Abstract

This study aims to analyze the research work and present an SLR (Systematic Literature Review) on the initiatives taken by players in the banking sector, especially toward the technological innovations done in the field of AI (Artificial Intelligence) and ML (Machine Learning) that have contributed to the growth of the sector as well towards the ease of doing and building trust amongst consumers in the digitalized era of Banking. Growing security risks in cyberspace accompany the enormous and complex digital versions of virtual services. In total, 734 articles were reviewed to explore how Artificial Intelligence and Machine Learning have been used in various banking facets and how they have evolved to cater to different banking sector requirements. The findings reveal the areas where these modern-age technologies have been adopted and where the same can be used efficiently. Lastly, this study elaborates and evaluates the applications of these technologies on the parameters of scalability going further, keeping in mind the unprecedented dynamic times, and serving the very purpose of banks and how the banks are dealing with all the opportunities and challenges these new technologies bring in. This SLR also provides an overview of the research that can be taken up in future by the researchers in this domain.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The banking sector has been changing rapidly, and the pandemic COVID-19 made the pace of change even more unprecedented. Digitalization in the banking sector is one of the noticeable changes which took off at such an incredible pace that now it is easier to think about banks with digital solutions [1]. Now we are talking about Neobanks or Mobile-only banks, which will be far from what we had a few years back as brick-and-mortar banks. Though, the digitalization in banking and every other field is making the lives of consumers easier in a way; the service providers are required to deal with the technicalities involved. They need to see that their businesses grow and, at the same time, must take care of the challenges arising from the rampant usage of technology. The adoption of technology is a compulsion for banks to meet the requirements of their customers, keeping in mind the ease of doing, the quality of services being provided, and the techno-functional innovation done in the market to take care of the threats posed by the new entrants and the existing competitors. Thus, adopting new-age technology is always at the top of the priority list of all banks these days. Now we have been talking about Banking 4.0, which needs to be in sync with Industry 4.0/5.0 [2], and accordingly, the technology has to be adopted both to match the growth and the issues which will come up with the growth desired [3, 4].

Artificial Intelligence refers to the ability of machines to perform tasks that typically require human intelligence, such as learning, problem-solving, decision-making, and perception. AI can be achieved through various techniques, including rule-based systems, expert systems, machine learning, and deep learning. Rule-based and expert systems are early approaches to AI that rely on manually programmed rules and expert knowledge to make decisions or solve problems. Machine learning, on the other hand, uses statistical algorithms to automatically learn patterns from data and make predictions or decisions based on those patterns. Deep learning is a subset of machine learning that uses artificial neural networks with multiple layers to extract high-level features from data.

Artificial intelligence and machine learning are being used extensively by the banking sector. The domains where high-end techniques are required are the performance of the bank branches, customer segmentation, credit evaluation, and E-banking. With the growing use of Blockchain technologies in banking, the use of AI & ML is bound to increase. Also, mobile banking has given a thrust to the usage of AI to reach out to more customers [5]. The study suggests the application of these new technologies is to enhance consumers' experience, the convenience of banking, strengthening risk management, back-end operations to be made more intelligent, data analytics, new revenue models using chatbots, RPA (Robotic Process Automation), and to ensure more secured payment operations. This is when banks are to show what they are offering, with the AI and ML being the technologies behind to beat the competition [6, 7].

In a world that is dematerializing increasingly and in which customer choices are driven by the relationship with the service provider more than the types and price of products, AI is disrupting the ways the banks used to work in the areas such as Algo trading, portfolio management, cyber security, sentiment analysis, fraud detection, and loan underwriting. The adaption of AI has also reduced the cost of banking operations, be it front-end or back-end operations [8,9,10]

As per a report by [11], estimates suggest that the banking industry will save more than a trillion dollars by 2030 using AI, including $31 billion by AI-based risk management. Institutions in the Financial Industry have already started adapting advanced techniques that use machine learning in their channels in various ways like customer segmentation, virtual assistants and chatbots, fraud and churn predictions [12], risk modeling and underwriting, portfolio management, data analysis, and others [11].

2 Background and motivation for the study

Although the Systematic Literature Reviews (SLRs) in the broader area of finance have added to the body of knowledge but are limited to have mainly concentrated on summing up or defining trends and applications of AI & ML, and there is no specific compilation on the search done in the Banking per se [13]. Researchers would gain an advantage from a robust discussion on the implications of its implementation and specific obstacles and opportunities for improvement in developing the subject, given the limited extent of a compilation of earlier research on AI & ML in banking especially. Review-based studies can help by incorporating existing information and outlining key areas that require significant academic effort. By conducting an SLR on the application of AI & ML in Banking, we respond to this need. SLRs are a valuable tool for summarizing knowledge in a particular area of study, identifying knowledge gaps, and opening up new research directions. By expanding on earlier SLRs [14, 15] in two different ways, this work adds to the body of knowledge on AI & ML in Banking. First, it offers a thematically organized, cutting-edge classification of earlier studies regarding their potential applications, constraints, and suggestions. Second, based on the results of the SLR, we suggest a methodology for synthesizing data that identifies possible gaps that should receive scholarly attention to advance the state of knowledge. Research objectives that are addressed in order to make this contribution are:

Research objectives that are addressed in order to make this contribution are:

-

1.

To present the most relevant areas of academic research on the uses of AI/ML in the banking industry.

-

2.

To study and present the main areas of banking where AI/ML has been used.

-

3.

The concerns of the people working in the Banking domain concerning AI/ML adoption.

-

4.

The potential applications of AI/ML in banking in the future.

3 Methodology

The current study conducts SLR based on the guidelines outlined in the previous exemplary research works [14]. The first methodology is bibliometric analysis which covers the analysis of articles to understand the trend of research in the area and the research with higher citations and their publication partners.

We followed the process into the following phases:

-

I)

Detailed planning on what needs to be reviewed,

-

II)

Execute the review, and

-

III)

Compile and present the outcome of the review.

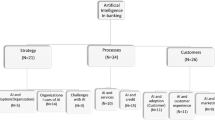

Each stage is divided into several steps and the process is presented in Fig. 1 from which the tasks from each stage can be easily comprehended.

We searched for the following terms in Scopus, Web of Science (WoS), and Google Scholar as the research papers indexed in these represent the articles of high quality and the ease of accessibility to the research scholars. Since the final selection is based on the citations, which represent the quality of the work of individual, the authors decided to choose the database based on its broader coverage as well.

A data of 997 articles were available after searching for Artificial Intelligence + Banking/ Banks, Machine Learning + Banking/ Banks, AI + Banking/ Banks, ML + Banking/ Banks, AIML + Banking/ Banks and Artificial Intelligence and Machine Learning + Banking/ Banks, NLP + Banking/ Banks, Big Data + Banking/ Banks searches.

In the first round of shortlisting of the research articles, using the automation software and the threshold of minimum 2 papers, we got relevant research authored by 18 authors only, who had at least 2 papers published (Fig. 2). This was done to keep a check on the quality of the papers being shortlisted for our SLR. Since the number of articles which got through this criterion were quite less in order to conduct the SLR, we went ahead to amend the threshold which was not based on the number of articles written but on the basis of citations the research work has been able to receive.

After carefully scrutinizing the details, 99 titles missed the years of publishing, 143 missed the source of publication, and 21 were in other languages than English. Thus, a total of 734 articles were found to be of relevance after the first round of filtration process. The shortlisting of the articles was done by choosing the articles and/or authors with higher citations and accordingly the sources of publication where the citations were relatively high (see Fig. 3).

In the second round and to answer one of our research questions, we looked at (a) the number of articles published per year Figs. 4, 5; (b) citations received by reviewed articles—Table 1; and (c) scholarly contributions by the source/Journal Fig. 6 and Table 2.

We did an analysis of the citation of the journal article and set the threshold to more than 25 citations as any number more than that is considered to be a good measure for the quality of a research article. This was done based on research as per which, a total of 49,417 business research papers, published between 1998 and 2023, received 769,676 citations. Interestingly, roughly one-third of the papers (32.88%) remained uncited during this time period.

