Abstract

Ethiopia has implemented numerous national development plans and strategies to achieve sustainable economic growth at both the national and regional levels, specifically in the Afar region. However, there has been a lack of assessment regarding the outcomes and expected goals of these plans and strategies, particularly for the regional economy. Hence, this study assesses the current and future gross domestic product (GDP) of Ethiopia’s Afar regional state. It analyzes the data using a descriptive and econometric model called autoregressive integrated moving average (ARIMA). The analysis shows that the regional GDP has been increasing over time, but per capita income remains below the national average. The service sector dominates the economy, while the growth of the industry sector has been stagnant. This indicates that development policies have not achieved their goals of reducing poverty and transforming the economy. Using the ARIMA model, it is projected that the Afar regional GDP will gradually increase from 19,300.20 Billion Birr to 21,678.20 Billion Birr between 2023q1 and 2025q4, with an average growth rate of 10%. It is important for development policies to prioritize not just economic growth, but also social development within local communities. This involves addressing issues related to institutional capacity, and governance, and leveraging agricultural resources to benefit agro-pastoralists and pastoralists, as the agricultural sector is the main driver of the economy. By understanding the present and projected GDP of the Afar regional state, policymakers and stakeholders can make informed decisions for sustainable and inclusive economic growth.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

There are several ways to measure economic growth, and some commonly used indicators are gross domestic product (GDP). GDP is a measure of overall economic activity within a country. It represents the market value of all final goods and services produced in a country during a specified time, typically a year. There are three ways to define GDP, all of which yield conceptually identical results. The first method calculates the GDP by summing the total expenditure on all final goods and services within the country during the specified period. This includes personal consumption expenditures, government expenditures, investment expenditures, and net exports [1].

The second approach involves calculating the GDP by aggregating the value added at each production stage across all industries within the country. This entails evaluating the growth in value contributed by each industry to the production process. Moreover, taxes on products are included, while subsidies on products are deducted to obtain the final GDP value. The third method determines the GDP by summing up the income generated through production within the country over the specified timeframe. This encompasses employee compensation (wages, salaries, and benefits), taxes on production and imports, as well as gross operating surplus or profits earned by businesses [1, 2].

Ethiopia, with a population of approximately 123 million as of 2022, is the second most populous country in Africa, trailing only behind Nigeria. In addition to its population size, Ethiopia is one of the fastest-growing economies in the region, with a growth rate of 6.4% in FY2021/22, which is slightly higher than the 6.3% growth in the previous year. GDP in Ethiopia was worth 126.78 billion US dollars in 2022, according to official data from the World Bank. Ethiopia’s gross domestic product (GDP) represents 0.06% of the world economy. Despite this progress, Ethiopia continues to face significant poverty challenges, as reflected by its per capita gross national income of US$ 1020. The supply side drivers of growth were industry and services, while the demand-side drivers were private consumption and investment. Nevertheless, Ethiopia has set a goal to achieve lower-middle-income status before 2025[3].

The increase in GDP was due to 7.6% growth in the service sector, 6.1% increase in agriculture, and 4.9% expansion in the industry sector. Consequently, the proportion of services in the GDP increased from 39.6 to 40%, while the share of agriculture decreased to 32.4%, and the industrial sector fell to 28.9% [4]. The GDP is projected to grow by 5.8% in 2023 and 6.2% in 2024, driven by industry, private consumption, and investment. The peace dividend, rebounding tourism, and the prospect of liberalizing more sectors are expected to boost the growth outlook [5].

The Afar region of the regional state in Ethiopia, with an estimated population of two million, is situated in the northeastern part of Ethiopia. The majority of its inhabitants, known as the Afar people, rely on their cattle for sustenance and livelihoods, as they predominantly lead pastoralist lifestyles [6]. The region is predominantly inhabited by individuals who practice either pastoralism or agro-pastoralism. In 2022, the real regional GDP of Afar stood at 18.33 billion Birr with an average annual growth rate of 5.26%, resulting in a per capita income was 185.9 dollar in real terms, whereas in nominal terms it was 2440.1 dollar [7].

In terms of the contribution of the sectors, the agriculture sector was the dominant sector in the regional economy, with an average contribution of 51% to the total real RGDP (Regional GDP). By 2022, the service sector contributed 31%, while the industry sector accounted for the remaining 18% in 2022 [7]. However, the share of the agricultural sector declined over time from 52.70% in 2012 to 50.84% in 2022. By contrast, the service sector’s contribution to RRGDP increased from 28.15% in 2012 to 30.89% in 2022 [7].

In Ethiopia, different national development plans and strategies have been launched, such as the Sustainable Development and Poverty Reduction Programme (SDPRP) covering 2003–2005; the Plan for Accelerated and Sustained Development to End Poverty (PASDEP) covered from 2005 to 2010, Growth and Transformation Plan I (GTP I) covered from 2010 to 2015; and Growth and Transformation Plan II (GTP II) covered from 2015 to 2020 to insure sustainable development, reducing poverty, and structural transformation of the economy from agriculture to industry-based economy. However, the outcomes and expected goals of these plans and strategies for the regional economy have not yet been evaluated.

GDP forecasts help governments, businesses, and individuals make informed decisions regarding their economic activities. This could include budgeting, investment planning, and policy formulation to promote economic growth. GDP forecasts assist policymakers in understanding the current and future state of the economy. This information is crucial in designing appropriate monetary, fiscal, and trade policies to ensure stability and sustainable growth. By analyzing the drivers of economic growth and potential external factors, policymakers and businesses can implement strategies to mitigate risks and respond to economic shocks. GDP forecasts provide a benchmark for evaluating the effectiveness of economic policies and for measuring the success of economic growth strategies. By comparing actual GDP figures with forecasted values, policymakers can assess the accuracy of their forecasts and make the necessary adjustments [8]. However, no investigations and studies have been conducted to forecast Afar’s regional state GDP so far.

