Abstract

Smallholder farmers, crucial to global food security, face challenges in sustainable integration into agricultural innovation due to inherent flaws in existing finance models. This research addresses the conspicuous gap in comprehensive reviews on sustainable finance in agriculture through a bibliometric approach. Financial constraints, limited market access, and climate vulnerability plague smallholder farmers, hindering the long-term sustainability of current financial models. This study aims to systematically map the scholarly landscape of sustainable finance models for smallholder farmers, focusing on the adoption of agricultural innovations. A critical knowledge gap exists regarding bibliometric patterns and trends in the adoption of agricultural innovations by smallholder farmers. The study utilizes the RAPID framework for a streamlined and evidence-based bibliometric review, employing RStudio and the bibliometrix-package. The analysis aims to recognize, assess, purge, investigate, and document key themes and emerging patterns in the literature. Noteworthy trends from bibliometric reviews indicate a rise in bibliometric approaches, with VOSviewer as a prevalent tool. This research contributes methodologically by advocating for Scopus as the primary database. The study’s significance lies in informing policy, practice, and research initiatives supporting smallholder farmers. By revealing bibliometric patterns, this study aims to guide the design of innovative and context-specific financial instruments, fostering a more sustainable and inclusive agricultural landscape. In conclusion, this research endeavors to bridge the knowledge gap and provide novel insights at the intersection of sustainable finance and agricultural innovation adoption. The anticipated outcomes will inform the development of tailored financial models, advancing the resilience and productivity of smallholder farmers globally.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Smallholder farmers, often residing in resource-constrained environments, play a pivotal role in global food security. Smallholder farmers are key actors in approaches aimed at reducing poverty and increasing global food production [1]. Exploring the prospective poverty implications linked to climate change mitigation involves examining the potential impact of macroeconomic losses and price changes as pathways to poverty, especially in low-income countries [2]. The sustainable integration of these enterprises into agricultural innovation adoption is crucial for fostering resilience and productivity. In Ref. [3] elaborate on the integration of agricultural technologies with a focus on sustainability for food and nutritional security. The technologies with immediate implications for food and nutritional security include those that affect food production, consequently resulting in outcomes that directly influence the availability and stability of food. However, existing finance models for these farmers face inherent challenges that hinder their sustainability. Notably, as observed from the current literature, there is a conspicuous absence of comprehensive reviews on the topic of sustainable finance in agriculture. In Ref. [4] explored how finance can be used to achieve the joint objectives of development, mitigation, and adaptation to climate change in sustainable agriculture. This article endeavors to explore and address these challenges through a bibliometric approach, shedding light on sustainable finance models for smallholder farmers.

The agricultural sector is no stranger to the struggles faced by smallholder farmers, who grapple with financial constraints, limited access to markets, and vulnerability to climate change [5,6,7]. In Ref. [8] emphasizes that access to finance is crucial for smallholder farmers because it helps to minimize the risks associated with agricultural production. Existing financial models, while providing initial support, often fall short in ensuring long-term sustainability for these farmers. Innovative financing has a notable adverse impact on technical inefficiency, and its significance persists in contributing to cost inefficiency, with a negative effect [9]. The inadequacy of current financial mechanisms poses a significant barrier to the widespread adoption of agricultural innovations, hindering the sector's potential for growth and resilience.

Within the intricate web of challenges faced by smallholder farmers in sustainable agriculture, a nuanced understanding of their context is crucial. Environmental cognition, for instance, has been shown to positively influence farmers' attitudes and subjective norms toward sustainable practices [10]. In Ref. [11] further highlight that financial inclusion and human capital, such as energy consumption and population, have an even stronger impact on environmental outcomes at higher tiers. To bolster financial inclusion, maintaining clear financial records is key, as it demonstrably increases production and income for farmers [12]. Education, participation in financial recordkeeping training, and experience obtaining financing are the key factors enabling this beneficial practice. However, this is only part of the solution. Given their pivotal role in global food systems, farmers merit tailored financial solutions that are free from conventional models. The dynamic nature of agricultural innovation, with new technologies and practices constantly emerging, further necessitates flexible and adaptable financial frameworks.

Despite extensive research on smallholder agriculture and sustainable finance, a critical knowledge gap persists regarding the specific bibliometric patterns and trends in the adoption of agricultural innovations by smallholder farmers. Understanding this gap is pivotal in devising targeted and effective financial models that can bridge existing shortcomings. Table 1 provides a comprehensive summary of several systematic reviews addressing the research topic of sustainable finance. The reviews encompass various methodologies, tools, and databases, shedding light on the evolution of related research.

Notably, the table reveals a gap in the systematic reviews specifically addressing sustainable finance in the agricultural sector. Systematic reviews in this domain began to emerge in 2020, employing qualitative approaches to explore conceptual aspects of sustainable finance. Quantitative methods, particularly bibliometric reviews, gained prominence in 2021. Despite qualitative reviews preceding their development, 60% of systematic reviews now utilize bibliometric analysis. VOSviewer stands out as the predominant tool for bibliometric analysis, with two articles utilizing Excel and one each utilizing the CiteSpace and Bibliometrix R packages. The article titled "Past, present, and future of sustainable finance: insights from big data analytics through machine learning of scholarly research" spans the longest span of 35 years. Additionally, researchers favor Scopus, although the Web of Science remains a reliable database choice.

