Abstract

Technology is paving innovative ways to provide financial services and improve the efficiency of financial systems. Since it is a dynamic field of research, it is important to look back on the ever-changing field of financial technology. This paper aims to analyse the existing research on financial technology through a bibliometric approach. The data were gathered from the Scopus database using secondary sources, and the analysis is presented descriptively along with science-mapping techniques. This paper offers an overview of the influential journals, authors, and organizations contributing to financial technology research. The study focuses on citation, cocitation, bibliographic coupling, and coauthorship analysis within the collected corpus. It is worth noting that this study is limited by the use of only one database, Scopus and excludes grey literature, this could lead to skewed results but this can be an arena for future research.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In the new era of digitalization, technology is disrupting traditional systems. One such disruption was coupled with the introduction of technology to the age-old field of finance. The intersection of finance and technology has given rise to a ground breaking phenomenon known as financial technology or fintech [1,2,3,4,5]. This transformative field has revolutionized how we manage, invest, and transact in finance, introducing innovative solutions that harness the power of cutting-edge technologies such as artificial intelligence, blockchain, and mobile applications [6,7,8,9]. As the fintech landscape continues to evolve astonishingly, there is a growing need to comprehend its vast scope, track its progress, and identify emerging trends and research directions [10, 11].

In response to this need, bibliometric analysis, an empirical methodology that employs quantitative indicators to evaluate scholarly publications, has emerged as a valuable tool for understanding the research landscape within a particular domain. Bibliometric analyses provide a comprehensive overview of a field's intellectual structure and knowledge flow, guiding researchers, policymakers, and industry practitioners in navigating complex terrain by examining publication patterns, citation networks, and collaboration trends.

This review article presents a meticulous bibliometric analysis of the Financial Technology domain, offering a panoramic view of the field's growth, influential contributors, and prominent research themes [12, 13].

Furthermore, this paper delves into the geographic distribution of research activity in fintech, revealing regional hotspots and identifying potential areas for international collaboration and knowledge exchange [14,15,16]. By understanding the global landscape of fintech research, policymakers and industry stakeholders can foster an environment conducive to innovation, regulatory frameworks, and strategic partnerships [17,18,19]. This bibliometric analysis serves as a valuable resource for researchers, policymakers, industry professionals, and academicians interested in the vibrant world of financial technology. The subsequent sections of the paper provide a detailed account of the study's objectives, research methodology, findings, conclusion, and references.

2 Objectives of the study

-

1.

To identify the most influential sources, organizations, and countries that published documents on finance technology.

-

2.

To analyse the development of foundational themes and present research development on finance technology.

-

3.

To recognize coauthorship between authors, organizations, and countries and its research trends in financial technology.

3 Research methodology

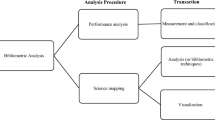

The two basic methods used in bibliometric analysis are science mapping and performance analysis [20,21,22]. The former examines the fundamental aspects of the data, such as year, nation, author, funding, etc., and describes the physical traits of the research participants [23,24,25]. The latter is science mapping, which can be performed using citation analysis, cocitation analysis, bibliographic coupling, or coauthorship analysis. Subsection 3.1 discusses a descriptive study of the gathered literature, and subsection 3.2 discusses the outcomes of scientific mapping.

3.1 Research software

VOSviewer is a software tool utilized for creating, displaying, and examining bibliometric networks. These networks can include authors, organizations, sources, etc. [19,20,21,22] VOSviewer enables the visualization of these networks with unprecedented speed and scalability, surpassing what can be accomplished manually. The study employs VOSviewer version 1.6.18 for these purposes.

3.2 Data sources and search strategy

The literature on financial technology was extracted from the Scopus database (https://www.scopus.com/). The following search strategy was formulated using the query string:

TITLE-ABS-KEY ("Fintech" OR "Finance Technology" OR "Financial Technology").

This query aimed to identify relevant documents that contained these key terms in their title, abstract, or keywords. A total of 1073 documents were initially extracted from the search. The inclusion criterion was applied to narrow the selection, limiting the document type to only articles. To ensure consistency and language accessibility, an exclusion criterion was applied to exclude documents written in languages other than English. Any documents labelled "in the press" were also excluded from the final selection: the selected documents and the literature on financial technology. A specific time frame limited the collection of documents, and all articles available from 1988 to 20222 were included.