Among the remaining 67.12% cited papers, those with one citation (10.60%) were the most common. Furthermore, 39.75% of the cited papers were cited between 1 and 10 times, while 27.37% of the cited papers were cited more than 10 times. Among the latter group, 2.78% (i.e., 1,372 papers) received more than 100 citations each. Overall, these results suggest that the majority of papers (67.12%) had an impact on the global business community through being cited and used. The average number of citations per paper for the entire study period was 15.58 [16].

In the second step, the Meta analysis is incorporated. It takes care of the variables used in the research as the explanatory variables and to see how these complement the research with the effect size. There are two approaches of meta-analysis viz. Fixed effect and Random effect model. Under both, the effect size reported in the study is calculated. This study used a random effect model. In the fixed effect model, the size is calculated as:

Vy is the variance within study and N is the size of the sample variables of the study. And the weight gets calculated as follows:

While in the random effect model, no single effect size of a sample of studies exists but that keeps on changing research work to work. It is the total of all the variables from within the research and between the research.

where t2 the between the studies variance and is calculated as:

And

wi is the weight of a study:

df is the degree of freedom and k is the number of research in a certain field.

Average effect size has the calculation as below:

4 Content analysis

We, based on our study on banking operations and drawing the inputs from select literature [17,18,19], list down the areas where the banks have applied or may apply AI and ML in the future [20, 21], and these are:

-

1.

Customer-oriented services

-

o

Customer acquisition and customer retention—CRM

-

o

Customer churning

-

o

Security of transactions

-

o

Selling third party products

-

o

Retail banking and investments [22]

-

o

-

2.

Credit scoring

-

3.

Digital financial inclusion

-

4.

Micro finance

-

5.

Prevention of frauds and cybercrimes

-

6.

Bank risk assessment and crises prediction (including prediction of rates declared by apex banks, their requirements etc.)

-

7.

Managing NPAs

-

8.

Bank operations and treasury

-

o

Services between banks (inter-bank transactions)

-

o

Clearinghouse

-

o

Front end and back-end operations like solving the queue problem in the physical banks.

-

o

-

9.

Banks’ role as financial consultant

Also, to answer the question of "What can AI and ML do in Banking?", the authors present a list of the explanations that justify the usage of these technologies in the banking sector, which are:

-

The banking sector is facing huge challenges.

-

Need for process-driven functioning without compromising on efficiency.

-

Promoting self-service

-

Tailor-made solutions for customers

-

Employees' productivity

-

Fraud to be minimized.

-

Managing humungous data while keeping the sanctity and speed of the process

-

Effective and timely decision-making [3].

In the financial years from 2007 to 2018, the CAGR of 10.94 percent was recorded in the total advances and 11.66 percent in total deposits in the banking industry. India's share of the world's retail credit market is huge, and in the emerging countries, it is the fourth largest. India's Immediate Payment Service (IMPS) is the only system recognized as a level 5 system as per the Faster Payments Innovation Index. AI has been integrated with the customer-centric functions of Indian businesses, including advances, cross-selling, and processes [23].

4.1 Customer orientated services

The contribution of AI in serving customers has reached a level where they can predict what customers may need and pitch the products accordingly. In their research, the scholars have developed an approach using time series data to project the customers' preference for personal loans. The system used classification with deep neural networks and random forest techniques. A system for identifying customers interested in credit products, based on classification with random forests and deep neural networks, is proposed. Their study shows the results proving the extraction of substantial patterns from the historical behavior of customers being used for the likelihood of purchasing a product [24]. In similar research, the authors commented that "Intelligent recommender systems" can be used to recommend a product to a customer based on the data used from the banking database. The proposed application of "CEBRA (CasE-Based Reasoning Application)." The technique uses the data points from the profile of the users, ratings, and contextual information of users. It can support the team in promoting the banks' products with improved end-user satisfaction [25].

Continuing with the remarkable usage of AI, it is being used as part of the front-end operations like identification and authentication, strengthening customer relationships, using voice assistants and chatbots [26], and recommending customers based on individual requirements per se. It is also being used in the functioning of middle office-related tasks of banks such as "Know Your Customer" (KYC) compliance, detection of frauds, and prevention Anti Money Laundering (AML) (Eleni [27]. KYC data can be used as a powerful tool for risk assessment for banks by identifying customers likely to be defaulters. The tool described and developed in one research work attempts to assess the risk more accurately using unique KYC data and ML techniques. It is best at the bank branch level to determine the degree of risk as the managers and regulators can measure it to see any suspicious behavior at that level, including suspicious transactions [28].

As per [29], Head of Digital and Mobile Strategy, Tinkoff Bank, Russia, their business model works towards providing the best services to all its customers irrespective of the ticket size, and they offer the same quality to all its customers by using AI in their customer care operations with the help of Voice and Text recognition tools provided by AI. The technology helps the market integrate irrespective of its location on the globe. This can be one of the reasons that banks are under tremendous pressure from global competition as the customers have also started expecting world-class services and products. Banks need to predict customers' choices. Technology helps deliver services online or over the phone. The new buzzword of this technology world is E-brain, a go-to technology in which the machine mimics the human brain [30].

A very peculiar feature of the services offered in financial services depends on whether it is focused on interacting with customers or processing transactions. While taking care of interaction with the customer, Artificial Intelligence can provide interactive, digital, and real-time tools to facilitate functions like providing advice sales and, at the same time, keeping the probability of fraud the lowest [31].

In dealing with customers, banks must work a lot on Customer Relationship Management (CRM), a pervasive strategy for building and continuously strengthening the relationship with an organization's loyal and long-lasting customers. Since customer acquisitions are always dearer, the objective of CRM is customer retention. Over the last few years, many algorithms based on Machine Learning for the early prediction of churning use various approaches like Decision Trees Learning, Logistic Regression, Naïve Bayes Artificial Neural Networks, Sequential Pattern Mining, Support Vector Machines, Market Basket Analysis, Regression Analysis, Linear Discriminant Analysis, and Rough Set Approach. There are studies motivated by the purpose of developing and evaluating the tools of AI and ML which can provide the best solution to the problem of churning. The CRM methodology is a blend of marketing strategy, processes, functions of the organization, and networking in order to hold the customers. The Banks can manage the customer book more efficiently if they can focus on four elements which are caring for existing customers, acquisition of new customers, long term collaboration with the current customers, and offering new services to them [32].

One of the exciting usages of AI (Artificial Intelligence) is to predict customers' preferences and, based on that, offer products and services to make them happy. AI technology is also being extensively used in voice-assisted customer support, detecting patterns in anti-money laundering, prevention, and detection of frauds well in time. As per the current study, the authors conclude that the two factors contributing to the new AI trends, especially in the banking sector, are societal and personal factors [33].

At present, the way Data Mining technology has also become mature; it is being avidly used in the banking domain to make the task of determining target customers automated and accordingly to promote the products of banks. In a very recent study done by the researchers, they used Bank Marketing Data from the "UCI Machine Learning Repository Database" along with the C5.0 algorithm to categorize the customers and accordingly proposed suggestions for marketing by the bank [34].

[35] also worked on enhancing the efficiency of models to predict using model-agnostic techniques that are explainable artificial intelligence techniques and can work with any of the models of Machine Learning once the model is trained. Though as per the research, it was found that the explainability behind customers moving away to other service providers was limited to the other models. To overcome that, they used SHAP (Shapley Additive exPlanations) method—a model-agnostic method and got better results.

An investigating research work [36] tries to answer the question of how the overall consumers' experience was affected by artificial intelligence technology adopted by the banking industry. The study covers how a consumer's adoption of digitalization affects the development of digital banking and what are going to be the different expectations of the customers while further investigating the scope of Neobanks. This investigation also helps banks see what better services the customers may demand on their app and make their virtual presence at par with the physical bank place by introducing replaceable options like chatbots and voice assistants to give an equivalent experience like a manager at a branch. It may also help Neobanks find the factors that make a customer choose online-only bank accounts and transmit more information to its existing customers, inducing them to opt for an account with a Neobank.

