground ozone, particulate matter pollution, carbon monoxide, sulfur dioxide, and nitrogen dioxide. The measure is a city-year measure defined as the average value of the daily air quality index in a firm’s location at t-1 and t. PM2.5 is another important indicator of air quality and refers to the density of particulate matter with a diameter of less than or equal to 2.5 microns in the atmosphere. The measure is a city-year measure defined as the average value of daily air pollution in a firm’s location at t-1 and t. The higher the values of AQ_Index and PM2.5 in a city become, the more severe the air pollution level is. Following Cassell et al. (2013) and Kedia and Rajgopal (2011), we also control for company and city characteristics. Among them, company characteristics considered include the rate of return on assets, the ratio of liabilities to assets, the level of analyst coverage, the scale of assets, the shareholding of institutional investors, the operating cycle of assets, the state-owned company, and political connections. City characteristic considered include land area, the natural rate of population growth, and the average salary of employees. See the table providing variable definitions in the appendix for further details.

4.3 Summary statistics

Table 1 presents the summary statistics derived from our model. The average value of Pena is 0.076, indicating that 7.6% of the companies in the sample have been sanctioned by regulators. The average value of AQ_Index is 4.246, and the minimum and maximum values are 3.732 and 5.037, respectively. The average value of PM2.5 is 3.692, and the minimum and maximum values are 2.953 and 4.622, respectively. The results show that air pollution levels across cities are quite different. The average value of Diff_AQ_Index is − 3.000, and the minimum and maximum values are − 54.477 and 19.561, respectively. The average value of Diff_PM2.5 is − 2.350, and the minimum and maximum values are − 45.030 and 14.931, respectively.

5 Empirical results

5.1 Basic regressions

Air pollution can affect regulators’ enforcement by influencing their unwillingness to travel and cognitive bias. As shown in Table 2, after controlling for industry and year fixed effects, the coefficients on AQ_Index and PM2.5 are negative and significant. After adding the control variables for firm and city characteristics, the coefficients on AQ_Index and PM2.5 are still negative and significant. These results suggest that air pollution has indeed reduced regulators’ enforcement, verifying hypothesis 1a.

The control variables are in line with prior research. In particular, Cassell et al. (2013) suggest that factors such as low profitability, high complexity, and engaging a small audit firm increase SEC scrutiny. Consistent with these results, we find that firms with low assets and low ROA and non-Big 4 audit firms are more likely to be penalized by regulators. Correia (2014) argues that politically connected firms are less likely to be involved in SEC enforcement actions, and we also find that regulators exhibit less enforcement of state-owned firms. Parsons et al. (2018) finds that firms with more leverage are more likely to engage in financial misconduct, and we also find a positive effect of leverage on enforcement. Kedia and Rajgopal (2011) suggest that analysts act as an external supervision mechanism that reduces firms’ misconduct, and we also find that firms with more analyst coverage are less likely to be subjected to enforcement by regulators.

5.2 Unwillingness to travel or cognitive bias?

Air pollution not only decreases regulators’ willingness to collect evidence for firm violations, leading to inadequate enforcement, but it also causes cognitive bias, triggering excessive enforcement. Following Amiram et al. (2018), we test whether regulators are more likely to suffer from type I (firms have not violated the law but regulators issue punishment) or type II errors (firms have violated the law but regulators do not issue punishment) when air pollution in firms’ locations is more severe.

First, we use the model developed by Dechow et al. (2011) to predict the expected probability of misconduct by a firm.

Second, we use the sample for 2005 to 2013 to estimate the coefficient of variables in model (2) and then use this coefficient to calculate the predicted value for 2013 to 2017 for the firms. If the predicted value of the firms is lower than the annual median value for their industry and if the firms are punished by regulators, the regulators suffer from type I errors. Otherwise, if the predicted value of firms is higher than the annual median value for their industry and the firms are not punished by regulators, the regulators suffer from type II errors. The results listed in Table 3 suggest that regulators are more likely to suffer from type II errors, verifying the mechanism of the unwillingness to travel.