Therefore, many studies have been conducted on GDP forecasting using the autoregressive integrated Moving Average (ARIMA) model for different nations in the world [2, 9,10,11,12,13,14,15,16,17]. For instance, Uwimana, Xiuchun [18] modeled and forecasted Africa’s GDP using time series models from to 1990–2030, found that GDP will grow at a rate of 5.52% and GDP will be $ $10,186.18 billion. Dritsaki [19] forecasted the real GDP of Greece using the ARIMA model and found that Greece’s real GDP rate is steadily improving. The majority of these studies have solely focused on forecasting, neglecting the evaluation of past GDP trends in relation to existing policies and strategies. Furthermore, they have failed to propose suitable policy alternatives to accompany the projected economic growth (GDP). Additionally, no studies have been conducted in Afar to forecast and assess the actual GDP of the region.

In conclusion, this study evaluating the current and predicting the future real GDP of Afar regional state in Ethiopia demands a comprehensive analysis of various economic indicators, influential factors, and development strategies. By considering these aspects, it becomes possible to gain valuable insights into the region’s economic performance and its potential for future growth.

2 Literature review

Gross Domestic Product (GDP) is a widely used indicator to measure the overall performance of an economy. However, estimating GDP forecasting in developing countries like Ethiopia can be challenging due to the limited availability of data and the complexity of the economy. In this literature review, we will discuss some of the key studies that have been conducted on estimating GDP forecasting in Ethiopia.

Ethiopia, the second most populous country in Africa, has been experiencing rapid economic growth over the past few decades. As a result, there has been a growing interest in predicting the country’s future economic performance, particularly its Gross Domestic Product (GDP) growth rate. This literature review aims to provide a comprehensive overview of the existing research on GDP prediction in Ethiopia, highlighting the various approaches, methods, and factors that have been studied.

Tesfaye [17] reviewed the empirical literature on GDP forecasting in Ethiopia and identified the major factors that affect GDP growth. The authors found that economic indicators such as agricultural production, inflation, and foreign direct investment have a significant impact on GDP growth in Ethiopia. They also noted that the country’s macroeconomic instability and political instability can affect GDP growth.

By a study Tadesse [16] employed a multivariate regression analysis to forecast GDP growth in Ethiopia. The authors found that economic indicators such as agricultural production, industrial production, and inflation have a significant impact on GDP growth. They also found that political instability and external shocks can affect GDP growth.

Alemu [15] estimating GDP in Ethiopia: A Bayesian Approach. This study used a Bayesian approach to estimate GDP in Ethiopia. The authors found that the Bayesian approach provides a more accurate estimate of GDP compared to traditional methods. They also found that economic indicators such as agricultural production, industrial production, and inflation have a significant impact on GDP growth.

Overall, these studies suggest that GDP forecasting in Ethiopia is a complex task that requires careful consideration of various economic indicators and external factors.

The article “Forecasting Egyptian GDP using ARIMA models” by Abonazel and Abd-Elftah [9] provides a comprehensive analysis of the Egyptian economy and its Gross Domestic Product (GDP) using ARIMA models. The authors use time series data from 1980 to 2016 to forecast the GDP of Egypt for the period up to 2020. The article explains that the GDP of Egypt has been experiencing a downward trend in recent years due to various factors such as political instability, terrorism, and economic sanctions. The authors use ARIMA models to forecast the future values of the GDP and to identify the key drivers of economic growth in Egypt.

Dritsaki [19] finds that the ARMA(2,1) model provides the most accurate forecasts of real GDP growth rates in Greece, with a mean absolute error (MAE) of 1.23% and a root mean squared error (RMSE) of 1.55%. The VECM model also provides accurate forecasts, with an MAE of 1.33% and an RMSE of 1.64%. In contrast, the AR and MA models have lower accuracy, with MAEs of 1.53% and 1.74%, respectively, and RMSEs of 2.05% and 2.46%, respectively. The author concludes that the ARMA(2,1) and VECM models are the most effective models for forecasting real GDP growth rates in Greece, and that these models can be useful for policymakers and economists in predicting future economic trends.

Ghazo [11] finds that the ARIMA model provides accurate predictions for both GDP and CPI, with a mean absolute error (MAE) of 2.3% for GDP and 1.5% for CPI in Jourdan economy. The author also compares the performance of the ARIMA model with other forecasting methods and finds that it outperforms them. Similarly, The article “Forecasting Inflation, Exchange Rate, and GDP using ANN and ARIMA Models: Evidence from Pakistan” by Hussain, Ghufran, and Ditta [12] explores the use of artificial neural network (ANN) and autoregressive integrated moving average (ARIMA) models to forecast inflation, exchange rate, and GDP in Pakistan. The study provides evidence on the effectiveness of these models in predicting economic indicators in an emerging economy like Pakistan.

The authors Ingale and Senan [13] propose an ARIMA model for predicting GDP (Gross Domestic Product) growth rates in the short-term. They use a time series data set of GDP growth rates for the United States from 1960 to 2020 and apply the ARIMA model to predict future GDP growth rates. The results show that the ARIMA model outperforms other statistical models such as linear regression and neural networks in terms of accuracy and computational efficiency.

The article by Nyoni and Bonga [10] focuses on modeling and forecasting GDP per capita in Rwanda. The study utilizes economic and financial data to develop a model for predicting the GDP per capita in Rwanda. The authors employ statistical techniques and economic indicators to construct the model, aiming to provide insights into the future economic performance of the country. The research contributes to the understanding of economic trends and factors influencing GDP per capita in Rwanda, offering valuable implications for policymakers, investors, and researchers.