The study [37] shows how the advances in technology are helping the financial service providers. Machine Learning algorithms were used to investigate variables that were causal to building the trust of consumers in Ukrainian Banks. This research can also help the banks use predictive analytics techniques to forecast the trust the customers have in the bank by calculating the confidence index using logistic regression, Random Forrest, Decision Tree, and XGBoost Models.

Of numerous usages of ML, one scholarly work by [38] proposes a model for efficient predictive segmentation of credit card customers considering their value to the bank. As per this, the standard methods like NNs, Logistic Regressions, Decision Trees, and random forest algorithms lead to an inferior classification, but Support Vector Machines with the DT method can lay down classifying explicit rules, and the clients from various segments can be dealt with suitable promotional strategies.

The AI may present a personalized mobile display or provide a unique menu to an individual customer. Some firms are using their data and Artificial intelligence to introduce the features required by an individual customer to make the app more appealing [39]. The decisions are taken by following the behavior of customers. If the customer of an app is logged in into a banking app a few times a day but stays on the first page, it may mean that the customer is looking at anything available on the first page, and AI can customize his login options in such a way that anytime he logs in, the preferred service is visible there by default. AI may help banks with offering a specific product based on his app usage, knowing about the login frequency, and identifying the chances of his slipping out or suggesting a new feature introduced based on his past login details are a few more innovative ideas [40].

4.2 Credit scoring and risk management

Credit scoring is a common technique for evaluating credit risk analytically. Artificial intelligence helps models used for credit scores perform better. There are hybrid models proposed for credit scoring using ensemble learning for decisions related to credit granting that use ten classifier agents for their ensemble model. In this, SVM, NN, and DTs were used for the classification accuracy, aimed to develop a model compared to the existing ones and to see if the new model can reduce the loss due to the wrong credit scoring by even a minimal number, it is of great importance [41].

Artificial intelligence and Machine learning have reached a level where their performance can be compared to humans. It has worked in areas like speech recognition, image classification, and machine translations, but in financial sectors, credit risk models involving human experts have always been preferred. In their work, the researchers have developed a model that will estimate the borrower's PD (Probability of Default), resulting in saving many losses by identifying appropriate people to whom the loans can be granted. In their study, the models such as the XGBoost and deep neural networks could give promising results comparable to other machine learning approaches [42]. Estimation of Probability of default using machine learning based on historical data was already existing. In the recent work, the authors tried to investigate the use of ML for a finer estimation named Spot Factoring. The model works on estimating the likelihood of an invoice being paid within the time allowed. Considering the overdue days, the regression of overdue days, making the machine learning rank the events based on the risk-related ranking is what their model does. They finally show that a regression model can result in higher profits and better spread the risk [43].

The methods of deciding whom to issue a credit card have primarily depended on the models evaluating the applicant's credit score. Machine learning has also been used in preparing the models. It has been growing with the efforts of researchers continuously working on improving models that apply a deep multiple kernel classifier that can work with profound structure and credit risk assessment in the presence of complex data. The results show that this model works better than the conventional and ensemble models. As the bad debts arising from the credit card business may hurt a bank a lot, the predictive intelligence doing the work of predicting the behavior of humans to know the risk of default can work wonders [44]. Some models can predict the early delinquency probabilities of a mortgage, including logit models' machine learning methods, and some variants are of the ensemble models. However, predictive accuracy is still a more significant challenge despite having training data [45].

Likewise, the financial services in Sweden have shown increased use of AI and ML over the last 5 years, as per the observation by authorities, consultants, and government authorities ancillary to the finance sector. The same goes for the trends reported by the World Bank, which call for the increased use of these new-age technologies complementary to traditional credit score models. Corporate customers use AI and ML less than individual loan applicants [46].

The researchers develop models on an online credit scoring non-parametric system, which continuously works on automatic reselection of all the features for a credit evaluation and keeps weighing the variables out based on their effect. The method used by the research is Kruskal–Wallis non-parametric statistical analysis which is based on ANN, Random Forests, SVM, and LR with Ridge Penalty [47,48,49].

4.3 Microfinance

Recently, due to the high costs of transactions compared to loan sizes, online crowdlending has started gaining traction. Mobile payments have also grown because of the ease of doing. Credit scoring in Microfinance solves the problems caused by information asymmetry, where the smaller borrowers may be ignorant about many factors while deciding to take the loan. The credit scoring models solve the problems arising out of information asymmetry. Credit scoring is used by institutions in the Microfinancing sector to expand financial inclusion while improving their front-end teams' productivity. However, granting loans to new customers will require the new credit scoring platforms to assess the risks adequately, and some of these are using the data points collected from online and social networking platforms to assess the creditworthiness of the borrowers. It still requires an assessment of risks for new borrowers. A spate of new credit scoring platforms is now collecting online data points from social networks to determine if the potential borrower is safe or risky [50]. Also, big data techniques are helpful when decisions are to be taken about lending money, and the credit banking risk in the case of equity loans needs to be measured. They can segregate the financial dataset into different types of risk groups [51].

4.4 Digital financial inclusion

We found work investigating AI's impact on Digital Financial Inclusion in the literature. People at the bottom of the pyramid are targeted and brought to the financially active category. There are companies in FinTech that are working on this inclusion. As per the study, it is found that AI has a powerful influence on the areas related to risk mitigation, solving the problem of information asymmetry, cybersecurity, and voice assistance using chatbots. The use of AI tools has been recommended by authors to increase the pace of digital financial inclusion [52, 53].

The issues involved in proper verification of the creditworthiness of a prospective client in the process of selling a credit instrument have always been a big problem for the financial sector players. As a solution, the researchers planned to check the economic and social background using a model based on a parallel social spider algorithm. For the credit assessment, nine internal and external measures were compared across commonly used algorithms, and the authors felt that due to insufficient data, the model could not work to the level expected. However, they want to continue exploring the work with large data sets [54]. For FinTech companies also, it is essential to be sure of the usage of AI and its tools for credit scoring purposes [55].

Banks have been following KYC regulations quite stringently recently, and the regulators are also making banks comply with the norms. It is desirable that with the growing risks of losses for banks, if the KYC data can be used, a machine learning algorithm can detect risk and can finalize various factors contributing to the risk. The authors, in their research, developed a model which gives an accuracy of 70%. They also concluded that at the branch level only, the degree of risk can be determined [28].

4.5 Prevention of frauds and cybercrimes

Fraud in the domain of the credit card business can be categorized, such as whether the fraud happens at the application level or when the electronic or manual cards get imprinted and so on. A fraudulent transaction on a credit card can be identified using deep learning techniques. Besides the ML algorithms, NN (Neural Network), including the Support vector machine and k-Nearest Neighbor techniques, are used for this purpose. There are ANN-based models developed and are near to foolproof for credit card fraud detection [56]. The same risk is involved in issuing loans to the customer. Different hybrid machine-learning models used for appropriate credit ratings have been proven to work well in such cases. Four types of hybrid models are proposed by the authors in their work, which may be used with self-organizing maps (SOM) and support vector machines (SVM) for various clustering and classification purposes [57, 58].

A study recommends using AI by financial institutions in fraud detection because it is highly accurate and can verify the reports' reliability [59]. The traditional tools were combined with knowledge graph models. Some new features were used, which may influence the performance of classifier models, to explore the information on FSFD (financial statement fraud detection) [60].

Previous studies have proposed an analysis procedure based on the best machine learning model. Organizations can use them to identify fraudulent actions that may pose a threat using their cloud-based analytical platform (SAS) Viya [61]. In one of the works, one algorithm for detecting fraudulent transactions was developed, which can detect a money transfer instant and allows timely help the organization detects potential fraud [62].

4.6 Bank risk assessment and crises prediction

The application of AI is also being witnessed in bank risk management. The global financial crisis has changed the working of banks with more stringent capital adequacy regulations, and now technology is driving the way banks work. AI has the potential to bring revolution in banking, and the techniques related to machine learning, speech recognition, NLP, and Deep Learning, can mimic how human beings think and may analyze big data in significantly less time. In their study, the authors look at the risks related to operations, credit, liquidity, and reputation and conclude that AI can potentially mitigate them [63]. AI, along with the Blockchain, can change the ways banks manage their risk fronts. Processing of Big Data, fraud prevention, AML processes, Risk modeling and forecasting, regulatory compliance, and cybersecurity; however, they must have a team of people along with infrastructure and the adaption of new-age technology to the core of their policies and strategies [64,65,66].

