Abstract

Despite the significant impacts of technology on the socioeconomic effects of climate policies, many previous researchers neglected the induced technical impacts and thus resulted in biased evaluations of climate policies. Hence, it is important that the induced technology should be endogenized in the policy evaluation framework. The purpose of this paper is the quantification of the technical impacts of the Chinese carbon tax using a Computable General Equilibrium (CGE) model. The technical impacts are denoted by the induced technological change (ITC), which is a function of the energy-use efficiency (EUE), energy-production efficiency (EPE), and nonenergy-production efficiency (ENE). The carbon tax will increase the energy cost share because of the internalisation of the abatement costs. This paper empirically shows that the carbon tax will decrease the energy cost share and production efficiency but increase the energy use and nonenergy production efficiency. Under the carbon tax, the ITC will decrease the energy use and production efficiency but increase the nonenergy production efficiency. The ITC will increase the RGDP, decrease the household welfare, and increase the average social cost of carbon (ASCC). This finding implies that the ITC of the carbon tax is biased towards the technical progress of nonenergy sectors; the emission abatement will become costlier under the ITC impacts. Although the quantification method of the technical impacts was from an existing published paper, the CGE analysis of the ITC impacts of the carbon tax in China is original in this paper.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

To address the challenges aroused by the accelerating global warming, the United Nation Framework Convention on Climate Change (UNFCCC) emphasises that technological transfers should be an important element in the global action to mitigate the climate change. This is because technology is at the root of the climate change as well as an integral part of the mitigation process [1]. Despite the significant role of technology in relieving the global warming, many previous studies exogenously treated technology in designing climate policies [2]. The omission of the technological impacts may overestimate the costs of climate policies, because the technological progress can lower the cost of reducing carbon emissions [3]. Hence, it is important to endogenously model the technical impacts in the evaluation of climate policies [4].

The endogenization of technology has already become popular to cope with the climatic issues [5, 6]. Previous researchers tend to use the induced technological change (ITC) to denote the technical impacts. As the ITC warrants earlier investments in the non-fossil carbon-free technology [7], the inclusion of the ITC in modelling the climatic issues may reduce the costs of climate policies [8]. The carbon pricing in climate policies may crowd out the intrinsic motivations and voluntary action to reduce emissions [9]. For example, although the carbon pricing increased the clean invention patents, its effect on the overall R&D was negative [10]. In addition to the negative impacts on technical progress, the ITC may have a negative feedback loop. For example, a promotion of the green technology induced by the ITC decreased the carbon price, and thus the fossil fuels would be used more, which would finally erase some stimulus by the ITC [11].

Whether climate policies will promote or inhibit technical progress still remain to be seen. In the literature, very few studies considered the technical impacts of climate policies when evaluating the policy effects. Neglecting the ITC impacts tend to result in biased policy evaluations. Among the studies that quantified the ITC impacts of climate policies, Gans [12] argued that only technologies directly abating the emissions would have an unambiguously positive impact on the technical innovation to enhance the policy effect of the emission reduction. However, the results in Gans [12] were only based on a single-sector model, which didn’t not conform to the multi-sector reality.

To my best knowledge, very little research has used multi-sector models to quantify the technical impacts of climate policies. This paper contributes to the literature by designing a multi-sector Computable General Equilibrium (CGE) model to evaluate the ITC impacts on the policy effects of the carbon tax in China. This is because a CGE model has many advantages over other multi-sector models, including the ability to study both national and sectoral mitigation policies [13]. Hence, modelling the technical impacts of the carbon tax based on a CGE model will lead to more trustworthy results, compared to the results of single-sector or other multi-sector models.

2 Method

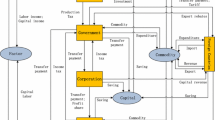

Based on the general equilibrium theory of Walras, CGE models derives from the pioneering work of Johansen [14]. In this paper, the CGE model is dynamic recursive as the research period is 2015–2030. In the CGE model, there are two regions (China and the rest of the world) and four economic entities (the representative household, enterprise, foreigner, and government). The social accounting matrix (SAM) is the foundation of the CGE model, and it is built basing on 2015 China Input–Output (IO) Table. The SAM is balanced via the stock account to ensure that the aggregate income is equal to aggregate expenditure. Using the stock account to balance the SAM will keep the original information of the other accounts from the IO Table. The balanced SAM is shown in Table 2 in Appendix 1.

According to Table 3 in Appendix 1, there were 42 sectors in 2015 China IO Table, but only 29 sectors are left through the aggregation and disaggregation process. Noticeably, the heat and electricity production sector is divided into the electricity sector and heat sector. Then the electricity sector is disaggregated into nine subsectors. Appendix 3 shows the equations denoting the disaggregation of the electricity sector.

The electricity disaggregation is necessary because the electricity subsectors exploiting renewables should not be limited by the carbon tax. Electricity disaggregation within the framework of a CGE model originates from Wing [15] who disaggregated the US electricity sector to analyse the US climate policy effects. In the China example, Lindner et al. [16] disaggregated the Chinese electricity sector in the 2007 input–output table. In this paper, I have followed Lindner et al. [16] to disaggregate the electricity sector in 2015 China Input–Output Table. After the disaggregation process, the nine electricity subsectors consist of eight generation subsectors and one transmission and distribution (TD) subsector. According to 2016 China Electric Power Yearbook, the Chinese power generation and grid investment in 2015 took up 45.9% and 54.1% of the electricity sectoral output respectively. Hence, the TD subsector output is assumed to occupy 54.1% of the electricity output, whilst the output of the generation subsectors altogether occupies 45.9% of the electricity output. The division of the electricity energy consumption is shown below: the coal consumption is distributed among the three coal generation subsectors based on the output; the oil consumption is divided among the subsectors exploiting nonrenewable energies [16]; the gas consumption is in the gas generation subsector only. The consumed electricity in the TD subsector is from the generation subsectors based on the sectoral electricity consumption mix in Lindner et al. [16]. A generation subsector is assumed to consume the electricity generated from its own only. The nuclear, hydro, wind, and solar generation subsectors are assumed to exploit renewables only and thus have no emissions.