4 Analysis and findings

Bibliometric analysis encompasses two primary methods: descriptive analysis and performance analysis Descriptive analysis focuses on exploring the essential characteristics of the data, such as the year of publication, country of origin, authorship, funding sources, and other relevant factors that describe the attributes of the research participants [17,18,19,20]. On the other hand, performance analysis involves science mapping techniques, which include bibliometric coupling, coword analysis, coauthorship analysis, citation analysis, and cocitation analysis [12].

4.1 Descriptive analysis of the collected documents

-

(a)

Year wise classification

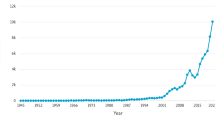

The publication timeline of the collected documents is depicted in Fig. 1. The analysis reveals that the documents span from 1998 to 2022. Among the collected documents, the highest number (385 documents) were published in 2022. It is important to note that the year 2023 was excluded from the analysis because the study was conducted before the completion of that year. Furthermore, the data indicate a noticeable increase in the number of documents published since 2016. This suggests a growing interest and focus on the topic of the study, as reflected in the rising volume of publications in subsequent years.

-

(b)

Countrywise distribution

From the collected data, China and the United Kingdom were the top publishing documents on Financial Technology, followed by the United States, Indonesia, Malaysia, South Korea, Italy, and India; Fig. 2 illustrates the countrywise distribution of the documents.

-

(c)

Sponsors

Research requires significant time and funding. Securing funding is competitive, with researchers seeking support from various sources. In the studied field, the National Natural Science Foundation of China sponsored the highest number of researchers (43). These funding bodies recognized the research's value and provided financial support. Other sponsors mentioned in Fig. 3 include the Horizon 2020 Framework Programme National Office for Philosophy and Social Sciences, the European Commission, the European Research Council, and the Economic and Social Research Council [1]. These organizations have contributed to the field, showcasing diverse funding sources for the studies conducted.

4.2 Science mapping

The following subsections present the science mapping of the collected corpus using citation analysis, cocitation analysis, bibliometric coupling, coword occurrence, and coauthorship analysis.

4.2.1 Citation analysis

-

(a)

Source

If we assume that citation is the only parameter for calculating the impact of a source, then IEEE Access, with a total of 858 citations, can be crowned the same way. Other sources with high citations include Sustainability (Switzerland), 825 citations, and Technological Forecasting and Social Change (795 citations). These sources are the most influential in the domain of financial technology (Fig. 4).

-

(b)

Authors

When the authors are taken as the frame of reference, the most cited author is the document “On the Fintech Revolution: Interpreting the Forces of Innovation, Disruption, and Transformation in Financial Services”, authored by Peter Gomber, Robert J. Kauffman, Chris Parker, and Bruce W. Weber has the highest citation count of 505, followed by the document Integration: the key to implementing the Sustainable Development Goals authored by David J Griggs, Owen Gaffney, Farooq Ullah, Belinda Reyers, Norichika Kanie, Bjorn Stigson, Paul Shrivastava, Melissa Leach, and Deborah A. O’Connell, with a citation count of 448 (Fig. 5).

-

(c)

Countries

A total of 107 countries were involved in studies on financial technology. A minimum threshold of fifteen documents was set to establish eligibility, resulting in 30 countries meeting the exclusion criteria. The United Kingdom was the most cited organization with 5443 citations, followed by China with 3173 citations. A comprehensive analysis of the number of citations and document representation can be found in Table 1 (Appendix). Therefore, based on these data, it can be concluded that the United Kingdom is the most influential country in publishing documents on financial technology. Figure 6 provides a network visualization representing a country as a unit of measurement in citation analysis.

Citation analysis of countries as units (refer to Table 2, appendix)

4.2.2 Cocitation analysis

-

(a)

Cited references

Now, considering the cocitation analysis of sources, it is important to understand that the documents were cited together in another document. Figure 7 shows that there are two main clusters of sources of publications on financial technology. The documents with the highest link strength are Fintech and Regtech: Impact on Regulators and Banks (Link strength = 10, citations = 24), authored by Ioannis Anagnostopoulos. Another prominent document is Fintech: Ecosystem, Business Models, Investment Decisions, and Challenges (Link strength = 10, citations = 22) by In Lee and Yong Jae Shin. These two documents can be attributed mostly to building foundational knowledge in financial technology.

-

(b)

Authors

Cocitation analysis involves examining the authors of publications cited together in another source. Figure 8 shows the presence of four main clusters of authors focusing on financial technology. Among these authors, R. P. Buckley.

Cocitation analysis of authors of publications (refer to Table 3, appendix)

stands out with the highest link strength, which measures the number and quality of citations he has received (link strength = 241.36, citations = 262). Based on the analysis, several notable authors associated with research on financial technology are R. P. Buckley, D.W. Arner (link strength = 235.72), and Y. Zhang (link strength = 200.88).