5.3 Cross-sectional test

First, regulators are less likely to visit firms when the air pollution levels perceived by regulators are more severe. Generally, regulators’ perceptions of air pollution depend on the difference in air pollution levels present between cities they visit and the cities they live in because people often evaluate the air quality in other cities based on the air quality of the cities in which they live. The greater the difference between air pollution levels in the firm’s city and those in the regulator’s city, the more obvious the impact of air pollution on their enforcement. As shown in columns (1) and (2) of Table 4, the coefficients of Diff_AQ_Index and Diff_PM2.5 are − 0.007 and − 0.009, respectively, both of which are significant at 1%. This result shows that the more severe pollution in the place where a company is located becomes, the weaker enforcement by regulators becomes.

Second, the negative relationship between air pollution and regulators’ enforcement depends on the disruption of visits to firms’ locations. Geographic proximity to firms could increase regulators’ visits to firms and thus mitigate the effect of air pollution on enforcement. As shown in columns (1) and (2) of Table 5, the coefficients on AQ_Index*Distance_Dum and PM2.5* Distance_Dum are positive and significant, suggesting that when the distance between firm locations and regulators is greater than 240 km, the negative relation between air pollution and enforcement significantly decreases.

Third, air pollution increases regulators’ personal costs and decreases their private benefits. Being busy gives regulators a reasonable excuse to satisfy private benefits and intensifies the negative effects of air pollution on enforcement. We use two methods to measure regulator busyness. First, the more companies within the jurisdiction of the CSRC's dispatch office there are, the busier the CSRC office is. Thus, the impact of air pollution on enforcement by regulators becomes more significant with an increase in the number of companies operating in the area charged by the CSRC's dispatch offices. As shown in columns (3) and (4) of Table 5, the coefficients on AQ_Index*N_Firm and PM2.5*N_Firm are negative and significant, which shows that regulator busyness exacerbates the negative effect of air pollution on enforcement. Second, IPOs, SEOs, and M&As require regulators to invest the most human and material resources. Ege et al. (2019) suggest that regulators become busier as the number of IPOs, SEOs, and M&As in the jurisdiction of SEC agencies increases. As shown in columns (3) and (4) of Table 4, the coefficients on AQ_Index* SEC_Busy and PM2.5* SEC_Busy are negative and significant, suggesting that the busier CSRC dispatch offices are, the more significant the negative impact of air pollution on CSRC dispatch offices becomes.

5.4 Is regulation less efficient for firms based in areas affected by air pollution?

Efficient enforcement means that regulators can accurately identify enterprises engaged in misconduct. Enforcement by regulators is less efficient when regulators do not identify firms with poor accounting quality or corporate governance.

First, the role of regulators is to monitor and enhance firms’ compliance with disclosure and accounting requirements (Nam and Thompson 2023). Air pollution decreases regulators’ visits to firms and makes it difficult for regulators to supervise firms with low information transparency. As shown in columns (1) and (2) of Table 6, the coefficients of AQ_Index* DA and PM2.5* DA are negative and significant, indicating that the less transparent information is, the more significant the negative impact of air pollution on enforcement becomes.

Second, Cassell et al. (2013) argue that firms with weaknesses in governance are positively associated with the receipt of a comment letter from the SEC, which suggests that the SEC is more efficient. Air pollution causing an unwillingness to travel makes regulators invest less time and energy in companies based in these regions; as a result, it becomes difficult for regulators to identify “bad apples.” According to Gompers et al. (2003), we construct corporate governance index G_Index to test whether the level of corporate governance affects the relationship between air pollution and enforcement. As shown in columns (3) and (4) of Table 6, the coefficients on AQ_Index* G_Index and PM2.5* G_Index are positive and significant, suggesting that regulators are less likely to identify firms engaged in misconduct when air pollution levels are higher in firm locations.

5.5 Robustness test

5.5.1 Endogeneity problems

As this study may be affected by missing variables, we try to mitigate this problem by applying instrumental variables. The natural ecosystem of a city takes a long time to evolve, and its formation predates the establishment of the CSRC system. At the same time, natural ecosystems can absorb waste gas and reduce air pollution. Thus, the effect of natural ecosystems on air pollution is exogenous. Accordingly, this paper uses the scale of the natural ecosystem as an instrumental variable that equals the ratio of the area of the natural ecosystem to the area of the city to which it belongs. As shown in Table 7, in the first stage of regression, the coefficients on AQ_Index and PM2.5 are negative and significant, suggesting that air pollution decreases as the scale of the natural ecosystem increases. In the second stage of the regression, the coefficients on IV are negative and significant, which shows that the regression results are still robust after excluding the influence of the omitted variables.