-

1.

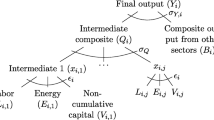

Production block

The production block of the CGE model shows the production of the goods within the economic system. The Leontief production function depicts the interrelations between the intermediate inputs and added values, while the constant elasticity of substitution (CES) functions denotes the production relations among the input factors. The elasticity parameters in the CES functions are from Guo et al. [17]. How the elasticity parameters affect the model indexes will be assessed by the sensitivity analysis in this paper.

-

2.

Income-expenditure block

In this block, the representative household consumes both the domestic and foreign goods, whilst its income source are from the labour, capital, and money transfers. The enterprise’s income only comes from the capital factor, but it pays the taxes to the government and sends the money transfer to the household.

-

3.

Government block

The governmental income only comes from the income tax and carbon tax, but it sends money transfers to the household. As no officially published data of the governmental energy consumption are available, I assume that the government has no energy consumption and thus emissions.

-

4.

Trade block

In this block, the goods are imported from the foreigner to the household, meanwhile the goods are exported from the enterprise to the foreigner. According to the Armington [18] assumption, the goods produced in different regions are imperfect substitutes.

-

5.

Dynamic block

The research period of this paper is 2015–2030, and 2015 is the base year. The dynamic data over the period 2016–2030 are derived from the base year data on the basis of a series of assumptions. The exogenously determined dynamic variables are the population, price, energy consumption growth rate, output growth rate, and capital accumulation. The projected population will follow the World Population Prospects by the United Nations. The export price will change proportionally to the price projection of the total OECD countries by OECD [19], whereas the GDP deflator, domestic commodity price, and import price will change proportionally to the price projection of China by OECD [19]. The projected energy consumption growth rate is from the International Energy Outlook by EIA [20]. The output growth of the energy sectors will follow the projected growth of the energy consumption, whilst the output growth of the nonenergy sectors will follow the regional GDP long-term forecast by OECD [21].

In the CGE policy evaluation framework, the ITC impact of the carbon tax is denoted by the efficiency changes resulting from the changes of the energy cost share (ECS). The rational of modelling the ITC impact is that the carbon tax increases the nonrenewable energy costs and thus changes the energy input, which finally affects the production functions of the CGE model.

In this paper, the quantification of the ITC impacts is based on Wang et al. [22] who studied the relation between the ECS and efficiencies. In the reality, the efficiency changes can be achieved by the R&D investment, which is influenced by the scale effect. For example, if the carbon tax increases the consumption costs of nonrenewable energy, the nonrenewable energy production will become less attractive, and thus resources will be shifted away from nonrenewable energy sectors. Consequently, the R&D investment in nonrenewable energy sectors will decrease, and thus the energy production efficiency will also decrease. Noticeable, the ITC in Wang et al. [22] were mainly the potential changes of the energy-saving technologies, but they excluded the induced development of the decarbonisation or clean energies. Hence, the ITC quantified in this paper may underestimate the technical impacts in the real world.

Wang et al. [22] endogenously determined the energy price, and the technical index was determined by the historical data using simple loglinear functions. In contrast, the energy price is exogenously determined in this paper according to OECD [19], and the future technical index is endogenously determined by the CGE model.

According to Wang et al. [22], the real GDP (RGDP) is as a constant-elasticity-of-substitution (CES) production function of the energy and nonenergy goods, shown in Eq. (1). The subscript t refers to the year; \(RGDP_{t}\) is the real GDP; \(NONEN_{t}\) is the nonenergy goods; \(EUE_{t}\) denotes the energy-use efficiency; \(TEC_{t}\) is the total energy consumption. In Eq. (1), the nonenergy-use efficiency is assumed to be one. \(\sigma\) is the elasticity of substitution between the energy and non-energy goods, and its centralised value is 0.4 given by Wang et al. [22].

Equation (1) implies that the defined ITC in this paper is embedded in the functional form of the RGDP rather than the production of energies. This is because this paper has incorporated the technical progress of both energy and nonenergy sectors. To this end, RGDP is a good index that measures the overall energy and nonenergy sectoral output. Noticeably, technical progress may be correlated with induced price changes. For example, technical progress may significantly reduce the production costs of a certain good and thus its price. As the ITC of the carbon tax in this paper is defined at the country level, it is a bit difficult to define the ITC impacts on the overall price index. Hence, RGDP, instead of GDP, is used to denote the ITC impacts in this paper.

The energy cost share (ECS) is defined in Eq. (2), where the subscript i and k denote a sector and energy respectively. \(EC_{ikt}\) is the sectoral energy consumption; \(ECS_{t}\) is the total energy cost share; \(PE_{ikt}\) is the energy price. The energy price in 2015–2018 are from the online open source (shown in Tables 4, 5, 6, 7 in Appendix 1). As far as I am concerned, the predicted price in 2019–2030 is currently unavailable. Hence, the future energy price, except for the electricity price, is assumed to change proportionally to the 2018 energy price based on the price projection by OECD [19]. The future electricity price will change proportionally to the 2019 electricity price in OECD [19].