The article “Forecasting Gross Domestic Product in the Philippines Using Autoregressive Integrated Moving Average (ARIMA) Model” conducted by Polintan, Cabauatan [14]. The research focuses on utilizing the Autoregressive Integrated Moving Average (ARIMA) model to forecast the Gross Domestic Product (GDP) in the Philippines. The study is detailed and provides insights into the application of ARIMA modeling in economic forecasting. Radzi [2], focuses on the application of Autoregressive Integrated Moving Average (ARIMA) models to forecast the Gross Domestic Product (GDP) and Consumer Price Index (CPI) of the Malaysian economy. The study aims to provide accurate predictions for these key economic indicators, which are crucial for policy-making, investment decisions, and overall economic planning.

The findings of Uwimana, Xiuchun [18] provide valuable insights into the GDP trends in Africa. The authors present their forecasts based on the application of time series models, shedding light on potential future economic developments in the region. The paper contributes to the understanding of economic dynamics in African countries and offers implications for policymakers, economists, and researchers interested in the region’s economic growth.

The majority of these studies have solely focused on forecasting, neglecting the evaluation of past GDP trends in relation to existing policies and strategies. Furthermore, they have failed to propose suitable policy alternatives to accompany the projected economic growth (GDP).

3 Methods

3.1 Description of study area

The Afar region is located in northeastern Ethiopia, bordering Eritrea to the north, Djibouti to the northeast, and the Ethiopian regions of Tigray and Amhara to the west. It is one of the eleven regional states in Ethiopia and covers an area of approximately 96,707 square kilometers. The Afar region has a semi-arid climate, with high temperatures and low rainfall. The average annual temperature ranges from 25 to 35 °C (77–95 °C), making it one of the hottest regions in Ethiopia. Rainfall is scarce and unreliable, with most areas receiving less than 200 mm (7.9 in) of rain per year [20].

The Afar region is home to a diverse range of ethnic groups, including Afar people, who are the dominant group in the region. The Afar people are traditionally pastoralists who rely on livestock herding for their livelihoods. They have a rich cultural heritage and are known for their unique traditions, including the salt trade. In terms of economic activities, the Afar region has significant potential for mineral resources, such as potash, salt, and geothermal energy. The region is also known for its salt extraction industry, with vast salt flats in the Danakil Depression exploited for commercial purposes [20].

3.2 Scope and source of data

In this study, time series GDP data for 52 quarters from 2009 to 2022 were drawn from secondary sources at the Afar Bureau of Finance [7]. In addition, other secondary data were emanated from the Ethiopia Ministry of Planning and Development, National Bank of Ethiopia, Ethiopia statistical service, IMF, World Bank database, and other government-published and unpublished works.

3.3 Methods of data analysis

The tools used to analyze the data in this study were both descriptive and inferential (econometric model) statistical analysis. Descriptive statistical analysis was used to analyze the survey data using measures of dispersion and central tendency, such as percentage, frequency, minimum, maximum, mean, standard deviation, and graphs. Regarding econometric analysis, the ARIMA model was employed to forecast the real GDP of the Afar regional state for the next five years.

3.4 Analytical framework

Time-series analysis is a statistical technique used to analyze and forecast time-series data, which is a sequence of observations recorded at equal intervals over time. The technique involves analyzing the patterns, trends, and cycles in the data to make predictions about future values. When dealing with large amounts of data, time-series analysis can provide highly precise short-run forecasts, as demonstrated by Granger and Newbold [21].

ARIMA models are highly versatile and extensively employed in the field of univariate time-series analysis. The ARIMA model is formed by combining three distinct processes: autoregressive (AR), differencing, and moving-average (MA).

The Autoregressive (AR) process is a mathematical representation that describes how a variable in a time series is linearly dependent on past values. It assumes that the current value of a variable can be predicted using a linear combination of its previous values. The order of the AR process, denoted by p, determines the number of lagged values considered in the prediction.

An autoregressive model of order p, AR (p), can be expressed as

where \({\varepsilon }_{t}\) is a white noise process, a sequence of independent and identically distributed (iid) random variables with \(E{(\varepsilon }_{t})=0\) and \(Var{(\varepsilon }_{t})={\sigma }^{2};{ \varepsilon }_{t} iid N\left(0, {\sigma }^{2}\right).\) In this model, all previous values can have additive effects on this level X and so on; so it's a long-term memory model.

The Differencing process (I) involves considering the differences between consecutive observations in a time series. It aims to remove any underlying trends or seasonality present in the data, thereby making it stationary. Stationarity is a crucial assumption in many time-series models including ARIMA. Differencing helps to stabilize the mean and variance of the series.

The Moving-Average (MA) process, On the other hand, the MA process models the dependency between an observation and a residual error from a moving average model applied to lagged observations. It considers the error terms of previous predictions to predict the future values. Similar to the AR process, the order of the MA process, denoted by q, determines the number of lagged error terms.

A time series \(\left\{{Y}_{t}\right\}\) is said to be a moving-average process of order q, MA (q) if

The model was expressed in terms of past errors as an explanatory variable. Therefore, only q errors will affect on \({Y}_{t}\), however higher-order errors do not affect on \({Y}_{t}\); this means that it is a short memory model.

Autoregressive moving-average (ARMA) model, he ARMA model represents a time series as a combination of its past values (AR component) and the errors or residuals from previous predictions (MA component). The AR component captures the linear relationship between current observations and past values. The MA component, on the other hand, captures the influence of past error terms on the current observation.

A time series [22] follows an autoregressive moving-average process of order p and q, ARMA (p, q), process if

This model can be a mixture of both AR and MA models above.