This article serves as a valuable addition to the literature, particularly in initiating research on sustainable finance in agriculture. Moreover, this study contributes to the field of methodological development by advocating for the use of bibliometric reviews with Scopus as the primary database. For a more comprehensive study, future research may consider employing the bibliometrix R package. The significance of this article lies in its potential to drive the application of sustainable finance within the specific context of agriculture.

This study aims to employ a bibliometric approach to analyze the literature on sustainable finance models for smallholder farmers, focusing on the adoption of agricultural innovations. By systematically mapping the scholarly landscape, the objective is to identify key themes, emerging patterns, and gaps in knowledge. This hypothesis posits that a comprehensive understanding of the literature will inform the development of more sustainable and tailored financial models for smallholder farmers.

The significance of this research lies in its potential to inform policy, practice, and research initiatives aimed at supporting smallholder farmers. By revealing bibliometric patterns, this study intends to contribute novel insights into the intersection of sustainable finance and agricultural innovation adoption. The outcomes are expected to guide the design of innovative and context-specific financial instruments, fostering a more sustainable and inclusive agricultural landscape.

2 Methods

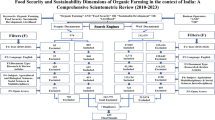

This study employs bibliometric analysis to systematically review and analyze the literature on sustainable finance models for smallholder farmers. Bibliometrics emerged in the early twentieth century [23] and subsequently evolved into a distinct field extensively employed for literature analysis [24]. The analysis was conducted using RStudio, a widely recognized integrated development environment for R, with the bibliometrix package, which is known for its robust capabilities in bibliometric research. The bibliometrix R package provides a set of tools for quantitative research in bibliometrics and scientometrics. The existence of substantial, effective statistical algorithms, access to high-quality numerical routines, and integrated data visualization tools are perhaps the strongest qualities to prefer R to other languages for scientific computation [25]. The underpinning framework guiding this study is the RAPID framework, an acronym encapsulating Recognition, Assessment, Purging, Investigation, and Documentation. The framework has been adapted from the works of [26, 27], and [28]. Figure 1 presents the RAPID framework.

The RAPID framework is a streamlined approach to bibliometric review that aims to provide evidence-based answers to research questions in a timely manner. It is particularly well suited for situations where time and resources are limited, such as when informing policy decisions or developing clinical guidelines. The RAPID framework is based on the following key principles: (1) Focus on the essential steps: The framework identifies the essential steps of the bibliometric review process and eliminates unnecessary or overly time-consuming activities; (2) Pragmatism and flexibility: The framework is pragmatic and flexible, allowing for adaptation to the specific context and resources available. (3) Transparency and rigor: The framework emphasizes transparency and rigor, ensuring that the review process is documented and reproducible.

2.1 Recognition

Recognizing diverse identities is vital for navigating and executing sustainability initiatives and advancing sustainability research. This necessitates increased focus on the positionality and reflexivity of researchers [29]. In the Recognition stage, we read various related literature related to sustainable finance, agriculture and technology. This led us to identify the need for a bibliometric review of sustainable finance models for smallholder farmers, focusing on agricultural innovation adoption. Consultation with experts in the field further refined our research questions and assisted in identifying key concepts and relevant terminology.

2.2 Assessment

The assessment stage focused on developing a comprehensive search strategy. We selected Scopus as our primary database and formulated the specified keywords and search terms. The search strategy aimed to identify studies related to sustainable finance models, agricultural innovation adoption, and smallholder farmers. Specifically, the query is structured as follows:

TITLE-ABS-KEY ((“sustainabl* financ*” OR “green financ*” OR “ESG financ*” OR “sustainabl* loan*” OR “green loan” OR “ESG loan”) AND (agricult* OR “smallholder* farmer*” OR “small-scale farmer*” OR “subsistenc* farmer*”) AND (((adopt* OR implement*) AND ((innovat* AND (tech* OR product*) OR ") OR “agricult* tech*”)).

2.3 Purging

The surging stage involved screening the retrieved studies based on predefined inclusion and exclusion criteria. The initial query yielded a total of 432 documents. To ensure the relevance and focus of the study, several filters were applied. First, documents not written in English were excluded, resulting in a refined dataset of 427 articles. Further refinement involved narrowing the document type to articles, yielding a final dataset of 365 articles for analysis. The exclusion of non-English articles was performed to avoid language bias. This decision was made to maintain consistency and clarity in the analyses.

The selected articles span a timespan from 2001 to 2024, providing a comprehensive overview of the evolution of the literature on sustainable finance models for smallholder farmers over the past two decades. This extended timeframe allows for a nuanced understanding of trends and developments in the field.

2.4 Investigation

In the Investigation stage, we imported the metadata (.csv) from the selected studies into RStudio with bibliometrix packages. RStudio was chosen as the analytical platform due to its versatility and widespread use in the academic and research community. The bibliometrix package within RStudio provides a robust set of functions specifically designed for bibliometric analysis. Its capabilities include the extraction of bibliographic information, cocitation analysis, and the generation of various visualizations, allowing for a comprehensive exploration of the scholarly landscape.

Utilizing bibliometric analysis, we explored sources, authors, documents, clustering, conceptual structure, intellectual structure, and social structure. This comprehensive analysis facilitated the synthesis of findings and the generation of conclusions. We embark on a comprehensive exploration of scientific production, citation patterns, and key entities. This journey begins with an examination of annual scientific production, average citations per year, and three-field plots (country, author, and keywords), offering a panoramic view of the evolving research landscape.