The energy-use efficiency (EUE) is defined in Eq. (3), different from Wang et al. [22], who defined the EUE based on the historical data. Wang et al. [22] implicitly assumed that the consumption goods equal the production goods, which implies that the consumption of the imported goods is equal to the production of the export goods. In the reality, this assumption is seldom met in the open economy. By comparison, I assume that the ECS in the consumption goods is the same as that in the production goods. In Eq. (3), the exponent is always negative because the elasticity parameter \(\sigma\) is always less than one. Hence, the EUE is negatively correlated with the ECS, and thus the increase of the ECS will decrease the EUE. This correlation is contrary to Wang et al. [22] who defined the EUE as a loglinear function of the ECS with a positive slope.

Equations (4) and (5) define the energy and nonenergy production goods respectively. The subscript e and ne refer to an energy sector and nonenergy sector respectively. \(QM_{it}\) and \(QE_{it}\) denote the sectoral import and export respectively. \(TEPC_{t}\) and \(NONEP_{t}\) denote the total energy and nonenergy production goods respectively. \(SGDP_{et}\) and \(SGDP_{ne,t}\) denote the output of the energy and nonenergy sector respectively.

Equations (6) and (7) denote the definition of the energy-production efficiency (EPE) and the nonenergy-production efficiency (ENE) respectively. I assume that the EPE and ENE in all the sectors are equal to the national level. Based on the definitions of the EUE, EPE and ENE, the technical index is defined in Eq. (8), according to Wang et al. [22]. \(TI_{t}\) denotes the technical index.

The carbon tax is supposed to change the ECS and thus affects the EUE, EPE and ENE. The ECS in the tax scenarios is defined in Eq. (9), where the superscript * stands for the tax scenarios. \(\Lambda_{t}\) is the abatement costs, and its value is calculated using Eq. (10). \(\theta_{1t} = 0.0741 \times 0.0904^{t - 1}\) and \(\theta_{2} = 2.6\) are from the DICE model by Nordhaus [23]. \(\mu_{t}\) is the proportion of the emission reduction, and its value is zero in the baseline scenario. Because of the abatement costs, the ECS in the tax scenarios is always larger than that in the baseline scenario.

The internalisation of the abatement costs increases the costs of the energy consumption. Wang et al. [22] argued that increasing the energy costs might enhance the technical progress because the increasing costs could accelerate the development of renewable energy and induce the energy-saving efficiency improvements. Nonetheless, Wang et al. [22] neglected the negative impacts of increasing the costs on the technical progress. Because the energy goods become more expensive under the imposition of the tax, more resources may be shifted to the nonenergy or renewable energy sectors. However, the impacts of this resource shift cannot be modelled in Wang et al. [22]. The resource shift is modelled in this paper: as more resources may be shifted away, the nonrenewable energy sectors may spend less funds on the R&D, and thus the EUE and EPE may decrease. Hence, a change in the energy cost share will finally change the technical index.

Finally, a sensitivity analysis is conducted where all the elasticity parameters are assumed to change between − 50% and 50%. In the range of ± 50%, the inputs in some sectors may turn from poor (good) substitutes to good (poor) substitutes [24]. In general, the low (high) elasticity parameters imply that the economy is flexible (stringent).

3 Scenarios

In this paper, the baseline scenario is designed as the foundation of the analysis where no carbon tax is imposed. In the tax scenarios, three fixed percentage tax rates of the carbon tax are imposed on the output of nonrenewable energy sectors, namely the 1%, 2%, and 3% tax, which is equivalently to 2.4–4.9, 3.6–7.8, and 4.4–9.8 $/t CO2 over the research period. According to Li and Jia [25], the National Development and Reform Commission and the Ministry of Finance of China has published the guidance for the ideal tax rate, where the low, medium, and high tax rate are 1.7, 4.2, and 6.7 $/t CO2 respectively. Hence, the 1% tax in this paper will vary around the medium tax rate; the 2% tax will vary between the medium and high tax rate; the 3% tax will vary around the high tax rate. All the exogenous variables and parameters are assumed to remain unchanged in the tax scenarios compared to the baseline scenario.

In the results section, to analyse the ITC impact on the model equilibrium, I compare the results of the CGE model including the technical impacts with the one excluding the impacts. In the baseline scenario, there are no result differences between the two models; however, considering the ITC impacts will change the model equilibrium in the tax scenarios.

4 Results

The real GDP data of this paper in 2016–2019 is compared to the GDP data (2015 constant price) published by China Statistical Yearbook. At present, 2021 China Statistical Yearbook, which will publish 2020 data, is still unavailable. The data comparison is shown in Table 1.

In Table 1, the 2015 GDP data in this paper is slightly different from the published data. The data difference is mainly caused by the balance of the SAM. In 2016–2019, the predictive data is very close to the real data as the data differences are less than 5%. Hence, Table 1 implies that the predictive RGDP data in this paper agrees with the reality. For the other key variables, like the energy and nonenergy efficiencies, the Chinese authorities have not published the official data.

Figure 10 in Appendix 2 shows the tax effect on the ECS. The carbon tax will decrease the ECS. This is because the tax will decrease the amount of energy consumption despite that it will increase the energy price. Nevertheless, Fig. 1 shows that the ITC will increase the ECS, because of the internalisation of the abatement costs. This ITC impact will increase as the tax rate rises; however, it will fluctuate in 2015–2020 but decline steadily in 2020–2030. This finding complies with Diaz and Puch [26] who argued that if the energy became scarcer under the imposition of the tax, the energy share would rise owing to the price increase.