The institutions with similar performance were grouped into categories using the clustering technique. After training the ANN, the training and testing accuracy was relatively high, motivating them to continue using the same model to predict that the institutions would not perform well in the future. The outcome of another experiment using ML methods' decision trees with some modifications to predict those credit organizations which are potentially unstable is encouraging while Supervised Machine Learning, including Bagging, Boosting, and Neural Networks techniques are also used to model the credit risk for financial institutions [67, 68].

Scholars in this field propose a toolkit based on ML that may detect rare events and events that can result in crises. A set of macroeconomic factors like the credit-to-GDP gap, stock prices, interest rates—both long-term and short-term, and inflation rates, along with the leads and lags, methods for filtering the data, and the time series analysis were collected, and out of the few models developed, the best model can help find the probability of banking crisis up to 6 quarters before the real-time and related to various economies [69].

Similarly, the econometricians construct an Early Warning System (EWS) as the primary predictive tool to predict and prevent the probable banking crisis. Based on the changes in the economic indicators and their impact, the information is extracted to predict the crisis. As per the author in their research, the experts voting EWS framework can infer crisis data more efficiently in various contexts [70]. Still, some finetuning to EWS models based on machine learning is required. These are of substantial value in predicting the banking domain's systematic crisis. The benchmark logit models developed in the previous research used the information efficiently and proved that it could have predicted the 2008 crisis for many countries [71, 72].

As the financial crises have become a recurring phenomenon and can be said to be banking crises, in one more of its kind of studies, a statistical model can detect the crises based on PUNN (Product Unit Neural Networks) and RBF (Radial Basis Function) networks. The techniques proposed are better than other existing statistical and AI methods as the model has been trained on the data of 18 years relevant to the problem [73]. In more research, the scholars applied their developed AI and ML models to predict bank failure. They could identify the banks with high risk by measuring the variables indicating financial distress [74,75,76].

4.7 Managing NPAs (non-performing assets)

Since the NPAs have become a significant problem for the banking industry, the banks need to have a robust system in place to determine the creditworthiness of the clients not only at the time of lending but also by looking into the forecasted financials of the clients. If the AIML can help banks determine the financial distress of the companies, it is possible that the losses incurred by banks can reduce substantially [77]. While AI is pervasive in banking, its application in dealing with NPAs has yet to be researched. In this study, the authors compared the machine learning algorithms and regression techniques for predicting the recovery percentage of non-performing loans. Cubist, random forest, and boosted trees techniques were used to analyze the datasets. To improve the performance of algorithms, the variables available from the loan contracts, along with some derived from the time series, were used and have contributed to better projections [78].

4.7.1 Operations and treasury

Operational problems like queuing problems are also being solved using AIML techniques now. Recently, ANN (Artificial Neural Networks) was used to solve queuing problems in a bank [79]. Workforce planning is also one area where the researchers could see the potential of AI and ML being used. In a study, the researchers developed a hybrid multistage approach for planning the workforce requirement in a bank's operation center using supervised and unsupervised algorithms [80].

AI and ML can also be used in the treasury of banks. For better prediction of cash, machine learning tools can be trained and used to predict the requirements in unforeseen situations. We may see the usage of these new technologies in cash forecasting, balance checking, and auto investment solutions to save time and increase efficiency [81].

4.8 Banks’ role as financial consultants

Artificial Intelligence is gaining acceptance in all fields, especially in the financial sector. In Banking, Stock Trading, and Insurance, the adoption of AI is increasing for its safety and security-providing features. As we have seen, AI can provide tools for controlling fraud within the boundaries of compliances and regulatory frameworks laid down by various authorities. It is expected that as we advance in Financial services and products, the risks and challenges of adopting the new technology will also increase, which needs to be taken care of considering both the service providers' intents and the acceptance of the same by the consumers as they belong to diverse topography and education levels [82].

In India, the State Bank of India (SBI) has attained integration of AI, ML, and DA in many of its projects like Shikhar—the model for issuing credit cards, instant digital loans on Yono, footfall reduction at branches, "Krishi" app-based lending, and ATM winback. Similarly, PNB—Punjab National Bank uses technology-based models to predict credit card default, Loan slippages in the MUDRA category, analyze the "National Automated Clearing House (NACH)" mandate, and sell third-party products. ICICI bank focuses on AI & ML-based "Zero Credit Touch" (ZCT) techniques in which the customers are given credit facilities without additional information required from the customers. HDFC has applied these technologies in aligning their business, data workflow from end to end, competency, and skill mapping. Citi Bank uses LR-based models of AI and ML to distinguish customers with a high propensity for their niche products. The Machine Learning models are also being used extensively for an optimized level of cash at the ATM level to minimize idle cash. AI-embedded TransUnion CIBIL is used for the credit scores, and the data is taken from social media, the history of the customer, SMSs, and address stability. Banks in India increasingly use AI and ML to enhance customer engagement, suitable products, and services, simplify banking operations, and prevent payment fraud. The AI-enabled chatbots available in vernacular language work on a 24 × 7 basis. This kind of service motivates customers to reach out to the banks for their little needs and helps with financial inclusion. AI being used to prevent fraud also enhances confidence and trust among people not yet part of the banking system. India has such platforms like "Unified Payments Interface (UPI)" and "Bharat Interface for Money (BHIM)," which uses AI extensively to promote payments in the digital world as well as advise the customer to make better financial decision, are also contributing towards financial inclusion [83].

Information extraction from various visual and textual documents has always been a challenge for all financial institutions. A study uses visual and textual information for a deep learning-based model to obtain helpful information. Their experiment showed an improved information extraction process using ML, and compared to the manual work, it was pretty fast and accurate [84, 85].

4.9 Infrastructure requirements to adapt AI and ML

Any organization would need to understand that three types of drivers must be taken care of for adopting AI and ML. First, the technological drivers in which the system trustworthiness, justifiability, Data quality, quantity control, and governance for technology would come. Another category would be organizational drivers, which require the technological readiness of the current workforce and adding more people with the required skillsets, hierarchical amendments, and the work structure to be aligned. The third one would be the environmental drivers, which are both internal and external. The concerns under this category include the fear of unemployment, chatbots misfunctioning, and algorithms continuing with the same bias as humans because of data sets being drawn from the available ones. Whether the adoption of AI and ML would be successful or not would depend on how an organization has handled these [86, 87].

5 Is it all “only” good?

As we have seen in the past, advancements, whether in technology or processes, however powerful and productive, also bring negatives. Similar is the case with the adoption of AI and ML. Many researchers have their views on all the positive sides of these technologies, but at the same time, some views raise relevant questions also.

As per a small survey conducted by the authors, one respondent working in financial markets stated that there is a type of fear that may be described as the fear of "Overfitting Patterns," due to which the AI has not been able to establish that confidence in Investors. As per him, it is difficult for AI to follow the more excellent noise-to-signal ratios, which exist in the Indian market per se, because an algorithm works onto trained set patterns, especially when the complexity is multiplied by high volatile relations between markets. Another respondent has reckoned with the same as per whom the structured data sets for the training of the algorithms are lacking in such a dynamic and complex eco-system. As AI becomes more human, finding a sustainable division between AI and the workforce will not be easy. As per a report from McKinsey, the statistics show that approximately fifty percent of the job profiles will be automated, and around 15 percent of people across the globe could lose their jobs [88]. In another study having research done on similar lines and having an exciting title talking about "The Feeling Economy," the authors state that going further, only jobs that require feelings will remain with human beings, and the thinking tasks will be taken over by machines [89].

Despite the widespread acceptance of AI and ML in the financial domain, there are concerns of the organizations, which included the tools to improve continuously, the availability of better training data for ML to be more accurate, the explicability of the model and its back testing, the performance management and monitoring along with keeping the privacy of end-users as its prime goal. All must be taken care of for AI to be in vogue [50].