Autoregressive integrated moving-average (ARIMA) models, the ARMA models can be expanded to include non-stationary series by introducing differentiation of the data series, resulting in ARIMA models. The overall non-seasonal model, ARIMA (p, d, q), consists of three parameters: p represents the autoregressive order, d represents the degree of differentiation, and q represents the moving-average order.

3.5 Box–Jenkins approach

The Box and Jenkins [23] approach in time series analysis, coined by statisticians George Box and Gwilym Jenkins, utilizes ARIMA models to determine the most accurate match between a time series model and historical data points of a time series. According to this approach, Fig. 1 illustrates the four iterative stages of modeling.

(adapted from [9])

Stages in the Box–Jenkins iterative approach

3.6 Authors bibliography

Abdurhman Kedir Ali is a assistant professor, lecturer and academic vice president of Samara University Ethiopia. He has a PhD degree in economics. Ahmed Abduletif is a is a assistant professor, lecturer at Samara University department of economics, Ethiopia. He has an PhD degree in economics. Getnet Mamo Habtie is a lecturer, researcher and community service provider at Samara University department of statistics, Ethiopia. He has an MSc degree in statistics from Addis Ababa University. Dagmawe Menelek Asfaw is assistant professor, lecturer, researcher and community service provider at University of Gondar department of economics, Ethiopia. He has an MSc degree in international economics from Addis Ababa University.

4 Result and discussion

4.1 Assessing major macroeconomic performance of the regional economy

The agricultural sector has experienced a consistent decline over the past decade, with a significant drop of 33.33% from the first quarter of 2020 to the fourth quarter of 2022. In 2020q1, the agriculture sector’s value stood at 11,160 million Birr, while in 2022q2, it decreased to 9783 million Birr. This decline can be attributed to various factors, including heightened vulnerability to natural disasters and shifts in government policies.

Conversely, the industrial sector has displayed fluctuations in its contribution to the GDP, reaching a peak of 3664 million Birr in 2022q1. However, overall, the trend has been relatively stable, with no significant growth or decline observed. In 2020q1, the industry sector had a value of 2278 million Birr, which increased to 3553 million Birr in 2022q2. This growth is likely influenced by increased demand for goods and services, technological advancements, and changes in government policies.

The service sector has seen a significant increase over the past decade, with a growth rate of 58.82% from 2020q1 to 2022q4. In 2020q1, the service sector had a value of 2829 million birr, while in 2022q2, it had a value of 5228 million Birr. This indicates the increasing dominance of the service sector in the economy. This growth is likely due to an increase in demand for services, such as healthcare, education, and financial services, as well as the growth of the digital economy (see Table 1).

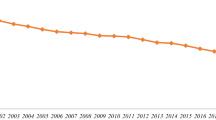

Based on the data provided, the GDP of the Afar regional state has been steadily increasing over the years, from 16,267 million Birr in 2020q1 to 19,061 million Birr in 2022q4. Afar GDP per capita refers to the average income per capita in Ethiopia’s Afar region. We observe fluctuations in both total GDP and GDP per capita over time for both Afar and Ethiopia. The figures indicate changes in economic performance and development. For Afar, the total GDP ranged from 16,267 million Birr to 19,061 million Birr over a given period. This suggests some variability in the economic output within this region. Afar’s GDP per capita ranges from 342.57 dollars to 1153.14 dollars over the same period. This indicates fluctuations in individual income levels within Afar over time (Table 1).

In the Afar region, GDP per capita ranged from 343 to 1126 dollars over the years. In Ethiopia, GDP per capita ranges from 468 to 1153 birr over the years. GDP per capita in the Afar region is generally lower than Ethiopia’s GDP per capita. This indicates that, on average, individuals in the Afar region have a lower income than the national average. However, it can be seen that both the Afar region and Ethiopia as a whole have experienced growth in GDP and GDP per capita over the years (see Table 1).

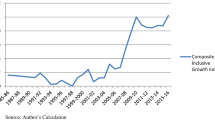

The agricultural sector has experienced varying growth rates over the years. In 2011, the growth rate was 3%, followed by no further growth in 2012. However, there was a significant increase in 2013, at a growth rate of 5%. The sector continued to grow at a steady pace of 5% and 6% in 2014 and 2015, respectively. In 2016, the growth rate slightly decreased to 4%, but rebounded in 2017, with a growth rate of 7%. The subsequent years saw a decline in the growth rate of 3% in 2018, 1% in 2019, and an increase of 6% in 2020. The growth rates for the agricultural sector were 2% in 2021 and 6% in 2022 (see Fig. 2).

The industrial sector experienced significant fluctuations in growth rates during the given period. It started with a high growth rate of 14% in 2011 and further increased to 17% in 2012. However, this growth rate declined to 9% in 2013. The sector experienced a slight recovery, with an increase of 11% in 2014, followed by a decrease to 4% in 2015. In contrast, there was a substantial increase of 17% in 2016 and 2017. This sector witnessed another fluctuation, decreasing to 3% in 2018, followed by a significant rise to an impressive growth rate of 26% in 2019. However, it faced challenges with negative growth rates of − 3% and − 1% in 2020 and 2021, respectively. The growth rate for the industrial sector in 2022 was 8%.

He service sector has exhibited consistent and noteworthy growth rates over the years. In 2011, the sector began with a growth rate of 11%, which then increased to 15% in 2012. Subsequently, the growth rates remained positive, with a steady pace of 12% in 2013. The sector experienced a significant surge in growth to 27% in 2014. In the following years, the growth rates continued to be positive but relatively lower, with rates of 9% in 2015, 17% in both 2016 and 2017, and 12% in 2018. There was a slight decline to 7% in 2019, followed by consistent growth at a rate of 7% in both 2020 and 2021. The growth rate of the service sector in 2022 was recorded at 10%.