According to Fig. 11 in Appendix 2, the carbon tax will significantly increase the EUE compared to the baseline scenario. This is because the carbon tax decreases the amount of energy to be consumed, and thus a rational entity has an incentive to use the limited amount of energy more efficiently. Nevertheless, Fig. 2 shows that the ITC of the carbon tax will significantly decrease the EUE. The economic intuition underlying this result is that the carbon tax will shift the resources toward the nonenergy sectors, and thus the EUE will decrease because of the scale effect. According to Fig. 2, the ITC impact on the EUE will be strengthened as the tax rate increases; however, it will decrease gradually in 2020–2030.

Figure 12 in Appendix 2 shows that the carbon tax will slightly decrease the EPE, compared to the baseline scenario. This is because the tax will increase the production costs of the energy sectors, and thus more resources will be shifted away, thereby reducing the R&D in energy production, according to Gerlagh [27] who developed an endogenous growth model to measure the accumulated innovations globally in 1970–2000. In addition, Fig. 3 shows that the ITC of the carbon tax will significantly decrease the EPE. This is because the tax will increase the production costs of the nonrenewable energy sectors. Hence, more resources will be shifted away from these sectors, their output efficiency is likely to decrease considering the scale effect.

Figure 13 shows in Appendix 2 shows the carbon tax will increase the ENE. This is because the carbon tax will reduce the competitivity of the nonrenewable energy sectors, which results in the transfer of the social capital towards the nonenergy sectors [28]. According to Fig. 4, the ITC of the tax will slightly increase the ENE. This ITC impact will rise as the tax rate increases, but it will decrease over time. The magnitude of the ITC impact on the ENE is smaller than that on the EUE and EPE.

Figure 14 in Appendix 2 shows that the carbon tax will increase the technical index, implying that the carbon tax will promote technical progress over the research period. In contrast, Fig. 5 shows that the ITC will slightly increase the technical index at the 1% tax over time. However, it had a negative impact recently at the 2% tax and 3% tax, but the ITC will increase the index since 2021.

Figure 6 shows how the carbon intensity will change under the ITC impact. According to Fig. 6, the ITC will negatively affect the CI. When the tax rate increases, this ITC impact will be strengthened but will fluctuate over time. However, the ITC impact on the carbon intensity is not distinct. This finding agrees with Nordhaus [29] who argued that the ITC had a modest impact on the reduction of the carbon intensity.

Figure 7 shows how the ITC will affect the Real GDP (RGDP) loss over time. Generally, the ITC will decrease the RGDP loss induced by the carbon tax; in other words, the ITC will bring about positive economic benefits. This is because technical progress increases productivity and thus boosts economic growth, according to the Solow–Swan Growth model [30].

In contrast, Fig. 8 shows the change of the household welfare loss, denoted by the equivalent variation, under the ITC impacts. Unlike the RGDP loss, the household welfare loss, induced by the carbon tax, will be increased by the ITC. This ITC impact will be weakened as the tax rate increases. Compared to the impact on the RGDP, the ITC impact on the household welfare is much smaller. This finding corresponds to the economic intuition that economic growth may not necessarily increase welfare, as economic growth may expand the wealth gap which decreases the overall welfare.

According to Fig. 9, the ITC will increase the ASCC over the studied period in the tax scenarios. The magnitude of this ITC impact is positively related to the tax rate. This finding complies with Jensen and Traeger [31] who empirically showed that the technological growth would increase the social cost of carbon when the economy growth was positive.

Tables 8 and 9 in Appendix 2 show the results of the sensitivity analysis at the 1% tax in 2015 and 2030 respectively. According to these tables, the percentage changes of the variables are much lower than the corresponding changes of the income elasticity parameters. Similar results could be found in the basline, 2% or 3% tax scenarios. This finding implies that the model results are robust to the income elasticities, and thus the results are meaningful.

5 Discussion

The carbon tax will slightly decrease the ECS, gradually increase the energy-use efficiency (EUE), minimally decrease the energy-production efficiency (EPE), significantly increase the nonenergy-production efficiency (ENE) and technical index, compared to the baseline scenario. Previously, Jin [32] also used a CGE model to show that the carbon taxation could induce the technical innovation in China.

In the tax scenarios, the ITC of the carbon tax will decrease the EUE. This finding complies with Diaz and Puch [26] who argued that if the energy became scarcer under the carbon tax, the energy share would increase in response to the rising energy price. In contrast, The ITC will decrease the EPE. This finding complies with Macaluso, Tuladhar [33] who showed the carbon tax would induce the substitutions toward less carbon-intensive energy sources and production technologies. Hence, with less resources allocated, the production efficiency of the energy sectors will decrease.

The ITC will increase the ENE. This finding complies with Ekins et al. [34], who empirically found the environmental tax reform could increase the productivity by 3.4%, and Chavas et al. [35], who empirically found the R&D had a large and positive effect on the agricultural productivity in the US.

The ITC of the tax will promote the technological development at the lower tax rate. However, at the higher tax rate, the ITC impact inhibited the technical progress recently but will promote the progress in the future. The promotion impact of the ITC corresponds to the fact that a climate policy could induce additional R&D investment and knowledge application in the carbon-saving innovation [32]. In contrast, the inhibition impact of the ITC implies that owing to the political economy constraints, the carbon pricing may be ineffective in orientating technology in the emerging and developing countries [36].