The researchers recorded similar observations in their work that the banking infrastructure needs to be modernized to have a better Artificial Intelligence application. The banks need to ensure the accuracy and quality of the data being used by AI to enhance customers' experience rather than hurting it. Besides these, the integration of technologies, constraints laid down by regulatory bodies, skilled workforce to work with advanced technologies, and the flexibility of processes and teams [90].

AI in the financial sector has already been accepted as a reality and has proven to provide many benefits to all the participants, but at the same time, the cons of it are to be managed [91]. There are studies that describe the landscape of AI and ML and have deliberated upon the aspects of those areas that have affected digital banking the most. As per the views presented, AI and ML are natural extensions to data-driven organizations. There are many challenges and opportunities for digital banking in these technologies. However, to exploit the full potential of all these new-age technologies, the banks need to be sure of the characteristics and shortcomings of the technology [92].

Digitalization has disrupted most industries functioning. In banking, customers are becoming tech-savvy as smartphones and gadgets have increased tremendously. The technology giants are posing indirect challenges to the banking system, which can still not come from their traditional ways of working [93]. Players like Paytm and payment banks like Airtel have paved the way for Neobanks. Traditional banking is no longer impressive. Banks are now sorting to the latest technology like AI and ML to meet customers' expectations, who want all the services at their fingertips, anytime, anywhere [94].

Other views also talk about the weaker side of AI and ML. A study provides an overview of these techniques with their usefulness in banking. Though these techniques have been there for some time, their usage is still limited, and there are many things to be learned about their widespread use is still somewhat limited, and there is still much to be learned about all these. There are many questions related to algorithms and the same usage in different situations. The selection of models and the variables remains a question to which answers are unavailable [68].

Another research done on the same lines shows that consumers and Russian businesses take AI positively. The specialists of SberBank, a Russian Bank, accept the AI implementation in their work and are not afraid of dismissals. It is also hoped that with time the resistance from both sides will also reduce, and the role of regulators will be important in making the banking environment conducive to these techniques [95].

The adoption of technologies related to AI must be evaluated with pros and cons. The benefits brought by AI will be accompanied by risks that may be unforeseen [96]. Artificial Intelligence brings many opportunities. Process automation, digital financial inclusion, personalized services, customer satisfaction, and smart wallets are the areas being worked upon by many FinTech start-ups [97, 98]. At the same time, the legislators are also optimistic about AI adoption. The challenges while adopting AI must also be prioritized: loss of jobs, privacy issues, creativity loss, acceptance concerns by users, operational requirements, digital divide, the large amount of quality data, AI vs. strategy alignment, and loss of the human touch.

Going further, we must realize that the demand for xAI (Explainable AI) will also rise, which is a step toward using AI relatively and unbiasedly. In one of the papers, the authors present the scope, the desiderata, and uses of explainable Artificial Intelligence (xAI) and machine learning used by the European Central Bank [99].

6 Latest in the area of AI and ML

As per the latest news, the banks are putting on money and resources to increase the use of AI, and the analysts at IHS Markit have predicted that by 2030, the value of AI in banking will be $300 billion. They also predict that AI technology will free employees from routine manual tasks and put them on more valuable tasks. As per the report, 1.3 million workers in the US and 500,000 workers in the UK would no longer be required. There is also a question about AI: whether the AI banking world was free of bias and assumptions existing before the adoption of AI. The risk of having prejudices persists because the algorithms are trained on the data available from historical data sets [100].

The future of AI seems to be brighter. As per the very innovative research, the authors proposed a technique using which the data scientists will measure the empathy behavior of the prospective consumers towards the products and services offered by the businesses [101]. Gradually the business will learn to use machine learning to evaluate and analyze the empathy of potential customers. They used connections between various aspects of emotional dimensions and behavioral reactions of individuals with "lexicon-based unsupervised machine learning methods" [102]

AI brings a very high level of automation and improvement inefficiencies, considered the most crucial factors offered by portfolio management and investment platforms. AI is seen in many areas of the financial system now and is at the core of all RegTech and FinTech companies [103,104,105].

The use of AI has reached another panacea in banking now. The very recent example of how open banking or Neobanks enables the international consumers of a bank to offer them enough flexibility and a better hold on their accounts to make well-thought-of financial decisions are adopted by the regulators. It can help businesses budget better. As per the author, open banking is growing fast and will be accepted by the world in two years. The same report talks about how the banks transform the customer experience through an AI-driven Human assistant named 'Fatema' who works autonomously and efficiently. It is a digital human, fully autonomous AI-driven. Unlike the other assistants, it appears like a human with emotional intelligence and knowledge of the bank products capable of engaging in the customer conversation. It has a digital brain that can learn and respond based on experience. ABC Bank of Bahrain, an only-mobile digital bank, has developed to deliver a personalized and hyper-realistic customer experience [106, 107].

Moreover, we heard that META (earlier Facebook) has announced that their fastest AI supercomputer, part of their Metaverse, will be ready very soon. They have also developed the AI research SuperCluster (RSC), the fastest globally [108].

As per research, the pros and cons of AI and ML are to be seen as a package. The Pros are enabling and fostering automation of all the banking processes; errors compared to human errors are lesser, the cost of banking services may reduce substantially, it is easier for machines to analyze the behavioral patterns of customers and to offer individualized services and AI and ML-enabled security threat recognition system will be fast and banks may response well in time [109]. Scholars conducting research have analyzed the features of banking Trojans using the cyber kill chain (CKC) based taxonomy. This particular taxonomy, derived from threat intelligence, offers a comprehensive understanding of the various stages of a cyber-attack. It can prove highly advantageous for security practitioners and the development of Trojans' detection and mitigation strategies using evolutionary computational intelligence [110].

Cons are that it will be disruptive in the beginning for all the banks to use AI in their processes, the complete automation may lead to a no-supervision situation, the inability of AI to decide under extraordinary circumstances, and security protocols will need to be foolproof for the whole environment to be automated [111, 112].

7 Discussions, conclusions and the way ahead

The adaptation of AI and ML has been noticeable in the banking sector for reasons well known now. After doing an extensive literature view of the selected research papers, we have been able to conclude the most common areas where these two technologies have been able to contribute. Most of it has been in activities around Customers, including acquisition, retention, churning, enhanced experience and ease, and loyalty.

The second most researched area is automated credit scoring techniques, where many scholars did find the application of AI and ML on a very advanced level.

The area of bank crisis prediction was the next area where we could find a large number of research articles, papers, and projects that have been published.

Fraud detection and prevention is also one of the areas where the usage of these technologies has been conceptualized. Along with this, work has been done on the early delinquency probability of mortgages.

Many studies [28, 42, 62] suggest that the area of Bank Risk Management is also one where the application of AI and ML is observed noticeably [113].

The application of AI and ML has been very little in the operational activities of banks, as suggested by the studies [5, 17, 80]. We could find very little literature on using these technologies in operations except on managing the workforce (only one paper) and solving the queuing problem.

We believe that the areas like managing NPAs, not only at the individual bank level but also at the level of the sector as a whole, AI and ML can be used to predict undesirable events well within the time and can alert the managers to take a necessary action to avoid the circumstances resulting into lost assets.

Also, commercial banks deal with Apex Banks for many reasons, including borrowing and depositing money for concise terms. The same is governed by frequently changing interest rate regimes and policies. Similarly, the banks deal with other commercial banks for such short-term money requirements. AI and ML can prove to be very handy for automated treasury management that may take care of all the probable requirements or surplus, considering the current policies and rates.

We propose the study be taken up by researchers in the areas mentioned above and analyze why the adoption of AI and ML in these areas has yet to be there so far, and if it is being done, to what level it has reached.

Using the automation software and based on the factor loading and related analysis, we identified some keywords which had minimum 30 occurrences in the database downloaded for this SLR. In all, 21 keywords met the criteria (Fig. 7, overly visualization, Table 3). For example, bank & machine learning, bank/banking & Artificial Intelligence show dense connecting lines and similar is the case with linkages between Bank/Banking & AI + ML also are dense but linkages between the bank/banking & ANN or Deep Learning or customer etc. to name a few are the keywords where the linkages are not that dense and hence these can be identified as the areas where the research gap exists for the research scholars to act upon.