Moving seamlessly into the sources analysis, we employ Bradford's law to identify the most relevant and core sources. This approach not only reveals the concentration of literature within specific journals but also highlights the impact of pivotal publications.

Shifting our focus to authors, we delve into the temporal aspects of their production, applying Lotka's law to assess author productivity. Simultaneously, we uncover the most influential affiliations and the countries that garner the most citations, shedding light on global collaboration patterns and regional influence.

Venturing into the realm of documents, we uncover the most globally cited documents, utilizing treemaps and trend topics to visualize citation distribution and emergent research trends. The TreeMap provides an intuitive representation of document importance, while trend topics dynamically highlight the evolving landscape of research interests.

This exploration extends into clustering analysis, where document coupling maps reveal thematic connections between diverse documents. This nuanced understanding aids in identifying clusters of related research, contributing to a more nuanced comprehension of the broader knowledge landscape.

Transitioning seamlessly to conceptual structure analysis, we examined co-occurrence networks, heatmaps, thematic evolution, and factorial analysis. Co-occurrence networks reveal relationships between keywords or concepts, while heatmaps visualize the strength of these associations. Thematic evolution and factorial analysis offer insights into the dynamic evolution of research themes over time.

In the intellectual structure domain, our analysis navigates cocitation networks to unravel intellectual connections between publications, illuminating key works and the foundational underpinnings of the research field.

Finally, we delve into social structure analysis, exploring collaboration networks among authors and institutions. The collaboration network provides a visual representation of the strength and extent of collaborative efforts within the research community. Moreover, the country collaboration world map visually underscores the global interconnectedness of regions contributing to scientific knowledge.

This study adheres to ethical standards in bibliometric research. The data used for analysis exhibit a high level of completeness across various metadata fields. Table 2 shows the completeness of the data.

It is noteworthy that the decision to exclude Keywords Plus, Number of Cited References, and Science Categories is deliberate, based on a thorough assessment of their completeness and relevance. This careful curation ensures the quality and reliability of the data used in the bibliometric analysis.

2.5 Documentation

The Documentation stage involved creating a comprehensive report summarizing the entire review process. This report includes the research question, search strategy, inclusion criteria, data extraction process, synthesis methods, and key findings. By adhering to the RAPID framework, we ensure clarity, transparency, and a robust foundation for the forthcoming article. The report will serve as a valuable resource for readers seeking insights into the bibliometric review process and the synthesized findings on sustainable finance models for smallholder farmers.

3 Results

After an exhaustive analysis of 365 documents, it was determined that these documents originated from 140 distinct sources. The annual growth rate of scholarly publications generated by a given country or institution is 4.89%. This metric serves as a valuable indicator, shedding light on the developmental trajectory, productivity, and innovation stemming from the research efforts of said country or institution.

A comprehensive examination revealed that a total of 1,042 authors contributed to the discourse on this research topic. Among these authors, a mere 37 documents were singularly crafted by a single author. Notably, international coauthorship in this study represented 39.18%, underscoring a commendable level of collaboration between authors hailing from different nations. This statistic holds significance because it reflects the degree of internationalization, quality, and impact of the research conducted by the respective country or institution. Concurrently, the coauthor per documents ratio was 3.52, signifying the extent of collaboration, interdisciplinary approaches, and overall productivity within the realm of research undertaken by the country or institution.

The entirety of the documents scrutinized in this article encompasses 1129 keywords meticulously chosen by their respective authors. Furthermore, an impressive total of 24,615 references were cited by these authors, with an average citation count of 15.75 for each document. Notably, the temporal aspect of the documents within this research domain reveals an average age of 0.973 years. Figure 2 visually encapsulates annual scientific production, providing a graphical representation of scholarly output over time.

Drawing insights from Fig. 2, it can be inferred that research on the topic of sustainable finance models for smallholder farmers has exhibited three distinct phenomena in the twenty-first century. The first phenomenon occurred when the topic remained stagnant and did not experience mass development until 2017. The acknowledgment of a collective agreement to construct a world based on 17 goals, aiming to enhance the quality of life for everyone by 2030, known as the Sustainable Development Goals (SDGs) of 2015, has stimulated research on this subject. Subsequently, it transitioned into an emerging field, witnessing a surge in research interest. From 2021 onward, it has evolved into a hotly debated subject, evident from a substantial spike compared to previous years. The notable increase observed from 2021 to 2023 signifies positive signals for continued growth in the forthcoming years.

In Fig. 3, the average citation count initially experienced a decline in 2013 compared to the preceding years. Intriguingly, after 2013, the average citation count steadily increased until 2024. This trend bodes well for researchers in the future, indicating a positive trajectory for continued investigation into this topic.

The outcomes of the three-field plot analysis (Fig. 4) highlight China as the most significant contributor to this research domain. Figure participants predominantly feature researchers with Chinese names such as Liu Z, Wang L, and Wang Y, among others. Additionally, the most frequently employed keyword by researchers is 'green finance', emphasizing a notable focus within this scholarly discourse.

3.1 Sources

Examining Fig. 5, it is evident that the average citations per year reveal valuable insights into the relevance of various sources. Notably, Environmental Science and Pollution Research emerges as the most pertinent source. Resource policy significantly follows, followed by sustainability (Switzerland). Despite the considerable gap, it is noteworthy that the pioneer in publishing articles on this topic was Ecological Economics, with its inaugural contribution dating back to 2001.