The ITC will decrease the deadweight loss induced by the carbon tax. Similar empirical evidence could be found in the previous research showing that the welfare costs of the environmental tax would decrease under the ITC impact [37]. This is because the ITC will increase the R&D expenditures to substantially lower the abatement costs [38], and also it will induce the positive spill-over effects to support the carbon-free technologies [38].

In contrast, the ITC will negatively affect the household welfare. This finding could be explained by the uncertainties existing in the household decision-making [39]. The household may have the limited resources to cope with the rising price of the nonrenewable energies induced by the carbon tax. In addition, the ITC will significantly decrease the EPE, which may also increase the nonrenewable energy price.

The positive impact of the ITC on the ASCC implies that the emission abatement will become costlier if the ITC impacts are considered. This finding is contrary to the previous argument that the ITC was conducive to enhancing the level of the emission abatement as well as reducing the total social cost of the abatement [40]. The result difference between Wang et al. [40] and this paper lies in the targeted scope of the ITC: Wang et al. [40] only focused on the impact of the low-carbon energy on the ASCC, but they did not analyse how such type of the ITC was related to the climate policies. In contrast, I have considered the general technological change induced by the carbon tax in this paper. In other words, this paper focuses on the ITC impacts on the policy effects of the carbon tax.

In summary, the empirical results in this paper generally fit in well with the previous research except that the result differences are mainly caused by the model assumptions and scope of the targeted sectors. However, I have only modelled the induced technological change (ITC) of the carbon tax, and thus this paper cannot reveal the pure socioeconomic impacts of the technical progress. In the reality, governmental policies targeted to promote the technical progress may be far more appealing than the carbon tax simulated in this paper. Another limitation of this paper lies in the quantification method of the ITC. I have modelled the ITC based on Wang et al. [22]. However, the ITC in their research mainly included the potential change of the energy-saving technologies but excluded the induced development of the decarbonisation or clean energies. The narrowed scope of the ITC is likely to underestimate the technical impacts. Hence, the quantification method of the ITC needs to be improved to cover all types of the potential technologies that may be changed.

This paper has only broadly given the empirical evidence of the ITC impacts of the carbon tax in China; however, the underlying mechanisms need to be explored in future research. For example, this paper has empirically shows that the carbon tax might give rise to technical progress biased towards the nonenergy sectors generally, but the underlying driving force of the biased technical progress remains to be researched.

Despite that the economy is divided into 29 sectors, the technical impacts are built upon the overall energy and nonenergy efficiencies. More sectoral details could be incorporated in the technical index; in other words, the technical index could be a function of all the sectoral efficiencies. In addition, regional disparities my affect the scope and extent of the technical progress. As a vast country, China has very different socioeconomic conditions between less and more developed regions. Hence, it is worthwhile to explore how the ITC impacts of the carbon tax will vary across the provinces.

Another interesting domain of the potential research lies in the inequality conditions that may be affected by the induced technological change of the carbon tax. Similar to most CGE studies, the household in this paper represents the entire households of the country. Therefore, the household welfare change shown in this paper can only display how the ITC impacts of the carbon tax affect the overall welfare. It is interesting to define the welfare change of the household subgroups induced by the ITC impacts of the carbon tax. In this way, the potential research will answer whether the ITC will increase or decrease the inequality which is directly linked to the overall welfare.

Tackling climate change is one of the most challenging seventeen sustainable development goals (SDGs) both for developed and developing nations [41]. At present, climate policies are effective measures that humans can adopt to decelerate the global warming [12]. Unfortunately, owing to the nonrivalry and nonexcludable features of the climate, the socioeconomic effects of climate policies are usually explored biasedly in literature. In this paper, I have quantified one underlying mechanism, namely the induced technological change, of the carbon tax. As climate policies have positive externalities, other underlying mechanisms, like health benefits and inequality impacts, should be also included in the policy evaluation framework. If all the underlying mechanisms of climate policies had been understood thoroughly in previous research, many climate policies would have been more appealing to governmental implementations. Hence, the SDG of climate action could have been achieved more easily.

6 Conclusions

This paper empirically shows that the carbon tax will decrease the energy cost share (ECS) and energy-production efficiency (EPE), but it will increase the energy-use efficiency (EUE), nonenergy-production efficiency (ENE) and technical index, compared to the baseline scenario. In the tax scenarios, the ITC will increase the ECS because of the internalization of the abatement costs; it will decrease the EUE and EPE but will further increase the ENE and technical index in addition to the tax policy effects. This finding implies that the induced technological change of the carbon tax is biased towards the nonenergy sectors. Despite that the ITC of the carbon tax will have negative impacts on the carbon intensity, it will increase the average social cost of carbon (ASCC), implying that the emission abatement will become costlier if the ITC impacts are considered. Although the ITC will increase the real GDP, it will decrease the household welfare. This finding implies that not every household will benefit from the economic boom induced by the ITC of the carbon tax; in other words, the ITC might expand the wealth gap.

This paper has established a research framework where one underlying mechanism of the carbon tax, namely the induced technological change, is explored. Hence, the carbon tax can be evaluated less biasedly. It is important to comprehensively understand the roles of climate policies which are significant parts of climate action, namely the 13th SDG by United Nations. Although this paper has only modelled the technical impacts of the carbon tax in China, the research framework could be applied to analyse climate policies elsewhere. This is because climate change is faced by the entire human beings, and it requires each country to take measures. Hence, the research framework in this paper could help understand the mechanisms of climate policies globally; however, climate action is still a very tough task that requires global efforts.