5.5.2 Additional robustness testing

First, according to Kedia and Rajgopal (2010), we use the number of sanctions made to measure enforcement by regulators. As shown in columns (1) and (2) of Table 8, the coefficients on AQ_Index and PM2.5 are negative and significant, suggesting that the frequency of enforcement by regulators decreases when air pollution levels in the areas where firms are located are severe.

Second, we use the average value of air pollution at t-1 and t as an explanatory variable in the main regression. To ensure the robustness of the regression results, we use air pollution in the current year to replace the average value. As shown in columns (3) and (4) of Table 8, the coefficients on AQ_Index and PM2.5 are negative and significant, suggesting that the results are still robust.

6 Conclusion and policy implications

As the air pollution becomes more and more serious, it not only has a negative impact on human health but also causes cognitive bias of human beings. These two combined effects are expected to reduce the efficiency of enforcement by regulators. Motivated by this observation in practice, this paper attempts to examine the relationship between air pollution levels and regulators’ enforcement levels. The empirical results show that air pollution in firms’ locations has a negative effect on enforcement by regulators. Moreover, regulators are more likely to suffer from type II errors, verifying the effect of the unwillingness to travel by regulators rather than cognitive bias. The cross-sectional analysis suggests that regulatory authorities located at long geographic distances from firms and with heavier workloads are more likely to be subject to the negative effects of air pollution. This paper also examines whether air pollution indeed reduces the supervision efficiency of regulators. The empirical results show that firms with low earnings quality and weak corporate governance are less likely to be penalized by regulators when air pollution in the firm’s location is more severe.

According to the aforementioned empirical results and key findings, the following policy recommendations are proposed. Firstly, air pollution not only affects market investors’ behaviors and employees’ productivity, but also has a negative impact on enforcement by regulators. Therefore, it is necessary to enhance and strengthen economic incentives for regulators who visit firms located in places with serious air pollution level. For example, higher subsidies can be offered to regulators who visit areas affected by more serious air pollution level, while lower subsidies can be given to regulators who visit areas with relative lower pollution levels. Secondly, there exists link between air pollution level and regulatory level. To promote high quality development of local economy and sustainable development of economic and society, the government should pay more attention to environment management and environment government such as encouraging firms to invest more environmentally friendly technology, more stringent environment policy and providing more energy conservation and emission reduction technology subsidies for firms. With improved and cleaner environmental quality level, the corresponding corporate government environment may be also improved due to more strict regulation. Higher environment quality creates win–win outcomes for environment government and corporate government. Thirdly, the regulatory authorities of listed companies should increase the sampling proportion of firms in air pollution areas, bring more firms in the area into the scope of supervision, force the regulators to carry out more on-the-spot supervision, and then reduce the negative impact of air pollution on the regulators’ behavior.

This paper also has some limitations, which are left for further study. Firstly, this paper does not provide direct evidence that air pollution hindered the regulators’ field investigation because the regulators do not disclose the data of field investigation. It’s a promising direction to investigate this question through questionnaire survey. Secondly, this study finds that air pollution can reduce the supervision of regulators, but ignore the influence of regulators’ characteristics. For example, after regulators experience diseases or major epidemics, whether the impact of air pollution on their supervision is more significant.

Availability of data and materials

The datasets generated during and/or analysed during the current study are available from the corresponding author on reasonable request.

Abbreviations

- CSRC:

-

China Securities Regulatory Commission

References

Amiram, D., Z. Bozanic, J.D. Cox, Q. Dupont, J.M. Karpoff, and R. Sloan. 2018. Financial reporting fraud and other forms of misconduct: A multidisciplinary review of the literature. Review of Accounting Studies 23 (2): 732–783.

Archsmith, J., Heyes, A., and Saberian, S. 2018. Air quality and error quantity: Pollution and performance in a high-skilled, quality-focused occupation. Journal of the Association of Environmental and Resource Economists, 5 (4): 827–863.

Cassell, C.A., L.M. Dreher, and L.A. Myers. 2013. Reviewing the SEC’s review process: 10-K comment letters and the cost of remediation. The Accounting Review 88 (6): 1875–1908.