The analysis of the overall GDP growth rate reveals a fluctuating pattern over the years. In 2011, the GDP growth rate started at a moderate level of 6%. However, it slightly decreased to 5% in 2012. The subsequent years saw an increase in the growth rate, with 7% in both 2013 and 2014. The GDP growth rate remained positive but relatively stable, with a significant surge to 10% in 2015. This was followed by consecutive years of growth ranging around 7–9%. Notably, there was a notable increase in the growth rate to 9% in both 2016 and 2017. However, the following years witnessed a slight decline, with growth rates of 8% in both 2018 and 2019. The GDP growth rate further decreased to approximately the range of 2–3%, with a projected growth rate of 6% for the year 2022.

In conclusion, the data show cases of varying growth rates of different sectors (agriculture, industry, and service) and the overall GDP growth rate from 2011 to 2022. The agricultural sector experienced fluctuations with both positive and negative growth rates. The industry sector demonstrated significant fluctuations, including periods of high and negative growth rates. The service sector has exhibited relatively stable growth rates throughout the study period. The overall GDP growth rate experienced fluctuations, but generally remained positive, with a projected growth rate of 6% for 2022 (see Fig. 2).

The share of agriculture in GDP gradually decreased from 69% in 2011 to 51% in 2022, indicating a shift away from agriculture and towards other sectors in the economy. Although there was a consistent decrease, the rate of decline slowed down after 2014. During the same period, the share of industry in GDP showed a slight increase from 14% in 2011 to 18% in 2017, with no significant upward or downward trends observed. From 2017 to 2021, the share of industry in GDP remained relatively stable at approximately 17–18%.

The share of services in GDP has grown continuously over the years, increasing from 17% in 2011 to 31% in 2022. This increase suggests the growing importance of the service sector to the economy. The growth rate accelerated after 2014, when the share of agriculture started declining faster (see Fig. 2). Overall, the analysis indicates a structural transformation of the economy, with a decline in the share of agriculture in GDP and a corresponding growth in the share of services. The share of the industry remained relatively stable throughout this period.

4.2 Evaluation the economy performance regarding major development plans and strategies

Ethiopia has implemented several development policies over the years, including the Development and Poverty Reduction Program (SDPRP), A Plan for Accelerated and Sustained, Development to End Poverty (PASDEP), Growth and Transformation Plan I (GTP I), and Growth and Transformation Plan II (GTP II). While these policies have had some positive impacts, they have also been criticized for various reasons.

Development and poverty reduction Programme (SDPRP). It was launched in 2002 as a comprehensive plan to reduce poverty and promote sustainable development in Ethiopia. The program aimed to achieve this through a series of interventions in key sectors, such as agriculture, education, health, and infrastructure development [24]. However, based on the data (see Table 1 and Fig. 3), the share of agriculture has continuously decreased throughout the period from 2011 to 2022, which questioned the food security, poverty reduction, and sustainable development objectives of the SDPRP plan. This was because, according to the Central Statistical Agency [25], more than 85% of the population has been practicing agriculture as a main source of livelihood.

In addition, the per capita income of the region is below the national level and below the average of sub-Saharan countries ($1690 in 2022). This is also a vital indication of the malfunctioning SDPRP regarding poverty reduction and sustainable development in the regional state of Afar.

4.2.1 Plan for Accelerated and Sustained Development to End Poverty (PASDEP)

Similar to the SDPRP, PASDEP also focuses on poverty reduction through accelerated and sustained development [26]. Again, the declining share of agriculture and reduction in per capita income raises questions about the effectiveness of this program in addressing the predetermined object in the region.

4.2.2 Growth and transformation plans I and II (GTP I and II)

GTP I aimed to promote economic growth and transformation [27]. GTP II is the follow-up plan for GTP I and likely continues the objectives of promoting economic growth and transforming the structure of the economy from agriculture based on industrial lead and inclusive growth [28]. However, such a plan does not achieve its objective, specifically, structural transformation of the economy from subsistence agriculture to industry sectors and inclusive growth.

The GTP has been criticized for failing to address regional disparities in development. It has been accused of favoring major urban centers, such as Addis Ababa, neglecting the needs of rural areas and marginalized communities. The data in Figs. 2, 3 show that the share of industry sector to total GDP did not show any significant improvement over the last decade, and the growth rate of this sector was below the growth rate of service sectors. In addition, the structural change in the economy of the region was transformed from agriculture to the service sector rather than the industry sector (see Fig. 3).

Despite the positive impacts, these policies faced challenges in achieving inclusive and equitable growth, addressing regional disparities, structural transformation of the economy, and reducing poverty in the Afar regional state as follows:

4.2.3 Lack of participation and consultation

Critics argue that development policies were not formulated with adequate participation and consultation from stakeholders, including civil society organizations, private sector actors, and local communities. This lack of participation has led to a disconnect between the policies and needs of the people, particularly the poor and pastoral communities [29, 30]. For example, in the formulation process of PASDEP, the government’s approach to policymaking was primarily top-down, rather than consultative. However, despite several discussions at the federal level led by the Prime Minister and facilitated by the poverty action network, most of these discussions primarily centered on implementation rather than the initial formulation stage [31].

Such development policies were not articulate-based resource endowments of the agro-pastoralist and pastoralist communities. This makes it difficult to mobilize resources in the agricultural sector, specifically livestock [30].

These policies have been criticized for prioritizing economic growth over social development and Investing in Social Services and Infrastructure, leading to widening income disparities and limited progress in reducing poverty. These policies have also been accused of promoting a “growth at all costs,” resulting in environmental degradation and social conflicts [31]. Climate change poses significant challenges to pastoral and agro-pastoral societies because of its impact on rainfall patterns, temperature fluctuations, and increased frequency of extreme weather events.