Data availability

The 2015 China Input–Output Table is from the National Bureau of Statistics (https://data.stats.gov.cn/ifnormal.htm?u=/files/html/quickSearch/trcc/trcc01.html&h=740). The SAM of the CGE model is presented in Table 2 in Appendix 1. The sector division in this paper is shown in Table 3 in Appendix 1. The coal, petroleum, natural gas, and electricity price data are listed in Tables 4, 5, 6, 7 in Appendix 1.

References

Akhavan IAN, Jabbari IN. Exploration of the potential role of technology transfer in the climate change regime. Manag Technol Changes Book. 2007;1:445–8.

Popp D. ENTICE: endogenous technological change in the DICE model of global warming. J Environ Econ Manag. 2004;48(1):742–68.

Fried S. Climate policy and innovation: a quantitative macroeconomic analysis. Am Econ J Macroecon. 2018;10(1):90–118.

Baker E, Shittu E. Uncertainty and endogenous technical change in climate policy models. Energy Econ. 2008;30(6):2817–28.

Goulder LH, Schneider SH. Induced technological change and the attractiveness of CO2 abatement policies. Resour Energy Econ. 1999;21(3–4):211–53.

Goulder LH, Mathai K. Optimal CO2 abatement in the presence of induced technological change. J Environ Econ Manag. 2000;39(1):1–38.

van der Zwaan BCC, et al. Endogenous technological change in climate change modelling. Energy Econ. 2002;24(1):1–19.

Loschel A. Technological change in economic models of environmental policy: a survey. Ecol Econ. 2002;43(2–3):105–26.

van den Bergh JCJM. Environmental and climate innovation: limitations, policies and prices. Technol Forecast Soc Chang. 2013;80(1):11–23.

Lin S, Wang BB, Wu W, Qi SZ. The potential influence of the carbon market on clean technology innovation in China. Clim Policy. 2018;18:71–89.

Folster S, Nystrom J. Climate policy to defeat the green paradox. Ambio. 2010;39(3):223–35.

Gans JS. Innovation and climate change policy. Am Econ J Econ Policy. 2012;4(4):125–45.

Jacoby HD, et al. Technology and technical change in the MIT EPPA model. Energy Econ. 2006;28(5–6):610–31.

Johansen L. A multi-sectoral study of economic growth. Amsterdam: North-Holland; 1960. p. 177.

Wing IS. Representing induced technological change in models for climate policy analysis. Energy Econ. 2006;28(5–6):539–62.

Lindner S, Legault J, Guan D. Disaggregating the electricity sector of China’s input–output table for improved environmental life-cycle assessment. Econ Syst Res. 2013;25(3):300–20.

Guo ZQ, et al. Exploring the impacts of a carbon tax on the Chinese economy using a CGE model with a detailed disaggregation of energy sectors. Energy Econ. 2014;45:455–62.

Armington PS. A theory of demand for products distinguished by place of origin. Staff Pap (International Monetary Fund). 1969;16(1):159–78.

OECD. Long-term baseline projections. OECD economic outlook: statistics and projections; 2014. https://stats.oecd.org/.

EIA. International energy outlook 2017; 2017. https://www.eia.gov/outlooks/archive/ieo17/.

OECD. GDP long-term forecast; 2018. https://data.oecd.org/gdp/gdp-long-term-forecast.htm.

Wang R, et al. Induced energy-saving efficiency improvements amplify effectiveness of climate change mitigation. Joule. 2019;3(9):2103–19.

Nordhaus W. Projections and uncertainties about climate change in an era of minimal climate policies. Am Econ J Econ Policy. 2018;10(3):333–60.

Lu YY, Stern DI. Substitutability and the cost of climate mitigation policy. Environ Resour Econ. 2016;64(1):81–107.

Li W, Jia ZJ. Carbon tax, emission trading, or the mixed policy: which is the most effective strategy for climate change mitigation in China? Mitig Adapt Strat Glob Change. 2017;22(6):973–92.

Diaz A, Puch LA. Investment, technological progress and energy efficiency. BE J Macroecon. 2019. https://doi.org/10.1515/bejm-2018-0063.

Gerlagh R. A climate-change policy induced shift from innovations in carbon-energy production to carbon-energy savings. Energy Econ. 2008;30(2):425–48.

Chen W, et al. Effects of an energy tax (carbon tax) on energy saving and emission reduction in guangdong province-based on a CGE model. Sustainability. 2017;9(5):681.

Nordhaus WD. Modelling induced innovation in climate-change policy. In: Grubler A, Nakicenovic N, Nordhaus WD, editors. Technological change and the environment. Resources for the Future Press; 2002. p. 259–90.

Solow RM. A contribution to the theory of economic growth. Q J Econ. 1956;70(1):65–94.

Jensen S, Traeger CP. Optimal climate change mitigation under long-term growth uncertainty: stochastic integrated assessment and analytic findings. Eur Econ Rev. 2014;69:104–25.

Jin W. Can technological innovation help China take on its climate responsibility? An intertemporal general equilibrium analysis. Energy Policy. 2012;49:629–41.

Macaluso N, et al. The impact of carbon taxation and revenue recycling on US industries. Climate Change Econ. 2018;9(1):1840005.

Ekins P, et al. Increasing carbon and material productivity through environmental tax reform. Energy Policy. 2012;42:365–76.

Chavas JP, Aliber M, Cox TL. An analysis of the source and nature of technical change: the case of US agriculture. Rev Econ Stat. 1997;79(3):482–92.

Finon D. Carbon policy in developing countries: giving priority to non-price instruments. Energy Policy. 2019;132:38–43.

Liu AA, Yamagami H. Environmental policy in the presence of induced technological change. Environ Resour Econ. 2018;71(1):279–99.