Chang, T., J.S.G. Zivin, T. Gross, and M.J. Neidell. 2016. The effect of pollution on worker productivity: Evidence from call-center workers in China. American Economic Journal Applied Economics. 11 (1): 151–172.

Chang, T., J.S.G. Zivin, T. Gross, and M.J. Neidell. 2016. Particulate pollution and the productivity of pear packers. American Economic Journal Economic Policy. 8 (3): 141–169.

Choi, J.H., Kim, J.B., Qiu, A.A., and Zang, Y. 2012. Geographic proximity between auditor and client: How does it impact audit quality? Auditing: A Journal of Practice & Theory, 31 (2): 43–72.

Correia, M.M. 2014. Political connections and SEC enforcement. Journal of Accounting & Economics 57 (2–3): 241–262.

Dechow, P.M., G.E. Weili, C.R. Larson, and R.G. Sloan. 2011. Predicting material accounting misstatements. Contemporary Accounting Research 28 (1): 17–82.

Defond, M.L., J.R. Francis, and N.J. Hallman. 2018. Awareness of SEC enforcement and auditor reporting decisions. Contemporary Accounting Research 35 (3): 277–313.

Dong, R., R. Fisman, Y. Wang, and N. Xu. 2019. Air pollution, affect, and forecasting bias: evidence from Chinese financial analysts. Journal of Financial Economics. 139 (3): 971–984.

Ege, M., J.L. Glenn, and J.R. Robinson. 2019. Unexpected SEC resource constraints and comment letter quality. Contemporary Accounting Research 37 (1): 33–67.

Fonken, L.K., X. Xu, Z.M. Weil, G. Chen, Q. Sun, S. Rajagopalan, and R.J. Nelson. 2011. Air pollution impairs cognition, provokes depressive-like behaviors and alters hippocampal cytokine expression and morphology. Molecular Psychiatry 16: 987–995.

Gompers, P., J. Ishii, and A. Metrick. 2003. Corporate governance and equity prices. The Quarterly Journal Economics 118 (1): 107–155.

Haaland, I., and A. Olden 2021. Information about fewer audits reduces support for economic relief programs. Working paper.

Hanna, R., and P. Oliva. 2015. The effect of pollution on labor supply: Evidence from a natural experiment in Mexico city. Journal of Public Economics 122: 68–79.

Huang, J., N. Xu, and H. Yu. 2020. Pollution and performance: Do investors make worse trades on hazy days? Management Science 66 (10): 4455–4476.

Kedia, S., and S. Rajgopal. 2011. Do the SEC’s enforcement preferences affect corporate misconduct? Journal of Accounting and Economics 51 (3): 259–278.

Li, C.K., J.H. Luo, and N.S. Soderstrom. 2020a. Air pollution and analyst information production. Journal of Corporate Finance 60: 1–24.

Li, J.J., M. Massa, H. Zhang, and J. Zhang. 2020b. Air pollution, behavioral bias, and the disposition effect in China. Journal of Financial Economics 142: 641–673.

Li, X., Z. Hu, J. Cao, and X. Xu. 2022. The impact of environmental accountability on air pollution: A public attention perspective. Energy Policy 161: 112733.

Liu, F., Y. Kang, K. Guo, and X. Sun. 2021. The relationship between air pollution, investor attention and stock prices: Evidence from new energy and polluting sectors. Energy Policy 156: 112430.

Luo, Y., and B. Malsch. 2020. Exploring improvisation in audit work through auditors' response to COVID-19. Working paper.

McDonnell, W., H. Donald, H. Milan, et al. 1983. Pulmonary effects of ozone exposure during exercise: Dose-response characteristics. Journal of Applied Physiology 54 (5): 1345–1352.

Nam, J.S., and R.A. Thompson. 2023. Does financial statement comparability facilitate SEC oversight? Contemporary Accounting Research, 40 (2): 1315–1349.

Neidell, M. 2009. Information, avoidance behavior, and health: The effect of ozone on asthma hospitalizations. Journal of Human Resources 44 (2): 450–478.

Parsons, C.A., Sulaeman, J., and Titman S. 2018. The geography of financial misconduct. Journal of Finance, 73 (5): 2087–2137.