The policies aimed at bringing about structural change were primarily focused on transitioning the economic framework towards an industrial sector, neglecting the potential repercussions on the agricultural sector. This oversight has led to significant economic instability, including issues such as unemployment, food insecurity, poverty, and trade deficits. As a result, the intended objectives of these policies have not been realized. Furthermore, these policies have faced criticism for failing to address concerns related to institutional capacity and governance. The absence of robust institutions and effective governance has impeded the successful execution of these policies, resulting in corruption, inefficiency, and wastage of resources [32].

4.3 Forecasting the regional GDP of Afar regional state

4.3.1 Post-estimation test

It is necessary to test for unit roots in each of the variables by using Augmented Dickey–Fuller (ADF) and Phillips–Perron (PP) tests in this study before conducting time series forecasting.

The Augmented Dickey Fuller and PP test results shown in Table 2 indicate that for the series in levels, the null hypothesis of a unit root cannot be rejected at the all percent level significance with a constant term and constant and trend term included. Therefore, all GDP variables are not stationary at level; in this way, we must have taken their first difference and checked their level of stationarity.

A non-stationary series can be made stationary through differencing [33]. The differenced series has n-1 observations after taking the first difference, n–2 observations after taking the second difference, and n–d observations after taking d differences. In this way, after taking the first difference of GDP, the Augmented Dickey Fuller and PP test results shown in Table 3 reject the null hypothesis of a unit root at all percent levels of significance. Therefore, GDP data are stationary after the first difference.

4.3.2 Identification

The first stage of the Box-Jenkins methodology is identification, which involves identifying the appropriate model for time-series data. This stage includes two key steps: determining the order of differencing and identifying the autoregressive (AR) and moving average (MA) components. The AC (Autocorrelation) and PAC (Partial Autocorrelation) graphs help us identify the type of process by identifying the exact numbers of p, d, and q.

The graph of partial autocorrelation (PAC) shows the order of the autoregressive component (value of p). In Fig. 4, eight lags exceed the confidence bands; however, because of parsimony, we have to select only lags 1, 5, and 13.

The autocorrelation (AC) graph shows the order of the moving average component (value of q). Looking the autocorrelation Fig. 5 shows that only the first and second lags exceeded the confidence bands or that the first lag was significant, and q was 1 and 2. Here, the given series is stationary after its first difference, or it is integrated of order one I (1), with a value of d = 1.

4.3.3 Estimation

Once the appropriate model has been identified in the first stage, the next step is to determine the best fit model from potential candidate models using the model with AIC, BIC, HQC, and the value of log-likelihood, and to estimate the parameters of the AR and MA components.

Table 4 presents time-series model candidates and their corresponding selection criteria. Among these models, ARIMA (1,1,2) stands out with lower scores in the AIC, BIC, and HQC and the highest value of log-likelihood. This indicates that ARIMA (1,1,2) performs better than the other models in terms of goodness of fit.

Therefore, the estimated regression equation of ARIMA (1,1,2) model is presented in Table 5:

4.3.4 Diagnostic test

The diagnostic verification stage is crucial for determining the adequacy of the ARIMA model. Various tests are conducted to check if the assumptions of the model are met and to assess the model's performance. Some common diagnostic tests used in the Box-Jenkins methodology are as follows.

4.3.4.1 Portmanteau test (white noise test)

The Portmanteau test is conducted to check whether the residuals of the ARIMA model are white noise. It tests the null hypothesis that the error term is a white noise. Based on Table 6, the result fails to reject the null hypothesis of the Portmanteau test. Therefore, the error term in the ARIMA(1,1,2) model is white noise.

4.3.4.2 ARMA process is invertible (MA root test)

If this test indicates that an ARMA process is invertible, then all the roots of the MA component must be located within the unit circle. Figure 6 shows that all MA roots lie inside the unit circle, indicating that the ARMA process is invertible.

4.3.4.3 ARMA process is covariance (AR root test)

Based on this test, a given ARMA process is said to be covariance; all AR roots should lie inside the unit circle. As shown in Fig. 6, all AR roots lie inside the circle; therefore, the ARMA process is a covariance.

4.3.4.4 Forecasting

Once the model has been evaluated and found to be adequate, the final stage involves using the model to generate forecasts for future periods. Since the ARIMA (1, 1, 2) model is fit to the GDP data, we can use Eq. (5) directly to forecast the GDP values for the next 3 years (12 quarters) out of the sample from 2023 to 2025.

Upon comparing the projected value with the actual value, it is evident that the average error is 0.145%, which is below the threshold of 5%. Consequently, we can conclude that the ARIMA (1,1,2) model is an effective forecasting tool.

According to the data under Table 7, the GDP is expected to increase gradually from 19,300.20 Billion Birr in the first quarter of 2023 to 21,678.20 Billion Birr in the fourth quarter of 2025, indicating positive economic growth during the forecast period. The increasing GDP values suggest that economic activity and output have expanded. However, it is important to note that these figures are forecasts and subject to various factors that can influence economic performance, such as government policies, global economic conditions, technological advancements, consumer behavior, and geopolitical events. Therefore, the actual GDP figures may differ from the forecast values.

Based on the data provided, the forecasted GDP for the Afar region shows a consistent upward trend from 2023 to 2025, indicating expected economic growth during this period (see Fig. 7). The GDP is projected to reach 21,037.79 billion Birr in the second quarter, 21,251.29 billion Birr in the third quarter, 21,464.76 billion Birr in the third quarter, and further 21,678.20 billion Birr in the last quarter (see Table 7). This indicates an expected growth rate of 10% on average over the last four quarters. The economy of the Afar regional state is primarily based on agriculture, specifically livestock production, which is crucial for the livelihoods of local communities. However, this sector is vulnerable to various factors such as climate change, droughts, conflicts, and market fluctuations. In order to achieve the predicted GDP growth over the next three years, it is essential for both the region and the nation to have a development policy that gives special attention to agriculture and livestock.