Kemfert C. Induced technological change in a multi-regional, multi-sectoral, integrated assessment model (WIAGEM) Impact assessment of climate policy strategies. Ecol Econ. 2005;54(2–3):293–305.

Knobloch F, et al. Simulating the deep decarbonisation of residential heating for limiting global warming to 1.5 degrees C. Energy Effic. 2019;12(2):521–50.

Wang KM, et al. The optimal research and development portfolio of low-carbon energy technologies: a study of China. J Clean Prod. 2018;176:1065–77.

Sinha A, Sengupta T, Alvarado R. Interplay between technological innovation and environmental quality: formulating the SDG policies for next 11 economies. J Clean Prod. 2020;242:118549.

CCI. The notification of the reform and development of the China coal industry in 2015; 2016. http://www.cnki.com.cn/Article/CJFDTotal-MTQG201603003.htm. Accessed 17 Oct 2019.

CCI. The annual report of the reform and development of the China coal industry in 2016; 2017. http://www.cqvip.com/QK/81066A/201703/671829591.html. Accessed 17 Oct 2019.

CCI. The annual report of the development of the China coal industry in 2017; 2018. https://www.cctd.com.cn/uploadfile/2018/0328/20180328093649264.pdf. Accessed 17 Oct 2019.

CCI. The annual report of the development of the China coal industry in 2018; 2019. https://www.cctd.com.cn/uploadfile/2019/0308/20190308093106638.pdf. Accessed 17 Oct 2019.

PCCL. The annual report of PetroChina Company Limited in 2016; 2017. http://static.cninfo.com.cn/finalpage/2017-03-31/1203239645.PDF. Accessed 17 Oct 2019.

PCCL. The annual report of PetroChina Company Limited in 2018; 2019. http://www.petrochina.com.cn/petrochina/rdxx/201903/d5935a7ea9b24ee58d754b3c4bf18574/files/dcf2b27e6ae14dd888b93248e5996678.pdf. Accessed 17 Oct 2019.

CPCC. The annual report of China Petroleum and Chemical Corporation in 2016; 2017. http://www.sinopec.com/listco/Resource/Pdf/20170326022.pdf. Accessed 17 Oct 2019.

CPCC. The annual report of China Petroleum and Chemical Corporation in 2018; 2019. http://www.sinopec.com/listco/Resource/Pdf/20190324311.pdf. Accessed 17 Oct 2019.

CGHL. The 2016/17 fiscal year report of China Gas Holdings Limited; 2017. http://pdf.dfcfw.com/pdf/H2_AN201707100708812540_1.pdf. Accessed 17 Oct 2019.

CGHL. The 2017/18 fiscal year report of China Gas Holdings Limited; 2018. http://pdf.dfcfw.com/pdf/H2_AN201807191168344395_1.pdf. Accessed 17 Oct 2019.

CGHL. The 2018/19 fiscal year report of China Gas Holdings Limited; 2019. https://www.shclearing.com/xxpl/cwbg/nb/201907/t20190719_548044.html. Accessed 17 Oct 2019.

NEA. The declaration of 2015 China electricity price; 2016. http://www.escn.com.cn/news/show-363034.html. Accessed 17 Oct 2019.

NEA. The declaration of 2016 China electricity price; 2017. http://www.gov.cn/xinwen/2017-12/31/content_5252010.htm. Accessed 17 Oct 2019.

NEA. The declaration of 2017 China electricity price; 2018. http://www.nea.gov.cn/2018-10/09/c_137519800.htm. Accessed 17 Oct 2019.

CG. Report on the work of the Government in 2018; 2018. http://www.gov.cn/zhuanti/2018lh/2018zfgzbg/zfgzbg.htm. Accessed 17 Oct 2019.

CG. Report on the work of the Government in 2019; 2019. http://www.gov.cn/zhuanti/2019qglh/2019lhzfgzbg/mobile.htm. Accessed 17 Oct 2019.

Acknowledgements

This paper is funded by Imperial College London.

Author information

Authors and Affiliations

Contributions

This paper was entirely written by the author. The author read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1: Data source

As China Statistical Yearbooks have not published the coal price data, I have referred to the data given by China Coal Industry [42,43,44,45]. According to Table 4 in Appendix 1, the coal price decreased sharply from 2015 to 2016 but remained stable in 2016–2018. In contrast, the coke price grew steadily in 2015–2018.

As far as I am concerned, there are no official data of the petroleum price. I have used the data given by PetroChina Company Limited [46, 47] and China Petroleum and Chemical Corporation [48, 49]. According to Table 5 in Appendix 1, the gasoline has the highest price, whilst the crude oil has the lowest price.

The retail price of the natural gas in China is unavailable from the official source. I have used the price data from China Gas Holdings Limited [50,51,52], shown in Table 6 in Appendix 1. In this paper, the 2015–2018 price corresponds to the 2015/16, 2016/17, 2017/18, and 2018/19 fiscal year price of the natural gas in CGHL. All the sectors, except for the transport, storage and post sector and service sector, face the price for the industrial use, whilst these sectors face the price for the commercial use. According to Table 6, the natural gas price for the household use was the lowest, whilst the price for the commercial use was the highest.

All the sectors are assumed to face the 2015–2017 electricity price according to National Energy Administration [53,54,55]. The electricity price is the same regardless of the generation sources. The Chinese government [56] announced that it would reduce the electricity price for the general industry and commerce by 10% in 2018, and the target was met in the 2019 government report [57]. The 2019 report also announced a further 10% reduction [57]. Hence, the electricity price is assumed to decrease by 10% in 2018 and 2019. According to Table 7 in Appendix 1, the electricity price decreased steadily in 2015–2019.