Building upon the findings from Fig. 6, a conclusion can be drawn that out of the 140 sources publishing articles on sustainable finance, only four journals qualify as core sources. These journals include Environmental Science and Pollution Research, Resources Policy, Sustainability (Switzerland), and Renewable Energy. This discernment emphasizes the selectivity and concentration of scholarly contributions within a limited pool of journals, underscoring the key publications shaping the discourse on sustainable finance for smallholder farmers.

3.2 Authors

Figure 7 provides a nuanced perspective on authors' production over time, where the size of the circles correlates directly with the number of articles produced by each author. Additionally, the deepening shade of blue indicates an increasing total citation count annually. Notably, the line elements in the figure delineate the timeframe of article production. Among the top 10 most relevant authors depicted in the figure, the production span ranges from 2021 to 2023. Chau KY, Iqbal W, and Li X stand out as authors who have been actively contributing to this research topic since 2021, while others commenced their article production in 2022.

As shown in Fig. 8, the number of authors writing one article reached 889 (85.3%). Subsequently, the count decreased to 780 authors (10.5%) for those whose articles were written. The number further decreased to 21 (2%) for those who had written three articles, gradually declined to 0.9% for authors contributing 4–5 articles, and reached a mere 0.1% for those writing 8 articles. This analysis indicates a continuous decline in the productivity of authors contributing to articles on this topic, with a significant drop observed in authors writing 1 or 2 articles.

Considering Fig. 9, China University of Geosciences and Fuzhou University of International Studies and Trade emerge as the most relevant affiliations for this topic, followed by Shandong University and Shandong University of Technology. Overall, the top 10 most relevant affiliations are predominantly from China.

Figure 10, illustrating the most cited countries, aligns with the prevalence of authors and affiliations from China. Notably, China has the most citations, followed by Pakistan and Indonesia. Intriguingly, five out of the top 10 cited countries are in Asia, with an additional three from Europe. This underscores the global impact and recognition of research on sustainable finance models for smallholder farmers.

3.3 Documents

In the realm of global citations, [30] stands out as the most cited article, amassing a substantial 250 citations, as illustrated in Fig. 11. Similarly, [31] has garnered 183 citations, while [32] has a commendable 174 citations.

Turning to Fig. 12, which delineates the keywords employed in this research topic, it is evident that “green finance” reigns supreme as the most frequently used keyword. The subsequent prominent keywords included “China,” “sustainable development,” “renewable energy,” and “sustainable finance.” The less prevalent keywords contributing to the topic include “carbon neutrality,” “circular economy,” “environmental protection,” and “ESG” (1%).

Figure 13 unveils the evolving trends within this topic. The keyword "SMES" initiates a growing trend from 2020 to 2022. In 2021, a new trend emerged with the keyword “sustainable finance.” The year 2022 witnessed the introduction of additional trends associated with keywords such as “green finance,” “China,” “sustainable development,” “sustainability,” and “economic growth,” all of which extended into 2023. This temporal analysis provides valuable insights into the shifting focus and emerging themes within the discourse on sustainable finance models for smallholder farmers.

3.4 Clustering

Clustering by a coupling map utilizes the concept of coupling maps to categorize documents based on their citation patterns. This approach groups documents that are frequently cited together, forming clusters on a plot divided into quadrants. The x-axis represents centrality, indicating the importance or influence of a unit in the network, while the y-axis represents the impact. Different-sized and colored clusters on the plot signify distinct topics. As per Fig. 14, the results of clustering by a coupling map reveal the presence of 10 clusters:

Cluster 1: Green finance, China and sustainable development.

Cluster 2: Green finance, sustainable development and fuzzy air.

Cluster 3: Green finance, renewable energy, and bibliometric analysis.

Cluster 4: Green finance, CO2 emissions, and China.

Cluster 5: Green finance, green financing and green bonds.

Cluster 6: Sustainable finance, SDGs, and sustainability.

Cluster 7: Green finance, renewable energy, and China.

Cluster 8: Green finance, energy efficiency, and China.

Cluster 9: Renewables, Chinese cities, and Chinese provinces.

Cluster 10: Green finance, asset pricing, and bitcoin.

These clusters provide a comprehensive overview of the thematic groupings within the field, showcasing the interconnectedness of topics and highlighting key areas of focus in the research landscape related to sustainable and green finance, particularly in the context of China.

3.5 Conceptual structure

As depicted in Fig. 15, Green Finance stands out as the central node in the research network on this topic. Within this network, at least seven different colors represent distinct research themes. Green signifies aspects related to the conceptualization of green finance, red relates to energy, and blue denotes sustainable finance. Additionally, purple corresponds to green financing. Furthermore, shades of pink, brown, and yellow represent greenwashing, green credit policy, and environmental issues, respectively. The co-occurrence heatmap is illustrated in Fig. 16.

Based on the heatmap, it can be inferred that interest in environmental issues, particularly green finance, is steadily increasing. This is evident from the prevalence of red dominating the heatmap, which indicates that these words or phrases frequently appear in the analyzed documents. This underscores that green finance is currently one of the most captivating topics for researchers.

Other words or phrases associated with green finance, such as “green innovation,” “financial development,” and “sustainability,” also recurrently appear in the analyzed documents. This indicates a growing interest in broader environmental issues as well.