Figure 7 presents the trends of the actual and forecasted Afar regional GDP values with their 95% confidence intervals.

5 Conclusion and recommendation

The GDP, which stands for Gross Domestic Product, serves as an indicator of the overall economic activity within a country. It reflects the total market value of all final goods and services produced in a specified time period, usually a year. Ethiopia has implemented various national development plans and strategies like SDPRP, PASDEP, GTP I, and GTP II to bolster its economy and increase GDP. However, the effectiveness and outcomes of these development plans and strategies in terms of regional economies have yet to be assessed. Consequently, the future trends and phenomena of Afar state’s regional economy, particularly in relation to GDP, remain undisclosed. This study aims to evaluate the performance of these development policies and strategies while utilizing the ARIMA model to forecast Afar's regional GDP for the next three years.

According to the provided data, the GDP of Afar regional state has shown a consistent growth trajectory, rising from 16,267 million Birr in 2020q1 to 19,061 million Birr in 2022q4. Over the years, the GDP per capita in the Afar region ranged between 343 and 1126 dollars, whereas Ethiopia’s GDP per capita fluctuated between 468 and 1153 birr. Generally, the GDP per capita in the Afar region tends to be lower than that of Ethiopia as a whole. The agricultural sector demonstrated periods of fluctuation, experiencing both positive and negative growth rates. Meanwhile, the industry sector exhibited significant fluctuations, with periods of both high and negative growth rates. On the other hand, the service sector displayed relatively stable growth rates throughout the study period.

Between 2011 and 2022, the share of agriculture in the country's GDP gradually declined from 69 to 51%. Conversely, the share of industry to GDP remained relatively stable at around 17–18% from 2017 to 2021. Over the years, the share of services to GDP exhibited continuous growth, increasing from 17% in 2011 to 31% in 2022. This analysis suggests a structural transformation of the economy, where the agriculture sector’s contribution to GDP decreased, while the services sector experienced growth. The industry sector’s share remained relatively stable during this period. However, despite the positive impacts, certain challenges were faced in implementing inclusive and equitable growth, addressing regional disparities, achieving structural transformation, and reducing poverty in the Afar regional state. These challenges may be attributed to factors such as a lack of participation and consultation, policies that were not tailored to the resource endowments of agro-pastoralist and pastoralist communities, prioritization of economic growth over social development, overemphasis on the agricultural sector for structural transformation, and inadequate attention to institutional capacity and governance.

The fittest ARIMA (1, 1, 2) model indicates a gradual increase in Afar regional GDP from 19,300.20 Billion Birr in the first quarter of 2023 to 21,678.20 Billion Birr in the fourth quarter of 2025. Specifically, the GDP is expected to reach 21,037.79 billion Birr in the second quarter, 21,251.29 billion Birr in the third quarter, 21,464.76 billion Birr in the third quarter, and further 21,678.20 billion Birr in the last quarter. Therefore, an average growth rate of 10% is anticipated in Afar’s GDP over the last four quarters. In Ethiopia, various national development plans and strategies have been launched to achieve sustainable economic growth in the nation as well as in the Afar regional state. However, such plans and strategies do not attain their objectives, particularly in the Afar regional state economy. Therefore, in order to achieve sustainable economic well-being and to address the forecasted amount of GDP in the region, any development plans and strategies should be:

-

Focusing not only on Economic Growth but also Social Development: The policies have been criticized for prioritizing economic growth over social development, leading to widening income disparities and limited progress in reducing poverty. These policies have also been accused of promoting a “growth at all costs,” which has resulted in environmental degradation and social conflicts. Therefore, development plans and strategies should focus not only on Economic Growth but also Social Development of societies.

-

The formulation of development policies should be participatory to local communities: development policies should be formulated with adequate participation and consultation with stakeholders, including civil society organizations, private sector actors, and local communities. This participation has led to a connection between the policies and needs of the people, particularly the poor and marginalized communities.

-

Adequate institutional capacity and governance: Policies should address institutional capacity and governance. Strong institutions and good lead to the effective implementation of policies, leading to the efficiency and proper use of resources.

-

Development policies were articulate-based resource endowments of the agro-pastoralist and pastoralist communities. This makes it a mobilized resource for the agricultural sector, specifically livestock.

-

Development policies should articulate the resource endowments of agro-pastoralist and pastoralist communities. This makes it an easily mobilized resource for the agricultural sector, specifically livestock.

-

Structural change policies, particularly in pastoral communities, should accompany and embody the agricultural sector as the main sector of the economy.

-

The Ethiopian 10-year perspective plan (2021–2030) should also be revised based on the need and resource endowment of pastoral and agro-pastoral communities.

In general, this study limited its scope in Afar regional state and predict the real GDP of the region for the coming future. However, it is not able to make inference about the national GDP for the coming future; therefore, further research should be done on the remaining regional state of Ethiopia, regarding GDP forecasting and assessing development policies.

Data availability

Raw data supporting the findings of this article will be made available by the corresponding author upon request, without restriction.

References

Fufa GB, Agemso WD. Modelling and forecasts of GDP in Ethiopia. Multivariate time series application. Int J Curr Adv Res. 2018;6(2):123–31.

Radzi HM, Bakar ASA. Forecasting GDP and CPI of the Malaysian economy using ARIMA models. Int J Adv Manag Bus Intell. 2022;3(1):1–15.

World Bank. World Bank Ethiopia overview 2023. https://www.worldbank.org/en/country/ethiopia/overview. Accessed 23 Sept 2023.