Further the keywords were analyzed by looking into the correlation matrix based on the count of the keywords used in the research articles shortlisted from the database, and the values were used as variable into SPSS software for the factor analysis. The keywords were found to be grouped in 9 clusters. The keywords which have an eigenvalue of 1 and more are the ones which have been used extensively in the research done in the area of AI & ML in the Banking Industry. This can also be observed in the Scree Plot (Fig. 8). The Scree Plot is a graphical representation of the explained variance per PC (Principal Component) and the Eigenvalues are the percentage or the absolute value of the explained variance. As per the Kaiser’s rule, to select the number of components while performing PCA (Principal Component Analysis), the components having eigenvalue of more than 1 are chosen. In our study components (Keywords) with id number 1 to 9 have eigenvalue greater than 1 and the keywords with id number 10 to 21 are the ones which have lesser than one eigenvalue. These are the terms which can be seen as the ones which have not been used much and the research done previously and that suggests that around these keywords the research gap exists.

The rotated variance components table shows the best fitment of a keyword with a cluster like the keyword Algorithm is best fit with cluster number 5 and so on (Table 4). Also, the rotated variance components table can be used to go for a research area based on the keywords falling into one cluster and that research area is likely to have more acceptable research work since the gap exists there as per the results obtained by statistical tests. It can also be seen that the clusters having lesser number of keywords falling into it as an opportunity to find an area of research using the combination of those keywords.

7.1 Limitations of the study

Since the databases available currently are not integrated and the researchers will always be in dilemma to choose amongst the available database, it becomes difficult to restrict to only 2 or 3 databases. Also, since the length of a research paper cannot be more than a stipulated number of pages, it was found very difficult to accommodate even the summary of important and highly cited papers. It was felt that the same research can be taken up further by looking into different functions of the banking industry and how AI and ML are affecting the individual functions with incorporating the crux of all the relevant research work in the research papers.

References

Pio L, Cavaliere L, Bhatia S. Digital technologies implementation within financial and banking system during socio distancing restrictions—back to the future.pdf. 2020; 307–315. https://doi.org/10.34218/IJARET.11.6.2020.027.

Mehdiabadi A, et al. Are we ready for the challenge of banks 4.0? designing a roadmap for banking systems in industry 4.0. Int J Financ Stud. 2020;8(2):1–28. https://doi.org/10.3390/ijfs8020032.

Kaur N, et al. Banking 4.0: the influence of artificial intelligence on the banking industry & how AI is changing the face of modern day banks. Int J Manag. 2020. https://doi.org/10.34218/ijm.11.6.2020.049.

Thach NN, et al. Technology quality management of the industry 4.0 and cybersecurity risk management on current banking activities in emerging markets—the case in Vietnam. Int J Qual Res. 2021;15(3):845–56. https://doi.org/10.24874/IJQR15.03-10.

González-Carrasco I, et al. Automatic detection of relationships between banking operations using machine learning. Inf Sci. 2019;485:319–46. https://doi.org/10.1016/j.ins.2019.02.030.

Chintalapati S. ‘Early adopters to early majority—what ’ s driving the artificial intelligence and machine learning powered transformation in financial services? Int J Financ Res. 2021. https://doi.org/10.5430/ijfr.v12n4p43.

Moro S, Cortez P, Rita P. Business intelligence in banking: a literature analysis from 2002 to 2013 using text mining and latent Dirichlet allocation. Expert Syst Appl. 2015;42(3):1314–24. https://doi.org/10.1016/j.eswa.2014.09.024.

Alghazo JM, Kazmi Z, Latif G. Cyber security analysis of internet banking in emerging countries: user and bank perspectives. In 2017 4th IEEE international conference on engineering technologies and applied sciences (ICETAS), 2017, pp. 1–6. https://doi.org/10.1109/ICETAS.2017.8277910.

Lee J, Wewege L, Thomsett MC. Disruptions and digital banking trends. J Appl Finance Bank. 2020;10(6):1792–6599.

Mehrotra A. Artificial Intelligence in financial services—need to blend automation with human touch. In 2019 International Conference on Automation, Computational and Technology Management, ICACTM 2019, 342–347. https://doi.org/10.1109/ICACTM.2019.8776741.

Ginimachine. Banking today: risk management with AI. 2018. https://ginimachine.com/blog/banking-today-risk-management-with-ai/.

Bilal Zoric A. Predicting customer churn in banking industry using neural networks. Interdiscip Descrip Complex Syst. 2016;14(2):116–24. https://doi.org/10.7906/indecs.14.2.1.

Goodell JW, et al. Artificial intelligence and machine learning in finance: Identifying foundations, themes, and research clusters from bibliometric analysis. J Behav Exp Finance. 2021. https://doi.org/10.1016/j.jbef.2021.100577.

Fethi MD, Pasiouras F. Assessing bank efficiency and performance with operational research and artificial intelligence techniques: a survey. Europ J Operat Res. 2010. https://doi.org/10.1016/j.ejor.2009.08.003.

Tranfield D, Denyer D, Smart P. Towards a methodology for developing evidence-informed management knowledge by means of systematic review. Br J Manag. 2003;14:207–22.

Mishra R, Ramesh DB. Highly cited research efforts in business, management and accounting: an analysis. Libr Philos Pract. 2020;2020:1–12.

Doumpos M, et al. Operational research and artificial intelligence methods in banking. Eur J Oper Res. 2023. https://doi.org/10.1016/j.ejor.2022.04.027.

Murinde V, Rizopoulos E, Zachariadis M. The impact of the FinTech revolution on the future of banking: opportunities and risks. Int Rev Financ Anal. 2022;81(March): 102103. https://doi.org/10.1016/j.irfa.2022.102103.

Arjun R, Kuanr A, Suprabha KR. Developing banking intelligence in emerging markets: systematic review and agenda. Int J Inf Manag Data Insights. 2021;1(2): 100026. https://doi.org/10.1016/j.jjimei.2021.100026.

Donepudi PK. AI and machine learning in banking: a systematic literature review. Asian J Appl Sci Eng. 2017;6(3):157–62.

Ukpong EG, Udoh II, Essien IT. Artificial intelligence : opportunities, issues and applications in banking, accounting, and auditing in Nigeria. Asian J Econ Bus Acc. 2019;10(1):1–6. https://doi.org/10.9734/AJEBA/2019/v10i130099.

Kumar KN, Balaramachandran PR. Robotic process automation—a study of the impact on customer experience in retail banking industry. J Internet Bank Commer. 2018;23(3):1–27.

Singh T, Pathak N. Emerging role of artificial intelligence in Indian banking sector. J Crit Rev. 2000. https://doi.org/10.55399/WGQO2090.

Ładyżyński P, Żbikowski K, Gawrysiak P. Direct marketing campaigns in retail banking with the use of deep learning and random forests. Expert Syst Appl. 2019;134:28–35. https://doi.org/10.1016/j.eswa.2019.05.020.

Hernández-nieves E, et al. CEBRA: a CasE-based reasoning application to recommend banking products. Eng Appl Artif Intell. 2021;104(June): 104327. https://doi.org/10.1016/j.engappai.2021.104327.

Suhel SF et al. Conversation to automation in banking through Chatbot using artificial machine intelligence language. In ICRITO 2020—IEEE 8th international conference on reliability, infocom technologies and optimization (trends and future directions), 611–618. 2020. https://doi.org/10.1109/ICRITO48877.2020.9197825.

Digalaki E (2019) The impact of artificial intelligence in the banking sector & how AI is being used in 2020. https://www.businessinsider.in/finance/news/the-impact-of-artificial-intelligence-in-the-banking-sector-how-ai-is-being-used-in-2020/articleshow/72860899.cms.

Chen TH. Do you know your customer? Bank risk assessment based on machine learning. Appl Soft Comput J. 2020;86:7. https://doi.org/10.1016/j.asoc.2019.105779.

Evdokimov M. Arriving at the right time. Global Finance. 2018. https://www.gfmag.com/magazine/december-2018/arriving-right-time.