Moreover, words or phrases related to the implementation of green finance, such as “green investments,” “green bonds,” and “green transformation,” are also frequently present in the analyzed documents. These findings suggest that researchers are increasingly eager to explore how green finance can be applied in everyday life. The interconnectedness of these terms reflects a comprehensive and expanding research landscape in the realm of green finance and its broader environmental implications.

Figure 17 presents a thematic evolution with four quadrants categorizing themes based on relevance degree (centrality) and development degree (density). The four quadrants are motor themes, niche themes, emerging or declining themes, and basic themes.

-

Motor Themes: These are foundational themes with high development and influence, representing the most important and widely studied aspects of the field. They exhibit high centrality and density, indicating frequent citations and strong connections to other themes. The ESG, green credit, and microfinance clusters fall into this category.

-

Niche Themes: These are smaller, specialized areas of research that may be less developed but hold the potential for significant contributions. Niche themes typically have a lower degree of centrality but a high degree of density. Cluster digital finance is considered a niche theme.

-

Emerging or declining themes: These are new or newly recognized areas of research showing signs of growth. They attract increasing amounts of attention and generate new ideas. Conversely, declining themes are losing popularity or importance. Sustainable financing and environmental performance are included in this category.

-

Basic Themes: Fundamental concepts shared across research fields, providing a common language. Basic themes have high centrality but can vary in density. Green finance, SMEs, COVID-19, renewable energy, and sustainable finance are classified as basic themes.

The results of the factorial analysis shown in Fig. 18 reveal four clusters marked by keywords in red, green, blue, and purple. The first cluster (red) is related to conceptual green finance. The second cluster (green) is related to policies to support green finance. Furthermore, the third cluster (blue) concerns sustainable finance, while the fourth cluster (purple) concerns technology and innovation.

3.6 Intellectual structure

Figure 19 represents a cocitation network that visually depicts the relationships between documents cocited by other documents. The intensity of cocitation reflects the semantic similarity between documents; higher cocitation values indicate greater semantic similarity, while lower values indicate lower similarity. Cocitation networks are instrumental in identifying existing topics or research fields within a scientific domain and revealing relationships between these topics or fields.

In this figure, each node represents a document labeled with the author’s name and publication year. Each edge signifies a cocitation relationship between 2 nodes. Nodes of the same color belong to the same cluster, indicating high semantic similarity. Conversely, nodes with low cocitation values are in different clusters, suggesting lower semantic similarity. The largest and densest cluster is the red cluster, potentially indicating a dominant research topic or field. The smallest and least dense cluster is the blue cluster, potentially representing a less popular research topic. The green and purple clusters are intermediate, suggesting the development of research topics or fields.

This figure can be used to analyze trends, patterns, and relationships among documents relevant to a specific research topic or field. By examining the figure, one can identify the most influential documents, those frequently cocited by others, documents most related to a specific research topic or field, and those that are newer or older. This figure aids in discovering relevant documents based on interests by examining existing clusters and their nodes. Moreover, identifying research gaps can be improved by examining less dense or rare clusters and nodes less connected to other clusters. Moreover, the figure assists in finding research opportunities by examining new or developing clusters and nodes with high cocitation values with other nodes.

3.7 Social structure

Figure 20 illustrates a collaboration network, a graphical representation of collaboration among researchers involved in scholarly publications. The network consists of colored circles representing researchers and connecting lines depicting collaborative relationships. From this network, it is evident that three groups of researchers collaborate intensively—namely, the red, green, and blue groups. Additionally, some researchers engage in interdisciplinary collaboration, as shown by the green nodes connecting with the red and yellow nodes. Overall, this collaboration network indicates strong collaboration among authors from diverse backgrounds and locations, likely driven by shared interests in specific research areas.

The country collaboration world map, as presented in Fig. 21, is a visual representation of collaboration between different countries. This map displays countries collaborating with each other and the level of their cooperation. The countries are depicted in shades of blue, ranging from light blue to dark blue. Various countries are connected by lines of different thicknesses, where thicker lines indicate closer research collaboration between the respective countries on this topic.

From the figure, it can be inferred that China serves as the epicenter, not only producing a significant number of articles but also collaborating with various countries across continents. International research collaboration has numerous benefits, such as enhancing research productivity, expanding access to research resources, improving research quality, and fostering cross-cultural understanding.

4 Discussion

The bibliometric analysis of sustainable finance for smallholder farmers provides a nuanced understanding of the current research landscape. While discussions predominantly revolve around green finance, it is crucial to acknowledge that sustainable finance extends beyond environmental considerations. Green finance refers to the financing of investments that yield environmental benefits [33]. Moreover, sustainable finance can be used to finance projects with environmental, social, and economic benefits, as well as benefits to other SDGs. Figure 22 shows a pyramid of sustainable finance, which illustrates the components of sustainable finance. This pyramid aligns with the sustainable finance system roadmap outlined by [34] and [35]. The literature indicates that appropriate sustainable development always requires innovative technologies. It is important to acknowledge the role of technology in achieving this goal [36]. In Ref. [37] noted that agricultural technology can increase agricultural carbon productivity not only locally but also nearby because it has positive spatial spillovers. This is why technology can be one of the building blocks of a sustainable financial system. This research reveals a significant gap in the exploration of sustainable finance models, with only a limited 6% of the keywords concentrating on sustainable finance and no occurrences of sustainable financing identified.