4.2.3 Bibliographic coupling

-

(a)

Sources

Sources trace the origin of an article, book, or editorial to the publisher. By examining a map from the combination of these sources, it becomes clear that Sustainability (Switzerland) is the publisher that has recently released documents on financial technology (refer to Fig. 9). Sustainability, an open access journal published by the MDPI, is a scholarly publication that encompasses the environmental, cultural, economic, and social aspects of human sustainability. This international and cross-disciplinary journal serves as an esteemed platform for exploring sustainability and sustainable development. With a semimonthly online release, it offers an advanced forum for research in this field, employing a peer-review process to ensure the quality of its content.

-

(b)

Authors

Citation analysis of countries as units (refer to Table 2, Appendix)

Bibliographic coupling refers to mapping authors who have been cited together in the references of a single document. This approach assumes that references cited together share thematic connections. This coupling method aims to identify authors who have conducted research in a specific domain, such as financial technology. In this study, a minimum of three documents was set as the eligibility criterion for each author, resulting in the selection of 4 out of 1036 authors. Figure 10 visually represents the density of bibliographic coupling, focusing on the four specific authors. Among them, N. Bernards has the highest link strength, determined by the number of connections with other authors (link strength = 29) and the number of citations received (83). Other noteworthy authors in this network include P. Langley, A. Leyshon, P. K. Ozili, and D. D. Tewari.

-

(c)

Country

Bibliographic coupling of the source as a unit (refer to Table 4, appendix)

Similarly, in this case, bibliographic coupling represents the scientific mapping of the countries that have been cited together in the references of a single document. The assumption is that references that are cited together have thematic connections. The motive behind this coupling is to find the authors who have indulged in the research on a specific domain, i.e., financial technology. To filter the 107 countries, a minimum of 5 documents were considered eligible. Figure 11 depicts the mapping of the bibliographic coupling of the eligible 60 countries. The country with the highest link strength is the United Kingdom (link strength = 14974, citations = 5443). Other significant countries involved in this research are China, the United States of America, Australia, Germany, Malaysia, India, Singapore, Spain, and Finland [3, 11].

4.2.4 Coword analysis

A coword analysis operates under the assumption that academic publications primarily describe their study material through author-defined keywords. This analysis uncovers the main areas of interest within a research topic by examining the relationships between cooccurring terms. When two relevant keywords appear together in the same document, this suggests a bibliometric association between the subjects related to those keywords. In this study, the search was conducted in the Scopus database with a specific focus on 'financial technology', which explains why it has emerged as the most frequently cooccurring keyword.

Initially, 703 documents contained a total of 2941 author keywords. A minimum occurrence threshold of 5 was applied to narrow the analysis, resulting in the selection and mapping of 137 keywords. The network visualization of these 137 words is presented in Fig. 12. The keyword 'financial technology' takes the lead, with 463 occurrences and a link strength of 792. Other significant keywords in the network include 'blockchain,' financial inclusion,' 'cryptocurrency,' 'bitcoin,' 'innovation,' and 'COVID-19.' Network visualization revealed nine distinct thematic clusters. The first cluster, containing 27 items, mainly focuses on the social benefits of financial technology and thus includes matters such as inclusion, sustainable development, poverty, insurance, and microfinance. The second cluster pertains to the stability of financial systems. Words such as 'financial regulation', 'risk', and 'stability’ can be observed within this cluster.

On the other hand, the fourth and fifth clusters revolve around emerging innovations in the field of financial technology, such as blockchain, cryptocurrency, artificial intelligence, machine learning, and smart contracts. The fifth and sixth clusters focus on the impact of COVID-19 on financial systems worldwide. This can be inferred from keywords such as 'pandemic', 'digital transformation', and ‘digitalization.' The last three clusters are engaged in the general way in which financial technology has the capability to transform financial institutions and services worldwide.

4.2.5 Coauthorship analysis

Coauthorship analysis examines the connections among researchers, focusing on how they collaborate. Understanding academic collaboration is important because coauthorship is a formal way for researchers to collaborate on ideas. In the context of the field of 'financial technology',' we utilize coauthorship analysis to identify notable academic collaborations among organizations and countries. Figure 13 illustrates all the organizations involved in the 1073 documents, with 5 clusters of authors collaborating. Notable collaborating organizations include the Chinese Academy of Social Sciences, the University of Aberdeen Business School, and the University of Edinburgh Business School.