Naziya H, Arya S, Avinash R. E-Brain ( Artificial Intelligence ): an edge to Indian banking system. Int J Manag IT Eng. 2019; 9(7).

Khan S, Rabbani MR. Artificial Intelligence and NLP-based Chatbot for Islamic banking and finance. Int J Inf Retriev Res (IJIRR). 2021;11(3):65–77.

Satheesh MK, Nagaraj S. Applications of artificial intelligence on customer experience and service quality of the banking sector. Int Manag Rev. 2021;17(1):9–17.

Domashova J, Mikhailina N. Usage of machine learning methods for early detection of money laundering schemes. Proc Comput Sci. 2021. https://doi.org/10.1016/j.procs.2021.06.033.

Wang D. Research on bank marketing behavior based on machine learning. AIAM2020—2nd international conference on artificial intelligence and advanced manufacture, 2020. 150–154. https://doi.org/10.1145/3421766.3421800.

Cao N. Explainable artificial intelligence for customer churning prediction in banking. 2021.

El-Gohary H, et al. An exploratory study on the effect of artificial intelligence-enabled technology on customer experiences in the banking sector. J Technol Adv. 2021;1(1):1–17. https://doi.org/10.4018/jta.20210101.oa1.

Adamyk B, et al. Analysis of Trust in Ukrainian banks based on machine learning algorithms. 2019 9th International conference on advanced computer information technologies (ACIT), (June 2019), 2020, pp. 234–239. https://doi.org/10.1109/ACITT.2019.8779974.

Djurisic V, et al. Bank CRM optimization using predictive classification based on the support vector machine method. Appl Artif Intell. 2020;34(12):941–55. https://doi.org/10.1080/08839514.2020.1790248.

Lee J-C, Chen X. Exploring users’ adoption intentions in the evolution of artificial intelligence mobile banking applications: the intelligent and anthropomorphic perspectives. Int J Bank Market. 2022;40(4):631–58. https://doi.org/10.1108/IJBM-08-2021-0394.

Sebring SS. AI and open platforms are priorities for 2019. Mobile Technol Outlook. 2019; 14–18.

Boughaci D, Alkhawaldeh AAK. Appropriate machine learning techniques for credit scoring and bankruptcy prediction in banking and finance: a comparative study. Risk Decis Anal. 2020;8:15–24. https://doi.org/10.3233/RDA-180051.

Munkhdalai L, et al. An empirical comparison of machine-learning methods on bank client credit assessments. Sustainability (Switzerland). 2019;11(3):1–23. https://doi.org/10.3390/su11030699.

Coenen L, Verbeke W, Guns T. Machine learning methods for short-term probability of default: a comparison of classification, regression and ranking methods. J Oper Res Soc. 2020. https://doi.org/10.1080/01605682.2020.1865847.

Wu C, et al. A predictive intelligence system of credit scoring based on deep multiple kernel learning. Appl Soft Comput. 2021;111: 107668. https://doi.org/10.1016/j.asoc.2021.107668.

Chen S, Guo Z, Zhao X. Predicting mortgage early delinquency with machine learning methods. Eur J Oper Res. 2021;290(1):358–72. https://doi.org/10.1016/j.ejor.2020.07.058.

Mesihovic AE, Nordström H. Artificial intelligence and machine learning usage in credit risk management. Handchir Mikrochir Plast Chir. 2019. https://doi.org/10.1055/a-0826-4789.

Ashofteh A, Bravo JM. A conservative approach for online credit scoring. Expert Syst Appl. 2021;176:114835. https://doi.org/10.1016/j.eswa.2021.114835.

Eduardo M, et al. Predict quality of service using intelligence system in banking sectors artificial. Linguistica Antverpiensia [Preprint], (3).

Petropoulos A, et al. Predicting bank insolvencies using machine learning techniques. Int J Forecast. 2020;36(3):1092–113. https://doi.org/10.1016/j.ijforecast.2019.11.005.

Ashta A, Herrmann H. Artificial intelligence and fintech: an overview of opportunities and risks for banking, investments, and microfinance. Strateg Change. 2021;30(3):211–22. https://doi.org/10.1002/jsc.2404.

Pérez-Martín A, Pérez-Torregrosa A, Vaca M. Big data techniques to measure credit banking risk in home equity loans. J Bus Res. 2018;89(August):448–54. https://doi.org/10.1016/j.jbusres.2018.02.008.

Mhlanga D. Industry 4.0 in finance: the impact of artificial intelligence (AI) on digital financial inclusion’. Int J Financ Stud. 2020;8(3):1–14. https://doi.org/10.3390/ijfs8030045.

Mogaji E, et al. Emerging-market consumers’ interactions with banking chatbots. Telemat Informat. 2021. https://doi.org/10.1016/j.tele.2021.101711.

Shukla UP, Nanda SJ. Designing of a risk assessment model for issuing credit card using parallel social spider algorithm. Appl Artif Intell. 2019;33(3):191–207. https://doi.org/10.1080/08839514.2018.1537229.

Cheng M, Qu Y. Does bank FinTech reduce credit risk? Evidence from China. Pac Basin Financ J. 2020;63(December 2019):1–24. https://doi.org/10.1016/j.pacfin.2020.101398.

Dubey SC, Mundhe KS, Kadam AA. Credit card fraud detection using artificial neural network and backpropagation. Proceedings of the international conference on intelligent computing and control systems, ICICCS 2020, 268–273. https://doi.org/10.1109/ICICCS48265.2020.9120957.

Błaszczyński J, et al. ‘Auto loan fraud detection using dominance-based rough set approach versus machine learning methods. Expert Syst Appl. 2021. https://doi.org/10.1016/j.eswa.2020.113740.

Kuiper O et al. Exploring explainable AI in the financial sector: perspectives of banks and supervisory authorities. arXiv preprint arXiv:2111.02244, 1–16. 2021.

Salameh RS, Lutfi KM. The role of artificial intelligence on limiting jordanian commercial banks cybercrimes. Accounting. 2021;7(5):1147–56. https://doi.org/10.5267/j.ac.2021.2.024.

Shen Y, et al. Financial feature embedding with knowledge representation learning for financial statement fraud detection. Procedia Comput Sci. 2021. https://doi.org/10.1016/j.procs.2021.04.110.

Domashova J, Zabelina O. Detection of fraudulent transactions using SAS Viya machine learning algorithms. Proc Comput Sci. 2021. https://doi.org/10.1016/j.procs.2021.06.025.

Domashova J, Kripak E. Identification of non-typical international transactions on bank cards of individuals using machine learning methods. Proc Comput Sci. 2021. https://doi.org/10.1016/j.procs.2021.06.023.

Swankie G, Broby D. Examining the impact of artificial intelligence on the evaluation of banking risk. The economics of artificial intelligence, (December), 2019. p. 18. https://www.researchgate.net/publication/337908452_Examining_the_Impact_of_Artificial_Intelligence_on_the_Evaluation_of_Banking_Risk?enrichId=rgreq-9e9f31b0f708a4b84a50c0de8a4b0346-XXX&enrichSource=Y292ZXJQYWdlOzMzNzkwODQ1MjtBUzo4MzUyNzgzNTY4OTM2OThAMTU3N.

Carmona P, Climent F, Momparler A. Predicting failure in the U.S. banking sector: an extreme gradient boosting approach. Int Rev Econ Financ. 2019;61(February 2018):304–23. https://doi.org/10.1016/j.iref.2018.03.008.

Dzhaparov P. Application of blockchain and artificial intelligence in bank risk management. Econ Manag. 2020;XVII(1):43–57.

Leo M, Sharma S, Maddulety K. Machine learning in banking risk management: a literature review. Risks. 2019. https://doi.org/10.3390/risks7010029.

Domashova J, Kulaev M. Technology of forecasting potentially unstable credit organizations based on machine learning methods. Proc Comput Sci. 2020. https://doi.org/10.1016/j.procs.2020.02.167.

Hu L, et al. Supervised machine learning techniques: an overview with applications to banking. Int Stat Rev. 2021;89(3):573–604. https://doi.org/10.1111/insr.12448.