Figure 13 underscores the dominance of green finance over sustainable finance, highlighting a critical imbalance in scholarly attention. Cluster 6, encompassing sustainability finance, SDGs, and sustainability, lacks centrality, indicating a need for future research to elevate its importance within the scholarly network. This finding suggests that sustainable finance, despite its potential, has yet to receive the attention it deserves in academic discourse. In Ref. [38] showcase the crucial role that financial technology (fintech) plays in enhancing agricultural productivity and sustainability. Through fintech, smallholder farmers can contribute to achieving multiple SDGs. Access to financing, market information, and precision agriculture tools empowers them to alleviate poverty (SDG 1), promote responsible consumption and production (SDG 12), and strengthen food security and improved nutrition (SDG 2). Additionally, digital finance acts as a catalyst for green innovation, slashing carbon footprints [39] by enabling renewable energy solutions and sustainable resource management, ultimately contributing to climate action (SDG 13). Reducing emissions is expected to boost agricultural supply and productivity, further diminishing malnutrition and bolstering food security [40]. This position of fintech is key for helping a thriving, resilient agricultural sector that prioritizes both economic prosperity and environmental responsibility.

Conceptually, Fig. 15 elucidates the gap between green finance and sustainable finance. While green finance is intricately connected to various concepts, such as financial and economic development, green technology innovation, and renewable energy, sustainable finance remains underdeveloped and is primarily linked to concepts such as the circular economy, ESG, climate change, and bibliometric analysis.

According to [41], sustainable finance and the circular economy are interconnected concepts that aim to address environmental, social and governance (ESG) challenges. Sustainable finance involves considering environmental and social factors when making investment decisions, and the circular economy is a framework that aims to reduce resource-mediated environmental risks and impacts. In the context of climate change, sustainable finance plays a crucial role in supporting climate change mitigation and adaptation efforts.

Interestingly, despite being in the emerging or declining themes quadrant, sustainable financing shows positive signs of growth in the thematic evolution map. Keywords such as ESG, SDG, climate risk, and sustainable banking converge into a motor theme, indicating a potential upward trajectory for sustainable financing as an emerging theme. This signifies that, although currently underexplored, sustainable financing holds promise for future research and development.

Figure 18 reinforces the interconnected nature of sustainable finance, ESG, and SDGs. This unity further emphasizes the importance of delving into the multifaceted dimensions of sustainable finance, particularly in the context of smallholder farmers adopting innovative agricultural technologies for enhanced sustainability. Traditional financing may fall short in meeting the specific needs of these farmers, making the development of tailored financial models crucial.

The global collaboration among 1,042 authors engaged in sustainable finance research, with an impressive 39.18% international coauthorship, indicating a shared commitment to addressing challenges faced by smallholder farmers. China has emerged as a significant contributor, with researchers such as Liu Z, Wang L, and Wang Y playing prominent roles. Affiliations, such as China University of Geosciences and Fuzhou University of International Studies and Trade, underscore China's pivotal role in shaping the discourse.

However, keyword analysis reveals a notable gap in attention given to practical implementation. While green financing keywords dominate at 31%, discussions on green financing constitute only 4%, indicating a gap in the exploration of the practical aspects of green financial models. Although sustainable finance has a limited capacity (6%), it lacks attention in terms of practical application, and no instances of sustainable financing have been identified.

Figure 5 highlights specific journals such as Environmental Science and Pollution Research, Resources Policy, Sustainability (Switzerland), and Renewable Energy as core sources shaping the discourse on sustainable finance. As illustrated in Fig. 19, China’s leading position in citations further emphasizes the global impact of research on sustainable finance models for smallholder farmers, with the most cited article, [30], playing a pivotal role.

The collaboration network depicted in Fig. 20 shows intense interdisciplinary collaboration among researchers, denoted by distinct groups in red, green, and blue. This diversity of expertise and shared interests in specific research areas contributes to the richness of the research landscape.

Figure 21's Countries’ collaboration world map underscores China’s central role in producing articles and collaborating extensively across continents. This international collaboration enhances research productivity, expands access to resources, and fosters cross-cultural understanding.

As the scholarly community navigates the evolving discourse, future research directions will play a pivotal role in shaping the development of sustainable finance models for smallholder farmers. Addressing knowledge gaps, fostering interdisciplinary collaboration, contributing to impactful journals, and focusing on financial aspects such as risk, profitability, and accessibility will be instrumental in furthering the effectiveness of sustainable financial models. Comprehensive research covering various aspects, including technology, agriculture, and policy, is essential for developing holistic and sustainable finance models for smallholder farmers adopting new agricultural technology/innovation. In addition, [42], who demonstrates robust studies that delve into implementation aspects and the consideration of trade-offs concerning equity, costs, finance, infrastructure, and technology access. The potential for transformative contributions to agricultural sustainability through sustainable financial models remains a promising avenue for future exploration.

5 Conclusion

This bibliometric analysis of sustainable finance models for smallholder farmers highlights a predominant focus on green finance, revealing a notable gap in the scholarly exploration of sustainable finance. The conceptual disparity between these themes emphasizes the need for broader research. While sustainable financing has emerged as an underexplored but promising theme, global collaboration, citation patterns, and journal selectivity underscore the relevance and recognition of this research. The study concludes by urging scholars to delve deeper into sustainable finance models, particularly tailored solutions for smallholder farmers adopting innovative agricultural technologies. Addressing identified gaps will contribute to transformative advancements in agricultural sustainability through effective financial models.