Appendix 2

See Tables 8, 9 and Figs. 10, 11, 12, 13, 14.

Appendix 3: The disaggregation of the electricity sector

The subscript i refers to a sector; t is the time.

\({\text{deltacoalgen}}_{{{\text{it}}}}\) is the share of the coal electricity composite input.

\({\text{deltaelec}}_{{{\text{it}}}}\) is the share of the electricity composite input.

\({\text{deltaelecgen}}_{{{\text{it}}}}\) is the share of the electricity-generation composite input;

\({\text{deltafipow}}_{{{\text{it}}}}\) is the share of the heat input.

\({\text{deltafosgen}}_{{{\text{it}}}}\) is the share of the fossil electricity input.

\({\text{deltaTD}}_{{{\text{it}}}}\) is the share of the electricity transmission input.

\({\text{deltaSuper}}_{{{\text{it}}}}\) is the share of the supercrit-coal electricity input.

\({\text{deltaUSC}}_{{{\text{it}}}}\) is the share of the USC-coal electricity input.

\({\text{deltaUSC}}\_{\text{subc}}_{{{\text{it}}}}\) is the share of the USC-subc-coal electricity composite input.

\({\text{deltasubc}}_{{{\text{it}}}}\) is the share of the subc-coal electricity input.

\({\text{deltaNG}}_{{{\text{it}}}}\) is the share of the gas electricity input.

\({\text{deltaFuel}}14_{{{\text{it}}}}\) is the share of the nuclear electricity input.

\({\text{deltaFuel}}15_{{{\text{it}}}}\) is the share of the hydroelectricity input.

\({\text{deltaFuel}}15\_16\_17_{{{\text{it}}}}\) is the share of the hydro-wind-solar electricity composite input.

\({\text{deltaFuel}}16_{{{\text{it}}}}\) is the share of the wind electricity input.

\({\text{deltaFuel}}16\_17_{{{\text{it}}}}\) is the share of the wind-solar electricity composite input.

\({\text{deltaFuel}}17_{{{\text{it}}}}\) is the share of the solar electricity input.

\({\text{deltarenewgen}}_{{{\text{it}}}}\) is the share of the renewable electricity generation input.

\({\text{Ecoalgen}}_{{{\text{it}}}}\) is the coal electricity composite input.

\({\text{Eelec}}_{{{\text{it}}}}\) is the electricity composite input.

\({\text{Eelecgen}}_{{{\text{it}}}}\) is the electricity-generation composite input;

\({\text{Efipow}}_{{{\text{it}}}}\) is the heat input.

\({\text{Efosgen}}_{{{\text{it}}}}\) is the fossil electricity input.

\({\text{ETD}}_{{{\text{it}}}}\) is the electricity transmission input.

\({\text{ESuper}}_{{{\text{it}}}}\) is the supercrit-coal electricity input.

\({\text{EUSC}}_{{{\text{it}}}}\) is the USC-coal electricity input.

\({\text{EUSC}}\_{\text{subc}}_{{{\text{it}}}}\) is the USC-subc-coal electricity composite input.

\({\text{Esubc}}_{{{\text{it}}}}\) is the subc-coal electricity input.

is the gas electricity input.

\({\text{EFuel}}14_{{{\text{it}}}}\) is the nuclear electricity input.

\({\text{EFuel}}15_{{{\text{it}}}}\) is the hydroelectricity input.

is the hydro-wind-solar electricity composite input.

\({\text{EFuel}}16_{{{\text{it}}}}\) is the wind electricity input.

\({\text{EFuel}}16\_17_{{{\text{it}}}}\) is the wind-solar electricity composite iut.

\({\text{EFuel}}17_{{{\text{it}}}}\) is the solar electricity input.

\({\text{Epow}}_{{{\text{it}}}}\) is the electricity-heat composite input.

\({\text{Erenewgen}}_{{{\text{it}}}}\) is the renewable electricity generation input.

\({\text{parpow}}_{{{\text{it}}}}\) is the elasticity parameter.

\({\text{PEcoalgen}}_{{{\text{it}}}}\) is the price of the coal electricity composite input.

\({\text{Pelec}}_{{{\text{it}}}}\) is the price of the electricity composite input.

\({\text{Pfipow}}_{{{\text{it}}}}\) is the price of the heat input.

\({\text{PEelecgen}}_{{{\text{it}}}}\) is the price of the electricity-generation composite input;

\({\text{PEfosgen}}_{{{\text{it}}}}\) is the price of the fossil electricity input.

\({\text{PEUSC}}\_{\text{subc}}_{{{\text{it}}}}\) is the price of the USC-subc-coal electricity composite input.

\({\text{PEFuel}}15\_16\_17_{{{\text{it}}}}\) is the price of the hydro-wind-solar electricity composite input.

\({\text{PEFuel}}16\_17_{{{\text{it}}}}\) is the price of the wind-solar electricity composite input.

\({\text{PErenewgen}}_{{{\text{it}}}}\) is the price of the renewable electricity generation input.

\({\text{Ppow}}_{{{\text{it}}}}\) is the price of the electricity-heat composite input.

\({\text{PQ}}\) is the energy price.

\({\text{tc}}\) is the tax rate.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Chen, S. The technical impacts of the carbon tax in China. Discov Sustain 2, 51 (2021). https://doi.org/10.1007/s43621-021-00060-9

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s43621-021-00060-9