Another group of collaborating institutes includes Montpellier Business School, Portsmouth Business School, Institute of Finance and Development, Nankai University, Judge Business School, and University of Cambridge. Figure 14 depicts the academic network among countries. Furthermore, countries such as China, the United Kingdom, the United States of America, Australia, Finland, Indonesia, and Malaysia are prominent in coauthorship activities.

5 Discussion

The bibliometric analysis sheds light on the arena of sociocultural reactions to financial technology around the globe. The volume of publications increased to a large extent beginning in the year 2020; this newfound interest can be attributed to the unprecedented COVID-19 pandemic, which elevated the significance of hands-free transactions. In 2020, just fewer than 100 documents were published, but this number jumped to approximately 400 documents in 2021. Regarding country-wide distribution, China and the United Kingdom are the lead researchers on financial technology. Additionally, an increasing trend of Asian countries devoting their research to this domain can be observed.

Moreover, the collaborations between countries are balanced. For instance, Asian, European, and North American countries collaborate via established academic networks. The bibliographic coupling reveals that certain European countries, such as the Netherlands, Italy, Belgium, and Luxembourg, produce research on similar topics. It is also noteworthy that although China is crowned for producing most of its literature, the United Kingdom marches ahead regarding citations. This shows that the latter’s work is comparatively more influential. Future research could revolve around blockchain, DeFi, AI, financial inclusion, regulation, and interindustry integration. Policymakers, scholars, and industry professionals should focus more on this field and tap into its promising potential. Anyhow, this study is limited to the literature extracted from one database, Scopus this could lead to an overall bias. Other factors that contributes to potential biases would be the not considering corpus published after 2023. However, these could be avenues for future reviews.

6 Conclusion

The primary aim of this study was to gain a comprehensive understanding of the quantity and characteristics of research conducted in the field of financial technology. Bibliometrics helps measure the impact and influence of sources and documents and identify coauthorship relationships among authors, organizations, and countries. The study showed that the most influential sources, countries, and authors publishing documents on financial technology were IEEE Access, the United Kingdom, Peter Gomber, Robert J. Kauffman, Chris Parker, and Bruce W. Weber, respectively. In the past, significant contributions came from Fintech and Regtech: Impact on Regulators and Banks authored by the Ioannis Anagnostopoulos document and R. P. Buckley as an author. More recently, impactful contributions were made by the country, the United Kingdom, the source, Sustainability (Switzerland), and N. Bernards as the author.

Future research trends in financial technology were identified to be focused on areas such as financial inclusion, regulation, sustainability, and digitalization. Academic collaboration in financial technology was observed primarily among countries such as China and the United Kingdom, organizations such as the Chinese Academy of Social Sciences, and the University of Aberdeen Business School. Some suggestions to surpass the weaknesses of this study would be to use multiple databases and to include grey literature. While doing that, one would be able to arrive at results which are universal in nature.

Data availability

No datasets were generated or analysed during the current study.

References

Perianes-Rodriguez A, Waltman L, van Eck NJ. Constructing bibliometric networks: a comparison between full and fractional counting. J Informet. 2016;10(4):1178–95. https://doi.org/10.1016/j.joi.2016.10.006.

van Eck NJ, Waltman L. VOSviewerVersion (1.6.18). VOSviewer: Visualizing Scientific Landscapes. 2022. https://www.vosviewer.com/. Accessed 25 2022.

Van Eck NJ, Waltman L. Software survey: VOSviewer is a computer program for bibliometric mapping. Scientometrics. 2009;84(2):523–38. https://doi.org/10.1007/s11192-009-0146-3.

Van Eck NJ, Waltman L. Visualizing bibliometric networks. Measuring Scholarly Impact. 2014. https://doi.org/10.1007/978-3-319-10377-8_13.

Hua W, Jiang J, Sun H, Wu J. A blockchain-based peer-to-peer trading framework integrating energy and carbon markets. Appl Energy. 2020;279:115539. https://doi.org/10.1016/j.apenergy.2020.115539.

Saksonova S, Kuzmina-Merlino I. Fintech as financial innovation—the possibilities and problems of implementation. Eur Res Stud J. 2017;1(3A):961–73. https://doi.org/10.35808/ersj/757.

Gabor D, Brooks S. The digital revolution in financial inclusion: international development in the fintech era. New Political Economy. 2016;22(4):423–36. https://doi.org/10.1080/13563467.2017.1259298.

Zhao Q, Tsai PH, Wang JL. Improving financial service innovation strategies for enhancing china’s banking industry competitive advantage during the fintech revolution: a hybrid MCDM model. Sustainability. 2019;11(5):1419. https://doi.org/10.3390/su11051419.