6 Recommendations and implications

This study suggests researchers need to broaden their focus on sustainable finance for smallholder farmers beyond green finance and environmental issues. Furthermore, sustainable finance is an underexplored topic that requires additional research, as it can affect the adoption of innovative agricultural technologies by smallholder farmers. The suggestion also continues to interdisciplinary and global collaboration among researchers, policymakers, and practitioners that is essential for addressing the complex dimensions of sustainable finance and developing effective models and policies. Future research should emphasize the practical implementation and longitudinal analysis of sustainable finance models to evaluate their challenges and impact over time. These recommendations and implications aim to guide future research efforts, fostering a more inclusive, impactful, and actionable body of knowledge in the realm of sustainable finance models for smallholder farmers.

Data availability

The authors confirm that the data supporting the findings of this study are available upon request from the corresponding author and the supplementary materials.

Code availability

Not applicable.

References

Intriago Zambrano JC, Diehl J, Ertsen MW. Sustainable business models for smallholder farmers: challenges for and lessons from the Barsha pump experience. Business Strategy & Development. 2023;6:684.

Fujimori S, Hasegawa T, Oshiro K, Zhao S, Sasaki K, Takakura J, et al. Potential side effects of climate change mitigation on poverty and countermeasures. Sustain Sci. 2023;18:2245–57.

Hatzenbuehler P, Peña-Lévano L. Adoption potential of sustainability-related agriculture technologies for smallholder farmers in the Global South. Sustainability. 2022;14:13176.

Huang JK, Wang YJ. Financing sustainable agriculture under climate change. J Integr Agric. 2014;13:698–712.

Tofu DA, Woldeamanuel T, Haile F. Smallholder farmers’ vulnerability and adaptation to climate change induced shocks: the case of Northern Ethiopia highlands. J Agric Food Res. 2022;8: 100312.

Zeleke T, Beyene F, Deressa T, Yousuf J, Kebede T. Vulnerability of smallholder farmers to climate change-induced shocks in East Hararghe zone, Ethiopia. Sustainability. 2021;13:2162.

Alidu A-F, Man N, Ramli NN, Haris NBM, Alhassan A. Smallholder farmers access to climate information and climate smart adaptation practices in the northern region of Ghana. Heliyon. 2022. https://doi.org/10.1016/j.heliyon.2022.e09513.

Wulandari E, Meuwissen MPM, Karmana MH, Oude Lansink AGJM. The role of access to finance from different finance providers in production risks of horticulture in Indonesia. PLoS One. 2021. https://doi.org/10.1371/journal.pone.0257812.

Appiah-Twumasi M, Donkoh SA, Ansah IGK. Innovations in smallholder agricultural financing and economic efficiency of maize production in Ghana’s northern region. Heliyon. 2022;8: e12087.

Wang H, Zhang L. The effect of environmental cognition on farmers’ use behavior of organic fertilizer. Environ Dev Sustain. 2023. https://doi.org/10.1007/s10668-023-04275-w.

Yıldırım DÇ, Demirtaş I, Yıldırım S, Turan T. The role of financial inclusion and human capital on the ecological deficit. Environ Dev Sustain. 2023. https://doi.org/10.1007/s10668-023-04181-1.

Wulandari E, Karyani T, Ernah, Alamsyah RTP. What makes farmers record farm financial transactions? Empirical evidence from potato farmers in Indonesia. Int J Fin Stud. 2023;11:1–11.

Jayaram R, Singh S. Sustainable finance: a systematic review. Int J Ind Cult Bus Manage. 2020;21:317–39.

Toxopeus H, Polzin F. Reviewing financing barriers and strategies for urban nature-based solutions. J Environ Manage. 2021;289: 112371.

Cunha FA, Meira E, Orsato RJ. Sustainable finance and investment: review and research agenda. Bus Strategy Environ. 2021;30:3821–38.

Purnomo A, Sari AK, Susanti T, Mannan SSA, Lumentut T. Sustainable finance study of bibliometric overview. IOP Conf Ser Earth Environ Sci. 2021. https://doi.org/10.1088/1755-1315/729/1/012124.

Kumar S, Sharma D, Rao S, Lim WM, Mangla SK. Past, present, and future of sustainable finance: insights from big data analytics through machine learning of scholarly research. Ann Oper Res. 2022. https://doi.org/10.1007/s10479-021-04410-8.

Luo W, Tian Z, Zhong S, Lyu Q, Deng M. Global evolution of research on sustainable finance from 2000 to 2021: a bibliometric analysis on WoS database. Sustainability. 2022;14:9435.

Rodriguez-Rojas MD, Clemente-Almendros JA, El Zein SA, Seguí-Amortegui L. Taxonomy and tendencies in sustainable finance: a comprehensive literature analysis. Front Environ Sci. 2022. https://doi.org/10.3389/fenvs.2022.940526.

Kashi A, Shah ME. Bibliometric review on sustainable finance. Sustainability. 2023;15:7119.

Becker M, de Lima MVA, Webber JB. Green, climate and sustainable finance: a bibliometric analysis. São Paulo: Seven Editora; 2023.

Dimmelmeier A. Sustainable finance as a contested concept: tracing the evolution of five frames between 1998 and 2018. J Sustain Fin Invest. 2023;13:1600–23.