Sun, C., X. Yi, T. Ma, W. Cai, and W. Wang. 2022. Evaluating the optimal air pollution reduction rate: Evidence from the transmission mechanism of air pollution effects on public subjective well-being. Energy Policy 161: 112706.

Zeng, Q., and L. He. 2023. Study on the synergistic effect of air pollution prevention and carbon emission reduction in the context of “dual carbon”: Evidence from China’s transport sector. Energy Policy 173: 113370.

Zivin, J.G., and M. Neidell. 2012. The impact of pollution on worker productivity. American Economic Review 102 (7): 3652–3673.

Acknowledgements

The authors are very grateful for the constructive comments of editors and referees.

Funding

No funding was received for conducting this study.

Author information

Authors and Affiliations

Contributions

CL: Conceptualization, methodology, investigation, writing original draft preparation. PZ: Conceptualization, investigation, validation, visualization, writing reviewing and editing. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors have no financial or proprietary interests in any material discussed in this article.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Variable definitions

Dependent variables | |

|---|---|

Pena | An indicator variable set to 1 if a firm faces enforcement by the CSRC in the current year and 0 otherwise |

Type_I_error | An indicator variable set to 1 if the expected possibility of a firm facing enforcement by regulators is lower than the annual average value in the industry and if the firm faces enforcement by regulators in the current year and 0 otherwise |

Type_II_error | An indicator variable set to 1 if the expected possibility of a firm facing enforcement by regulators is higher than the annual average value in the industry and if the firm does not face enforcement by regulators in the current year and 0 otherwise |

Independent variables | |

|---|---|

AQ_Index | A city-year measure defined as the average value of the daily air quality index in the firm’s location at t-1 and t |

PM2.5 | A city-year measure defined as the average value of the daily density of PM2.5 in the firm’s location at t-1 and t |

Diff_AQ_Index | A city-year measure defined as value equalling the average value of daily AQ in the firm’s location at t-1 and t minus the average value of daily AQ in the local CSRC’s location at t-1 and t |

Diff_PM2.5 | A city-year measure defined as value equalling the average value of daily PM2.5 in the firm’s location at t-1 and t minus the average value of daily PM2.5 in the local CSRC’s location at t-1 and t |

Distance_Dum | An indicator variable set to 1 if the distance between a firm and CSRC’s branch is above 240 km and 0 otherwise |

N_Frim | A firm-year measure defined as the average value of the lagged number of companies under the jurisdiction of the local CSRC office at t-1 and t |

Busy | A firm-year measure defined as the average value of the lagged sum of the number of IPOs, M&A, and SEOs at t-1 and t |

DA | A firm-year measure defined as abnormal accruals calculated by the revised Jones model |

G_Index | The score equals 1 if the company meets one of 36 corporate governance indicators and 0 otherwise after summing the scores. It is worth noting that firms in China do not disclose the value of non-audit fees. In addition, if the variable included indicators of firm’s violations, it would be likely to be mechanically related to penalties from the Securities Regulatory Commission. Thus, this indicator is not included |

Control variables | |

|---|---|

Inst | A firm-year measure defined as a firms’ number of shareholdings of institutional investors by total shareholdings |

Lev | A firm-year measure defined as a firm’s debt scaled by total assets |

N_Analysts | A firm-year measure defined as log (1 + the number of analysts covering the firm in the current year) |

Oper_Cycle | A firm-year measure defined as the lagged sum of the turnover rate of receivables and inventory |

Political_Connection | A firm-year indicator variable set to 1 for firms for which an executive has prior work experience with the government and 0 otherwise |

ROA | A firm-year measure defined as earnings before extraordinary items scaled by total assets |

Size | A firm-year measure defined as logged total assets |

SOE | A firm-year indicator variable set to 1 if a firm is a state-owned enterprise and 0 otherwise |

Land_Area | A city-year measure defined as log (1 + the land area in the city) |

Personal_Salart_Change | A city-year measure defined as the growth of per capita wages in a city |

Population_change | A city-year measure defined as natural population growth in a city |

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Li, C., Zhou, P. Do air pollution levels influence enforcement by regulators? Evidence from China. MSE 2, 14 (2023). https://doi.org/10.1007/s44176-023-00023-6

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1007/s44176-023-00023-6