Le LT, Yarovaya L, Nasir MA. Did COVID-19 change spillover patterns between Fintech and other asset classes? Res Int Business Finance. 2021;58:101441. https://doi.org/10.1016/j.ribaf.2021.101441.

Ozili PK. Financial inclusion research around the world: a review. SSRN Electron J. 2020. https://doi.org/10.2139/ssrn.3515515.

Always MK. FinTech in COVID-19 and beyond: what factors are affecting customers’ Choice of FinTech applications? J Open Innovat Technol Market Complexity. 2020;6(4):153. https://doi.org/10.3390/joitmc6040153.

Kang J. Mobile payment in Fintech environment: trends, security challenges, and services. Human-Centric Comput Inform Sci. 2018. https://doi.org/10.1186/s13673-018-0155-4.

Muganyi T, Yan L, Sun HP. Green finance, fintech, and environmental protection: evidence from China. Environ Sci Ecotechnol. 2021;7:100107. https://doi.org/10.1016/j.ese.2021.100107.

Leong C, Tan B, Xiao X, Tan FTC, Sun Y. Nurturing a FinTech ecosystem: The case of a youth microloan startup in China. International Journal of Information Management. 2017;37(2):92–7. https://doi.org/10.1016/j.ijinfomgt.2016.11.006.

Doan HT, Cho J, Kim D. Peer-to-peer energy trading in smart grid through blockchain: a double auction-based game theoretic approach. IEEE Access. 2021;9:49206–18. https://doi.org/10.1109/access.2021.3068730.

Li Y, Spigt R, Swinkels L. The impact of FinTech start-ups on incumbent retail banks’ share prices. Financial Innovat. 2017. https://doi.org/10.1186/s40854-017-0076-7.

Cai CW. Disruption of financial intermediation by FinTech: a review on crowdfunding and blockchain. Account Finance. 2018;58(4):965–92. https://doi.org/10.1111/acfi.12405.

Jones E, Knaack P. Global financial regulation: shortcomings and reform options. Global Policy. 2019;10(2):193–206. https://doi.org/10.1111/1758-5899.12656.

Abad-Segura E, González-Zamar MD, López-Meneses E, Vázquez-Cano E. Financial technology: review of trends. Approaches Manag Math. 2020;8(6):951. https://doi.org/10.3390/math8060951.

Yue P, Korkmaz AG, Yin Z, Zhou H. The rise of digital finance: Financial inclusion or debt trap? Finance Res Lett. 2022;47:102604. https://doi.org/10.1016/j.frl.2021.102604.

Lu Z, Wu J, Li H, Nguyen DK. Local bank, digital financial inclusion and SME financing constraints: empirical evidence from China. Emerging Markets Finance Trade. 2021;58(6):1712–25. https://doi.org/10.1080/1540496x.2021.1923477.

Hommel K, Bican PM. Digital entrepreneurship in finance: fintechs and funding decision criteria. Sustainability. 2020;12(19):8035. https://doi.org/10.3390/su12198035.

Najib M, Ermawati WJ, Fahma F, Endri E, Suhartanto D. FinTech in the small food business and its relation with open innovation. J Open Innovat Technol Market Complexity. 2021;7(1):88. https://doi.org/10.3390/joitmc7010088.

Brown E, Piroska D. Governing fintech and fintech as governance: the regulatory sandbox, riskwashing, and disruptive social classification. New Political Econ. 2021;27(1):19–32. https://doi.org/10.1080/13563467.2021.1910645.

Dospinescu O, Dospinescu N, Agheorghiesei DT. FinTech services and factors determining the expected benefits of users: evidence in romania for millennials and generation Z. EM Ekonomie Manag. 2021;24(2):101–18. https://doi.org/10.15240/tul/001/2021-2-007.

Author information

Authors and Affiliations

Contributions

Original draft, writing: Hannah Biju, Jaheer Mukthar K.P Data Collection and methodology fixing: Amir Dhia, Doris Padmini, JK Singh, Sanjay Singh Funding acquisition: amir Dhia prooofing and second draft: Jaheer Mukthar K.P, Amir Dhia

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

See Tables 1, 2, 3, 4, 5 and 6

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Biju, H., Mukthar, K.P.J., Dhia, A. et al. A bibliometric analysis of financial technology: unveiling the landscape of a rapidly evolving field. Discov Sustain 5, 72 (2024). https://doi.org/10.1007/s43621-024-00256-9

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s43621-024-00256-9