Coffinet J, Kien JN. Detection of rare events: a machine learning toolkit with an application to banking crises. J Financ Data Sci. 2019;5(4):183–207. https://doi.org/10.1016/j.jfds.2020.04.001.

Wang T, et al. A machine learning-based early warning system for systemic banking crises. Appl Econ. 2021;53(26):2974–92. https://doi.org/10.1080/00036846.2020.1870657.

Beutel J, List S, Schweinitz GV. Does machine learning help us predict banking crises ? J Financ Stabil. 2019;45: 100693. https://doi.org/10.1016/j.jfs.2019.100693.

Messai AS, Gallali MI. Financial leading indicators of banking distress: a micro prudential approach—evidence from Europe. Asian Soc Sci. 2015;11(21):78–90. https://doi.org/10.5539/ass.v11n21p78.

Gutiérrez PA, et al. Hybridizing logistic regression with product unit and RBF networks for accurate detection and prediction of banking crises. Omega. 2010;38(5):333–44. https://doi.org/10.1016/j.omega.2009.11.001.

Celik AE, Karatepe Y. Evaluating and forecasting banking crises through neural network models: an application for Turkish banking sector. Expert Syst Appl. 2007;33(4):809–15. https://doi.org/10.1016/j.eswa.2006.07.005.

Li S, Tung WL, Ng WK. A novelty detection machine and its application to bank failure prediction. Neurocomputing. 2014;130:63–72. https://doi.org/10.1016/j.neucom.2013.02.043.

Paule-Vianez J, Gutiérrez-Fernández M, Coca-Pérez JL. Prediction of financial distress in the Spanish banking system: an application using artificial neural networks. Appl Econ Anal. 2020;28(82):69–87. https://doi.org/10.1108/AEA-10-2019-0039.

Shie FS, Chen M-Y, Liu Y-S. Prediction of corporate financial distress: an application of the America banking industry. Neural Comput Appl. 2012;21(7):1687–96. https://doi.org/10.1007/s00521-011-0765-5.

Bellotti A, et al. Forecasting recovery rates on non-performing loans with machine learning. Int J Forecast. 2021;37(1):428–44. https://doi.org/10.1016/j.ijforecast.2020.06.009.

Satya Hermanto RP, et al. Waiting-time estimation in bank customer queues using RPROP neural networks. Procedia Comput Sci. 2018. https://doi.org/10.1016/j.procs.2018.08.147.

Serengil SI, Ozpinar A. Workforce optimization for bank operation centers: a machine learning approach. Int J Interact Multimed Artif Intell. 2017;4(6):81. https://doi.org/10.9781/ijimai.2017.07.002.

Rafi M et al. ATM cash prediction using time series approach. In 2020 3rd International conference on computing, mathematics and engineering technologies: idea to innovation for building the knowledge economy, iCoMET 2020. 2020. https://doi.org/10.1109/iCoMET48670.2020.9073937.

Ghosh S, Chanda D. Artificial intelligence and banking services—way forward. Productivity. 2020;61(1):11–8.

Ravikumar T, et al. Banking on Artificial Intelligence to bank the unbanked. Ann RSCB. 2021;25(5):129–32.

Huang J, Chai J, Cho S. Deep learning in finance and banking: a literature review and classification. Front Bus Res China. 2020. https://doi.org/10.1186/s11782-020-00082-6.

Oral B, et al. ‘Information extraction from text intensive and visually rich banking documents. Inf Process Manag. 2020. https://doi.org/10.1016/j.ipm.2020.102361.

Samsudeen SN, et al. Drivers of artificial intelligence in banking service sectors view project E-learning view project drivers of artificial intelligence in banking service sectors. Solid State Technol. 2017;63(5):7.

Yan TC, Schulte P, LEE Kuo Chuen D. Chapter 11—InsurTech and FinTech: banking and insurance enablement. In Lee Kuo Chuen D, Deng R (eds) Handbook of blockchain, digital finance, and inclusion, Vol 1. Academic Press, 2018, 249–281. https://doi.org/10.1016/B978-0-12-810441-5.00011-7.

Manyika J, et al. Workforce transitions in a time of automation—executive summary. Mckinsey globar institute, (December), p. 28. 2017.https://www.mckinsey.com/~/media/McKinsey/FeaturedInsights/FutureofOrganizations/What thefutureofworkwillmeanforjobsskillsandwages/MGI-Jobs-Lost-Jobs-Gained-Executive-summary-December-6–2017.ashx.

Huang MH, Rust R, Maksimovic V. The feeling economy: managing in the next generation of artificial intelligence (AI). Calif Manag Rev. 2019;61(4):43–65. https://doi.org/10.1177/0008125619863436.

Indriasari E, Gaol FL, Matsuo T. Digital banking transformation: application of artificial intelligence and big data analytics for leveraging customer experience in the Indonesia banking sector. In Proceedings—2019 8th International Congress on Advanced Applied Informatics, IIAI-AAI 2019, 863–868. https://doi.org/10.1109/IIAI-AAI.2019.00175.

Fernández A. Artificial intelligence in financial services. Analytical articles. Econ Bull. 2019.

Tsindeliani IA, et al. Digital transformation of the banking system in the context of sustainable development. J Money Launder Control. 2022;25(1):165–80. https://doi.org/10.1108/JMLC-02-2021-0011.

Naimi-Sadigh A, Asgari T, Rabiei M. Digital transformation in the value chain disruption of banking services. J Knowl Econ. 2022;13(2):1212–42. https://doi.org/10.1007/s13132-021-00759-0.

Singh K. Banks banking on AI. Int J Adv Res Manag Soc Sci. 2020;9(9):1–11.

Ryzhkova M, et al. Consumers’ perception of artificial intelligence in banking sector. SHS Web Conf. 2020;80:01019. https://doi.org/10.1051/shsconf/20208001019.

Romao M, Costa J, Costa CJ. Robotic process automation: a case study in the banking industry. In Iberian Conference on Information Systems and Technologies, CISTI. 2019. https://doi.org/10.23919/CISTI.2019.8760733.

Ali H, Abdullah R, Zaki Zaini M. Fintech and its potential impact on islamic banking and finance industry: a case study of Brunei Darussalam and Malaysia. Int J Islam Econ Financ IJIEF. 2019;2(1):73–108. https://doi.org/10.18196/ijief.2116.

Ghandour A. Opportunities and challenges of artificial intelligence in banking: systematic literature review. TEM J. 2021. https://doi.org/10.1051/e3sconf/201911002028.

Navarro CM, Kanellos G, Gottron T. Desiderata for Explainable AI in statistical production systems of the European Central Bank. ECML PKDD ’21: workshop on Bias and Fairness in AI. 2021; 1(1). http://arxiv.org/abs/2107.08045.

Buck G. AI to take bank jobs, too’. Corporate Finance & Capital | TRENDS Global Finance. 2019.

Castelli M, Manzoni L, Popovič A. An artificial intelligence system to predict quality of service in banking organizations. Comput Intell Neurosci. 2016. https://doi.org/10.1155/2016/9139380.

Hossain S, Rahman MF. Detection of potential customers’ empathy behavior towards customers’ reviews. J Retail Consum Serv. 2021. https://doi.org/10.1016/j.jretconser.2021.102881.

Al-Ajlouni A, Al-Hakim DMS. Financial technology in banking industry: challenges and opportunities. SSRN Electron J. 2018. https://doi.org/10.2139/ssrn.3340363.

Consoli D. Technological cooperation and product substitution in UK retail banking: the case of customer services. Inf Econ Policy. 2005;17(2):199–215. https://doi.org/10.1016/j.infoecopol.2004.04.001.

Palmié M, et al. The evolution of the financial technology ecosystem: an introduction and agenda for future research on disruptive innovations in ecosystems. Technol Forecast Soc Change. 2020. https://doi.org/10.1016/j.techfore.2019.119779.

Long G, et al. Federated learning for open banking. In: Yang Q, Fan L, Han Y, editors., et al., Federated learning: privacy and incentive. Cham: Springer International Publishing; 2020. p. 240–54. https://doi.org/10.1007/978-3-030-63076-8_17.

Waary S et al. Digital with a human touch. World’s best digital banks 2021.