Pritchard A. Statistical bibliography or bibliometrics. J Doc. 1969;25:348.

Diem A, Wolter SC. The use of bibliometrics to measure research performance in education sciences. Res High Educ. 2013;54:86–114.

Aria M, Cuccurullo C. Bibliometrix: an R-tool for comprehensive science mapping analysis. J Informetr. 2017;11:959–75.

Costa DF, de Melo Carvalho F, de Melo Moreira BC, do Prado JW. Bibliometric analysis on the association between behavioral finance and decision making with cognitive biases such as overconfidence, anchoring effect and confirmation bias. Scientometrics. 2017;111: 1775–99. https://doi.org/10.1007/s11192-017-2371-5

do Prado JW, de Castro Alcântara V, de Melo Carvalho F, Vieira KC, Machado LKC, Tonelli DF. Multivariate analysis of credit risk and bankruptcy research data: a bibliometric study involving different knowledge fields (1968–2014). Scientometrics. 2016; 106:1007–29. https://doi.org/10.1007/s11192-015-1829-6.

Maia SC, de Benedicto GC, do Prado JW, Robb DA, de Almeida Bispo ON, de Brito MJ. Mapping the literature on credit unions: a bibliometric investigation grounded in Scopus and Web of Science. Scientometrics. 2019; 120: 929–60. https://doi.org/10.1007/s11192-019-03165-1.

Hakkarainen V, Ovaska U, Soini K, Vainio A. ‘Being’and ‘doing’: interconnections between researcher identity and conceptualizations of sustainability research. Sustain Sci. 2023;18:2341–55.

Zhou X, Tang X, Zhang R. Impact of green finance on economic development and environmental quality: a study based on provincial panel data from China. Environ Sci Pollut Res. 2020;27:19915–32.

Muganyi T, Yan L, Sun H. Green finance, fintech and environmental protection: evidence from China. Environ Sci Ecotechnol. 2021;7: 100107.

Hsu C-C, Quang-Thanh N, Chien F, Li L, Mohsin M. Evaluating green innovation and performance of financial development: mediating concerns of environmental regulation. Environ Sci Pollut Res. 2021;28:57386–97.

Klein A, Widge V, Bergedieck L, Maheshwari A, Avendano Ugaz F. Green finance: a bottom-up approach to track existing flows (vol. 2): full report (English) [Internet]. Washington, D.C.; 2019 Nov. Report No.: 143345. https://documents.worldbank.org/en/publication/documents-reports/documentdetail/788041573021878350/full-report

Robins N, Zadek S, Li W, Rooprai G, Perry F, Avendaño F, et al. Roadmap for a sustainable financial system (English). Washington, D.C.; 2017 Nov. http://unepinquiry.org/wp-content/uploads/2017/11/Roadmap_for_a_Sustainable_Financial_System.pdf

Mashari DPS, Zagloel TYM, Soesilo TEB, Maftuchah I. A bibliometric and literature review: alignment of green finance and carbon trading. Sustainability. 2023;15:7877.

Ion I, Gheorghe FF. The innovator role of technologies in waste management towards the sustainable development. Proc Econ Fin. 2014;8:420–8.

Liu J, Yuan Y, Lin C, Chen L. Do agricultural technical efficiency and technical progress drive agricultural carbon productivity? based on spatial spillovers and threshold effects. Environ Dev Sustain. 2023. https://doi.org/10.1007/s10668-023-04217-6.

Mapanje O, Karuaihe S, Machethe C, Amis M. Financing sustainable agriculture in Sub-Saharan Africa: a review of the role of financial technologies. Sustainability. 2023. https://doi.org/10.3390/su15054587.

Javeed SA, Cai X, Latief R. Driving sustainable growth by unlocking the power of digital finance functions: the moderation of environmental regulations. Environ Dev Sustain. 2023. https://doi.org/10.1007/s10668-023-04244-3.

Adesete AA, Olanubi OE, Dauda RO. Climate change and food security in selected Sub-Saharan African Countries. Environ Dev Sustain. 2023;25:14623–41. https://doi.org/10.1007/s10668-022-02681-0.

Sepetis A. Sustainable finance and circular economy. Circular economy and sustainability: Volume 1: Management and Policy. 2022; 207–26.

Halsnæs K, Some S, Pathak M. Beyond synergies: understanding SDG trade-offs, equity and implementation challenges of sectoral climate change mitigation options. Sustain Sci. 2023;19:1–15.

Acknowledgements

The authors would like to thank Universitas Padjadjaran for funding this article.

Funding

Open access funding provided by University of Padjadjaran. The authors would like to thank Universitas Padjadjaran for funding this article.

Author information

Authors and Affiliations

Contributions

All authors contributed to the study conception and design. Material preparation, data collection and analysis were performed by Raden Trizaldi Prima Alamsyah, Eliana Wulandari, Zumi Saidah, and Hepi Hapsari. The first draft of the manuscript was written by Raden Trizaldi Prima Alamsyah and all authors commented on previous versions of the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Alamsyah, R.T.P., Wulandari, E., Saidah, Z. et al. Discovering sustainable finance models for smallholder farmers: a bibliometric approach to agricultural innovation adoption. Discov Sustain 5, 107 (2024). https://doi.org/10.1007/s43621-024-00277-4

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s43621-024-00277-4