National Bank of Ethiopia. National Bank of Ethiopia Annual Report 2021/22. 2022. https://nbebank.com/wp-content/uploads/pdf/annualbulletin/Annual%20Report%202020-2021/2021-22%20Annual%20report.pdf.

African Development Bank. Ethiopia Economic Outlook: Recent macroeconomic and financial developments. 2023. https://www.afdb.org/en/countries/east-africa/ethiopia/ethiopia-economic-outlook.

UNICEF. Afar regional brief. Addis Ababa: UNICEF; 2022.

Afar Bureau of Finance. Estimation of Regional Gross Domestic Product (RGDP) of Afar Regional State (2020–2022). Afar Bureau of Finance; 2022.

Wabomba MS, Mutwiri M, Fredrick M. Modeling and forecasting Kenyan GDP using autoregressive integrated moving average (ARIMA) models. Sci J Appl Math Stat. 2016;4(2):64–73.

Abonazel MR, Abd-Elftah AI. Forecasting Egyptian GDP using ARIMA models. Rep Econ Fin. 2019;5(1):35–47.

Nyoni T, Bonga WG. Modeling and forecasting GDP per capita in Rwanda. DRJ-J Econ Fin. 2019;4(2):21–9.

Ghazo A. Applying the ARIMA Model to the process of forecasting GDP and CPI in the Jordanian economy. Int J Fin Res. 2021;12(3):70.

Hussain L, Ghufran B, Ditta A. Forecasting inflation, exchange rate, and GDP using ANN and ARIMA models: evidence from Pakistan. Sustain Bus Soc Emerg Econ. 2022;4(1):25–32.

Ingale K, Senan R. Predictive analysis of GDP by using ARIMA approach. Pharm Innov J. 2023;12(5):309–15.

Polintan SN, et al. Forecasting gross domestic product in the Philippines using autoregressive integrated moving average (ARIMA) model. Eur J Comput Sci Inf Technol. 2023;11(2):100–24.

Alemu M, Tadesse T, Teklewold H. Estimating GDP in Ethiopia: a Bayesian approach. J Econ Fin. 2019;44(2):1–15.

Tadesse T, Alemu M, Teklewold H. Forecasting GDP in Ethiopia: an empirical analysis. J Econ Fin. 2018;42(1):1–18.

Tesfaye T, Teklewold H, Alemu M. GDP forecasting in Ethiopia: a review of the empirical literature. J Econ Sustain Dev. 2017;8(1):1–15.

Uwimana A, Xiuchun B, Shuguang Z. Modeling and forecasting Africa’s GDP with time series models. Int J Sci Res Publ. 2018;8(4):41–6.

Dritsaki C. Forecasting real GDP rate through econometric models: an empirical study from Greece. J Int Bus Econ. 2020;3(1):13–9.

Central Statistical Agency. Population and housing census of Ethiopia: Administrative Report. 2012. Addis Ababa: Central Statistical Agency; 2017.

Granger CWJ, Newbold P. Forecasting economic time series. Academic press; 2014.

Yang B et al. Application of ARIMA model in the prediction of the gross domestic product. In: 2016 6th international conference on mechatronics, computer and education informationization (MCEI 2016). 2016. Atlantis Press.

Box GEP, Jenkins GM. Time series analysis-forecasting and control. J Math Appl. 1985;13(26).

Ethiopia Ministry of Finance and Economic Development: sustainable development and poverty reduction program (SDPRD). Ethiopia: Addis Ababa; 2002.

Central Statistical Agency. Population projection of Ethiopia for all regions at Wereda level from 2014–2017. Federal Democratic Republic of Ethiopia. Central Statistical Agency; 2018.

Ministry of Finance and Economic Development. Ethiopia: building on progress a plan for accelerated and sustained development to end poverty (PASDEP). Ministry of Finance and Economic Development: Addis Ababa; 2006.

Ministry or Finance and Economic Development. Growth and transformation plan I (GTP I). Ministry or Finance and Economic Development: Addis Ababa; 2010.

Ministry or Finance and Economic Development. Growth and transformation plan II (GTP II). Ministry or Finance and Economic Development: Addis Ababa; 2016.

Lamson-Hall P, et al. A new plan for African cities: the Ethiopia urban expansion initiative. Urban Studies. 2019;56(6):1234–49.

Haile TG. Comparative analysis for the SDPRP, PASDEP and GTP of the FDR of Ethiopia. Glob J Bus Econ Manag Curr Issues. 2015;5(1):13–25.

Tafesse TT. Ethiopia’s development policies: a critical review. J Sustain Dev Afr. 2016;18(4):345–57.

Mariam AG. Ethiopia’s development policies: challenges and opportunities. J Afr Dev. 2018;20(2).

Alan W. Chapter 5: Box-Jenkins (ARIMA) forecasting; 2018.

Acknowledgements

Special thanks go to Mr. Atinkugn Assefa and Mr. Abibual Getachew for their constructive comments on this manuscript.

Funding

This research received no external funding.

Author information

Authors and Affiliations

Contributions

DMA made substantial contributions to the conception or design of the work; the acquisition, analysis, or interpretation of data; and the creation of new software used in the work. AKA drafted the manuscript, revised it critically for important intellectual content, and approved the version to be published. AAA drafted the manuscript and revised the creation of the new software used. GMH designed the study, acquisition, and analysis and revised.

Corresponding author

Ethics declarations

Competing interests

No potential conflict of interest was reported by the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Ali, A.K., Abdulkadr, A.A., Habtie, G.M. et al. Evaluate the current and predict the future real GDP of Afar regional state, Ethiopia. Discov Sustain 5, 9 (2024). https://doi.org/10.1007/s43621-024-00181-x

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s43621-024-00181-x